Defence Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433054 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Defence Market Size

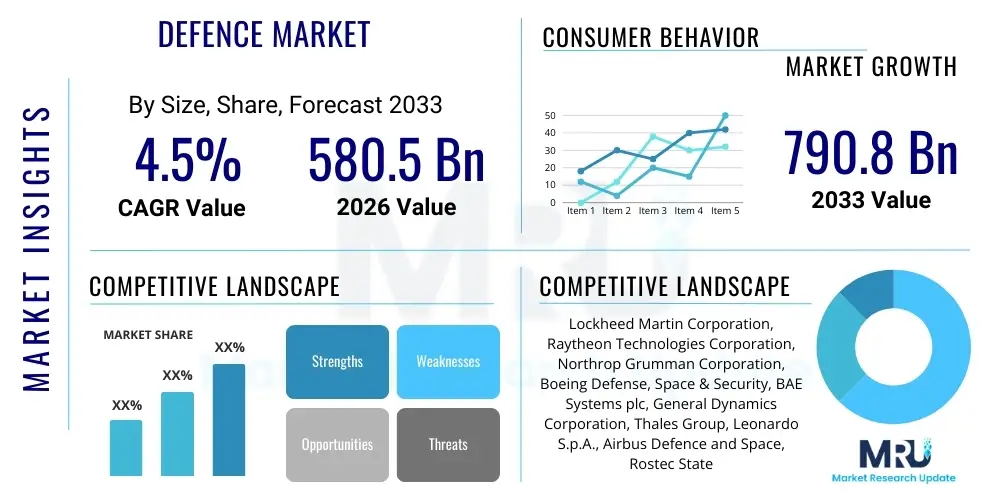

The Defence Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 580.5 Billion in 2026 and is projected to reach USD 790.8 Billion by the end of the forecast period in 2033.

Defence Market introduction

The global Defence Market encompasses the production, procurement, maintenance, and deployment of military equipment, technologies, and services utilized by national governments and authorized defense agencies worldwide. This market is fundamentally driven by geopolitical instability, modernization requirements across conventional and unconventional warfare domains, and the continuous advancement of disruptive military technologies. Key products range from sophisticated weapon systems, advanced surveillance and reconnaissance platforms, protective gear, and specialized military communication infrastructure (C4ISR). The complexity of modern conflicts necessitates continuous investment in high-end solutions, making the sector highly capital-intensive and subject to stringent governmental regulatory frameworks and long procurement cycles.

Major applications of defence products span air superiority, naval dominance, land force protection, missile defense, and, increasingly, cyber and space warfare capabilities. The market’s dynamism is fueled by a critical need for interoperability among allied forces and the integration of autonomous systems and Artificial Intelligence (AI) to enhance mission effectiveness while reducing human risk. Furthermore, the shift towards multi-domain operations (MDO) demands integrated systems capable of seamless coordination across land, sea, air, space, and cyber domains, boosting demand for unified command and control solutions.

The primary benefits derived from robust defense capabilities include ensuring national security, projecting diplomatic influence, protecting critical infrastructure, and maintaining regional stability. Key driving factors accelerating market expansion include escalating global terrorism threats, persistent border disputes, the navalization of strategic sea lanes, and substantial governmental budgetary allocations towards R&D for next-generation systems like hypersonic weapons, directed energy systems, and advanced electronic warfare tools. The ongoing technological arms race between major global powers mandates consistent modernization cycles, sustaining high levels of investment in the defense industrial base.

Defence Market Executive Summary

The Defence Market is characterized by robust governmental spending, primarily concentrated in North America and the Asia Pacific region, reflecting shifting global power dynamics and heightened security concerns. Business trends indicate a strong move toward platform modernization, focusing on upgrading legacy systems with digital capabilities, particularly in areas like predictive maintenance (MRO) and sensor fusion. Furthermore, major defense contractors are increasingly engaging in strategic mergers and acquisitions to consolidate technological expertise, especially in nascent fields such as quantum computing and advanced materials for stealth technology. Supply chain resilience has become a critical focus post-pandemic, driving efforts toward regionalizing manufacturing and securing long-term access to specialized components, particularly microelectronics.

Regional trends highlight the emergence of the Asia Pacific as the fastest-growing market, propelled by territorial disputes, significant naval expansion programs in countries like China and India, and rising defense exports from nations seeking strategic independence. North America maintains its position as the largest market, driven by substantial R&D budgets allocated by the US Department of Defense (DoD) for sophisticated, high-end technologies like hypersonic missiles and advanced networking capabilities for joint force operations. European defence spending, particularly within NATO member states, is experiencing a notable uplift, stimulated by geopolitical conflicts in Eastern Europe, reinforcing requirements for rapid deployment forces and high-readiness inventory stockpiles.

Segment trends underscore the dominance of the Airborne segment, covering fighter jets, bombers, and unmanned aerial vehicles (UAVs), which continues to attract the largest procurement expenditure due to their crucial role in air superiority and precision strike missions. However, the C4ISR segment (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) is exhibiting the highest growth rate, directly influenced by the need for better situational awareness and real-time data fusion across complex battle spaces. Technology segments, particularly cybersecurity and AI, are experiencing exponential demand, transforming defence from a hardware-centric industry into a data and software-driven operational environment.

AI Impact Analysis on Defence Market

User inquiries regarding AI's influence on the Defence Market primarily revolve around ethical considerations (Lethal Autonomous Weapon Systems - LAWS), operational efficiency gains, and the necessary infrastructure investment required for mass deployment. Users frequently ask about the timeline for fully autonomous systems, how AI integration impacts traditional defense procurement cycles, and the cybersecurity risks associated with reliance on intelligent algorithms. The key themes summarized across these user questions center on balancing technological advantage with moral responsibility, ensuring robust testing and validation processes for AI-driven decision-making tools, and understanding the requisite data architecture needed to feed sophisticated machine learning models operating in contested environments.

The integration of Artificial Intelligence represents a transformative shift, moving defence capabilities beyond human cognitive limitations and into realms of rapid, data-driven execution. AI is being leveraged extensively in predictive maintenance, drastically reducing equipment downtime and optimizing logistics by forecasting component failures. Furthermore, AI algorithms are crucial for processing vast amounts of sensor data collected by surveillance platforms, allowing for faster target recognition, complex pattern detection, and enhanced situational awareness for commanders. This capability significantly shortens the OODA (Observe, Orient, Decide, Act) loop, providing a crucial operational advantage.

However, the ethical and regulatory landscape surrounding military AI remains highly complex. While AI offers unparalleled speed in decision-making, especially in domains like missile defense and electronic warfare, concerns persist regarding accountability and reliability in highly stressed, unpredictable combat scenarios. Significant investments are therefore being channeled into robust, explainable AI (XAI) frameworks to ensure transparency and trust in autonomous systems. The market is witnessing accelerated development in cognitive electronic warfare, where AI learns and adapts countermeasures in real-time against sophisticated enemy jamming techniques, fundamentally changing the dynamics of spectrum control.

- Enhances C4ISR efficiency through real-time data fusion and predictive intelligence.

- Accelerates decision cycles (OODA loop optimization) in contested environments.

- Drives the development of Lethal Autonomous Weapon Systems (LAWS).

- Revolutionizes logistics and readiness via AI-driven predictive maintenance (MRO).

- Increases demand for sophisticated cybersecurity measures to protect AI models and data feeds.

- Facilitates multi-domain coordination and interoperability through cognitive networking.

- Requires significant development in Explainable AI (XAI) for ethical and trust requirements.

DRO & Impact Forces Of Defence Market

The Defence Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces dictating market trajectory. Major drivers include intensifying geopolitical tensions globally, particularly border disputes in Asia and regional power competition, compelling nations to prioritize military strength. Coupled with this is the continuous technological obsolescence of legacy military platforms, forcing governments to allocate substantial budgets for modernization and replacement cycles. Opportunities exist predominantly in the development and commercialization of dual-use technologies, such as advanced sensor technology and secure communication systems, which can transition between military and civil applications, potentially diversifying revenue streams for contractors. However, the market faces significant restraints, notably the cyclical nature of governmental defence budgets, which are often subject to political shifts and macroeconomic pressures, leading to unpredictable procurement schedules and program cuts.

One of the most powerful drivers is the pervasive nature of asymmetrical warfare and the proliferation of sophisticated non-state actor threats, demanding investment not only in traditional platforms but also in specialized counter-insurgency and counter-terrorism technologies, including intelligence gathering and advanced reconnaissance tools. Furthermore, the commitment of NATO members to meet the 2% GDP defense spending target acts as a strong macro-driver, ensuring sustained financial inflow into the European defence industrial base. The transition to space as a contested domain is also a crucial opportunity, sparking massive investment in satellite hardening, orbital debris management, and advanced space-based surveillance capabilities, opening up entirely new segments for specialized technology providers.

Restraints are often imposed by strict export controls and stringent regulatory compliance requirements, particularly concerning sensitive technologies, which limit the ability of defence firms to access certain international markets and lengthen the time required for product deployment. The market is also heavily impacted by the shortage of skilled technical labor, specifically engineers and specialists capable of working with highly complex domains like directed energy and quantum encryption, potentially slowing innovation cycles. Overall, the market remains highly inelastic; while budget cycles pose short-term restraints, the fundamental driver of national security ensures long-term, stable demand, defining the sector's unique growth dynamics and high barrier to entry.

Segmentation Analysis

The Defence Market is extensively segmented based on Type, Application, and Technology, reflecting the specialized requirements of modern military operations. Understanding these segmentations is crucial as they reveal where governmental priorities and spending allocations are concentrated. The market continues to evolve from platform-centric procurement towards capability-driven acquisitions, meaning integrated systems and technologies are increasingly valued over standalone hardware. The segmentation structure helps track the velocity of technological disruption, showing rapid growth in areas that enhance connectivity, situational awareness, and precision strike capabilities across all domains, from terrestrial operations to high-altitude and orbital environments.

- By Type:

- Airborne (Fighter Aircraft, Military Helicopters, UAVs/Drones, Transport Aircraft)

- Naval (Submarines, Surface Combatants, Aircraft Carriers, Patrol Vessels)

- Land-based (Armored Vehicles, Artillery Systems, Missile Systems, Tactical Vehicles)

- Space-based (Military Satellites, Launch Services, Ground Segment Infrastructure)

- By Application/Mission:

- C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance)

- Weapon Systems (Missile Systems, Munitions, Directed Energy Weapons)

- Protection and Security (Cybersecurity, Electronic Warfare, Border Security)

- Training and Simulation (Flight Simulators, Ground Combat Simulators, Virtual Reality Training)

- Maintenance, Repair, and Overhaul (MRO)

- By Technology:

- Artificial Intelligence (AI) and Machine Learning

- Hypersonics

- Cyber Warfare

- Directed Energy Weapons (DEW)

- Advanced Materials and Manufacturing (3D Printing for spare parts)

Value Chain Analysis For Defence Market

The defence value chain is long, complex, and highly integrated, involving sophisticated upstream suppliers, system integrators, and government end-users. Upstream analysis focuses on the highly specialized supplier base, including manufacturers of high-performance raw materials, microelectronics, advanced sensors, and proprietary software components. These Tier 2 and Tier 3 suppliers often possess unique technological patents and require rigorous certification processes, creating high barriers to entry. Geopolitical risks, particularly regarding the secure supply of rare earth elements and critical microchips, significantly influence upstream stability. System integrators, the prime contractors, then manage these inputs, assembling complex weapon systems and platforms while absorbing substantial R&D costs.

The midstream involves the core activities of research, development, assembly, and rigorous testing, often conducted in collaboration with government defence laboratories. This stage is characterized by substantial investment in advanced manufacturing capabilities, stringent quality assurance, and adherence to classified specifications. The downstream segment is defined by sales, often managed through direct government-to-government (G2G) contracts or foreign military sales (FMS), and importantly, the long-term support phase, including maintenance, spare parts logistics, and subsequent platform upgrades (MRO). The profitability often shifts toward the sustainment and upgrade phase rather than initial procurement.

The distribution channel is predominantly direct, given the nature of the products and the security implications. Prime contractors deal directly with national Ministries of Defence or armed forces. Indirect channels are limited but exist for certain ancillary services, smaller components, or specialized training solutions offered through authorized intermediaries or local joint ventures required for technology transfer in recipient nations. The direct procurement model ensures maximum security, facilitates customized technological integration, and supports critical long-term sustainment contracts essential for operational readiness.

Defence Market Potential Customers

The primary customers in the Defence Market are national governments, specifically their centralized Ministries of Defence, military branches (Army, Navy, Air Force, Space Force), and associated intelligence and security agencies. These buyers require equipment and services that align directly with specific national security mandates, operational doctrines, and integrated defense strategy plans. Procurement decisions are highly strategic, involving multi-year planning, rigorous capability assessments, and substantial legislative oversight regarding budget appropriation. The core demand is driven by the necessity to replace aging inventories, counter evolving threats, and maintain a technological edge against potential adversaries, necessitating continuous investment in advanced platforms and digital warfare tools.

Secondary but important customer groups include international peacekeeping organizations (like the United Nations, requiring equipment for rapid deployment and logistical support), domestic homeland security departments (seeking surveillance, border control, and cybersecurity solutions), and allied military coalitions (like NATO, requiring standardized, interoperable equipment). While the government remains the ultimate decision-maker, requirements often originate from operational users—the uniformed personnel—who specify the tactical and strategic performance needs. These requirements are then translated into formal requests for proposals (RFPs) that guide prime contractor development.

The defining characteristic of these buyers is the demand for long-term support and lifecycle management. A potential customer not only purchases a platform (e.g., a fighter jet) but also mandates contracts covering decades of maintenance, training, parts supply, and future technological insertion. This long-term commitment emphasizes reliability, technological maturity, and the financial stability of the vendor. Buyers prioritize vendors who can provide secure, sovereign capabilities and often require significant offsets or technology transfer agreements as part of large procurement contracts, particularly in emerging defence markets seeking to build their own industrial base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580.5 Billion |

| Market Forecast in 2033 | USD 790.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Boeing Defense, Space & Security, BAE Systems plc, General Dynamics Corporation, Thales Group, Leonardo S.p.A., Airbus Defence and Space, Rostec State Corporation, Elbit Systems Ltd., Israel Aerospace Industries (IAI), Rheinmetall AG, Saab AB, Hindustan Aeronautics Limited (HAL), Mitsubishi Heavy Industries, Hanwha Defense, L3Harris Technologies, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Defence Market Key Technology Landscape

The technological landscape of the Defence Market is rapidly shifting towards digitization, automation, and speed, driven by the necessity for multi-domain superiority. A cornerstone technology is the development and deployment of hypersonic weapons, capable of traveling at Mach 5 or higher, which fundamentally challenge existing missile defense architectures and necessitate massive investment in early warning and tracking systems. Simultaneously, Directed Energy Weapons (DEW), including high-energy lasers and high-power microwaves, are moving from laboratory concepts to operational prototypes, offering low-cost, high-speed defense against drones, missiles, and artillery, promising a paradigm shift in air defense capabilities.

Furthermore, the focus on Cyber Warfare capabilities is paramount, encompassing advanced offensive cyber operations alongside robust defensive infrastructure hardening. Modern conflicts are increasingly fought across digital networks, making secure, resilient communication and command systems essential. This drives significant investment in quantum-resistant encryption and advanced intrusion detection systems. In parallel, advancements in stealth technology and signature management, leveraging metamaterials and advanced composite structures, continue to define the market for next-generation combat aircraft and naval vessels, enhancing survivability and operational reach in highly contested airspaces and maritime zones.

The convergence of 5G and future 6G networks with military applications is creating the foundation for Joint All-Domain Command and Control (JADC2) systems, providing the high-bandwidth, low-latency connectivity required for real-time sensor-to-shooter linking across dispersed forces. This network modernization is complemented by the widespread integration of advanced sensor technologies, including synthetic aperture radar (SAR), multispectral imaging, and miniature MEMS sensors, enhancing intelligence gathering capabilities across all domains. These technology areas collectively ensure that future military advantages will be derived from data superiority and network resilience, rather than solely platform quantity.

Regional Highlights

- North America: This region maintains its position as the largest and most technologically advanced defense market globally, primarily fueled by the extensive budgetary allocations of the United States. Demand is concentrated on high-end, complex systems such as fifth and sixth-generation fighters, sophisticated missile defense shields (e.g., THAAD, Aegis), and deep investment in transformative technologies like quantum computing and AI for battlefield management. The US military modernization strategy, particularly initiatives like the Joint All-Domain Command and Control (JADC2), drives immense R&D spending and dictates many global technological standards. Canadian defence spending, while smaller, is focused on arctic surveillance capabilities and naval modernization programs.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by escalating regional tensions, prominent maritime disputes, and sustained, aggressive military spending by major powers such as China and India. China's rapid naval expansion and its efforts to achieve technological parity with Western powers generate significant demand across all segments, particularly advanced shipbuilding, missile technology, and cyber capabilities. India's focus on indigenization (Make in India) and replacing outdated Soviet-era equipment contributes substantially to regional market growth, creating strong opportunities for technology transfer and local manufacturing partnerships, especially in aerospace and artillery systems.

- Europe: The European market is experiencing mandated growth, largely stimulated by NATO commitments requiring member states to increase defence spending towards 2% of GDP, a necessity amplified by the geopolitical events in Eastern Europe. The focus here is on replenishing ammunition stockpiles, enhancing high-readiness ground forces, and strengthening collaborative defence programs like the Future Combat Air System (FCAS) and Main Ground Combat System (MGCS). Countries like Germany, France, and the UK are prioritizing digitization, electronic warfare, and standardized, interoperable equipment for rapid cross-border deployment.

- Middle East and Africa (MEA): This region is characterized by high levels of defence imports due to persistent security threats, complex internal conflicts, and the need for border protection and counter-terrorism capabilities. Major importers like Saudi Arabia, UAE, and Israel drive demand for advanced air superiority platforms, missile defense systems, and C4ISR solutions to manage regional instability. Spending is highly volatile but remains robust, with a growing trend towards local assembly and maintenance capabilities to secure long-term military independence and support domestic employment goals.

- Latin America: The Latin American defence market is smaller and more constrained by economic volatility and lower average defense budgets relative to GDP. Procurement focuses primarily on maritime security (counter-narcotics, EEZ patrol), internal security, and modernizing light transport and surveillance aircraft fleets. Market growth is stable but moderate, relying heavily on foreign suppliers for advanced platforms and requiring competitive financing terms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Defence Market.- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Boeing Defense, Space & Security

- BAE Systems plc

- General Dynamics Corporation

- Thales Group

- Leonardo S.p.A.

- Airbus Defence and Space

- Rostec State Corporation

- Elbit Systems Ltd.

- Israel Aerospace Industries (IAI)

- Rheinmetall AG

- Saab AB

- L3Harris Technologies, Inc.

- Huntington Ingalls Industries

- Mitsubishi Heavy Industries (MHI)

- Hanwha Defense

- Hindustan Aeronautics Limited (HAL)

- Naval Group

Frequently Asked Questions

Analyze common user questions about the Defence market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind current global defence market growth?

The market is primarily driven by escalating global geopolitical tensions, particularly territorial disputes in strategic regions like the South China Sea and Eastern Europe, necessitating urgent military modernization programs and increased governmental budgetary allocations for national security and strategic deterrence capabilities.

Which technology segment is expected to show the fastest growth rate in the defence industry?

The C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) and related AI/Cyber warfare technology segments are projected to exhibit the fastest growth. This acceleration is due to the critical need for real-time situational awareness, multi-domain integration (JADC2), and defense against sophisticated cyber threats.

How does the shift to multi-domain operations (MDO) impact defence procurement?

MDO necessitates a significant shift from procuring standalone platforms to acquiring integrated systems that ensure interoperability across land, air, sea, space, and cyber domains. This drives demand for networked sensors, cognitive computing, and standardized communication protocols for seamless joint force execution.

What role do export controls play as a restraint in the defence market?

Strict governmental export controls, enforced by leading defence exporting nations (e.g., ITAR, EAR), act as a major restraint by limiting the accessibility of highly sensitive technologies to certain international buyers. These regulations increase transaction complexity and often mandate lengthy approval processes for foreign military sales (FMS).

Which region currently dominates the global defence market expenditure?

North America, led by the United States, dominates the global defence market expenditure due to its extensive research and development budgets, commitment to maintaining technological superiority, and ongoing platform modernization initiatives across all military branches.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Mobile Tower Defence Games Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- C4Isr Market Size Report By Type (.), By Application (Command and Control, Computing, Intelligence, Surveillance and Reconnaissance, Electronic Warfare, Communications, , Defence & Space, Homeland Security, Commercial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Directed Energy Weapons (Dew) Market Size Report By Type (High Energy Laser Technology, High Power Microwave Technology, Particle Beam Weapon, Plasma Weapon, Sonic Weapon), By Application (Defence and Homeland Security), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Thermocouple Market Size Report By Type (Nickel-Alloy Thermocouples, Tungsten/Rhenium-Alloy Thermocouples, Chromel-Gold/Iron-Alloy Thermocouples, Type J Thermocouple, Type K Thermocouple, Type T Thermocouple, Type N Thermocouple, Type E Thermocouple, Type B Thermocouple, Type R Thermocouple, Type S Thermocouple, Others), By Application (Industrial Applications, Automotive, Optical, Metal Manufacturing, Aerospace, Defence Application), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Gallium Arsenide Gaas Radio Frequency Rf Semiconductor Market Size Report By Type (Filter and Duplexer, Power Amplifier, Switch, Low Noise Amplifier, Very High Frequency (VHF) and Ultra-High Frequency (UHF), Super-high Frequency (SHF), Extremely High Frequency (EHF),, Up to 5 V, 5.1 to 20 V, Above 20 V), By Application (Consumer Devices, Telecommunication, Aerospace and Defence and SATCOM, Automotive, Community Antenna Television (CATV) and Wired Broadband, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager