DC Plasma Power Generators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435125 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

DC Plasma Power Generators Market Size

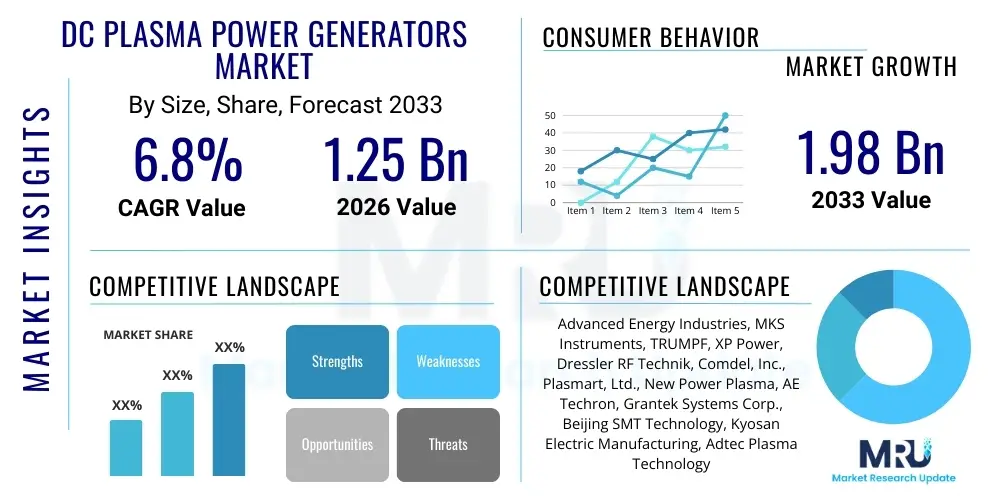

The DC Plasma Power Generators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.98 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the escalating demand for high-precision deposition and etching processes in advanced semiconductor fabrication, especially for memory chips (3D NAND) and logic devices manufactured at sub-10nm nodes. The intrinsic ability of DC plasma power generators to deliver highly stable, reliable, and precise energy delivery is foundational to achieving the stringent quality requirements mandated by modern microelectronics production.

The market expansion is also significantly supported by the continuous development and deployment of renewable energy infrastructure, particularly the manufacturing of thin-film photovoltaic (PV) modules and specialized industrial coatings that require plasma-enhanced chemical vapor deposition (PECVD) or physical vapor deposition (PVD) processes. As global economies pivot towards sustainable energy solutions, the production capacity for solar cells and high-efficiency batteries, both reliant on plasma technology, is increasing. Furthermore, technological advancements, including the shift towards solid-state DC generators offering better efficiency, faster response times, and superior reliability compared to traditional linear power supplies, are crucial market accelerators, enabling manufacturers to optimize throughput and reduce maintenance overheads.

DC Plasma Power Generators Market introduction

The DC Plasma Power Generators Market encompasses highly specialized electronic devices designed to supply stable and regulated direct current (DC) power to plasma processing equipment used primarily in manufacturing and research environments. These generators convert line power into precise DC voltage and current, essential for initiating and sustaining plasma discharge in vacuum chambers. The resultant plasma is then utilized for critical surface modification applications, including sputtering, etching, deposition, and ion implantation. Major applications span the high-technology spectrum, including the fabrication of integrated circuits (ICs), manufacturing of flat panel displays (FPDs), application of wear-resistant coatings, and the production of advanced architectural glass. The principal benefit derived from using advanced DC plasma generators lies in their exceptional precision and control over the plasma parameters, ensuring uniformity, reproducibility, and high material quality, thereby minimizing defects in sensitive manufacturing steps. Driving factors for market growth include the escalating global demand for smaller, faster, and more energy-efficient electronic devices, alongside robust investment in emerging display technologies like OLED and MicroLED, all of which heavily rely on sophisticated DC plasma processing.

DC Plasma Power Generators Market Executive Summary

The DC Plasma Power Generators market is characterized by intense technological competition centered on efficiency, stability, and digital control capabilities. Business trends indicate a strong focus on developing solid-state power supplies that offer significantly reduced footprint, higher power density, and sophisticated digital interface capabilities compliant with Industry 4.0 standards for remote monitoring and predictive maintenance. Strategic collaborations between plasma equipment manufacturers and generator suppliers are becoming commonplace to create fully optimized process tools. Geographically, the Asia Pacific region dominates the market, fueled by massive investments in semiconductor foundries, particularly in China, South Korea, and Taiwan, which serve as global hubs for advanced electronics manufacturing. Regional trends in North America and Europe emphasize research-intensive applications and high-value niche industrial coatings, driven by stringent quality standards in aerospace and medical device sectors. Segment trends highlight the increasing prominence of Pulsed DC (PDC) generators, which offer superior control over substrate charging and arc management, making them indispensable for processing insulating or thermally sensitive materials, thus catering effectively to complex film deposition requirements in cutting-edge electronics and functional coatings.

AI Impact Analysis on DC Plasma Power Generators Market

User queries regarding the impact of Artificial Intelligence (AI) on the DC Plasma Power Generators Market frequently revolve around topics such as predictive maintenance integration, real-time process optimization through machine learning (ML), and the role of AI in quality control and yield enhancement. Users are keen to understand how AI algorithms can analyze vast datasets generated by high-frequency monitoring of plasma parameters (voltage, current, impedance, optical emission spectroscopy) to detect anomalies or drift instantaneously, far surpassing human capabilities in complex process monitoring. The primary concern is often the successful integration of proprietary ML models into existing generator hardware and control systems, ensuring data security and interoperability across diverse manufacturing platforms. Expectations are high regarding AI's potential to autonomously tune generator output parameters to maintain process stability despite variations in chamber conditions or material loading, thereby drastically improving throughput and reducing the reliance on highly specialized process engineers for routine tuning. Ultimately, the consensus theme is that AI will transform these power generators from mere power sources into intelligent, self-optimizing system components crucial for achieving the ultra-high yields necessary in next-generation semiconductor manufacturing.

- AI algorithms enable predictive maintenance by analyzing power usage patterns and internal component degradation signatures, drastically reducing unexpected downtime.

- Machine learning models are employed for real-time process control, optimizing plasma stability and uniformity by dynamically adjusting DC generator output parameters based on sensor feedback.

- AI facilitates enhanced defect detection and yield management by correlating generator performance data with wafer inspection results, identifying subtle correlations previously unnoticed.

- Autonomous process tuning using deep learning reduces material waste and speeds up recipe development for new materials and complex multi-layer structures.

- Improved energy efficiency is achieved through AI-driven load management, optimizing power consumption based on immediate process demands and energy cost fluctuations.

- AI enhances equipment utilization rates (OEE) by providing deep insights into operational inefficiencies and suggesting proactive adjustments to operational schedules and parameters.

DRO & Impact Forces Of DC Plasma Power Generators Market

The DC Plasma Power Generators Market is propelled by increasing global investment in advanced manufacturing, particularly the semiconductor industry's transition to smaller feature sizes and three-dimensional architectures (3D NAND, FinFETs), which demand exceptionally stable and precise power delivery systems. However, the market faces significant restraints, primarily stemming from the high initial capital expenditure associated with purchasing and integrating high-end, solid-state DC generators, coupled with the long qualification cycles required in regulated industries like aerospace and medical device manufacturing. Opportunities abound in the burgeoning fields of flexible electronics, advanced battery production (lithium-ion and solid-state), and the development of next-generation optical coatings, all requiring sophisticated plasma processes that high-performance DC generators enable. The primary impact forces include the exponential growth in data generation driving demand for memory and processing power, regulatory pressure towards greener manufacturing (pushing demand for energy-efficient generators), and the competitive landscape necessitating continuous innovation in arc management and control algorithms to ensure zero-defect processing.

A major driver is the accelerating shift towards solid-state generators, replacing older vacuum tube and linear technologies. Solid-state devices offer superior efficiency, minimal maintenance, and higher power density, allowing manufacturers to integrate robust plasma systems into smaller footprints. This migration is essential for meeting the demands of high-throughput fabs that require continuous, reliable operation. Furthermore, the global proliferation of IoT devices, 5G technology, and high-performance computing (HPC) mandates a sustained surge in semiconductor production, directly correlating with increased procurement of advanced DC plasma generation units used in crucial etching and deposition phases. The necessity for highly uniform film thickness and crystalline structure across large substrates further emphasizes the role of stable DC power supplies capable of minimizing process variations across the entire chamber area, driving demand for technologically superior products.

Key restraints include the complexity of integration and the specialized expertise required for operating and maintaining these high-voltage, high-frequency systems. Manufacturers face steep learning curves when adopting next-generation digitally controlled generators, necessitating substantial investment in workforce training. Moreover, the long lifecycle of semiconductor capital equipment means that the replacement cycle for legacy generators can be slow, especially for facilities operating mature process nodes, which temporarily dampens immediate market growth for the newest technologies. Another critical restraint involves supply chain vulnerabilities, particularly concerning specialized electronic components and high-purity materials needed for robust solid-state construction, which can be impacted by geopolitical events and trade restrictions, thus affecting pricing and delivery lead times for market participants globally.

Segmentation Analysis

The DC Plasma Power Generators Market is segmented based on the fundamental operating characteristics and end-use applications, providing a clear structural view of demand dynamics across various industries. Analysis by Type (e.g., Pulsed DC, Radio Frequency) reveals differential adoption rates based on specific process requirements, such as the need for precise energy delivery versus arc suppression capabilities. Segmentation by Power Output (e.g., Less than 10 kW, Above 50 kW) directly correlates with the scale and throughput of the target manufacturing facility, ranging from small R&D labs to large-scale semiconductor foundries. The application segmentation provides the most critical insights, showing the dominance of semiconductor and flat panel display sectors due to their inherently complex, plasma-intensive manufacturing flows, while emerging applications in advanced optics and material science present long-term growth opportunities.

- By Type: Low Frequency (LF), Medium Frequency (MF), Radio Frequency (RF), Pulsed DC (PDC)

- By Power Output: Less than 10 kW, 10 kW – 50 kW, Above 50 kW

- By Application: Semiconductor Manufacturing, Industrial Coating, Photovoltaic Manufacturing, Flat Panel Display (FPD) Manufacturing, Research & Development

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA)

Value Chain Analysis For DC Plasma Power Generators Market

The value chain for the DC Plasma Power Generators Market starts with upstream activities involving the sourcing of highly specialized electronic components, including power semiconductor modules (IGBTs, MOSFETs), control microprocessors, and high-quality passive components necessary for constructing the robust power delivery circuitry. Key upstream suppliers include advanced component manufacturers specializing in high-frequency switching technology and digital signal processing (DSP) chips, dictating the generator's performance metrics, efficiency, and size. Midstream involves the core manufacturing process, where original equipment manufacturers (OEMs) design, assemble, calibrate, and rigorously test the generators to meet exacting industry standards, often requiring custom configurations based on the plasma tool parameters. Downstream analysis focuses on the distribution channel, which predominantly relies on specialized direct sales teams due to the technical complexity of the product, targeting system integrators and large end-users (Tier 1 semiconductor fabs). Indirect channels involve partnerships with larger semiconductor equipment providers who integrate the DC generators as a subsystem within a complete processing tool, providing comprehensive sales and service support. This structure emphasizes direct engagement with technical buyers who require extensive pre-sales consultation and post-installation support for integration and optimization within their vacuum systems.

DC Plasma Power Generators Market Potential Customers

The primary customers for DC Plasma Power Generators are large-scale manufacturers and research institutions heavily engaged in vacuum processing techniques. The largest segment of end-users consists of semiconductor fabrication plants (fabs) and outsourced semiconductor assembly and test (OSAT) companies, which use these generators for critical steps such as thin-film deposition (PVD/PECVD) and reactive ion etching (RIE) during the production of microchips, memory devices, and sensors. Another significant customer base includes flat panel display manufacturers (LCD, OLED, and MicroLED), where DC plasma technology is crucial for depositing high-uniformity conductive or insulating layers across large glass substrates. Additionally, specialty industrial coating companies utilize DC generators for metallization and hard coating applications in aerospace components, automotive parts, and biomedical devices, requiring precision surface treatments. Finally, academic and corporate research and development centers focusing on advanced material science, nanotechnology, and future electronic device prototypes represent a continuous, albeit smaller, segment of highly specialized buyers seeking the most technologically advanced and flexible power solutions for experimental setups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Advanced Energy Industries, MKS Instruments, TRUMPF, XP Power, Dressler RF Technik, Comdel, Inc., Plasmart, Ltd., New Power Plasma, AE Techron, Grantek Systems Corp., Beijing SMT Technology, Kyosan Electric Manufacturing, Adtec Plasma Technology Co., Ltd., Serac Group, Daihen Corporation, Seki Technotron Corp., EMD Electronics (Merck), Coherent, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DC Plasma Power Generators Market Key Technology Landscape

The technological evolution within the DC Plasma Power Generators Market is strongly focused on enhancing power stability, reducing electromagnetic interference (EMI), and improving digital control capabilities crucial for advanced process nodes. The most significant shift involves the complete migration from older, bulky linear and switch-mode power supplies to compact, high-frequency solid-state generators. These modern generators utilize advanced silicon carbide (SiC) and gallium nitride (GaN) power devices, enabling faster switching speeds and drastically higher efficiencies, which are critical for minimizing heat generation and maximizing energy transfer to the plasma. Furthermore, technological advancements include sophisticated arc suppression circuitry and rapid-response short-circuit protection features, essential for maintaining continuous plasma stability, especially when processing substrates prone to charging or arcing, which if uncontrolled, can destroy delicate microelectronic structures.

A core technological differentiator is the incorporation of advanced digital signal processing (DSP) for precise control and monitoring. Modern DC plasma generators are equipped with embedded controllers that manage power delivery parameters, modulate pulse widths in Pulsed DC mode, and provide detailed real-time diagnostic data via standardized communication protocols (e.g., EtherCAT, Profinet). This digital capability supports the increasing demands of Industry 4.0, allowing for seamless integration into factory-wide control systems, remote diagnostics, and predictive modeling using AI/ML tools. The development of multi-output generators capable of powering complex plasma source arrays simultaneously while maintaining phase coherence is also gaining traction, particularly in large-area deposition systems for FPD and solar cell manufacturing, necessitating complex power synchronization technologies.

Moreover, the advancement of Pulsed DC (PDC) technology represents a crucial trend. PDC generators offer advantages in processing materials with insulating or low-conductivity characteristics by rapidly switching the DC bias on and off, effectively mitigating the buildup of surface charge and suppressing dangerous arcing events. This capability is paramount in high-aspect-ratio etching and deposition processes where sidewall charging is a major constraint on yield and uniformity. Research is continuously focused on optimizing the pulse shape, frequency, and duty cycle to achieve ideal ion energy distributions and plasma density profiles. The integration of wide-bandgap semiconductor devices like SiC in these high-power, high-speed switching circuits is instrumental in realizing the next generation of highly efficient and ultra-stable Pulsed DC plasma power sources, ensuring market dominance in cutting-edge semiconductor fabrication equipment.

Regional Highlights

The market for DC Plasma Power Generators exhibits significant geographical variance influenced by localized industrial capacity and technological adoption rates. The Asia Pacific (APAC) region stands out as the undisputed leader, driven by the immense manufacturing volume of microelectronics, flat panel displays, and solar cells concentrated in countries like China, South Korea, Taiwan, and Japan. North America and Europe, while having smaller manufacturing footprints compared to APAC, are critical hubs for research and development, demanding highly specialized, low-volume, high-precision DC plasma systems for advanced aerospace coatings, medical device fabrication, and next-generation R&D projects.

- Asia Pacific (APAC): Dominates the global market share due to high investment in semiconductor fabrication facilities (e.g., TSMC, Samsung, SK Hynix) and the world's largest consumer electronics manufacturing base. China's push for self-sufficiency in semiconductor production is driving massive procurement of advanced plasma equipment.

- North America: Characterized by strong demand from academic institutions, national labs, and specialized manufacturers in high-reliability sectors (aerospace, defense). Focus is on technological leadership, particularly in advanced materials and solid-state DC generator technology R&D.

- Europe: Growth is steady, driven by the automotive industry's demand for advanced surface coatings, and regulatory initiatives promoting photovoltaic manufacturing (Green Deal). Germany and France are key centers for industrial coating and scientific instrumentation production.

- Latin America (LATAM): Represents an emerging market with limited domestic production capacity, primarily relying on imports for maintenance and expansion in light industrial and academic applications. Growth is slow but steady, tied to regional economic development and infrastructure investment.

- Middle East and Africa (MEA): Currently holds the smallest share, with demand focused mainly on oil and gas industry-related specialized coatings and materials research in university settings. Regional investment in high-tech infrastructure remains a potential long-term growth catalyst.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DC Plasma Power Generators Market.- Advanced Energy Industries

- MKS Instruments

- TRUMPF

- XP Power

- Dressler RF Technik

- Comdel, Inc.

- Plasmart, Ltd.

- New Power Plasma

- AE Techron

- Grantek Systems Corp.

- Beijing SMT Technology

- Kyosan Electric Manufacturing

- Adtec Plasma Technology Co., Ltd.

- Serac Group

- Daihen Corporation

- Seki Technotron Corp.

- EMD Electronics (Merck)

- Coherent, Inc.

- Hitachi High-Tech Corporation

- Lam Research Corporation (Provider of integrated tools)

Frequently Asked Questions

Analyze common user questions about the DC Plasma Power Generators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the DC Plasma Power Generators Market?

The primary factor driving demand is the aggressive expansion and technological progression within the semiconductor manufacturing industry, particularly the transition to 3D architectural chips (e.g., 3D NAND and FinFETs) which require ultra-stable and precise DC power for critical etching and deposition processes at sub-10nm nodes.

How does Pulsed DC (PDC) technology differ and why is it important?

Pulsed DC technology rapidly switches the DC power on and off at high frequencies, which effectively neutralizes electrical charge accumulation on insulating or thermally sensitive substrates, preventing damaging arcing, and thereby significantly improving process uniformity and yield in complex film deposition.

Which geographical region dominates the DC Plasma Power Generators Market?

The Asia Pacific (APAC) region holds the dominant market share, driven by extensive industrial investments in semiconductor, flat panel display (FPD), and photovoltaic manufacturing capacity across key countries including China, South Korea, and Taiwan.

What role does Artificial Intelligence (AI) play in modern DC plasma generators?

AI is increasingly utilized for predictive maintenance, real-time optimization of power output parameters based on process sensor feedback, and enhanced diagnostic capabilities, transforming generators into intelligent, self-monitoring components compliant with Industry 4.0 requirements for higher efficiency and reliability.

What are the key technological advancements expected in this market?

Key technological advancements include the widespread adoption of solid-state power devices (SiC/GaN) for increased efficiency and reliability, improved digital signal processing (DSP) for precision control, and sophisticated arc management systems essential for next-generation fabrication challenges.

The DC Plasma Power Generators Market is fundamentally intertwined with the success of the global electronics supply chain, acting as an indispensable enabling technology. As devices become smaller, more complex, and require superior material characteristics, the demand for generators capable of delivering ultra-stable, digitally controllable power will only intensify. The shift toward solid-state designs minimizes physical footprint while maximizing power density and efficiency, addressing critical operational concerns within multi-billion dollar manufacturing environments. Companies prioritizing investment in digital interfaces and robust arc management systems are best positioned to capture market share, particularly in high-growth segments like 3D memory and OLED display production. Furthermore, the inherent longevity and reliability of new generation solid-state units contribute to lower total cost of ownership (TCO) for end-users, strengthening their attractiveness over traditional power systems. The increasing utilization of hydrogen and other specialty gases in plasma processes, often requiring precise power ramping and control, further mandates the integration of high-performance DC generators with advanced flow and pressure control systems, ensuring predictable and reproducible results critical for complex chemical reactions within the vacuum chamber. This specialized requirement ensures continued differentiation and high barriers to entry for new market competitors.

Future growth hinges significantly on the pace of adoption of cutting-edge plasma applications beyond traditional semiconductor manufacturing. For example, the use of DC plasma for synthesizing novel materials, such as thin-film perovskite solar cells or specialized superconducting layers, provides niche, high-value avenues for market expansion. The regulatory environment in Europe and North America, favoring domestic production of strategic technologies, is also encouraging local manufacturers to upgrade existing facilities with state-of-the-art plasma equipment, contributing to market growth in these mature economies. Moreover, the integration of DC plasma systems into roll-to-roll (R2R) processing lines, designed for flexible electronics and large-area deposition, presents engineering challenges related to power uniformity and stability across vast surface areas, requiring generators with exceptional stability features and advanced feedback loop controls. Addressing these scalability challenges through technological innovation is paramount for unlocking potential in emerging flexible display and specialized packaging industries, cementing the generator's status as a core component of future industrial manufacturing architectures.

The competitive landscape remains moderately consolidated, dominated by a few major players who command significant intellectual property related to power supply architectures and control algorithms. These leaders leverage established relationships with tier-one semiconductor equipment manufacturers (SEMs) and maintain global service networks, providing a substantial competitive advantage. Smaller, niche manufacturers often focus on specialized segments, such as low-power academic research systems or customized high-frequency pulsing units, utilizing agility to address highly specific customer needs that major firms may overlook. Successful market strategies involve continuous R&D investment in digital technologies, aimed at enhancing communication standards, integrating real-time diagnostics, and developing modular power platforms that allow for flexible scaling and configuration by end-users. Pricing pressure, particularly in the mass-production segments of APAC, requires manufacturers to continuously optimize their supply chain and manufacturing efficiencies without compromising the stringent quality and stability requirements demanded by high-stakes applications like microchip fabrication. This careful balance between cost optimization and technological excellence defines the strategic direction of key market participants moving forward.

The emphasis on energy efficiency is not merely an environmental consideration but a fundamental economic driver for semiconductor fabs, which consume immense amounts of electricity. Advanced DC plasma generators, utilizing GaN and SiC components, dramatically reduce internal power losses compared to legacy systems, directly translating into lower operational costs for end-users. This efficiency imperative is further reinforced by global initiatives aiming to reduce the carbon footprint of manufacturing, positioning high-efficiency generators as a critical component of sustainable semiconductor production roadmaps. Furthermore, the market is seeing increased demand for generators with enhanced fault tolerance and redundancy features, ensuring that unexpected component failures do not cascade into catastrophic production halts. Manufacturers are addressing this by implementing hot-swappable power modules and sophisticated internal health monitoring systems, minimizing mean time to repair (MTTR) and maximizing equipment availability. The robust nature of the latest generator designs is essential for maintaining the continuous, 24/7 operational requirements inherent in modern high-volume fabrication facilities, guaranteeing the predictable flow of highly sensitive production cycles and safeguarding yield integrity against power-related disturbances.

Looking ahead, the integration of virtual reality (VR) and augmented reality (AR) tools for remote servicing and maintenance of DC plasma generators is emerging as a significant trend, especially in light of global travel restrictions and the need for immediate, specialized technical support across geographically dispersed manufacturing sites. These tools enable remote experts to guide on-site technicians through complex diagnostic and repair procedures, reducing downtime and operational expense. Furthermore, the ongoing push for heterogeneous integration and advanced packaging technologies in the semiconductor sector requires highly localized and tightly controlled plasma processes. This drives the demand for specialized, low-power, high-precision DC plasma generators that can be integrated directly into advanced packaging equipment, facilitating processes like wafer bonding and micro-bumping. The versatility and adaptability of modern DC power supplies to these highly constrained and precise applications ensure their long-term relevance across the entire spectrum of microelectronic manufacturing, from front-end fabrication to advanced back-end packaging and assembly. The market thus continues its trajectory of innovation, responding dynamically to the rigorous demands of the digital economy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager