Definite Purpose Contactors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434615 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Definite Purpose Contactors Market Size

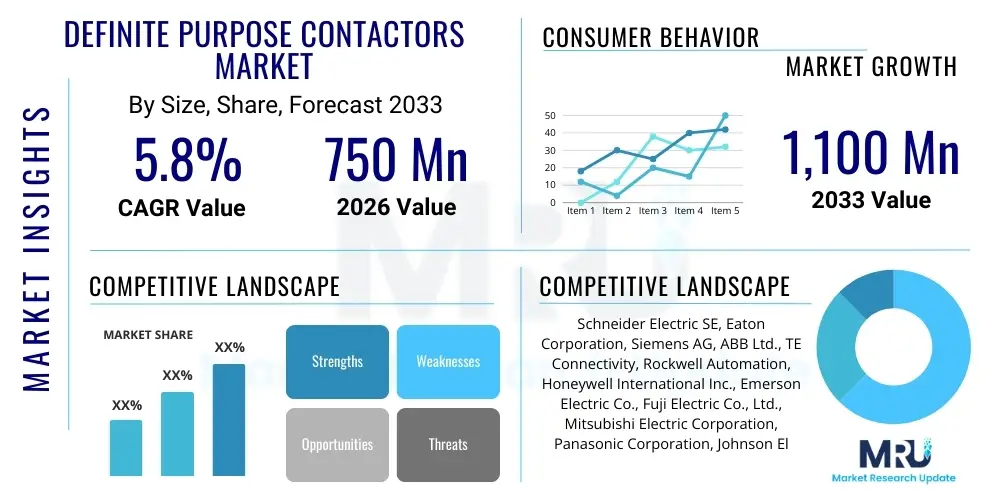

The Definite Purpose Contactors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,100 Million by the end of the forecast period in 2033.

Definite Purpose Contactors Market introduction

Definite Purpose Contactors (DPCs) are electromechanical switching devices specifically designed for use in heating, ventilation, air conditioning (HVAC), refrigeration, and lighting applications. Unlike general-purpose industrial contactors, DPCs are manufactured to meet the specific operational requirements, current ratings, and duty cycles typically encountered in commercial and residential appliance markets. These devices are crucial for reliably switching electric power to compressors, fans, pumps, and resistive loads, offering high performance in confined spaces and under varying environmental conditions.

The primary benefit of utilizing DPCs lies in their optimized cost structure and compact design, which facilitates easier installation and integration into standardized equipment such as packaged air conditioners and heat pumps. Major applications include residential air conditioning units, commercial rooftop units, food service refrigeration equipment, and specialized lighting controls. The robust nature and predictable performance of DPCs ensure operational efficiency and longevity for the systems they control. Furthermore, D they often feature design characteristics, such as specific terminal configurations and mounting options, tailored to the Original Equipment Manufacturer (OEM) needs in the climate control industry.

Key driving factors accelerating the market growth include the robust expansion of the global construction sector, particularly in emerging economies, leading to increased installation of HVAC systems. Stringent energy efficiency regulations and the resulting demand for high-performance, precise control components also favor the adoption of modern DPCs. Furthermore, the rapid growth in data center infrastructure and the associated need for advanced cooling systems mandate the use of reliable contactors for power management. These factors, combined with continuous technological advancements leading to smaller, more resilient contactor designs, solidify the market's positive trajectory.

Definite Purpose Contactors Market Executive Summary

The Definite Purpose Contactors market is characterized by stable growth, driven predominantly by cyclical demand in the residential and commercial construction sectors and mandates for enhanced energy efficiency in appliances. Current business trends indicate a strong shift towards solid-state and hybrid DPCs that offer superior switching capabilities and reduced maintenance, addressing the evolving needs of advanced refrigeration and variable frequency drive systems. Consolidation among major players is moderate, yet intense competition exists among regional manufacturers focusing on cost optimization and speed-to-market strategies, particularly in the Asia Pacific region. Supply chain stability, while historically vulnerable to raw material price fluctuations, is improving through localized manufacturing hubs established by key multinational corporations.

Regionally, North America maintains a leading position due to its mature HVAC industry and high installed base of residential and commercial climate control systems, alongside strict regulatory standards promoting component replacement and upgrade cycles. However, the Asia Pacific region is projected to exhibit the highest growth rate, fueled by rapid urbanization, substantial investment in infrastructure, and increasing disposable incomes leading to higher penetration of air conditioning units in countries like China and India. Europe shows steady, albeit slower, growth, focusing heavily on integrating DPCs into high-efficiency heat pump technologies compliant with the European Union's decarbonization goals. Latin America and MEA remain nascent markets, poised for accelerated growth as construction activity increases.

Segment trends reveal that contactors rated above 50 Amperes are experiencing significant uptake, primarily due to the deployment of larger commercial cooling systems and industrial motor control applications. By pole type, 2-pole and 3-pole configurations dominate the market share, catering to standard single-phase and three-phase motor applications, respectively. The primary application segment driving revenue is Heating, Ventilation, and Air Conditioning (HVAC), which accounts for the largest share, followed closely by commercial refrigeration. Future segment growth is expected to be buoyed by the integration of smart features into contactors, allowing for predictive maintenance and integration into Building Management Systems (BMS).

AI Impact Analysis on Definite Purpose Contactors Market

User inquiries regarding AI's influence on the Definite Purpose Contactors market primarily center on how artificial intelligence can enhance predictive maintenance, optimize HVAC system energy consumption, and automate component failure diagnosis. Users seek information on whether traditional DPCs will be superseded by smart devices capable of communicating condition data, and how AI-driven analytics will affect replacement cycles and inventory management for maintenance providers. Key themes include the integration of sensing technologies, the need for DPCs to handle variable loads dictated by AI-optimized systems, and the potential for reduced operational downtime through automated failure anticipation, thereby shifting the industry focus from simple switching devices to intelligent control elements.

- AI algorithms can analyze operational parameters (current, temperature, voltage fluctuations) gathered by integrated sensors within DPC systems to predict potential contact welding or coil failure, significantly reducing unscheduled downtime.

- AI-driven Building Management Systems (BMS) use sophisticated models to optimize HVAC cycling and load management, requiring DPCs that can handle more complex, variable switching demands with higher precision and reliability.

- Generative AI models assist OEM design teams in simulating extreme load conditions and thermal stress, accelerating the development of next-generation, more durable DPCs tailored for specific high-efficiency applications.

- Automated inventory and supply chain optimization, powered by AI, can forecast demand for specific DPC ratings based on regional weather patterns, building construction rates, and historical failure data, improving logistics efficiency for manufacturers and distributors.

- AI aids in quality control during the manufacturing process by analyzing high-speed visual inspection data, identifying microscopic defects in contact materials or coil windings that human inspectors might miss, ensuring superior product reliability.

- Smart DPCs, when integrated into IoT networks, feed real-time performance data to cloud-based AI platforms, enabling remote monitoring and automatic fault reporting, crucial for large-scale commercial refrigeration and data center cooling.

DRO & Impact Forces Of Definite Purpose Contactors Market

The market is fundamentally driven by the accelerating global demand for energy-efficient climate control and refrigeration systems, spurred by rising temperatures and regulatory mandates. Key drivers include the massive scale of residential and commercial construction, particularly in developing regions, and the high replacement rate mandated by the short operational lifespan of DPCs in continuous duty cycles. However, the market faces significant restraints, including the high dependency on volatile raw material prices (copper, silver, steel) used in contact and coil construction, and the intense cost pressure exerted by OEMs who prioritize low-cost components. Opportunities arise from the burgeoning market for heat pumps and electric vehicle charging infrastructure, both requiring specialized high-reliability contactors, alongside technological advancements in hybrid and solid-state switching solutions which promise higher performance and greater longevity, collectively shaping the market landscape through dynamic impact forces.

Segmentation Analysis

The Definite Purpose Contactors market is comprehensively segmented based on several crucial parameters, including the number of poles, ampere rating, and end-user application, allowing for a detailed understanding of market dynamics across diverse industrial and commercial landscapes. The segmentation highlights the heterogeneous nature of demand, ranging from simple 1-pole switches for lighting circuits to robust 4-pole contactors utilized in heavy industrial refrigeration systems. Analyzing these segments provides strategic insights into manufacturing specialization, pricing strategies, and regional consumption patterns, essential for market participants aiming to optimize product portfolios and penetrate high-growth niches within the climate control ecosystem.

- By Pole Type:

- 1-Pole

- 2-Pole

- 3-Pole

- 4-Pole

- By Ampere Rating:

- 20A - 30A

- 31A - 50A

- Above 50A

- By Application:

- HVAC (Heating, Ventilation, and Air Conditioning)

- Refrigeration (Commercial and Industrial)

- Lighting and Energy Management

- Motor Control and Pumps

- Power Supplies and Generators

- By End-Use Industry:

- Residential

- Commercial

- Industrial

Value Chain Analysis For Definite Purpose Contactors Market

The value chain for Definite Purpose Contactors begins with the Upstream Analysis, which focuses heavily on the procurement of critical raw materials such as high-ppurity copper for coils, silver alloys for contacts (due to their conductivity and arc resistance), and specific polymers and ceramics for housing and insulation. Stability and pricing volatility in these material markets directly influence the final manufacturing cost and competitive positioning of the contactor producers. Key activities at this stage involve forging strong supplier relationships and implementing hedging strategies to mitigate commodity price risks, ensuring a steady supply of high-quality components necessary for reliable contactor performance.

The core manufacturing stage involves precision stamping, winding, assembly, and rigorous testing processes. Manufacturers often specialize in highly automated production lines to meet the high-volume, low-margin demands characteristic of the OEM market. Distribution Channel analysis reveals a hybrid approach: direct sales dominate high-volume transactions with major HVAC and refrigeration OEMs (Original Equipment Manufacturers), ensuring customized designs and just-in-time delivery. Conversely, indirect channels, involving specialized electrical distributors and wholesalers, manage the aftermarket demand for replacement parts and service technicians, providing broad geographical coverage and inventory availability to service professionals.

Downstream analysis highlights the integration of DPCs into finished systems. The primary buyers are large appliance and climate control manufacturers who integrate these contactors into units before shipment to installers, commercial builders, and residential consumers. The ultimate success of a DPC manufacturer is tied not only to initial component cost but also to its reliability, which impacts the warranty claims and brand reputation of the finished appliance manufacturer. Therefore, quality assurance and compliance with international standards (UL, CE) are paramount throughout the entire value chain.

Definite Purpose Contactors Market Potential Customers

The primary consumers and buyers in the Definite Purpose Contactors market are diverse, reflecting the ubiquitous use of these devices across commercial and residential infrastructure. The largest group consists of Original Equipment Manufacturers (OEMs) specializing in Heating, Ventilation, and Air Conditioning (HVAC) systems. This includes manufacturers of packaged terminal air conditioners (PTACs), central air conditioning units, heat pumps, and large commercial rooftop units. These customers require high volumes of customized, cost-optimized DPCs that integrate seamlessly into their proprietary designs, demanding exceptional consistency and long-term supply agreements.

Another critical customer segment involves commercial refrigeration equipment manufacturers. This encompasses producers of reach-in freezers, walk-in coolers, industrial cold storage units, and specialized food service equipment. Reliability is non-negotiable for this segment, as failure can lead to significant economic loss due to spoiled perishables. Furthermore, the aftermarket segment—comprising electrical wholesalers, HVAC service contractors, and maintenance repair operations (MRO)—represents a constant stream of demand for replacement units necessary for routine maintenance and breakdown repair in existing installed bases across residential, commercial, and light industrial settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,100 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric SE, Eaton Corporation, Siemens AG, ABB Ltd., TE Connectivity, Rockwell Automation, Honeywell International Inc., Emerson Electric Co., Fuji Electric Co., Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Johnson Electric Holdings Limited, Gems Sensors & Controls, GEMS, Sprecher + Schuh, Lovato Electric S.P.A., Larsen & Toubro Limited, Klockner Moeller, Hubbell Incorporated, and Danfoss Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Definite Purpose Contactors Market Key Technology Landscape

The technology landscape for Definite Purpose Contactors is rapidly evolving, moving beyond traditional electromechanical designs to incorporate hybrid and solid-state solutions, enhancing operational longevity and reliability. A significant technological focus is on optimizing the contact materials, primarily moving towards silver-cadmium oxide or silver-tin oxide alloys, which provide superior arc suppression and resistance to welding, crucial for applications involving frequent cycling and high inductive loads, such as large compressor motors. Manufacturers are also heavily investing in advanced coil technology, utilizing specialized materials and designs to reduce coil temperature rise and power consumption, thereby improving the overall energy efficiency of the DPC unit.

Furthermore, the integration of electronic components represents a key technological frontier. Hybrid contactors, which combine the robustness of mechanical contacts with the precision of solid-state switching components, are gaining traction, especially in variable-speed motor control where rapid, precise switching is required. Another important area of development is the miniaturization and optimization of the footprint, crucial for installation in modern, compact HVAC and refrigeration units. This involves using specialized polymers and advanced molding techniques to ensure high dielectric strength and thermal stability in smaller packages, maintaining the required UL and CE safety certifications while reducing component size.

The push for intelligent control systems has also driven the development of DPCs with integrated monitoring capabilities. Newer models incorporate internal sensors for temperature and current sensing, allowing them to interface directly with Building Management Systems (BMS) or centralized control units. This enables advanced features like predictive maintenance alerts based on contact wear monitoring and remote diagnostics, moving the DPC from a simple mechanical switch to a connected component essential for optimizing system performance and reducing lifecycle costs in commercial infrastructure.

Regional Highlights

North America currently holds a dominant share of the Definite Purpose Contactors market, primarily attributed to a mature and highly regulated HVAC industry, particularly in the United States and Canada. The region benefits from high consumer spending on large residential and commercial climate control systems and an established infrastructure for component manufacturing and distribution. Strict regulatory adherence, such as compliance with National Electrical Code (NEC) standards and specific UL listings, drives continuous component upgrades and a high replacement cycle, ensuring steady demand for specialized and certified DPCs. The region is also a key adopter of smart building technologies, favoring DPCs with integrated IoT capabilities for advanced monitoring and control.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally, driven by unprecedented infrastructure development, rapid urbanization, and rising middle-class incomes that significantly boost the demand for residential air conditioning and commercial refrigeration units. Countries such as China and India are witnessing massive increases in construction projects, fueling OEM production of HVAC equipment. While cost sensitivity remains high in this region, the increasing focus on energy efficiency standards and reliability, particularly in critical infrastructure and export-oriented manufacturing, is gradually shifting demand towards higher quality, reliable DPCs, potentially reshaping the competitive landscape over the forecast period.

Europe represents a stable but moderate growth market, largely sustained by stringent environmental regulations and the strong push towards renewable energy integration, particularly through high-efficiency heat pump systems. European manufacturers are focused on developing DPCs optimized for specific low-GWP (Global Warming Potential) refrigerant systems and those compliant with the Ecodesign Directive. Latin America and the Middle East & Africa (MEA) are emerging regions where market expansion is heavily correlated with oil and gas investments and commercial infrastructure projects. Demand in the MEA region is particularly high for robust, high-amperage DPCs capable of withstanding extreme temperatures typical of desert climates, required for large-scale cooling plants and industrial processes.

- North America (US, Canada): Dominant market share; driven by high replacement cycles, stringent regulatory environment, and advanced smart building adoption.

- Asia Pacific (China, India, Japan): Highest growth rate; propelled by massive infrastructure expansion, urbanization, and rapid OEM manufacturing scale-up.

- Europe (Germany, UK, France): Focus on high-efficiency solutions, particularly for heat pump applications, supported by EU decarbonization policies.

- Latin America: Emerging market; growth linked to new construction and industrial modernization projects, albeit with higher reliance on imports.

- Middle East & Africa (MEA): High demand for heavy-duty, robust DPCs suitable for extreme temperature environments (e.g., district cooling and data centers).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Definite Purpose Contactors Market.- Schneider Electric SE

- Eaton Corporation

- Siemens AG

- ABB Ltd.

- TE Connectivity

- Rockwell Automation

- Honeywell International Inc.

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Johnson Electric Holdings Limited

- Gems Sensors & Controls

- Sprecher + Schuh

- Lovato Electric S.P.A.

- Larsen & Toubro Limited

- Klockner Moeller

- Hubbell Incorporated

- Danfoss Group

- Parker Hannifin Corporation

Frequently Asked Questions

Analyze common user questions about the Definite Purpose Contactors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Definite Purpose Contactors and standard Industrial Contactors?

Definite Purpose Contactors (DPCs) are specifically engineered and certified for high-volume applications in HVAC, refrigeration, and lighting, focusing on low initial cost, compact size, and specific amperage ratings (usually 20A to 120A). Industrial contactors are typically designed for broader, more rugged industrial motor control, offering higher current ratings, greater customization, and higher durability standards, often impacting cost and size.

How does the adoption of Variable Frequency Drives (VFDs) impact the demand for DPCs?

While VFDs often handle motor speed control, they still require power switching components for primary isolation and fault protection. VFD adoption increases demand for specialized DPCs and hybrid contactors capable of handling non-sinusoidal waveforms and high inrush currents associated with VFD-controlled systems, ensuring reliable disconnect functionality and system integrity.

Which geographical region exhibits the highest growth potential for Definite Purpose Contactors?

The Asia Pacific (APAC) region, particularly driven by large-scale infrastructure and residential development in economies like China and India, is projected to demonstrate the highest Compound Annual Growth Rate (CAGR) due to the escalating installation of HVAC and commercial refrigeration equipment.

What are the key technological advancements expected to influence the DPC market over the next five years?

Key advancements include the transition to hybrid and solid-state DPCs for enhanced longevity and quieter operation, the integration of IoT sensors for predictive maintenance and remote diagnostics, and the development of contact materials capable of managing the specialized demands of high-efficiency refrigerants and electric heat systems.

What are the major restraints affecting the profitability and growth of the DPC market?

The primary restraints include significant pressure from Original Equipment Manufacturers (OEMs) to minimize component cost, which limits margin expansion, and high volatility in the pricing of raw materials, such as copper and silver, critical for manufacturing the current-carrying components within the contactors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager