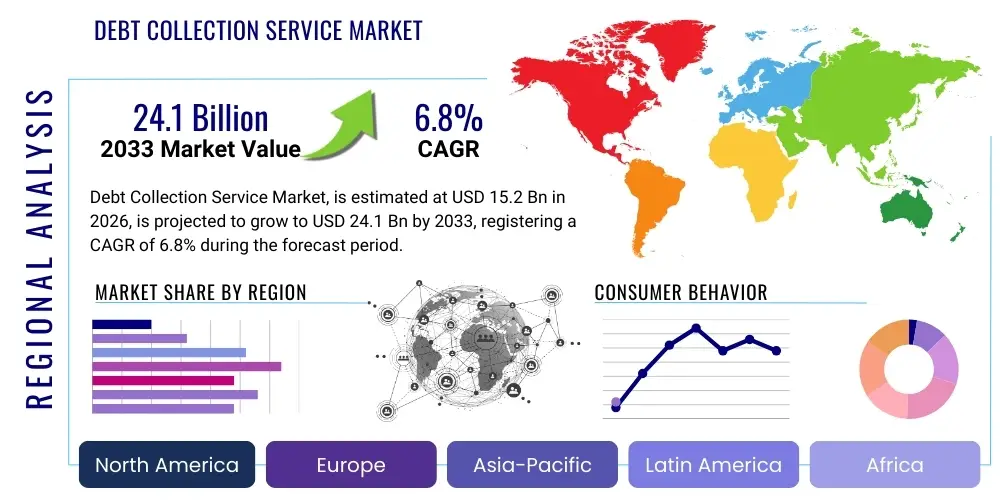

Debt Collection Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434966 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Debt Collection Service Market Size

The Debt Collection Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 24.1 Billion by the end of the forecast period in 2033.

Debt Collection Service Market introduction

The Debt Collection Service Market encompasses specialized financial services aimed at recovering outstanding debts owed by individuals or businesses to creditors. These services are crucial for maintaining liquidity and financial stability across various industries, including banking, healthcare, retail, and telecommunications. Market participants range from traditional third-party collection agencies to advanced debt purchasers and specialized legal firms. The primary services offered include early-stage collections (soft collections), late-stage recovery (hard collections), and debt buying. The operational landscape is highly regulated, necessitating compliance with consumer protection laws such as the Fair Debt Collection Practices Act (FDCPA) in the U.S. and equivalent legislation globally. This regulatory environment drives the need for sophisticated technology and compliant practices among service providers.

The product, or service, is defined by its ability to efficiently and ethically manage the lifecycle of delinquent accounts, optimizing recovery rates while preserving customer relationships where possible. Major applications span business-to-consumer (B2C) and business-to-business (B2B) debt recovery, addressing diverse asset classes from credit card debt and medical bills to commercial loans and utilities. The fundamental benefit provided by these services is the conversion of non-performing assets into cash flow for the creditor, simultaneously reducing operational overhead associated with internal collections and mitigating the impact of bad debt write-offs on financial statements. Furthermore, outsourced services offer specialized expertise, scalability, and access to sophisticated skip tracing and litigation management resources that are often unavailable in-house.

Driving factors for market growth include the steady rise in consumer debt levels globally, particularly in unsecured categories like credit cards and personal loans, coupled with the increasing complexity of regulatory frameworks which incentivizes creditors to outsource to compliant experts. Economic volatility and inflation pressures contribute significantly to default rates, fueling demand for professional recovery services. Furthermore, technological advancements, especially in predictive analytics and automation, are transforming collection efficacy and customer engagement strategies, allowing agencies to handle larger volumes of accounts with greater precision and adherence to personalized, customer-centric communication protocols, thereby enhancing both recovery potential and brand protection for the originating creditor.

Debt Collection Service Market Executive Summary

The Debt Collection Service Market is experiencing robust growth driven primarily by structural increases in global consumer and commercial indebtedness and accelerated adoption of digital transformation strategies by collection agencies. Business trends indicate a shift towards specialized, data-driven collection methodologies, moving away from high-volume, generic contact strategies. Integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive dialing, segmentation, and compliance monitoring is now standard practice among leading market players, enhancing operational efficiency and compliance rigor. Furthermore, merger and acquisition activities are consolidating the market, enabling larger entities to acquire specialized technology and expand geographical footprints, particularly in high-growth emerging economies where credit penetration is rapidly expanding. Regulatory scrutiny remains a core business challenge, compelling agencies to prioritize consumer experience and ethical engagement, transforming debt collection from a reactive process into a managed financial service.

Regional trends demonstrate North America's continued dominance, largely due to high levels of consumer debt, a mature outsourcing market, and rapid technological adoption in financial services. However, Asia Pacific (APAC) is projected to exhibit the fastest growth, propelled by the massive expansion of the middle class, burgeoning digital lending platforms, and increasing financial inclusion, which invariably leads to higher debt volumes requiring professional management. European market dynamics are characterized by strict adherence to GDPR and national debt collection regulations, fostering demand for technologically compliant collection services focused on sophisticated data governance. The adoption rate of cloud-based collection platforms is accelerating across all regions, replacing legacy on-premise systems to ensure flexibility and scalability in response to fluctuating economic conditions and regulatory changes.

Segment trends highlight the service component segment maintaining a larger market share, yet the software segment is poised for the higher growth rate, reflecting the industry's investment in automation tools such as debt collection software and integrated customer relationship management (CRM) platforms specifically designed for collections. By deployment model, cloud-based solutions are rapidly gaining traction over traditional on-premise solutions due to lower total cost of ownership (TCO) and enhanced capabilities for remote workforce management, a critical factor post-pandemic. Among end-users, the Banking, Financial Services, and Insurance (BFSI) sector remains the primary revenue generator due to the sheer volume of delinquent loans and credit products, while the healthcare sector is demonstrating significant growth, driven by rising medical expenses and complexity in payment cycles, creating substantial outsourcing opportunities for debt recovery specialists.

AI Impact Analysis on Debt Collection Service Market

User inquiries regarding AI's influence in the Debt Collection Service Market frequently revolve around ethical concerns, automation potential, and compliance adherence. Key themes include: "How can AI optimize contact strategies while maintaining FDCPA compliance?", "Will AI completely replace human collectors, or merely augment their capabilities?", and "What are the security implications of using machine learning models on sensitive financial data?". Users are intensely focused on AI's capability to generate highly personalized collection paths, predicting the debtor's willingness and ability to pay, thereby maximizing recovery efficiency without resorting to aggressive or non-compliant tactics. There is significant expectation that AI tools, such as natural language processing (NLP) in chatbots and conversational AI, will handle routine interactions, freeing human agents to manage complex, sensitive, or litigious cases. The collective expectation is that AI will be a transformative force, improving profitability through efficiency gains while concurrently lowering regulatory risk by enforcing strict compliance rules within the automated processes.

The introduction of sophisticated AI algorithms is fundamentally altering the traditional debt collection workflow, moving it from a reactive, volume-based outreach model to a proactive, predictive, and highly segmented approach. AI-driven scoring models utilize thousands of data points—including past payment history, engagement patterns, demographic data, and external economic indicators—to accurately prioritize accounts for contact. This precision minimizes unnecessary outreach to low-likelihood recovery accounts, concentrating resources on high-potential cases. Furthermore, AI systems are instrumental in optimizing communication channels and timing, determining whether a debtor is best reached via email, SMS, automated voice assistant, or live agent call, significantly enhancing the probability of successful contact and resolution.

Concerns about algorithmic bias and fairness are actively addressed by leading vendors through transparent model development and rigorous testing, ensuring that automated decisions comply with anti-discrimination laws. The adoption of AI is also paramount for advanced regulatory compliance, as AI engines can monitor and flag potential compliance violations in real-time during agent-customer interactions or automatically adjust automated communication scripts based on geographical or demographic regulatory requirements. This dual impact—improving both efficiency and compliance—is accelerating AI adoption, solidifying its role as the central technological backbone for modern debt collection operations worldwide.

- Enhanced Predictive Modeling: AI algorithms accurately forecast payment probability and optimal resolution strategies.

- Intelligent Automation: Use of Robotic Process Automation (RPA) and chatbots to handle routine inquiries and payment processing.

- Real-time Compliance Monitoring: AI systems analyze voice and text communications for regulatory adherence and violation flagging.

- Personalized Debtor Engagement: ML optimizes contact channels, timing, and messaging tone for increased recovery rates.

- Operational Cost Reduction: Automation minimizes the need for large manual call center staff for low-value tasks.

- Advanced Skip Tracing: AI analyzes vast datasets to locate debtors faster and more accurately.

- Risk Mitigation: Automated adherence to consumer protection laws reduces litigation exposure for creditors and agencies.

DRO & Impact Forces Of Debt Collection Service Market

The dynamics of the Debt Collection Service Market are powerfully shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the growth trajectory and operational challenges for industry stakeholders. A primary driver is the persistently high level of global consumer and corporate debt, stemming from accessible credit, coupled with macroeconomic volatility that pushes default rates higher, naturally increasing the inventory of delinquent accounts requiring professional management. This is further amplified by the shift among financial institutions and large corporations to outsource their non-core activities, including internal collections departments, to specialist agencies that offer scale and efficiency. Conversely, the market faces significant restraints, most notably the stringent and increasingly complex regulatory environment across major economies, which imposes heavy compliance burdens and operational costs, necessitating extensive technological investment to avoid punitive fines and reputational damage. Public perception and consumer sensitivity towards debt collection practices also act as a constraint, demanding ethical conduct and transparent communication.

Opportunities within the market primarily reside in the technological transformation of collection processes. The adoption of digital-first collection strategies, leveraging mobile applications, secure payment portals, and conversational AI, presents a massive opportunity to engage tech-savvy debtors effectively and reduce the reliance on traditional, costly phone-based outreach. Furthermore, expansion into underserved or rapidly developing markets, particularly in APAC and Latin America, where consumer credit markets are maturing quickly, offers substantial avenues for growth for international collection firms. The specialization of services, focusing on niche, high-value debt classes such as highly complex B2B receivables or specific segments of healthcare debt, allows agencies to command premium pricing and reduce competition from generalist firms. These opportunities require agility and investment in proprietary data analytics capabilities.

The primary impact forces driving competition and structural change include technological disruption (accelerated by AI and cloud computing), regulatory shifts (enhancing compliance requirements), and consolidation (driven by M&A activities). The necessity for technological investment to achieve AEO efficiency and meet regulatory standards acts as a barrier to entry for smaller, less capitalized firms, driving market concentration. The impact of economic cycles is profound; during downturns, the supply of delinquent debt increases, boosting market volume, but the quality of debt often decreases, requiring more intensive collection efforts. Conversely, during expansions, debt quality improves, but the volume might stabilize. Effective management of these forces—leveraging technology for compliance and efficiency while navigating economic cycles—is critical for sustained profitability and market leadership in the debt collection ecosystem.

Segmentation Analysis

The Debt Collection Service Market is meticulously segmented based on Component, Deployment Mode, Collection Type, and End-User, reflecting the diverse operational and technological landscape of the industry. Analyzing these segments provides a granular view of market dynamics, revealing where investment is flowing and which technologies are driving efficiency gains. The service component, encompassing outsourcing, contingency collections, and legal services, currently dominates the market share due to the specialized expertise and scale required for efficient debt recovery. However, the software segment, comprising dedicated collection management platforms, analytical tools, and communication suites, is the fastest-growing area, demonstrating the industry's commitment to automation and digital transformation to enhance recovery rates and ensure compliance.

Segmentation by deployment mode clearly illustrates the industry's rapid migration towards cloud-based solutions. Cloud deployment offers superior flexibility, scalability, and integration capabilities necessary for managing geographically dispersed operations and adapting quickly to evolving regulatory mandates, making it the preferred choice for new deployments and digital upgrades. While on-premise solutions still hold relevance, particularly for large financial institutions with legacy infrastructure and strict data sovereignty requirements, the trend is decisively moving towards secure, hybrid, or full cloud models. This shift impacts vendors by prioritizing platform-as-a-service (PaaS) and software-as-a-service (SaaS) offerings tailored for the collections industry, featuring robust security protocols and integrated compliance checks.

The end-user segmentation confirms the financial sector (BFSI) as the largest consumer of debt collection services, driven by vast consumer credit portfolios. Nevertheless, the fastest emerging segments are healthcare and telecom. The healthcare sector is struggling with complex patient billing and insurance fragmentation, leading to rising self-pay balances, creating a massive outsourcing opportunity. Similarly, the rapid churn and contract complexity in telecommunications necessitate professional recovery to manage high volumes of small, diverse debts efficiently. Understanding these segmental nuances is crucial for market participants looking to tailor their technology investments, operational models, and regulatory compliance strategies to capture targeted growth opportunities.

- By Component:

- Software (Collection Management Systems, Analytics, Communication Tools)

- Services (First-Party Outsourcing, Third-Party Collection, Litigation/Legal Services)

- By Deployment Mode:

- On-Premise

- Cloud-Based

- By Collection Type:

- Early Stage Collections (Soft Collections)

- Late Stage Collections (Hard Collections)

- Debt Purchasing/Debt Sales

- By End-User:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Telecommunications and Utilities

- Retail and E-commerce

- Government and Public Sector

Value Chain Analysis For Debt Collection Service Market

The value chain for the Debt Collection Service Market begins with the upstream suppliers, primarily technology providers and data enrichment services. Technology suppliers furnish the sophisticated Collection Management Systems (CMS), AI platforms for predictive analytics, and automated communication tools that form the operational backbone of collection agencies. Data suppliers provide credit reports, skip tracing information, and demographic data essential for locating debtors and assessing their ability to pay. The efficiency and quality of these upstream inputs directly determine the recovery rates and compliance capabilities of the collection firms. Strong relationships with vendors that offer compliant, customizable, and integrated technology stacks are critical for maintaining a competitive edge in a highly regulated industry.

Midstream activities involve the core collection agencies, which are the primary service providers responsible for executing the recovery process. This phase includes account segmentation, communication strategy development, debtor outreach (direct contact and digital engagement), negotiation, and payment processing. The distribution channel is predominantly direct, where creditors (e.g., banks, hospitals) contract directly with third-party collection agencies or utilize internal, first-party collection teams (often using software solutions). However, indirect distribution also plays a role, particularly through debt purchasers who buy delinquent portfolios at a discount and then employ collection agencies or their own recovery teams. Legal and compliance services also form a vital midstream component, ensuring all actions adhere to federal and local consumer protection laws.

Downstream analysis focuses on the interaction with the end-users (debtors) and the ultimate customer (the original creditor). The success of the value chain is measured by the recovery rate and the speed of cash conversion for the creditor, minimizing the loss from bad debt write-offs. Efficient distribution relies heavily on secure digital channels for payment and communication. Direct channels are favored for control and brand protection, especially in early-stage collections. Technology, particularly cloud-based SaaS platforms, streamlines the downstream flow by providing creditors with real-time access to account status, performance metrics, and compliance audit trails. The increasing emphasis on ethical debt resolution also impacts the downstream component, focusing on negotiation and rehabilitation rather than aggressive enforcement, thereby influencing long-term creditor-customer relationships.

Debt Collection Service Market Potential Customers

The primary consumers and end-users of Debt Collection Services are organizations across various sectors that extend credit, goods, or services on deferred payment terms, leading to the accumulation of accounts receivable that may become delinquent. These customers seek services to maximize cash flow recovery, minimize internal collection costs, and ensure compliance with complex regulatory mandates. The core buyer group is the Banking, Financial Services, and Insurance (BFSI) sector, encompassing commercial banks, credit unions, credit card issuers, mortgage companies, and peer-to-peer lending platforms, all of which generate massive volumes of unsecured and secured debt requiring specialized recovery efforts.

Beyond traditional financial institutions, the healthcare industry represents a rapidly expanding segment of potential customers. Hospitals, large physician groups, diagnostic labs, and medical billing companies face increasing challenges managing high-deductible plans and rising patient financial responsibility, leading to substantial growth in patient self-pay debt. These entities often lack the internal expertise and technology to manage consumer debt effectively and are increasingly outsourcing this complex task. The telecommunications and utilities sectors are also major buyers, managing high-volume, relatively small balances associated with monthly service contracts, requiring efficient, technologically driven collection solutions that handle high account churn.

Furthermore, government agencies at the federal, state, and local levels constitute a significant, though specialized, customer base, outsourcing the recovery of unpaid taxes, student loans, parking fines, and social security overpayments. Retailers and e-commerce platforms that offer proprietary credit cards or buy-now-pay-later (BNPL) schemes are emerging as high-growth customers, demanding agile collection services integrated with digital engagement strategies. Essentially, any organization that manages significant accounts receivable and faces credit risk represents a potential customer for both outsourced collection services and specialized collection management software solutions, driving demand for scalable, compliant, and technology-enabled recovery partners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 24.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PRA Group, Encore Capital Group, Transworld Systems Inc. (TSI), IQor, Alorica, Allied Global, Portfolio Recovery Associates, Receivables Management Partners, General Revenue Corporation, Asta Funding, Midland Credit Management, Credit Corp Group, Global Debt Recovery Services, Experian, FICO, Nucleus Software. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Debt Collection Service Market Key Technology Landscape

The technological landscape of the Debt Collection Service Market is undergoing rapid transformation, largely centered on enhancing automation, improving predictive accuracy, and ensuring rigorous compliance through advanced software solutions. The primary technological drivers include Artificial Intelligence (AI) and Machine Learning (ML), which are utilized extensively in credit scoring, debt segmentation, and determining the optimal contact strategy for each debtor. AI algorithms analyze massive datasets to predict the likelihood of payment, allocate accounts to the appropriate collection track (e.g., digital, human agent, litigation), and even dynamically adjust collection strategies based on real-time engagement data. This shift from bulk processing to individualized, data-driven engagement is the core of modern collections technology, significantly boosting recovery efficiency and reducing operational overhead associated with inefficient contact methods. Furthermore, these AI systems are integrated with sophisticated Natural Language Processing (NLP) tools that power advanced chatbots and automated voice assistants, enabling 24/7 self-service options and reducing the burden on human agents.

Robotic Process Automation (RPA) plays a crucial role in streamlining back-office operations, automating repetitive, high-volume tasks such as data entry, account scrubbing, payment reconciliation, and generating compliant documentation. RPA bots execute these processes faster and more accurately than human staff, minimizing errors and ensuring adherence to strict internal protocols and external regulations. The shift to cloud-based Collection Management Systems (CMS) is also a dominant technological trend. Cloud solutions offer unparalleled agility, allowing agencies to scale their operations instantly to handle fluctuating debt volumes and ensuring business continuity. They facilitate seamless integration of disparate systems, including CRM platforms, payment processors, and regulatory compliance databases, providing a unified, centralized view of the collection lifecycle and enhancing operational transparency for both the agency and the creditor clients.

Digital communication channels are mandatory technology components, driving the need for secure, omnichannel engagement platforms. These platforms support integrated outreach across SMS, email, secure web portals, and social media, ensuring that collection efforts meet the preferences of modern consumers while remaining compliant with communication regulations (e.g., TCPA). Cybersecurity and data governance technologies are paramount, given the sensitive nature of financial and personal data handled by collection agencies. Strong encryption, robust access controls, and real-time audit trails are essential features of modern collection software, mitigating the risk of data breaches and ensuring compliance with stringent data protection laws like GDPR and CCPA. The convergence of these technologies—AI for prediction, RPA for process efficiency, and cloud for scalability—defines the competitive edge in the contemporary debt collection market, making technology investment a prerequisite for market leadership.

Regional Highlights

The Debt Collection Service Market exhibits significant regional variation in terms of maturity, regulatory complexity, and growth dynamics. North America, particularly the United States, represents the largest market share globally. This dominance is attributable to the high levels of consumer debt (credit cards, mortgages, student loans), a deeply entrenched culture of credit usage, and a highly mature ecosystem of specialized collection agencies and debt purchasers. The U.S. market is technologically advanced, characterized by high adoption rates of AI and sophisticated compliance software driven by the rigorous requirements of the FDCPA, CFPB regulations, and state-specific laws. Canada also contributes significantly, though its regulatory landscape is slightly more fragmented across provincial jurisdictions. The maturity and scale of the BFSI and healthcare sectors in North America ensures continuous, high-volume demand for outsourced recovery services, solidifying its position as the leading revenue generator.

Europe constitutes the second-largest market, marked by intense regulatory diversity across member states and strict consumer protection mandates, notably the General Data Protection Regulation (GDPR). This regulatory environment necessitates highly sophisticated, technology-enabled compliance solutions. Western European countries, such as the UK, Germany, and France, possess mature credit markets and well-established collection industries. The growth trajectory in Europe is steady, driven by cross-border collections resulting from the integrated EU economy and the need for compliant solutions that respect varying national insolvency laws and communication restrictions. There is a strong trend towards ethical collections and rehabilitation strategies, moving away from aggressive tactics, which favors agencies leveraging digital, consent-based communication channels and offering flexible payment plans orchestrated by smart software.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid urbanization, massive expansion of digital lending platforms, and increasing financial inclusion across countries like China, India, and Southeast Asia. As credit penetration rises, so does the volume of non-performing loans (NPLs), creating vast opportunities for outsourced collection agencies. Many APAC markets are leapfrogging older collection technologies, adopting cloud-based, mobile-first solutions directly to handle the influx of new debtors. The diverse regulatory landscape and varying levels of enforcement across these nations require market participants to possess hyper-localized strategies. Meanwhile, Latin America (LATAM) and the Middle East & Africa (MEA) present burgeoning opportunities, characterized by volatile economies that generate high NPL ratios. Growth in these regions is often constrained by political instability and underdeveloped legal frameworks for debt recovery, yet the increasing institutionalization of financial services is steadily improving market conditions for structured collection services.

- North America: Market leader due to high consumer debt, mature financial sector, and advanced adoption of compliance-driven AI technology.

- Europe: Second largest market, growth driven by cross-border collections, strict adherence to GDPR, and demand for ethical, digital collection strategies.

- Asia Pacific (APAC): Fastest-growing region, boosted by expansion of digital lending, rising NPL volumes in China and India, and adoption of mobile-first collection solutions.

- Latin America (LATAM): Emerging market potential driven by high NPL ratios and increasing financial formalization, requiring localized, high-tech solutions.

- Middle East and Africa (MEA): Growth linked to increased banking activity and credit penetration, though often challenged by regulatory fragmentation and geopolitical instability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Debt Collection Service Market.- PRA Group

- Encore Capital Group

- Transworld Systems Inc. (TSI)

- IQor

- Alorica

- Allied Global

- Portfolio Recovery Associates

- Receivables Management Partners (RMP)

- General Revenue Corporation (GRC)

- Asta Funding

- Midland Credit Management (MCM)

- Credit Corp Group

- Global Debt Recovery Services

- FICO (Technology Provider)

- Experian (Technology/Data Provider)

- Nucleus Software (Technology Provider)

- CBE Group

- CollectAmerica

- Sitel Group

- Convergys Corporation (now part of Concentrix)

Frequently Asked Questions

Analyze common user questions about the Debt Collection Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.How is Artificial Intelligence (AI) fundamentally changing debt collection strategies?

AI transforms debt collection by enabling predictive analytics for optimal debtor scoring, automating routine contact via conversational interfaces (chatbots/voice assistants), and ensuring real-time compliance monitoring. This shifts the focus from manual, high-volume calls to highly targeted, compliant, and cost-efficient digital engagement strategies, maximizing recovery rates.

What are the primary drivers of growth in the Debt Collection Service Market?

Key drivers include persistently rising global consumer debt levels, increasing reliance on outsourcing by BFSI and Healthcare sectors to manage delinquent accounts, and the necessity for agencies to adopt advanced technology (like cloud and automation) to navigate complex and stringent regulatory requirements efficiently across multiple jurisdictions.

Which regional market shows the highest growth potential for debt collection services?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth. This acceleration is driven by the rapid expansion of unsecured digital lending, increasing financial inclusion among large populations, and the corresponding spike in Non-Performing Loans (NPLs) requiring professional, scalable recovery management solutions.

What are the major compliance challenges facing collection agencies globally?

Major compliance challenges revolve around adhering to stringent data protection laws such as GDPR (Europe) and CCPA (California), coupled with specific consumer protection acts like the FDCPA (US). Agencies must continuously invest in technology to ensure ethical conduct, verify communication limits, and maintain secure data handling protocols to mitigate litigation risk.

How does the segmentation by deployment mode affect the market outlook?

The market is rapidly shifting toward cloud-based deployment for collection management systems (CMS). Cloud solutions offer enhanced scalability, lower total cost of ownership (TCO), and superior integration capabilities needed for omnichannel communication and regulatory updates, making them the preferred choice over legacy on-premise systems for future deployments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager