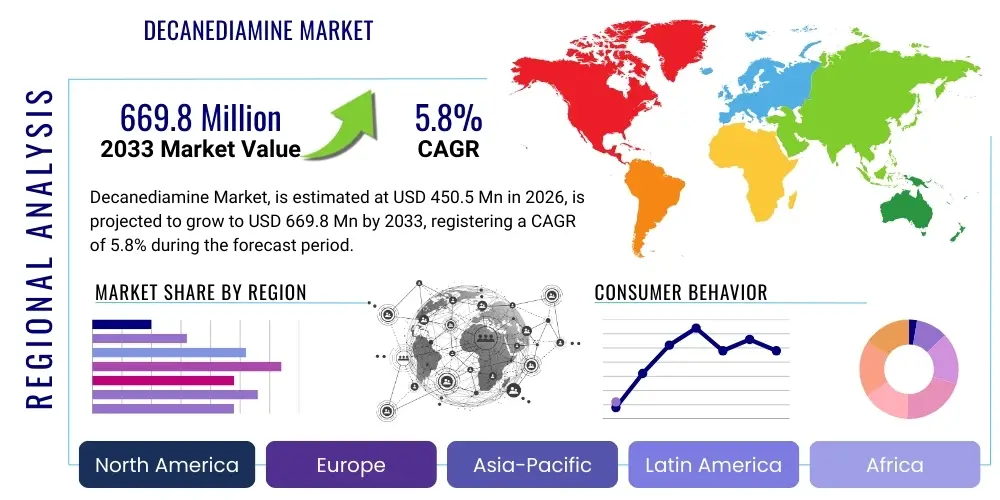

Decanediamine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438321 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Decanediamine Market Size

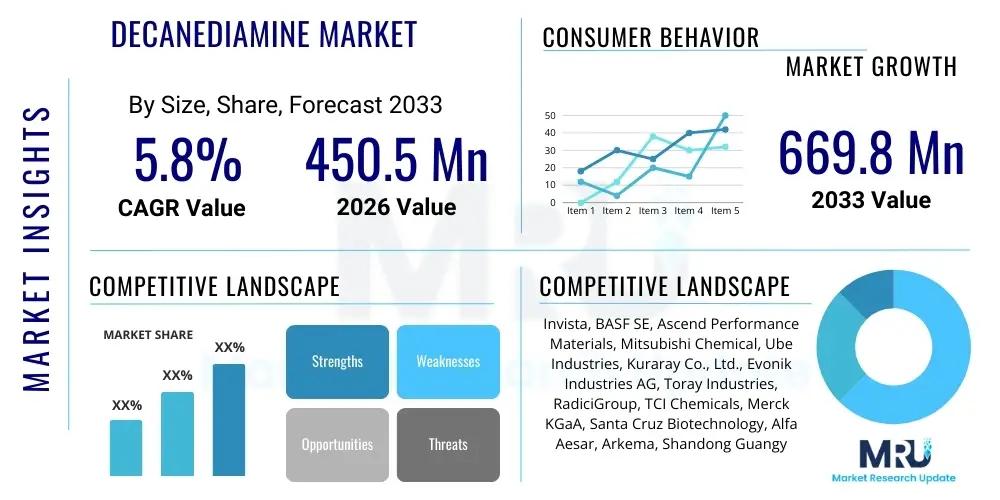

The Decanediamine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 669.8 Million by the end of the forecast period in 2033.

Decanediamine Market introduction

Decanediamine, also known as 1,10-Diaminodecane, is a crucial long-chain aliphatic diamine primarily recognized for its application in the synthesis of specialized polymers, notably bio-based and high-performance polyamides like Nylon 1010. This compound serves as a foundational building block, imparting superior chemical resistance, high thermal stability, and low moisture absorption characteristics to the resulting materials, making it indispensable in high-end industrial applications. Its synthesis often involves complex chemical processes, though increasing interest is focused on sustainable, bio-based routes to align with global environmental mandates.

The core applications of Decanediamine span automotive components, industrial coatings, electrical insulation, and sophisticated adhesives. Its robust chemical structure allows for the creation of engineering plastics that withstand harsh operating conditions, fulfilling the stringent performance requirements of modern manufacturing sectors. Beyond polyamides, Decanediamine derivatives are utilized in epoxy curing agents, specialized polyurethanes, and corrosion inhibitors, expanding its market penetration across various chemical intermediate segments.

Market growth is predominantly driven by the burgeoning demand for lightweight yet high-strength materials in the automotive and aerospace industries, necessitated by fuel efficiency standards and the transition toward electric vehicles. Furthermore, the push for bio-based polymers, driven by consumer preference and regulatory support for renewable resources, positions Decanediamine, especially when derived from renewable feedstocks, for significant expansion in the coming years. Increased industrialization and infrastructure development, particularly in Asia Pacific, further stimulate consumption in paints, coatings, and specialized textiles sectors.

Decanediamine Market Executive Summary

The Decanediamine market is experiencing robust expansion driven by pronounced global business trends emphasizing sustainable chemistry and high-performance engineering materials. The shift towards bio-based raw materials, reducing reliance on petrochemical derivatives, constitutes a primary trend reshaping supply chain dynamics and fostering innovation in synthesis pathways. Furthermore, the persistent demand for specialty polyamides (Nylon 1010 and Nylon 610) in electronics and automotive lightweighting initiatives ensures sustained market trajectory. Strategic collaborations between chemical producers and automotive original equipment manufacturers (OEMs) focused on material validation and optimization are defining competitive advantage.

Regionally, Asia Pacific maintains its dominance, spurred by massive industrial expansion, rapid growth in electric vehicle (EV) manufacturing, and increased public infrastructure investment requiring durable coatings and adhesives. North America and Europe demonstrate mature market characteristics, focusing intensely on regulatory compliance, circular economy principles, and the adoption of high-value, niche applications where Decanediamine's performance advantages justify higher costs. Regulatory pressures concerning VOC emissions and the push for bio-content mandate continuous material reformulation, benefiting high-performance, low-emission diamine derivatives.

In terms of segmentation, the application segment dominated by Nylon 1010 synthesis is projected to register the highest growth rate, reflecting its superior properties for demanding applications. The end-use segment shows maximum traction within the Automotive and Electronics industries, owing to the non-negotiable requirements for thermal stability and dielectric strength. Key competitive strategies revolve around technological differentiation in synthesis (e.g., fermentation versus traditional hydrogenation), securing stable raw material supply, and expanding production capacity to meet escalating regional demand, particularly in fast-growing Asian economies.

AI Impact Analysis on Decanediamine Market

Common user questions regarding AI's impact on the Decanediamine market often center on optimizing complex chemical synthesis processes, predicting raw material price fluctuations (especially for bio-based feedstocks), and enhancing product quality control and traceability. Users frequently inquire whether AI can accelerate the discovery of novel, more efficient catalysts for Decanediamine production or improve the efficiency of polymerization processes involving this monomer. The underlying concern is how computational intelligence can reduce operational costs, minimize waste in synthesis, and ensure timely, high-purity output to meet demanding industrial specifications, particularly in niche markets where performance variance is unacceptable. Users also seek clarity on AI's role in forecasting the complex supply-demand balance influenced by volatile agricultural feedstock markets.

The integration of Artificial Intelligence and Machine Learning (ML) platforms is beginning to revolutionize several facets of the Decanediamine value chain, moving beyond traditional statistical process control. AI algorithms are being deployed to model reaction kinetics and thermodynamics in real-time, allowing manufacturers to fine-tune reaction parameters such as temperature, pressure, and catalyst ratios dynamically, thereby maximizing yield and purity while minimizing energy consumption. Furthermore, predictive maintenance powered by AI sensors installed on reactors and distillation columns significantly reduces unplanned downtime, a critical factor given the high capital expenditure and continuous operational requirements of diamine production facilities.

The most significant impact of AI is anticipated in the R&D phase, particularly in materials informatics. AI-driven platforms can rapidly screen thousands of potential catalyst combinations or bio-feedstock sources to identify the most sustainable and cost-effective pathways for Decanediamine production, drastically cutting down the time and cost associated with traditional experimentation. Moreover, AI models are increasingly used for sophisticated demand forecasting, integrating macro-economic indicators, automotive production forecasts, and commodity price trends to provide highly accurate production schedules, optimizing inventory levels and mitigating risks associated with supply chain disruptions.

- AI optimizes reaction conditions in synthesis for higher Decanediamine yield and purity.

- Machine Learning (ML) models predict maintenance needs for critical production equipment, reducing downtime.

- AI accelerates R&D by screening novel, sustainable catalysts and bio-feedstocks.

- Advanced analytics enhance supply chain resilience and raw material procurement strategy, especially for bio-based inputs.

- Deep Learning algorithms improve quality control by detecting subtle variations in product specifications.

DRO & Impact Forces Of Decanediamine Market

The Decanediamine market is primarily driven by the escalating global demand for high-performance engineering plastics, particularly specialized polyamides (Nylon 1010) required for lightweighting initiatives in the automotive and aerospace sectors. Restraints include the high capital investment required for dedicated production facilities, the complexity and cost associated with sourcing bio-based raw materials consistently, and volatility in global petrochemical prices which affects the competitiveness of non-bio alternatives. Opportunities are abundant in the expanding renewable polymer space, niche applications such as high-purity lubricants and advanced electrical insulation materials, and geographical expansion into emerging industrial hubs in Southeast Asia and Latin America. These elements interact as significant impact forces, dictating pricing strategy, investment cycles, and competitive differentiation.

Drivers: The global automotive industry's pivot towards electric vehicles necessitates the increased use of Decanediamine-derived high-performance polymers due to their superior thermal management, low density, and electrical insulation properties compared to traditional materials. Regulatory mandates worldwide promoting sustainable and bio-derived chemical inputs incentivize manufacturers to adopt bio-Decanediamine production, establishing a powerful market pull. Furthermore, urbanization and subsequent growth in the construction sector drive demand for highly durable paints, coatings, and sealants that incorporate Decanediamine derivatives for enhanced longevity and performance, particularly resistance to chemical and abrasive wear.

Restraints: A significant challenge is the potential for sharp fluctuations in the price and availability of raw materials, whether petrochemical (e.g., sebacic acid derivatives) or agricultural (for bio-based routes), creating uncertainty in operational expenditure. Additionally, the purification and separation processes required to achieve the high purity levels demanded by polymerization applications are energy-intensive and technologically demanding, acting as a barrier to entry for smaller producers. Competition from cheaper, shorter-chain diamines in less demanding applications also restricts the full market potential of Decanediamine, requiring producers to focus strictly on high-value, specialized segments.

Opportunities: The primary opportunity lies in capitalizing on the growing consumer and industrial preference for sustainable solutions. Developing cost-effective, large-scale fermentation processes for bio-Decanediamine could drastically reduce production costs and market reliance on volatile commodity markets. Exploration into novel applications, such as high-density energy storage materials or specialized medical device components that require extreme purity and biocompatibility, offers avenues for premium pricing and market diversification. Continuous refinement of catalytic processes to improve reaction selectivity and reduce by-product formation represents a critical technological opportunity for market players.

Impact Forces: The overarching impact force is the regulatory environment, particularly in Europe and North America, which favors sustainable materials and restricts the use of certain chemicals, pushing demand toward high-purity, environmentally compliant Decanediamine. Economic volatility affects end-user industries like automotive and construction, translating into cyclical demand patterns for the product. Technological advancement in polymerization techniques, which allows for the efficient incorporation of long-chain diamines, directly impacts the feasibility and scale of Decanediamine usage. Competitive intensity, driven by leading global chemical firms vying for control over bio-based feedstock processing patents, also exerts significant pressure on market dynamics and strategic positioning.

Segmentation Analysis

The Decanediamine market segmentation provides a granular view of consumption patterns, driven primarily by application type, end-use industry, and geographical distribution. Understanding these segments is critical for strategic planning, resource allocation, and identifying high-growth pockets within the broader chemical industry landscape. The market structure reflects a strong correlation between material properties and specific industrial needs, with high-performance segments demanding ultra-pure Decanediamine, while standard-grade applications utilize it primarily as a cost-effective chemical intermediate. Segmentation by application highlights the dominance of polymer synthesis, particularly in the production of high-temperature resistant and moisture-resistant polyamides.

The segmentation by end-use industry clearly indicates the pivotal role Decanediamine plays in supporting advanced manufacturing sectors such as automotive and electronics, where material reliability is paramount. The shift toward sustainable materials has also necessitated a segmentation distinction based on source: petrochemical-derived versus bio-derived Decanediamine. This dual source segmentation is increasingly important as companies strive to meet both performance and sustainability metrics. Regional analysis remains crucial, revealing contrasting consumption dynamics where developed economies focus on specialty, high-margin applications, and emerging economies prioritize volume production for mass-market industrialization.

Growth projections vary significantly across these segments. The bio-based segment, while smaller currently, is poised for accelerated growth due to strong environmental mandates and technological breakthroughs in fermentation technology. Within applications, the demand for specialized coatings and adhesives for renewable energy infrastructure (e.g., wind turbine blades, solar panel frames) represents a rapidly expanding niche. Comprehensive segmentation allows market participants to tailor their marketing and distribution strategies, focusing on technical service and application development support in segments like electronics and aerospace, where detailed specification compliance is mandatory.

- By Source

- Petrochemical-based Decanediamine

- Bio-based Decanediamine (derived from renewable oils or fermentation)

- By Application

- Nylon 1010 Synthesis (Polyamide 1010)

- Nylon 610 Synthesis (Polyamide 610)

- Polyurethanes

- Epoxy Curing Agents

- Adhesives and Sealants

- Coatings and Paints

- Lubricants and Corrosion Inhibitors

- By End-Use Industry

- Automotive and Transportation

- Electrical and Electronics

- Textiles and Consumer Goods

- Construction and Infrastructure

- Industrial Manufacturing

- Aerospace and Defense

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Decanediamine Market

The Decanediamine value chain initiates with the procurement and processing of raw materials, which significantly differ depending on the production route—either petrochemical or bio-based. The upstream segment involves securing critical chemical precursors like sebacic acid (often derived from castor oil for bio-routes) or specific diacids/nitriles derived from petroleum resources. Consistency in quality and stable pricing of these raw materials are paramount, as they constitute a large portion of the final production cost. Producers engaged in bio-based synthesis must manage complex agricultural supply chains, which are susceptible to climatic and geopolitical volatility, necessitating strong backward integration or long-term procurement agreements.

The midstream segment focuses on the manufacturing process, involving hydrogenation, ammonolysis, or fermentation followed by intensive purification and crystallization to achieve high-purity Decanediamine. This stage requires significant technological expertise, specialized catalytic systems, and stringent quality control protocols to meet the polymerization-grade specifications required by downstream users. Major global chemical companies dominate this transformation stage, leveraging proprietary technology and economies of scale. Direct distribution channels are prevalent here, especially for large-volume contracts with tier-one polymer manufacturers, ensuring specification integrity and reducing handling costs.

The downstream segment includes the utilization of Decanediamine by polymer manufacturers (e.g., Nylon 1010/610 producers), coatings and adhesives formulators, and specialized chemical mixers. These end-users incorporate Decanediamine as a monomer or cross-linking agent to create finished engineering materials, which are then sold to the final consumer industries (Automotive, Electronics, Construction). Distribution channels become more diversified here, utilizing both direct sales for massive industrial users and indirect channels through regional distributors and specialized chemical traders for smaller-volume, niche applications like research chemicals or bespoke lubricant formulations. Efficiency in distribution, especially across continents, is crucial for maintaining competitive pricing and timely delivery.

Decanediamine Market Potential Customers

The potential customer base for Decanediamine is extensive, fundamentally comprising industries that require materials exhibiting superior mechanical strength, excellent thermal resistance, and low moisture uptake. The largest buyers are integrated polymer manufacturers specializing in high-performance polyamides. These companies utilize Decanediamine as a key monomer to produce specific bio-polymers like Nylon 1010, which caters directly to high-specification demands from the automotive and aerospace industries for lightweight structural components, engine parts, and specialized tubing. Their procurement decisions are heavily influenced by product purity, reliable supply, and certification regarding bio-content or sustainability.

Another significant customer segment includes formulators of advanced coatings, adhesives, and sealants. In the construction and infrastructure sectors, these customers require Decanediamine derivatives for high-durability epoxy curing agents and cross-linkers that enhance the resilience and lifespan of protective coatings applied to steel structures, bridges, and industrial flooring. Furthermore, the electronics industry acts as a crucial buyer, utilizing Decanediamine-based materials for electrical insulation, connector parts, and circuit board components where precise dielectric properties and thermal stability under prolonged operation are non-negotiable requirements. These customers prioritize technical support and customized product specifications.

The growing electric vehicle (EV) sector represents an accelerating customer segment. EV manufacturers require advanced thermal management materials and durable yet lightweight battery casings and internal structural components that can withstand high voltage and fluctuating temperatures. Decanediamine-derived polymers are ideally suited for these demanding applications. Finally, the specialty lubricants and corrosion inhibitor market also includes high-value customers, such as manufacturers of specialized machinery, hydraulic fluids, and industrial maintenance products, who require Decanediamine derivatives for their high-purity and superior chemical stability characteristics, often procuring through specialized chemical distribution networks rather than direct sourcing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 669.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Invista, BASF SE, Ascend Performance Materials, Mitsubishi Chemical, Ube Industries, Kuraray Co., Ltd., Evonik Industries AG, Toray Industries, RadiciGroup, TCI Chemicals, Merck KGaA, Santa Cruz Biotechnology, Alfa Aesar, Arkema, Shandong Guangyin New Materials, Cathay Industrial Biotech, Kingfa Sci. & Tech. Co., Ltd., Solvay, Wanhua Chemical Group, Asahi Kasei Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Decanediamine Market Key Technology Landscape

The technology landscape for Decanediamine production is undergoing a significant transformation, moving from traditional chemical synthesis routes, such as the hydrogenation of dinitriles derived from petroleum, towards more sustainable and sophisticated biotechnological methods. A key technological focus is the development and commercialization of bio-based Decanediamine (bio-DDA), often achieved through the fermentation of renewable feedstocks like vegetable oils or sugars. This shift requires expertise in industrial biotechnology, strain engineering, and large-scale fermentation processes to ensure high yield and purity while maintaining cost competitiveness against petrochemical counterparts. Companies investing heavily in R&D are seeking highly selective enzymes and microorganisms that can efficiently catalyze the conversion process, mitigating the need for harsh chemical reagents and reducing energy consumption.

Beyond bio-synthesis, advancements in catalytic technology are crucial for optimizing existing production lines. New generations of heterogeneous and homogeneous catalysts are being explored to improve reaction selectivity, minimize side product formation, and enhance the overall sustainability of the process. Techniques such as continuous flow chemistry are also gaining traction, allowing for safer, more efficient, and scalable production of high-purity Decanediamine compared to traditional batch processes. The precision afforded by these advanced catalytic systems is vital, as the downstream polymerization processes demand extremely pure monomer feedstocks to achieve the desired high molecular weight and consistent mechanical properties in the final polyamide.

Furthermore, technology related to purification and separation is paramount. Achieving the high-purity (typically 99.5% or greater) required for polymerization requires state-of-the-art distillation, crystallization, and chromatographic techniques. Innovations in membrane separation technology and solvent-free purification methods are being adopted to reduce the environmental footprint and operational costs associated with traditional purification. The adoption of smart manufacturing principles, including the use of advanced process control (APC) systems and Industrial Internet of Things (IIoT) sensors, facilitates real-time monitoring and autonomous optimization of the entire synthesis and purification chain, ensuring consistent product quality and operational efficiency.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the Decanediamine market both in terms of production capacity and consumption volume, primarily fueled by the rapid expansion of the manufacturing sector in China, India, and Southeast Asian countries. The region serves as the global hub for automotive component manufacturing, electronics assembly, and textile production, all of which are significant end-users of high-performance polyamides like Nylon 1010. Furthermore, substantial governmental investment in infrastructure and urbanization drives demand for coatings and adhesives. The market is characterized by intense price competition and growing investment in large-scale bio-based Decanediamine production facilities to align with regional sustainability goals. Consumption growth is consistently higher than the global average.

- North America: North America represents a mature, high-value market focused on specialized applications in aerospace, defense, and high-end automotive segments (especially the electric vehicle sector). The region prioritizes product innovation and sustainability, leading to strong demand for certified bio-based Decanediamine, despite higher production costs. Regulatory frameworks, such as stringent environmental standards and support for domestically produced bio-materials, shape market dynamics. Key market players emphasize technical partnerships and supply chain resilience, often sourcing from regional producers or partners with advanced technological capabilities.

- Europe: Europe is a leader in adopting stringent sustainability policies, driving the earliest and most robust demand for bio-derived Decanediamine and its derivatives, particularly in Germany and Italy. The automotive industry, facing strict CO2 emission standards, is a critical driver for lightweighting materials utilizing Nylon 1010. The market is characterized by high levels of technological sophistication, a strong focus on circular economy principles, and rigorous chemical safety regulations (e.g., REACH). European companies often lead in developing innovative, low-VOC coatings and highly durable industrial products, maintaining premium pricing for high-specification Decanediamine.

- Latin America (LATAM): The LATAM market exhibits nascent but accelerating growth, primarily centered in Brazil and Mexico, driven by burgeoning local automotive assembly and increasing foreign direct investment in manufacturing. Brazil is particularly relevant due to its robust agricultural sector, providing potential feedstock for local bio-based chemical production, though petrochemical-based imports still hold a dominant market share. Infrastructure development and expansion of the energy sector (oil & gas and renewables) create incremental demand for specialized coatings and pipe linings.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is a relatively smaller consumer market for Decanediamine but is strategically important due to its vast petrochemical feedstock resources. While consumption is generally low, regional investment in diversification, infrastructure modernization, and developing local manufacturing capabilities (e.g., in Turkey and South Africa) is expected to spur future demand for construction chemicals and industrial materials. The market is highly reliant on imports of finished Decanediamine monomers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Decanediamine Market.- Invista

- BASF SE

- Ascend Performance Materials

- Mitsubishi Chemical

- Ube Industries

- Kuraray Co., Ltd.

- Evonik Industries AG

- Toray Industries

- RadiciGroup

- TCI Chemicals

- Merck KGaA

- Santa Cruz Biotechnology

- Alfa Aesar

- Arkema

- Shandong Guangyin New Materials

- Cathay Industrial Biotech

- Kingfa Sci. & Tech. Co., Ltd.

- Solvay

- Wanhua Chemical Group

- Asahi Kasei Corporation

Frequently Asked Questions

Analyze common user questions about the Decanediamine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Decanediamine primarily used for in the industry?

Decanediamine (1,10-Diaminodecane) is fundamentally used as a monomer in the synthesis of high-performance long-chain polyamides, primarily Nylon 1010 and Nylon 610. These polymers are valued for their exceptional thermal resistance, low moisture absorption, and mechanical strength, making them essential in automotive lightweighting and electronics.

How does bio-based Decanediamine differ from petrochemical-based Decanediamine?

Bio-based Decanediamine is derived from renewable biological feedstocks, such as castor oil derivatives or fermentation processes utilizing sugars, making it a sustainable alternative. Petrochemical-based Decanediamine is derived from fossil fuels. Both typically yield the same high-purity chemical structure required for polymerization, but bio-based options help companies meet sustainability and environmental mandates.

Which region dominates the global Decanediamine market consumption?

The Asia Pacific (APAC) region currently holds the largest share in the Decanediamine market consumption and production. This dominance is attributed to high volume demand from rapidly expanding manufacturing sectors, particularly automotive production, electronics, and construction activities across China and other emerging economies.

What are the key drivers propelling the Decanediamine market growth?

The major drivers include the increasing global demand for vehicle lightweighting in the automotive industry (especially for EVs), stringent regulatory mandates favoring bio-polymers and sustainable chemistry, and the necessity for durable, high-specification materials in specialized applications like high-end industrial coatings and aerospace components.

What is the projected Compound Annual Growth Rate (CAGR) for the Decanediamine market?

The Decanediamine market is projected to grow at a healthy Compound Annual Growth Rate (CAGR) of 5.8% between the forecast years of 2026 and 2033, driven largely by adoption in high-performance polymer applications and the sustainable bio-based segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager