Dedicated Host Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437772 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Dedicated Host Market Size

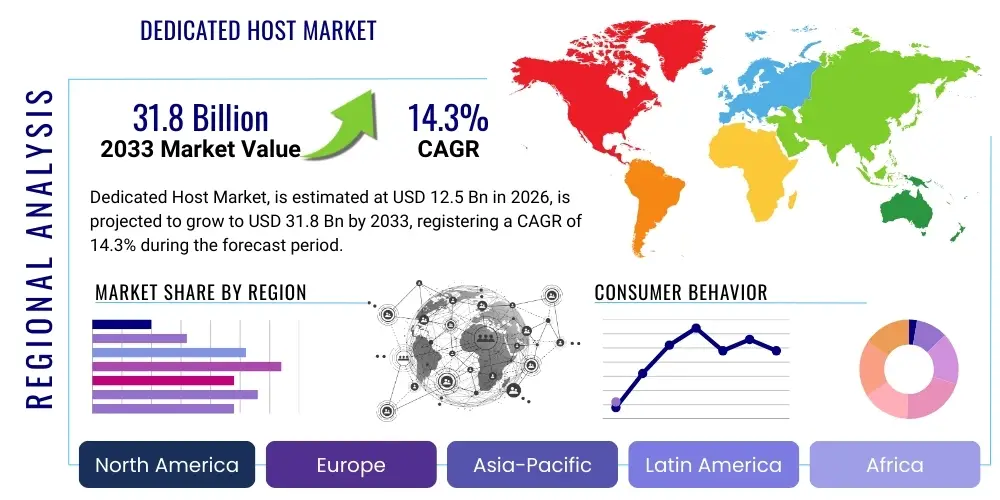

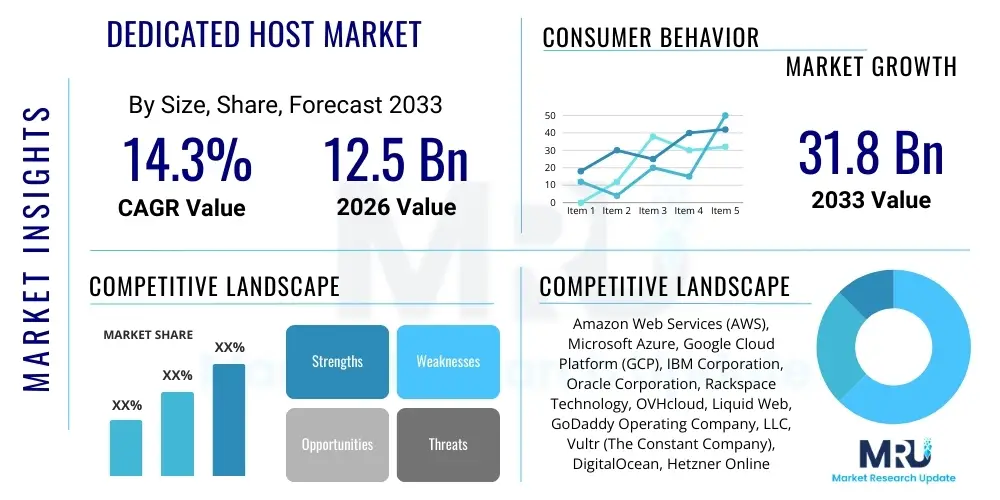

The Dedicated Host Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.3% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing demand for customized computing environments that offer enhanced performance, stringent security, and compliance with data sovereignty regulations, especially across highly regulated industries like BFSI and Healthcare. The shift from shared hosting environments to fully isolated, single-tenant infrastructure is accelerating market valuation.

Dedicated Host Market introduction

The Dedicated Host Market encompasses the provision of physical server infrastructure reserved entirely for a single client's use, offering unparalleled control over hardware, operating systems, and network configurations. This service model is distinct from traditional virtualization or shared cloud environments, ensuring performance consistency, predictable resource allocation, and meeting critical regulatory requirements such as HIPAA, GDPR, and PCI DSS. Dedicated hosts are integral for high-performance computing (HPC) workloads, complex database management, and running legacy applications that require specific hardware certifications or licensing models incompatible with multi-tenant clouds. The infrastructure ensures zero "noisy neighbor" effect, making it the preferred choice for latency-sensitive applications and mission-critical operations where resource contention cannot be tolerated. The core value proposition lies in the convergence of physical infrastructure isolation with the flexibility and elasticity offered by modern cloud management platforms, thereby bridging the gap between bare metal and public cloud services.

Key market offerings include both bare-metal dedicated servers and dedicated instances within a public cloud provider's physical machine, known as dedicated hosts. These solutions are employed across a diverse set of applications, including robust web hosting for high-traffic e-commerce platforms, complex gaming server infrastructure requiring low latency, and advanced data analytics requiring massive parallel processing capabilities. The product's technical specifications often include customization options for CPU type (e.g., Intel Xeon Scalable processors or AMD EPYC), memory configuration (DDR4/DDR5 ECC RAM), high-speed storage (NVMe SSDs), and specialized networking capabilities (10G/25G/100G Ethernet). The growing complexity of corporate IT environments, coupled with the need for hybrid and multi-cloud strategies, further enhances the appeal of dedicated hosting, allowing enterprises to maintain existing software investments while benefiting from cloud operational efficiency.

Major benefits driving the adoption of dedicated hosts include enhanced security due to physical isolation, superior compliance posture, deterministic performance, and optimal cost control for sustained, high-utilization workloads. Driving factors are multifaceted, centered around the rapid proliferation of high-density data workloads, the necessity for stringent data governance and localization (data residency), and the increasing adoption of computationally intensive applications such as large-scale simulations and real-time transaction processing. Furthermore, dedicated environments facilitate easier licensing portability for specific vendor software (like Oracle or Microsoft), which often mandates physical core restrictions, making the dedicated host model a financially viable and technically necessary solution for numerous large enterprises. This confluence of performance, security, and economic factors solidifies the dedicated host market’s trajectory toward sustained growth across the forecast period.

Dedicated Host Market Executive Summary

The Dedicated Host Market is experiencing significant upward momentum, characterized by a fundamental shift in enterprise infrastructure preferences towards isolated, high-performance environments. Current business trends indicate a robust demand originating from highly regulated sectors, particularly Financial Services and Healthcare, which require absolute control over data location and hardware specifications to meet increasingly strict global regulatory frameworks. A critical trend involves the rise of hybrid dedicated hosting models, where clients leverage dedicated resources colocated within hyperscale cloud environments (AWS Dedicated Hosts, Azure Dedicated Hosts, Google Cloud Sole-Tenant Nodes). This approach allows enterprises to capitalize on the operational benefits of the cloud while retaining hardware exclusivity. Furthermore, strategic mergers and acquisitions among core dedicated infrastructure providers and specialized managed service providers are shaping the competitive landscape, aiming to offer end-to-end solutions combining bare metal control with advanced managed services like disaster recovery and security monitoring.

Regionally, North America maintains its dominance due to early and high-volume adoption of complex IT infrastructure, the presence of major hyperscale vendors, and stringent industry regulations demanding isolated environments. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by rapid digital transformation initiatives in emerging economies like India and China, coupled with burgeoning demand for low-latency gaming infrastructure and expanding data center footprint across Southeast Asia. Europe is characterized by strong emphasis on data sovereignty (GDPR compliance), making dedicated hosts an essential component of local digital strategies, particularly in Germany, the UK, and France. Segment trends reveal that the Managed Services segment is growing faster than the Unmanaged segment, as enterprises increasingly seek expertise to handle the complexity of hardware management, patching, and networking configuration, thereby reducing operational overhead and accelerating time-to-market for new applications. The adoption rate is highest within the IT & Telecom sector, followed closely by Gaming and Media & Entertainment, reflecting the critical need for predictable performance.

In summary, the market trajectory is defined by the convergence of traditional bare-metal performance requirements and modern cloud elasticity, offering a premium solution for complex and regulated workloads. Key drivers include the need for superior data security, licensing optimization, and high-performance computing acceleration. The executive outlook suggests that investments will heavily flow into automation tools and infrastructure-as-code capabilities for dedicated hosts, allowing providers to deliver more flexible, rapidly provisioned, and customized services. The market's resilience is further underscored by the geopolitical landscape, where data localization mandates continue to necessitate dedicated physical presence in specific jurisdictions, ensuring sustained growth across all major geographical segments over the forecast period.

AI Impact Analysis on Dedicated Host Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Dedicated Host Market predominantly revolve around performance requirements, data security implications, and the economics of deploying large AI models. Key themes analyzed include whether dedicated hosts offer the necessary GPU density and high-speed interconnects (e.g., InfiniBand) required for training massive models, the challenges of ensuring data privacy for proprietary training datasets, and the total cost of ownership (TCO) compared to specialized public cloud AI instances. Users are keenly interested in how dedicated environments can minimize data transfer costs and maintain predictable latency for real-time inference applications at the edge. The consensus expectation is that the demand for dedicated hosts optimized with specific AI hardware (e.g., NVIDIA H100 GPUs) will surge, driven by companies seeking sovereignty and enhanced utilization for consistently running complex machine learning operations, moving beyond the shared, potentially throttled resources common in multi-tenant environments.

- AI workloads necessitate extreme computing power, making dedicated hosts with specific GPU and CPU configurations indispensable for efficient model training and large-scale data processing.

- Data sovereignty and privacy requirements, especially for sensitive training data used in financial or healthcare AI models, drive demand toward isolated dedicated infrastructure compliant with sector-specific mandates.

- Dedicated hosts mitigate the "noisy neighbor" problem, guaranteeing deterministic performance crucial for ensuring the reproducibility and consistent execution speed of time-sensitive AI inference and deployment cycles.

- The ability to customize the server stack, including specific interconnect technologies (like RDMA over Converged Ethernet - RoCE) and high-speed parallel file systems (e.g., Lustre), directly supports specialized distributed AI training frameworks.

- AI infrastructure deployment often involves optimizing software licensing; dedicated environments simplify managing licensing requirements for proprietary AI development tools and operating systems based on core counts.

- Edge AI applications, requiring localized processing and low latency, increasingly utilize regional dedicated hosting centers to ensure real-time model execution closer to data sources, supporting autonomous systems and industrial IoT.

- Cloud providers are enhancing their dedicated host offerings with optimized AI hardware (e.g., high-density GPU racks) to capture the accelerating enterprise investment in machine learning operations (MLOps) platforms.

- The implementation of dedicated hosts helps organizations achieve better cost predictability for persistent, high-utilization AI infrastructure compared to the variable, burstable pricing models of general public cloud GPU instances.

- The integration of advanced cooling solutions (like liquid cooling) within dedicated host data centers is becoming essential to support the thermal demands of next-generation AI accelerators, ensuring peak performance.

- AI monitoring and security tools can be deployed natively and exclusively on dedicated host infrastructure, offering deeper introspection and control over the security posture of critical intellectual property embedded in AI models.

DRO & Impact Forces Of Dedicated Host Market

The Dedicated Host Market dynamics are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces driving the market's evolution and segmentation. Key drivers include the overwhelming need for high-performance computing (HPC) across scientific research, gaming, and simulation industries, coupled with the persistent pressure on enterprises to adhere to stringent global data localization and security mandates (e.g., data residency laws). These factors necessitate physically isolated, single-tenant environments. Furthermore, the inherent need for predictable resource utilization, particularly for mission-critical applications that cannot tolerate latency fluctuations, strongly favors dedicated infrastructure over burstable, shared alternatives. The ability to optimize expensive legacy software licensing by tying it to specific physical cores within a dedicated host remains a significant economic driver for large enterprises.

However, the market faces notable restraints, primarily centered around the comparatively higher upfront capital expenditure (CapEx) required for dedicated infrastructure versus the operational expense (OpEx) models of public cloud services, which can deter smaller enterprises. The inherent complexity associated with managing dedicated infrastructure, including hardware maintenance, patching, and networking, acts as another barrier, often requiring specialized internal IT staff. While managed dedicated host services mitigate this to some extent, the responsibility for the operating system and application layer often remains with the client. Moreover, the procurement and provisioning timelines for dedicated physical resources are generally longer than the instantaneous scalability offered by multi-tenant cloud platforms, introducing friction for organizations prioritizing speed and rapid elasticity.

Opportunities within the market are predominantly situated in the rapid expansion of edge computing, where dedicated, low-latency infrastructure is required closer to end-users or industrial IoT devices, particularly in sectors like manufacturing and automotive. The explosive growth in specialized AI/Machine Learning workloads, demanding custom-configured hardware (high-density GPUs, specialized interconnects), presents a lucrative niche for dedicated host providers capable of offering bleeding-edge hardware platforms. Furthermore, the continued proliferation of hybrid and multi-cloud strategies ensures that dedicated hosts, acting as a foundational layer, remain strategically relevant, allowing enterprises to anchor core regulated systems while utilizing the public cloud for non-sensitive, elastic workloads. These converging forces ensure sustained innovation in dedicated resource virtualization and management tools, enhancing the competitiveness and accessibility of dedicated hosting solutions.

Segmentation Analysis

The Dedicated Host Market is meticulously segmented based on key functional, technical, and end-user characteristics, providing distinct views of market dynamics and adoption patterns. Segmentation by Type (Managed vs. Unmanaged) highlights the operational choices available to customers; Managed services are gaining traction as businesses seek to offload infrastructure complexities, focusing internal resources on core competencies, while Unmanaged services appeal to enterprises with specialized internal expertise requiring root-level control. Technical segmentation based on Operating System (Linux vs. Windows) reflects the underlying application landscape, where Linux dominates web serving, open-source development, and data analytics, while Windows remains essential for enterprise applications reliant on the Microsoft ecosystem (e.g., SQL Server, Exchange).

Further segmentation by Application demonstrates the diverse use cases, ranging from robust Web Hosting and high-demand Gaming Infrastructure to complex Data Analytics and critical Business Continuity/Disaster Recovery services. These application requirements dictate the necessary hardware specifications, such as latency tolerance, storage IOPS, and network throughput. The final crucial segment is by Industry Vertical, where BFSI (Banking, Financial Services, and Insurance) and Healthcare exhibit particularly strong demand due to non-negotiable regulatory and compliance requirements mandating physical resource isolation and data residency assurances. The high-growth segments, such as IT & Telecom and Media & Entertainment, are driven by the need for low-latency delivery and handling massive concurrent user traffic, solidifying dedicated hosting as a premium infrastructure choice across diverse enterprise needs.

- By Type:

- Managed Dedicated Hosting: Includes OS management, security patching, monitoring, backups, and network support provided by the host.

- Unmanaged Dedicated Hosting (Self-Managed): Provides the bare metal server and core infrastructure; client manages the OS, applications, and security.

- By Operating System:

- Linux-Based Dedicated Hosts (e.g., CentOS, Ubuntu, Red Hat): Dominant for web infrastructure, open-source development, and high-performance computing.

- Windows-Based Dedicated Hosts (e.g., Windows Server): Essential for Microsoft-centric enterprise workloads, proprietary applications, and specific licensing requirements.

- By Application:

- Web Hosting and E-commerce: For high-traffic websites, high-availability e-commerce platforms, and content delivery networks (CDNs).

- Gaming and Streaming: Requires extremely low latency, high bandwidth, and robust server stability to support massive multiplayer online games and video streaming.

- Data Analytics and Business Intelligence: Used for large-scale data warehousing, complex ETL (Extract, Transform, Load) processes, and big data management where predictable IOPS are critical.

- Disaster Recovery and Backup Services: Providing isolated resources for critical data replication and failover mechanisms.

- Application Hosting (SaaS/PaaS Providers): Offering stable, powerful backend infrastructure for cloud-native or proprietary SaaS offerings.

- By Industry Vertical:

- IT & Telecommunication: Driving innovation in network function virtualization and hosting complex enterprise resource planning (ERP) systems.

- BFSI (Banking, Financial Services, and Insurance): Mandates dedicated infrastructure for core banking applications and transactional data compliance (e.g., PCI DSS).

- Healthcare and Life Sciences: Requires strict physical isolation to comply with regulations like HIPAA, ensuring the security of Protected Health Information (PHI).

- Media & Entertainment: Necessitates high-throughput servers for content creation, rendering, and rapid distribution of digital media assets.

- Government and Public Sector: Requires dedicated, often locally hosted, infrastructure for national security and citizen data protection.

Value Chain Analysis For Dedicated Host Market

The value chain for the Dedicated Host Market begins upstream with hardware suppliers and data center infrastructure providers, focusing on the procurement of high-performance components such as CPUs, GPUs, high-speed storage (NVMe), and networking equipment (e.g., Cisco, Juniper). This upstream segment is crucial as the quality and performance of the dedicated host are directly tied to the underlying hardware specifications and the density and efficiency of the physical data center facility (power, cooling, redundancy). Strategic relationships between dedicated hosting providers and major hardware manufacturers are essential for securing competitive pricing and early access to next-generation server technologies, particularly those specialized for AI and high-frequency trading.

The midstream involves the core dedicated hosting providers (Hyperscalers and Specialized Hosts) who manage the data center operations, network connectivity (Tier 1 bandwidth access), server configuration, and provisioning of the dedicated environment. This stage encompasses the crucial elements of security hardening, network topology design, and the development of proprietary management portals and APIs that allow clients to interact with their dedicated resources seamlessly. Efficiency in provisioning and maintaining high utilization rates of the physical infrastructure is key to profitability in this segment. Providers often invest heavily in automation tools to reduce human intervention and accelerate the deployment process, moving towards a "bare metal as a service" operational model.

Downstream analysis focuses on the distribution channels and the end-users. Distribution is primarily direct, where hosting providers sell services directly to enterprise clients and SMBs, leveraging sales teams and detailed consultative processes to match hardware configurations with specific workload requirements. Indirect channels, however, are gaining prominence, involving partnerships with Managed Service Providers (MSPs), System Integrators (SIs), and Value-Added Resellers (VARs). These partners often bundle the dedicated host infrastructure with higher-level application management, security services, and consulting, delivering a complete, customized solution to the end customer. The end-user procurement decision is heavily influenced by factors such as geographical data center availability, certification (e.g., SOC 2, ISO 27001), service level agreements (SLAs), and technical support quality, making customer service and reliability critical determinants of success in the downstream market.

Dedicated Host Market Potential Customers

The primary consumers and beneficiaries of the Dedicated Host Market are organizations with mission-critical applications, high security compliance needs, and workloads demanding predictable, extreme performance levels. End-users fall across various industry verticals, but the most significant buyers are typically large enterprises in regulated sectors. These organizations prioritize infrastructure that guarantees data sovereignty and physical isolation, making dedicated hosts an unavoidable necessity for core business processes. Specific buyer segments include financial trading platforms requiring microsecond latency, large pharmaceutical companies managing proprietary research data, and multinational corporations needing to deploy enterprise applications (like SAP or Oracle) under strict licensing constraints.

Furthermore, digital-native businesses such as high-growth e-commerce platforms, software-as-a-service (SaaS) providers, and online gaming companies represent substantial potential customers. These users are driven by the requirement for massive, sustained traffic handling capabilities and the need to avoid performance throttling common in shared environments, especially during peak load periods. For SaaS companies, dedicated hosts offer the reliability and resource certainty necessary to meet stringent customer SLAs. The rapid expansion of MLOps and AI research has also created a new class of potential customers: data science departments and research institutions seeking dedicated GPU clusters for training deep learning models, where customized hardware and guaranteed resource allocation are paramount for reducing training time and cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 31.8 Billion |

| Growth Rate | 14.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Corporation, Oracle Corporation, Rackspace Technology, OVHcloud, Liquid Web, GoDaddy Operating Company, LLC, Vultr (The Constant Company), DigitalOcean, Hetzner Online GmbH, Equinix, Inc., Lumen Technologies, Alibaba Cloud, Tencent Cloud, dedicated.co, ServerMania, Leaseweb, InterServer. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dedicated Host Market Key Technology Landscape

The Dedicated Host Market is technologically driven, heavily reliant on advancements in server hardware, virtualization technology, and automation software. A core component of the modern dedicated host landscape is the adoption of cutting-edge processor architectures, primarily high-core-count CPUs from Intel (Xeon Scalable, particularly the latest generations optimized for cloud density) and AMD (EPYC processors, known for superior core density and memory bandwidth). Coupled with these are high-speed networking innovations, including 25G, 100G, and increasingly 400G Ethernet connectivity, often leveraging specialized low-latency protocols such as RoCE or InfiniBand, which are crucial for distributed computing environments like HPC clusters and AI training farms. The widespread integration of Non-Volatile Memory Express (NVMe) Solid State Drives (SSDs) is fundamental, offering substantial improvements in I/O performance over legacy SATA or SAS interfaces, thereby reducing data access latency for demanding applications like large transactional databases.

Virtualization and management technologies form the software layer of the technology landscape. While the host hardware is dedicated, the management plane often utilizes hypervisors like VMware vSphere, Microsoft Hyper-V, or open-source solutions like KVM, allowing the customer to run multiple virtual machines (VMs) on their dedicated physical server, optimizing resource utilization while maintaining hardware isolation. Crucially, API-driven automation and Infrastructure-as-Code (IaC) tools (e.g., Terraform, Ansible) are transforming dedicated host provisioning, enabling providers to offer nearly instant deployment capabilities that mimic the speed of public cloud services. This shift to automated orchestration is essential for hyperscalers who provide dedicated hosts as part of their broader cloud ecosystem, ensuring seamless integration between dedicated and shared resources within a hybrid setup.

Security and power efficiency are also central technology focuses. Advanced hardware-based security features, such as Intel SGX (Software Guard Extensions) and AMD SEV (Secure Encrypted Virtualization), are being incorporated to protect data in use within the dedicated environment. Furthermore, data center operators are investing heavily in advanced cooling technologies, including direct-to-chip liquid cooling solutions, to efficiently manage the extreme heat generated by high-density, high-power components like the latest GPUs and high-core CPUs used for AI workloads. This technological evolution ensures that dedicated hosts remain the benchmark for performance, security, and customizable hardware solutions, positioning the market to effectively address the accelerating demands of specialized computing.

Regional Highlights

The Dedicated Host Market exhibits varied growth and adoption patterns across major geographical regions, influenced by economic maturity, regulatory environments, and data center infrastructure density. North America (NA) currently holds the largest market share, characterized by its technological leadership, the presence of major hyperscale cloud providers offering dedicated host services, and robust demand from the extensive financial, IT, and media sectors. The region's market is highly sophisticated, with rapid adoption of premium, high-performance dedicated resources for AI/ML training and complex enterprise migrations. Stringent requirements for compliance (e.g., SOX, HIPAA) in the US and Canada further solidify the reliance on physically isolated infrastructure, ensuring predictable growth and substantial investment in next-generation dedicated hardware.

Europe stands as the second-largest market, with growth primarily driven by the imperative of GDPR and data sovereignty laws across the European Union. Countries like Germany, the UK, and France show high demand for local, dedicated infrastructure to guarantee data residency, making local European providers and compliant offerings from hyperscalers highly competitive. The market is particularly strong in BFSI and Government verticals, which mandate data processing within national borders. The European segment also witnesses growing adoption among online gaming and industrial IoT companies seeking low-latency connectivity via dedicated physical infrastructure positioned strategically near key business and population centers, emphasizing reliability and regional network connectivity.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid digitalization, massive population adoption of online services, and significant government initiatives supporting local data center development in emerging economies. Countries such as China, India, Japan, and Australia are seeing explosive growth in demand for dedicated hosts, driven by massive domestic e-commerce traffic, the proliferation of large-scale gaming infrastructure, and localized data compliance requirements that differ across jurisdictions. Investment in dedicated capacity in APAC is crucial for global enterprises looking to establish a secure and high-performance footprint in this dynamic and expanding digital economy.

- North America (NA): Dominant market share due to advanced infrastructure maturity, large-scale enterprise adoption, and the headquarters of major hyperscale providers (AWS, Azure, Google Cloud). High demand is concentrated in finance, technology, and compliance-heavy sectors.

- Europe: Growth propelled by GDPR and national data localization laws. Strong focus on hybrid solutions where dedicated hosts fulfill regulatory mandates. Key markets include Germany (strong data protection culture), UK (financial services), and Nordic countries (sustainable data center operations).

- Asia Pacific (APAC): Highest CAGR expected. Driven by rapid digital transformation, increasing internet penetration, and strong government support for local data storage and computing. Significant demand from gaming, streaming media, and large-scale manufacturing (Industry 4.0).

- Latin America (LATAM): Emerging market characterized by increasing investment in data center infrastructure, particularly in Brazil and Mexico. Demand is driven by local enterprises seeking stable performance and adherence to regional data privacy regulations.

- Middle East and Africa (MEA): Growth is accelerating, supported by government-led initiatives like Saudi Arabia's Vision 2030 and UAE's digital economy push. Oil & Gas, Finance, and government sectors are key adopters, emphasizing local data residency and robust security through dedicated environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dedicated Host Market.- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Corporation

- Oracle Corporation

- Rackspace Technology

- OVHcloud

- Liquid Web

- GoDaddy Operating Company, LLC

- Vultr (The Constant Company)

- DigitalOcean

- Hetzner Online GmbH

- Equinix, Inc.

- Lumen Technologies

- Alibaba Cloud

- Tencent Cloud

- dedicated.co

- ServerMania

- Leaseweb

- InterServer

Frequently Asked Questions

Analyze common user questions about the Dedicated Host market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Dedicated Host and a standard Virtual Private Server (VPS)?

The primary difference lies in resource isolation and hardware exclusivity. A VPS runs on a physical server shared with many other users (multi-tenant environment), meaning performance can be impacted by others (the "noisy neighbor" effect). Conversely, a Dedicated Host grants exclusive access to an entire physical server, ensuring 100% resource allocation, deterministic performance, and physical isolation crucial for security and stringent regulatory compliance like HIPAA or PCI DSS.

How do Dedicated Hosts address strict data sovereignty and regulatory compliance requirements?

Dedicated Hosts are essential for compliance because they provide guaranteed physical location and isolation of data. Customers know exactly where their data resides (down to the physical server rack) and that no other customer’s data shares the underlying hardware. This simplifies meeting regulatory mandates, such as GDPR's data residency requirements or financial sector data isolation rules, which often require single-tenant environments to maintain control and auditability over the entire hardware stack.

Are Dedicated Hosts cost-effective compared to public cloud instances for long-term, high-utilization workloads?

For applications characterized by high, sustained utilization (typically above 70%) over extended periods (3+ years), Dedicated Hosts are generally more cost-effective than burstable public cloud instances. They eliminate variable usage charges and offer greater licensing flexibility for proprietary enterprise software (like Oracle or Microsoft), allowing organizations to optimize license count based on physical cores rather than virtual cores, leading to significant Total Cost of Ownership (TCO) savings over time.

What role does the Dedicated Host Market play in modern Hybrid and Multi-Cloud strategies?

Dedicated Hosts serve as the secure, high-performance anchor point in Hybrid and Multi-Cloud strategies. They house core, compliance-sensitive systems (database, ERP) requiring physical isolation, while the public cloud handles elastic, less sensitive workloads. Major cloud providers offer dedicated hosts directly integrated into their networks, allowing seamless, low-latency communication between dedicated resources and shared cloud services, thus bridging the gap between traditional enterprise IT and modern cloud agility.

How is the Dedicated Host Market incorporating specialized hardware for AI and High-Performance Computing (HPC)?

The market is increasingly focused on offering specialized hardware configurations featuring high-density, cutting-edge GPUs (e.g., NVIDIA H100) and high-speed, non-blocking interconnects (e.g., InfiniBand or RoCE). Providers offer customized dedicated server clusters optimized for distributed AI training and complex HPC simulations, providing researchers and enterprises the raw computational power and guaranteed resource allocation necessary to reduce model training times and run massive parallel processing jobs efficiently and predictably.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager