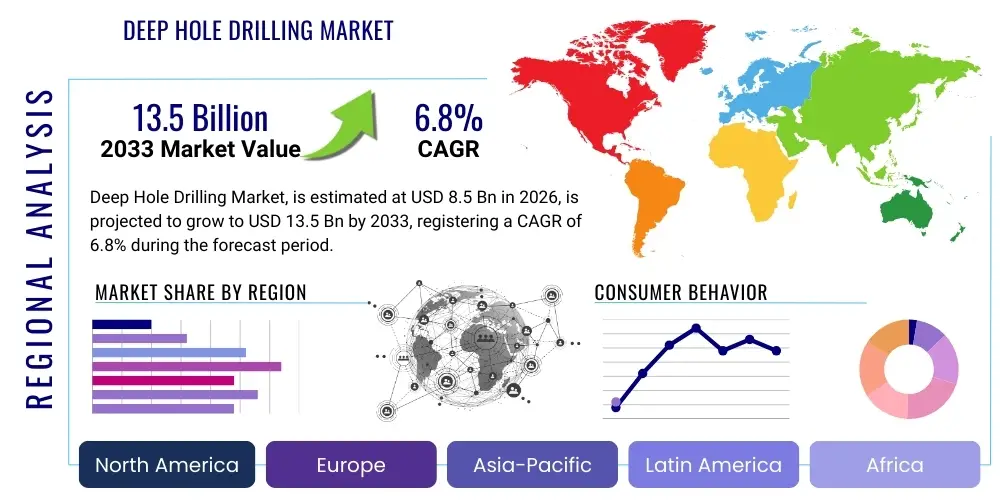

Deep Hole Drilling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437249 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Deep Hole Drilling Market Size

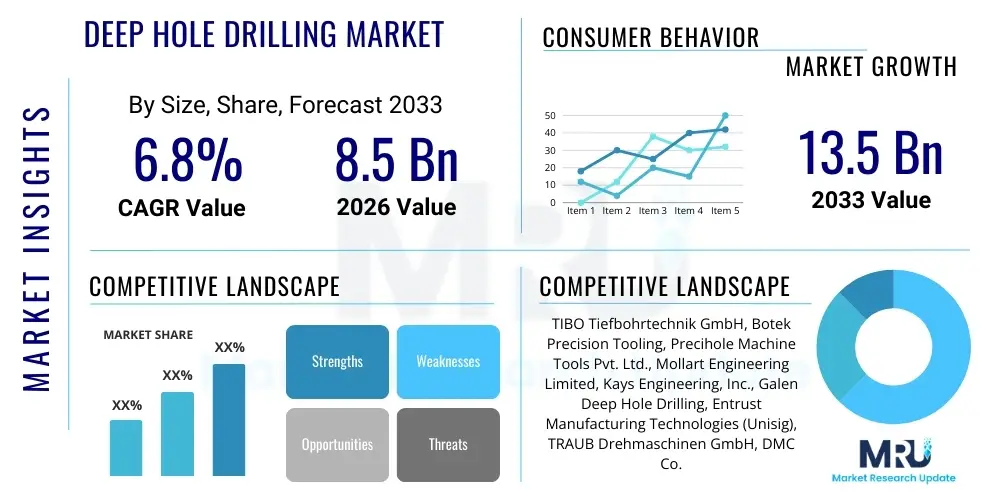

The Deep Hole Drilling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is significantly fueled by the escalating demand for high-precision components across advanced manufacturing sectors globally, particularly within automotive, aerospace, and energy industries, which require manufacturing processes capable of achieving extremely accurate hole geometry, exceptional straightness, and high aspect ratios (length-to-diameter ratios often exceeding 20:1). The necessity for precise internal features in complex components, such as cooling channels in mold tooling and critical hydraulic bores in aircraft structures, is the primary volume driver, compensating for the high capital expenditure associated with specialized deep hole drilling machinery.

Market expansion is also supported by the continuous shift towards processing advanced, difficult-to-machine materials, including high-strength steel alloys, nickel-based superalloys (like Inconel), and titanium. These materials, essential for enhancing product performance, longevity, and fuel efficiency in applications like turbine engines and medical implants, necessitate specialized drilling techniques that manage heat generation, vibration, and chip evacuation effectively at extreme depths. Conventional drilling methods fail under these rigorous conditions, cementing the critical role of dedicated deep hole drilling systems. Furthermore, global infrastructural investments, particularly in power generation (nuclear and thermal) and oil and gas extraction, require large-scale, deep-drilled components, supporting the sustained high-value segment of the market.

Deep Hole Drilling Market introduction

The Deep Hole Drilling Market is fundamentally concerned with specialized machining techniques and associated equipment designed to produce holes with exceptional depth-to-diameter ratios, far surpassing the capabilities of standard twist drilling. These processes, chiefly categorized into gundrilling, BTA (Boring and Trepanning Association) drilling, and trepanning, are indispensable for manufacturing components where internal feature quality—specifically straightness, concentricity, and surface finish—is mandatory for functional integrity. Products benefiting from this technology range from complex mold plates and injection systems to turbine shafts, hydraulic manifolds, and critical military components. The market serves as a crucial enabler for modern high-precision engineering, allowing manufacturers to achieve internal geometries previously unattainable, thus supporting the miniaturization and increased performance of end-products.

The operational success of deep hole drilling hinges on three interdependent factors: the specialized tooling design, effective high-pressure coolant delivery, and efficient chip management. For instance, gundrilling utilizes a single-lip cutting tool with an internal channel for coolant delivery and an external V-groove for chip evacuation, optimizing stability and process control for small, ultra-precise bores. Conversely, BTA drilling employs a drill tube that allows the coolant to flow externally around the tube and the chips to exit internally through the tube, making it highly efficient for larger diameters and higher material removal rates (MRR). The sophisticated integration of Computer Numerical Control (CNC) technology ensures precise parameter control over spindle speed, feed rate, and coolant pressure, which are all critical for preventing tool breakage and maintaining geometric accuracy when drilling through challenging materials.

Driving factors for the adoption of deep hole drilling include the relentless demand for fuel-efficient vehicles necessitating lightweight, high-performance engine components; the expansion of civil and military aerospace manufacturing requiring complex hydraulic and cooling circuits; and the surge in advanced medical device production demanding intricate micro-holes. The principal benefit derived by end-users is the achievement of superior dimensional accuracy and internal surface quality, which reduces post-drilling operations (such as honing or reaming) and enhances the functional life of the component. The efficiency gains delivered by modern, automated deep hole drilling systems—which integrate process monitoring and fault detection—further solidify their economic justification in high-volume, high-value production environments globally.

Deep Hole Drilling Market Executive Summary

The Deep Hole Drilling Market is currently navigating a period of intense technological advancement, characterized by increased integration of multi-functional capabilities into machine platforms and a pronounced focus on smart manufacturing principles (Industry 4.0). Key business trends include aggressive vertical integration by leading machine manufacturers offering complete tooling and application support packages, moving beyond simply selling hardware. Furthermore, there is a strong market segmentation between suppliers focusing on ultra-high precision, low-diameter gundrilling (targeting medical and electronics) and those dominating the large-diameter BTA segment (targeting oil/gas and heavy machinery). Competitive strategy is increasingly shifting toward software superiority, leveraging advanced control systems that optimize drilling parameters in real-time for improved efficiency and tool longevity, particularly when handling exotic aerospace materials.

Geographically, the market’s center of gravity continues to shift eastward, with Asia Pacific (APAC) emerging as the undeniable leader in terms of machine installation volume and highest Compound Annual Growth Rate (CAGR). This regional dominance is rooted in the tremendous scale of automotive and mold manufacturing in countries like China and India, coupled with strategic governmental investments in domestic high-tech industries. While North America and Europe maintain technological leadership in niche areas—specifically ultra-precision and defense applications—the operational capacity expansion and raw component demand in APAC dictate global volume trends. Investment in the Middle East remains closely tied to the volatile but structurally necessary expenditures in upstream and downstream oil and gas processing infrastructure.

Segment analysis highlights that the CNC Machine Type segment is witnessing overwhelming adoption, largely replacing conventional hydraulic or manual systems due to the imperative for repeatability and complex contouring capabilities required by modern design standards. Among technologies, BTA drilling holds the highest revenue share because of its extensive use in heavy industry and high material removal efficiency for larger bores, while gundrilling is projected to exhibit faster proportional growth due to the accelerating demand for small, critical holes in medical implants and micro-hydraulics. The overall trend emphasizes automation, process reliability, and the ability to machine increasingly hardened and abrasive workpiece materials without compromising tight geometric tolerances.

AI Impact Analysis on Deep Hole Drilling Market

Analysis of common user questions reveals a strong focus on how Artificial Intelligence (AI) can mitigate the inherent risks and variability associated with deep hole drilling, particularly concerning tool failure, chip control, and maintaining thermal stability over long drilling cycles. Users are actively seeking solutions that move beyond simple preventative maintenance schedules toward truly predictive, adaptive machining processes. Major concerns include the difficulty in implementing AI algorithms on legacy machinery and the need for standardized data collection from diverse sensor inputs (torque, vibration, acoustic emissions, temperature, and pressure) to feed accurate machine learning models. The expectation is that AI will dramatically reduce cycle times by intelligently adjusting feed rates and coolant flow based on instantaneous conditions inside the bore, rather than relying on conservative, pre-set parameters.

AI is fundamentally transforming process optimization by enabling real-time condition monitoring and adaptive control loops. Machine learning algorithms can analyze complex, multivariate sensor data to accurately distinguish between optimal chip formation, abnormal wear patterns, and imminent tool breakage conditions, something human operators struggle to achieve consistently, especially in blind-hole applications. By identifying subtle shifts in acoustic signatures or motor load, AI systems can instruct the CNC controller to automatically adjust parameters, potentially increasing the feed rate until a critical variable is reached, thereby maximizing throughput safely. This capability is paramount when drilling high-value components where scrapping a part due to tool failure results in immense financial loss.

Furthermore, AI facilitates the creation of highly accurate digital twins of the drilling machine and workpiece interaction. These digital models, trained on thousands of hours of operational data, allow manufacturers to simulate complex scenarios, predict the structural integrity of the component after drilling, and optimize the tool path and tooling selection before any physical material is cut. This proactive, simulation-based approach minimizes trial-and-error, dramatically speeding up the setup time for new jobs involving novel materials or unprecedented aspect ratios. The application of AI in quality assurance is also significant, as computer vision systems can analyze the surface finish and geometric accuracy of drilled holes post-operation, automating inspection processes that were historically slow and subject to human fatigue.

- Real-time adaptive control of spindle speed and feed rate based on dynamic sensor feedback

- Predictive maintenance alerts minimizing unscheduled machine downtime and catastrophic tool failure

- Automated diagnosis and classification of root causes for non-optimal drilling performance (e.g., poor chip evacuation)

- Optimization of specialized coolant flow and pressure based on material thermal properties

- Enhanced tool condition monitoring utilizing deep learning analysis of high-frequency vibration data

- Development of digital twin models for optimizing complex drilling strategies in advanced materials

DRO & Impact Forces Of Deep Hole Drilling Market

The Deep Hole Drilling Market operates under a dynamic set of Drivers, Restraints, and Opportunities (DRO), underpinned by significant operational impact forces. A dominant driver is the non-negotiable requirement for high-precision components in safety-critical applications, particularly within the aerospace industry (jet engine components, landing gear) and specialized medical manufacturing (orthopedic implants, surgical tools). These sectors strictly mandate the geometric accuracy and surface integrity achievable only through dedicated deep hole drilling processes. Additionally, the proliferation of complex superalloys and high-strength steels across manufacturing sectors inherently increases the dependence on advanced drilling technologies capable of handling extreme hardness and abrasive characteristics efficiently.

Key restraints significantly impacting market growth include the exceptionally high initial capital investment required to acquire advanced CNC deep hole drilling machinery, which often includes integrated automation, proprietary high-pressure coolant systems, and highly customized tooling. This barrier to entry limits market participation primarily to large corporations and specialized contract manufacturers, especially in developing economies. Furthermore, the reliance on highly skilled labor—operators and programmers with specialized knowledge of chip load management, tool deflection compensation, and thermal control—poses a persistent operational bottleneck, contributing to high labor costs and potential operational inconsistencies if training standards are not rigorously maintained.

Significant opportunities are emerging from the pervasive adoption of Industry 4.0 principles, allowing for the integration of IoT sensors, cloud-based data analytics, and AI into deep hole drilling workflows. These technological enhancements enable remote diagnostics, predictive process control, and performance benchmarking across multiple global facilities, enhancing operational efficiency and justifying high machine costs through maximized uptime. The increasing need for sophisticated mold and die tooling with intricate cooling channels to reduce plastic injection molding cycle times also presents a lucrative niche for specialized deep hole drilling service providers. The continuous search for better, environmentally friendly coolants and MQL (Minimum Quantity Lubrication) systems offers a pathway for sustainable innovation, mitigating environmental impact while maintaining high performance.

Segmentation Analysis

The segmentation of the Deep Hole Drilling Market provides a critical framework for understanding the diverse technological offerings and distinct end-user demands that shape the industry landscape. Segmentation by Technology—Gundrilling, BTA Drilling, and Trepanning—is crucial, as the choice between these methods is dictated by the required hole diameter, aspect ratio, and the specific material being processed. Gundrilling, focused on smaller diameters and extreme precision, caters heavily to the medical and aerospace hydraulic sectors, whereas BTA drilling handles larger components and higher MRRs, vital for oil and gas and heavy machinery. This technological divergence dictates specialized tooling and coolant system requirements across the market.

Further granularity is provided through segmentation by Machine Type (Conventional vs. CNC) and Application. The dominance of CNC Deep Hole Drilling Machines reflects the industry’s shift toward automation, requiring machines that can handle complex, multi-axis movements and integrate seamless parameter adjustments. Application segmentation clearly delineates primary demand elasticity: the Automotive sector drives high volume, often focusing on standardized engine component drilling; in contrast, the Aerospace and Medical segments drive innovation in materials processing and ultra-precision capability, demanding customized, high-rigidity machines capable of drilling exotic alloys with exceptionally tight tolerances. Analyzing these segments is essential for machine manufacturers to prioritize R&D investment and tailor product offerings to specific industrial pain points.

- By Technology:

- Gundrilling: Used for small, ultra-precise holes (up to 50mm) requiring superior straightness and finish.

- BTA (Boring and Trepanning Association) Drilling: Optimized for medium to large diameter holes (above 20mm) with efficient internal chip evacuation.

- Trepanning: Specialized for removing a core of material from large workpieces, highly efficient for creating very large holes or reducing component weight.

- Ejector Drilling Systems: A variant of BTA, often utilized for larger diameter holes, offering excellent chip control.

- By Machine Type:

- Conventional Deep Hole Drilling Machines: Manually operated or semi-automatic systems, typically used for simpler, lower volume tasks or repair work.

- CNC Deep Hole Drilling Machines: Automated, high-precision systems with multi-axis control, dominating high-volume and complex manufacturing.

- Customized and Hybrid Machines: Integrated platforms combining deep hole drilling with milling, tapping, or turning capabilities.

- By Application/End-Use Industry:

- Automotive: Engine blocks, crankshafts, fuel injection components, mold tooling for plastic parts.

- Aerospace & Defense: Landing gear, turbine shafts, hydraulic manifolds, specialized cooling channels in structural components.

- Oil & Gas: Downhole drilling tools, drill collars, high-pressure valves, heat exchanger components.

- Medical: Orthopedic implants, surgical instruments, bone screws, micro-fluidic devices.

- Mold & Die: Deep cooling circuits, ejector pin holes, specialized tooling inserts.

- Energy (Power Generation): Boiler drums, turbine components, nuclear reactor parts.

- Heavy Machinery: Large structural components, specialized shafts, and hydraulic cylinders.

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Deep Hole Drilling Market

The Deep Hole Drilling Market value chain commences with specialized upstream suppliers providing high-performance materials, predominantly tungsten carbide powder and various high-speed steels necessary for manufacturing durable, precise cutting tools and drill tips. This phase involves complex processes such as sintering, PVD/CVD coating, and precision grinding, which directly determine the tool's performance and lifespan when encountering hard and abrasive materials. Key upstream relationships are characterized by long-term contracts and collaborative R&D focused on developing proprietary tool geometries and coating formulas that maximize wear resistance and minimize friction, a critical factor given the extreme pressures and temperatures involved in deep drilling.

The midstream segment is dominated by equipment manufacturers and system integrators who design and assemble the complex machinery, encompassing the machine structure (bed, spindle), proprietary high-pressure coolant systems, and advanced CNC controllers. Distribution channels for deep hole drilling machines are typically direct, reflecting the high value and customization inherent in these systems. Direct distribution ensures comprehensive technical consultation, bespoke machine configuration tailored to the customer’s specific material and volume requirements, and direct factory after-sales service. Conversely, standard tooling and consumables (coolants, carbide inserts) often utilize indirect channels—regional distributors and specialized tooling suppliers—to ensure rapid, localized delivery to end-users globally, minimizing operational downtime.

The downstream involves the execution of the deep hole drilling process by End-Users, ranging from massive multi-national OEMs to highly specialized contract manufacturers (job shops). Value is realized downstream through the creation of highly functional, high-integrity components critical for the final product assembly. Customers in the aerospace sector demand precise conformance to Nadcap and AS9100 quality standards, necessitating extensive documentation and metrology. The distribution strategy ensures that high-end customers receive direct, immediate technical support for complex machine malfunctions, while widespread indirect channels support the essential, high-frequency needs for perishable tooling and machine maintenance across all industrial applications. This specialized value chain structure ensures the transfer of cutting-edge technology from materials science to the manufacturing floor.

Deep Hole Drilling Market Potential Customers

The core customer base for the Deep Hole Drilling Market consists of manufacturers operating under stringent quality control and facing complex machining challenges, demanding superior precision that conventional methods cannot deliver. Primary end-users include major Automotive Tier 1 and Tier 2 suppliers who require high-volume production of crucial engine components such as crankshaft oil galleries, fuel injector bores, and transmission parts. As powertrain designs become more intricate, driven by emissions regulations and efficiency goals, the demand for precise internal drilling solutions accelerates. Furthermore, companies involved in plastic injection molding are vital customers, needing machines to drill intricate, highly parallel cooling channels in mold inserts to achieve optimal thermal management and rapid, uniform cooling cycles.

A second major category of potential customers resides in the aerospace and defense sector, comprising aircraft manufacturers, component specialists, and MRO (Maintenance, Repair, and Overhaul) facilities. These customers utilize deep hole drilling for flight-critical parts, including large-diameter landing gear structures, complex hydraulic manifolds for flight control, and specialized parts made from difficult superalloys like Waspaloy and high-temperature steel. The extremely high cost of these raw materials and finished components necessitates drilling machinery that guarantees first-pass success and minimizes geometric deviations, making the investment in premium, technologically advanced deep hole drilling systems an economic necessity rather than an optional enhancement.

The medical device industry represents a rapidly expanding customer segment, specifically requiring micro-scale deep hole drilling capabilities (often using gundrilling technology) for creating internal passages in delicate instruments, custom-designed bone fixation devices, and intricate components for minimally invasive surgical tools. Precision, surface finish, and cleanliness are paramount in this sector. Finally, the energy sector, encompassing firms involved in oil extraction, nuclear power generation, and specialized heavy equipment manufacturing, constitutes the bulk buyer of large-scale BTA and Trepanning systems. These companies require machines capable of drilling massive components—such as long shafts, specialized piping, and heat exchanger tube sheets—to significant depths, prioritizing robustness, high throughput, and the ability to process heavy-duty carbon steels and specialized corrosion-resistant alloys.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TIBO Tiefbohrtechnik GmbH, Botek Precision Tooling, Precihole Machine Tools Pvt. Ltd., Mollart Engineering Limited, Kays Engineering, Inc., Galen Deep Hole Drilling, Entrust Manufacturing Technologies (Unisig), TRAUB Drehmaschinen GmbH, DMC Co. Ltd., A.M.T. Machining Systems, SMTCL, HAAS Automation, Inc., Sumitomo Electric Hardmetal Corp., Sandvik AB, Kennametal Inc., Star Cutter Company, DMG MORI, Allied Machine & Engineering Corp., Buhler Industries Inc., Buhler Technologies GmbH, Honge Precision Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Deep Hole Drilling Market Key Technology Landscape

The technological landscape of the Deep Hole Drilling Market is primarily characterized by the evolution of cutting tool material science and the sophistication of machine control systems. Current advancements in gundrilling focus on utilizing advanced Polycrystalline Diamond (PCD) and specialized carbide grades, optimized with multilayer coatings (such as TiAlN or AlCrN) to enhance wear resistance and thermal stability when processing extremely hard materials like hardened tool steel or aerospace superalloys. Furthermore, tool geometry innovations, including multi-flute designs for improved stability and asymmetrical cutting edges, are pushing the boundaries of feed rates and surface finish quality for small-diameter bores, critical for miniaturized components in medical and electronics applications.

In the heavy-duty segment (BTA and Trepanning), the focus is on maximizing material removal rates (MRR) while minimizing operational instability over vast depths. Key technology developments include modular tool head systems featuring indexable carbide inserts, which drastically reduce the cost and complexity of tooling replacement compared to traditional welded heads. Crucially, the management of high-pressure coolant—often operating between 50 to 150 bar—is becoming increasingly sophisticated, utilizing variable frequency drives and advanced filtration systems to ensure optimal chip flushing efficiency and prevent pump contamination, directly correlating to improved hole straightness and reduced tool wear across long production runs.

The most transformative technology remains the full integration of multi-axis CNC functionality. Modern deep hole drilling machines are often highly rigid, temperature-controlled platforms capable of performing off-center line drilling, helical deep hole drilling, and subsequent milling/tapping operations without removing the workpiece. This integration drastically reduces cumulative tolerance errors associated with part transfer and setup, achieving unprecedented geometric accuracy on complex parts. Furthermore, the incorporation of advanced sensing technology—vibration accelerometers, acoustic emission sensors, and real-time thermal cameras—feeds data directly into the CNC controller, forming the backbone for the AI-driven predictive control systems that are setting new industry standards for unmanned, reliable deep drilling operations.

Regional Highlights

The Asia Pacific (APAC) region continues its trajectory as the dominant and most dynamic market for deep hole drilling equipment, primarily driven by China's colossal manufacturing base and continuous urbanization. The sustained, large-scale investment in the automotive sector, focusing on both internal combustion engine components and new energy vehicle parts, necessitates high volumes of precision drilled components. Furthermore, the region's expanding mold and die industry, supplying tools for global electronics and consumer goods production, relies heavily on deep hole drilling for complex cooling channels. This environment supports the growth of both large CNC machine sales and the associated tooling and service markets, making APAC the key strategic focus area for global manufacturers seeking volume growth.

North America and Europe maintain a strong footing as highly mature markets, distinguished by their emphasis on technological specialization, rather than sheer volume. Demand here is characterized by the need for ultra-high precision, custom solutions tailored for sectors with zero-defect tolerance policies, such as military aviation, space exploration hardware, and specialized medical implants utilizing exotic materials like Nitinol and advanced composites. European market growth, particularly in Germany and Italy, is driven by the robust machine tool manufacturing base that pioneers the integration of Industry 4.0 components, focusing on machine efficiency, reduced environmental impact through minimal lubrication technology (MQL), and superior process monitoring systems.

Emerging regions, including Latin America (LATAM) and the Middle East & Africa (MEA), present focused opportunities. In LATAM, the market is stimulated by foreign direct investment in localized automotive assembly and heavy equipment production, requiring reliable and robust drilling solutions. MEA's market is intrinsically linked to the cyclic yet essential investments in the upstream oil and gas industry. The necessity to drill and manufacture specialized high-pressure components and downhole tooling dictates demand for large, powerful BTA and trepanning machines capable of operating under harsh operational requirements. Geopolitical stability and oil price fluctuations remain the dominant factors influencing capital expenditure in the MEA deep hole drilling sector.

- Asia Pacific (APAC): Highest volume market; driven by high-scale production in automotive, electronics, and mold & die sectors. Leads in installed base of conventional and entry-level CNC machines, with rapid adoption of advanced systems in high-tech clusters.

- North America: Focus on R&D and high-value applications (Aerospace, Defense, Advanced Medical); leading market for customized, multi-axis, AI-integrated deep hole drilling platforms.

- Europe: Strong domestic machine tool manufacturing base; driven by high-performance automotive (motorsports), stringent regulatory standards, and demand for energy-efficient drilling solutions and micro-machining.

- Middle East & Africa (MEA): Demand almost entirely concentrated on the oil and gas sector, requiring large, heavy-duty BTA equipment and specialized tooling for energy infrastructure components.

- Latin America (LATAM): Steady growth linked to localized industrial maintenance (MRO) and expansion of regional automotive supply chains, favoring versatile, robust machine types.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Deep Hole Drilling Market.- TIBO Tiefbohrtechnik GmbH

- Botek Precision Tooling

- Precihole Machine Tools Pvt. Ltd.

- Mollart Engineering Limited

- Kays Engineering, Inc.

- Galen Deep Hole Drilling

- Entrust Manufacturing Technologies (Unisig)

- TRAUB Drehmaschinen GmbH

- DMC Co. Ltd.

- A.M.T. Machining Systems

- SMTCL

- HAAS Automation, Inc.

- Sumitomo Electric Hardmetal Corp.

- Sandvik AB

- Kennametal Inc.

- Star Cutter Company

- DMG MORI

- Allied Machine & Engineering Corp.

- Buhler Industries Inc.

- Buhler Technologies GmbH

- Honge Precision Industry Co., Ltd.

- Sunnen Products Company

- Doosan Machine Tools

Frequently Asked Questions

Analyze common user questions about the Deep Hole Drilling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between gundrilling and BTA drilling?

Gundrilling is optimized for small diameters (typically up to 50mm) and extreme precision, utilizing an external chip removal channel and internal coolant delivery for superior straightness. BTA drilling is designed for larger diameters and higher material removal rates, efficiently evacuating chips internally through the drill tube, making it preferred for heavy machinery and energy components.

How does the high aspect ratio affect deep hole drilling feasibility?

The high aspect ratio (L:D) is the defining challenge, severely complicating coolant delivery, chip evacuation, and hole straightness control due to tool deflection. Feasibility relies entirely on specialized machine rigidity, advanced anti-vibration systems, proprietary tooling geometries, and high-pressure coolant management to maintain tight geometric tolerances over long distances.

Which end-user industry is driving the most significant growth in the market?

The Asia Pacific automotive and electronics mold & die sectors drive the highest volume growth due to extensive capacity expansion. However, the aerospace and defense sector drives the highest technological demand and revenue growth per unit, requiring premium CNC machines for processing complex, high-cost exotic materials like specialized nickel and titanium alloys.

What role does automation play in reducing operational costs for deep hole drilling?

Automation via CNC systems and integrated machine platforms significantly reduces labor dependency, minimizes setup errors, and enables continuous, lights-out operation. The use of AI-driven process monitoring within these systems maximizes tool life and optimizes feed rates in real-time, drastically increasing machine utilization and lowering the scrap rate, which directly cuts per-part manufacturing costs.

Is the deep hole drilling market significantly impacted by the shift towards electric vehicles (EVs)?

The market is adapting, not contracting. While traditional engine block drilling decreases, new demand emerges for high-precision components critical to EV manufacturing, including complex cooling plates, thermal management systems for battery packs, and specialized mold tooling requiring intricate internal channels to ensure fast and consistent cooling.

What technological factors are critical for achieving high precision in superalloy deep hole drilling?

Achieving precision in superalloys requires robust machine rigidity, precise thermal stabilization of the workpiece and machine structure, advanced tooling materials (PCD/coated carbide), and closed-loop control systems. Real-time monitoring of torque and vibration is essential to mitigate the work-hardening tendency of superalloys and prevent immediate tool failure.

How are environmental concerns influencing the design of deep hole drilling machines?

Environmental concerns are accelerating the adoption of Minimum Quantity Lubrication (MQL) and advanced closed-loop coolant filtration systems. Machine designs are incorporating improved chip handling and separation systems to reduce coolant consumption, waste generation, and energy usage, aligning with global sustainability mandates and reducing operational hazard exposure.

What is the primary constraint facing small contract manufacturers entering the deep hole drilling market?

The primary constraint is the massive upfront capital investment required for high-precision CNC deep hole drilling machines, coupled with the specialized tooling, high-pressure coolant infrastructure, and the difficulty in acquiring and retaining expert technicians skilled in managing complex process parameters.

How do machine manufacturers ensure hole straightness over extreme lengths?

Hole straightness is ensured through several techniques: high machine rigidity, the use of specialized vibration dampening systems, piloting the drill into a pre-drilled guide bushing, precise alignment of the spindle and whip guides, and continuous real-time monitoring of cutting force feedback to compensate dynamically for tool deflection during the drilling cycle.

What is the difference between trepanning and BTA drilling in large-diameter applications?

BTA drilling removes all material in the hole path, creating solid chips. Trepanning is used for very large diameters where it cuts an annular groove, leaving a solid core of material intact. Trepanning is highly material-efficient and faster for large bore sizes as it removes less material in the form of chips, but it requires specialized core recovery procedures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Deep Hole Drilling Market Statistics 2025 Analysis By Application (Automotive, Aerospace, Machine Tools), By Type (Gun Drilling, BTA / STS), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Deep Hole Drilling Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Gun drilling, BTA / STS, Others), By Application (Automotive, Aerospace, Machine tools, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Deep Hole Drilling Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Gun drilling, BTA / STS, Others), By Application (Aerospace, Automotive, Machine Tool, Construction, Mining, Oil and Gas, Energy, Military and Defense, Die Mould, Heat Exchanger Plate Machining, Medical, Electronics, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager