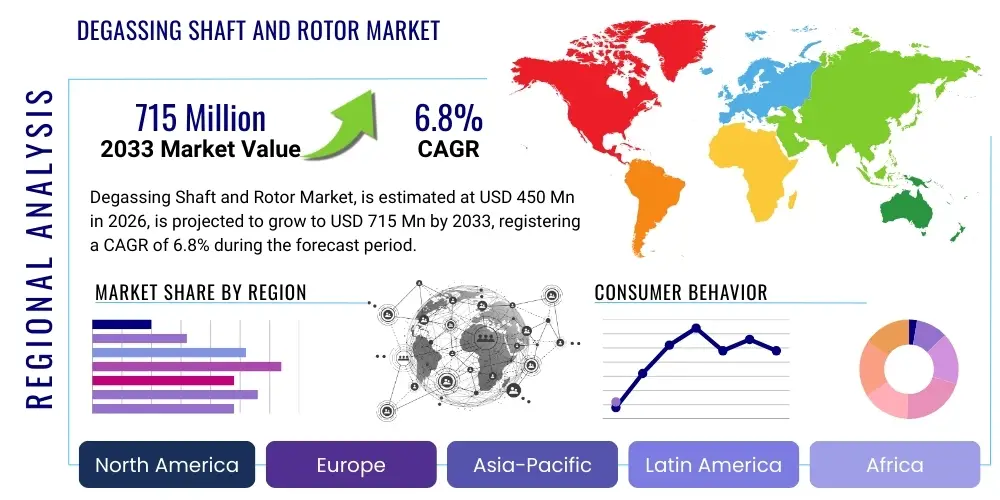

Degassing Shaft and Rotor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433472 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Degassing Shaft and Rotor Market Size

The Degassing Shaft and Rotor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $850 million USD in 2026 and is projected to reach $1,350 million USD by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating demand for high-quality, lightweight aluminum alloys across critical industrial sectors, particularly automotive and aerospace, where stringent material purity standards necessitate highly efficient metal treatment processes. The global push toward energy efficiency and weight reduction in transportation systems inherently fuels the requirement for robust and reliable degassing equipment components, positioning this market for sustained expansion over the next decade. Furthermore, the inherent need to minimize hydrogen content and non-metallic inclusions in molten aluminum directly translates into increased consumption of advanced rotor and shaft materials designed for superior mechanical strength and oxidation resistance at extreme temperatures.

Market valuation reflects the increasing investment by primary and secondary aluminum producers in modernization and capacity expansion projects. The shift from traditional flux injection methods to rotary degassing technology, which utilizes these specialized shafts and rotors, provides superior metallurgical benefits, including enhanced removal efficiency of dissolved gases and improved final product characteristics. This technological evolution ensures better mechanical properties, surface finish, and overall integrity of cast aluminum components, thereby validating the premium pricing associated with high-performance materials like high-density graphite and silicon carbide (SiC) composites used in manufacturing these critical parts. The market size calculation incorporates replacement cycles for consumables, which are frequent due to the corrosive and abrasive nature of molten metal environments, contributing a significant recurring revenue stream to the overall market valuation projection.

The projected CAGR of 6.8% is underpinned by strong regional demand, especially within the Asia Pacific region, driven by rapid industrialization and burgeoning automotive production hubs in countries such as China and India. Technological advancements, focusing on extending the service life of degassing components through novel coatings and material compositions, are also expected to positively influence market volume and value. While the initial investment in high-end materials might be higher, the subsequent reduction in operational downtime and improved metal quality offers a compelling economic argument for end-users, solidifying the forecast trajectory toward the $1.35 billion USD mark by 2033. The continuous regulatory pressure to adopt cleaner production methods further supports the adoption of efficient degassing techniques, providing structural tailwinds for market growth.

Degassing Shaft and Rotor Market introduction

The Degassing Shaft and Rotor Market centers on the specialized, high-performance components crucial for the purification of molten non-ferrous metals, predominantly aluminum and its alloys. Degassing is a vital metallurgical process designed to remove dissolved hydrogen gas and non-metallic inclusions (oxides, nitrides) from the melt prior to casting, ensuring the final cast product possesses the requisite mechanical properties and surface quality, free from porosity and defects. The rotor, often conical or proprietary-shaped, is mounted on a shaft and submerged into the molten metal, spinning rapidly to create fine inert gas bubbles (usually argon or nitrogen). This action maximizes the contact surface area between the gas and the melt, facilitating the effective removal of impurities. The components are typically manufactured from materials like high-purity graphite, silicon carbide (SiC), or advanced refractory ceramics, chosen for their exceptional thermal shock resistance, non-wetting properties, and chemical inertness in hostile, high-temperature environments exceeding 700°C.

Major applications of rotary degassing equipment, and consequently their core components, include primary aluminum smelting plants, secondary aluminum recycling facilities, and various foundries specializing in high-pressure die casting, gravity casting, and continuous casting operations. The primary benefit derived from effective degassing is the substantial improvement in aluminum quality, which directly translates into enhanced tensile strength, ductility, and fatigue resistance of the final components. These purified materials are essential for sectors like automotive manufacturing, where weight reduction (using high-strength aluminum parts) improves fuel efficiency and reduces emissions, and aerospace, where structural integrity is paramount. The increasing complexity of aluminum alloys, such as high-magnesium and high-silicon variants, further mandates rigorous degassing practices to manage their specific inclusion profiles, thereby driving demand for tailored shaft and rotor designs that offer optimal turbulence and gas distribution.

Driving factors for this market include the global expansion of aluminum production capacity, particularly fueled by the burgeoning demand from electric vehicle (EV) manufacturing, which relies heavily on lightweight body and battery casing components. Furthermore, the rising awareness of quality standards and the economic necessity of reducing scrap rates in sophisticated casting operations compel manufacturers to invest in state-of-the-art degassing technology. Regulatory frameworks promoting material recyclability and sustainable industrial practices also indirectly favor secondary aluminum production, where efficient degassing is even more critical due to higher impurity levels typically found in scrap input. The necessity for components that can endure extreme operating conditions while maintaining chemical purity dictates a high-value market for advanced material solutions in shafts and rotors, propelling continuous innovation in material science and structural design within this niche.

Degassing Shaft and Rotor Market Executive Summary

The Degassing Shaft and Rotor Market is experiencing robust growth characterized by significant technological shifts towards high-density, coated materials, particularly Silicon Carbide (SiC) and advanced graphite grades, driven by the imperative to extend component lifespan and enhance operational efficiency in molten metal processing. Business trends indicate strong consolidation among leading material suppliers and equipment manufacturers who are actively engaging in vertical integration and strategic partnerships to control the supply chain and offer integrated degassing solutions. The core dynamic remains the recurring revenue generated from replacement parts, as these components are consumables, highly susceptible to wear, corrosion, and erosion in the aggressive environment of molten aluminum. Investment is heavily focused on optimizing rotor geometry to achieve maximum hydrogen removal efficiency with minimal energy input and metal turbulence, directly addressing end-user demands for reduced operational costs and improved metal yield. Furthermore, globalization of manufacturing has led to increased price competition, particularly for standard graphite components, pushing key players to differentiate through patented designs, customized engineering services, and superior material performance guarantees.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of market expansion, primarily due to the massive scale of aluminum production and consumption in China and India, serving their rapidly expanding automotive and construction industries. North America and Europe, while being mature markets, exhibit consistent demand driven by strict quality control standards, high levels of secondary aluminum recycling activities, and the transition to high-performance casting processes required for aerospace and premium automotive applications. These regions often lead in adopting next-generation materials like reaction-bonded SiC shafts due to their superior longevity, despite the higher initial cost. Middle East and Africa (MEA) are emerging regions, benefiting from significant primary aluminum smelting capacity expansions, thus presenting high growth potential for degassing equipment suppliers focused on large-scale production requirements, although purchasing decisions here are often highly sensitive to competitive pricing and robust after-sales support infrastructure.

Segmentation trends reveal a strong preference for Silicon Carbide (SiC) shafts and rotors, especially in continuous, high-volume operations, owing to their outstanding resistance to chemical attack and wear compared to traditional graphite counterparts. However, graphite remains dominant in smaller foundries and batch operations due to its cost-effectiveness and ease of machining. The Application segment shows the automotive industry as the dominant consumer, catalyzed by the intense push for lightweighting in internal combustion engine (ICE) vehicles and the foundational requirements of the growing Electric Vehicle (EV) platform components. The secondary aluminum refining segment is also growing exponentially, demanding increasingly specialized degassing solutions capable of handling varying levels of impurities found in recycled scrap. This dynamic market structure necessitates manufacturers to maintain diverse portfolios catering to different operational scales, purity requirements, and budget constraints across the global aluminum processing ecosystem.

AI Impact Analysis on Degassing Shaft and Rotor Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Degassing Shaft and Rotor Market predominantly revolve around predictive maintenance, optimization of the degassing process parameters, and quality control automation. Users are highly interested in how AI can minimize component failure rates, a major cost driver due to the consumable nature of shafts and rotors. Specific concerns focus on developing smart systems that can analyze real-time sensor data—such as torque, vibration, gas flow rate, temperature fluctuations, and hydrogen content readings—to predict the optimal replacement time for the shaft and rotor before catastrophic failure occurs, thereby maximizing service life without risking metal quality compromise. Another key theme is the potential for AI-driven process control, where algorithms could dynamically adjust rotor speed and inert gas injection based on continuous monitoring of the melt bath chemistry and inclusion levels, ensuring consistent purity regardless of input material variations. Expectations are centered on achieving higher utilization rates of equipment, reducing operational variability, and fundamentally improving the cost-efficiency of the molten metal treatment phase through sophisticated data analysis and autonomous control loops.

- AI-Powered Predictive Maintenance: Utilizing machine learning models analyzing vibration and temperature data to forecast the remaining useful life (RUL) of the shaft and rotor, preventing unexpected equipment failure and minimizing downtime.

- Process Optimization and Control: Implementing AI algorithms to dynamically adjust rotor rotation speed, immersion depth, and inert gas flow rates based on real-time melt quality metrics (e.g., hydrogen levels and inclusion counts), ensuring optimal degassing efficiency and reduced inert gas consumption.

- Material Quality Traceability: Using AI to correlate material properties (shaft and rotor) with operational parameters and final metal purity output, aiding manufacturers in optimizing future material compositions for enhanced performance and longevity.

- Automated Defect Detection: Leveraging computer vision and AI for non-contact monitoring of the rotor wear and erosion state during short inspection stops, enhancing safety and accuracy in maintenance planning.

- Supply Chain Forecasting: Utilizing AI to predict future demand for specific material types (e.g., graphite vs. SiC) based on global aluminum production trends and alloy type shifts, optimizing inventory management for suppliers.

DRO & Impact Forces Of Degassing Shaft and Rotor Market

The Degassing Shaft and Rotor Market dynamics are fundamentally shaped by the interplay of several powerful forces: the consistent requirement for high-quality, defect-free aluminum castings (Driver), the high cost of advanced materials and their limited lifespan (Restraint), and the rapid evolution of lightweighting technologies in electric vehicles (Opportunity). Impact forces, such as the frequent replacement cycle of these high-wear consumables, exert a strong and continuous demand pressure on manufacturers, ensuring market stability. The global commitment to sustainability further amplifies this market, as efficient degassing supports the increased utilization of recycled aluminum, which inherently requires more intensive purification due to higher impurity loads. Conversely, market growth is often tempered by the significant capital expenditure required to install advanced degassing units and the necessity for precise material compatibility between the shaft, rotor, and the specific aluminum alloy being processed, presenting a technical hurdle for smaller operators.

Drivers include the explosive growth of the automotive industry's focus on lightweight materials, particularly for electric vehicle structures and components, where premium aluminum alloys demand stringent purity levels to maintain structural integrity and crash performance. Furthermore, the global trend towards increasing secondary aluminum production (recycling) significantly boosts the need for efficient degassing systems, as recycled scrap typically contains higher concentrations of harmful hydrogen and inclusions compared to primary aluminum. Restraints primarily involve the high unit cost of specialized, high-performance materials, especially Silicon Carbide (SiC) and proprietary coated graphite, coupled with their relatively short service life in extreme thermal and chemical environments, leading to high operational expenditures for end-users. Regulatory requirements in developed economies concerning process emissions and product safety standards also implicitly drive the adoption of reliable and precise degassing equipment, although adherence to specific local environmental standards can sometimes act as a localized operational restraint due to complex compliance procedures.

Opportunities are predominantly found in the development of next-generation materials, such as ceramic matrix composites (CMCs) and enhanced protective coatings (e.g., anti-oxidation treatments), which promise significantly extended operational life and reduced replacement frequency, enhancing the value proposition for end-users. Additionally, market expansion is achievable through penetration into niche applications, such as magnesium and copper melt treatment, where similar purification principles apply, diversifying the core customer base beyond just the aluminum industry. The impact forces are generally high, characterized by the intense competitive environment among material suppliers, constant pricing pressure from high-volume aluminum producers, and the critical performance dependency of the overall casting process on the reliable operation of these components. Any failure of the shaft or rotor can lead to costly downtime and scrap generation, making reliability a non-negotiable factor that dictates purchasing decisions and material selection.

Segmentation Analysis

The Degassing Shaft and Rotor Market is comprehensively segmented based on material type, application, and end-user, reflecting the diverse operational requirements across the molten metal treatment industry. The primary material segmentation distinguishes between components made of graphite, which are favored for their low cost and excellent thermal conductivity, and advanced materials such as Silicon Carbide (SiC), which offer superior longevity, wear resistance, and oxidation protection, particularly crucial in demanding, continuous operations. Application segmentation highlights the different process stages where these components are utilized, ranging from large-scale primary aluminum melting furnaces and holding furnaces to more localized use in secondary refining and specific casting lines. This segmentation is vital for manufacturers to tailor product specifications—such as length, diameter, and rotor geometry—to the precise hydrodynamic and thermal requirements of various furnace designs and production volumes.

End-user analysis further categorizes consumption based on the final industry benefiting from the purified aluminum, with the automotive sector dominating due to its immense demand for lightweight components used in engine blocks, body structures, and complex chassis parts. The aerospace industry, demanding the highest material purity and smallest tolerance for inclusions, represents a high-value, albeit smaller, segment requiring ultra-premium material performance. Other segments like packaging (aluminum cans) and construction (aluminum extrusions) require large volumes of metal with good surface quality, influencing material purchasing decisions towards cost-effective, high-throughput degassing solutions. Understanding these diverse segments is crucial for market participants to accurately forecast demand, allocate research and development resources toward specific material innovations, and execute targeted sales strategies that address the unique technical and economic constraints of each end-user group.

The geographic segmentation remains critical, dividing the market into major industrial regions like North America, Europe, and the dominant Asia Pacific region. Material adoption patterns often vary regionally; for instance, European and North American markets show a higher inclination towards adopting expensive, long-life SiC components due to higher labor and operational costs, where maximizing uptime is paramount. Conversely, high-volume production centers in APAC often balance quality requirements with procurement cost efficiencies, leading to robust demand for optimized graphite solutions. Overall, this detailed segmentation framework provides a granular view of market dynamics, highlighting areas of high growth (e.g., SiC in continuous casting) and stable demand (e.g., standard graphite in smaller foundries), enabling precise market sizing and strategic planning for competitive advantage.

- By Material Type:

- High-Purity Graphite Shafts and Rotors

- Silicon Carbide (SiC) Shafts and Rotors

- Ceramic and Composite Materials

- By Application:

- Aluminum Melting Furnaces (Primary Smelting)

- Holding Furnaces

- Secondary Aluminum Refining

- Casting Operations (Die Casting, Sand Casting, Continuous Casting)

- By End-User Industry:

- Automotive (Body, Engine, EV Components)

- Aerospace and Defense

- Packaging (Cans and Foils)

- Construction and Building

- Electrical and Electronics

- By Rotor Type:

- Standard Impeller Designs (Conical)

- Proprietary and Optimized Geometries

Value Chain Analysis For Degassing Shaft and Rotor Market

The value chain for the Degassing Shaft and Rotor Market begins with the upstream sourcing of raw materials, primarily high-quality carbon sources for graphite manufacturing and high-purity silica and carbon for Silicon Carbide production. This upstream stage involves complex material processing, including graphitization, sintering, and advanced chemical vapor deposition (CVD) processes to achieve the necessary purity and density required for molten metal contact applications. Key material suppliers, such as specialty chemical and carbon manufacturers, hold significant power at this stage, as the performance and ultimate cost of the final product are highly dependent on the raw material quality. Following material production, the components undergo precision machining, often involving specialized computer numerical control (CNC) equipment, particularly for complex rotor geometries, where tight tolerances are necessary to ensure optimal hydrodynamic performance and balancing during high-speed rotation in the melt. Furthermore, advanced surface treatments and protective coatings, designed to resist oxidation and wear, are applied in this midstream manufacturing phase, adding substantial value.

The downstream analysis focuses on the distribution channels and end-user consumption. Direct sales channels are common for large-scale, primary aluminum producers and major automotive foundries that require customized designs and consistent technical support. Manufacturers of degassing systems often integrate the shaft and rotor into their overall equipment offerings, selling them as part of a complete system package. Conversely, indirect distribution through specialized industrial distributors and local agents is prevalent for servicing smaller foundries and the replacement market, leveraging their regional presence and expertise in rapid parts supply. The end-users—aluminum smelters and foundries—are highly sensitive to component lifespan and performance, as downtime is extremely costly, giving a high bargaining power to suppliers who can demonstrate superior component reliability and longevity, despite potentially higher unit prices. The replacement market for shafts and rotors is robust, providing continuous revenue streams, often managed through long-term service agreements with equipment suppliers.

The flow of value emphasizes technological innovation at the manufacturing stage, where patents on rotor geometry, material composition, and coating technology create significant competitive differentiation. Effective logistics are crucial in the distribution channel, given the fragile nature of some ceramic and graphite components and the urgency required for replacement parts to minimize operational disruptions. The overall value chain is highly specialized, requiring deep expertise in refractory materials science and metallurgical processes. Direct interaction between component manufacturers and end-users, facilitated by technical sales teams, is essential for troubleshooting application-specific wear issues and developing customized solutions. This tight linkage ensures that component design evolves in direct response to changing aluminum alloy specifications and increasing demands for metal purity, thereby continuously pushing the market towards higher performance materials and more intricate product designs throughout the entire lifecycle of the components.

Degassing Shaft and Rotor Market Potential Customers

The primary potential customers for Degassing Shafts and Rotors are entities engaged in high-volume production, processing, or casting of non-ferrous metals, overwhelmingly dominated by the global aluminum industry. This includes integrated primary aluminum smelters operated by major multinational corporations that require massive, continuous degassing systems to purify virgin metal prior to further processing or casting into billets and slabs. These large-scale operators are characterized by purchasing decisions based on longevity, operational stability, and total cost of ownership (TCO), favoring high-end SiC or advanced coated graphite solutions capable of enduring extended operational cycles without frequent replacements. Furthermore, secondary aluminum refiners, which process scrap aluminum for recycling, constitute a rapidly expanding customer base. These recyclers face complex purification challenges due to the varied input quality of scrap, necessitating highly effective and durable degassing components that can efficiently handle high inclusion and gas levels, thereby creating a substantial, specialized demand for robust rotors and shafts.

Another crucial customer segment encompasses independent and captive foundries, ranging from small job shops to large casting operations dedicated to automotive, aerospace, and general industrial component production. Within the automotive sector, customers include Tier 1 suppliers and Original Equipment Manufacturers (OEMs) that operate their own dedicated casting facilities for manufacturing parts like cylinder heads, engine blocks, and increasingly, structural components for electric vehicle battery casings and chassis. The stringent safety and performance requirements in automotive and aerospace dictate extremely high standards for metal purity, making continuous monitoring and reliable degassing components absolutely essential. These customers prioritize components that guarantee minimal porosity and maximum defect-free production runs, often leading them to adopt the latest, most advanced proprietary rotor designs for maximized gas removal efficiency and metal homogenization across the melt bath.

Beyond the core aluminum sectors, ancillary customers include manufacturers of other non-ferrous metals, such as certain specialized copper and magnesium alloy processors, although these segments represent a smaller volume of the overall market. Additionally, metallurgical research institutions and specialty alloy developers frequently require customized or small-batch degassing shafts and rotors for experimental setups and pilot plant operations focusing on advanced material science. Overall, the purchasing power and frequency across all these customer types are directly correlated with global industrial production rates, particularly in the automotive and construction sectors, making them highly cyclical consumers. Suppliers must therefore focus their sales efforts on proving component reliability, providing technical expertise on optimizing degassing parameters, and ensuring swift replacement logistics to serve the non-negotiable uptime requirements of this critical customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 million USD |

| Market Forecast in 2033 | $1,350 million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon, Pyrotek, Foseco (Vesuvius plc), Morgan Advanced Materials, Saint-Gobain, GrafTech International, Shandong Sinotech, Sinosteel Advanced Materials, Avignon Ceramics, Rauschert Technical Ceramics, VESCO, Luyang Energy-Saving Materials, Toyo Tanso Co., Ltd., Tokai Carbon Co., Ltd., Entegris, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Degassing Shaft and Rotor Market Key Technology Landscape

The technology landscape of the Degassing Shaft and Rotor market is characterized by a relentless focus on material science innovation aimed at improving longevity, mechanical stability, and efficiency in the extreme environment of molten aluminum. The foundational technology involves the choice between high-purity, isostatically molded graphite and advanced Silicon Carbide (SiC) based ceramics. SiC technology, particularly reaction-bonded SiC (RBSC) or pressureless sintered SiC (SSiC), offers superior hardness, erosion resistance, and minimal oxidation rate compared to graphite, making it the preferred choice for high-volume, continuous operations where minimizing replacements is economically critical. Technological advancements in SiC manufacturing focus on achieving dense, non-porous structures that prevent metal penetration and corrosion. Conversely, graphite technology focuses on optimizing density and pore size through specialized impregnation techniques (e.g., anti-oxidation treatments using phosphate salts or borates) to extend service life and improve resistance to thermal shock, ensuring it remains a viable, cost-effective option for batch operations.

A significant technological frontier involves the development and application of specialized protective coatings. These coatings, often based on advanced ceramics, borides, or nitrides (such as silicon nitride or aluminum nitride), are applied to both graphite and SiC components to form a protective barrier against chemical attack by molten aluminum and corrosive fluxes, thereby significantly slowing down oxidation and wear. The key challenge in coating technology is ensuring strong adhesion to the substrate material and maintaining structural integrity despite repeated thermal cycling between room temperature and operating temperatures above 700°C. Furthermore, advancements in rotor geometry design are crucial. Proprietary rotor shapes, deviating from simple conical designs, utilize computational fluid dynamics (CFD) modeling to optimize gas bubble size distribution, maximize the contact interface for impurity removal, and minimize melt turbulence, which can otherwise lead to dross formation and energy loss. These designs aim to achieve the highest possible hydrogen removal efficiency (HRE) while reducing operational energy consumption.

Beyond material composition and geometry, the market is increasingly integrating sensor technology and digitalization. Advanced systems often incorporate embedded temperature sensors and data logging capabilities within the shaft mechanism, allowing operators to monitor operational stress and thermal fatigue in real-time. This data feeds into sophisticated control systems that automate gas flow and rotation speed adjustments, optimizing the metallurgical process based on actual conditions rather than fixed parameters. Emerging technologies also include non-contact monitoring systems utilizing ultrasonic or electromagnetic waves to measure metal purity and hydrogen content directly during the degassing process, further enabling fine-tuned control. The convergence of superior material science, sophisticated hydrodynamic modeling, and advanced process monitoring represents the future direction of the market, driven by the goal of maximizing metal quality assurance, minimizing component degradation, and achieving absolute operational reliability for global aluminum producers in increasingly competitive environments.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for degassing shafts and rotors, driven by the colossal aluminum production capacity centered in China and India, catering to massive infrastructure, packaging, and automotive demands. The region’s rapid industrialization and expansion of secondary aluminum production facilities necessitate continuous investment in high-throughput degassing equipment. While cost sensitivity is higher here, the sheer volume of consumption ensures market dominance. Key growth drivers include the massive scale of EV battery component manufacturing and government initiatives supporting metal recycling, which elevates the need for robust purification processes.

- North America: This region represents a mature, high-value market characterized by stringent quality controls, particularly in the aerospace and advanced automotive sectors. Demand is consistently high, driven primarily by replacement cycles and the preference for premium, high-performance materials like SiC due to higher labor costs, justifying the investment in longer-lasting components to minimize maintenance downtime. The robust recycling industry in the US and Canada also fuels steady demand for heavy-duty degassing components capable of handling varied scrap inputs.

- Europe: Europe is a technologically sophisticated market focusing heavily on material innovation and sustainability. Regulatory pressures and high environmental standards encourage the adoption of highly efficient rotary degassing over less effective methods. Key demand segments are the premium automotive sector and specialized casting houses. European consumers often prioritize TCO and environmental performance, leading to strong uptake of high-efficiency, corrosion-resistant components and systems integrated with AI-driven monitoring for precise control and resource minimization.

- Latin America (LATAM): The market here is growing steadily, primarily associated with localized aluminum smelting operations catering to regional construction and industrial needs. Market penetration is moderate, with purchasing decisions often heavily influenced by procurement costs. Graphite solutions remain popular due to cost-effectiveness, though there is gradual adoption of SiC technology as production scales and quality requirements stiffen, reflecting increasing investment in modernizing aging industrial infrastructure, particularly in countries like Brazil and Mexico.

- Middle East and Africa (MEA): MEA is significant due to the presence of large, primary aluminum smelters that benefit from low-cost energy inputs, resulting in high-volume production. These large facilities require consistent, reliable, large-scale degassing shafts and rotors. Demand is stable and driven by long-term contracts for maintenance and supply of consumables. The market here is characterized by the use of large, specialized equipment suited for high capacity, requiring suppliers capable of managing complex international logistics and providing intensive on-site technical support for continuous, critical operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Degassing Shaft and Rotor Market.- SGL Carbon

- Pyrotek

- Foseco (Vesuvius plc)

- Morgan Advanced Materials

- Saint-Gobain

- GrafTech International

- Shandong Sinotech

- Sinosteel Advanced Materials

- Avignon Ceramics

- Rauschert Technical Ceramics

- VESCO

- Luyang Energy-Saving Materials

- Toyo Tanso Co., Ltd.

- Tokai Carbon Co., Ltd.

- Entegris, Inc.

- Refractory Solutions GmbH

- Sichuan Zigong Industrial Ceramics Co., Ltd.

- Mersen Corporate

- Dalian Fuyuan Refractory Co., Ltd.

- Resco Products, Inc.

Frequently Asked Questions

Analyze common user questions about the Degassing Shaft and Rotor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are most commonly used for manufacturing degassing shafts and rotors?

The most common materials are high-purity, isostatically molded graphite and advanced Silicon Carbide (SiC) ceramics. Graphite is favored for its cost-effectiveness and thermal shock resistance, while SiC is chosen for superior wear resistance, longevity, and anti-oxidation properties in high-volume, continuous operations.

Why is the replacement frequency of degassing shafts and rotors so high?

Shafts and rotors are consumable components due to the extremely corrosive, abrasive, and high-temperature environment of molten aluminum. They suffer from chemical attack, mechanical erosion, and oxidation, necessitating frequent replacement to maintain optimal degassing efficiency and prevent contamination.

How does the use of degassing shafts and rotors benefit the aluminum industry?

They are essential for removing dissolved hydrogen gas and non-metallic inclusions, significantly improving the purity of molten aluminum. This purification enhances the final cast product's mechanical properties, reduces porosity defects, minimizes scrap rates, and ensures compliance with stringent industry quality standards, especially for automotive and aerospace components.

Which end-user segment drives the highest demand in this market?

The automotive industry is the dominant end-user segment, fueled by the global push for vehicle lightweighting (including electric vehicle component manufacturing) and the requirement for high-strength, defect-free aluminum alloys in structural and engine parts.

What role does Artificial Intelligence play in optimizing the use of these components?

AI is increasingly utilized for predictive maintenance, analyzing real-time sensor data (vibration, temperature) to forecast the remaining useful life of the components, thus minimizing unplanned downtime. AI also optimizes operational parameters, such as rotor speed and gas flow, to maximize degassing efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager