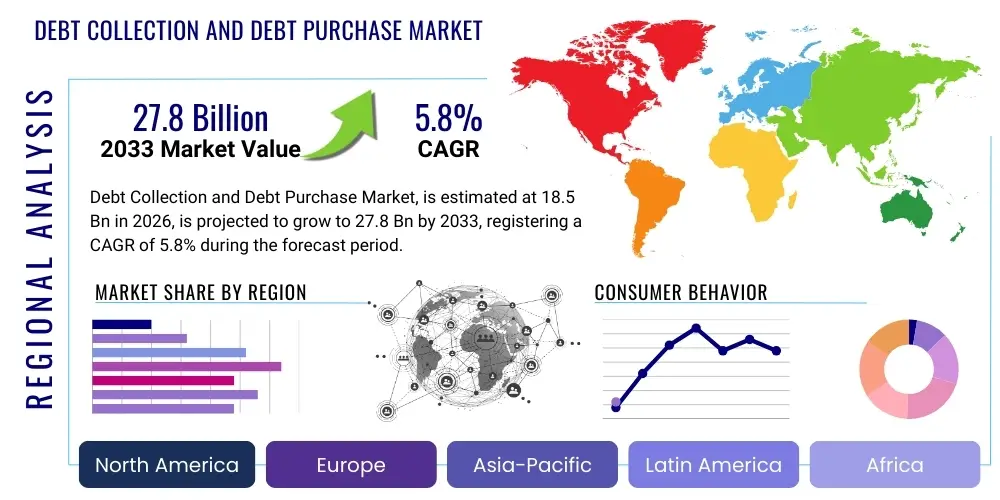

Debt Collection and Debt Purchase Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439702 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Debt Collection and Debt Purchase Market Size

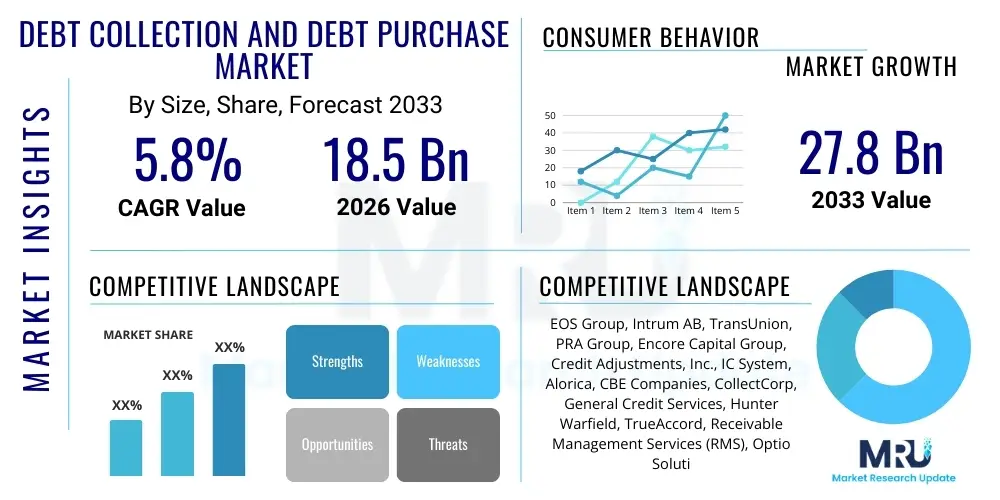

The Debt Collection and Debt Purchase Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.8 Billion by the end of the forecast period in 2033. This robust growth is primarily driven by an increasing global debt burden across consumer, commercial, and government sectors, coupled with the rising complexity of financial products and the evolving regulatory landscape surrounding debt recovery practices. The market encompasses a broad spectrum of services, including first-party and third-party collection, as well as the outright purchase of non-performing loans (NPLs) and other delinquent receivables from financial institutions and other creditors seeking to offload risk and improve balance sheet liquidity.

The market's expansion is further fueled by technological advancements, such as the integration of artificial intelligence and machine learning, which enhance efficiency, predictive analytics, and personalized communication strategies in debt recovery. As economies fluctuate, the demand for specialized debt management solutions intensifies, providing consistent opportunities for market players. Furthermore, the increasing sophistication of data analytics allows for more precise targeting of debtors and optimized collection strategies, contributing significantly to the market's overall value and sustained growth trajectory over the forecast period.

Debt Collection and Debt Purchase Market introduction

The Debt Collection and Debt Purchase Market is a crucial component of the global financial ecosystem, providing essential services that manage and recover outstanding debts for creditors across various sectors. This market primarily revolves around two core activities: debt collection, where agencies act on behalf of the original creditor to retrieve overdue payments, and debt purchase, where specialist firms acquire delinquent debt portfolios at a discount, assuming ownership and the associated risks and rewards of collection. The products and services offered range from early-stage collections and customer retention strategies to legal debt recovery and the management of distressed assets, tailored to diverse debt types including consumer credit, mortgage, student loans, utilities, and commercial debts.

Major applications of these services are found in financial institutions, including banks, credit unions, and fintech lenders, as well as telecommunications companies, utility providers, healthcare organizations, and government entities. The primary benefits for creditors include improved cash flow, reduced operational costs associated with in-house collections, enhanced balance sheet health through the removal of non-performing assets, and compliance with stringent regulatory frameworks. For debt purchasers, the benefit lies in acquiring assets at a discount with the potential for significant returns, while simultaneously freeing up capital for creditors and mitigating their financial risks. This symbiotic relationship ensures market efficiency and liquidity in the credit markets.

Driving factors for this market's growth are multifaceted. A primary driver is the continuous expansion of credit markets globally, leading to higher volumes of both performing and non-performing loans. Economic downturns or periods of instability often exacerbate this, increasing the necessity for professional debt recovery. Additionally, the increasing complexity of regulatory compliance, such as GDPR, CCPA, and various national consumer protection laws, makes outsourcing to specialized agencies an attractive option for many creditors. Technological advancements, particularly in data analytics, AI, and automation, are further propelling the market by enabling more efficient, ethical, and effective collection strategies, improving recovery rates and customer experience.

Debt Collection and Debt Purchase Market Executive Summary

The Debt Collection and Debt Purchase Market is experiencing dynamic shifts, driven by evolving business trends, distinct regional developments, and granular segment-specific transformations. Business trends indicate a strong move towards digital transformation, with an emphasis on data-driven decision-making, predictive analytics, and omnichannel communication strategies to engage debtors effectively while maintaining a customer-centric approach. There is a growing inclination among creditors to outsource non-core activities, including debt collection, to specialized agencies that possess advanced technological capabilities and expertise in regulatory compliance. Furthermore, the market is seeing increased consolidation, as larger players acquire smaller, niche firms to expand their service offerings, geographical reach, and technological prowess. Ethical considerations and consumer protection are becoming paramount, pushing firms to adopt transparent and fair collection practices, often leveraging technology for better adherence to compliance standards and improved public perception. This also reflects a broader shift towards pre-emptive debt management and advisory services, aiming to prevent defaults rather than merely recovering them post-factum.

Regional trends reveal significant variations in market maturity, regulatory frameworks, and growth drivers. North America and Europe, as established markets, are characterized by sophisticated regulatory environments, high levels of outsourcing, and a strong focus on advanced analytics and digital solutions. These regions often see substantial activity in NPL portfolio sales, driven by bank deleveraging initiatives and stricter capital requirements. Asia Pacific, on the other hand, is emerging as a high-growth region, fueled by expanding credit markets, a burgeoning middle class, and increasing financial literacy, albeit with diverse regulatory landscapes across countries. Latin America and the Middle East & Africa are also showing considerable potential, primarily driven by expanding consumer credit, economic development, and the gradual formalization of financial systems, leading to a greater need for structured debt management. These emerging markets often present opportunities for innovative collection models tailored to local socio-economic conditions.

Segmentation trends highlight a diversification of services and specialization within the market. By debt type, consumer debt collection and purchase remain dominant, but commercial debt and specialized categories like healthcare or student loan debt are witnessing increasing sophistication in tailored solutions. Technology-driven segments, such as AI-powered collections and digital payment platforms, are experiencing rapid adoption, transforming traditional recovery methods. Client industry segmentation shows that while financial services are the primary clients, telecom, utilities, and healthcare sectors are increasingly relying on external agencies. The focus is shifting towards value-added services beyond mere recovery, including analytics, advisory, and proactive default prevention strategies, indicating a move towards a more holistic approach to credit risk management across all segments. This trend underscores the market's evolution from a reactive recovery mechanism to a proactive risk management partner for creditors.

AI Impact Analysis on Debt Collection and Debt Purchase Market

User inquiries regarding AI's impact on the Debt Collection and Debt Purchase Market frequently revolve around its potential to revolutionize efficiency, automate routine tasks, and enhance predictive capabilities. Common concerns include the ethical implications of AI-driven decisions, the potential for bias in algorithms, data privacy issues, and the impact on human employment within the sector. Users are also keen to understand how AI can personalize debtor interactions, improve recovery rates, and ensure regulatory compliance, alongside exploring its role in assessing credit risk and optimizing portfolio valuations. The overarching theme is a strong interest in AI's capacity to drive significant operational improvements and strategic advantages, balanced with a need for robust governance and responsible implementation to mitigate associated risks and foster trust among consumers and regulators.

- Enhanced predictive analytics for identifying high-risk accounts and optimizing collection strategies.

- Automation of routine tasks, such as initial outreach, payment reminders, and administrative processes, freeing up human agents for complex cases.

- Personalized communication strategies tailored to individual debtor preferences and financial situations, improving engagement and recovery rates.

- Improved data analysis capabilities for better segmentation of debt portfolios and more accurate valuation of distressed assets.

- Reduced operational costs through increased efficiency and fewer manual interventions in the collection lifecycle.

- Advanced fraud detection mechanisms, protecting both creditors and legitimate debtors.

- Real-time compliance monitoring and reporting, reducing the risk of regulatory breaches and ensuring ethical practices.

- Development of AI-powered chatbots and virtual assistants for 24/7 customer support and payment facilitation.

- Support for more empathetic and effective negotiation strategies by providing agents with relevant debtor insights.

DRO & Impact Forces Of Debt Collection and Debt Purchase Market

The Debt Collection and Debt Purchase Market is shaped by a confluence of powerful drivers, inherent restraints, emerging opportunities, and significant impact forces that dictate its trajectory and operational landscape. Key drivers include the ever-increasing volume of global credit issuance, which naturally leads to a proportional rise in non-performing loans (NPLs) and other delinquent accounts. Economic volatility and downturns also serve as powerful catalysts, pushing more consumers and businesses into debt and necessitating professional recovery services. Furthermore, the growing complexity of financial products and a globalized economy mean that creditors often face challenges in managing diverse debt portfolios internally, prompting greater reliance on specialized third-party agencies and debt purchasers who possess specific expertise and technology. The continuous need for financial institutions to maintain healthy balance sheets and comply with stringent capital adequacy regulations, such as Basel III, often compels them to offload NPLs, thus stimulating the debt purchase segment. The technological revolution, particularly in artificial intelligence, machine learning, and data analytics, is a significant driver, enabling more efficient, personalized, and ethical debt recovery processes.

Conversely, the market faces several notable restraints. Stringent and evolving regulatory frameworks, such as the General Data Protection Regulation (GDPR) in Europe, the Fair Debt Collection Practices Act (FDCPA) in the US, and various consumer protection laws globally, impose significant compliance burdens, increasing operational costs and limiting certain collection practices. Negative public perception and stigma associated with debt collection can hinder recovery efforts and damage brand reputation, requiring agencies to invest heavily in ethical practices and customer-centric approaches. Economic recovery periods, while generally beneficial, can also reduce the volume of NPLs available for purchase or collection, potentially impacting market growth temporarily. Additionally, data security concerns and the risk of cyber-attacks pose ongoing challenges, as agencies handle sensitive personal and financial information. The fragmentation of debtor data across multiple systems and the difficulty in obtaining accurate, up-to-date contact information also act as a constraint on efficiency.

Opportunities within this market are abundant and diverse. The expansion into emerging markets, where credit penetration is growing rapidly and debt recovery infrastructure is nascent, presents significant growth avenues. The increasing adoption of digital payment solutions and omnichannel communication strategies offers new, less intrusive ways to engage debtors and facilitate payments. Specialization in niche debt types, such as healthcare, student loans, or small and medium-sized enterprise (SME) debt, allows firms to carve out distinct competitive advantages. The growing demand for value-added services beyond mere recovery, including credit risk consulting, portfolio analytics, and preventative debt management solutions, opens new revenue streams. Strategic partnerships between traditional collection agencies, fintech companies, and data analytics providers are fostering innovation and expanding market reach. Impact forces such as technological disruption, regulatory shifts, changes in consumer behavior towards digital interactions, and macroeconomic fluctuations will continue to reshape the market. The increasing focus on Environmental, Social, and Governance (ESG) principles also impacts collection practices, driving demand for socially responsible and ethically sound approaches. These forces necessitate continuous adaptation and innovation from market participants to remain competitive and compliant, highlighting the dynamic nature of this critical financial sector.

Segmentation Analysis

The Debt Collection and Debt Purchase Market is highly segmented to address the diverse needs of creditors and the varied nature of outstanding debts. This segmentation allows market participants to specialize and tailor their services, enhancing efficiency and effectiveness in recovery efforts. Understanding these segments is crucial for strategic planning, market entry, and identifying growth opportunities within the industry, as each segment presents unique operational challenges, regulatory considerations, and technological requirements. The market is primarily segmented by debt type, service type, client industry, and regional presence, reflecting the multifaceted landscape of debt management and recovery.

- By Debt Type:

- Consumer Debt (Credit Cards, Personal Loans, Auto Loans, Mortgages, Student Loans)

- Commercial Debt (B2B Receivables, Trade Credit)

- Healthcare Debt (Medical Bills, Patient Accounts)

- Utility Debt (Electricity, Gas, Water, Telecommunications)

- Government Debt (Taxes, Fines, Social Security Overpayments)

- By Service Type:

- First-Party Collections (Outsourcing of early-stage collections)

- Third-Party Collections (Traditional debt collection agencies)

- Debt Purchase / NPL Portfolio Management (Acquisition of delinquent debt portfolios)

- Legal Collections (Litigation and enforcement services)

- Skip Tracing & Asset Location

- Credit Counseling & Debt Management Plans

- By Client Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications

- Utilities

- Healthcare

- Retail & E-commerce

- Government & Public Sector

- Automotive

- Real Estate

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Debt Collection and Debt Purchase Market

The value chain for the Debt Collection and Debt Purchase Market is intricate, involving multiple stakeholders from the point of original credit issuance to the final recovery of funds. At the upstream end, the value chain begins with the original creditors—banks, financial institutions, telecommunication companies, utility providers, and retailers—who extend credit or services to consumers and businesses. These entities are responsible for initial credit assessment, loan origination, and internal billing and collection efforts for performing loans. As accounts become delinquent, these creditors decide whether to pursue in-house collections, outsource to third-party agencies, or sell the non-performing loan (NPL) portfolios to debt purchasers. The efficiency of their internal processes, data accuracy, and the quality of customer relationships significantly influence the later stages of the value chain.

Downstream, the value chain encompasses the specialized activities of debt collection agencies and debt purchase firms. Debt collection agencies act as intermediaries, employing various strategies such as telephone calls, written correspondence, digital communications (email, SMS, chatbots), and legal actions to recover funds on behalf of the original creditor, typically for a contingency fee or fixed fee. Debt purchasers, on the other hand, acquire the legal ownership of delinquent debt portfolios at a discount, taking on the full risk and reward of collection. They then employ similar, or often more aggressive, collection strategies, frequently leveraging advanced analytics to maximize recovery. Both types of entities rely heavily on technology platforms for case management, communication, and compliance. Distribution channels in this market are predominantly direct, with creditors directly engaging collection agencies or debt purchasers. Indirect channels may involve brokers or intermediaries who facilitate the sale of NPL portfolios between multiple creditors and debt purchasers, especially for larger, more complex transactions. The integration of data analytics and AI tools across all these stages is enhancing the efficiency and profitability of the downstream activities, fostering a more sophisticated approach to debt recovery and management.

The efficiency and effectiveness of the entire value chain depend significantly on seamless information flow, robust technological infrastructure, and adherence to regulatory standards at each step. Upstream decisions by original creditors regarding underwriting and initial collection efforts directly impact the quality of debt portfolios entering the downstream market. Downstream players, including collection agencies and debt purchasers, differentiate themselves through superior analytical capabilities, ethical collection practices, and technological innovation. The choice between direct engagement with agencies/purchasers versus utilizing brokers for portfolio sales depends on the creditor's internal capabilities, the size and nature of the portfolio, and market conditions. Overall, the value chain is characterized by a continuous drive for optimization, aiming to balance recovery rates with cost efficiency and customer experience, while navigating a complex legal and ethical landscape. The evolving regulatory environment often dictates significant changes in operational methodologies across the entire chain, reinforcing the need for adaptive strategies and technology integration.

Debt Collection and Debt Purchase Market Potential Customers

The Debt Collection and Debt Purchase Market serves a wide array of potential customers, primarily encompassing any entity that extends credit or provides services on a deferred payment basis and subsequently faces challenges with overdue or non-performing accounts. The largest segment of end-users are financial institutions, including commercial banks, retail banks, credit unions, and fintech lenders, which regularly generate substantial volumes of consumer and commercial debt. These institutions leverage collection agencies to manage delinquent credit card accounts, personal loans, mortgages, auto loans, and business lines of credit, improving their liquidity and reducing their burden of non-performing assets. Debt purchasers offer banks a strategic avenue to offload large portfolios of NPLs, freeing up capital and enhancing their balance sheet health, particularly under stringent regulatory mandates.

Beyond traditional banking, the market's potential customers extend significantly into various other industries. Telecommunication companies frequently engage debt collection services for unpaid mobile phone bills, internet services, and subscription fees. Utility providers, including electricity, gas, and water companies, are consistent clients due to the recurring nature of their services and the prevalence of overdue accounts. The healthcare sector is also a major end-user, with hospitals, clinics, and individual practitioners outsourcing the collection of outstanding medical bills, which often involve complex insurance claims and patient payment plans. Retailers, e-commerce platforms, and other businesses that offer credit or operate on post-payment models also turn to specialized agencies to recover consumer and commercial receivables, protecting their profit margins and ensuring financial stability. Government bodies, at various levels, represent another crucial customer segment, utilizing debt collection services for overdue taxes, fines, student loan defaults, and various social security overpayments, aiming to ensure public fund recovery and fiscal responsibility. The common thread among all these potential customers is the need to efficiently recover outstanding monies, minimize financial losses, and maintain operational fluidity without diverting excessive internal resources to the often-complex and labor-intensive process of debt recovery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EOS Group, Intrum AB, TransUnion, PRA Group, Encore Capital Group, Credit Adjustments, Inc., IC System, Alorica, CBE Companies, CollectCorp, General Credit Services, Hunter Warfield, TrueAccord, Receivable Management Services (RMS), Optio Solutions, National Credit Systems, Revco Solutions, NCO Group, CMRE Financial Services, Midland Credit Management |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Debt Collection and Debt Purchase Market Key Technology Landscape

The Debt Collection and Debt Purchase Market is increasingly driven by sophisticated technological advancements that enhance efficiency, compliance, and recovery rates. Core to this landscape are robust debt collection software platforms that serve as the central nervous system for operations, managing case workflows, automating communication, tracking payments, and ensuring regulatory adherence. These platforms often integrate modules for customer relationship management (CRM) to maintain detailed debtor profiles, financial accounting tools for accurate record-keeping, and compliance engines that monitor interactions against legal requirements. The shift from manual processes to integrated digital solutions has profoundly impacted the speed and scalability of collection efforts, allowing agencies to manage larger portfolios with fewer resources while maintaining quality and transparency.

Furthermore, the market heavily relies on advanced data analytics and business intelligence tools. These technologies are crucial for segmenting debt portfolios, predicting debtor behavior, and optimizing contact strategies based on historical data and demographic information. Machine learning (ML) and artificial intelligence (AI) are rapidly gaining prominence, enabling predictive dialing, sentiment analysis during calls, automated negotiation, and highly personalized communication via chatbots and virtual assistants. AI-driven systems can identify the most effective channels and times to contact debtors, suggest optimal payment plans, and even flag potential compliance risks in real-time. This predictive capability significantly reduces wasted effort and improves the likelihood of successful recovery, transforming reactive collection into a proactive, data-informed process.

Beyond core platforms and analytics, other key technologies include omnichannel communication tools that integrate voice, email, SMS, and secure online portals to offer debtors flexible and preferred contact methods. Cloud computing provides the necessary scalability and flexibility for data storage and processing, supporting remote workforces and distributed operations. Robotic Process Automation (RPA) is increasingly being adopted to automate repetitive administrative tasks, such as data entry and report generation, further boosting operational efficiency. Security technologies, including advanced encryption and multi-factor authentication, are paramount to protect sensitive financial and personal data, ensuring compliance with data protection regulations and maintaining customer trust. The continuous evolution and integration of these technologies are reshaping the competitive landscape, making technological superiority a critical differentiator for market players seeking to optimize recovery, minimize costs, and navigate complex regulatory environments effectively.

Regional Highlights

- North America: A mature market characterized by stringent regulations (FDCPA, TCPA, CCPA), high adoption of digital collection tools, and a significant volume of consumer and commercial debt. The US leads in market size and technological innovation, with Canada showing steady growth.

- Europe: Highly fragmented market with diverse regulatory landscapes across countries (e.g., GDPR, national consumer credit laws). Strong focus on NPL portfolio sales driven by bank deleveraging. Western Europe is mature, while Eastern Europe is rapidly developing.

- Asia Pacific (APAC): Emerging as a high-growth region fueled by expanding credit markets, urbanization, and increasing consumer spending, leading to higher debt volumes. Varied regulatory maturity across countries (e.g., China, India, Australia), creating diverse opportunities.

- Latin America: Demonstrating significant growth potential due to increasing financial inclusion and consumer credit expansion. Market development is often driven by local economic conditions and evolving regulatory frameworks in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Nascent but rapidly growing market with increasing credit penetration, particularly in GCC countries and South Africa. Driven by economic diversification initiatives and the formalization of financial sectors, leading to a greater demand for professional debt management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Debt Collection and Debt Purchase Market.- EOS Group

- Intrum AB

- PRA Group

- Encore Capital Group

- TransUnion (Collections & Risk Solutions)

- Experian (Decision Analytics)

- CBE Companies

- Alorica

- IC System

- Credit Adjustments, Inc.

- National Credit Systems

- TrueAccord

- Hunter Warfield

- CollectCorp

- General Credit Services

- Receivable Management Services (RMS)

- Optio Solutions

- Revco Solutions

- CMRE Financial Services

- Midland Credit Management (a subsidiary of Encore Capital Group)

Frequently Asked Questions

Analyze common user questions about the Debt Collection and Debt Purchase market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between debt collection and debt purchase?

Debt collection involves an agency working on behalf of the original creditor to recover outstanding payments, typically for a fee or percentage. Debt purchase, conversely, means a company buys the delinquent debt portfolio from the original creditor at a discount, taking full ownership and the associated risks and rewards of collecting it themselves.

How is AI transforming the debt collection industry?

AI is transforming debt collection by enabling advanced predictive analytics for risk assessment, automating routine communication and administrative tasks, personalizing debtor interactions, and ensuring real-time regulatory compliance. It improves efficiency, recovery rates, and the overall customer experience by providing data-driven insights.

What are the main regulatory challenges faced by the market?

The main regulatory challenges include adhering to diverse and evolving consumer protection laws (e.g., FDCPA, GDPR, CCPA), managing data privacy and security, and ensuring ethical collection practices. Non-compliance can lead to significant fines and reputational damage.

Which industries are the primary clients for debt collection and debt purchase services?

The primary client industries are Banking, Financial Services, and Insurance (BFSI), Telecommunications, Utilities, Healthcare, Retail & E-commerce, and Government entities. Any business extending credit or deferred payment services is a potential client.

What are the growth prospects for the Debt Collection and Debt Purchase market in emerging regions?

Emerging regions, particularly in Asia Pacific and Latin America, offer significant growth prospects due to increasing credit penetration, expanding middle classes, and developing financial infrastructures. These regions are witnessing a growing need for formalized debt management solutions as their economies mature and credit markets expand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager