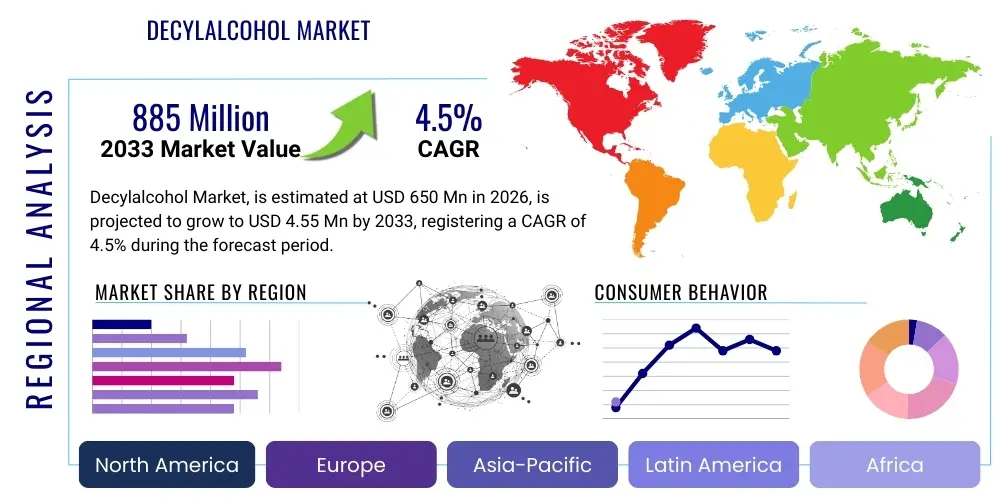

Decylalcohol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438268 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Decylalcohol Market Size

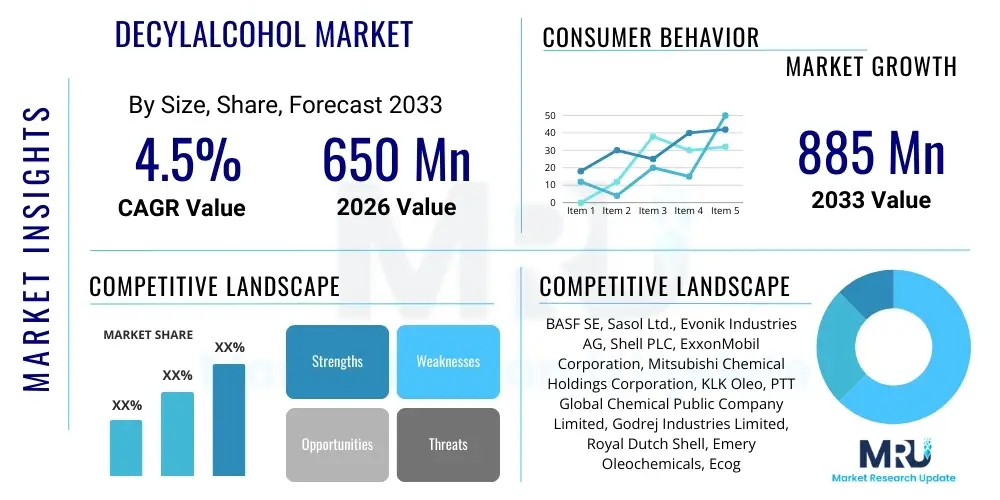

The Decylalcohol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 885 Million by the end of the forecast period in 2033.

Decylalcohol Market introduction

Decylalcohol, chemically known as n-Decanol, is a straight-chain fatty alcohol derived primarily from petrochemical feedstock through the oxo synthesis process or from natural oils and fats via hydrogenation. This colorless liquid acts as a crucial intermediate in the chemical manufacturing industry. Its unique properties, including low volatility and excellent solvency, make it indispensable across a wide spectrum of applications, specifically in the production of high-performance surfactants, plasticizers, lubricants, and synthetic resins. The market growth is inherently tied to the expansion of end-use sectors such as construction, automotive, and personal care, where specialized chemical compounds derived from decylalcohol enhance product performance and longevity.

The primary application of decylalcohol lies in the synthesis of phthalate and non-phthalate plasticizers, such as dioctyl phthalate (DOP) and diisodecyl phthalate (DIDP), which are essential for imparting flexibility and durability to polyvinyl chloride (PVC) products. Furthermore, its derivatives, including ethoxylates and sulfates, are widely utilized as non-ionic and anionic surfactants in detergents, cleaning agents, and emulsifiers, driven by the global demand for effective cleaning solutions and sophisticated personal care formulations. The versatility of decylalcohol as a chemical building block ensures its sustained relevance across industrial and consumer markets.

Key driving factors propelling the decylalcohol market include the rising demand for high-performance plasticizers in the burgeoning construction and automotive industries, particularly in developing economies. Additionally, stringent regulatory shifts favoring biodegradable and less toxic surfactant options are encouraging the use of natural-source decylalcohol derivatives. The increasing consumption of household and industrial cleaning products globally, alongside continuous innovation in specialty chemicals, further solidifies the market's positive trajectory. However, fluctuations in crude oil prices, which directly impact feedstock costs, remain a critical challenge for market stability.

Decylalcohol Market Executive Summary

The Decylalcohol market demonstrates robust growth, primarily fueled by the accelerating construction activities in Asia Pacific and the increasing global adoption of non-phthalate plasticizers due to environmental regulations. Business trends indicate a strong focus on strategic mergers and acquisitions among key producers to consolidate supply chains and achieve economies of scale, alongside increased investment in bio-based decylalcohol production to cater to sustainability mandates. Producers are increasingly differentiating their offerings based on purity levels and compliance with specific regional regulatory standards, particularly concerning volatile organic compounds (VOCs) and material safety.

Regionally, Asia Pacific (APAC) stands as the dominant and fastest-growing market segment, underpinned by massive industrialization, rapid urbanization, and significant expansion of the manufacturing base for PVC, coatings, and textiles in countries like China and India. North America and Europe, while mature, are characterized by high demand for specialty surfactants and a strong push toward sustainable chemicals, driving innovation in renewable feedstock utilization. Market segmentation analysis highlights the continued dominance of the plasticizers application segment, closely followed by surfactants, reflecting the material’s foundational role in high-volume industrial and consumer goods production.

Segment trends reveal that the synthetic decylalcohol derived from petrochemical sources still holds the largest market share due to cost-effectiveness and stable supply volumes, but the natural or bio-based decylalcohol segment is gaining traction rapidly, especially in Europe, supported by consumer preference for natural ingredients in cosmetics and cleaning products. The inherent volatility of raw material prices necessitates flexible pricing strategies and vertical integration across the value chain to mitigate risk, positioning technological efficiency in production processes as a key competitive differentiator for market participants aiming to capture sustained profitable growth.

AI Impact Analysis on Decylalcohol Market

User inquiries regarding AI's influence on the Decylalcohol market frequently center on how artificial intelligence can optimize complex chemical manufacturing processes, predict raw material price volatility (crude oil and natural gas derivatives), and accelerate R&D for novel, sustainable derivatives. Users are keenly interested in predictive maintenance models for reactors and distillation columns, seeking to reduce downtime and improve operational efficiency (OEE). Another common theme is the role of machine learning in supply chain logistics, specifically forecasting demand across diverse end-use sectors and optimizing inventory management for intermediate chemicals. Consequently, the key expectation is that AI integration will lead to significant cost reductions in manufacturing, enhanced product quality through real-time process control, and faster development cycles for bio-based alternatives.

The implementation of AI and advanced analytics is transforming the operational landscape of decylalcohol production. Smart sensor deployment coupled with multivariate statistical analysis allows manufacturers to monitor critical process parameters, such as temperature, pressure, and catalyst efficiency, with unprecedented accuracy. This real-time data flow enables predictive maintenance scheduling, preventing costly failures and ensuring continuous, high-purity yield. Furthermore, computational chemistry, powered by AI, is being utilized to model and simulate molecular interactions, accelerating the discovery and scaling of new decylalcohol-based surfactants and polymers with optimized environmental profiles, addressing regulatory pressures.

Supply chain resilience, a critical concern given the commodity nature of feedstock, is significantly enhanced by AI applications. Machine learning algorithms analyze global economic indicators, geopolitical events, and historical price data to generate highly accurate forecasts for feedstock costs and future demand across geographic regions. This predictive capability allows procurement teams to secure raw materials at optimal times, minimizing price exposure and inventory holding costs, thus ensuring a competitive edge in the highly sensitive decylalcohol market.

- AI-driven optimization of oxo synthesis and hydrogenation processes for increased yield and energy efficiency.

- Predictive maintenance schedules deployed for critical production assets, minimizing unplanned operational stoppages.

- Machine learning models utilized for accurate forecasting of petrochemical feedstock prices and end-use demand fluctuations.

- Accelerated R&D and formulation of novel, eco-friendly decylalcohol derivatives using computational chemistry simulations.

- Enhanced supply chain visibility and risk management through AI-powered logistics and inventory optimization systems.

DRO & Impact Forces Of Decylalcohol Market

The Decylalcohol market is powerfully influenced by a confluence of driving factors, primarily centered around the global demand for durable and flexible materials in infrastructure and the consumer shift toward high-performance cleaning and personal care products. Major growth drivers include the continuous expansion of the PVC industry, which relies heavily on decylalcohol-derived plasticizers, and the strong growth trajectory of the surfactants segment, driven by urbanization and rising disposable incomes globally. These factors create sustained demand momentum for the core chemical intermediate across diverse manufacturing verticals, necessitating consistent capacity expansion and technological upgrades.

However, the market faces significant restraints that necessitate strategic management. The primary restraint is the inherent volatility in the prices of crude oil and natural gas, which constitute the foundational feedstock for synthetic decylalcohol production. This price instability directly impacts manufacturing costs and profit margins, making long-term financial planning challenging. Furthermore, increasing regulatory scrutiny, particularly in developed regions like Europe, regarding the use of phthalate plasticizers derived from decylalcohol forces manufacturers to invest heavily in the development and adoption of safer, non-phthalate alternatives, adding complexity and cost to production processes.

Opportunities for market players are abundant, particularly in leveraging the transition towards sustainable chemistry. The burgeoning interest in bio-based chemicals presents a substantial avenue for growth, encouraging investment in processes that utilize renewable raw materials such as palm kernel oil or coconut oil to produce natural decylalcohol. Additionally, untapped potential exists in specialty applications, including advanced lubricants, specialized textile auxiliaries, and high-pgrade cosmetics, which command premium pricing and require high-purity decylalcohol derivatives. Successfully capitalizing on these opportunities requires deep market understanding, robust R&D capabilities, and strategic partnerships across the supply chain.

Segmentation Analysis

The Decylalcohol market is rigorously segmented based on product type, application, and end-use industry, providing granular insights into demand patterns and competitive landscapes. Product type segmentation distinguishes between synthetic decylalcohol, primarily sourced from petrochemicals via the Ziegler or Oxo processes, and natural decylalcohol, derived from vegetable oils. Application segmentation reflects the material's versatility, covering its use in plasticizers, surfactants, lubricants, solvents, and other chemical intermediates. End-use segmentation tracks consumption across key industries such as construction, automotive, textile, cosmetics, and household care, identifying which sectors are the major volume drivers and growth accelerators for the market.

The dominance of the synthetic segment is largely due to established infrastructure, high efficiency, and stable supply volumes, although the natural segment is growing at a faster pace driven by environmental consciousness and regulatory mandates in consumer markets. Within applications, plasticizers retain the largest revenue share, reflecting the widespread use of flexible PVC in pipes, cables, and automotive interiors. The surfactants segment, however, is witnessing accelerated growth due to the expanding global market for high-performance detergents and personal hygiene products, especially in emerging economies undergoing rapid population growth and improved sanitation standards.

Geographic segmentation is critical, with Asia Pacific exhibiting the highest consumption rates, powered by its colossal manufacturing and construction sectors. North America and Europe, focusing on high-value specialty chemicals, drive demand for high-purity grades and bio-based alternatives. Understanding these segmentation dynamics is vital for market players to tailor production capacities, develop specialized product portfolios, and strategically allocate resources to maximize penetration in high-growth niches while maintaining leadership in established high-volume markets.

- By Type:

- Synthetic Decylalcohol (Petrochemical-based)

- Natural Decylalcohol (Bio-based, derived from oils)

- By Application:

- Plasticizers (e.g., DINP, DIDP)

- Surfactants (Non-ionic and Anionic)

- Lubricants and Oil Additives

- Solvents and Cosolvents

- Chemical Intermediates

- Others (Flavors, Fragrances)

- By End-Use Industry:

- Construction

- Automotive

- Consumer Goods and Cosmetics

- Textiles and Leather

- Chemical Processing

- Paints and Coatings

- By Region:

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (Saudi Arabia, UAE, South Africa, Rest of MEA)

Value Chain Analysis For Decylalcohol Market

The value chain for Decylalcohol commences with the upstream extraction and processing of primary raw materials, predominantly petrochemical feedstocks such as ethylene or propylene, which are crucial for the synthetic production route via oxo synthesis. For the natural route, the upstream segment involves the cultivation, harvesting, and refining of natural fats and oils, specifically palm kernel or coconut oil. Efficiency in this initial stage, particularly securing stable and cost-effective access to feedstock, determines the overall profitability and competitive positioning of decylalcohol manufacturers. Key challenges at this stage include managing the volatility of global commodity markets and ensuring sustainable sourcing practices for bio-based materials.

The core manufacturing stage involves complex chemical reactions—oxo synthesis followed by hydrogenation for synthetic routes, or hydrogenation/hydrolysis for natural routes—to produce the final high-purity decylalcohol. Major manufacturers invest heavily in continuous process improvements, catalyst technology, and energy optimization to reduce operating costs and meet stringent purity requirements demanded by downstream producers of plasticizers and surfactants. Direct distribution often involves bulk sales to large chemical conglomerates or captive consumption, where vertically integrated companies use the produced alcohol internally for derivative synthesis, thereby capturing a greater share of the value.

The downstream segment encompasses the conversion of decylalcohol into value-added derivatives. These derivatives, including Diisodecyl Phthalate (DIDP), decyl glucoside surfactants, and specialty lubricants, are then sold to various end-use industries. Distribution channels are typically complex, involving direct sales teams for major industrial accounts, regional distributors for smaller volume buyers, and specialized agents for international trade. Indirect channels play a vital role in reaching dispersed consumer goods manufacturers. The efficiency of this downstream segment relies on responsive logistics, customized product formulation capabilities, and strong technical support to end-users in specialized application development.

Decylalcohol Market Potential Customers

The primary consumers and end-users of Decylalcohol are large-scale chemical derivative manufacturers who leverage its properties as an essential intermediate. Companies specializing in plasticizer manufacturing, particularly those producing high-volume compounds like Diisodecyl Phthalate (DIDP) and Diisodecyl Adipate (DIDA) for PVC compounding, represent the largest customer base. These customers operate within the construction sector (for piping, flooring, roofing) and the automotive industry (for interior components, wire coatings), where flexibility, durability, and heat resistance are paramount material requirements.

Another significant customer segment comprises manufacturers in the Fast-Moving Consumer Goods (FMCG) and personal care industries. These companies require decylalcohol derivatives, predominantly in the form of ethoxylated or sulfated surfactants (such as decyl glucoside), for formulation into detergents, dishwashing liquids, shampoos, and specialized cleaning agents. The demand here is driven by the need for effective cleaning performance combined with gentleness and, increasingly, biodegradability, which aligns particularly well with the attributes of natural decylalcohol derivatives.

Furthermore, specialty chemical manufacturers targeting niche applications form a robust customer base. This includes producers of advanced industrial lubricants, which use decylalcohol as a base oil component or additive to enhance thermal stability and lubricity. Customers in the paints, coatings, and resins industry also utilize decylalcohol as a solvent or coalescing agent to improve film formation and performance. The diversity of these end-user applications ensures a broad and relatively stable demand profile for decylalcohol across global manufacturing ecosystems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 885 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Sasol Ltd., Evonik Industries AG, Shell PLC, ExxonMobil Corporation, Mitsubishi Chemical Holdings Corporation, KLK Oleo, PTT Global Chemical Public Company Limited, Godrej Industries Limited, Royal Dutch Shell, Emery Oleochemicals, Ecogreen Oleochemicals, VVF Limited, The Dow Chemical Company, Jiangsu Danhua Group, Sinopec Corp., Perstorp Group, Arkema S.A., TCI Chemicals (India) Pvt. Ltd., KH Neochem Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Decylalcohol Market Key Technology Landscape

The technological landscape of the Decylalcohol market is dominated by two fundamental production pathways: the Oxo synthesis process for synthetic decylalcohol and the catalytic hydrogenation of fatty acids derived from natural oils for bio-based decylalcohol. Oxo synthesis, which involves the hydroformylation of an olefin (nonene) followed by hydrogenation, remains the most prevalent industrial method due to its high efficiency and scalability, relying heavily on advancements in specialized catalysts, such as rhodium-based systems, to maximize selectivity and minimize side product formation. Continuous technological refinement focuses on improving energy integration within these large-scale petrochemical complexes to reduce operational expenditure and enhance sustainability performance.

Significant innovation is also being observed in the development of efficient separation and purification technologies. To meet the high-purity requirements for premium applications, particularly in cosmetics and specialty lubricants, advanced distillation techniques, including vacuum and fractional distillation columns, are crucial. Manufacturers are integrating process intensification methods to reduce equipment size and improve throughput. Furthermore, the industry is exploring membrane separation and specialized solvent extraction techniques to enhance the final product quality while simultaneously reducing the energy footprint associated with conventional thermal separation processes.

The emerging technological frontier is centered on bio-based production routes, utilizing renewable feedstocks like palm kernel or coconut oil. Key technological advancements here involve enzyme-catalyzed hydrolysis and subsequent continuous flow hydrogenation of C10 fatty acids. This bio-route is receiving heavy investment, driven by sustainability goals, aiming to overcome the current challenges related to feedstock availability fluctuations and ensuring the final product meets the identical performance specifications of petrochemical-derived decylalcohol. Research into microbial fermentation processes to directly produce fatty alcohols also represents a long-term disruptive potential, offering a pathway toward truly carbon-neutral production.

Regional Highlights

The global Decylalcohol market exhibits distinct regional dynamics, driven by varied industrial activity levels, regulatory environments, and consumer preferences for sustainability.

- Asia Pacific (APAC): APAC is the global leader in both consumption and production, spearheaded by the massive manufacturing output in China and India. This region's dominance is attributed to rapid urbanization, exponential growth in infrastructure development, and the expansion of the automotive and construction sectors, which drive the demand for plasticizers. Furthermore, the rising adoption of personal care and household cleaning products among the growing middle-class population significantly boosts the demand for decylalcohol-based surfactants. Capacity expansion and new plant construction are concentrated in this region.

- North America: This region is a mature market characterized by stringent environmental regulations and a high demand for specialty, high-purity decylalcohol, particularly for synthetic lubricants and specialty coatings. Growth is less volume-driven and more value-driven, focusing on innovation in non-phthalate plasticizers and high-performance, bio-based surfactants, reflecting a strong emphasis on sustainability and product safety in the consumer market.

- Europe: Europe mandates strong regulatory compliance, particularly concerning REACH and directives limiting the use of certain phthalates, positioning the region as a pioneer in the adoption of bio-based decylalcohol. While overall industrial growth may be slower than in APAC, the high concentration of major chemical producers and strong demand from the premium cosmetics and high-end automotive sectors ensure sustained, high-value demand for specialized and sustainable derivatives.

- Latin America (LATAM): This region offers moderate growth potential, driven by expanding construction sectors in countries like Brazil and Mexico. Market growth is closely linked to internal economic stability and foreign direct investment into manufacturing capabilities. The market primarily consumes synthetic decylalcohol for mass-market plasticizer and basic surfactant applications.

- Middle East and Africa (MEA): Growth in MEA is bolstered by substantial investments in petrochemical infrastructure and the establishment of new downstream chemical conversion facilities, particularly in the Gulf Cooperation Council (GCC) countries. These countries, leveraging abundant oil and gas reserves, are aiming to become major exporters of chemical intermediates, including decylalcohol.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Decylalcohol Market.- BASF SE

- Sasol Ltd.

- Evonik Industries AG

- Shell PLC

- ExxonMobil Corporation

- Mitsubishi Chemical Holdings Corporation

- KLK Oleo

- PTT Global Chemical Public Company Limited

- Godrej Industries Limited

- Royal Dutch Shell

- Emery Oleochemicals

- Ecogreen Oleochemicals

- VVF Limited

- The Dow Chemical Company

- Jiangsu Danhua Group

- Sinopec Corp.

- Perstorp Group

- Arkema S.A.

- TCI Chemicals (India) Pvt. Ltd.

- KH Neochem Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Decylalcohol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Decylalcohol in industrial applications?

Decylalcohol is primarily utilized as a vital chemical intermediate for synthesizing high-performance plasticizers (such as DIDP) used extensively in PVC manufacturing, and for creating surfactants (detergents, emulsifiers) crucial for the household care and personal care industries. Its straight-chain structure and low toxicity make it an effective building block for specialty chemicals.

How is the demand for synthetic Decylalcohol different from bio-based Decylalcohol?

Synthetic Decylalcohol, derived from petrochemicals, dominates the market volume due to cost-efficiency and stable supply, catering primarily to high-volume industrial uses like plasticizers. Bio-based Decylalcohol, sourced from natural oils, is rapidly growing in demand, especially in Europe and North America, driven by consumer preference and regulatory pressure for sustainable and biodegradable ingredients in cosmetics and specialty cleaning products.

Which application segment holds the largest share in the Decylalcohol Market?

The plasticizers application segment accounts for the largest market share. Decylalcohol is indispensable for producing non-phthalate plasticizers like DIDP, which provide necessary flexibility and durability to PVC products used across the robust construction and automotive sectors globally.

What key factors restrain the growth of the Decylalcohol market?

The primary constraint on market growth is the volatility of upstream feedstock prices, specifically crude oil and natural gas derivatives, which are essential for synthetic decylalcohol production. Additionally, increasing environmental regulations targeting high-volume phthalate plasticizers pose a significant challenge requiring costly shifts toward non-phthalate alternatives.

How does the Asian Pacific region influence the global Decylalcohol market?

Asia Pacific is the fastest-growing and largest consuming region, acting as the epicenter of global demand. Fueled by intensive infrastructure development, burgeoning manufacturing sectors, and rapid urbanization, APAC dictates global supply chains and significantly influences pricing and capacity expansion decisions for decylalcohol producers worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager