DDAF Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432905 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

DDAF Film Market Size

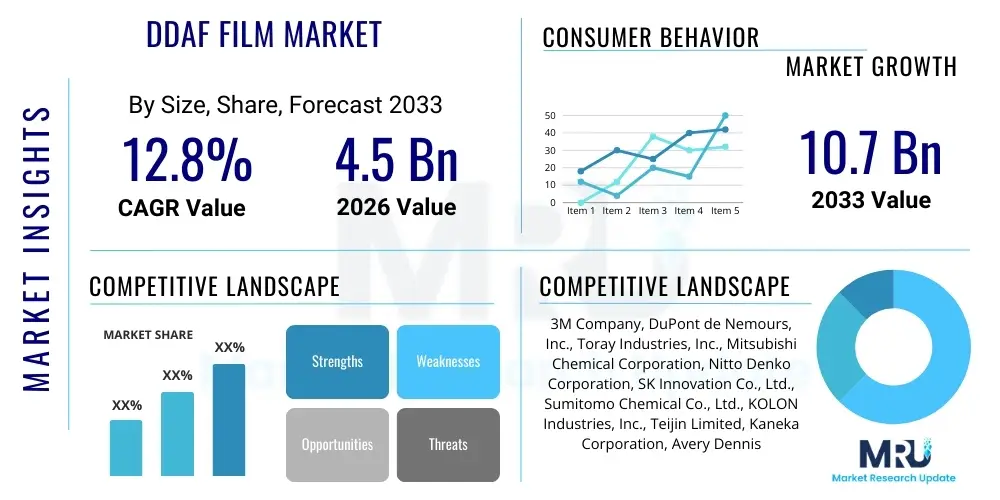

The DDAF Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% (CAGR) between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 10.7 Billion by the end of the forecast period in 2033.

DDAF Film Market introduction

The DDAF Film Market, often associated with highly specialized polymer films used primarily in advanced display technology, semiconductor manufacturing, and high-performance optical applications, is characterized by its demand for exceptional precision and functional integration. These films, standing for Dual-Directional Anti-Fog or a similarly complex technical nomenclature relevant to light management or protective coatings, serve critical roles in enhancing product longevity, optical clarity, and operational efficiency across various consumer and industrial electronics. The product category encompasses a diverse range of multilayered films, including barrier films, functional coatings, and specialty optical sheets, each engineered to meet stringent performance requirements such as moisture resistance, thermal stability, and superior light transmittance. The complexity of manufacturing DDAF films demands high capital expenditure and sophisticated coating and lamination techniques, positioning the market as technology-intensive and innovation-driven. Furthermore, the inherent need for customization based on end-user specifications, particularly in the premium display sector, drives continuous research and development efforts among key market participants.

Major applications of DDAF Film span across flexible displays (OLED, micro-LED), automotive smart glass, advanced medical imaging screens, and specialized protective packaging requiring high barrier properties. In the display segment, DDAF films are crucial for minimizing internal reflections, managing thermal dissipation, and providing scratch resistance, thereby directly contributing to improved visual quality and durability of premium electronic devices. The proliferation of foldable and rollable screen technologies acts as a significant catalyst, as these innovative form factors necessitate films that can withstand dynamic mechanical stress while maintaining performance integrity. The shift toward miniaturization and higher integration density in electronic components further mandates the use of ultra-thin, high-performance DDAF solutions, pushing material science boundaries.

The core benefits derived from DDAF Film adoption include enhanced product lifespan, superior optical performance, and reduced maintenance costs for end-products. Driving factors for market expansion are fundamentally linked to the global acceleration of digitalization, the rapid adoption of 5G technology necessitating new device architectures, and increasing consumer demand for high-resolution, immersive display experiences across all device categories. Regulatory advancements promoting energy efficiency and sustainable materials also influence product development, pushing manufacturers toward bio-based or recyclable film substrates. The market's growth trajectory is therefore deeply intertwined with macroeconomic trends in consumer electronics production and the continuous advancement of semiconductor and display fabrication processes.

DDAF Film Market Executive Summary

The DDAF Film Market is experiencing robust expansion driven primarily by escalating demand from the Asia Pacific region, particularly South Korea, China, and Taiwan, which collectively dominate global display and semiconductor manufacturing capacity. Business trends indicate a strong focus on strategic mergers and acquisitions among established players aiming to consolidate technological expertise and secure intellectual property rights related to novel coating chemistries and deposition techniques. Furthermore, there is a distinct trend towards vertical integration, where film manufacturers are increasingly partnering directly with Original Equipment Manufacturers (OEMs) to tailor film specifications precisely to new product launch requirements, minimizing time-to-market. The competitive landscape is intensely focused on material innovation, specifically exploring next-generation functional materials like graphene and metal oxides to further enhance film performance attributes such as conductivity and flexibility, a necessity for future generations of flexible electronics.

Regional trends highlight that while APAC serves as the primary production hub and largest consumption area, North America and Europe demonstrate substantial growth in high-value, niche applications such as aerospace display systems and advanced photovoltaic modules, where stringent quality control and customized solutions command premium pricing. European market growth is also supported by rigorous environmental standards, stimulating innovation in eco-friendly and solvent-free coating technologies. Emerging markets in Latin America and the Middle East, though currently smaller, present significant long-term potential fueled by increasing foreign investment in localized electronics assembly and infrastructure development projects that require high-performance materials for construction and automotive sectors. The varying regulatory frameworks across these regions necessitate a geographically tailored market entry and product compliance strategy for global manufacturers.

Segment trends underscore the dominance of the functional coating segment, particularly films engineered for enhanced barrier properties against oxygen and moisture, essential for sensitive electronic components. By material type, polymer-based films, including PET and PEN, remain foundational, but the highest growth rate is anticipated in specialty hybrid films combining polymer matrices with inorganic nanoparticles for superior optical and mechanical resilience. In terms of end-use, the consumer electronics segment—encompassing smartphones, tablets, and wearable devices—continues to be the largest revenue generator. However, the automotive sector, driven by the integration of large-format dashboard displays and sophisticated Heads-Up Display (HUD) systems, is forecast to exhibit the most accelerated growth, requiring highly durable and thermally stable DDAF solutions that meet rigorous automotive safety standards and lifespan requirements.

AI Impact Analysis on DDAF Film Market

Common user inquiries concerning AI’s influence on the DDAF Film Market predominantly revolve around three critical areas: Can AI optimize the complex manufacturing process to reduce defect rates and material waste? How will AI-driven predictive maintenance models affect the lifespan and quality control of high-speed coating machinery? And, finally, is AI capable of accelerating the discovery and formulation of new functional film materials? These questions highlight a collective expectation that AI will primarily serve as a powerful tool for operational efficiency and accelerated R&D, rather than replacing the physical film product. Users seek assurance regarding quality consistency, desiring AI-powered inspection systems capable of real-time, micron-level defect detection during high-volume production, ultimately aiming for zero-defect output and faster market delivery of customized film solutions.

- AI-driven Quality Inspection: Implementation of deep learning algorithms for real-time, automated defect classification and rejection during the continuous roll-to-roll manufacturing process, significantly reducing reliance on manual inspection.

- Predictive Maintenance: Utilization of machine learning models to analyze sensor data from coating equipment, predicting potential machine failures and scheduling proactive maintenance, thereby maximizing uptime and operational efficiency.

- Material Informatics: AI systems accelerating the simulation and screening of novel polymer chemistries and functional additives, drastically shortening the R&D cycle for next-generation DDAF films with improved properties (e.g., enhanced flexibility or barrier performance).

- Supply Chain Optimization: Leveraging AI for predictive demand forecasting and inventory management of raw materials (polymers, solvents, functional nanoparticles), mitigating supply chain risks and improving responsiveness to market fluctuations.

- Process Parameter Optimization: Using reinforcement learning to fine-tune complex coating parameters (temperature, tension, speed, thickness) in real-time, ensuring optimal film uniformity and quality across different production batches.

DRO & Impact Forces Of DDAF Film Market

The DDAF Film Market is subject to a complex interplay of forces. Key drivers include the relentless global expansion of OLED and flexible display technologies, mandating specialized, durable film components. Simultaneously, the restraints revolve heavily around the high cost associated with raw material sourcing (especially rare earth elements and specialized polymers) and the extreme capital investment required for establishing and maintaining ultra-clean room manufacturing environments necessary for defect-free film production. The primary opportunity lies in the rapid adoption of electric vehicles and autonomous driving systems, which require vast areas of smart, durable display surfaces and sensors protected by high-performance films. These dynamics create a high-impact environment where technological breakthroughs in material science or process optimization can rapidly shift competitive advantages, while global economic volatility and geopolitical tensions related to critical material sourcing act as persistent, high-magnitude external impact forces influencing overall market stability and pricing structures.

Segmentation Analysis

The DDAF Film Market is fundamentally segmented based on Material Type, Application, and End-Use Industry, reflecting the diverse and specialized requirements of its clientele. The Material Type segmentation differentiates between standard polymer substrates (like PET, PC, and PMMA) and advanced engineered materials, including hybrid films incorporating metal meshes, nanocoatings, or ceramic layers to impart specific functionalities such as increased conductivity or extreme abrasion resistance. Analyzing the market through these technical segments provides insight into the technological readiness and cost structures associated with different film generations. The complexity and performance variation between these material categories are substantial, influencing their suitability for ultra-premium applications versus standard protective use.

Application segmentation categorizes the market based on the functional role the film plays—for example, barrier films (oxygen/moisture control), optical films (polarizers, diffusers, anti-reflection), and structural films (adhesives, protective layers). Barrier films are experiencing exceptional demand growth due to the need to protect moisture-sensitive technologies like flexible OLEDs and quantum dot displays. Concurrently, the End-Use Industry segmentation highlights the primary revenue streams, ranging from Consumer Electronics (the largest segment) and Automotive to Healthcare and Aerospace. The increasing integration of touch interfaces and advanced sensing capabilities across all these industries ensures sustained demand for specialized DDAF films that can seamlessly integrate electronics and optics while offering robust environmental protection.

Strategic analysis of these segments reveals that while volume growth is driven by consumer electronics, the highest profitability margins often reside in the niche application segments such as high-temperature aerospace coatings and medical device films, which require extensive certification and unique performance guarantees. Therefore, market participants are strategically investing in both high-volume, cost-efficient production lines for consumer markets and specialized, lower-volume facilities dedicated to high-performance industrial applications. The detailed understanding of segmental dynamics is crucial for targeted product development and effective resource allocation.

- By Material Type:

- Polymer Films (PET, PEN, PC, PI)

- Hybrid Films (Inorganic/Organic Composites)

- Metal Mesh Films

- Inorganic Coated Films (SiO2, Al2O3)

- By Application:

- Barrier Films (Moisture and Oxygen)

- Optical Films (Anti-Reflection, Anti-Glare, Diffusion)

- Protective Films (Scratch and Abrasion Resistance)

- Adhesive Films

- By End-Use Industry:

- Consumer Electronics (Smartphones, Tablets, Wearables)

- Automotive (HUD, Interior Displays, Smart Windows)

- Healthcare (Medical Imaging, Diagnostic Screens)

- Aerospace and Defense

- Industrial and Commercial Displays

Value Chain Analysis For DDAF Film Market

The DDAF Film market value chain commences with the upstream analysis, focusing on raw material procurement, which includes the synthesis of specialized polymer resins (such as high-grade polyimides or specific polyesters), sourcing of functional nanoparticles (like ITO, Ag nanowires, or metal oxides), and procurement of specialty solvents and additives. This stage is dominated by large chemical companies and specialized material suppliers whose pricing and availability directly influence the downstream manufacturing costs. Fluctuations in petroleum prices and geopolitical stability in key chemical producing regions pose significant risks to this part of the chain. Manufacturers of DDAF films must maintain robust supplier diversity and focus on efficient material usage to mitigate high input costs and ensure the purity required for optical-grade products.

The midstream process involves the core manufacturing activities: substrate preparation, specialized coating (via roll-to-roll, slot die, or vacuum deposition techniques), curing, lamination, and precise slitting/die-cutting. This segment is highly capital-intensive, requiring expensive cleanroom environments and complex, high-speed machinery. Quality control and technological differentiation primarily occur here, where proprietary coating formulations and process patents define competitive advantage. Direct distribution channels often involve the film manufacturer selling large rolls or sheets directly to Tier 1 display module assemblers or end-product manufacturers (OEMs). This direct engagement facilitates customized product specifications and quicker feedback loops essential for rapid product iteration in electronics manufacturing.

Downstream analysis involves the integration of the DDAF film into the final product, such as flexible displays, automotive interiors, or specialized windows. This segment is characterized by complex assembly processes and relies heavily on high-precision handling equipment. Indirect distribution channels primarily utilize specialized distributors or converters who perform final-stage processing (e.g., precise patterning or application-specific lamination) before supplying smaller volume integrators or niche market consumers. The efficiency of the entire value chain is critically dependent on seamless communication and strict quality standards maintained from the resin producer through to the final end-user application, emphasizing the importance of robust quality management systems throughout the supply network.

DDAF Film Market Potential Customers

The primary potential customers and end-users of DDAF films are highly sophisticated manufacturing entities operating within the electronics and specialized component fabrication sectors. This group includes Tier 1 display panel manufacturers (such as Samsung Display, LG Display, and BOE), who require vast quantities of optical and barrier films for their high-volume production of OLED and LCD modules used in televisions, monitors, and mobile devices. These customers prioritize high uniformity, consistent quality, and the ability of the film supplier to deliver films tailored to specific layer thicknesses and functional chemistries necessary for achieving specific display performance characteristics, like color gamut and viewing angles. The relationship with these major display manufacturers often dictates the technical roadmap for film innovation.

Another significant customer cluster is the assembly segment of the automotive industry, specifically OEMs and their Tier 1 suppliers specializing in interior components and advanced driver-assistance systems (ADAS). As vehicle interiors evolve into integrated digital cockpits featuring large, multi-functional touch displays and ambient lighting systems, the demand for DDAF films that offer superior thermal stability, anti-shattering properties, and highly effective anti-glare coatings becomes paramount. These buyers necessitate films that meet stringent automotive qualification standards (e.g., heat aging and vibration testing) and require long-term supply stability, given the extended life cycle of vehicle models compared to consumer gadgets.

Finally, niche industrial and medical device manufacturers represent high-value potential customers. In the healthcare sector, DDAF films are sought after for use in protective covers for diagnostic imaging equipment and surgical monitors, where clarity, resistance to harsh chemical cleaning agents, and antimicrobial properties are essential. Industrial customers, including manufacturers of ruggedized computing devices and outdoor signage, demand films with extreme environmental resistance (UV stability, chemical resistance, and wide temperature operation). These specialized buyers prioritize technical partnership and customization over high volume, often requiring bespoke film specifications and extensive application support from the film supplier.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 10.7 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, DuPont de Nemours, Inc., Toray Industries, Inc., Mitsubishi Chemical Corporation, Nitto Denko Corporation, SK Innovation Co., Ltd., Sumitomo Chemical Co., Ltd., KOLON Industries, Inc., Teijin Limited, Kaneka Corporation, Avery Dennison Corporation, Tesa SE, Eastman Chemical Company, DIC Corporation, CCL Industries Inc., Fuji Film Corporation, Dai Nippon Printing Co., Ltd., Honeywell International Inc., Heraeus Holding GmbH, Saint-Gobain S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DDAF Film Market Key Technology Landscape

The DDAF Film market's technological landscape is characterized by constant innovation in coating and material science, driven by the demanding requirements of next-generation electronic devices. Key technologies center on ultra-precision coating techniques necessary for depositing thin, uniform layers of functional materials onto flexible substrates. Slot die coating, micro-gravure coating, and sophisticated vacuum deposition methods like Physical Vapor Deposition (PVD) and Atomic Layer Deposition (ALD) are foundational. These methods enable the precise control of film thickness down to the nanometer level and are critical for achieving high barrier performance (measured in low WVTR – Water Vapor Transmission Rate) and optimal optical characteristics without introducing microscopic defects. Maintaining a cleanroom environment equivalent to ISO Class 4 or better is a technological prerequisite for maximizing yield and minimizing product failure in high-end DDAF production.

Furthermore, significant technological investments are focused on material composition, particularly the development of high-performance hybrid films. This involves integrating inorganic elements, such as transparent conductive oxides (TCOs) or ceramic nanoparticles, into flexible polymer matrices. The objective is to combine the flexibility and low cost of polymers with the superior electrical, thermal, or barrier properties of inorganic materials. For example, advancements in flexible transparent conductive films utilize silver nanowires (AgNWs) or metal meshes embedded in the film structure, replacing traditional Indium Tin Oxide (ITO) to improve durability and conductivity for foldable display touch sensors, addressing a key limitation of previous generations of films. Ongoing research in self-healing polymers and bio-degradable substrates is also starting to influence long-term R&D strategies.

The manufacturing process is increasingly reliant on sophisticated inline monitoring and control systems, representing a major technological advancement. High-speed, high-resolution inspection systems, often incorporating machine vision and specialized lighting techniques, are essential for identifying minute defects in real-time during the continuous production process. Coupling these vision systems with AI-driven analytics allows for instantaneous process adjustments, maximizing material utilization and ensuring that films meet the incredibly strict defect tolerances required by leading display manufacturers. This technological convergence of material science, precision engineering, and advanced data analytics defines the cutting edge of the DDAF film manufacturing process, ensuring scalability and consistency for complex multilayer film stacks.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the undisputed epicenter of the DDAF Film Market, driven by its overwhelming concentration of global display panel manufacturers (e.g., in China, South Korea, Taiwan) and semiconductor foundries. This region accounts for the largest share of both consumption and production volume, fueled by massive capital investment in advanced electronics manufacturing capacities, particularly for flexible OLED production and 5G-enabled device assembly. Key growth drivers include robust domestic markets and export-oriented electronics giants.

- North America: Characterized by high-value, niche applications, North America is a critical market for DDAF films used in aerospace displays, medical devices, and high-performance automotive cockpits. Growth is slower in terms of volume but extremely high in terms of value per unit, due to stringent performance requirements and the need for custom-engineered solutions. Strong R&D capabilities and the presence of leading material science firms sustain innovation in this region.

- Europe: The European market demonstrates steady demand, heavily influenced by the automotive sector, especially Germany and France, where advanced HUD systems and integrated vehicle displays necessitate high-quality optical and durable protective films. Furthermore, European regulatory pressures push for sustainable manufacturing, favoring suppliers developing eco-friendly coating materials and processes.

- Latin America (LATAM): Currently a nascent market for DDAF films, LATAM exhibits growth potential driven by increasing foreign investment in localized electronics assembly and the modernization of infrastructure, requiring industrial displays and protective coatings. Market development is focused on imported finished goods, but local manufacturing hubs are expected to gradually increase their demand for raw film materials.

- Middle East and Africa (MEA): Growth in MEA is primarily linked to large-scale infrastructure projects, expansion of commercial displays (digital signage), and adoption of high-end consumer electronics. The region serves as a crucial area for protective films designed to withstand extreme environmental conditions, particularly high heat and dust, requiring specialized UV-resistant and thermally stable DDAF formulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DDAF Film Market.- 3M Company

- DuPont de Nemours, Inc.

- Toray Industries, Inc.

- Mitsubishi Chemical Corporation

- Nitto Denko Corporation

- SK Innovation Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- KOLON Industries, Inc.

- Teijin Limited

- Kaneka Corporation

- Avery Dennison Corporation

- Tesa SE

- Eastman Chemical Company

- DIC Corporation

- CCL Industries Inc.

- Fuji Film Corporation

- Dai Nippon Printing Co., Ltd.

- Honeywell International Inc.

- Heraeus Holding GmbH

- Saint-Gobain S.A.

Frequently Asked Questions

Analyze common user questions about the DDAF Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is DDAF Film and where is it primarily used?

DDAF Film refers to specialized, multi-layered polymer sheets engineered for high-performance applications, typically involving display optimization. It is primarily used in consumer electronics (flexible OLED screens, smartphones), automotive cockpits (Heads-Up Displays), and semiconductor fabrication for achieving superior optical clarity, mechanical durability, and environmental barrier protection against moisture and oxygen.

What are the main technological challenges limiting DDAF Film market growth?

The primary technological challenges include maintaining zero-defect film quality during high-speed, roll-to-roll manufacturing, mitigating the high production cost associated with ultra-pure raw materials (such as specialized polyimides), and developing films that can withstand the extreme bending radius required by future foldable and rollable device architectures without performance degradation.

Which geographical region dominates the DDAF Film production and consumption?

The Asia Pacific (APAC) region, driven by the major display and electronics manufacturing hubs in countries like China, South Korea, and Taiwan, dominates both the production and consumption of DDAF films. This dominance is a result of large-scale capacity investments and localized supply chains catering to the global consumer electronics industry.

How is AI impacting the manufacturing process of DDAF Films?

AI is significantly impacting DDAF film manufacturing by implementing deep learning algorithms for real-time, high-resolution defect detection during production, optimizing complex process parameters (e.g., coating thickness and speed), and streamlining predictive maintenance for expensive coating equipment, ultimately leading to higher yields and reduced waste.

What materials are driving innovation in the next generation of DDAF Films?

Innovation is centered on high-performance hybrid materials, specifically combining traditional polymers with functional inorganic components such as silver nanowires (AgNWs) for flexible transparency, ceramic nanoparticles for superior barrier properties, and advanced polyimides (PI) for enhanced thermal and mechanical resilience essential for foldable displays.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager