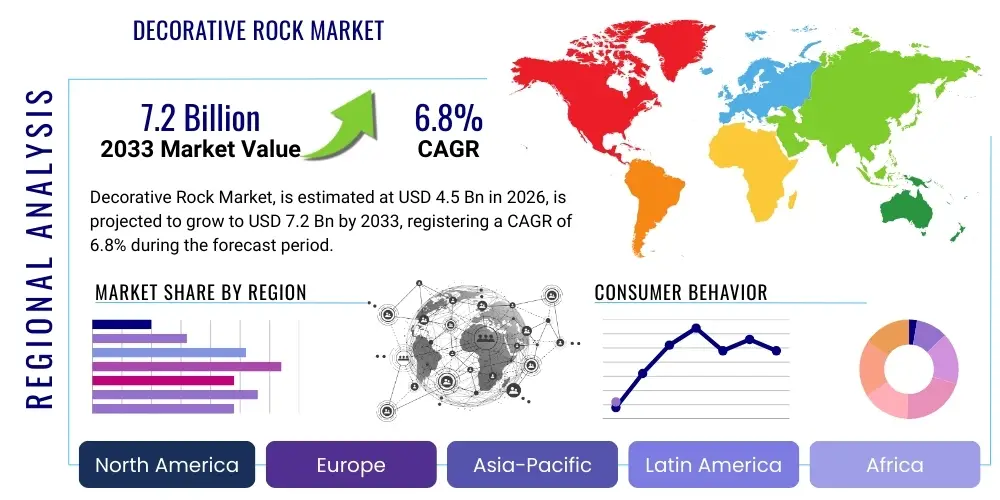

Decorative Rock Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437482 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Decorative Rock Market Size

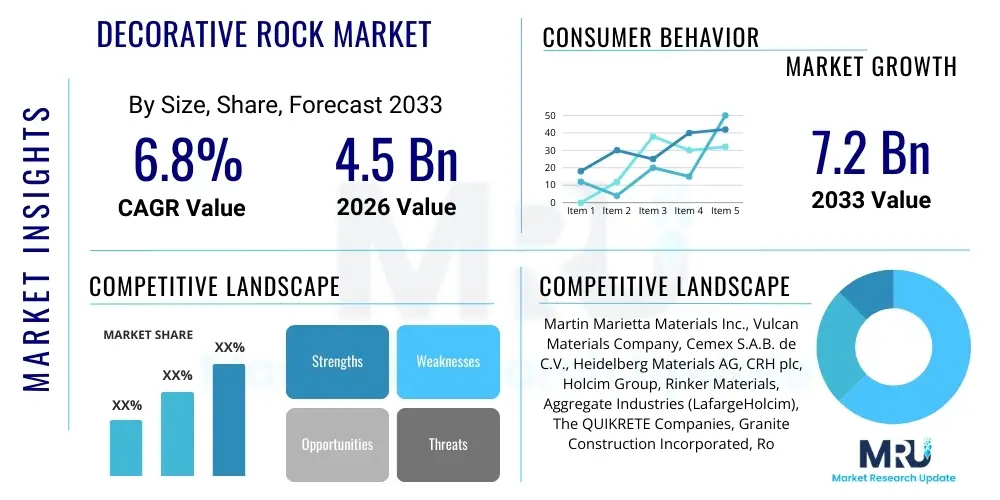

The Decorative Rock Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Decorative Rock Market introduction

The Decorative Rock Market encompasses a diverse range of natural stone products utilized primarily for aesthetic enhancement and functional landscaping purposes in residential, commercial, and public spaces. These materials, which include river pebbles, decorative gravel, crushed granite, marble chips, boulders, and flagstones, are essential components in modern landscape architecture, providing texture, color, and contrast to outdoor environments. Beyond their visual appeal, decorative rocks offer significant practical benefits, such such as improving soil drainage, preventing erosion, suppressing weed growth, and creating durable, low-maintenance surfaces for walkways and garden beds. The inherent durability and long lifespan of these natural resources contribute to their strong market acceptance across various climatic conditions.

Major applications of decorative rock span landscaping design, construction aggregates, hardscaping projects, and specialized uses such as water features, aquarium substrates, and interior décor elements. The residential sector remains the dominant consumer, driven by increasing homeowner investment in curb appeal, outdoor living spaces, and DIY gardening projects. Furthermore, large-scale commercial applications, including corporate campuses, municipal parks, and hospitality venues, significantly contribute to demand, leveraging decorative stone to create sophisticated and sustainable external environments. The perceived value of natural aesthetics, combined with the functional attributes of moisture retention and thermal mass regulation, solidifies the importance of these materials in sustainable urban development.

Key driving factors accelerating market growth include rapid global urbanization leading to extensive infrastructure and public park development, a surge in the popularity of professional landscaping services, and a continuous trend toward sustainable and natural building materials. Consumers increasingly favor natural stones over synthetic alternatives due to their environmental compatibility and unique appearance. The market is also benefiting from technological advancements in quarrying and processing, which are improving the efficiency of production and enabling the creation of new textures and finishes that cater to evolving design preferences. Regulatory support for permeable paving solutions, which often utilize specific decorative rock types, further underscores the positive growth trajectory of the industry.

Decorative Rock Market Executive Summary

The Decorative Rock Market is characterized by robust growth, primarily fueled by the strong rebound in residential construction and increased consumer focus on high-quality outdoor living spaces post-pandemic. Key business trends indicate a definitive shift toward sustainable sourcing practices and the introduction of engineered or recycled decorative materials, responding to stringent environmental regulations and rising consumer ecological awareness. Pricing volatility remains a challenge, influenced heavily by global logistics costs and fuel prices necessary for transporting these heavy materials from quarries to end-users. Strategic partnerships between large material suppliers and regional landscaping firms are becoming critical for streamlining the supply chain and ensuring timely project delivery, especially in highly active housing markets.

Regionally, the Asia Pacific (APAC) area demonstrates the highest growth potential due to expansive urbanization, significant government investment in public infrastructure, and a burgeoning middle class driving residential renovations and commercial landscaping projects in countries like China and India. North America and Europe, while representing mature markets, maintain substantial demand, driven by premium product lines, high-end hardscaping, and strong DIY consumer engagement. The regulatory environments in these mature markets, particularly regarding quarrying permits and environmental impact assessments, shape supply dynamics, favoring suppliers who invest in environmentally sound extraction and processing technologies.

Segmentation trends highlight the increasing preference for smaller-sized decorative gravel and pebbles, particularly in permeable paving applications, addressing urban runoff challenges. The end-user segment is increasingly diversified, showing strong growth in demand from specialized sectors such as aquaculture and interior design (using small, polished stones). Furthermore, the decorative rock market is witnessing segmentation based on color and type, with consumers prioritizing locally sourced materials where transportation costs are minimized, leading to a fragmented, yet specialized, supplier base tailored to specific geological regions.

AI Impact Analysis on Decorative Rock Market

User queries regarding the impact of Artificial Intelligence (AI) on the Decorative Rock Market primarily revolve around optimizing the complex logistics of heavy materials, enhancing the precision of aesthetic design, and improving the efficiency of quarrying and material processing. Consumers and industry professionals frequently inquire about AI tools that can simulate different rock types and configurations in landscaping designs, helping them visualize outcomes before purchase, thereby minimizing errors and waste. Furthermore, significant concern is noted regarding how AI can be leveraged for predictive maintenance of quarrying equipment and for automating the quality control process—specifically, sorting rocks by size, color consistency, and geological purity, which are currently laborious manual tasks. The overarching expectation is that AI integration will lead to reduced operational costs, improved material consistency, and faster supply chain response times, ultimately making decorative rock more accessible and cost-effective for large-scale projects.

AI's role in the Decorative Rock Market extends significantly into resource management and sustainable practice optimization. Predictive analytics, powered by machine learning algorithms, are now being employed to forecast demand cycles more accurately, allowing producers to minimize overstocking and reduce environmental strain associated with excessive quarrying. This data-driven approach assists in optimizing inventory levels across multiple distribution centers, crucial given the high cost of storing and transporting heavy, low-margin products. Moreover, AI models are increasingly utilized in geological surveying to identify high-quality mineral deposits with greater precision, reducing exploratory drilling and minimizing disruption to the natural environment.

The most transformative application of AI is emerging in customer-facing design interfaces. AI-driven landscaping and architectural visualization software allows end-users, from homeowners to professional designers, to input parameters and instantly render photorealistic visualizations utilizing specific types of decorative rock. This capability dramatically reduces the sales cycle, improves customer satisfaction by aligning expectations with the final product, and provides suppliers with valuable data on current design trends and material preferences, driving targeted marketing and production strategies tailored to real-time market needs.

- AI-powered predictive logistics optimize transportation routes for heavy materials, reducing fuel costs and delivery times.

- Machine learning algorithms enhance quality control by automating the visual sorting of decorative rocks based on color, size, and texture consistency.

- AI visualization tools enable customers to integrate specific rock products into 3D landscape designs, improving purchase confidence and reducing design errors.

- Predictive maintenance schedules for quarrying machinery, derived from AI analysis of sensor data, minimize costly downtime and extend equipment lifespan.

- Data analytics derived from sales patterns forecast regional demand for specific rock types, optimizing inventory management and reducing environmental waste from surplus extraction.

DRO & Impact Forces Of Decorative Rock Market

The Decorative Rock Market’s dynamics are governed by a complex interaction of driving forces (D), restrictive factors (R), and compelling growth opportunities (O), which collectively shape the market’s impact forces. The primary driver is the robust growth in global residential and commercial construction, specifically in luxury real estate and municipal hardscaping projects, where high-quality decorative elements are non-negotiable. Furthermore, increased consumer awareness of sustainable and durable outdoor materials strongly supports market expansion. Conversely, the market faces significant restraints, chiefly concerning high transportation and logistics costs due to the material's weight and bulk, which often represent a substantial portion of the final product price. Environmental regulations pertaining to quarry licensing, land reclamation, and dust control also impose financial and operational burdens on producers, acting as critical restrictive forces.

Opportunities for expansion lie predominantly in the realm of material innovation and recycling initiatives. The development of high-quality engineered or composite decorative rocks using industrial byproducts, such as slag or recycled glass, addresses both cost restraints and environmental concerns, offering premium-priced alternatives. Moreover, the increasing adoption of dry landscaping and xeriscaping practices, particularly in drought-prone regions, creates substantial demand for decorative gravel and stone mulches that conserve water. Technological advances in processing, such as advanced tumbling and polishing techniques, allow producers to differentiate their products, accessing niche, high-margin markets like bespoke interior design elements and high-end pool landscaping.

The cumulative impact forces strongly favor market growth, provided the industry successfully navigates the logistical and regulatory complexities. The persistent consumer demand for aesthetics and permanence in outdoor spaces acts as a foundational support. However, the external factor of fluctuating fuel prices and tightening global supply chain efficiency requirements exert continuous pressure on operational costs. Strategic investments in localized sourcing and decentralized processing facilities are necessary mitigation strategies to dampen the negative impact of high transportation expenses and ensure stable pricing for end-users, thereby maintaining the market's positive momentum.

- Drivers: Increased residential remodeling investment; Rising trend of elaborate outdoor living spaces; Need for low-maintenance, durable landscaping solutions; Growth of commercial real estate development.

- Restraints: High logistics and transportation costs associated with bulk, heavy materials; Strict environmental regulations impacting quarrying permits and operations; Availability of low-cost, synthetic alternatives.

- Opportunity: Development and adoption of recycled and engineered decorative materials; Expansion into water conservation landscaping (xeriscaping); Technological advancements in rock finishing and coloring; Growing demand in emerging economies for infrastructure beautification.

- Impact Forces: High leverage of construction activity (positive); Strong influence of global fuel prices on cost structure (negative); Increasing pressure for sustainable sourcing practices (transformative).

Segmentation Analysis

The Decorative Rock Market is meticulously segmented based on several key parameters to provide granular insights into market dynamics and consumer behavior. Primary segmentation occurs by Product Type, distinguishing materials such as river pebbles, crushed stone, boulders, and flagstones, each serving specific functional and aesthetic roles. Further classification by Application focuses on areas like Residential Landscaping, Commercial Projects, Infrastructure Development, and specialized uses such as Aquascaping, which helps producers tailor their material properties and marketing efforts to distinct end-user needs. Analyzing these segments is critical for understanding regional preferences, identifying emerging high-growth product categories, and strategically positioning companies within the competitive landscape.

The market is also segmented by Distribution Channel, primarily differentiating between direct sales (B2B, often to large construction firms and professional landscapers) and retail sales (B2C, involving garden centers, home improvement stores, and specialized stone yards). The End-User segmentation separates demand derived from professional contractors and architects versus individual homeowners, reflecting different volume requirements, purchasing criteria, and sensitivity to price versus quality. This multifaceted segmentation allows market participants to refine their product mix; for instance, premium, highly polished pebbles are primarily directed through specialized B2C channels, whereas bulk crushed stone is predominantly sold through B2B channels for infrastructure projects.

Understanding the interplay between these segments reveals critical commercial opportunities. For example, the growing residential segment is increasingly favoring decorative gravel and small pebbles due to their versatility and ease of installation, driving demand for packaged, ready-to-use products sold through large retail chains. Simultaneously, the commercial segment, particularly infrastructure and public works, requires high volumes of durable, large-format decorative boulders and flagstones, emphasizing logistical capabilities and long-term supply contracts. Continuous monitoring of segment performance ensures alignment of production capacity with actual market requirements, supporting sustained growth.

- By Product Type:

- Pebbles and River Stones

- Decorative Gravel and Crushed Stone

- Boulders and Rip Rap

- Flagstone and Pavers

- Specialty Aggregates (e.g., Colored Glass, Marble Chips)

- By Application:

- Residential Landscaping and Hardscaping

- Commercial and Public Parks

- Construction and Infrastructure (Road Embellishment)

- Interior Design and Water Features

- By End-User:

- Professional Landscapers and Contractors

- Residential Consumers (DIY)

- Government and Municipal Agencies

- By Distribution Channel:

- Direct Sales (Quarries to Project Sites)

- Retail Channels (Home Improvement Stores, Garden Centers)

- E-commerce Platforms and Specialty Stone Dealers

Value Chain Analysis For Decorative Rock Market

The value chain of the Decorative Rock Market begins with intensive upstream activities centered around raw material extraction. This involves geological surveying, land acquisition, obtaining regulatory permits, and the actual quarrying and mining of natural stone deposits. The efficiency and environmental compliance of quarrying operations are paramount, as the raw material cost is inherently linked to geographical proximity and extraction difficulty. Major upstream challenges include regulatory hurdles, environmental remediation costs, and capital intensity for heavy machinery acquisition. Suppliers who own and operate multiple, strategically located quarries gain significant competitive advantages by controlling raw material quality and mitigating transportation risks early in the supply chain.

The midstream phase involves complex processing, which includes crushing, screening, washing, tumbling (to achieve smooth finishes like river pebbles), sizing, and potentially coloring or coating the rock materials. Investment in advanced processing technology, such as automated sorting and sizing equipment, is critical for achieving the aesthetic consistency demanded by modern landscaping specifications. Following processing, effective distribution channels dictate market penetration. Direct distribution involves delivering bulk products directly from the quarry to large construction sites or municipal projects. Indirect distribution relies on a network of wholesalers, regional stone yards, and major retail chains (e.g., Home Depot, Lowe’s) that package and market the products to smaller contractors and the B2C segment. E-commerce platforms are increasingly serving as a significant indirect channel for niche, premium, or smaller-volume packaged goods.

Downstream activities involve the professional application and installation of decorative rock, typically managed by landscaping architects, contractors, and specialized hardscaping firms, who represent the final link to the end-user. The success of the downstream market relies heavily on design trends, the availability of skilled labor for installation, and the quality assurance of the stone material. Direct relationships with key downstream players allow producers to gather critical feedback on product performance and emerging aesthetic preferences. High-quality packaging, specialized regional sales support, and targeted marketing efforts aimed at both the professional installer and the DIY homeowner define success in the competitive downstream environment.

Decorative Rock Market Potential Customers

The Decorative Rock Market serves a broad spectrum of end-users, segmented primarily into professional contractors and residential consumers. Professional end-users, including landscape architecture firms, large-scale general contractors, and municipal public works departments, represent the largest volume purchasers, driven by requirements for infrastructure projects, large commercial hardscapes, and high-end residential developments. These buyers prioritize bulk availability, consistent quality assurance, adherence to strict specifications (e.g., specific sizing and aggregate strength), and reliable, long-term supply contracts. The purchasing cycle for professional clients is typically driven by project timelines and budget constraints, necessitating competitive pricing and robust logistical support from suppliers.

Residential consumers form the second major segment, encompassing individual homeowners and small-scale DIY enthusiasts. This segment is characterized by higher demand for packaged, manageable quantities, ease of transport, and aesthetic appeal, often prioritizing color, texture, and convenience over bulk price efficiency. Retail channels, garden centers, and online platforms are crucial for accessing this customer base. Their purchasing decisions are highly influenced by current gardening and home improvement trends, as well as seasonal factors relating to outdoor project execution, with demand peaking significantly during spring and summer months.

Niche customers constitute a growing third segment, including specialized businesses such as aquarium and terrarium builders, interior designers specifying decorative stones for lobbies or water features, and agricultural users requiring specialized rock materials for drainage or soil conditioning. Although these groups purchase lower volumes individually, their need for highly specialized or unique materials—such as exotic colors, specific grain sizes, or polished finishes—often commands premium pricing and higher margins for suppliers focusing on customized product lines. Addressing the diverse needs of these three customer profiles requires a highly flexible production and distribution strategy capable of managing both large bulk orders and high-value packaged goods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Martin Marietta Materials Inc., Vulcan Materials Company, Cemex S.A.B. de C.V., Heidelberg Materials AG, CRH plc, Holcim Group, Rinker Materials, Aggregate Industries (LafargeHolcim), The QUIKRETE Companies, Granite Construction Incorporated, Rocky Mountain Stone, Kafka Granite, LLC, Delaware Quarries, K.C. Border Stones, Pebble Junction, MDI Rock, Southwest Boulder & Stone, Inc., Valley View Stone, Eurovia (Vinci), Tarmac (CRH). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Decorative Rock Market Key Technology Landscape

The Decorative Rock Market leverages specialized technologies primarily focused on extraction efficiency, material processing precision, and logistics optimization, shifting away from purely conventional quarrying methods. Advanced quarry management systems incorporating drone mapping and 3D modeling are crucial for optimizing blast patterns and maximizing rock yield while minimizing environmental disturbance. This not only improves the safety profile of operations but also allows for precise extraction of specific layers or types of stone required for high-grade decorative applications. Furthermore, the integration of heavy machinery equipped with telematics and IoT sensors enables real-time monitoring of equipment performance, facilitating predictive maintenance strategies and significantly enhancing operational uptime, which is vital in a highly capital-intensive industry.

In the processing segment, the adoption of sophisticated screening and sorting technologies is paramount for achieving the consistent quality and uniform sizing demanded by the decorative market. High-resolution optical sorters and automated color grading systems are replacing manual inspection methods, ensuring that pebbles, gravel, and crushed stone meet stringent aesthetic specifications, free from impurities or undesirable color variances. New surface finishing technologies, including enhanced industrial tumbling barrels and specialized chemical coatings, are being employed to produce polished river stones and colored aggregates that resist fading and weathering, thereby increasing the premium value and lifespan of the product. The ability to apply durable, aesthetically pleasing finishes significantly expands the market's reach into high-end landscape design.

Logistical technology plays a transformative role in managing the supply chain for these heavy materials. GPS tracking and fleet management software optimize delivery schedules and routing for bulk haulage, reducing fuel consumption and operational costs. Moreover, customized software solutions are being developed to manage inventory in large storage yards, tracking specific rock types, sizes, and quantities using digitized systems rather than traditional manual methods. This digital integration facilitates seamless order fulfillment, reduces loading errors, and improves the overall customer experience, which is a critical differentiator in the competitive environment where logistics efficiency often outweighs minor price differences.

Regional Highlights

- North America (NA): Dominates the market value due to high consumer spending on home improvement, robust residential construction starts, and a strong DIY culture. The US and Canada exhibit high demand for premium flagstones, large decorative boulders, and specialized mulch alternatives (gravel) used in sustainable, water-wise landscaping projects. The region benefits from established supply chain networks and a high concentration of professional landscaping firms driving large-scale commercial contracts. Environmental concerns are promoting the use of recycled materials, driving innovation among key regional players.

- Europe: Characterized by mature markets with a strong regulatory focus on sustainability and material provenance. Demand is concentrated in Western European countries (Germany, UK, France) for natural stone pavers and polished pebbles, often specified for historical restoration and public space enhancements. The emphasis on high-quality, long-lasting materials and preference for locally sourced natural products, often slate, limestone, and granite, drives a highly fragmented but quality-focused market.

- Asia Pacific (APAC): Expected to register the highest Compound Annual Growth Rate (CAGR) owing to rapid urbanization, massive infrastructure development, and a surge in luxury real estate projects, particularly in China, India, and Southeast Asian nations. Government initiatives focused on beautification of public areas, parks, and highways create huge bulk demand for crushed decorative stone and aggregates. The market is competitive, focusing on volume and efficiency, although quality demand is rising in high-tier residential segments.

- Latin America (LATAM): Growth is steady, driven by urbanization in major metropolitan areas such as São Paulo and Mexico City. The market relies heavily on locally extracted, regional stones. Economic volatility occasionally impacts project scale, yet consistent demand exists in the high-end residential sector for imported and unique stone varieties for pool and patio areas.

- Middle East and Africa (MEA): High growth driven by large-scale commercial and hospitality projects in the Gulf Cooperation Council (GCC) countries, requiring aesthetically sophisticated desert landscaping solutions. Specialized demand for drought-tolerant hardscaping materials, including colored gravel and large, imported decorative rocks, is significant. Africa represents an emerging market, primarily focused on basic decorative aggregates tied to foundational infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Decorative Rock Market.- Martin Marietta Materials Inc.

- Vulcan Materials Company

- Cemex S.A.B. de C.V.

- Heidelberg Materials AG

- CRH plc

- Holcim Group

- Rinker Materials

- Aggregate Industries (LafargeHolcim)

- The QUIKRETE Companies

- Granite Construction Incorporated

- Rocky Mountain Stone

- Kafka Granite, LLC

- Delaware Quarries

- K.C. Border Stones

- Pebble Junction

- MDI Rock

- Southwest Boulder & Stone, Inc.

- Valley View Stone

- Eurovia (Vinci)

- Tarmac (CRH)

- BCI Stone

- Kornstone Aggregate & Landscape Supply

- Green Rock Co.

- New England Stone

- American Decorative Stone, Inc.

Frequently Asked Questions

Analyze common user questions about the Decorative Rock market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Decorative Rock Market?

The Decorative Rock Market is primarily driven by global increases in residential and commercial construction activity, particularly the expansion of outdoor living spaces and hardscaping projects. Additionally, the growing consumer preference for durable, low-maintenance, and aesthetically pleasing natural materials over synthetic alternatives, coupled with rising adoption of xeriscaping practices for water conservation, significantly boosts demand across North America and APAC.

How do logistics and transportation costs impact the final price of decorative rock?

Logistics and transportation costs exert a substantial impact on the final price of decorative rock due to the material's inherent weight and bulk. These costs often constitute a significant portion of the retail price, especially for long-haul distances. Market efficiency is highly dependent on optimized routing, localized sourcing, and proximity of quarries to major metropolitan consumer hubs to mitigate these operational expenses and ensure competitive pricing.

What role does sustainability play in the decorative rock industry?

Sustainability is becoming a crucial factor, influencing both sourcing and product development. Consumers and regulators increasingly demand environmentally compliant quarrying operations, proper land reclamation, and reduced environmental footprints. This trend is accelerating the adoption of recycled concrete aggregates and engineered decorative materials derived from industrial waste, offering eco-friendly alternatives to traditionally quarried stones and positioning companies as sustainable suppliers.

Which decorative rock segment shows the highest growth potential in the next five years?

The decorative gravel and pebble segment is anticipated to exhibit the highest growth potential. This is driven by its versatility in residential landscaping, use in permeable paving solutions for urban drainage management, and strong demand in water conservation landscaping (xeriscaping). The availability of these products in packaged, ready-to-use formats also facilitates ease of purchase for the expanding DIY consumer base.

How is AI technology transforming the sourcing and design processes in this market?

AI is transforming the market by optimizing complex logistics through predictive modeling, leading to faster and cheaper bulk delivery. In design, AI visualization software allows architects and consumers to simulate rock placement and aesthetics in 3D landscapes instantly. Furthermore, AI-driven optical sorting enhances product consistency and quality control at the processing stage, guaranteeing uniformity in size and color demanded by high-end projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager