DC Solenoids Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432457 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

DC Solenoids Market Size

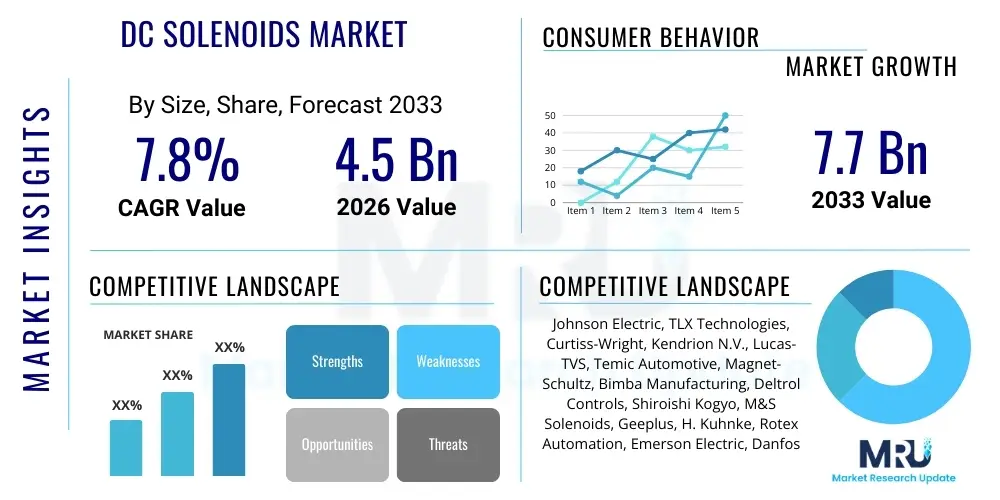

The DC Solenoids Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

DC Solenoids Market introduction

The DC Solenoids Market encompasses the design, manufacturing, and distribution of electromechanical devices that convert electrical energy into linear or rotary mechanical motion using direct current (DC). These devices operate based on the principle of electromagnetic induction, featuring a coil of wire wrapped around a movable armature or plunger. When DC current flows through the coil, a magnetic field is generated, pulling or pushing the armature, thereby executing a mechanical task. DC solenoids are highly valued across numerous industries due to their fast response time, reliable operation, compact size, and simplified control circuitry compared to their AC counterparts.

DC solenoids serve as critical components in automated systems, acting primarily as actuators, locks, or valves. Major applications span high-volume sectors such as automotive systems (door locks, fuel injectors, transmission control), industrial automation (sorting machinery, pneumatic and hydraulic valve control), and medical devices (fluid dispensing, diagnostic equipment). The primary benefit derived from deploying DC solenoids is precision control and high cycle life, crucial for demanding applications requiring repetitive, accurate movement. Furthermore, the inherent efficiency of certain DC solenoid types, particularly latching solenoids, which require power only during switching, contributes significantly to energy savings in battery-operated or resource-constrained environments.

Key driving factors propelling market expansion include the rapid growth of the electric vehicle (EV) sector, where DC solenoids are integral to battery management systems and charging infrastructure; the increasing complexity and automation level in modern manufacturing facilities; and the growing demand for precision fluid control in portable medical instruments. Miniaturization trends in electronics and mechanical components further boost the adoption of micro-DC solenoids, enabling sophisticated functionalities in compact designs. These dynamics position the DC solenoids market for sustained growth, driven by technological advancements and widespread integration into essential infrastructure.

DC Solenoids Market Executive Summary

The DC Solenoids Market is experiencing robust expansion driven by pronounced business trends favoring automation, electrification, and compact actuation solutions. Major business trends include increased outsourcing of specialized component manufacturing, strategic partnerships between solenoid manufacturers and Tier 1 automotive suppliers, and a substantial investment surge in research and development aimed at improving power density and reducing component size. Market participants are focusing on developing high-temperature-resistant and high-cycle-life solenoids tailored for harsh industrial and aerospace environments. Furthermore, sustainability initiatives are driving the demand for highly efficient, latching-type solenoids that minimize continuous power draw, aligning with global efforts to reduce energy consumption in automated machinery.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive industrialization, expanding domestic automotive production—especially in China and India—and significant governmental support for smart infrastructure development. North America and Europe maintain strong market shares, characterized by high adoption rates in sophisticated aerospace, defense, and high-precision medical sectors, demanding customized, high-reliability products. Segment trends indicate that the Linear Solenoid category dominates the market due to its versatility and broad application base, but the Latching Solenoid segment is projected to exhibit the highest CAGR, primarily due to rising integration in critical infrastructure and advanced battery management systems (BMS) in EVs, requiring power retention without continuous draw.

In terms of application, the Automotive segment remains the largest consumer, benefiting from the global shift towards complex electronic systems and hybrid/electric vehicle platforms. However, the Industrial Automation sector shows accelerated adoption, driven by Industry 4.0 mandates for integrated pneumatic and hydraulic control systems that rely heavily on robust DC solenoids for rapid valve switching. Competition within the market is intense, necessitating continuous innovation in coil materials, magnetic flux optimization, and manufacturing techniques to offer superior performance characteristics, such as reduced heat generation, extended operational life, and minimal acoustic noise, thus ensuring market differentiation and competitive advantage.

AI Impact Analysis on DC Solenoids Market

User queries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the DC Solenoids domain frequently revolve around predictive maintenance, optimization of actuation performance, and the potential for smart solenoids capable of self-diagnosis. Key themes include concerns about whether AI can reduce failure rates in high-stress applications like aerospace and heavy machinery, expectations for energy consumption optimization through intelligent duty cycle management, and the feasibility of using ML algorithms to fine-tune solenoid manufacturing tolerances for zero-defect production. Users anticipate that AI-driven quality control will revolutionize the inspection process, moving from manual checks to real-time, sensor-based analysis of solenoid operational parameters, thereby enhancing reliability and operational efficiency across critical infrastructure.

- AI-driven Predictive Maintenance: Utilizing sensor data from solenoids (temperature, current draw, response time) to predict potential failures before they occur, significantly improving uptime in industrial systems and complex automotive assemblies.

- Optimized Manufacturing Processes: Implementing machine learning algorithms for real-time adjustments of winding tension, core material selection, and heat treatment during production, leading to enhanced uniformity and reduced scrap rates.

- Smart Duty Cycle Management: AI controlling the pulse width modulation (PWM) of DC current based on real-time load and environmental factors, maximizing energy efficiency and extending the lifespan of the solenoid coil and mechanical components.

- Advanced Quality Inspection: Employing computer vision and acoustic signature analysis, powered by AI, to detect subtle defects in solenoid assembly or operation that are undetectable through conventional manual inspection methods.

- Automated Design Simulation: AI algorithms assisting engineers in optimizing electromagnetic design parameters, such as core geometry and magnetic materials, to achieve higher force output or lower power consumption for specific application constraints rapidly.

- Integration with IoT Ecosystems: AI enabling solenoids to communicate operational status and maintenance requirements directly within larger Industrial Internet of Things (IIoT) frameworks, facilitating system-wide diagnostics and remote control.

DRO & Impact Forces Of DC Solenoids Market

The DC Solenoids Market is significantly influenced by a confluence of driving forces, inherent limitations, and emerging opportunities, all impacting competitive dynamics and strategic decision-making. The principal driver is the pervasive trend of automation across all industrial verticals, necessitating reliable, high-speed electromechanical actuators for precise control of fluid, motion, and locking mechanisms. Simultaneously, the rapid global expansion of the Electric Vehicle (EV) industry acts as a major catalyst, as EVs require sophisticated DC solenoids for battery contactors, thermal management, and various safety features. The growing complexity of automotive transmission systems further enhances demand for proportional DC solenoids capable of modulating fluid flow precisely, ensuring smooth operation and enhanced fuel efficiency.

Despite strong drivers, the market faces notable restraints, particularly concerns over the power consumption and subsequent heat generation in continuously energized (non-latching) DC solenoids, which can limit their application in energy-sensitive or confined electronic systems. Furthermore, the volatility in the pricing and supply chain of critical raw materials, such as copper for windings and specialized steel/iron alloys for cores, presents manufacturing and cost challenges, potentially affecting profit margins. Another restraint involves the operational reliability challenge presented by extremely high cycle applications, where mechanical wear and fatigue, particularly in the plunger return springs, necessitate regular maintenance or component replacement.

Opportunities in this sector are abundant, primarily centered around the integration of DC solenoids into emerging technologies like hydrogen fuel cells and advanced robotics, which demand specialized, highly durable, and compact actuation solutions. The rise of smart manufacturing (Industry 4.0) provides a fertile ground for developing intelligent, networked solenoids with integrated sensors and microprocessors for real-time condition monitoring and diagnostic capabilities. The overall market dynamics suggest that while traditional market segments remain stable, the future growth trajectory is increasingly dependent on successful technological evolution towards smaller, faster, more energy-efficient, and digitally integrated solenoid solutions, significantly enhancing the impact forces of technological advancement and regulatory compliance.

Segmentation Analysis

The DC Solenoids Market is strategically segmented based on crucial dimensions, including the functional mechanism (Type), the specific industry utilizing the component (Application), and the purchasing category (End-User). This segmentation is vital for analyzing market dynamics, identifying high-growth niches, and formulating targeted business strategies. The segmentation highlights the technical diversity inherent in the market, ranging from simple on/off linear actuators to complex proportional control systems designed for modulating critical flows in precise industrial environments. Understanding the interplay between these segments is paramount for component suppliers aiming to align their product portfolios with evolving industry demands and technological mandates across different regions.

- By Type:

- Linear Solenoids

- Rotary Solenoids

- Latching Solenoids

- Proportional Solenoids

- By Application:

- Automotive (Fuel Systems, Transmission, Door Locks, Braking Systems)

- Industrial Automation (Pneumatic and Hydraulic Valve Control, Material Handling)

- Medical Devices (Fluid Dispensing, Diagnostic Equipment, Patient Monitoring)

- Aerospace and Defense (Actuators, Safety Systems, Fuel Flow Control)

- HVAC and Fluid Control (Refrigeration Systems, Water Management)

- Consumer Electronics

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Aftermarket and Maintenance, Repair, and Operations (MRO)

Value Chain Analysis For DC Solenoids Market

The value chain of the DC Solenoids Market begins with the upstream procurement of essential raw materials, primarily high-grade magnetic core materials (soft iron, specialized steel alloys), electrical conductors (copper wire for coils), and insulating materials. The core competence at the upstream level lies in sourcing high-purity, stable materials that ensure optimal magnetic flux density and minimal hysteresis loss, which directly correlates with the final solenoid efficiency and lifespan. Strategic relationships with specialized material suppliers are crucial to mitigating the risk associated with commodity price volatility and ensuring consistent quality, as minor variations in material composition can significantly affect the solenoid's performance characteristics, such as response time and holding force. This initial phase dictates the quality and cost base of the final product, necessitating rigorous material inspection and qualification processes.

The midstream phase involves the core manufacturing processes: coil winding, core machining, armature assembly, housing fabrication, and final testing. Manufacturers often invest heavily in highly automated precision winding machinery to ensure tight tolerances and consistent resistance in the electromagnetic coils, which is a key determinant of the solenoid's thermal stability and actuation force. Distribution channels form the critical link to the downstream market. Direct channels involve sales to large Original Equipment Manufacturers (OEMs), particularly in the automotive and aerospace sectors, where bespoke designs and high volumes necessitate close collaboration and technical support from the manufacturer. Indirect channels utilize specialized industrial distributors and fluid power component suppliers who serve smaller OEMs, maintenance providers, and the aftermarket segment, offering inventory management and localized technical expertise.

The downstream market comprises the end-users across diverse applications, ranging from high-precision medical pump manufacturers to large-scale industrial machinery integrators. The distribution strategy must be flexible; direct sales ensure deeper integration into complex projects, offering tailored solutions and faster feedback loops for product improvement. Conversely, indirect distribution ensures broad market penetration, especially in the MRO segment where immediate availability and standardized components are prioritized. The overall value chain emphasizes vertical integration for complex, high-reliability products, particularly in the defense and aerospace segments, while utilizing optimized, localized distribution networks for high-volume, standardized industrial and consumer products, ensuring both quality control and competitive lead times.

DC Solenoids Market Potential Customers

Potential customers for DC solenoids are highly diversified, encompassing sectors that rely on precise, reliable electromechanical actuation for critical functions. The largest segment of buyers consists of Original Equipment Manufacturers (OEMs) in the automotive industry, which procure millions of units annually for applications ranging from engine management and transmission control units to safety systems like ABS and advanced driver-assistance systems (ADAS). These buyers demand stringent quality controls, high-volume supply capabilities, and often require specialized solenoid designs that meet demanding thermal and vibration resistance standards specific to vehicular operation. The rapid growth of electric vehicle manufacturing has created a new class of high-volume OEM customers requiring specialized DC contactors and latching solenoids for high-voltage battery management systems.

Another major customer segment is the Industrial Automation and Robotics sector. Companies involved in factory automation, pneumatic and hydraulic control system manufacturing, and specialized machine building are key buyers. These customers utilize DC solenoids for controlling valve flow, sequencing operations, robotic grippers, and safety interlocks, often seeking proportional solenoids for fine control and robust construction suitable for harsh factory environments. Compliance with industry standards like ISO and specific regional safety mandates is a critical purchasing criterion for this group. Furthermore, the Medical Device manufacturing industry represents a high-value, albeit lower-volume, customer base, purchasing precision micro-solenoids for drug delivery systems, ventilator flow control, and sophisticated diagnostic instruments, prioritizing miniaturization, ultra-high reliability, and biocompatibility of materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Electric, TLX Technologies, Curtiss-Wright, Kendrion N.V., Lucas-TVS, Temic Automotive, Magnet-Schultz, Bimba Manufacturing, Deltrol Controls, Shiroishi Kogyo, M&S Solenoids, Geeplus, H. Kuhnke, Rotex Automation, Emerson Electric, Danfoss, Parker Hannifin, SMC Corporation, Festo, CNH Industrial. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DC Solenoids Market Key Technology Landscape

The technology landscape of the DC Solenoids Market is characterized by continuous advancements focused on improving efficiency, force-to-size ratio, and longevity. One critical area of development involves the optimization of magnetic materials. Manufacturers are increasingly utilizing specialized high-permeability ferromagnetic alloys for the plunger and core components to maximize the magnetic field generated by the coil, leading to higher actuation forces without increasing the electrical power input. This material science innovation allows for significant miniaturization, crucial for integration into complex, space-constrained electronic assemblies found in modern vehicles and portable medical equipment. Furthermore, advancements in coil winding techniques, such as utilizing flat wire or specialized bobbin designs, reduce the overall solenoid volume and improve heat dissipation, enabling higher duty cycles.

A major technological shift is the widespread adoption of electronic control interfaces, primarily leveraging Pulse Width Modulation (PWM) technology. PWM allows DC solenoids to be driven with variable current and voltage pulses, offering sophisticated control over actuation speed, holding force, and power consumption. This shift enables proportional control capabilities, transforming the solenoid from a simple on/off switch into a precise modulating device essential for applications like hydraulic proportional valves and fuel metering systems. Furthermore, integrating specialized embedded temperature and position sensors into the solenoid body is becoming standard practice. These sensors enable real-time diagnostic feedback, supporting predictive maintenance algorithms and ensuring that the solenoid operates within its optimal thermal and mechanical limits, directly boosting operational reliability.

The move toward latching solenoid technology represents a significant advancement for energy efficiency. Latching solenoids utilize permanent magnets in conjunction with the electromagnet, requiring only a momentary current pulse to switch the state (open or closed) and zero power to maintain that state. This technology is vital for battery-powered systems, emergency shut-off valves, and high-security locking mechanisms, providing inherent fail-safe capabilities and dramatically reducing energy overhead. Additionally, advanced finite element analysis (FEA) and computational fluid dynamics (CFD) are now routinely used in the design phase to simulate performance under various conditions, rapidly optimizing parameters such as damping, spring stiffness, and electromagnetic coupling, thereby accelerating the development cycle for highly customized, application-specific DC solenoid solutions.

Regional Highlights

- Asia Pacific (APAC) Dominance: The APAC region, led by China, Japan, South Korea, and India, holds the largest market share and is projected to exhibit the highest growth rate. This dominance is attributed to massive industrial infrastructure investment, robust growth in the domestic automotive industry (particularly EV manufacturing), and the establishment of global electronics and automation manufacturing hubs. The low-cost manufacturing advantages and expanding consumer base demanding advanced industrial machinery further fuel the regional market expansion, making APAC a critical region for investment in DC solenoid production capacity.

- North America (NA) Focus on High-Reliability: North America represents a mature yet highly demanding market characterized by stringent quality standards in aerospace, defense, and high-precision medical sectors. The demand here centers on high-performance, custom-engineered solenoids that meet rigorous military and aviation specifications. Technological innovation, especially in smart solenoids with integrated electronics and sensor packages for real-time diagnostics, is a key driver, supported by a strong domestic presence of major Tier 1 and aerospace contractors.

- Europe's Emphasis on Industrial Automation and Efficiency: Europe maintains a significant market position, primarily driven by advanced industrial automation (Industry 4.0 adoption) and a strong focus on energy efficiency standards. The market here demands proportional and latching solenoids for sophisticated fluid power systems and pneumatic controls in machinery. Germany and Italy, home to major automotive and industrial machinery manufacturers, are key contributors, emphasizing durability, regulatory compliance, and solutions tailored for challenging operational environments, such as high vibration and extreme temperatures.

- Latin America (LA) and MEA Emerging Opportunities: Latin America and the Middle East & Africa (MEA) are emerging markets showing gradual growth, largely tied to infrastructure development, oil and gas sector investments, and expanding local manufacturing capabilities. Solenoid demand in these regions is heavily influenced by construction equipment, agricultural machinery, and basic automation needs. Market entry strategies often focus on standardized, cost-effective solutions for fluid control and basic electromechanical actuation, with growth potential tied to ongoing urbanization and industrial modernization projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DC Solenoids Market.- Johnson Electric

- TLX Technologies

- Curtiss-Wright

- Kendrion N.V.

- Lucas-TVS

- Temic Automotive

- Magnet-Schultz

- Bimba Manufacturing

- Deltrol Controls

- Shiroishi Kogyo

- M&S Solenoids

- Geeplus

- H. Kuhnke

- Rotex Automation

- Emerson Electric

- Danfoss

- Parker Hannifin

- SMC Corporation

- Festo

- CNH Industrial

Frequently Asked Questions

Analyze common user questions about the DC Solenoids market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a DC solenoid and an AC solenoid?

The primary difference lies in the power source and core design. DC solenoids use direct current, typically featuring a solid, cylindrical core, offering reliable, quiet operation, and simpler control circuits. AC solenoids use alternating current, generally require a laminated core to prevent eddy currents, and are often louder but can generate high initial pull force, though they are less commonly used for precision control compared to DC types.

Which segment of the DC Solenoids Market is expected to see the fastest growth rate?

The Latching Solenoids segment is anticipated to exhibit the fastest growth. This is driven by their superior energy efficiency, requiring power only for switching, not holding. They are crucial components in electric vehicle battery management systems and various critical fluid control applications where power conservation and fail-safe operation are essential design criteria.

How is the adoption of electric vehicles (EVs) impacting the demand for DC solenoids?

EV adoption is a major market driver, significantly increasing demand for high-voltage DC solenoids, known as contactors, used in battery connection and disconnection for safety and charging management. Additionally, EVs require numerous small DC solenoids for thermal management systems, charging port locks, and interior electronic controls, boosting both volume and technology requirements.

What key technological trends are influencing the design of modern DC solenoids?

Key trends include miniaturization for high power-to-size ratios, integration of advanced electronic controls like Pulse Width Modulation (PWM) for proportional operation, and the incorporation of embedded sensors for real-time diagnostic monitoring and predictive maintenance capabilities, enhancing overall system intelligence and reliability.

Which region currently leads the global DC Solenoids Market in terms of market size?

The Asia Pacific (APAC) region currently leads the global DC Solenoids Market size, primarily due to its expansive industrial base, high-volume production of automotive components, especially in China and India, and pervasive government investment in sophisticated automation infrastructure across manufacturing sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager