Deep Well Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438933 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Deep Well Pump Market Size

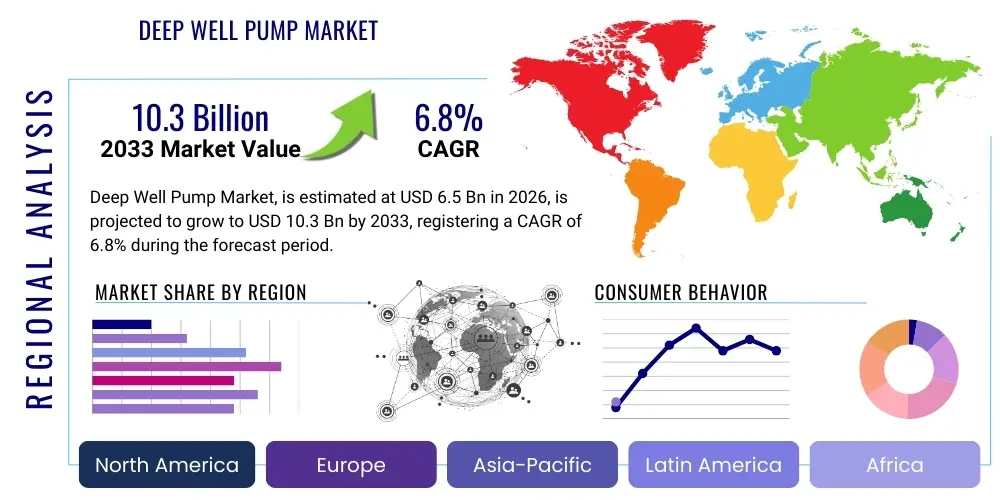

The Deep Well Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for reliable water sources across agricultural, industrial, and municipal sectors, particularly in regions facing acute water stress. Investments in large-scale infrastructure projects, coupled with advancements in submersible and vertical turbine pump technologies, are key factors contributing to this robust market trajectory, ensuring efficient water extraction from deep underground reservoirs to meet increasing consumption needs.

Deep Well Pump Market introduction

The Deep Well Pump Market encompasses specialized pumping systems designed to lift water or other fluids from significant depths, typically exceeding 50 feet. These pumps are critical components of modern hydrology, engineered for high head and robust operation in diverse environments. Deep well pumps are generally categorized into submersible pumps, which operate fully submerged within the well casing, and vertical turbine pumps, which utilize above-ground motor assemblies. Their core function is to provide reliable, high-pressure fluid transfer necessary for sustaining operations in key sectors globally, ensuring continuity of supply from aquifers and deep boreholes.

Major applications of deep well pumps span across essential economic activities, including large-scale irrigation systems necessary for commercial agriculture, municipal water supply networks, and specialized industrial processes such as mining, oil and gas extraction, and geothermal energy utilization. The primary benefits derived from these sophisticated systems include high energy efficiency, reduced maintenance requirements associated with submerged operation, and unparalleled reliability in delivering consistent flow rates over extended periods. Their robust construction materials, often stainless steel or specialized alloys, ensure longevity even in corrosive or abrasive subterranean environments, making them indispensable for sustainable resource management.

Market growth is predominantly driven by increasing global population density, necessitating expanded municipal water infrastructure, coupled with the critical need for efficient irrigation to bolster food security in developing economies. Furthermore, the accelerating depletion of shallow water tables due to climate change and over-extraction compels users to drill deeper wells, thereby increasing the reliance on high-performance deep well pump systems. Technological driving factors include the integration of Variable Frequency Drives (VFDs) for optimized power consumption and the incorporation of smart monitoring sensors that enhance operational control and predictive maintenance capabilities, significantly improving the Total Cost of Ownership (TCO).

Deep Well Pump Market Executive Summary

The Deep Well Pump Market is characterized by vigorous business trends focusing on enhancing energy efficiency and integrating advanced monitoring technologies. Key manufacturers are prioritizing the development of pumps compatible with renewable energy sources, notably solar power, to cater to remote agricultural and off-grid municipal installations, particularly prominent in Asia Pacific and Africa. Regional trends show that Asia Pacific dominates the market due to massive investments in agriculture-based water infrastructure and rapid urbanization across nations like China and India, while North America and Europe emphasize replacement cycles utilizing premium, highly efficient pump models adhering to stringent energy standards. Segment trends highlight the increasing prominence of submersible pumps, driven by their operational efficiency and ease of installation in narrow boreholes, and a growing application share in industrial sectors, including sophisticated dewatering processes and mineral extraction, alongside the traditional dominance of agricultural irrigation.

AI Impact Analysis on Deep Well Pump Market

User queries regarding the impact of Artificial Intelligence (AI) on the Deep Well Pump Market primarily revolve around themes of predictive maintenance, optimization of energy usage, and autonomous operation in remote locations. Common concerns address how AI algorithms can analyze vibration data, current draw, and pressure fluctuations in real-time to forecast potential component failures, thereby minimizing costly downtime and extending Mean Time Between Failures (MTBF). Users are also keen on understanding the role of machine learning in adjusting pump speed and operation cycles based on fluctuating water table levels, energy tariffs, and actual demand patterns, moving the industry toward a truly demand-responsive and resource-efficient water extraction model. The consensus expectation is that AI integration will fundamentally shift the industry from reactive servicing to proactive, data-driven asset management, ultimately lowering operational expenditures and improving environmental sustainability.

- AI-driven Predictive Maintenance: Utilizing sensor data (pressure, temperature, vibration) to forecast equipment failure, optimizing maintenance scheduling and reducing unplanned outages.

- Energy Consumption Optimization: Machine learning algorithms adjust Variable Frequency Drives (VFDs) in real-time based on electricity costs and hydrological data, minimizing specific energy consumption (SEC).

- Autonomous System Management: Implementing AI models for automatic regulation of flow rates and pump starts/stops according to reservoir levels and immediate demand signals.

- Enhanced Diagnostics and Troubleshooting: AI assists operators by quickly identifying root causes of performance degradation through pattern recognition in historical operational data.

- Integration with Smart Grids: Optimizing pump operation to interact dynamically with utility load shedding programs, providing demand response capabilities.

- Improved Water Resource Management: Using AI to analyze regional water usage and aquifer recovery rates, ensuring sustainable long-term extraction planning.

DRO & Impact Forces Of Deep Well Pump Market

The Deep Well Pump Market dynamics are fundamentally shaped by a powerful confluence of drivers such as global water scarcity and increasing industrialization, counterbalanced by restraints like high initial investment costs and reliance on consistent electricity supply, while abundant opportunities exist in solar-powered systems and the revitalization of aging municipal infrastructure. These forces, collectively referred to as DRO (Drivers, Restraints, Opportunities), exert significant pressure on market participants, dictating strategic investment areas and product development trajectories. Impact forces derived from these dynamics include the escalating environmental scrutiny on water usage and the rapidly falling costs of renewable energy components, compelling manufacturers to innovate toward more sustainable and cost-effective solutions for deep water extraction.

Drivers: A primary driver is the accelerating decline in global freshwater resources, compelling agricultural and municipal sectors to access deeper aquifers. This is coupled with robust population growth, particularly in emerging economies, demanding massive expansions of urban and rural water supply infrastructure. Furthermore, industrial growth, especially in mining (requiring deep dewatering) and manufacturing (needing high-purity water sources), fuels the demand for high-capacity, durable deep well pumps. Government initiatives aimed at improving irrigation efficiency and ensuring water security also act as significant market catalysts, subsidizing the adoption of modern, high-efficiency pumping equipment.

Restraints: The market faces several critical restraints, notably the relatively high initial capital expenditure required for drilling deep boreholes and procuring specialized submersible equipment, which can deter adoption in smaller agricultural operations. Operational restraints include the susceptibility of pumps to voltage fluctuations and the necessity for robust, reliable electricity access, which remains a challenge in many rural areas. Additionally, the complexity of maintenance for submerged equipment requires specialized labor and tools, contributing to higher servicing costs and potential downtime if not managed efficiently, posing an operational hurdle for end-users.

Opportunities: Significant growth opportunities lie in the proliferation of solar-powered deep well pumping systems, offering a viable, sustainable alternative to grid power in remote locations, massively expanding the market reach, especially in Africa and South Asia. The vast segment of aging municipal water infrastructure in established economies presents a massive replacement and upgrade opportunity, driving demand for modern, smart, and energy-efficient pumping solutions compliant with contemporary environmental standards. Moreover, the integration of Industrial Internet of Things (IIoT) sensors and AI for condition monitoring opens avenues for lucrative service contracts and value-added digital offerings, transforming the business model for key manufacturers.

- Drivers (D): Global water stress and diminishing surface water availability; rapid urbanization and subsequent municipal infrastructure expansion; increased need for efficient irrigation systems in agriculture; industrial demand from mining and process industries.

- Restraints (R): High upfront installation and drilling costs; dependency on stable electricity supply; complexity and cost of submerged pump maintenance; vulnerability to abrasive solids and chemical corrosion in certain deep wells.

- Opportunity (O): Development and mass adoption of solar photovoltaic (PV) powered pumping systems; lucrative replacement market for aging municipal and industrial pumps; integration of VFDs and smart monitoring technologies (IIoT); expansion into niche geothermal energy applications.

- Impact Forces: Increasing environmental regulations promoting energy efficiency (Tier 2/3 motors); fluctuating commodity prices impacting raw material costs (e.g., stainless steel); technological convergence of pumping systems with digital data platforms; climate change impact accelerating the need for deeper well access.

Segmentation Analysis

The Deep Well Pump Market is segmented primarily based on Product Type, Operational Mechanism, Power Rating, and End-User Application. This segmentation allows for a precise understanding of market dynamics specific to different consumer needs, ranging from high-flow municipal water supply systems to low-flow domestic use cases. The dominant segments are Submersible Pumps, favored for their efficiency and reliability in deep settings, and the Agricultural sector, which represents the largest volume consumer globally due to extensive irrigation requirements. Analyzing these segments is crucial for strategic planning, revealing distinct technological requirements and geographical concentrations of demand, guiding product innovation towards high-growth niches such as the solar-powered segment.

Submersible pumps continue to lead the market share due to their superior efficiency, as they require less external priming and eliminate suction lift issues inherent in above-ground systems. Conversely, vertical turbine pumps maintain a specialized but significant share, primarily in large-scale municipal water treatment plants and industrial facilities where high capacity and accessible maintenance are prioritized. Segmentation by power rating is critical, distinguishing between small, single-phase units (used for residential and small farm irrigation) and large, multi-stage, three-phase units essential for municipal and industrial operations, where efficiency standards are stringent and operational demands are continuous. The transition towards more powerful yet compact units demonstrates a key technological advancement across all segments.

Application-based segmentation clearly illustrates the interdependence of market growth with global demographic trends. Agriculture remains the foundational segment, heavily influenced by weather patterns and government subsidies for efficient irrigation. The municipal segment, however, is projected to exhibit the fastest growth, driven by rapid urbanization and the necessity for replacing outdated infrastructure in developed countries, coupled with building new water networks in developing regions. Industrial applications, encompassing mining dewatering, oil and gas field operations, and specific process manufacturing, demand highly customized, ruggedized pump solutions, providing opportunities for high-margin specialized product offerings, driving revenue concentration among major multinational manufacturers.

- By Type:

- Submersible Pumps (Dominant type, high efficiency, minimal noise)

- Vertical Turbine Pumps (High-flow applications, easier maintenance access)

- By Operational Mechanism:

- Centrifugal Pumps (Most common, high flow, multiple stages)

- Positive Displacement Pumps (Niche applications, high pressure, low flow)

- By Power Rating:

- Below 5 HP (Residential, small farm use)

- 5 HP to 25 HP (Medium-scale agriculture, commercial use)

- Above 25 HP (Municipal water works, heavy industrial operations)

- By Application (End-User):

- Agriculture (Irrigation, livestock)

- Municipal Water Supply (Potable water, distribution networks)

- Industrial (Mining dewatering, process water supply, manufacturing)

- Residential (Domestic use, private wells)

Value Chain Analysis For Deep Well Pump Market

The value chain for the Deep Well Pump Market is complex, beginning with the upstream supply of specialized raw materials, primarily high-grade stainless steel, cast iron, and specific corrosion-resistant alloys necessary for pump longevity in harsh subterranean environments. Upstream analysis focuses heavily on material sourcing and the manufacturing of precision components like impellers, diffusers, and motor windings, which require specialized fabrication expertise. Suppliers of high-efficiency electric motors and Variable Frequency Drives (VFDs) form another critical upstream component, directly influencing the final product's energy performance rating, a key competitive metric in the downstream market.

Midstream activities involve the core manufacturing, assembly, and rigorous testing of the deep well pump systems. This stage is dominated by major pump companies that invest heavily in research and development to optimize hydraulic efficiency and ensure regulatory compliance (e.g., energy consumption standards). The complexity of integrating sophisticated electronics, such as monitoring sensors and smart controllers, into the mechanical structure necessitates close collaboration between pump manufacturers and technology providers, ensuring seamless interaction between hardware and software components for condition monitoring and predictive maintenance functionalities demanded by modern end-users.

Downstream activities involve distribution, installation, and after-sales servicing. Distribution channels are bifurcated into direct sales for large, customized municipal or industrial projects, and indirect channels relying on an extensive network of specialized dealers, authorized distributors, and water well drilling contractors. These contractors play a vital role, often acting as technical consultants who select and install the appropriate pump system based on borehole specifications and hydrological survey data. After-sales service, including maintenance, repair, and parts supply, is crucial for maintaining customer loyalty and capturing recurring revenue, often managed through certified service centers specializing in submerged equipment retrieval and repair.

- Upstream Analysis: Raw material suppliers (specialized steel, copper); motor component manufacturers; VFD and electronic controller suppliers.

- Downstream Analysis: Installation services (drilling contractors); maintenance and repair workshops; consulting engineers for system specification.

- Distribution Channel (Direct): Sales directly to large municipal authorities, major industrial clients (e.g., mining companies), and EPC contractors for large infrastructure projects.

- Distribution Channel (Indirect): Global network of authorized dealers, wholesalers, local distributors, and specialized pump retailers who serve the vast agricultural and residential markets.

Deep Well Pump Market Potential Customers

The primary consumers and end-users of deep well pumps are diverse, spanning governmental bodies, large private corporations, and millions of individual agricultural producers. Key potential customers include municipal waterworks departments globally, which are responsible for extracting, treating, and distributing potable water to urban populations, necessitating high-volume, reliable pumping stations often utilizing vertical turbine or large submersible pumps. These entities prioritize longevity, energy efficiency, and compliance with strict public health standards, driving demand for premium, highly certified equipment designed for continuous, decades-long operation without failure.

Another major customer segment is the commercial agriculture industry, including large farm holdings, cooperative farms, and governmental irrigation projects. These customers require robust, cost-effective pumps—increasingly solar-powered—capable of handling large volumes of water necessary for field crop irrigation, especially in arid and semi-arid regions. The purchasing decision in this sector is heavily influenced by the pump's power efficiency and reliability during critical peak irrigation seasons, directly impacting crop yields and operational profitability, making VFD integration and low maintenance requirements attractive features.

Furthermore, the industrial sector constitutes a highly lucrative customer base, particularly companies engaged in mining (for dewatering deep pits and tunnels), oil and gas exploration (for managing produced water and water injection), and geothermal energy production. These applications require pumps capable of operating under extreme conditions, including high temperatures, high pressures, and handling chemically aggressive or highly abrasive fluids. Specialized consulting engineers and system integrators often act as intermediaries for these industrial customers, specifying highly customized, engineered-to-order pump solutions that meet stringent safety and environmental regulations specific to their industrial processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos, Xylem, KSB Group, Flowserve Corporation, Sulzer, Franklin Electric, Wilo Group, Ebara Corporation, Weir Group, Atlas Copco, SPP Pumps, Ruhrpumpen, Shakti Pumps, LEO Group, Aqua Group, C.R.I. Pumps, Vican Pump, Cornell Pump Company, DWT, Pioneer Pump. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Deep Well Pump Market Key Technology Landscape

The Deep Well Pump Market's technological landscape is rapidly evolving, driven by the imperative for enhanced energy efficiency, durability, and integration with smart digital controls. A cornerstone technology is the widespread adoption of High-Efficiency Motor Standards (such as IE3 and IE4), coupled with advanced hydraulic designs that minimize friction losses within the impellers and diffusers. Furthermore, the integration of Variable Frequency Drives (VFDs) is crucial; VFDs allow the pump motor speed to be precisely adjusted to match the flow requirements, dramatically reducing energy consumption compared to fixed-speed operation, especially in municipal and irrigation applications characterized by fluctuating demand and variable water levels.

Material science innovation also plays a critical role, particularly the development and application of corrosion-resistant and abrasion-resistant materials, such as specialized stainless steels, ceramic coatings, and engineered plastics for internal components. These advancements are essential for extending the operational lifespan of pumps in challenging environments, such as wells containing high mineral content, sand, or corrosive chemicals found in industrial wastewater or geothermal brine. The refinement of sealing technologies, including advanced mechanical seals and stuffing boxes, contributes significantly to reducing maintenance requirements and preventing costly water ingress into the motor housing, a common cause of pump failure in deep installations.

The increasing prominence of the Industrial Internet of Things (IIoT) represents the most impactful technological shift. Modern deep well pumps are frequently equipped with integrated sensors (pressure transducers, temperature probes, vibration monitors) that transmit real-time operational data wirelessly to cloud-based monitoring platforms. This enables sophisticated remote diagnostics, performance benchmarking, and, crucially, the implementation of condition-based monitoring programs. These systems utilize data analytics, sometimes powered by AI, to predict maintenance needs weeks or months in advance, minimizing unscheduled downtime and optimizing the overall efficiency of large-scale water extraction networks, enhancing resource security and operational reliability across all end-user segments.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, driven by substantial demand for agricultural irrigation systems, particularly in countries like India, China, and Southeast Asia. Rapid urbanization and subsequent massive governmental investments in developing municipal water infrastructure to support exploding urban populations are key accelerators. The region also sees high adoption rates of solar-powered deep well pumps due to poor grid connectivity in rural areas and strong government subsidies promoting sustainable water management practices.

- North America: This region is characterized by a mature market focused heavily on replacement and technological upgrades rather than new infrastructure expansion. Demand is driven by strict energy efficiency regulations (e.g., U.S. Department of Energy standards) pushing the adoption of premium, high-efficiency, VFD-equipped submersible and vertical turbine pumps for municipal and large industrial applications. The oil and gas sector, particularly for deep well disposal and enhanced oil recovery processes, also contributes significantly to specialized pump demand.

- Europe: The European market is highly regulated and innovation-driven, prioritizing sustainability and ultra-high efficiency. The focus here is on integrating smart pumping solutions (IIoT and cloud connectivity) for advanced utility management and optimizing water usage across municipal and industrial sectors. Central and Eastern Europe provide growth opportunities through the modernization of Soviet-era water infrastructure, while Western Europe emphasizes strict compliance with environmental directives and circular economy principles.

- Middle East and Africa (MEA): This region exhibits high growth potential, fueled by extreme water scarcity issues necessitating deep drilling for aquifer access, particularly for municipal and agricultural needs. Large-scale desalination projects and infrastructure developments in the GCC countries demand robust, high-capacity vertical turbine pumps. Africa's market growth is predominantly centered on small-to-medium-scale solar submersible pumps, providing vital off-grid water solutions for remote communities and subsistence farming, often supported by international aid and local governmental programs focused on water security.

- Latin America (LATAM): Market growth in LATAM is closely linked to the expansion of commercial agriculture (especially in Brazil and Argentina) and mining activities (Chile, Peru). While infrastructure investment lags compared to APAC, the demand for reliable deep well pumps for large irrigation systems remains strong. Political stability and economic conditions often dictate the pace of large project approvals, but the continuous need for water resources ensures consistent baseline demand across major countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Deep Well Pump Market.- Grundfos

- Xylem

- KSB Group

- Flowserve Corporation

- Sulzer

- Franklin Electric

- Wilo Group

- Ebara Corporation

- Weir Group

- Atlas Copco

- SPP Pumps

- Ruhrpumpen

- Shakti Pumps

- LEO Group

- Aqua Group

- C.R.I. Pumps

- Vican Pump

- Cornell Pump Company

- DWT

- Pioneer Pump

Frequently Asked Questions

Analyze common user questions about the Deep Well Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Deep Well Pump Market?

Market growth is predominantly driven by increasing global water scarcity, compelling reliance on deeper aquifers, coupled with rapid urbanization and the necessity to expand municipal water supply infrastructure globally. Furthermore, the escalating demand for efficient agricultural irrigation systems and stringent energy efficiency regulations contribute significantly to the adoption of advanced pumping technologies.

How do solar-powered deep well pumps impact market development, especially in emerging economies?

Solar-powered pumps are crucial market disruptors, providing a sustainable, cost-effective, and grid-independent solution for water access in remote agricultural and rural municipal areas. This technology significantly reduces long-term operational costs associated with electricity or diesel, accelerating market penetration in regions like Africa and South Asia where reliable power infrastructure is often lacking.

What is the main difference between submersible and vertical turbine deep well pumps?

Submersible pumps have the motor and the pump housing entirely submerged in the well fluid, offering high efficiency and quiet operation, suitable for narrow boreholes. Vertical turbine pumps utilize a motor mounted above ground, driving the submerged pump bowls via a long shaft, which simplifies motor maintenance and is typically preferred for high-flow, large-capacity municipal or industrial applications.

Which application segment holds the largest share in the Deep Well Pump Market?

The Agriculture segment holds the largest volume share due to the massive global requirement for irrigation to support crop production and food security. However, the Municipal water supply segment is projected to show the fastest growth rate, driven by essential infrastructure replacement projects in mature economies and network expansion in developing urban centers.

How does the integration of IIoT and AI benefit deep well pump operations?

IIoT sensors and AI algorithms enable real-time condition monitoring, remote performance optimization, and crucial predictive maintenance capabilities. This digital integration maximizes operational uptime, reduces energy consumption through precise VFD control, and drastically lowers the Total Cost of Ownership by anticipating and preventing component failures before they occur.

What role does the selection of materials play in deep well pump longevity?

Material selection, particularly the use of specialized stainless steel, high-grade cast iron, and engineered ceramics, is vital for resisting corrosion and abrasion caused by aggressive subterranean water compositions (high sand, high mineral content, or chemical brine). Using appropriate, durable materials ensures extended Mean Time Between Failures (MTBF) and robust operation over the system's intended lifecycle.

What regulations primarily influence the deep well pump industry in mature markets?

In mature markets like North America and Europe, stringent energy efficiency standards, such as minimum efficiency indices for motors and hydraulic performance mandates (e.g., DOE standards in the U.S.), heavily influence product development. Compliance with these regulations drives manufacturers to invest in highly efficient motors (IE3/IE4) and superior hydraulic designs to minimize energy usage and meet environmental sustainability targets.

How significant is the replacement market within the deep well pump sector?

The replacement market is extremely significant, especially in developed regions where existing municipal and older industrial infrastructure is reaching the end of its service life (20-30 years). The need to replace aging, inefficient pumps with modern, smart, and energy-compliant models represents a large and continuous revenue stream for market players, driving demand for modern retrofit solutions.

Define the concept of high head capability in deep well pump applications.

High head capability refers to the pump's ability to lift fluid vertically against significant gravitational pressure and system friction losses over long distances or depths. Deep well pumps are specifically engineered with multiple impellers (stages) to generate the high pressure necessary to overcome the substantial static head presented by deep boreholes, ensuring adequate flow is delivered to the surface or distribution point.

What are the challenges associated with maintaining deep well submersible pumps?

The primary challenge is the requirement for specialized equipment (cranes, specific retrieval rigs) and skilled personnel to pull the entire pump and motor assembly out of the well for diagnosis or repair, which is inherently time-consuming and expensive. This difficulty strongly reinforces the market trend toward highly reliable, low-maintenance designs and remote monitoring systems to minimize the frequency of required retrievals.

Which geographical region is currently leading the overall deep well pump market consumption?

The Asia Pacific (APAC) region currently leads the market consumption by volume and value, predominantly driven by massive infrastructure expansion projects in major economies like China and India, coupled with extensive, necessity-driven demand from the agricultural sector for irrigation pumping solutions across the subcontinent.

What are VFDs and why are they critical to modern deep well pump efficiency?

Variable Frequency Drives (VFDs) are electronic devices that control the speed of the electric motor by varying the frequency and voltage of the electrical supply. They are critical because they allow the pump's output to precisely match the fluid demand, preventing unnecessary energy wastage associated with running the pump at a fixed, maximum speed, thereby optimizing energy efficiency dramatically, especially in variable-load systems.

How does the mining industry utilize deep well pump technology?

The mining industry utilizes deep well pump technology primarily for dewatering—removing large volumes of groundwater from deep underground pits, shafts, and tunnels to facilitate safe extraction operations. These applications demand extremely robust, high-capacity, and often abrasion-resistant vertical turbine or heavy-duty submersible pumps designed to handle harsh, sediment-laden water.

What are the key restraint factors affecting the deep well pump market growth?

Key restraint factors include the high initial capital investment required for drilling and purchasing the specialized, high-capacity pumping systems. Additionally, the operational reliance on a stable and continuous electricity supply, particularly challenging in rural or remote global regions, acts as a significant impediment to widespread adoption without concurrent investment in alternative power sources like solar PV.

How is the Deep Well Pump Market structured in terms of key segments by type?

The market is primarily segmented by Type into Submersible Pumps and Vertical Turbine Pumps. Submersible pumps are the dominant segment due to their efficiency and ease of installation in deep wells, while Vertical Turbine Pumps are preferred for large flow rates and surface-accessible motor maintenance in municipal and large industrial setups.

What emerging opportunities exist within the deep well pump value chain?

Emerging opportunities are concentrated in the provision of comprehensive service contracts centered around IIoT integration, offering customers data-driven maintenance and performance optimization services. Furthermore, expanding the manufacturing base and distribution network for solar-powered pump accessories and complete off-grid solutions represents a major growth opportunity, particularly in high-sunshine developing regions.

In the Value Chain, why are drilling contractors considered a critical downstream component?

Drilling contractors are critical because they often act as the primary interface with the end-user, providing technical consultation on well depth, casing size, and hydrological data. Their expertise is essential for correctly sizing and installing the appropriate deep well pump system, influencing brand loyalty and ensuring successful system operation, thereby integrating sales and service functions.

How does global climate change influence the demand for deep well pumps?

Climate change exacerbates droughts and increases reliance on irrigation, simultaneously causing the depletion of shallow groundwater tables. This necessitates drilling deeper wells to access sustainable water sources, directly increasing the global demand for high-performance, multi-stage deep well pumps capable of operating reliably at greater depths and higher heads.

What is the typical lifespan of a deep well pump system under optimal conditions?

Under optimal operating conditions, utilizing high-quality materials and benefiting from efficient motor and VFD controls, a deep well pump system can typically have a service life ranging from 15 to 25 years. This longevity, however, is significantly dependent on the abrasive nature of the pumped fluid, the stability of the power supply, and adherence to regular, proactive maintenance schedules.

Which industrial sectors are significant consumers of specialized deep well pumps?

The most significant industrial consumers include the mining industry for dewatering purposes, the oil and gas sector for water management (injection and produced water handling), and power generation plants, particularly those utilizing geothermal energy which requires highly specialized, heat- and corrosion-resistant pumping systems for brine circulation.

Explain the importance of corrosion-resistant alloys in pump manufacturing for geothermal applications.

Geothermal applications involve pumping extremely hot, often chemically aggressive brine containing high concentrations of corrosive salts and minerals. Corrosion-resistant alloys (such as specialized stainless steels or Hastelloy) are mandatory to prevent rapid material degradation, maintain hydraulic integrity, and ensure the operational safety and lifespan of the pumping equipment under these severe temperature and chemical stresses.

What governmental policies accelerate the adoption of deep well pump technology in developing countries?

Government policies that accelerate adoption include subsidies for agricultural pumping equipment, particularly solar PV systems, along with large-scale public investment programs aimed at expanding rural and urban potable water access (e.g., national water security missions). These policies often incentivize the purchase of highly efficient, certified pump models, aligning resource management with economic development goals.

How do advancements in hydraulic design contribute to pump efficiency?

Advancements in hydraulic design involve optimizing the shape and geometry of impellers, diffusers, and casing components using Computational Fluid Dynamics (CFD) modeling. This optimization minimizes internal friction and turbulence within the pump stages, maximizing the conversion of electrical energy into useful kinetic energy and pressure head, thereby significantly reducing the overall specific energy consumption (SEC) of the unit.

What is the market outlook for the Latin American deep well pump market?

The Latin American market outlook is moderately positive, driven primarily by the sustained demand from large commercial agricultural enterprises (like soybean and sugar cane production) and continued, though often fluctuating, investment in the high-demand mining sector. Future growth hinges on stabilizing regional economies and increasing public spending on water infrastructure modernization.

Why is the precise measurement of the water table critical for efficient pump operation?

The precise measurement of the dynamic water table level is critical because it dictates the total head the pump must overcome and prevents the pump from running dry (drawdown), which can cause catastrophic damage to the unit. Continuous monitoring allows VFD systems and smart controls to optimize pump speed dynamically, maximizing efficiency while protecting the equipment from adverse operating conditions.

Which segments are most likely to adopt AI and IIoT technologies in the near term?

The Municipal Water Supply and large-scale Industrial segments (such as mining and utilities) are most likely to rapidly adopt AI and IIoT. These sectors have high operational expenditures, large asset bases, and critical needs for uninterrupted supply, making the investment in predictive maintenance and remote operational optimization highly cost-effective and strategically necessary for risk mitigation.

Define the term 'Specific Energy Consumption' (SEC) in the context of deep well pumps.

Specific Energy Consumption (SEC) is a critical efficiency metric defined as the amount of energy (in kilowatt-hours, kWh) required to pump a unit volume of water (typically cubic meter or thousand gallons). Lower SEC values indicate higher energy efficiency, which is a key performance indicator favored by municipal authorities and large commercial users seeking to minimize long-term operational costs.

What competitive advantages do manufacturers gain through vertical integration in the deep well pump market?

Manufacturers who achieve vertical integration—controlling the production of critical components like motors, VFDs, and hydraulic parts—gain significant competitive advantages. These advantages include tighter quality control over the entire system, reduced reliance on external suppliers, faster time-to-market for new technologies, and ultimately, better control over manufacturing costs and pricing strategies across diverse product lines.

How does the shift towards sustainable practices influence pump design and materials?

The push for sustainable practices necessitates the design of pumps with superior energy efficiency (minimizing carbon footprint) and the use of environmentally safe, often recyclable, materials. This includes prioritizing non-leaching, corrosion-resistant internal components and engineering pumps optimized for integration with renewable energy sources like solar power, reducing dependence on fossil fuel-derived electricity.

What future technological advancements are expected to reshape the deep well pump market?

Future advancements are expected to focus heavily on greater autonomy and digitalization, including self-diagnosing pumps that automatically adjust for wear, advanced non-metallic materials (composites) for enhanced durability, and improved battery storage solutions integrated with solar systems, allowing 24/7 operation in remote locations without grid connectivity challenges.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Deep Well Pump Market Size By Regional (Europe, North America, South America, Asia Pacific, Middle East And Africa), Industry Growth Opportunity, Price Trends, Competitive Shares, Market Statistics and Forecasts 2025 - 2032

- Deep Well Pump Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Clear Water, Sewage, Sea), By Application (The Mine Emergency Rescue, Construction, Agricultural Irrigation And Drainage, Urban Water, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager