Defense Robotics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435605 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Defense Robotics Market Size

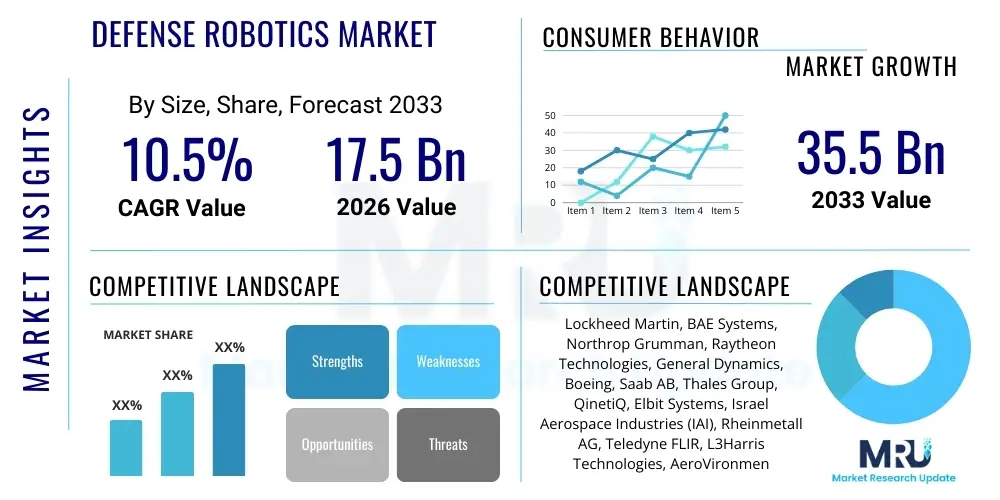

The Defense Robotics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 35.5 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by increasing global defense budgets allocated towards modernization programs, emphasizing the procurement of unmanned systems to mitigate risks to personnel in hazardous environments, and enhancing operational efficiency across various military domains including air, land, and sea. The continuous integration of advanced sensing capabilities, artificial intelligence (AI), and secure communication technologies into robotic platforms is accelerating adoption globally, particularly in developed nations prioritizing technological superiority in defense capabilities.

Defense Robotics Market introduction

The Defense Robotics Market encompasses the development, manufacturing, and deployment of autonomous and semi-autonomous systems designed specifically for military and defense applications. These robotic systems—including Unmanned Aerial Vehicles (UAVs), Unmanned Ground Vehicles (UGVs), and Unmanned Maritime Vehicles (UMVs)—are crucial tools utilized for intelligence, surveillance, and reconnaissance (ISR), combat operations, logistical support, explosive ordnance disposal (EOD), and border patrol. The primary objective of these sophisticated platforms is to increase mission effectiveness while significantly minimizing the exposure of human soldiers to direct combat and high-risk zones, thereby improving force protection and operational tempo. Modern defense robotics are characterized by their integration with complex sensor suites, advanced navigation systems, and capabilities for real-time data processing.

Key applications of defense robotics span the spectrum of military operations, from deep penetration surveillance conducted by stealth UAVs to heavy-duty logistical transport performed by UGVs in rugged terrain. These products offer substantial benefits, including persistent presence capabilities, precise target engagement, reduction in collateral damage through enhanced situational awareness, and the ability to operate effectively in environments deemed too dangerous or inaccessible for human intervention. The reliability and endurance of contemporary robotic platforms have made them indispensable assets in asymmetric warfare scenarios and territorial defense strategies adopted by major global powers.

Driving factors for market growth are manifold, centering on geopolitical instability necessitating heightened defense preparedness, rapid technological advancements particularly in autonomy and machine learning, and significant capital investments from leading military powers aiming to achieve operational parity or dominance. Furthermore, the global proliferation of sophisticated threat vectors, including complex improvised explosive devices (IEDs) and swarming drone attacks, fuels the demand for advanced countermeasure robotics and specialized EOD units, positioning robotics as a central component of future military architectures.

Defense Robotics Market Executive Summary

The global Defense Robotics Market is experiencing a transformative period characterized by accelerating technological convergence between traditional defense manufacturing and cutting-edge digital technologies, notably AI and machine learning. Business trends indicate a shift towards modular and multi-role platforms, allowing defense ministries to deploy versatile systems adaptable to various operational requirements, promoting cost efficiency and rapid modernization cycles. Strategic mergers, acquisitions, and partnerships between established defense contractors and specialized AI software firms are becoming commonplace, aimed at securing advanced integration capabilities and maintaining a competitive edge in rapidly evolving autonomous systems. Procurement cycles are increasingly favoring fully autonomous solutions over remotely piloted systems, driven by the need for speed and responsiveness in contested environments.

Regionally, North America maintains its dominance due to massive R&D spending by the U.S. Department of Defense and the presence of major industry players specializing in advanced autonomous systems development. However, the Asia Pacific region is demonstrating the highest growth trajectory, spurred by geopolitical tensions, escalating military spending from nations like China, India, and South Korea, and localized efforts to develop indigenous defense technology capabilities. Europe is focused primarily on collaborative projects aimed at standardized robotic platforms and joint procurement programs under initiatives like Permanent Structured Cooperation (PESCO), concentrating on enhancing interoperability across NATO and EU member states.

Segment trends reveal that the Unmanned Aerial Vehicle (UAV) segment retains the largest market share due to its established utility in ISR missions and armed combat operations, but the Unmanned Ground Vehicle (UGV) segment, particularly those focused on logistical and EOD functions, is projected to register the fastest growth rate driven by increased demand for robust ground support in urban and complex terrains. Furthermore, the rising focus on naval defense and maritime security is pushing significant investment into Unmanned Maritime Vehicles (UMVs), emphasizing anti-submarine warfare (ASW) and mine countermeasure (MCM) applications. The move towards higher levels of autonomy—from semi-autonomous to fully autonomous—is the core technological driver across all major platform segments.

AI Impact Analysis on Defense Robotics Market

Common user questions regarding AI's impact on the Defense Robotics Market frequently revolve around ethical governance (the lethal autonomy debate), operational reliability, and the potential for rapid technological obsolescence of non-AI enabled systems. Users are keenly interested in how AI enhances decision-making under stress, particularly in swarm tactics and complex multi-domain operations, and whether AI integration significantly reduces the cognitive load on human operators while maintaining positive control. Based on this analysis, the key theme summarizing AI’s influence is its role as the critical accelerator, transforming robotic platforms from mere tools into intelligent force multipliers capable of adaptive mission execution, necessitating stringent new standards for verification, validation, and transparency in defense systems.

The integration of artificial intelligence is fundamentally redefining the capabilities and roles of defense robotics, moving beyond simple programmed actions to complex, adaptive behavior. AI algorithms enable robots to process vast amounts of sensor data in real-time, facilitating autonomous navigation in GPS-denied environments, improved target recognition, and sophisticated threat prioritization. This shift empowers platforms to operate effectively with minimal or delayed human intervention, crucial for high-speed, long-duration missions, and in scenarios where secure communication links are compromised. Furthermore, advanced AI techniques like deep learning are enhancing predictive maintenance capabilities, ensuring higher system readiness and optimizing operational logistics across the fleet of defense robots.

The profound impact of AI also extends to command and control structures, enabling distributed operations where human operators manage entire fleets of autonomous agents rather than individually controlling single systems. This concept, often termed 'human-on-the-loop' or 'human-supervised autonomy,' aims to leverage the speed and precision of machines while retaining human ethical oversight, particularly in engagement decisions. The ethical and legal frameworks governing Lethal Autonomous Weapon Systems (LAWS) remain a significant point of discussion and regulation, but the military advantage offered by AI-driven robotics in terms of strategic depth and responsiveness is driving continuous investment across all major defense programs globally, securing AI as the core competitive technology for the next generation of defense hardware.

- AI enhances real-time data fusion and situational awareness for robotic platforms.

- Enables complex swarm coordination and cooperative maneuvers among multiple systems.

- Facilitates autonomous decision-making in navigation and complex threat evasion (path planning).

- Improves target recognition and classification accuracy through computer vision and machine learning.

- Drives predictive maintenance schedules, increasing operational availability and reducing downtime.

- Crucial for operating effectively in environments lacking reliable satellite communication or GPS signals.

DRO & Impact Forces Of Defense Robotics Market

The dynamics of the Defense Robotics Market are shaped by powerful Drivers (D), significant Restraints (R), emerging Opportunities (O), and the overarching Impact Forces that dictate market evolution and strategic investment priorities. The primary driver is the pervasive global mandate to minimize casualties in combat zones and high-risk operations, compelling defense organizations to adopt unmanned systems for hazardous tasks such as EOD, ISR in denied airspace, and patrol duties in highly volatile regions. Complementing this is the strategic imperative among major military powers to maintain technological superiority, leading to massive R&D expenditure on integrating advanced autonomy, secure networking, and hyper-spectral sensing capabilities into next-generation robotic platforms. The continuous evolution of asymmetric threats, including sophisticated IEDs and state-sponsored cyber warfare, further necessitates robust robotic solutions capable of operating autonomously and resisting electronic countermeasures.

Conversely, the market faces inherent Restraints primarily related to the steep initial development costs associated with highly specialized military-grade hardware and software, often coupled with long and complex procurement cycles burdened by strict regulatory oversight. Public and ethical concerns surrounding the development and deployment of Lethal Autonomous Weapon Systems (LAWS) present a significant non-technical restraint, requiring lengthy international dialogues and establishing clear rules of engagement before mass deployment. Furthermore, the technical challenge of ensuring absolute cybersecurity for robotic control systems and data links is paramount, as vulnerability to hacking or jamming could compromise entire missions, leading to hesitation in the rapid adoption of fully autonomous capabilities.

Opportunities for growth are abundant, notably through the rapid maturation of AI and machine learning, which promises fully autonomous, decision-making capabilities, significantly expanding the mission profile of robotic systems beyond remote control. The development of smaller, cheaper, and expendable robotic systems (swarming technology) offers new strategic possibilities for saturation attacks and resilient ISR coverage. Geographically, significant untapped potential exists in developing economies seeking affordable, reliable patrol and surveillance solutions. The final major force impacting the market is the sustained, high-impact competition among global aerospace and defense primes, which drives rapid innovation cycles and pushes the boundaries of hardware miniaturization and power efficiency, ultimately making highly complex systems more deployable and cost-effective over time. These forces collectively dictate a market environment focused on maximizing lethality and survivability through intelligent automation.

Segmentation Analysis

The Defense Robotics Market is highly segmented, primarily based on the operational domain (Platform), the type of mission executed (Application), and the level of computer-driven intervention (Type). This segmentation provides a granular view of investment flows and technological priorities across the global defense industry. Analysis reveals that platform segmentation, particularly Unmanned Aerial Vehicles (UAVs), historically dominates revenue generation due to the mature ecosystem and diverse range of mission capabilities, from tactical reconnaissance to strategic strike. However, the fastest growth is anticipated in segments addressing logistical autonomy and underwater security, reflecting emerging operational gaps in modern warfare.

Application-based segmentation highlights Surveillance and Reconnaissance (ISR) as the foundational market driver, given the constant military need for pervasive, real-time intelligence gathering, often requiring prolonged robotic endurance. However, the Explosive Ordnance Disposal (EOD) segment remains critically important and highly specialized, relying on robust, rugged UGVs. The market is also segmented by technology maturity, categorized as Semi-Autonomous and Autonomous, with significant governmental efforts pushing systems towards true autonomy, necessitating advancements in sensor fusion, secure communication protocols, and robust decision-making frameworks that operate reliably under various operational constraints, including severe weather and electronic warfare attacks.

Understanding these segments is essential for strategic planning, as different military forces prioritize investment based on unique geographical challenges and strategic objectives—for instance, naval powers heavily invest in Unmanned Maritime Vehicles (UMVs) for patrolling littoral waters and deep-sea surveillance, while forces engaged in counter-insurgency prioritize versatile UGVs for urban conflict and route clearance. The trend toward multi-domain operations (MDO) is blurring the lines between these segments, demanding systems that can communicate and operate cooperatively across air, land, and sea, thereby driving future product development towards open architecture and standardized interfaces.

- By Platform:

- Unmanned Ground Vehicles (UGV)

- Unmanned Aerial Vehicles (UAV)

- Unmanned Maritime Vehicles (UMV)

- By Application:

- Surveillance and Reconnaissance (ISR)

- Explosive Ordnance Disposal (EOD) and Mine Countermeasures (MCM)

- Combat Support and Logistics

- Search and Rescue

- Homeland Security and Border Patrol

- By Type (Autonomy Level):

- Semi-Autonomous (Human-on-the-loop)

- Autonomous (Human-supervised)

Value Chain Analysis For Defense Robotics Market

The value chain for the Defense Robotics Market begins with upstream activities focused on foundational research, component manufacturing, and specialized hardware design. This phase involves highly technical suppliers providing core technologies such as advanced microprocessors, sophisticated sensors (LIDAR, thermal, EO/IR), high-capacity batteries, and ruggedized materials. Suppliers in this upstream segment are often specialized technology firms, distinct from the final system integrators, and operate under strict security and quality control standards required for military applications. The innovation intensity at this stage determines the overall system performance, particularly concerning power efficiency, payload capacity, and processing speed, making supply chain resilience and assured microelectronics access critical national security priorities.

Midstream activities involve the design, software development, and system integration carried out by major defense contractors and prime integrators. This is where the core value is added, transforming components into operational robotic platforms. This stage focuses heavily on developing proprietary control software, AI algorithms, secure communication links, and rigorous testing protocols to ensure reliability and compliance with military specifications. Direct distribution channels are predominantly used, where defense prime contractors (e.g., Lockheed Martin, Northrop Grumman) engage directly with governmental defense procurement agencies or military branches through multi-year contracts and foreign military sales (FMS). Due to the classified nature and high cost of these systems, indirect distribution through third-party distributors or commercial off-the-shelf (COTS) models is rare, typically reserved only for certain non-lethal ISR or training systems.

Downstream activities center on deployment, training, maintenance, and long-term support. Once systems are delivered, the prime contractor often provides extensive lifecycle support, including software updates, hardware modernization, and specialized training for military personnel on operation and maintenance. The requirement for continuous upgrades, particularly in software and AI modules, ensures recurring revenue streams for the integrators. The distribution channel is thus characterized by deep, long-term relationships between the system providers and the end-user military organizations, often requiring localized manufacturing, maintenance depots, and technology transfer agreements, especially in large international contracts.

Defense Robotics Market Potential Customers

The primary purchasers and end-users in the Defense Robotics Market are governmental defense departments and military organizations globally, driven by strategic defense requirements and modernization goals. These customers include the major land forces, navies, and air forces of sovereign nations, often operating under centralized procurement bodies such as the U.S. Department of Defense (DoD), the UK Ministry of Defence (MoD), and similar agencies in high-spending nations across Asia Pacific and Europe. These entities prioritize platforms that offer high reliability, advanced autonomy, interoperability with existing legacy systems, and robust cybersecurity features, reflecting the critical nature of their missions.

Secondary, but growing, customer segments include homeland security agencies, border patrol units, and specialized counter-terrorism forces, which utilize ruggedized robotic platforms for surveillance, critical infrastructure protection, and mitigating domestic threats. These customers typically favor UGVs and smaller UAVs focused on urban environments and non-lethal reconnaissance, prioritizing ease of operation and lower total ownership costs relative to front-line military systems. International alliances, like NATO, also act as major collective buyers, focusing on standardized, interoperable systems to enhance coalition operations, often driving demand for common standards in data communication and platform compatibility.

In terms of expenditure, the United States remains the single largest buyer, setting global benchmarks for capability requirements and driving foundational technological development. However, emerging nations increasing their defense budgets, particularly in the Middle East and parts of Asia, represent significant growth potential, seeking to rapidly upgrade their capabilities through the acquisition of mature, proven robotic systems from established global suppliers, thereby diversifying the customer base geographically and increasing the complexity of export control policies and licensing agreements required for technology transfer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 35.5 Billion |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin, BAE Systems, Northrop Grumman, Raytheon Technologies, General Dynamics, Boeing, Saab AB, Thales Group, QinetiQ, Elbit Systems, Israel Aerospace Industries (IAI), Rheinmetall AG, Teledyne FLIR, L3Harris Technologies, AeroVironment, Boston Dynamics, Mitsubishi Heavy Industries, Hanwha Systems, Kongsberg Gruppen, Oshkosh Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Defense Robotics Market Key Technology Landscape

The technological foundation of the Defense Robotics Market is rapidly evolving, driven by the need for enhanced autonomy, survivability, and interoperability across multiple domains. Central to this landscape are advancements in sensor fusion technologies, allowing robotic platforms to combine data from disparate sources—such as electro-optical (EO), infrared (IR), LIDAR, and radar systems—to create a unified, high-resolution operational picture, which is critical for navigation in complex environments and accurate target identification. Secure, high-bandwidth communication protocols, particularly those resistant to jamming and cyber-attacks, are also paramount, enabling reliable remote control or supervised autonomous operation over long distances and in contested electromagnetic spectrums. Power efficiency remains a major challenge, driving extensive research into advanced battery technologies (e.g., solid-state, high energy density lithium derivatives) and novel propulsion systems to extend mission endurance.

Another pivotal technological area is the development and implementation of advanced artificial intelligence and machine learning frameworks tailored for edge computing in ruggedized military hardware. These AI systems facilitate real-time, on-board processing for tasks like autonomous tactical path planning, collaborative swarming behaviors, and sophisticated threat assessment without continuous reliance on human input or off-board data centers. Furthermore, the adoption of modular, open-architecture system designs is a key trend, moving away from proprietary, monolithic systems. This approach allows defense customers to rapidly integrate new payloads, software updates, and advanced sensors from different vendors, promoting rapid capability evolution and system lifespan extension, which aligns with modern defense acquisition strategies emphasizing flexibility and competitive sourcing.

The increasing focus on multi-domain operations (MDO) necessitates the development of common operating systems and standard interfaces (such as ROS-M or similar military standards) to ensure seamless communication and cooperative engagement between air, ground, and sea robotic assets. Technologies enabling robust, non-GPS navigation—utilizing terrain matching, inertial measurement units (IMUs), and celestial navigation techniques—are crucial for ensuring mission success in environments where satellite connectivity may be denied by adversaries. Finally, material science breakthroughs, particularly in lightweight yet highly protective composite materials, are essential for enhancing the survivability and payload capacity of all platforms, ensuring they can withstand harsh operational conditions and direct attack.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market for defense robotics globally. This dominance is underpinned by massive and sustained annual defense budgets, a robust technological research base, and the presence of world-leading defense prime contractors like Lockheed Martin, Northrop Grumman, and Boeing. The region is characterized by an emphasis on advanced, fully autonomous systems and significant investment in classified programs related to AI, hypersonics, and next-generation unmanned platforms capable of multi-domain operations (MDO). The US military's clear focus on technological superiority and leveraging robotics to reduce soldier exposure in high-threat areas ensures continuous demand across all segments, particularly in high-end UAVs and complex UMV systems for naval superiority. Research initiatives like those led by DARPA consistently push the boundaries of robotic capability, establishing global benchmarks for performance and autonomy levels.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market over the forecast period, driven by escalating geopolitical tensions, territorial disputes, and the subsequent rapid military modernization efforts of major economies, including China, India, and South Korea. China's indigenous development of advanced military drones and UGVs, backed by substantial state investment in AI, is reshaping the regional power balance and spurring competitive procurement from neighboring nations. The demand in APAC is diverse, ranging from advanced ISR capabilities required for maritime domain awareness (driving UMV demand) to rugged UGVs needed for challenging border security and counter-insurgency operations in diverse terrains. Localized manufacturing and technology transfer agreements are frequently demanded by regional governments, accelerating the growth of local defense ecosystems and driving strong regional CAGR.

- Europe: The European market demonstrates steady growth, motivated by the ongoing commitment to modernization within NATO and the collaborative procurement efforts under the EU’s Permanent Structured Cooperation (PESCO). European defense spending has increased following recent geopolitical events, with a strong focus on enhancing interoperability between member states' robotic fleets. Key drivers include developing advanced reconnaissance UAVs, particularly Medium Altitude Long Endurance (MALE) systems, and specialized EOD and counter-IED UGVs. Major players like BAE Systems, Thales Group, and Saab are heavily involved in developing standardized, highly secured platforms suitable for joint operations. Ethical and regulatory discussions around the implementation of AI and autonomy remain a key consideration in European defense planning, often resulting in highly supervised autonomous systems deployments.

- Middle East and Africa (MEA): The MEA region is a substantial importer of defense robotics, particularly high-end ISR and combat UAVs, driven by regional conflicts, border security challenges, and counter-terrorism mandates. High defense expenditures in nations like Saudi Arabia, UAE, and Israel sustain continuous demand. While many systems are procured through Foreign Military Sales (FMS) from North America and Europe, Israel maintains a strong indigenous defense robotics industry, serving both regional needs and global export markets with specialized UGVs and tactical UAVs. The focus in the MEA is often on robust, battle-proven technology that can perform reliably in extremely harsh, high-temperature desert conditions, favoring durability and reliable communication systems.

- Latin America: The Latin American market for defense robotics is relatively nascent but growing, primarily driven by needs for border surveillance, drug interdiction operations, and patrolling vast, difficult-to-monitor territories. Demand centers on more affordable, tactical-level UAVs and small UGVs for reconnaissance and security rather than large, strategic combat platforms. Procurement is often constrained by budget limitations and economic volatility, leading to a preference for multi-role systems and COTS (Commercial Off-the-Shelf) technology adapted for military use, focusing on surveillance rather than lethal autonomy.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Defense Robotics Market.- Lockheed Martin Corporation

- BAE Systems plc

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Boeing Defense, Space & Security

- Saab AB

- Thales Group

- QinetiQ Group plc

- Elbit Systems Ltd.

- Israel Aerospace Industries (IAI)

- Rheinmetall AG

- Teledyne FLIR LLC

- L3Harris Technologies, Inc.

- AeroVironment, Inc.

- Boston Dynamics (Focus on military applications development)

- Mitsubishi Heavy Industries, Ltd.

- Hanwha Systems Co., Ltd.

- Kongsberg Gruppen ASA

- Oshkosh Corporation (Specialized UGVs)

Frequently Asked Questions

Analyze common user questions about the Defense Robotics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Defense Robotics Market?

The primary driver is the necessity for minimizing human risk (casualty reduction) in volatile combat and high-threat environments, coupled with major military modernization programs focused on integrating advanced autonomous systems for operational superiority and persistent surveillance capabilities across all domains (air, land, and sea).

Which segment, by platform, currently holds the largest market share in defense robotics?

The Unmanned Aerial Vehicle (UAV) segment currently holds the largest market share. This is due to the established operational maturity of drones in critical missions such as Intelligence, Surveillance, and Reconnaissance (ISR), target acquisition, and increasingly, armed strike capabilities worldwide.

How is Artificial Intelligence (AI) fundamentally impacting defense robotics?

AI is transforming robotics by enabling true autonomy. It facilitates real-time data fusion, predictive decision-making, sophisticated swarm coordination, and autonomous navigation in GPS-denied areas, shifting platforms from remotely controlled tools to intelligent, adaptive force multipliers supervised by human operators.

What are the main ethical and regulatory challenges restraining market adoption?

The main challenges revolve around the complex ethical and regulatory governance of Lethal Autonomous Weapon Systems (LAWS). Concerns about accountability, human oversight (the 'human-on-the-loop' debate), and the verification/validation of AI safety and predictability in combat scenarios significantly constrain rapid, widespread deployment of fully autonomous systems.

Which geographical region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate. This accelerated expansion is fueled by rising geopolitical tensions, significant military budget increases from major regional powers like China and India, and large-scale modernization efforts focused on achieving technological parity with Western military forces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager