Debt Arbitration Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431914 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Debt Arbitration Market Size

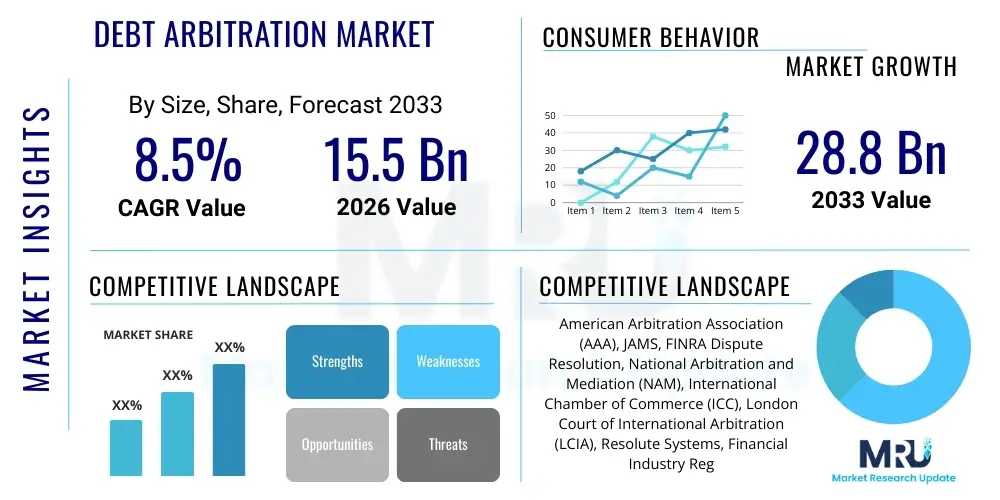

The Debt Arbitration Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 28.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the persistent increase in consumer debt globally, coupled with a regulatory environment increasingly favoring non-judicial and cost-effective methods for resolving financial disputes between debtors and creditors. The increasing burden of credit card debt and student loans, particularly in developed economies, necessitates efficient resolution mechanisms, positioning debt arbitration as a critical component of the financial ecosystem.

The valuation reflects the rising acceptance among financial institutions and consumers regarding arbitration as a superior alternative to lengthy and expensive litigation. Creditors leverage arbitration clauses to streamline dispute management, reduce operational overheads associated with court appearances, and maintain privacy in sensitive financial matters. Simultaneously, debtors benefit from quicker resolutions and potentially more favorable, confidential settlements facilitated by impartial third parties. The structural shift towards formalized Alternative Dispute Resolution (ADR) processes ensures sustained demand for specialized arbitration services, contributing significantly to the expanding market size over the forecast horizon.

Furthermore, technological advancements, including the implementation of specialized case management software and secure digital platforms for document exchange and virtual hearings, are enhancing the efficiency and accessibility of debt arbitration services. This modernization effort is crucial for managing high volumes of consumer debt cases efficiently, thereby expanding the capacity of service providers. The integration of data analytics for preemptive risk assessment and tailored settlement offers further solidifies the market’s expansion, attracting new players and investments aimed at optimizing the resolution lifecycle.

Debt Arbitration Market introduction

The Debt Arbitration Market encompasses the structured process of resolving financial disputes, primarily concerning outstanding consumer or commercial debt, through a neutral third-party arbitrator rather than traditional court litigation. This mechanism, formalized under specific contractual clauses or statutory provisions, offers a confidential, faster, and often less expensive route for debtors and creditors to reach a binding resolution. Major applications of debt arbitration include addressing disputes arising from credit card agreements, installment loans, mortgage foreclosures, and specific commercial contracts. The process is designed to analyze the merits of the claims and counterclaims, leading to a legally enforceable award or settlement that mandates specific actions from both parties, ensuring financial closure and mitigating prolonged legal uncertainty.

Key benefits driving the adoption of debt arbitration include significant reductions in the time and expense associated with litigation, the ability to select arbitrators with specific expertise in financial law, and the preservation of business relationships, which can be severely damaged by public court battles. For creditors, the predictability and enforceability of arbitration clauses are critical for portfolio risk management, while debtors often find the proceedings more accessible and less intimidating than the formal court system. This increasing preference for non-judicial resolution acts as a primary driving factor, supported by the global proliferation of unsecured debt and the necessity for scalable dispute resolution services in high-volume lending sectors.

Driving factors also include legislative mandates and consumer protection movements that promote fair and expedited resolution pathways for financially stressed individuals. The structure of the market is defined by specialized law firms, dedicated arbitration institutions (such as AAA or JAMS), and internal departments within major financial institutions that manage their extensive arbitration caseloads. The product—the arbitration service itself—is characterized by its impartiality, adherence to specific procedural rules, and the delivery of a conclusive, binding decision, making it an indispensable tool in modern debt management and recovery strategies across various jurisdictions.

Debt Arbitration Market Executive Summary

The Debt Arbitration Market is currently experiencing robust growth, driven primarily by persistent global consumer debt levels and a strong macroeconomic shift towards efficient Alternative Dispute Resolution (ADR). Business trends indicate a marked consolidation among specialized arbitration service providers, who are increasingly leveraging sophisticated technology platforms to handle the surging volume of cases stemming from credit cards, student loans, and personal insolvency matters. Major financial institutions are embedding robust arbitration clauses into new loan agreements, reflecting a strategic preference for private, manageable dispute resolution over public, unpredictable litigation. Furthermore, there is a growing trend of specialized fintech companies entering the market, offering AI-driven pre-arbitration mediation tools that streamline the initial negotiation phases and prepare cases more efficiently for formal arbitration, thereby reducing overall cycle times and operational costs for both parties.

Regionally, North America remains the dominant market, particularly the United States, due to the widespread inclusion of arbitration clauses in consumer contracts and a high prevalence of consumer debt. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapidly expanding middle classes, increasing access to consumer credit, and the maturation of legal frameworks in countries like India and China, which are actively promoting international commercial arbitration standards. Europe shows steady, mature growth, focusing on regulatory compliance and cross-border debt recovery mechanisms, often balancing between national consumer protection laws and the efficiency of private arbitration. These regional variations highlight different levels of maturity in ADR adoption and regulatory acceptance.

Segment trends reveal that arbitration focused on unsecured debt, particularly credit card balances, constitutes the largest market share due to its high volume and standardized nature. The fastest-growing segment, however, is arbitration concerning student loan debt, reflecting the increasing financial strain on younger generations globally. Service provider segmentation shows a clear demand for dedicated, large-scale arbitration institutions over smaller, independent law firms, owing to the former's capacity for handling large volumes and their perceived institutional neutrality. The future growth will be heavily reliant on technology adoption, specifically in leveraging machine learning to predict arbitration outcomes and optimize case scheduling, ensuring transparency and reducing administrative burden across all market segments.

AI Impact Analysis on Debt Arbitration Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance fairness and efficiency in debt resolution, specifically focusing on whether AI tools could replace human arbitrators or merely serve as sophisticated assistants. Common user questions revolve around the potential for algorithmic bias in settlement recommendations, the accuracy of AI in predicting case outcomes based on historical data, and the deployment of Natural Language Processing (NLP) to automate the review of complex legal documentation and evidence presentation. Users are generally keen on understanding how AI can democratize access to timely arbitration by lowering costs and speeding up the procedural aspects, especially concerning high-volume, low-value consumer debt cases. The underlying consensus suggests an expectation that AI will be transformative, moving the process away from manual document review and toward predictive, data-driven dispute management.

The analysis of these user queries reveals several key themes: first, a high expectation regarding AI’s ability to standardize case evaluation and reduce human subjectivity, leading to potentially fairer outcomes. Second, a concern about the ethical implications, particularly the potential for existing financial biases embedded in training data to be perpetuated by the AI models, which could disproportionately affect vulnerable debtor populations. Third, a strong interest in practical implementation, such as AI's role in optimizing the settlement process by determining the optimal negotiation range for both creditors and debtors before the formal arbitration stage begins. Overall, users anticipate that AI integration will primarily focus on administrative automation, evidence organization, and predictive modeling, rather than wholesale replacement of the arbitrator, who remains crucial for the judgment and application of legal principles.

Ultimately, AI is poised to significantly reduce the discovery phase and evidence preparation time in debt arbitration, allowing legal teams to focus on substantive arguments rather than procedural minutiae. Machine learning models can swiftly analyze vast databases of previous arbitration awards and court precedents to provide sophisticated strategic guidance to the parties involved, improving the quality of arguments presented and accelerating decision-making. This technological enhancement is expected to increase the scalability of arbitration services, making it a viable and attractive option for an even wider range of financial disputes, thereby broadening the overall market reach and operational efficiency. The integration will push the market toward becoming a more transparent and data-informed ecosystem.

- AI-driven predictive analytics optimizes settlement recommendations, improving negotiation efficiency.

- Natural Language Processing (NLP) automates the review and classification of contract documents and debt evidence, speeding up case preparation.

- Machine Learning models forecast arbitration outcomes, aiding strategic decision-making for both debtors and creditors.

- Automated virtual hearing platforms reduce logistical costs and enhance accessibility for remote participants.

- Implementation of smart contracts and blockchain technology for secure, auditable, and immutable arbitration record-keeping.

- Chatbots and conversational AI systems provide preliminary advice and intake services for debtors seeking resolution options.

- Enhanced detection of fraudulent claims or systematic unfair lending practices through sophisticated pattern recognition software.

DRO & Impact Forces Of Debt Arbitration Market

The dynamics of the Debt Arbitration Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its growth trajectory and resilience. A primary driver is the accelerating volume of global consumer debt, especially unsecured credit and student loans, which requires scalable resolution mechanisms that courts cannot efficiently provide. Supporting this are regulatory shifts in major economies that either mandate or strongly encourage the use of Alternative Dispute Resolution (ADR) for consumer financial matters, viewing it as essential for maintaining economic stability and consumer confidence. The cost-effectiveness and speed of arbitration compared to conventional litigation further cement its market position, attracting large financial institutions seeking to manage high-volume defaults efficiently. These driving forces ensure a continuous influx of cases into the arbitration system, necessitating market expansion and innovation in service delivery.

However, the market faces significant restraints that temper its potential. The major constraint is the persistent skepticism among certain debtor advocacy groups and consumers regarding the perceived impartiality of arbitral panels, particularly when the creditor institution repeatedly utilizes the same few arbitration providers—an issue often referred to as "repeat player bias." Furthermore, the non-mandatory nature of many arbitration agreements, coupled with state-level legislative attempts to restrict mandatory arbitration clauses, introduces legal uncertainty and inconsistency across jurisdictions. Operational restraints include the initial high cost of setting up a formal arbitration proceeding compared to direct negotiation, which can be prohibitive for individuals with very small debt balances, potentially limiting market penetration in the lowest tier of consumer debt disputes.

The opportunities within the Debt Arbitration Market are substantial and technology-driven. The integration of specialized fintech solutions, including AI-powered platforms for case screening and documentation, presents a critical opportunity to drastically reduce operational costs and enhance transparency, mitigating concerns about procedural bias. A second major opportunity lies in the specialization of services for burgeoning debt sectors, such as digital asset disputes and cross-border insolvency matters, which require specialized legal and technical expertise that general court systems often lack. Impact forces, such as global economic volatility leading to increased default rates and intensified competition among service providers pushing prices down, collectively dictate the market structure. The push for greater international harmonization of arbitration rules acts as a strong positive impact force, facilitating easier enforcement of awards across different countries and attracting larger, multinational financial institutions as consistent clients.

Segmentation Analysis

The Debt Arbitration Market is segmented across several critical dimensions, including the Type of Debt, the Service Provider category, and the End-User demographic, each reflecting distinct operational characteristics and demand patterns. Segmentation by debt type is crucial as it dictates the complexity and volume of the cases; for instance, standardized credit card disputes are high-volume and process-driven, contrasting sharply with complex, higher-value mortgage or commercial debt arbitration which requires highly specialized financial and real estate expertise. This foundational segmentation allows market participants to tailor their services, pricing models, and technological infrastructure to specific dispute categories, maximizing operational efficiency and expertise utilization.

Segmentation by Service Provider differentiates between large institutional bodies, which offer global reach and standardized procedures, and specialized law firms or boutique consulting agencies that provide customized, high-touch services often focused on complex corporate debt. The growth trajectory of dedicated arbitration institutions is notably stronger, benefiting from the perception of neutrality and economies of scale. Analyzing these segments is essential for understanding competitive dynamics, where larger players increasingly invest in digital platforms to process consumer cases at scale, while specialized providers maintain their niche by focusing on complex, bespoke resolutions in areas like syndicated loans or bankruptcy-related disputes. The clear delineation in service provision highlights the diverse needs of both debtors and creditors in the market.

Finally, segmentation by End-User (Individuals vs. Small Businesses vs. Large Corporations) dictates the case size and the legal resources deployed. Arbitration involving individual consumers focuses heavily on regulatory compliance, consumer protection, and quick, affordable resolutions, often dealing with unsecured debt. Conversely, arbitration involving large corporations generally relates to significant commercial disputes, inter-company debts, and complex financial instruments, demanding sophisticated legal and financial analysis. This multi-faceted segmentation structure is indispensable for market researchers and strategy developers seeking to identify high-growth areas and tailor their marketing efforts to specific client needs and regulatory environments within the dynamic debt resolution landscape.

- By Type of Debt:

- Credit Card Debt Arbitration

- Student Loan Debt Arbitration

- Mortgage and Real Estate Debt Arbitration

- Personal Installment Loan Debt Arbitration

- Commercial Debt Arbitration (B2B)

- By Service Provider:

- Dedicated Arbitration Institutions (e.g., AAA, JAMS)

- Specialized Law Firms

- Financial Institution Internal Arbitration Departments

- Online Dispute Resolution (ODR) Platforms

- By End-User:

- Individuals/Consumers

- Small and Medium Enterprises (SMEs)

- Large Corporations and Financial Institutions

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Debt Arbitration Market

The value chain of the Debt Arbitration Market begins with upstream activities centered on case origination and preliminary dispute management. This includes the initial identification of defaulted debt by creditors, the implementation of debt collection procedures, and the formal invocation of the arbitration clause embedded within the lending contract. Key upstream participants are financial institutions, loan servicers, and specialized debt collection agencies, who manage the flow of potential arbitration cases. Efficiency in this stage relies heavily on internal systems for tracking delinquencies and generating accurate documentation required for formal proceedings. The quality and comprehensiveness of the upstream data significantly determine the ease and speed of the subsequent arbitration process, making data standardization a critical value driver.

The core value addition occurs in the central arbitration phase, which involves the designation of the arbitrator, the exchange of legal briefs and evidence (discovery), the formal hearing (either virtual or in-person), and the issuance of the binding award. Service providers—dedicated arbitration institutions and specialized law firms—are the central nodes in this stage. Their value proposition rests on maintaining absolute impartiality, providing procedural expertise, and leveraging secure digital platforms for case management. Downstream activities involve the enforcement of the arbitration award, which may require confirmation in a court of law, debt restructuring, or initiation of legal recovery mechanisms. Effective downstream service ensures that the resolution achieved through arbitration translates into tangible financial closure for both parties.

Distribution channels for debt arbitration services are primarily direct, involving the contractual relationship between the financial institution and the arbitration body. However, indirect channels play an increasingly significant role, particularly through legal referral networks, specialized debt relief counselors, and online platforms that act as intermediaries, connecting debtors to appropriate resolution services. Direct distribution is preferred by large financial institutions for high-volume, standardized disputes, while complex commercial arbitration often utilizes indirect channels involving high-profile legal counsel. The integration of Online Dispute Resolution (ODR) platforms represents a crucial modernization of the distribution channel, offering scalability and accessibility that bypasses traditional geographical and logistical barriers, thus streamlining the overall flow of cases through the value chain.

Debt Arbitration Market Potential Customers

The primary customers of the Debt Arbitration Market are segmented based on their role in the credit lifecycle and the volume of disputes they generate. Financial Institutions, including commercial banks, credit unions, and non-bank lenders, represent the largest and most consistent customer base. They utilize arbitration services to efficiently manage risk, minimize litigation expenses, and enforce debt collection across massive portfolios of consumer and commercial loans. Their continuous demand for private and expedited resolution mechanisms is driven by the necessity to maintain high recovery rates while adhering to strict regulatory compliance, particularly concerning consumer protection laws. These institutions view arbitration as a strategic risk mitigation tool.

Another significant customer group comprises Individual Consumers and Households burdened by high levels of unsecured debt (e.g., credit card debt or student loans) who seek a structured, less adversarial path to resolution than bankruptcy or court action. While consumers are often the beneficiaries of the arbitration process—seeking debt modification or validation—they represent the ultimate end-users whose debt profiles dictate the case volume. Specialized debt settlement companies and consumer advocacy groups often serve as the immediate client gateway for these individuals, facilitating the arbitration process on their behalf. This segment’s demand is highly sensitive to macroeconomic indicators like unemployment rates and prevailing interest rate environments.

Furthermore, Small and Medium Enterprises (SMEs) and Large Corporations are key customers, primarily requiring arbitration services for commercial disputes such as vendor payment disagreements, breach of contract related to supply chain financing, or disputes arising from complex inter-company lending agreements. For large corporations, the emphasis is often on maintaining confidentiality and leveraging industry-specific expertise available through specialized arbitrators, which is crucial for protecting proprietary business interests. The demand from this segment is cyclical, often correlated with economic activity and M&A volume, but generally involves higher-value cases that require sophisticated procedural management and detailed financial analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 28.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Arbitration Association (AAA), JAMS, FINRA Dispute Resolution, National Arbitration and Mediation (NAM), International Chamber of Commerce (ICC), London Court of International Arbitration (LCIA), Resolute Systems, Financial Industry Regulatory Authority (FINRA), National Center for Dispute Settlement (NCDS), FairClaims, Resolution Forum Inc., Accord ADR Services, ADR Services International, CDRS, Arbitration Resolution Services, Mediate.com, New Era Debt Solutions, Consumer Debt Counselors, National Debt Relief. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Debt Arbitration Market Key Technology Landscape

The technology landscape of the Debt Arbitration Market is rapidly evolving, driven by the need for scalability, security, and enhanced transparency in dispute resolution. Central to this evolution is the deployment of sophisticated case management systems (CMS) that handle document storage, scheduling, communication, and financial tracking in a centralized and secure manner. These platforms replace fragmented manual processes, significantly reducing administrative overhead and minimizing procedural errors. Furthermore, the adoption of specialized e-discovery and data visualization tools allows parties to efficiently process massive amounts of financial evidence and transactional data, which is essential in complex debt cases. The ability to conduct secure, high-quality virtual hearings via integrated videoconferencing technology has become standard, dramatically increasing the market's reach and reducing the travel costs associated with traditional arbitration.

Artificial Intelligence (AI) and Machine Learning (ML) are emerging as critical transformative technologies within the sector. AI is primarily used for predictive analytics, where models are trained on historical arbitration outcomes to forecast potential awards or settlement values, providing legal teams with a strategic advantage during negotiation. Additionally, Natural Language Processing (NLP) tools automate the synthesis of key clauses from loan agreements and regulatory documents, speeding up the legal review process. These advanced technologies not only increase efficiency but also contribute to AEO and GEO goals by generating structured data that can be queried by search engines, making the arbitration process information more accessible to potential users seeking resolution options.

Another crucial technological development is the implementation of blockchain and distributed ledger technology (DLT) for maintaining an immutable, transparent record of all evidence presented, procedural steps taken, and the final arbitration award. While not yet widespread, DLT has the potential to address persistent concerns regarding the security and integrity of the process, particularly in cross-border debt arbitration where jurisdictional enforcement can be challenging. Furthermore, the rise of Online Dispute Resolution (ODR) platforms specifically designed for low-value consumer disputes leverages customized algorithms to facilitate automated negotiation and binding settlements without extensive human intervention, representing a cost-effective alternative for high-volume, standardized debt types, driving significant market expansion through technological enablement.

Regional Highlights

Regional analysis of the Debt Arbitration Market reveals distinct market characteristics and growth drivers across major global territories, heavily influenced by local regulatory frameworks, cultural acceptance of ADR, and regional debt consumption patterns. North America, particularly the United States, represents the largest and most mature market segment. This dominance is attributable to the long-standing legal acceptance of binding arbitration clauses in consumer financial agreements and the sheer volume of consumer credit outstanding. The region benefits from highly organized and well-established arbitration institutions, advanced technological adoption, and a legal culture that seeks efficient alternatives to crowded court dockets. Growth here is steady, focusing on regulatory compliance and technology optimization to manage existing high-volume credit card and student loan debt cases.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market due to rapid economic development, increasing access to consumer credit, and the gradual adoption of modern arbitration laws in large economies such as China, India, and Australia. As financial transactions and cross-border lending increase, disputes inevitably follow, creating massive demand for formal, efficient resolution mechanisms. While the acceptance of binding consumer arbitration is uneven across APAC nations, the growth in commercial debt arbitration is extremely robust, often following international standards established by bodies like the UNCITRAL Model Law. Investment in ODR platforms is also accelerating in this region to address the needs of vast, geographically dispersed populations.

Europe constitutes a mature, complex market characterized by a tension between national consumer protection laws and the efficiency demands of pan-European financial services. Mandatory consumer arbitration is less prevalent than in the US; however, commercial debt arbitration, particularly relating to corporate lending and cross-border insolvency, is highly utilized. The market is primarily driven by the need for harmonized resolution processes across the Eurozone. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but present significant long-term growth opportunities as financial inclusion increases and legal frameworks mature, with specific demand arising in areas like oil and gas financing and infrastructure debt disputes, necessitating specialized and culturally sensitive arbitration services.

- North America: Dominant market share driven by mandatory arbitration clauses, high levels of consumer debt (especially credit card and student loans), and advanced technology adoption by major institutions.

- Europe: Mature market focused on cross-border commercial debt resolution; constrained by varied national consumer protection regulations but supported by institutional excellence in international arbitration.

- Asia Pacific (APAC): Highest growth rate fueled by rapid economic expansion, increasing consumer credit penetration, and regulatory reforms favoring ADR in emerging economies like India and China.

- Latin America (LATAM): Developing market characterized by growing consumer credit demand and reliance on arbitration for resolving disputes related to resource extraction and infrastructure financing.

- Middle East and Africa (MEA): Emerging opportunities in commercial and financial disputes, driven by large-scale sovereign debt and project finance, seeking international standards for resolution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Debt Arbitration Market.- American Arbitration Association (AAA)

- JAMS (Judicial Arbitration and Mediation Services)

- FINRA Dispute Resolution Services

- National Arbitration and Mediation (NAM)

- International Chamber of Commerce (ICC)

- London Court of International Arbitration (LCIA)

- Resolute Systems, LLC

- Arbitration Resolution Services (ARS)

- FairClaims

- National Center for Dispute Settlement (NCDS)

- Accord ADR Services

- New Era Debt Solutions

- National Debt Relief

- Consumer Debt Counselors (CDC)

- ADR Services International

- Mediate.com

- Judicate West

- Resolution Forum Inc.

- CDR Services Inc.

- Consumer Arbitration Program (CAP)

Frequently Asked Questions

Analyze common user questions about the Debt Arbitration market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between debt arbitration and debt litigation?

Debt arbitration is a private, less formal process utilizing a neutral third-party arbitrator to reach a binding decision, typically faster and less costly than debt litigation, which occurs in the public court system and follows rigid judicial procedures. Arbitration emphasizes confidentiality and often involves industry-specific expertise.

Are arbitration awards legally binding and enforceable across jurisdictions?

Yes, arbitration awards are legally binding. In many jurisdictions, especially those that adhere to the New York Convention, a properly issued arbitration award is enforceable in courts worldwide, providing global enforceability crucial for international debt recovery and cross-border financial transactions.

How does AI impact the fairness and transparency of the debt arbitration process?

AI enhances transparency by standardizing case evaluation and evidence review, minimizing human error. It improves fairness by analyzing vast precedents to inform objective settlement ranges, though careful management is required to prevent algorithmic bias based on historical data patterns.

Which segment of debt represents the largest volume in the current arbitration market?

Arbitration concerning unsecured consumer debt, specifically high-volume credit card debt and general personal installment loans, currently constitutes the largest segment volume due to the widespread use of mandatory arbitration clauses in these standardized lending agreements globally.

What are the main alternatives to debt arbitration for consumers?

Main alternatives include direct negotiation with the creditor, participation in formal debt settlement programs, filing for personal bankruptcy (Chapter 7 or 13), or traditional court litigation. Arbitration is generally preferred over litigation for its cost-effectiveness and speed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager