Defense Tactical Computers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433493 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Defense Tactical Computers Market Size

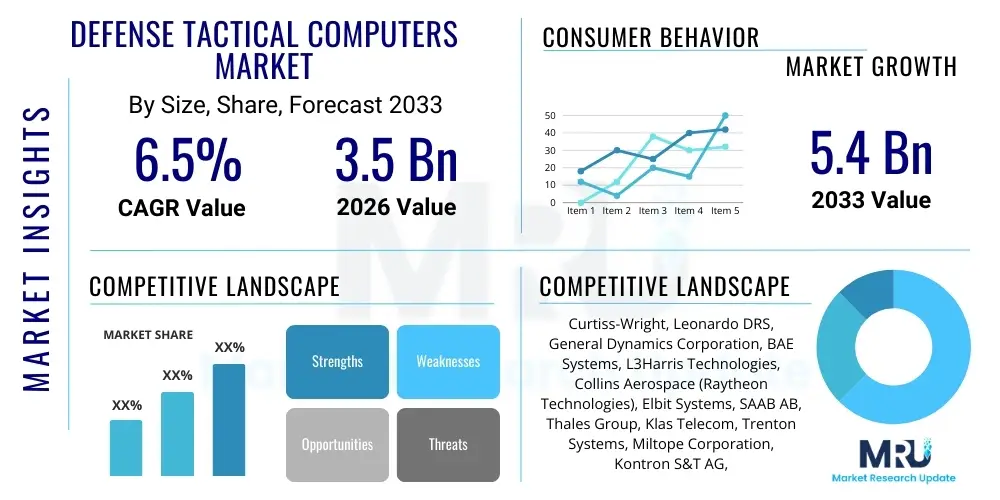

The Defense Tactical Computers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. This robust expansion is fueled primarily by the continuous modernization efforts undertaken by global armed forces, prioritizing enhanced situational awareness, networked warfare capabilities, and real-time data processing across diverse operational environments. Tactical computers, defined by their ruggedization and capability to withstand extreme temperatures, shock, vibration, and electromagnetic interference (EMI), are indispensable assets in modern C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems, driving significant investment from major defense spenders across North America, Europe, and Asia Pacific. The transition from legacy analog systems to high-performance, digitally networked combat platforms necessitates reliable computational power at the tactical edge, underpinning the market's predictable upward trajectory throughout the forecast period.

The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033. This valuation reflects the high unit cost associated with mission-critical, military-specification hardware, which requires rigorous testing and certification processes to ensure operational reliability under combat conditions. Growth is further accelerated by the increasing demand for modular open systems architectures (MOSA), allowing military users to rapidly integrate new software and hardware components, thereby reducing upgrade costs and maintaining technological superiority. The integration of high-bandwidth connectivity solutions, such as 5G capabilities and advanced satellite links, into tactical computer systems enhances interoperability between joint forces, significantly boosting the demand for ultra-low latency processing units designed specifically for complex battlefield computations and sensor fusion.

Defense Tactical Computers Market introduction

The Defense Tactical Computers Market encompasses specialized computing hardware systems engineered to meet stringent military standards (MIL-STD) for use in harsh operational environments, including extreme temperatures, high altitude, heavy vibration, dust, and moisture exposure. These products range from ruggedized laptops and tablets used by dismounted soldiers to vehicle-mounted workstations and mission computers integrated into airborne and naval platforms. The core product function is to provide reliable, secure, and high-speed processing capabilities essential for modern network-centric warfare, enabling real-time data fusion, command execution, and enhanced situational awareness. Major applications span C4I (Command, Control, Communications, Computers, and Intelligence), weapon system control, targeting, data storage, and complex simulation for training and mission rehearsal. Tactical computers are foundational elements in digitizing the battlefield, transforming raw sensor data into actionable intelligence for military decision-makers operating under highly pressurized circumstances, thus offering critical operational benefits in terms of precision, speed, and survivability.

Driving factors for this specialized market include escalating geopolitical tensions necessitating military readiness upgrades, the pervasive trend toward battlefield digitalization, and the increasing complexity of modern weaponry systems, which demand greater computational throughput. Furthermore, the imperative for interoperability among allied forces—particularly NATO and regional coalitions—is driving the standardization and adoption of common computing architectures and secure communication protocols, fostering market growth. These systems must not only be physically robust but also incorporate advanced security features, including encryption and anti-tamper technologies, to protect sensitive data from sophisticated cyber threats and electronic warfare attacks, positioning cybersecurity as a significant value proposition within the tactical computing ecosystem. The market is constantly evolving, incorporating the latest commercial off-the-shelf (COTS) processing technologies, but adapting them through ruggedization to meet demanding military specifications, balancing high performance with resilience.

Defense Tactical Computers Market Executive Summary

The Defense Tactical Computers Market is characterized by stable growth, underpinned by long-term defense procurement cycles and a focused investment in modern C4ISR capabilities globally. Key business trends include the strong preference for Modular Open Systems Architecture (MOSA) designs, facilitating faster technology insertion and reducing vendor lock-in, alongside the increasing adoption of high-performance embedded computing (HPEC) solutions necessary for processing vast amounts of sensor data generated by advanced platforms like unmanned aerial vehicles (UAVs) and sophisticated radars. Companies are heavily investing in miniaturization and thermal management technologies to deliver high-density computing power in size, weight, and power (SWaP)-constrained environments, such as fighter jets and man-portable devices, driving competitive differentiation based on ruggedization levels and computing efficiency. Strategic partnerships between hardware manufacturers and defense primes are critical for securing large, multi-year contracts, especially in markets pursuing comprehensive platform modernization programs.

Regional trends indicate North America maintaining its dominance, attributed to the substantial defense budget of the United States Department of Defense (DoD) and its ongoing emphasis on network modernization programs like the Joint All-Domain Command and Control (JADC2), which relies heavily on resilient tactical computing infrastructure. Asia Pacific, driven by the aggressive military expansion of countries like China, India, and South Korea, exhibits the fastest growth rate, fueled by border security challenges and naval modernization efforts. European trends are marked by increased collaborative defense spending under initiatives like Permanent Structured Cooperation (PESCO), focusing on standardized, cross-platform tactical solutions. Segment trends highlight ground-based platforms (vehicles and dismounted soldier systems) as the largest application area, demanding highly ruggedized mobile computing, while the airborne segment demonstrates the highest revenue per unit due to the sophisticated processing requirements for electronic warfare and mission control systems, emphasizing graphics processing units (GPUs) and specialized field-programmable gate arrays (FPGAs).

AI Impact Analysis on Defense Tactical Computers Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) integration will fundamentally alter the requirements for Defense Tactical Computers, specifically focusing on necessary upgrades in processing power, memory bandwidth, and thermal dissipation capacities. A primary concern revolves around the challenge of deploying robust AI models, which are typically resource-intensive, onto SWaP-constrained tactical edge devices, where latency and power consumption are critical limitations. Key expectations center on AI's role in accelerating real-time intelligence synthesis—such as automatic target recognition (ATR), predictive maintenance, and autonomous decision support—reducing the cognitive load on human operators. The integration necessitates specialized hardware components, particularly high-efficiency Neural Processing Units (NPUs) or dedicated AI accelerators, designed for performing high-speed inference locally on the tactical platform, thus reducing reliance on vulnerable cloud or command center connectivity and ensuring operational continuity in denied or contested environments. Furthermore, questions arise regarding the security and trustworthiness of AI algorithms deployed tactically, prompting demand for explainable AI (XAI) capabilities embedded within the operating software of tactical computer systems.

- AI mandates significantly higher processing requirements (tera operations per second – TOPS) on tactical hardware, driving the adoption of specialized accelerators like GPUs and FPGAs.

- Real-time sensor data fusion and automatic target recognition (ATR) powered by ML necessitate ultra-low latency, pushing processing closer to the data source (edge computing).

- AI enhances operational autonomy and decision support systems, requiring tactical computers to host complex, locally trained inference models for functioning in disconnected environments.

- Predictive maintenance and system health monitoring, utilizing ML algorithms, improve the reliability and uptime of integrated tactical platforms, increasing dependency on embedded diagnostic computing.

- The development of secure, trusted, and explainable AI (XAI) modules is becoming a critical software requirement for military-grade tactical computing systems to ensure operator confidence and accountability.

- Advanced thermal management solutions are becoming vital due to the high heat output generated by simultaneous CPU/GPU/NPU operations necessary for executing complex AI workloads at the tactical edge.

DRO & Impact Forces Of Defense Tactical Computers Market

The Defense Tactical Computers Market is shaped by a confluence of influential factors categorized as Drivers, Restraints, and Opportunities (DRO), which collectively determine the long-term strategic investments and technological trajectory. The primary drivers include global military modernization cycles, particularly the transition toward network-centric and joint all-domain operations (JADO), requiring pervasive, resilient computing nodes across all platforms. Increased reliance on unmanned systems (UAVs, UGVs, USVs), which need sophisticated embedded processing for autonomy and secure data links, further accelerates demand. These drivers are balanced by significant restraints, chiefly the exceedingly long procurement and certification cycles inherent in defense contracting, often delaying the deployment of cutting-edge COTS technology. Furthermore, the need to comply with stringent military specifications (MIL-STD 810G/H, MIL-STD 461) adds substantial cost and complexity compared to standard commercial hardware, constraining market accessibility for non-specialized vendors.

The market faces external impact forces related to technological obsolescence, where the rapid pace of commercial technology development outstrips the slower military adoption rate, creating challenges in maintaining backward compatibility while offering state-of-the-art performance. Budgetary constraints in certain non-NATO defense markets also pose a restraint, forcing some nations to prioritize platform maintenance over comprehensive digital upgrades. However, substantial opportunities exist in the shift towards Modular Open Systems Architecture (MOSA), which promises to streamline upgrade pathways and reduce total lifecycle costs, appealing directly to cost-sensitive defense customers. The proliferation of AI/ML integration at the tactical edge represents the most profound opportunity, driving demand for specialized, high-performance computing modules optimized for inference, creating new, high-value product categories and competitive arenas within the rugged computing space.

Impact forces also include geopolitical instability, which consistently acts as a macro-driver, spurring immediate needs for defense spending spikes and accelerating the fielding of advanced tactical assets. Conversely, stringent export controls, such as the International Traffic in Arms Regulations (ITAR) and similar regional mechanisms, limit technology transfer and global market reach, creating localized competitive barriers. Cybersecurity threats represent a critical force; as tactical systems become more networked, the need for integrated hardware-level security, anti-tamper technologies, and Supply Chain Risk Management (SCRM) becomes paramount, adding another layer of specialized requirement and complexity to the development and manufacturing of defense tactical computers. The balance between maximizing processing performance (a driver) and minimizing size, weight, and power (SWaP) consumption (a restraint) dictates core innovation strategies for all major market participants.

Segmentation Analysis

The Defense Tactical Computers Market is comprehensively segmented based on the hardware type, the operational platform they are installed upon, and the specific application or function they serve within the military ecosystem. Understanding these segments is crucial for analyzing market dynamics, identifying high-growth niches, and aligning product development with specific end-user requirements, particularly concerning ruggedization levels and computational demands. The segmentation reflects the diverse operational needs of modern militaries, ranging from dismounted soldier systems requiring lightweight, highly mobile devices to complex airborne command centers demanding massive parallel processing capabilities and certified redundancy.

Segmentation by Type reveals distinct product categories, each optimized for different user scenarios. Rugged Laptops and Tablets offer portability and familiar human-machine interfaces (HMIs) for field command and reconnaissance. Vehicle-Mounted Computers provide robust, stationary workstations crucial for combat vehicles, tanks, and mobile command posts, demanding high vibration and shock resistance. Segmentation by Platform (Ground, Naval, Airborne) reflects varying environmental standards; for instance, airborne platforms require certifications for altitude and strict electromagnetic interference (EMI) standards, while naval systems must contend with extreme corrosion and specialized mounting requirements. Application segmentation highlights the primary mission focus, with C4I systems often requiring the highest level of network security and real-time processing capability, contrasting with logistics systems that prioritize data storage and secure database access.

- By Type:

- Rugged Laptops

- Rugged Tablets

- Vehicle-Mounted Computers (VMC)

- Handheld Computers/PDAs

- Mission Computers (Embedded Systems)

- By Platform:

- Ground (Vehicular, Dismounted Soldier)

- Airborne (Fixed-Wing, Rotary-Wing, UAVs)

- Naval (Surface Ships, Submarines)

- By Application:

- Command, Control, Communications, Computers, and Intelligence (C4I)

- Weapon Systems Control

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Logistics and Maintenance

- Training and Simulation

- By Component:

- Hardware (Processors, Memory, Storage, Displays)

- Software (Operating Systems, Middleware, Application Software)

Value Chain Analysis For Defense Tactical Computers Market

The value chain for the Defense Tactical Computers Market begins with Upstream Analysis, which focuses on the sourcing of critical components and foundational technologies. This stage is dominated by major semiconductor and component providers (e.g., Intel, AMD, NVIDIA, Micron) who supply high-performance COTS processors, memory modules, and specialized graphic processing units (GPUs). Successful downstream integration relies heavily on the quality and longevity of these COTS components, which are subsequently integrated into military-grade systems through rigorous ruggedization processes, including specialized chassis design, thermal management integration, and custom I/O connectivity implementation. Key upstream factors include supply chain resilience, vulnerability to export controls (especially for high-end microprocessors), and the ability of suppliers to maintain long-term availability of components essential for long defense lifecycle support contracts.

The midstream of the value chain is characterized by Original Equipment Manufacturers (OEMs) and specialized systems integrators (like Curtiss-Wright, Leonardo DRS, and General Dynamics). These entities specialize in the design, assembly, testing, and military certification of the tactical computers, adapting COTS components to meet MIL-STD 810G/H (environmental), MIL-STD 461 (EMI/EMC), and custom security requirements. They hold the critical intellectual property related to rugged enclosure design, proprietary cooling systems, and specialized firmware. The distribution channel in this sector is predominantly indirect, relying on direct engagement between the OEMs and major defense prime contractors (e.g., Lockheed Martin, Boeing, BAE Systems) or directly with governmental procurement agencies. Direct sales are common for replacement units or smaller specialized procurements, whereas major platform integration contracts utilize an indirect model through large prime contractors responsible for system-level integration.

Downstream analysis involves the final deployment, maintenance, and lifecycle support of the tactical computers within end-user military organizations across ground, air, and naval platforms. The complexity of these systems mandates continuous technical support, software updates, and hardware refreshes, creating substantial long-term service revenue for manufacturers. Crucially, the military's emphasis on long operational lifecycles means that the service and support segment of the value chain, including obsolescence management and repair capabilities, represents a significant proportion of the total cost of ownership (TCO) and, consequently, a major profit center for the systems integrators. This necessitates robust logistics infrastructure and certified repair facilities globally to ensure mission readiness and operational continuity for deployed units.

Defense Tactical Computers Market Potential Customers

The potential customer base for the Defense Tactical Computers Market is highly consolidated, primarily comprising governmental military and defense agencies responsible for national security and defense procurement globally. These entities include national Ministries of Defense (MoDs), specific service branches (Army, Navy, Air Force, Marine Corps), and specialized paramilitary or intelligence organizations requiring ruggedized computing capabilities for field operations. The largest and most influential customers are the defense departments of major global powers, such as the U.S. Department of Defense (DoD), NATO member states' defense organizations, and the rapidly modernizing military forces in the Asia Pacific region, specifically China's PLA, the Indian Armed Forces, and South Korea’s military. Procurement decisions are driven by modernization schedules, geopolitical risk assessments, and adherence to specific national and international military specifications, ensuring that technological capability and operational reliability supersede immediate cost concerns.

Secondary, but growing, customer segments include large defense prime contractors (Tier 1 integrators) like Lockheed Martin, Northrop Grumman, and Thales Group. These companies act as immediate buyers by integrating tactical computer systems as sub-components into larger platforms, such as new fighter aircraft, naval vessels, or armored fighting vehicles. In this capacity, the primes specify precise technical requirements and integration standards, effectively shaping the demand signals passed to the specialized rugged computing manufacturers. Furthermore, security and intelligence agencies often constitute a niche, high-value customer group requiring bespoke, highly secure, and often miniaturized tactical computing solutions for covert operations and sophisticated data processing tasks where extreme secrecy and ruggedness are paramount.

The procurement cycle for these end-users is typically long and involves stringent testing and evaluation phases, prioritizing proven performance, vendor reliability, and the availability of secure supply chains. Given the mission-critical nature of the hardware—where failure can result in loss of life or mission failure—customer loyalty is high once a system is successfully certified and integrated across a platform fleet. Consequently, manufacturers prioritize obtaining requisite military certifications and establishing long-term support contracts, fostering decades-long relationships with key governmental customers, focusing on total lifecycle support rather than just initial hardware sales.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Curtiss-Wright, Leonardo DRS, General Dynamics Corporation, BAE Systems, L3Harris Technologies, Collins Aerospace (Raytheon Technologies), Elbit Systems, SAAB AB, Thales Group, Klas Telecom, Trenton Systems, Miltope Corporation, Kontron S&T AG, Mercury Systems, Abaco Systems, EIZO Rugged Solutions, Chassis Plans, Aitech Systems, GETAC Technology Corporation, Crystal Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Defense Tactical Computers Market Key Technology Landscape

The technological landscape of the Defense Tactical Computers Market is defined by the rigorous requirements for combining state-of-the-art commercial processing power with specialized military-grade resilience. A core technological trend is the pervasive adoption of High-Performance Embedded Computing (HPEC), utilizing powerful multi-core processors, massive parallel processing GPUs, and high-speed interconnect fabrics (like PCIe and 100 Gigabit Ethernet) to handle complex mission requirements such as sensor fusion, real-time video processing, and sophisticated electronic warfare applications. Manufacturers are constantly adapting the latest COTS microprocessors, but the critical differentiator lies in the proprietary techniques used for ruggedization, including specialized conduction cooling, vibration dampening systems, and the utilization of thermal dissipation materials to ensure reliable operation under extreme environmental loads without relying on active fan cooling which introduces failure points. Furthermore, the push towards virtualization and containerization allows multiple mission-critical applications to run concurrently and securely on a single hardware unit, maximizing resource utilization in SWaP-constrained military platforms.

Another fundamental technological shift is the move toward Modular Open Systems Architecture (MOSA) and Open VPX standards (VITA). MOSA mandates the use of non-proprietary interfaces and standardized hardware formats, allowing the military to integrate technology from multiple vendors, significantly reducing proprietary costs and accelerating technology refreshment cycles. This shift impacts system design from the physical chassis to the operating system level, promoting interoperability and reducing the obsolescence risk inherent in defense systems. Security technology is also paramount; modern tactical computers incorporate hardware-level security measures, including Trusted Platform Modules (TPMs), encryption accelerators, and advanced anti-tamper methodologies compliant with the U.S. government's stringent security directives, ensuring data integrity and platform security against sophisticated cyber threats and physical intrusion attempts.

Emerging technologies strongly influencing the market include the miniaturization of high-density storage (Solid State Drives - SSDs), which replaces vulnerable rotating media, and the integration of specialized AI accelerators (NPUs) designed for low-power, high-efficiency inference at the tactical edge. Connectivity advancements, particularly the utilization of high-bandwidth, resilient communication protocols (like advanced tactical data links and nascent 5G deployment capabilities), necessitate tactical computers with high-speed input/output (I/O) capabilities and sophisticated network processing cards. Moreover, advancements in display technology, focusing on sunlight readability, night vision compatibility, and extremely durable touchscreens, remain critical for human-machine interface (HMI) components in ruggedized tablets and workstations, ensuring optimal performance for operators in varied lighting and operational scenarios.

Regional Highlights

The geographic analysis of the Defense Tactical Computers Market reveals distinct growth patterns and investment priorities across major global regions, heavily correlated with geopolitical risk, national defense budgets, and technological maturity.

- North America: This region holds the largest market share, driven primarily by the colossal defense spending of the United States. The demand is concentrated on advanced, high-performance computing for network modernization initiatives like JADC2 and major platform upgrades (e.g., F-35, ground vehicle replacements). North American militaries prioritize HPEC solutions, MOSA compliance, and AI readiness, ensuring continuous, high-volume demand for certified, cutting-edge tactical hardware. Canada and other regional partners also contribute through NATO standardization efforts and Arctic defense requirements, emphasizing extreme cold weather ruggedization.

- Europe: Europe represents a significant market experiencing steady growth fueled by renewed concerns over regional security and commitments to meet NATO spending targets. Procurement focuses on interoperability and standardized solutions for multinational operations. Key markets such as the UK, France, and Germany are heavily invested in upgrading ground vehicle fleets and developing pan-European defense programs (PESCO), requiring robust, networked tactical computers for coalition force coordination and secure data exchange. Emphasis is placed on secure communications and low-SWaP systems for drone platforms.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, characterized by aggressive military modernizations in countries like China, India, South Korea, and Japan, largely driven by escalating regional tensions and territorial disputes. The demand here is massive and fragmented, covering everything from basic rugged tablets for infantry modernization (India) to highly sophisticated mission computers for naval and airborne platforms (China, Japan). Investment focuses heavily on domestically produced or licensed technology to enhance self-reliance and technological parity with Western powers, often balancing cost-effectiveness with performance specifications.

- Latin America (LATAM): The LATAM market is relatively smaller but stable, concentrating primarily on internal security, border control, and limited naval/air patrol modernization. Demand is highly price-sensitive, often favoring refurbished or less complex, highly durable rugged solutions. Key customers include Brazil and Colombia, investing in C4I systems for border surveillance and counter-narcotics operations, preferring vehicle-mounted and handheld tactical computers tailored for challenging jungle and mountain terrains.

- Middle East and Africa (MEA): The MEA market shows substantial, albeit volatile, growth tied closely to fluctuating oil prices and regional conflicts. Nations like Saudi Arabia, UAE, and Israel are major spenders, acquiring advanced Western defense technology, including high-end tactical computing for missile defense, surveillance, and advanced ground warfare systems. Israel, as a major domestic defense technology producer, acts as both a consumer and a key innovator in tactical computing, especially concerning unmanned systems and electronic warfare applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Defense Tactical Computers Market, highlighting their strategic focus on ruggedization, MOSA compliance, and embedded processing innovation.- Curtiss-Wright

- Leonardo DRS

- General Dynamics Corporation

- BAE Systems

- L3Harris Technologies

- Collins Aerospace (Raytheon Technologies)

- Elbit Systems

- SAAB AB

- Thales Group

- Klas Telecom

- Trenton Systems

- Miltope Corporation

- Kontron S&T AG

- Mercury Systems

- Abaco Systems

- EIZO Rugged Solutions

- Chassis Plans

- Aitech Systems

- GETAC Technology Corporation

- Crystal Group

Frequently Asked Questions

Analyze common user questions about the Defense Tactical Computers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between commercial and defense tactical computers?

The fundamental difference lies in ruggedization and compliance with military specifications (MIL-STD). Tactical computers are engineered to withstand extreme environmental stress—including shock, vibration, temperature extremes, and EMI—and incorporate specialized features like hardware-based security, anti-tamper mechanisms, and certified operational security, which are absent in commercial off-the-shelf (COTS) devices.

How is Modular Open Systems Architecture (MOSA) impacting procurement in this market?

MOSA is critical as it mandates the use of non-proprietary, standardized interfaces (like Open VPX) and protocols, preventing vendor lock-in. This enables military customers to rapidly integrate new hardware and software components from different suppliers, significantly speeding up technology refreshment, reducing lifecycle costs, and mitigating obsolescence risks for long-lived defense platforms.

Which segment holds the largest share of the Defense Tactical Computers Market by application?

The Command, Control, Communications, Computers, and Intelligence (C4I) segment typically holds the largest market share. C4I systems are foundational for modern networked warfare, demanding highly secure, resilient, and powerful tactical computing hardware for real-time situational awareness, data fusion, and command execution across all domains (ground, air, and naval).

What role does Artificial Intelligence play in driving demand for new tactical hardware?

AI deployment at the tactical edge (Edge AI) is a major demand driver. AI/ML enables capabilities like automatic target recognition (ATR), predictive logistics, and autonomous decision-making. This requires tactical computers to integrate specialized, high-performance embedded computing (HPEC) components, specifically GPUs and NPUs, capable of running complex inference models with low latency and high power efficiency.

What are the key technological challenges in developing airborne tactical computers?

Airborne tactical computers face stringent Size, Weight, and Power (SWaP) constraints, alongside extreme requirements for thermal management due to limited cooling opportunities. They must also comply strictly with aerospace-specific certifications (e.g., RTCA DO-160) and intense electromagnetic interference (EMI) standards (MIL-STD 461) to ensure flight safety and mission effectiveness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager