Deep Learning in Drug Discovery and Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432531 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Deep Learning in Drug Discovery and Diagnostics Market Size

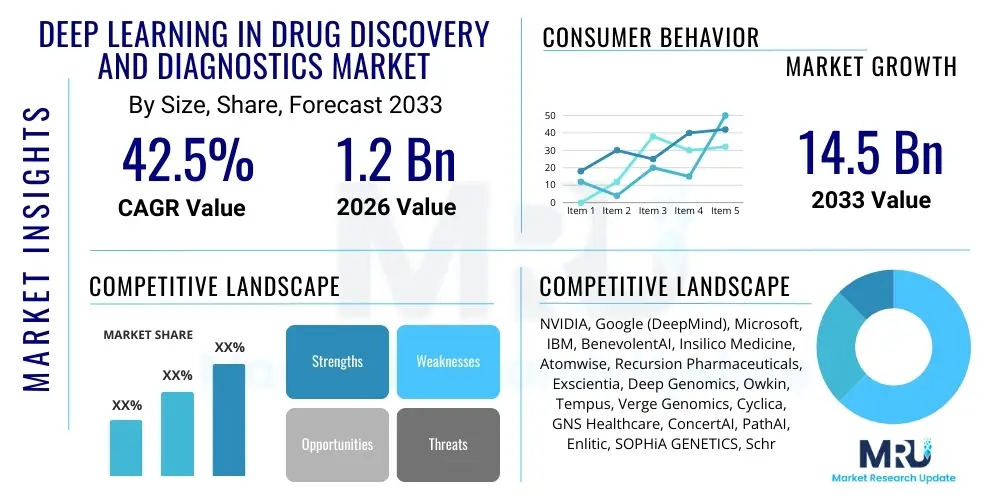

The Deep Learning in Drug Discovery and Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 42.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $14.5 Billion by the end of the forecast period in 2033.

Deep Learning in Drug Discovery and Diagnostics Market introduction

The Deep Learning (DL) in Drug Discovery and Diagnostics Market encompasses the application of sophisticated neural networks—such as Convolutional Neural Networks (CNNs), Recurrent Neural Networks (RNNs), and Generative Adversarial Networks (GANs)—to revolutionize the pharmaceutical and clinical pathology industries. This technology leverages massive biological, chemical, and patient data sets to accelerate the most complex stages of R&D, significantly reducing the time and cost associated with bringing a new therapeutic agent or diagnostic tool to market. The core product offering includes specialized software platforms, predictive modeling tools, and integrated service solutions designed for high-throughput screening, target identification, compound optimization, and automated medical image analysis.

Major applications driving market expansion include the acceleration of hit-to-lead and lead optimization processes, enabling the design of novel molecules with optimized pharmacokinetic properties (ADME/Tox prediction). In the diagnostic realm, deep learning models are critically utilized for enhancing the accuracy and speed of medical image interpretation (e.g., radiology, pathology slides), personalized risk stratification, and the identification of subtle biomarkers undetectable by traditional methods. These capabilities fundamentally address the current limitations of traditional research, which often suffers from high failure rates and protracted timelines in early-stage development.

The primary benefits driving the rapid adoption of deep learning include unprecedented efficiency gains, enhanced precision in prediction, and the potential to unlock treatments for previously intractable diseases. Key driving factors include the exponential growth in biological data (genomic, proteomic, clinical trial data), substantial investments from pharmaceutical giants and venture capitalists in AI startups, and increasing regulatory acceptance of AI-driven tools, positioning deep learning as a pivotal technology transforming biomedical research globally.

Deep Learning in Drug Discovery and Diagnostics Market Executive Summary

The Deep Learning in Drug Discovery and Diagnostics Market is characterized by intense innovation, significant strategic partnerships, and substantial financial backing, primarily targeting the pharmaceutical research bottleneck and improving clinical decision support. Business trends indicate a shift towards end-to-end integrated platforms that combine data management, model development, and regulatory submission support, moving beyond siloed, task-specific tools. Furthermore, M&A activity is robust, with large established technology firms and pharmaceutical companies acquiring niche AI biotechs to internalize core deep learning capabilities and secure intellectual property related to proprietary algorithms and novel compound libraries generated through AI.

Regionally, North America maintains market dominance due to early adoption, high levels of governmental and private funding for biomedical research, and the presence of leading technological giants and established biotechnology clusters. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by expanding healthcare infrastructure, vast, diverse patient populations generating large datasets, and increasing governmental initiatives promoting digital transformation in healthcare and life sciences. Europe also represents a significant market, emphasizing explainable AI (XAI) due to stringent regulatory environments like GDPR and focusing on collaborative research between academia and industry.

Segment trends reveal that the Drug Discovery application segment, particularly target identification and lead optimization, holds the largest market share due to the immediate financial incentive of accelerating the drug pipeline and reducing late-stage failures. However, the Diagnostics segment is projected to grow rapidly, driven by the increasing integration of AI in clinical settings for automated pathology, radiological screening, and genomic sequencing interpretation, proving crucial for realizing the promise of personalized medicine. Technology-wise, Convolutional Neural Networks (CNNs) remain predominant, especially within diagnostics and image-based drug screening, while generative models like GANs are rapidly gaining traction in novel molecular design and synthesis planning.

AI Impact Analysis on Deep Learning in Drug Discovery and Diagnostics Market

Common user questions surrounding the impact of AI in this sector often center on validation and trust: "How reliable are AI-generated drug candidates compared to traditional methods?", "What are the regulatory pathways for AI-diagnostics?", and "Can AI models truly handle the complexity and diversity of human biological data without introducing bias?" These inquiries reflect a necessary skepticism regarding model explainability, data privacy, and the reproducibility of results derived from black-box algorithms. Users are also highly interested in the economic impact, specifically asking about the projected Return on Investment (ROI) from deep learning integration, the necessary expertise required for deployment, and how AI might shift the fundamental roles of research scientists and clinical pathologists.

The key themes emerging from user expectations revolve around AI’s potential to dramatically lower the cost of Phase I failures by improving preclinical toxicity prediction and enhancing target specificity, thereby de-risking the entire drug development process. In diagnostics, expectations focus on achieving near-perfect diagnostic accuracy for complex diseases like cancer and neurodegenerative disorders, enabling earlier intervention and precision treatment planning. The collective consensus points towards AI being an indispensable tool that augments human expertise, moving the industry away from slow, iterative experimentation towards predictive, hypothesis-driven discovery cycles. Regulatory bodies are increasingly responding to these concerns by issuing guidelines focusing on dataset diversity, model robustness, and transparent documentation, addressing the urgent need for verifiable and trustworthy AI solutions in high-stakes healthcare environments.

The profound integration of deep learning models has shifted the paradigm from empirical screening to computational prediction. This transformation has necessitated new infrastructures capable of handling petabytes of multi-omics data and has spurred the development of specialized talent skilled in both biology/chemistry and machine learning engineering. AI’s influence extends beyond mere efficiency; it is enabling the discovery of entirely new classes of therapeutic targets and diagnostic biomarkers that were previously inaccessible, fundamentally redefining the scientific approach to biological complexity and disease mechanisms. The industry anticipates that within the forecast period, the majority of initial drug targets and diagnostic protocols for novel diseases will be, at least in part, identified or optimized using deep learning frameworks, establishing AI as the central engine of biomedical innovation.

- Accelerated R&D timelines, reducing average drug development time by up to 30%.

- Significant reduction in preclinical failure rates through improved toxicity and efficacy prediction.

- Enablement of personalized medicine by analyzing vast genomic and clinical datasets for tailored treatment selection.

- Enhanced precision in diagnostic imaging and pathology analysis, leading to earlier disease detection.

- Creation of novel, de novo drug candidates with optimized chemical structures via generative models.

- Increased demand for large, curated, and standardized biological and clinical datasets.

- Focus shift towards Explainable AI (XAI) to ensure regulatory compliance and clinical adoption trust.

DRO & Impact Forces Of Deep Learning in Drug Discovery and Diagnostics Market

The market expansion is fundamentally shaped by powerful drivers, persistent restraints, and significant long-term opportunities, all interacting to form critical impact forces. The primary drivers include the urgent need for efficient drug development models given the soaring R&D costs and diminishing returns from traditional methods, coupled with the explosion of high-quality, high-volume biological data accessible through high-throughput sequencing and electronic health records (EHRs). These drivers create an immediate demand signal for predictive deep learning solutions capable of mining complex biological relationships. However, progress is tempered by significant restraints, namely the scarcity of interdisciplinary talent skilled in both clinical science and deep learning engineering, the inherent "black box" nature of complex neural networks challenging regulatory approval (the explainability issue), and pervasive concerns regarding data privacy, security, and the fragmentation of clinical data sources across institutions.

Opportunities for exponential growth are concentrated in untapped areas such as the application of deep learning in precision oncology, rare disease therapeutics, and personalized biomarker development for autoimmune disorders. The ability of deep learning to rapidly integrate multi-omics data (genomics, transcriptomics, proteomics, metabolomics) presents an opportunity to move beyond single-target therapies towards complex polypharmacology approaches. Furthermore, the development of robust, federated learning frameworks provides a pathway to leverage decentralized clinical data without compromising patient privacy, thereby overcoming a major data access restraint. These opportunities encourage continuous investment and technological refinement, ensuring the long-term viability and disruptive potential of the market.

The impact forces synthesized from these dynamics are compelling. The positive impact force is the undeniable economic imperative to cut costs and accelerate time-to-market, forcing pharmaceutical companies to integrate deep learning as a core competency rather than a peripheral tool. Conversely, the negative impact force stems from the high initial capital investment required for computational infrastructure and specialized personnel, creating a significant barrier to entry for smaller firms and potentially widening the gap between technology leaders and laggards. Ultimately, the market trajectory will be determined by the speed at which regulatory bodies adapt to and standardize approval pathways for AI-driven discoveries, thereby translating technological potential into widespread clinical and commercial reality.

Segmentation Analysis

The Deep Learning in Drug Discovery and Diagnostics Market is meticulously segmented based on Application, Component, Technology, and End-User, reflecting the diverse deployment strategies across the life sciences ecosystem. This structured segmentation allows for focused technological development and precise market targeting. The analysis highlights that while the tools and technologies (Component and Technology segments) are crucial for market enablement, the ultimate growth and value creation are realized through specific clinical and research applications, particularly in oncology diagnostics and novel drug candidate generation, which attract the majority of investment capital and partnership focus.

The Application segment demonstrates the clearest delineation of market value, with Drug Discovery applications commanding dominance due to their direct influence on pipeline profitability. Within Diagnostics, the utilization of deep learning in medical imaging analysis—including MRI, CT, and histological slides—is experiencing exponential growth, driven by the immediate clinical benefits of reduced human error and increased throughput. This segment is characterized by rapid deployment in clinical decision support systems and high demand for software-as-a-service (SaaS) models tailored for hospital networks and large diagnostic centers seeking operational efficiency improvements.

Technologically, the differentiation between models like CNNs, optimized for image and sequence recognition, and generative models, optimized for designing novel outputs (molecules or data), indicates evolving R&D priorities. End-user analysis underscores the pivotal role of Pharmaceutical and Biotechnology companies as the primary revenue generators, driven by large licensing agreements and custom model development contracts. However, the academic and research institutes segment is critical for foundational model development and public validation, often serving as crucial early adopters and providers of foundational, high-quality training datasets that fuel commercial advancements.

- Application:

- Drug Discovery (Target Identification, Lead Optimization and Candidate Selection, ADME/Tox Prediction, De Novo Drug Design)

- Diagnostics (Medical Imaging Analysis, Pathology and Digital Histology, Genomics and Precision Medicine, Biomarker Discovery)

- Component:

- Software (On-premise Solutions, Cloud-based Platforms)

- Services (Consulting, Implementation, Training and Support)

- Technology:

- Convolutional Neural Networks (CNNs)

- Recurrent Neural Networks (RNNs)

- Deep Neural Networks (DNNs)

- Generative Adversarial Networks (GANs) and Autoencoders

- End-User:

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Diagnostic Centers & Hospitals

- Contract Research Organizations (CROs)

Value Chain Analysis For Deep Learning in Drug Discovery and Diagnostics Market

The value chain for deep learning in this sector is highly complex, starting with the foundational upstream elements involving data generation and foundational technology supply. Upstream analysis focuses on technology providers such as high-performance computing (HPC) infrastructure developers (e.g., NVIDIA, AWS, Google Cloud) and proprietary biological data generators (genomic sequencing providers, biobanks, EHR vendors). These entities provide the necessary computational power and standardized, high-quality raw materials (data) that are essential for training complex deep learning models. The quality, accessibility, and standardization of these upstream data sources directly dictate the effectiveness and non-biased nature of the resulting predictive models.

The midstream segment involves the core intellectual property and platform development, comprising specialized AI companies (e.g., Insilico Medicine, BenevolentAI) and dedicated data science units within larger pharmaceutical companies. This stage focuses on algorithm design, model training, validation, and the creation of user-friendly platforms and APIs that translate raw data and algorithms into usable scientific predictions. Distribution channels here are primarily direct, involving licensing agreements, strategic partnerships, and enterprise subscriptions for cloud-based software solutions. Indirect channels involve integration through CROs or specialized consulting firms that act as intermediaries, tailoring generic AI platforms for specific client R&D requirements.

Downstream analysis focuses on the final application and adoption of the deep learning output by end-users. This includes pharmaceutical R&D departments utilizing predicted novel targets, clinical trials leveraging AI-optimized patient selection, and diagnostic centers employing automated image analysis tools for patient care. The success at this stage is measured by tangible outcomes: reduced time-to-market for drugs, increased diagnostic accuracy, and improved patient outcomes. Effective collaboration between midstream platform developers and downstream clinical practitioners is paramount for model refinement and ensuring the practical utility and regulatory compliance of AI-driven tools in real-world clinical and research environments, establishing a high-value feedback loop.

Deep Learning in Drug Discovery and Diagnostics Market Potential Customers

The potential customer base for deep learning solutions in drug discovery and diagnostics is diverse yet highly concentrated among entities dealing with large-scale biomedical data processing and R&D acceleration challenges. The most significant end-users are large multinational Pharmaceutical and Biotechnology Companies. These organizations are driven by the urgent need to replenish diminishing drug pipelines and control escalating R&D expenditures, making them prime candidates for investing heavily in predictive models for target identification, lead optimization, and toxicology screening. Their demand is centered around bespoke solutions, large-scale data integration, and secure, on-premise or compliant private cloud deployments, ensuring data exclusivity and regulatory adherence.

Another rapidly expanding customer segment includes Academic and Research Institutes, often leveraging government grants and institutional funding to explore foundational deep learning applications. While their purchasing power may be lower than large pharma, they are critical for validating new model architectures, generating public domain data sets, and developing open-source tools that ultimately push the boundaries of the field. These institutions primarily seek cost-effective, high-performance computing resources and collaborative licensing arrangements to utilize advanced deep learning software platforms for fundamental biological research and disease mechanism elucidation.

Furthermore, Diagnostic Centers and Hospital Networks represent a crucial vertical, especially for applications related to medical imaging, digital pathology, and clinical decision support systems. These customers seek tools that can integrate seamlessly into existing Electronic Health Record (EHR) and Picture Archiving and Communication System (PACS) infrastructure, prioritizing real-time processing capabilities, high throughput, and verifiable clinical accuracy to improve patient triage and reduce clinical labor costs. Finally, Contract Research Organizations (CROs) act as crucial intermediaries, adopting deep learning tools to enhance the efficiency of their services (e.g., clinical trial design, biomarker analysis) offered to pharma and biotech clients, thereby expanding the reach of these AI technologies across the industry supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $14.5 Billion |

| Growth Rate | CAGR 42.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NVIDIA, Google (DeepMind), Microsoft, IBM, BenevolentAI, Insilico Medicine, Atomwise, Recursion Pharmaceuticals, Exscientia, Deep Genomics, Owkin, Tempus, Verge Genomics, Cyclica, GNS Healthcare, ConcertAI, PathAI, Enlitic, SOPHiA GENETICS, Schrödinger |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Deep Learning in Drug Discovery and Diagnostics Market Key Technology Landscape

The Deep Learning in Drug Discovery and Diagnostics market relies on a specialized technological ecosystem centered around high-performance computing and nuanced neural network architectures tailored for complex biological data. The dominant technological frameworks include TensorFlow, PyTorch, and Keras, which provide the underlying infrastructure for building, training, and deploying large-scale neural networks. Hardware acceleration, predominantly through NVIDIA’s specialized Graphics Processing Units (GPUs) and increasingly Application-Specific Integrated Circuits (ASICs), is indispensable for handling the massive computational load required for molecular dynamics simulations, image segmentation, and deep genomic sequencing analysis, effectively defining the practical scale of research capabilities.

Specific neural network types dictate the effectiveness within different application segments. Convolutional Neural Networks (CNNs) are the foundational technology for diagnostics, excelling in pattern recognition in visual data. They are extensively used in analyzing medical images (CT, MRI), pathological slides (histopathology analysis for cancer staging), and phenotypic screens in drug discovery. Their ability to automatically learn hierarchical spatial features makes them unparalleled for tasks like tumor boundary detection and classification. Similarly, Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) networks are essential for sequence data analysis, particularly in genomics, where they process linear biological data like DNA, RNA, and protein sequences to predict structure, function, and regulatory elements. The use of Transformer models, initially popularized in natural language processing (NLP), is rapidly expanding into protein structure prediction and molecular interaction modeling, offering superior handling of long-range dependencies in sequence data compared to traditional RNNs.

Furthermore, Generative Models such as Generative Adversarial Networks (GANs) and Variational Autoencoders (VAEs) are critical for the cutting-edge application of De Novo Drug Design. These models are employed not just to screen existing libraries, but to create novel molecular scaffolds with specific desired properties, overcoming the limitations of pre-existing chemical space. The technological landscape is also increasingly focused on developing methods for Explainable AI (XAI), which seeks to provide transparent rationales for the model's predictions. This is achieved through techniques like SHAP (SHapley Additive exPlanations) and LIME (Local Interpretable Model-agnostic Explanations), which are crucial for gaining regulatory approval and clinical trust, particularly in high-risk diagnostic and therapeutic decisions. The synthesis of these hardware, framework, and model innovations drives the market’s capability to automate and optimize traditionally manual and labor-intensive processes.

Regional Highlights

- North America: North America, particularly the United States, commands the largest share of the Deep Learning in Drug Discovery and Diagnostics Market. This dominance is attributed to the presence of major pharmaceutical headquarters, pioneering biotechnology firms, world-class academic research institutions, and large-scale funding from both public and private sectors (e.g., NIH, venture capital). The region benefits from early adoption of advanced computational tools, a robust regulatory framework that is proactively engaging with AI applications (e.g., FDA guidance on SaMD—Software as a Medical Device), and the highest concentration of skilled AI talent globally. The mature ecosystem facilitates strong collaboration between tech giants (like Google, Microsoft) and life sciences companies, driving rapid commercialization of innovative deep learning solutions across both drug R&D and clinical diagnostics.

- Europe: Europe represents a significant and rapidly growing market, driven by governmental emphasis on digital health initiatives and substantial EU-wide research funding programs (e.g., Horizon Europe). Key countries such as the UK, Germany, and Switzerland are hubs for pharmaceutical innovation and feature strong research partnerships. The European market, however, places a greater emphasis on ethical AI frameworks and data governance, largely due to GDPR regulations, which mandates that AI solutions prioritize data privacy and model explainability. This focus fosters the development of advanced, compliant federated learning platforms, positioning Europe as a leader in ethical AI deployment within clinical settings and drug safety monitoring.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. Growth is fueled by massive, diverse patient populations generating large datasets critical for training robust deep learning models, increasing governmental investments in healthcare infrastructure modernization (especially in China, India, and South Korea), and a burgeoning local technology sector. While adoption started later than in North America, rapid digital transformation and less stringent historical regulatory barriers in certain jurisdictions allow for swift deployment of new diagnostic technologies. The primary focus areas in APAC include applying deep learning for population health management, high-throughput genomic analysis, and addressing region-specific health challenges.

- Latin America (LATAM) and Middle East & Africa (MEA): These emerging markets are seeing gradual adoption, primarily concentrated in metropolitan and specialized research centers (e.g., Brazil, Saudi Arabia, UAE). Adoption is driven by the need to leapfrog existing technological deficits and address high burdens of infectious and chronic diseases. Growth is currently dependent on international partnerships and the establishment of scalable cloud infrastructure to support computational demands, offering significant long-term opportunities as digital integration accelerates and localized data pooling initiatives gain traction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Deep Learning in Drug Discovery and Diagnostics Market.- NVIDIA

- Google (DeepMind)

- Microsoft

- IBM

- BenevolentAI

- Insilico Medicine

- Atomwise

- Recursion Pharmaceuticals

- Exscientia

- Deep Genomics

- Owkin

- Tempus

- Verge Genomics

- Cyclica

- GNS Healthcare

- ConcertAI

- PathAI

- Enlitic

- SOPHiA GENETICS

- Schrödinger

Frequently Asked Questions

Analyze common user questions about the Deep Learning in Drug Discovery and Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of Deep Learning in accelerating drug discovery R&D?

Deep Learning significantly accelerates R&D by improving the accuracy of target identification, predicting molecular properties (ADME/Tox) early in the pipeline, and enabling the computational design of novel chemical entities (de novo design), thereby drastically reducing the reliance on slow and expensive high-throughput physical screening methods and minimizing late-stage failures.

Which neural network architecture is most critical for diagnostic imaging analysis?

Convolutional Neural Networks (CNNs) are the most critical architecture for diagnostic imaging, including radiology and digital pathology. CNNs excel at automatically learning complex spatial features and patterns within image data, allowing for precise segmentation, classification of diseases (e.g., cancer grading), and automated quantification of pathological findings.

What are the major challenges hindering the widespread adoption of deep learning in clinical settings?

The primary challenges include the "black box" nature of deep learning models (lack of explainability), which hinders clinical trust and regulatory approval; concerns over data privacy and security (GDPR, HIPAA); and the difficulty in obtaining large, standardized, and unbiased training datasets necessary for robust model generalization across diverse patient populations.

How does Deep Learning contribute to the realization of precision medicine?

Deep Learning facilitates precision medicine by analyzing vast multi-omics datasets (genomics, proteomics, clinical data) to identify patient subgroups, predict individual responses to specific treatments, and discover personalized biomarkers, allowing clinicians to tailor therapeutic strategies for optimal efficacy and minimized adverse effects.

Which geographical region is expected to demonstrate the highest growth rate in this market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by significant government investments in modernizing healthcare IT, the enormous and diverse patient data pools available for training models, and a rapid increase in technological adoption across major economies like China, India, and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager