Deburring Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436403 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Deburring Tools Market Size

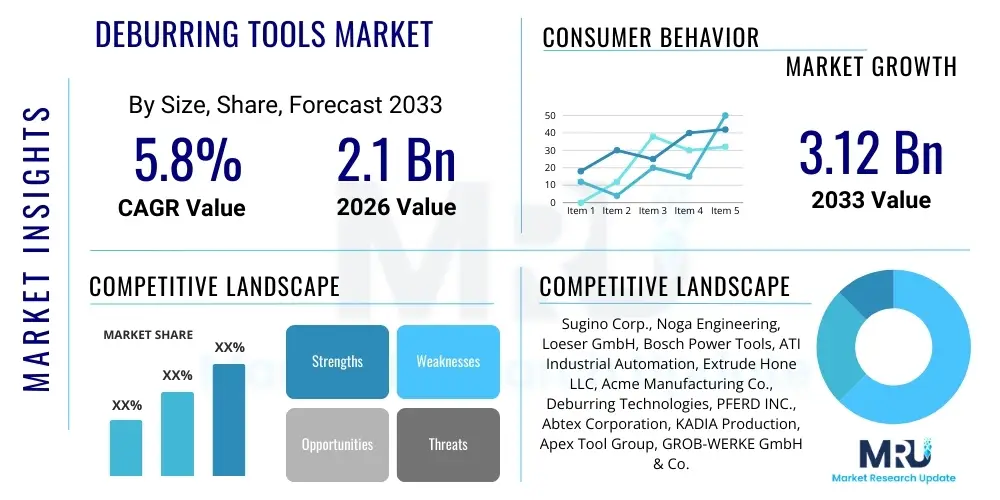

The Deburring Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.12 Billion by the end of the forecast period in 2033. This consistent expansion is driven by the global imperative for achieving high-precision components across critical manufacturing sectors, including aerospace, automotive, and medical device production. As manufacturing processes become increasingly complex, generating tighter tolerances and demanding superior surface finishes, the reliance on advanced and efficient deburring solutions is escalating, contributing significantly to market valuation growth. Furthermore, the shift towards automation in manufacturing necessitates integrated deburring solutions, reinforcing market momentum.

Deburring Tools Market introduction

The Deburring Tools Market encompasses various mechanical, chemical, and thermal systems designed to remove unwanted material projections, known as burrs, formed during machining operations such as drilling, milling, and stamping. Deburring is a critical post-processing step essential for improving component functionality, ensuring safety, and meeting stringent quality standards in finished products. Product descriptions range from simple handheld manual tools to highly sophisticated Automated Deburring Systems (ADS) utilizing CNC machining, robotic arms, or non-traditional methods like electrochemical deburring (ECM) or thermal energy method (TEM).

Major applications of deburring tools span numerous heavy and precision industries, notably automotive manufacturing (engine components, transmission parts), aerospace (turbine blades, structural elements), medical devices (implants, surgical tools), and general precision engineering. The primary benefits of effective deburring include enhanced dimensional accuracy, reduced friction and wear, improved component aesthetics, and increased lifespan of machinery. Crucially, in high-stress applications like aerospace and defense, burr removal prevents potential points of failure, ensuring operational reliability and compliance with rigorous safety regulations.

Driving factors for this market include the escalating demand for high-quality, zero-defect parts resulting from stricter regulatory environments and consumer expectations. Furthermore, the global proliferation of advanced manufacturing techniques, such as high-speed machining and the processing of complex materials (e.g., composites and specialty alloys), generates challenging burr formations that require specialized, efficient deburring solutions. The accelerating adoption of Industry 4.0 principles, integrating robotics and automation into production lines, further fuels the demand for automated and integrated deburring cells capable of high throughput and consistent quality.

Deburring Tools Market Executive Summary

The global Deburring Tools Market is experiencing robust growth, primarily propelled by the integration of automation technologies and the stringent quality requirements mandated by high-stakes industries. Business trends indicate a pronounced shift from manual operations toward automated and CNC-integrated deburring solutions, driven by the need to minimize labor costs, ensure process repeatability, and handle large volumes of complex parts efficiently. Key market participants are focusing intensely on developing hybrid deburring processes that combine mechanical removal with non-traditional methods, offering superior surface finishes and handling intricate geometries inherent in modern components. Furthermore, the focus on sustainable manufacturing is pushing innovation toward processes that minimize secondary waste and energy consumption.

Regional trends highlight the Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by rapid industrialization, massive investments in automotive and electronics manufacturing (particularly in China, India, and South Korea), and the increasing adoption of factory automation. North America and Europe maintain significant market shares, characterized by a strong presence of aerospace and medical device manufacturing, demanding sophisticated and high-precision automated systems. Segment trends reveal that the automated deburring equipment segment, including robotic systems and CNC integration kits, is exhibiting the highest growth rate due to its capacity for consistent, high-volume production. By application, the automotive industry remains the largest consumer, though the aerospace sector demands the most specialized and high-value equipment due to extremely tight tolerance requirements.

Overall, the market trajectory is characterized by technological convergence, where machine vision, advanced robotics, and specialized abrasive technologies are merging to create highly adaptive deburring solutions. Companies are strategically engaging in mergers and acquisitions to acquire niche expertise in specialized deburring techniques (e.g., micro-deburring for electronics) and expand their geographical reach, ensuring they meet the diverse regulatory and technical demands across global manufacturing hubs. The challenge remains in developing universally adaptable solutions capable of efficiently removing various types of burrs (feather burrs, rollover burrs, tear burrs) from diverse material compositions without compromising the parent material integrity.

AI Impact Analysis on Deburring Tools Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Deburring Tools Market predominantly center on how AI enhances quality control, optimizes robotic deburring paths, and predicts tooling wear. Common questions revolve around the use of machine vision for real-time burr detection, whether AI can automate decision-making regarding deburring parameters (speed, pressure, abrasive type), and how predictive maintenance models improve equipment uptime. Users are keenly interested in reducing reliance on subjective human inspection and achieving 'first-time-right' deburring outcomes through intelligent process control. The key themes summarized from user concerns focus on precision improvement, operational efficiency enhancement, and the cost justification of integrating complex AI systems into existing manufacturing workflows, particularly for high-mix, low-volume production environments.

AI's primary influence is realized through its ability to analyze massive datasets generated during the machining and deburring processes, translating raw sensor data into actionable insights. For automated deburring, AI algorithms optimize the robotic tool path based on geometric variations and real-time feedback from force sensors, ensuring uniform material removal and reducing cycle times significantly compared to pre-programmed or manually adjusted paths. Furthermore, AI-driven anomaly detection systems are crucial for identifying minute burrs or surface defects that conventional quality inspection methods might miss, guaranteeing compliance with micron-level tolerances required in medical or semiconductor components. This intelligence layer transforms deburring from a variable post-process into a highly controlled, optimized manufacturing step.

- AI-driven Machine Vision Systems for high-speed, non-contact burr detection and classification.

- Optimization of robotic trajectories and parameter selection (e.g., speed, feed rate, pressure) using deep reinforcement learning.

- Predictive maintenance schedules for deburring tools (abrasives, cutters) based on real-time wear analysis, minimizing unexpected downtime.

- Automated quality assurance and feedback loops, adjusting upstream machining parameters to minimize initial burr formation.

- Integration of cognitive services to interpret complex CAD models and automatically generate the most efficient deburring strategies for new components.

DRO & Impact Forces Of Deburring Tools Market

The dynamics of the Deburring Tools Market are shaped significantly by several intertwined Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. A major driver is the accelerating trend of miniaturization and the associated demand for micro-level precision in sectors like electronics and medical devices, necessitating highly controlled and precise burr removal techniques. Complementary to this, the global push toward fully automated manufacturing environments (Industry 4.0 adoption) mandates reliable, integrated deburring solutions that can operate autonomously within production cells, further boosting demand for robotic and automated equipment rather than manual tools. This trend is reinforced by increasingly stringent global quality control standards, particularly in regulated industries like aerospace (AS9100) and medical (ISO 13485), where a single residual burr can lead to catastrophic component failure.

However, the market faces notable restraints. The initial high capital expenditure required for sophisticated automated deburring systems, particularly those involving advanced robotics and custom fixtures, remains a significant barrier for Small and Medium Enterprises (SMEs). Technical challenges also persist, especially in achieving consistent and complete burr removal across complex, variable geometries and materials, as burr characteristics (size, shape, hardness) vary significantly based on the machining process. Additionally, the lack of standardized, objective metrics for burr measurement and removal effectiveness complicates the implementation and validation of automated solutions, demanding specialized skill sets for operation and maintenance.

Opportunities abound, particularly in the proliferation of Additive Manufacturing (AM). Components produced via 3D printing often require extensive post-processing, including the removal of support structures and surface texture refinement, creating a vast new application area for advanced deburring and surface finishing technologies like Abrasive Flow Machining (AFM) and electrochemical processes. Furthermore, the development of hybrid deburring technologies—combining mechanical, chemical, and thermal methods—offers a pathway to address complex geometries and tight tolerance requirements more effectively. The expansion of manufacturing capacity in emerging economies, driven by supportive government policies and low labor costs, represents a geographic opportunity for suppliers of cost-effective automated and semi-automated deburring solutions.

Segmentation Analysis

The Deburring Tools Market is segmented based on product type, operation mode, end-use industry, and technology, reflecting the diverse requirements of modern manufacturing environments. Segmentation analysis is crucial for understanding specific market niches and identifying high-growth areas, particularly where technological complexity intersects with industry demand. The segmentation by Product Type, differentiating between manual, semi-automated, and fully automated systems, highlights the ongoing shift toward higher efficiency and repeatability offered by automated solutions, which typically command higher prices and market share in mature industrial regions.

Further granularity is achieved through segmentation by End-Use Industry, where the market is critically dependent on capital investment cycles and regulatory frameworks specific to sectors such as automotive, aerospace & defense, electronics, and general machinery. For instance, the aerospace segment demands ultra-high precision, justifying investment in specialized technologies like Electrochemical Deburring (ECM) and Thermal Energy Method (TEM), while the automotive sector prioritizes high-volume throughput and robust, durable mechanical deburring systems. The segmentation by Technology, focusing on conventional abrasive methods versus non-traditional techniques (ECM, TEM, AFM), helps in gauging the adoption rate of cutting-edge, complex solutions essential for next-generation material processing.

- By Product Type:

- Manual Deburring Tools (Scrapers, Chamfering Tools)

- Semi-Automated Systems (Benchtop Machines, Pneumatic Tools)

- Fully Automated Systems (Robotic Deburring Cells, CNC Integrated Tools)

- By Technology:

- Abrasive Deburring (Grinding, Brushing)

- Non-Traditional Deburring (ECM, TEM, AFM, Ultrasonic)

- Machine-Based Deburring (CNC Machining, Edge Finishing)

- By End-Use Industry:

- Automotive

- Aerospace & Defense

- Medical Devices

- Electronics & Semiconductor

- General Machinery & Fabrication

- By Operation Mode:

- Benchtop/Stationary

- Portable/Handheld

Value Chain Analysis For Deburring Tools Market

The value chain for the Deburring Tools Market begins with upstream analysis, focusing on the sourcing of critical raw materials and components necessary for manufacturing deburring equipment. This includes high-grade metals (e.g., tool steel, tungsten carbide) for cutters and blades, specialized abrasive materials (e.g., diamond, cubic boron nitride, aluminum oxide) for brushes and grinding media, and complex electronic and mechanical components (e.g., robotic arms, force sensors, CNC controllers) for automated systems. Suppliers in this segment heavily influence the cost structure and technological capability of the final product. Maintaining a resilient supply chain, especially for specialized sensor and control components, is critical for manufacturers of automated deburring cells, ensuring minimal delays in complex system integration.

The manufacturing stage involves the design, precision machining, and assembly of deburring equipment. High-end automated system manufacturers invest heavily in Research and Development (R&D) to integrate advanced software, proprietary abrasive technologies, and machine vision capabilities. This stage requires significant intellectual property protection and deep engineering expertise to customize solutions for specific industrial applications (e.g., micro-deburring for hydraulics vs. large-scale engine block deburring). Efficiency in manufacturing, leveraging lean principles and modular design, is essential for maintaining competitive pricing and timely delivery in a market where customization is often required.

Downstream analysis focuses on the distribution channels and end-user engagement. Distribution is typically handled through a mix of direct sales and specialized industrial distributors or integrators. Direct sales are preferred for large, complex automated systems (e.g., robotic cells) that require installation, commissioning, and deep technical support directly from the manufacturer. Indirect channels, utilizing specialized tool and machinery distributors, are common for manual tools, standard abrasives, and simpler semi-automated benchtop machines. The final link is the end-user—the manufacturing facilities—where product performance, reliability, post-sales service, and technical training are paramount factors influencing purchasing decisions and brand loyalty. Integrators play a vital role, often modifying and integrating standard deburring tools into a complete, customized manufacturing line solution.

Deburring Tools Market Potential Customers

Potential customers, or end-users/buyers, of deburring tools encompass a broad spectrum of industries where component quality and surface integrity are non-negotiable prerequisites for functionality and safety. The automotive sector constitutes a major customer base, requiring deburring for engine components, transmission gears, braking systems, and various stamped metal parts to ensure optimal performance and longevity. As Electric Vehicles (EVs) proliferate, deburring requirements shift slightly toward battery housing components and sophisticated cooling systems, maintaining the demand for high-throughput, repeatable processes.

The aerospace and defense industry represents a high-value customer segment characterized by extremely stringent quality standards (AS9100). Buyers in this sector, including major aircraft manufacturers and component suppliers, require specialized tools and non-traditional methods (like ECM and TEM) for deburring high-strength alloys and intricate geometries found in turbine blades, landing gear components, and structural elements. These customers prioritize process validation, traceability, and zero-defect performance, often justifying the highest investment in automated and custom-engineered deburring solutions.

Furthermore, the medical device manufacturing industry is a rapidly expanding customer segment, driven by the need for micro-precision deburring on surgical tools, orthopedic implants, and miniature components used in diagnostics. Given the direct impact on human health, surface finish requirements are exceptionally high, making Abrasive Flow Machining (AFM) and micro-abrasive blasting popular choices. Other significant buyers include electronics and semiconductor manufacturers (requiring micro-deburring for connectors and chip-level components), as well as general machinery and tooling companies that rely on deburring for gears, hydraulics, and general fabrication tasks to enhance machine performance and reduce warranty claims.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.12 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sugino Corp., Noga Engineering, Loeser GmbH, Bosch Power Tools, ATI Industrial Automation, Extrude Hone LLC, Acme Manufacturing Co., Deburring Technologies, PFERD INC., Abtex Corporation, KADIA Production, Apex Tool Group, GROB-WERKE GmbH & Co. KG, Meheen Manufacturing, 3M Company, Osborn International, DLY Technology, Dynabrade Inc., LUKAS-ERZETT Vereinigte Schleif- und Fräswerkzeuge GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Deburring Tools Market Key Technology Landscape

The technology landscape of the Deburring Tools Market is characterized by a rapid evolution toward highly sophisticated, integrated, and non-contact methods designed to tackle the challenges posed by modern materials and complex component geometries. Conventional abrasive deburring remains foundational but is increasingly being optimized through the use of advanced abrasive materials, such as engineered ceramics, monocrystalline diamonds, and specialized coated abrasives, which offer significantly longer tool life and superior finish quality compared to traditional methods. Furthermore, the integration of specialized tooling and fixture designs into standard machining centers (CNC deburring) allows manufacturers to perform deburring simultaneously or immediately following the primary machining operation, greatly reducing cycle time and the need for separate handling.

A major technological frontier involves Non-Traditional Deburring Methods (NTDM) which utilize processes beyond mechanical cutting or abrasion. Electrochemical Deburring (ECM) is vital for high-precision, hard-to-reach areas, especially in aerospace and automotive components, as it removes material without creating secondary burrs or inducing thermal stress. Similarly, the Thermal Energy Method (TEM), or thermal deburring, is used to rapidly combust burrs off components, especially suitable for cross-drilled holes and difficult internal intersections, offering fast, high-volume processing. Abrasive Flow Machining (AFM) utilizes a flowable, polymer-based abrasive media to precisely hone and finish internal passages and complex surfaces, making it indispensable for intricate hydraulic blocks and 3D printed components.

The highest level of technological advancement is seen in automated systems, leveraging robotics, sophisticated sensing, and predictive control. Robotic deburring cells use collaborative robots (cobots) equipped with multi-axis force compliance systems. These systems actively monitor the pressure applied by the deburring tool against the workpiece, ensuring consistent material removal even with slight geometric variations in the component. Machine vision systems, often powered by AI, are integrated pre- and post-deburring to inspect burr presence and assess surface quality in real-time, providing immediate feedback loops that optimize the tool's performance and significantly reduce the subjective nature of quality control. This convergence of advanced materials, non-contact physics, and smart automation defines the cutting edge of the deburring market, catering to zero-tolerance applications.

Regional Highlights

The geographical distribution of the Deburring Tools Market showcases varied technological adoption rates and demand patterns driven by regional manufacturing concentration and regulatory requirements.

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, propelled by rapid expansion in manufacturing sectors, particularly automotive assembly, consumer electronics production, and heavy machinery fabrication in China, Japan, and South Korea. The region's growth is characterized by significant investment in large-scale factory automation projects, driving high demand for automated and integrated deburring solutions to handle large production volumes. India and Southeast Asian countries are emerging as key manufacturing hubs, increasing the consumption of both manual tools and cost-effective semi-automated equipment.

- North America: This region maintains a strong market presence, characterized by high demand for specialized, high-precision deburring technologies, primarily driven by the robust aerospace, defense, and medical device manufacturing industries. Customers in North America prioritize advanced non-traditional methods (ECM, AFM) and high-end robotic systems that ensure traceability and meet extremely tight quality specifications. Innovation and R&D spending on AI-integrated inspection and deburring cells are concentrated here.

- Europe: Europe is a mature market heavily reliant on the automotive (especially luxury and high-performance vehicles) and advanced machinery manufacturing sectors (Germany, Italy, France). The European market is defined by a strong emphasis on consistent quality, environmental regulations, and worker safety, which fuels the adoption of high-efficiency automated systems and sophisticated, ergonomically designed manual tools. Regulatory compliance with machinery directives also drives demand for state-of-the-art, validated deburring processes.

- Latin America (LATAM): This region shows steady growth, primarily focused on supporting automotive assembly and basic fabrication industries, with Brazil and Mexico being the dominant markets. Demand often centers on reliable, durable, and moderately priced semi-automated and conventional mechanical deburring systems, with increasing investment in more advanced technologies as foreign direct investment boosts local manufacturing complexity.

- Middle East and Africa (MEA): Growth in MEA is moderate but concentrated, driven by infrastructure development, oil & gas industry demands, and nascent aerospace initiatives. Specialized deburring tools for maintenance, repair, and overhaul (MRO) operations within the energy sector are significant, although general manufacturing adoption of advanced automated systems lags behind other major regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Deburring Tools Market.- Sugino Corp.

- Noga Engineering

- Loeser GmbH

- Bosch Power Tools

- ATI Industrial Automation

- Extrude Hone LLC

- Acme Manufacturing Co.

- Deburring Technologies

- PFERD INC.

- Abtex Corporation

- KADIA Production

- Apex Tool Group

- GROB-WERKE GmbH & Co. KG

- Meheen Manufacturing

- 3M Company

- Osborn International

- DLY Technology

- Dynabrade Inc.

- LUKAS-ERZETT Vereinigte Schleif- und Fräswerkzeuge GmbH & Co. KG.

- Brush Research Manufacturing Co., Inc.

Frequently Asked Questions

Analyze common user questions about the Deburring Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of automated deburring systems?

The primary driver is the necessity for consistent quality, repeatability, and high throughput in precision manufacturing, especially in sectors like automotive and aerospace, where manual deburring fails to meet tight tolerance and volume demands. Automation minimizes human error and labor costs while ensuring component integrity.

How do non-traditional deburring methods differ from conventional mechanical processes?

Non-traditional methods, such as Electrochemical Deburring (ECM) or Abrasive Flow Machining (AFM), use chemical reactions, thermal energy, or flowable media rather than mechanical cutting or abrasion. This allows for precise burr removal from complex internal geometries and delicate materials without causing secondary burrs or mechanical stress.

Which end-use industry is the largest consumer of deburring tools?

The automotive industry remains the largest consumer globally, driven by the massive volume of machined components (engine parts, transmission gears, braking systems) that require precise edge finishing to ensure performance, reliability, and extended operational life of vehicles.

What role does Artificial Intelligence (AI) play in modern deburring technology?

AI is crucial for enhancing precision and efficiency by powering machine vision systems for real-time burr detection, optimizing robotic tool paths based on component geometry variations, and providing predictive maintenance insights for minimizing equipment downtime in automated cells.

What is the current growth outlook for the Deburring Tools Market in the Asia Pacific region?

The Asia Pacific region is expected to exhibit the highest growth rate, fueled by rapid industrialization, extensive foreign investment in electronics and automotive manufacturing hubs (e.g., China and India), and the increasing regional adoption of Industry 4.0 automation technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager