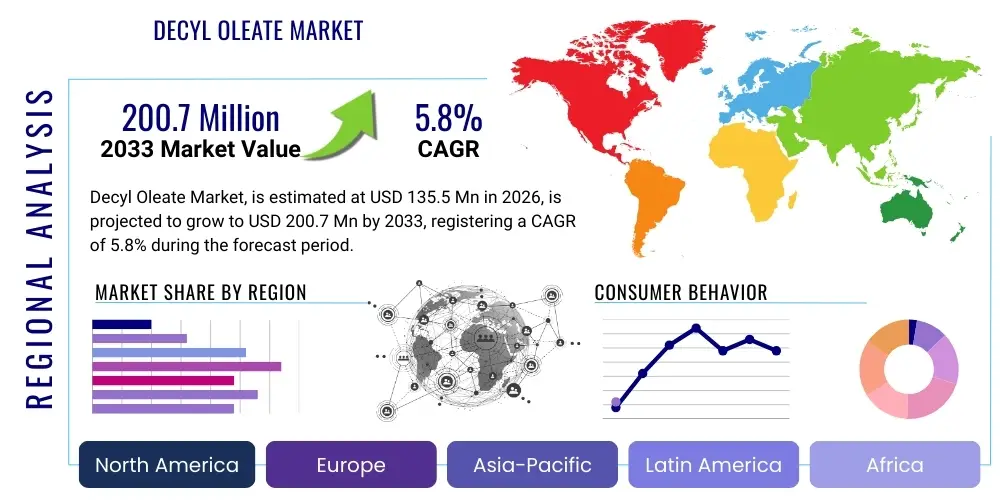

Decyl Oleate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437449 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Decyl Oleate Market Size

The Decyl Oleate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $135.5 Million in 2026 and is projected to reach $200.7 Million by the end of the forecast period in 2033.

Decyl Oleate Market introduction

Decyl Oleate is a widely utilized synthetic ester derived from decyl alcohol and oleic acid, primarily functioning as a medium-spreading emollient within the cosmetics and personal care industry. Chemically, it is known for its non-greasy feel, excellent spreadability, and ability to improve the texture and consistency of formulations. Its light emolliency makes it ideal for use in high-end moisturizing creams, lotions, sunscreens, and decorative cosmetics where rapid absorption and a smooth skin feel are critical determinants of consumer acceptance. The product acts by forming a thin, non-occlusive layer on the skin surface, significantly reducing transepidermal water loss and thereby enhancing skin hydration and softness.

The primary driver for the Decyl Oleate market expansion is the unrelenting global demand for sophisticated personal care products, particularly those marketed under the "natural-derived" or "plant-based" banner, given that oleic acid is often sourced from natural oils like olive, rapeseed, or palm oil. Major applications include skincare (anti-aging creams, body lotions), hair care (conditioners, styling products), and pharmaceuticals (topical drug delivery systems). Its stability against oxidation and compatibility with a wide array of formulation ingredients further solidifies its position as a staple ingredient for cosmetic chemists seeking versatile and high-performance emollients.

A key benefit of Decyl Oleate, which underpins its market significance, is its ability to dissolve UV filters effectively, making it indispensable in sun care formulations. Furthermore, it aids in pigment dispersion in color cosmetics, ensuring even and stable coverage. The market is also driven by technological advancements in esterification processes, leading to higher purity grades and more sustainable production methods, addressing the stringent regulatory standards concerning consumer safety and environmental impact across North America and Europe. This continuous focus on enhanced purity and sustainable sourcing is crucial for maintaining competitive advantage.

Decyl Oleate Market Executive Summary

The Decyl Oleate market is experiencing robust growth fueled by several converging business trends, most notably the shift towards natural and sustainable cosmetic ingredients and the rising consumer spending on premium skin care products in emerging economies. The market exhibits significant fragmentation among producers, yet consolidation is anticipated as major chemical companies seek to integrate specialized ester producers to secure supply chains and expand their functional ingredient portfolios. Key business trends include the emphasis on achieving RSPO (Roundtable on Sustainable Palm Oil) certification for palm-derived Decyl Oleate and the increasing investment in enzymatic synthesis techniques to reduce energy consumption and waste, aligning with global green chemistry initiatives.

Regionally, the Asia Pacific (APAC) region stands out as the primary growth engine, driven by massive population density, rapid urbanization, and a burgeoning middle class demanding imported or high-quality local cosmetic brands, particularly in countries like China, India, and South Korea. North America and Europe, while mature, dictate premiumization trends and stringent regulatory frameworks (e.g., REACH), forcing producers globally to adopt higher purity standards and rigorous safety testing protocols. These mature markets focus heavily on high-value, niche applications such as sensitive skin formulations and certified organic product lines, commanding higher price points and margin potential.

Segment-wise, the cosmetics and personal care sector remains the dominant application segment, followed distantly by industrial lubricants and specialized pharmaceutical applications. Within the personal care segment, the demand for Decyl Oleate in sunscreens is growing disproportionately due to global awareness campaigns regarding UV protection and the need for stable, non-whitening formulations. Manufacturers are responding by offering tailored grades optimized for specific viscosity and spreadability profiles, further segmenting the market based on functional performance (e.g., light-feel versus richer emollience). Pricing stability is moderately affected by volatility in crude oil and vegetable oil markets, which supply the raw materials (decyl alcohol and oleic acid).

AI Impact Analysis on Decyl Oleate Market

Common user inquiries concerning AI's influence on the Decyl Oleate market often revolve around how AI can accelerate novel formulation discovery, optimize complex supply chain logistics, and enhance quality control during manufacturing. Users are keen to understand if machine learning algorithms can predict consumer preferences for specific emollient textures or identify optimal ingredient combinations faster than traditional R&D methods. The prevailing concern is whether AI adoption will democratize formulation science or centralize expertise among large corporations capable of investing heavily in data infrastructure. Essentially, users expect AI to transition Decyl Oleate production and application from empirical testing to predictive modeling, ensuring higher product efficacy, faster time-to-market for new cosmetic lines, and robust consistency in bulk production, minimizing batch-to-batch variations.

- AI-driven Predictive Formulation: Algorithms analyze thousands of ingredient compatibility datasets to suggest optimal concentrations of Decyl Oleate, reducing laboratory trial time by up to 40%.

- Supply Chain Optimization: Machine learning models forecast oleic acid and decyl alcohol price fluctuations and availability, enabling manufacturers to execute strategic bulk purchasing and hedging against commodity market volatility.

- Enhanced Quality Control (QC): AI-powered machine vision systems monitor esterification processes in real-time, detecting impurities or deviations in color, viscosity, or ester content with greater precision than traditional spectroscopic methods.

- Sustainable Sourcing Optimization: AI tracks and verifies the sustainability certifications (e.g., RSPO traceability) of raw materials used in Decyl Oleate synthesis, improving supply chain transparency for environmentally conscious end-users.

- Consumer Preference Modeling: AI analyzes social media trends and consumer feedback data to link specific sensory attributes (like non-greasy feel) directly to Decyl Oleate concentration, guiding product development.

DRO & Impact Forces Of Decyl Oleate Market

The dynamics of the Decyl Oleate market are governed by a complex interplay of drivers, restraints, and opportunities, collectively categorized as impact forces. A primary driver is the accelerating consumer preference for mild, non-irritating emollients, especially as clean beauty movements gain traction globally, positioning Decyl Oleate favorably due to its excellent dermatological profile and light feel. However, the market faces significant restraint from the volatile pricing of its primary raw materials, particularly oleic acid derived from vegetable sources, which can fluctuate wildly based on agricultural output, climate change effects, and geopolitical trade policies. Opportunities lie heavily in biotechnological advancements, specifically enzymatic esterification, which promises higher yield, lower energy inputs, and reduced solvent usage, meeting the industry's dual need for efficiency and sustainability.

The impact forces further include intense regulatory scrutiny in key regions, which acts as both a barrier to entry for smaller, less compliant manufacturers and an accelerator for innovation among established players committed to safety and transparency. The market is also strongly influenced by substitution risk, particularly from novel bio-based emollients and specialized silicone alternatives that offer comparable or superior sensory properties for certain high-end applications. The continuous evolution of skin microbiome science is driving formulators to seek excipients that are inert and non-disruptive, offering a significant opportunity for Decyl Oleate to be positioned as a safe, established, and well-understood cosmetic base ingredient compatible with microbiome-friendly claims.

Consequently, the overarching impact force driving market expansion remains the inelastic demand from the global cosmetics industry, which requires reliable, high-volume supply of functional esters to maintain the quality and appeal of mass-market and luxury products alike. The pressure on cost optimization, while maintaining quality standards suitable for premium brand usage, forces manufacturers to continually refine their production technology and streamline their feedstock procurement strategies. Successfully navigating the raw material volatility while capitalizing on sustainable production methods is key to long-term market leadership and resilience against competitive forces.

Segmentation Analysis

The Decyl Oleate market is structurally segmented primarily based on application, end-user industry, and grade of purity, reflecting the diverse requirements across consumer and industrial sectors. The application segmentation delineates how the product is utilized, with the primary categories being sunscreens, moisturizers, color cosmetics, and hair care products, each requiring Decyl Oleate for specific functional attributes such as UV filter solubilization or improved tactile feel. Geographic segmentation remains crucial, as regulatory standards and consumer purchasing power dramatically influence product penetration and demand across different regions, with APAC and North America being the key revenue generators.

Segmentation by grade of purity is increasingly relevant, separating technical-grade Decyl Oleate used in industrial applications (e.g., metalworking fluids, textile processing) from high-purity cosmetic and pharmaceutical grades. Cosmetic grade requires minimal residual catalyst or contaminants, adhering to strict industry standards set by bodies like the Cosmetic Ingredient Review (CIR). Pharmaceutical grade, though niche, demands the highest level of purity and traceability for use in topical drug delivery systems and sterile preparations, often commanding a significant price premium due to rigorous testing and documentation requirements.

Finally, segmentation by source is emerging as a critical factor due to sustainability trends, distinguishing between Decyl Oleate derived from palm oil (requiring RSPO certification), olive oil, rapeseed oil, or synthetic petrochemical routes. This source differentiation allows brands to align their formulations with specific environmental and ethical positioning, heavily influencing buyer decisions, especially among European and North American CPG companies committed to transparent sourcing declarations.

- By Application

- Skincare (Moisturizers, Anti-Aging Creams)

- Sun Care Products (Sunscreens, After-Sun Lotions)

- Hair Care (Conditioners, Shampoos)

- Color Cosmetics (Foundations, Lipsticks)

- Pharmaceutical (Topical Ointments, Transdermal Patches)

- Industrial Lubricants and Fluids

- By Grade

- Cosmetic Grade

- Pharmaceutical Grade

- Technical Grade

- By Source

- Plant-Derived (Palm, Olive, Rapeseed)

- Synthetic/Petrochemical Derived

- By End-User Industry

- Cosmetics and Personal Care

- Pharmaceuticals

- Chemical and Industrial

Value Chain Analysis For Decyl Oleate Market

The value chain for Decyl Oleate begins significantly upstream with the sourcing and processing of feedstock, primarily focusing on fatty alcohols (Decyl Alcohol) and fatty acids (Oleic Acid). Oleic acid is predominantly derived from the hydrolysis of vegetable oils such as palm, soybean, or olive oil, making upstream analysis highly dependent on agricultural commodity pricing and climate stability, which directly influence the cost structure of the end product. Key upstream players include agricultural processors and specialized oleochemical manufacturers that perform the initial splitting and distillation processes. The move towards certified sustainable sourcing, particularly RSPO-certified palm derivatives, adds complexity and cost at this stage, but is non-negotiable for market access in sensitive regions.

The midstream stage involves the core manufacturing process: the esterification of decyl alcohol and oleic acid, followed by purification, filtration, and quality assurance testing. This stage is dominated by specialty chemical manufacturers who leverage advanced batch or continuous reaction technologies, increasingly incorporating enzymatic catalysis to improve efficiency and purity. The successful management of this stage dictates the final product's grade (cosmetic, technical, or pharmaceutical) and its compliance with international regulatory bodies. Intense focus is placed on achieving minimal residual alcohol content and low acid value to ensure product stability and safety in final formulations.

Downstream analysis highlights the intricate distribution channel structure. Decyl Oleate flows primarily through B2B channels, categorized into direct sales and indirect distribution. Direct sales involve large-volume agreements between manufacturers and major multinational cosmetic corporations (e.g., L’Oréal, Estée Lauder), ensuring tailored specifications and supply reliability. Indirect channels rely on regional chemical distributors and specialized cosmetic ingredient suppliers who manage inventory, handle smaller orders, and provide technical support to thousands of small and medium-sized cosmetic brands. The effectiveness of the indirect channel is crucial for penetrating niche markets and supporting localized formulation trends, requiring strong logistical capabilities and comprehensive knowledge of regional chemical regulations.

Decyl Oleate Market Potential Customers

The primary customers for Decyl Oleate are large-scale contract manufacturers and global brand owners within the cosmetics and personal care sector who utilize the ingredient as a key functional component. These end-users, such as multinational beauty conglomerates and specialized skincare brands, value Decyl Oleate for its performance as a non-comedogenic emollient, solvent for active ingredients, and texture enhancer. The purchasing decisions of these major CPG entities are driven by ingredient safety profile, supply chain traceability, competitive pricing, and the supplier's capacity to deliver high-volume, consistent quality that meets internal specifications and international safety standards.

Secondary potential customers include smaller, independent clean beauty brands and artisanal cosmetic producers who prioritize natural-derived ingredients and excellent sensory qualities, often procuring smaller volumes through specialized distributors. These customers seek out suppliers who can provide comprehensive documentation regarding the sourcing and sustainability profile of the Decyl Oleate. Furthermore, specialized chemical companies serving the industrial sector purchase technical grade Decyl Oleate for its lubricating properties in metalworking and textile finishing processes, where stability and viscosity modification are paramount requirements.

A growing, albeit niche, customer segment is the pharmaceutical industry, particularly companies focused on dermatological preparations and topical drug delivery systems. These buyers require pharmaceutical-grade material, which necessitates stringent documentation, low impurity levels, and compliance with Good Manufacturing Practice (GMP) guidelines. For these end-users, Decyl Oleate acts as a safe, inert vehicle or penetration enhancer, and the primary purchasing criterion shifts from cost to regulatory compliance and the supplier's established track record in pharmaceutical excipient provision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $135.5 Million |

| Market Forecast in 2033 | $200.7 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Stepan Company, Emery Oleochemicals, KLK Oleo, P&G Chemicals, Kao Corporation, Croda International Plc, Phoenix Chemical Inc., Mosselman S.A., Jarchem Industries Inc., Alzo International Inc., The Lubrizol Corporation, Lonza Group, Wacker Chemie AG, Oleon NV, VVF LLC, Acme-Hardesty Co., Mona Industries Inc., Fine Organics, Hallstar Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Decyl Oleate Market Key Technology Landscape

The manufacturing technology for Decyl Oleate is predominantly based on esterification reactions, which historically utilized strong acid catalysts under high heat. However, the market is rapidly pivoting towards sophisticated technologies that emphasize efficiency, purity, and environmental sustainability. A major technological shift is the increasing adoption of enzymatic esterification, utilizing immobilized lipases. This green chemistry approach operates under milder conditions (lower temperature and pressure), significantly reducing energy consumption and minimizing the formation of undesirable byproducts, which in turn simplifies the downstream purification process. Enzymatic methods are highly valued for producing 'natural-derived' Decyl Oleate with fewer residual chemical contaminants, meeting the stringent quality demands of the cosmetic sector.

Another crucial technological development involves continuous process manufacturing (CPT) replacing traditional batch processes. CPT enhances consistency, allows for better scalability, and reduces overall operational costs by maintaining a steady state. Furthermore, advancements in specialized purification techniques, such as molecular distillation and membrane filtration, are essential for achieving the ultra-high purity required for pharmaceutical and sensitive cosmetic applications. These technologies effectively remove trace impurities, including unreacted alcohol/acid and heavy metals, ensuring the final product meets global pharmacopeial standards and dermatological safety requirements.

The integration of advanced analytical chemistry tools, particularly sophisticated Gas Chromatography-Mass Spectrometry (GC-MS) and High-Performance Liquid Chromatography (HPLC), is critical for quality control and ensuring lot-to-lot consistency. Manufacturers are leveraging these technologies not just for final product testing but for real-time monitoring of the reaction kinetics. This data-driven approach, often paired with AI and statistical process control (SPC), allows producers to precisely control reaction parameters and instantly adjust conditions, thereby optimizing yield and minimizing waste in line with Lean Manufacturing principles. These technological investments are fundamental for sustaining a competitive edge in a market sensitive to both quality and cost.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, production, and regulatory landscape of the Decyl Oleate Market. The market analysis reveals distinct consumption patterns and growth trajectories across major geographical segments.

- Asia Pacific (APAC): This region represents the fastest-growing market, primarily fueled by massive consumer bases in China, India, and ASEAN countries. Rapid expansion in domestic cosmetics manufacturing, coupled with increasing disposable incomes and westernization of beauty standards, drives high demand for functional emollients like Decyl Oleate. South Korea and Japan remain key innovation hubs, demanding premium, high-purity grades for their sophisticated skincare formulations.

- North America: Characterized by high consumer awareness regarding ingredient transparency and safety. The United States is a significant market, emphasizing sustainability and natural derivation. Demand here is dominated by premium skincare and sun care segments, where Decyl Oleate is valued for its non-greasy texture and effectiveness in solubilizing UV filters. Stringent FDA and state-level regulations push manufacturers towards traceable and compliant supply chains.

- Europe: A mature but highly regulated market, dominated by the EU’s REACH legislation and strong consumer preferences for certified sustainable products, particularly those using RSPO-certified palm derivatives or alternatives like olive oil. Germany, France, and the UK are major consumption centers, with strong emphasis on cosmetic safety, quality, and environmental impact, driving innovation in enzymatic and green synthesis technologies.

- Latin America (LATAM): Brazil leads the regional demand, possessing a large domestic personal care industry. Market growth is stable, driven by mass-market cosmetic usage and local production capacity. Price sensitivity is higher compared to North America and Europe, often leading to a stronger market presence for cost-effective technical grades.

- Middle East and Africa (MEA): This region is experiencing nascent growth, primarily centered in the GCC countries (UAE, Saudi Arabia) driven by luxury cosmetic imports and increasing local manufacturing initiatives. The climate necessitates robust formulations (e.g., high SPF sunscreens), providing a consistent underlying demand for stable emollients. Regulatory frameworks are progressively becoming more formalized, aligning with international standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Decyl Oleate Market.- BASF SE

- Stepan Company

- Emery Oleochemicals

- KLK Oleo

- P&G Chemicals

- Kao Corporation

- Croda International Plc

- Phoenix Chemical Inc.

- Mosselman S.A.

- Jarchem Industries Inc.

- Alzo International Inc.

- The Lubrizol Corporation

- Lonza Group

- Wacker Chemie AG

- Oleon NV

- VVF LLC

- Acme-Hardesty Co.

- Mona Industries Inc.

- Fine Organics

- Hallstar Company

Frequently Asked Questions

Analyze common user questions about the Decyl Oleate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Decyl Oleate primarily used for in cosmetic formulations?

Decyl Oleate is primarily used as a non-greasy, medium-spreading emollient and skin conditioning agent. Its main functions include moisturizing the skin by reducing water loss, improving the texture of creams and lotions, and acting as a solvent for fat-soluble ingredients such as UV filters and pigments in color cosmetics.

Is Decyl Oleate considered natural or sustainable in the cosmetic industry?

While Decyl Oleate is chemically synthesized through the esterification of decyl alcohol and oleic acid, the oleic acid component is frequently sourced from natural vegetable oils (e.g., palm, olive, rapeseed). Therefore, it is often marketed as 'natural-derived.' Sustainability depends heavily on the sourcing of the feedstock, particularly the use of certified sustainable palm oil (RSPO).

How does the volatility of raw material prices impact the Decyl Oleate market?

The market price of Decyl Oleate is highly sensitive to the volatile global commodity prices of vegetable oils (especially palm and soybean oil), which are the primary sources of oleic acid. Fluctuations directly affect the manufacturing cost, leading to potential margin pressures for producers and fluctuating procurement costs for end-user cosmetic companies.

Which advanced manufacturing technology is gaining traction in Decyl Oleate production?

Enzymatic esterification utilizing immobilized lipases is rapidly gaining traction. This green chemistry approach allows for the synthesis of high-purity Decyl Oleate under milder, more sustainable conditions compared to traditional chemical catalysis, aligning with consumer demand for cleaner, environmentally friendly ingredients.

Which regional market holds the highest growth potential for Decyl Oleate?

The Asia Pacific (APAC) region, specifically countries like China and India, exhibits the highest growth potential. This is driven by rapid urbanization, significant growth in the local beauty and personal care manufacturing sectors, and rising consumer demand for sophisticated, functional cosmetic ingredients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager