Decabromodiphenyl Ethane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433653 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Decabromodiphenyl Ethane Market Size

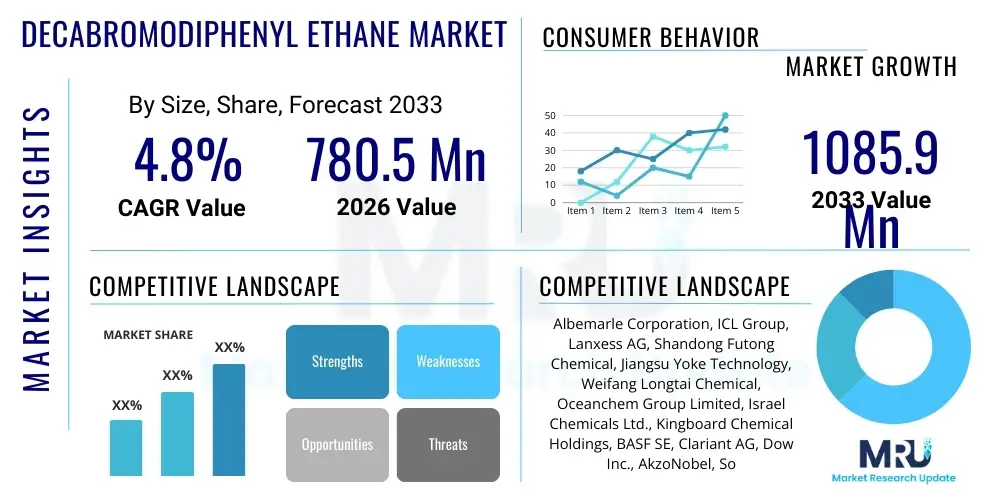

The Decabromodiphenyl Ethane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 780.5 Million in 2026 and is projected to reach USD 1085.9 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the stringent global regulatory shift away from traditional polybrominated diphenyl ethers (PBDEs), particularly DecaBDE, positioning Decabromodiphenyl Ethane (DBDPE) as a preferred, non-hazardous alternative in various high-performance applications. The rising global demand for durable and flame-retardant materials in infrastructure development, consumer electronics, and automotive industries provides a robust foundation for market expansion.

Decabromodiphenyl Ethane Market introduction

Decabromodiphenyl Ethane (DBDPE or Saytex 8010) is a highly effective, non-aromatic, additive flame retardant that has become a critical component in manufacturing processes requiring high levels of fire safety compliance. Chemically, it is C14H4Br10, characterized by excellent thermal stability, low volatility, and high bromine content, making it highly efficient in extinguishing flames across various polymer matrices, including high-impact polystyrene (HIPS), polypropylene (PP), polyamides, and cross-linked polyethylene (XLPE). Its primary function is to prevent ignition and slow the spread of fire, fulfilling demanding safety standards in end-use sectors.

The transition toward DBDPE is largely necessitated by environmental and health concerns associated with older flame retardant chemistries. DBDPE offers a superior environmental profile compared to its predecessors, lacking the potential for bioaccumulation and persistent toxic effects, which aligns with modern global sustainability goals. Major applications of DBDPE span high-voltage wire and cable insulation, electronic device casings, automotive interior components, and specialized textile coatings. The inherent stability and effectiveness of DBDPE ensure that manufacturers can achieve required UL (Underwriters Laboratories) and equivalent international safety ratings without compromising material integrity or processing ease, solidifying its market position as the standard-bearer for new-generation brominated flame retardants.

Key market driving factors include the rapid expansion of the 5G infrastructure, necessitating large volumes of flame-retardant cable sheathing; increasing penetration of electric vehicles (EVs), which require fire-safe battery enclosures and charging components; and strict building and construction codes globally mandating fire-resistant materials. Furthermore, continuous technological advancements in polymer science and additive manufacturing techniques are expanding the material compatibility and application spectrum of DBDPE, allowing it to be effectively incorporated into complex composite materials and high-purity plastics required in sophisticated electronic hardware.

Decabromodiphenyl Ethane Market Executive Summary

The Decabromodiphenyl Ethane market is undergoing structural growth, driven predominantly by regulatory compliance and rapid technological adoption in electronics and construction sectors. Business trends show a strong shift towards capacity expansion in Asia Pacific, particularly China and India, which are key manufacturing hubs for polymers and electronics components that utilize DBDPE. Companies are increasingly focused on improving production efficiency and reducing the cost-in-use for end-users through specialized masterbatch formulations, enhancing the dispersion and effectiveness of the retardant within the polymer. Regional trends highlight APAC as the largest consumer, fueled by massive infrastructure projects and robust electronics manufacturing output. Europe and North America maintain high value shares due to rigorous fire safety standards in aerospace, automotive, and high-specification construction, preferring DBDPE over less stable alternatives.

Segment trends indicate that the plastics and polymers application segment, particularly engineering plastics used in consumer electronics and automotive parts, remains the dominant revenue generator. Within electronics, the miniaturization trend and the demand for higher heat resistance in printed circuit boards (PCBs) and related housings are critical growth vectors for high-purity DBDPE grades. The textile segment, though smaller, is experiencing steady growth due to increased safety requirements for industrial curtains, protective clothing, and upholstery used in public transport. Overall, the market is characterized by moderate consolidation among primary manufacturers but intense competition in downstream formulation and distribution, leading to constant innovation in delivery systems and product handling.

Furthermore, sustainability remains a defining concern. While DBDPE is accepted globally as a replacement for DecaBDE, ongoing research into non-halogenated alternatives presents a potential long-term constraint. However, the current cost-effectiveness and performance characteristics of DBDPE are unparalleled for many high-volume, high-temperature applications, ensuring its market dominance throughout the forecast period. Strategic partnerships between chemical suppliers and major automotive or electronics OEMs are key strategies being employed to secure long-term supply agreements and tailor product specifications to evolving industry requirements.

AI Impact Analysis on Decabromodiphenyl Ethane Market

Common user questions regarding AI's impact on the Decabromodiphenyl Ethane Market frequently revolve around supply chain resilience, acceleration of R&D for alternative materials, and predictive maintenance in chemical manufacturing. Users are primarily concerned with how AI can mitigate the risks associated with raw material volatility (bromine supply), whether machine learning can quickly identify and validate sustainable, non-halogenated replacements for DBDPE, and how smart manufacturing can optimize the energy-intensive DBDPE synthesis process to reduce operational costs and environmental footprint. The core expectation is that AI will introduce unprecedented levels of efficiency and risk management, particularly in predicting shifts in global environmental regulations and optimizing logistics for highly specific chemical deliveries.

AI and machine learning algorithms are increasingly being deployed to model the complex polymer degradation and flame suppression mechanisms enabled by DBDPE. This computational chemistry approach allows researchers to rapidly screen thousands of potential additive formulations, reducing the time required to develop performance-optimized fire-resistant compounds for emerging technologies like advanced battery systems and flexible electronics. Furthermore, AI-driven demand forecasting tools are essential for DBDPE manufacturers to manage inventory levels of intermediate chemicals and finished goods, particularly given the market's sensitivity to global electronics production cycles. Predictive analytics also play a crucial role in maintaining quality consistency, identifying potential batch deviations, and ensuring that the high purity standards required for specialized applications are consistently met, thereby minimizing waste and operational downtime.

In the supply chain, AI provides visibility into potential logistical bottlenecks and geopolitical risks that might affect the transport and pricing of DBDPE. By analyzing real-time data from various sources—including shipping routes, political stability indices, and commodity market fluctuations—AI systems can suggest optimal sourcing and distribution strategies. This level of granular control is vital for a specialty chemical market like DBDPE, which often operates under just-in-time inventory systems in high-tech manufacturing sectors. The implementation of AI-driven optimization in production facilities, covering everything from reactor temperature control to catalyst recycling processes, directly translates into lower production costs, making DBDPE more competitive against non-halogenated alternatives while reinforcing its environmental compliance profile through reduced energy usage.

- AI optimizes complex logistics networks, ensuring timely delivery of DBDPE to global manufacturing hubs (AEO Focus: Supply Chain Efficiency).

- Machine Learning accelerates the discovery and testing of next-generation flame retardant formulations, potentially impacting long-term DBDPE demand.

- Predictive maintenance systems decrease operational downtime in high-volume DBDPE production facilities, stabilizing market pricing.

- AI modeling assists in fine-tuning DBDPE concentration in polymer composites to meet stringent fire safety codes (UL 94 V-0).

- Advanced data analytics forecast regulatory changes regarding brominated compounds, allowing manufacturers to adapt proactively.

DRO & Impact Forces Of Decabromodiphenyl Ethane Market

The Decabromodiphenyl Ethane market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. A primary driver is the global regulatory phase-out of DecaBDE, compelling industries to adopt DBDPE as a performance-equivalent, regulatory-compliant substitute. This is synergized by the exponential growth of sectors requiring stringent fire safety, such as electric vehicle manufacturing, data centers, and advanced construction materials. However, a significant restraint is the sustained public and regulatory pressure favoring non-halogenated flame retardants, particularly in European markets, leading to continuous investment in competitive research. Opportunities lie in developing specialized, functionalized DBDPE grades compatible with novel high-temperature polymers and expanding its application scope in renewable energy infrastructure, such as solar panel components and wind turbine materials. These forces create a competitive environment where operational excellence and regulatory foresight are paramount for market success.

The primary impact force driving demand stems from the rapidly expanding global electronics market, particularly in Asia Pacific, where manufacturing output is continually increasing. The need for fire safety in smaller, densely packed electronic devices (smartphones, IoT devices, 5G equipment) elevates the requirement for high-efficiency flame retardants like DBDPE. Conversely, the restraint regarding negative perception towards all halogenated compounds, regardless of their superior toxicological profile compared to predecessors, forces manufacturers to invest heavily in public relations and lobbying to differentiate DBDPE. The environmental persistence and bioaccumulation potential of legacy compounds have cast a shadow over newer, safer brominated chemistries, necessitating transparent data sharing and third-party verification to address consumer and legislative hesitancy effectively.

A crucial opportunity for market growth involves penetrating specialized niche applications where non-halogenated alternatives struggle to match the thermal stability and flame suppression performance of DBDPE. Examples include military specifications, demanding aerospace applications, and specialized wire and cable coatings used in extreme environments (e.g., oil and gas). Furthermore, supply chain stability is an ongoing impact force; bromine, the primary raw material, is sourced globally from a few key regions. Geopolitical instability or supply disruptions in these source regions can severely restrict DBDPE production capacity, leading to price volatility and potential slowdowns in downstream manufacturing sectors that rely on stable material supply. Successful market players are those that establish highly diversified supply chains and enter into long-term procurement contracts to mitigate this operational risk, ensuring sustained profitability even amid external shocks.

Segmentation Analysis

The Decabromodiphenyl Ethane market is primarily segmented based on Grade Type, Application, and End-Use Industry, reflecting the diverse requirements of the end-user base. The segmentation by Grade Type typically differentiates between Standard Grade, suitable for bulk applications like construction insulation and general polymers, and High Purity Grade, essential for sensitive electronics components and high-specification engineering plastics where impurities must be minimized to ensure optimal electrical and thermal performance. This differentiation is critical as price points and target markets vary significantly between the two grades. The application analysis further distinguishes the market, focusing on how the retardant is incorporated, such as powder addition, masterbatch formulation, or compound blending, which dictates the ease of processing for the polymer manufacturer.

The segmentation by End-Use Industry provides the clearest view of market demand drivers, with Electronics, Automotive, Construction, and Textiles being the dominant categories. The Electronics segment demands the highest performance, driven by safety certifications and regulatory requirements for minimal smoke density and low corrosivity during combustion. The Automotive segment is growing rapidly, specifically targeting safety components and interior fabrics to comply with global flammability standards (e.g., FMVSS 302). The Construction sector utilizes DBDPE extensively in pipe insulation, roofing membranes, and wire jacketing, contributing to building longevity and adherence to fire codes. Analyzing these segments helps manufacturers tailor product specifications, such as particle size and surface treatment, to optimize dispersion and fire-retardant effectiveness within specific polymer matrices.

A further, increasingly important segmentation involves regulatory compliance status, where markets are divided based on adherence to specific standards like REACH (Europe) or TSCA (USA). This regulatory segmentation dictates regional market accessibility and necessitates specific product documentation and safety data sheets (SDS) for export and domestic sales. Given the global nature of electronics and automotive manufacturing supply chains, manufacturers often produce a single DBDPE grade that meets the most stringent international standards to facilitate ease of global commerce, streamlining production but potentially increasing base costs. The future market structure will likely see increased fragmentation in specialized grades designed for sustainability metrics, such as improved recyclability of the final polymer product containing DBDPE.

- By Grade Type:

- Standard Grade

- High Purity Grade

- By Application:

- Plastics (Polymer compounding)

- Textiles

- Coatings and Adhesives

- By End-Use Industry:

- Electronics & Electrical Appliances

- Automotive

- Building & Construction

- Aerospace & Defense

- By Form:

- Powder

- Granules/Pellets (Masterbatch)

Value Chain Analysis For Decabromodiphenyl Ethane Market

The Decabromodiphenyl Ethane value chain is characterized by high integration and reliance on specific raw material availability, beginning with upstream sourcing of elemental bromine and basic hydrocarbons (Ethane/Diphenyl). Upstream analysis focuses on the chemical extraction and purification of bromine, which is energy-intensive and geographically concentrated, making suppliers of raw bromine a powerful component in the chain. Manufacturers of DBDPE then engage in complex bromination processes to synthesize the final product. Key activities at this stage include process optimization, environmental compliance management (especially handling byproducts), and quality control to meet the high purity requirements of the electronics sector. Consolidation among major DBDPE producers ensures economies of scale but also creates dependency risk.

Moving downstream, the distribution channel is highly specialized, involving direct sales to large polymer compounders and indirect sales through specialty chemical distributors to smaller manufacturers. Direct distribution is common for high-volume, standard-grade DBDPE destined for major automotive or construction material suppliers. Indirect channels rely on regional distributors who manage inventory, handle technical support, and repackage the product into smaller, customized quantities. These distributors often add value by offering technical consultation on optimal incorporation techniques (e.g., masterbatch formulation ratios) to the end-user. The final step involves the incorporation of DBDPE into various resins and textiles by end-product manufacturers in the electronics, automotive, and construction sectors.

The primary margin capture points exist at the raw material procurement stage (negotiating bromine prices) and the final product formulation stage, where DBDPE is integrated into specialty compounds or masterbatches that command premium pricing due to superior processing characteristics. Efficiency in the logistics of highly sensitive chemicals is crucial. Since the end-product performance is heavily reliant on the dispersion and stability of DBDPE within the matrix, the quality control and technical expertise provided by both the manufacturer and the distributor are critical differentiating factors. Any disruption, either upstream in bromine supply or downstream in regulatory clearances, significantly impacts the stability and profitability across the entire value chain.

Decabromodiphenyl Ethane Market Potential Customers

Potential customers for Decabromodiphenyl Ethane are fundamentally defined by sectors with critical needs for fire safety compliance, material durability, and thermal stability. The primary end-users are large-scale polymer compounding companies that specialize in engineering plastics, which require high levels of flame retardancy for subsequent sale to OEMs. These compounders purchase DBDPE powder in bulk and incorporate it into resins like ABS, HIPS, PP, and PBT, creating ready-to-mold granules for final product manufacturing. A significant portion of demand also originates directly from major original equipment manufacturers (OEMs) in the Electronics industry, specifically those producing casings, connectors, and internal components for servers, computers, and sophisticated network equipment where fire safety is paramount for data integrity and consumer protection.

Another crucial customer segment is the Wire and Cable manufacturing industry, particularly companies producing cables for high-voltage transmission, telecommunications (5G deployment), and transportation infrastructure (rail and metro systems). These customers demand specific, highly pure grades of DBDPE for use in XLPE and PVC cable jacketing to meet rigorous fire propagation and smoke emission standards. Furthermore, the burgeoning electric vehicle (EV) sector represents a high-growth segment, with manufacturers requiring fire-safe materials for battery housings, internal wiring harnesses, and charging equipment. These buyers emphasize not only flame retardancy but also light-weighting and durability under sustained thermal stress, leading them to favor high-performance additives like DBDPE that offer exceptional stability without compromising mechanical properties.

Finally, the Construction and Textile industries constitute steady, reliable customer bases. Construction firms and material producers require DBDPE for fire barriers, roofing insulation materials, and pipe coatings to adhere to mandatory building codes. Textile buyers, including those supplying materials for public transportation (aircraft, trains, buses) and contract furniture, purchase specialized DBDPE formulations for topical application or fiber incorporation to meet fire resistance standards for upholstery and curtaining. The purchasing decision across all these segments is driven by three main criteria: regulatory compliance, cost-effectiveness (performance per unit cost), and the ease of incorporating the flame retardant into their existing manufacturing processes without negatively affecting the final product’s physical attributes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 780.5 Million |

| Market Forecast in 2033 | USD 1085.9 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, ICL Group, Lanxess AG, Shandong Futong Chemical, Jiangsu Yoke Technology, Weifang Longtai Chemical, Oceanchem Group Limited, Israel Chemicals Ltd., Kingboard Chemical Holdings, BASF SE, Clariant AG, Dow Inc., AkzoNobel, Solvay SA, Chemtura Corporation, Huber Engineered Materials, Mitsubishi Chemical Corporation, Nippon Chemical Industrial Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Decabromodiphenyl Ethane Market Key Technology Landscape

The technology landscape for the Decabromodiphenyl Ethane market is primarily focused on improving synthesis efficiency, enhancing purity, and optimizing the integration methods for end-user applications. In manufacturing, the core technology involves the liquid-phase catalytic bromination of diphenylethane. Recent technological advancements concentrate on continuous process improvements aimed at reducing energy consumption and increasing yield, primarily through optimized catalyst systems and improved recycling of reaction solvents. Crucially, producers are investing in advanced purification techniques, such as recrystallization and specialized filtration, to meet the extremely low impurity requirements demanded by high-specification electronic applications, ensuring the final product does not contribute to corrosion or electrical failure under operational stress. This focus on purity is a key differentiator against lower-cost, standard-grade suppliers.

Further technological advancements are centered around 'delivery technology'—the mechanism by which DBDPE is incorporated into polymers. The trend has shifted heavily towards pre-dispersed masterbatches and specialized compounded granules, rather than relying solely on raw powder addition. Masterbatch technology ensures homogeneous dispersion of the flame retardant throughout the polymer matrix, which is vital for achieving consistent fire performance and optimal mechanical properties in the final product. Sophisticated compounding equipment, including twin-screw extruders and specialized dosing systems, are utilized to handle the high filler loading required, minimizing material degradation during processing and maximizing throughput efficiency. This technological refinement improves the ease of use for downstream manufacturers and reduces the risk of dust exposure during handling.

Beyond synthesis and integration, the technological landscape includes analytical and predictive technologies. Advanced spectroscopic techniques (e.g., Fourier-transform infrared spectroscopy, X-ray fluorescence) are employed for rigorous quality assurance and rapid compositional analysis, ensuring batch consistency. Furthermore, Computational Fluid Dynamics (CFD) and fire modeling software are increasingly being used by large compounders and research institutions to predict the fire behavior of new materials containing DBDPE. This predictive technological approach significantly shortens the product development cycle by reducing the need for expensive, large-scale physical flammability tests, such as those mandated by UL 94 or NFPA standards. This integration of digital modeling validates DBDPE's performance across varied application environments efficiently and accurately.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global DBDPE market in terms of volume consumption, driven by its status as the world's primary manufacturing hub for electronics, automotive components, and construction materials. Countries like China, South Korea, and Japan lead in the fabrication of high-specification electronics, necessitating large quantities of high-purity DBDPE for PCBs and device casings. Furthermore, massive investments in infrastructure development, including 5G networks and urban expansion in India and Southeast Asia, fuel demand for flame-retardant wire and cable jacketing. The region benefits from lower operating costs and the presence of major local manufacturers, making it a critical area for both production and consumption. The regulatory environment, while gradually tightening, has generally favored the adoption of DBDPE as a suitable replacement for banned PBDEs.

- Europe: Europe represents a high-value, highly regulated market for DBDPE. The continent's strict environmental policies, governed primarily by REACH regulations, mandate high standards for chemical safety and low toxicity. While regulatory pressure for non-halogenated alternatives is highest here, DBDPE remains essential for specific demanding applications in aerospace, high-speed rail, and specialized construction where its performance cannot be easily replicated. The European market focuses heavily on premium, environmentally documented grades of DBDPE, and consumption growth is tied directly to the recovery and expansion of the high-end automotive and specialized machinery sectors, emphasizing quality and sustainability certifications.

- North America: North America is characterized by robust demand from the Electronics and Automotive sectors, heavily influenced by stringent safety standards imposed by organizations like UL, NFPA, and FMVSS. The high rate of innovation in data center technology, electric vehicle production, and smart home devices drives the need for reliable fire safety additives. While domestic production capacity is stable, the market relies on imports, often resulting in slightly higher pricing compared to APAC. Market growth is closely linked to government spending on infrastructure renewal and the sustained momentum of residential and commercial construction, requiring compliance with evolving fire codes in states like California and New York.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions show moderate but accelerating growth, primarily centered around major construction projects, particularly in the GCC countries, and automotive manufacturing expansion in Brazil and Mexico. Demand in these regions is largely price-sensitive, often favoring standard-grade DBDPE. Infrastructure development, especially in energy and telecommunications, is a key driver. Regulatory structures are typically less complex than in Europe or North America but are trending toward greater adoption of international safety standards, creating long-term opportunities for DBDPE suppliers establishing local distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Decabromodiphenyl Ethane Market.- Albemarle Corporation

- ICL Group

- Lanxess AG

- Shandong Futong Chemical

- Jiangsu Yoke Technology

- Weifang Longtai Chemical

- Oceanchem Group Limited

- Israel Chemicals Ltd.

- Kingboard Chemical Holdings

- BASF SE

- Clariant AG

- Dow Inc.

- AkzoNobel

- Solvay SA

- Chemtura Corporation

- Huber Engineered Materials

- Mitsubishi Chemical Corporation

- Nippon Chemical Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Decabromodiphenyl Ethane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Decabromodiphenyl Ethane (DBDPE) and why is it preferred over DecaBDE?

DBDPE is a high-efficiency additive brominated flame retardant used primarily in polymers for electronics and construction. It is preferred because, unlike DecaBDE (Decabromodiphenyl Ether), DBDPE is not classified as bioaccumulative or persistent, meeting stricter global environmental regulations like REACH while offering equivalent or superior thermal performance.

Which end-use industries drive the highest demand for DBDPE?

The electronics and electrical appliances industry drives the highest demand, utilizing high-purity DBDPE in casings, printed circuit boards (PCBs), and wire insulation to meet mandatory UL and international fire safety standards. The automotive sector, particularly the electric vehicle segment, is the fastest growing consumer.

How do regulatory changes impact the future growth of the DBDPE market?

Regulatory changes are the primary market driver. The ongoing global phase-out of legacy brominated compounds necessitates the substitution with safer alternatives like DBDPE. However, continuous pressure favoring non-halogenated retardants acts as a long-term constraint, forcing manufacturers to focus on lifecycle analysis and improved sustainability profiles for DBDPE.

What is the key technological trend influencing DBDPE usage?

The key technological trend is the shift from using raw DBDPE powder to advanced masterbatch and compounded formulations. This technology ensures superior, homogeneous dispersion within the polymer matrix, improving the final product’s fire performance, mechanical strength, and manufacturing efficiency for the end-user.

Which geographical region dominates the production and consumption of Decabromodiphenyl Ethane?

The Asia Pacific (APAC) region dominates both the production and consumption of DBDPE. This dominance is attributed to the concentration of global electronics and polymer manufacturing capacity in countries like China, and massive infrastructure development requiring fire-safe materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager