Dehydrated Onion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433890 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Dehydrated Onion Market Size

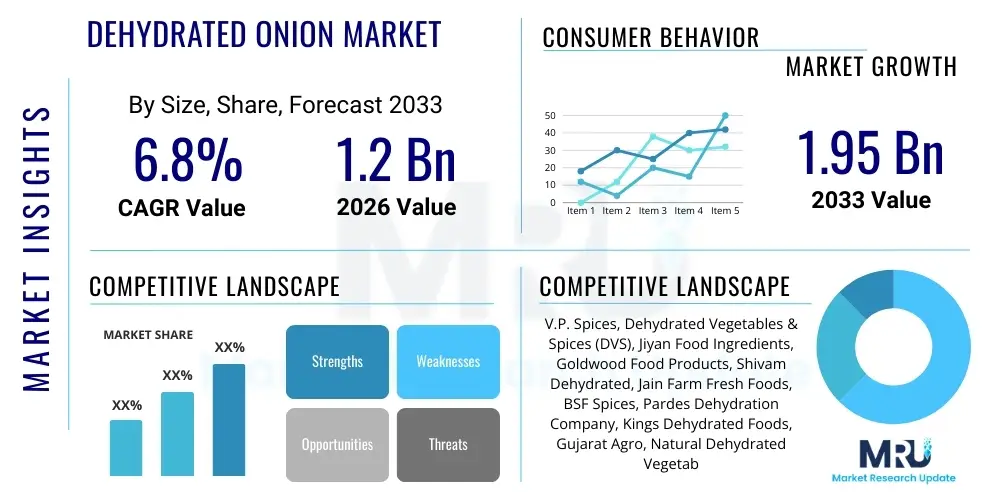

The Dehydrated Onion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.95 Billion by the end of the forecast period in 2033.

Dehydrated Onion Market introduction

The Dehydrated Onion Market encompasses the production, processing, and distribution of onions that have undergone moisture removal techniques, primarily through hot air drying, vacuum drying, or freeze drying, to extend shelf life and reduce transportation costs. This process preserves the flavor, aroma, and nutritional profile of the fresh onion while making it highly convenient for use in processed foods and ready-to-eat meals. The resulting product is utilized in various forms, including flakes, kibbled, minced, chopped, granulated, and powdered, catering to diverse industrial requirements across the food and beverage industry.

Major applications of dehydrated onions span across the burgeoning convenience food sector, including soups, sauces, gravies, seasonings, savory snacks, and fast-food preparations. They are essential ingredients in spice blends and rubs, offering consistency in flavor that fresh produce often lacks due to seasonal variations. The primary benefits driving market adoption include enhanced shelf stability, significantly reduced weight and volume for logistics efficiency, year-round availability regardless of harvest cycles, and ease of storage without requiring refrigeration. These characteristics make dehydrated onions particularly attractive to large-scale food manufacturers and the institutional catering segment worldwide.

The market growth is fundamentally driven by the global shift towards processed and packaged foods, increasing urbanization, and the rising demand for ethnic cuisines and globally inspired flavors that rely on standardized, consistent ingredients. Furthermore, consumer demand for clean-label and natural flavoring alternatives, coupled with technological advancements in drying methodologies that better retain the natural qualities of the onion, are propelling market expansion. Strict quality control standards in the food industry, demanding uniformity and safety, further solidify the position of dehydrated onions as preferred additives over fresh alternatives in many commercial applications.

Dehydrated Onion Market Executive Summary

The global Dehydrated Onion Market demonstrates robust growth, primarily fueled by rapid expansion in the packaged food sector and substantial investments in drying technology across Asia Pacific and North America. Key business trends include a heightened focus on organic and non-GMO variants, driven by consumer preference for natural ingredients, alongside increased vertical integration among major players to ensure stable raw material sourcing and consistent quality. Companies are also investing heavily in advanced freezing and vacuum drying techniques that minimize nutrient and volatile oil loss, thereby yielding premium-grade products suitable for high-end seasoning markets. Supply chain optimization, leveraging enhanced logistics to serve diverse global demand promptly, remains a critical competitive differentiator.

Regionally, Asia Pacific, particularly India and China, serves both as a major production hub and a rapidly expanding consumption market, capitalizing on abundant agricultural resources and a massive, growing population demanding processed foods. North America and Europe, characterized by mature food processing industries and high demand for ready-to-eat products, are leading the consumption of high-specification dehydrated onion powder and flakes. The Middle East and Africa are emerging as high-potential markets, driven by urbanization and rising disposable incomes leading to the adoption of convenience cooking solutions. Regulatory frameworks regarding food safety and quality standards significantly influence market dynamics across all key regions.

Segment trends reveal that the powder and granules segment holds the dominant market share due to its versatility and ease of blending in seasonings, snacks, and ready meals. Conversely, the flakes and kibbled segment is experiencing rapid growth, driven by their aesthetic appeal and functional use in visible applications like soups and instant noodles. By end-user, the food processing industry remains the largest segment, with significant uptake also observed in the food service and retail sectors, especially concerning bulk institutional use and packaged retail spices. The drying technology segment shows a noticeable pivot toward energy-efficient and quality-preserving methods, enhancing the overall market offering.

AI Impact Analysis on Dehydrated Onion Market

Analysis of common user questions regarding AI's impact on the Dehydrated Onion Market reveals a primary focus on supply chain optimization, predictive quality control, and agricultural efficiency. Users frequently ask how AI can predict onion crop yields and disease outbreaks to secure stable raw material sourcing. There is also significant interest in AI-driven processing efficiency, specifically concerning optimizing drying times and temperatures to reduce energy consumption while maximizing flavor retention. Furthermore, users are keen to understand how AI analytics can forecast demand fluctuations across diverse global markets, enabling producers to manage inventory effectively and minimize waste, thereby enhancing the overall profitability and sustainability of the dehydration process.

- AI-powered predictive agriculture optimizes raw onion procurement by forecasting yield variability and minimizing supplier risks.

- Machine learning algorithms enhance processing efficiency by dynamically adjusting drying parameters (temperature, airflow) for optimal quality and energy conservation.

- Computer vision systems, integrated with sorting machinery, improve quality control by accurately detecting and removing defective or discolored onion pieces during inspection.

- AI analytics refine inventory management and demand forecasting, matching production schedules to anticipated market needs across various geographies and product formats (powder vs. flakes).

- Adoption of robotic process automation (RPA) in packaging and logistics streamlines end-of-line operations, increasing throughput and reducing labor costs in the final stages of the supply chain.

DRO & Impact Forces Of Dehydrated Onion Market

The market's trajectory is primarily shaped by increasing global demand for processed foods (Driver), tempered by the volatile pricing of raw onions and high initial capital expenditure required for advanced drying infrastructure (Restraints). Opportunities arise from the rapidly expanding functional food and nutraceutical sectors, seeking natural and clean-label ingredients, and the scope for technological innovation in sustainable, low-energy drying methods (Opportunity). These factors interact dynamically, with the powerful force of escalating global convenience food consumption consistently outweighing the pricing volatility, leading to a generally upward growth trend. However, the market must navigate regulatory forces pertaining to food additives and quality standards, which demand continuous investment in sophisticated processing technologies.

Key drivers include the pervasive trend of urbanization and subsequent reliance on ready-to-eat meals and packaged snacks, where dehydrated onions serve as a non-perishable, flavorful foundation. The shift towards international cuisine adoption, which standardizes seasoning components, further boosts demand. Additionally, manufacturers prioritize dehydrated ingredients due to their superior logistics profile—being lightweight and having extended shelf life—which drastically reduces refrigeration dependency and supply chain complexity compared to fresh produce.

Conversely, significant restraints exist, notably the dependence on favorable agricultural conditions, which leads to high price volatility and supply chain instability for the raw material. The dehydration process itself is energy-intensive, imposing substantial operational costs, particularly for premium drying techniques like freeze-drying. Furthermore, competition from synthetic flavor enhancers, though often less preferred by health-conscious consumers, presents a price challenge in certain low-cost market segments. Navigating stringent global food safety and import/export regulations also requires complex quality management systems, acting as a barrier to entry for smaller players.

Segmentation Analysis

The Dehydrated Onion Market is intricately segmented based on product form, color, technology, and end-user, reflecting the diverse applications and industrial requirements. Analyzing these segments provides crucial insights into market dynamics, enabling targeted investment and product development strategies. The segmentation highlights the predominance of powdered formats due to their extensive use in industrial seasoning blends, juxtaposed with the rapid growth of premium white onion flakes favored in high-visibility culinary applications. Understanding these splits allows companies to optimize production lines and tailor distribution strategies to specific end-user needs, whether in large-scale food manufacturing or niche retail markets.

The technological segmentation underscores the ongoing shift from conventional sun drying towards more controlled, hygienic, and quality-preserving methods like vacuum and freeze-drying, crucial for meeting stringent export quality standards. The end-user analysis confirms the overwhelming importance of the food processing industry, particularly manufacturers of savory snacks, sauces, and instant meals, as the primary consumer base, dictating volume demand and required specifications. Geographic segmentation reveals the critical balance between production concentration in Asian regions and high-value consumption in mature Western markets, defining global trade flows and pricing structures.

- By Product Form:

- Powder

- Flakes/Kibbled

- Minced/Chopped

- Granules

- By Color:

- Red Onion

- Pink Onion

- White Onion

- By Technology:

- Air Drying

- Freeze Drying

- Vacuum Drying

- Other Drying Methods

- By End User:

- Food Processing Industry (Sauces, Seasonings, Snacks, Ready Meals)

- Food Service/Horeca

- Retail/Household

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Dehydrated Onion Market

The value chain for the Dehydrated Onion Market begins with the upstream segment, which involves agricultural production and raw material aggregation. This stage is critical as the quality, variety, and cost of fresh onions directly determine the final product quality and profitability. Key activities here include specialized farming practices, ensuring low moisture content varieties are cultivated, and efficient harvesting and initial storage to minimize spoilage before processing. Due to the high weight-to-value ratio of raw onions, proximity of farming areas to processing units is a major consideration for cost optimization.

The midstream processing stage involves core activities such as cleaning, slicing, dehydration, milling, and sterilization. This stage is highly capital-intensive, requiring specialized machinery for advanced drying technologies (air, vacuum, or freeze drying) and strict adherence to hygiene standards. The distribution channel then takes over, which includes both direct sales to large food manufacturers (B2B model) and indirect channels utilizing distributors and brokers to reach smaller industrial clients, foodservice providers, and retail packing facilities. Direct distribution allows for better quality control and relationship management with large anchor customers, while indirect channels provide wider market penetration.

The downstream analysis focuses on the end-users: the food processing industry, foodservice (HORECA), and retail consumers. The majority of dehydrated onions are directed towards large food manufacturers who use them as essential flavor ingredients in seasoning blends, soups, and ready-to-eat meals. The retail segment typically receives the product in smaller packaged containers for household use. Optimization of the value chain involves minimizing waste at the agricultural level, improving energy efficiency during dehydration, and ensuring streamlined logistics to maintain product integrity up to the point of consumption, thereby maximizing value extraction across all stages.

Dehydrated Onion Market Potential Customers

The primary customers for dehydrated onions are large-scale industrial buyers within the food processing sector, specifically those engaged in manufacturing savory packaged goods. These customers rely heavily on the consistency, long shelf life, and standardized flavor profile offered by dehydrated products. Manufacturers of snack foods, including chips and extruded products, utilize dehydrated onion powder extensively in flavor coatings. Similarly, companies specializing in ready-to-eat meals, instant noodles, and canned goods find dehydrated onions indispensable for flavor base creation, reducing the need for cold chain logistics and prep time.

Another crucial customer segment is the institutional foodservice sector, encompassing catering companies, hotels, restaurants, and fast-food chains (HORECA). These bulk buyers prioritize convenience, portion control, and reduced labor costs associated with fresh preparation. Dehydrated forms, particularly flakes and kibbled onions, offer significant logistical advantages for high-volume kitchen operations while maintaining robust flavor necessary for quality culinary outcomes. The consistent quality year-round is vital for maintaining brand standards across multi-outlet operations.

The retail market constitutes the third significant customer group, where dehydrated onions are sold as packaged spices or spice blends directly to household consumers. This segment is highly influenced by consumer trends towards home cooking, ethnic food preparation, and demands for natural, single-ingredient spice options. Additionally, customers in the nutraceutical and functional food sector are emerging as potential buyers, seeking the natural compounds found in onions, such as flavonoids and sulfur compounds, in concentrated dehydrated forms for encapsulation or blending into health supplements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | V.P. Spices, Dehydrated Vegetables & Spices (DVS), Jiyan Food Ingredients, Goldwood Food Products, Shivam Dehydrated, Jain Farm Fresh Foods, BSF Spices, Pardes Dehydration Company, Kings Dehydrated Foods, Gujarat Agro, Natural Dehydrated Vegetables, S V Agri Foods, Drying Technology Inc., Oceanic Foods, Darshan Foods, ITC Spices Division, Olam Food Ingredients, McCormick & Company, Garlico Industries, Kripa International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dehydrated Onion Market Key Technology Landscape

The technological landscape of the Dehydrated Onion Market is dominated by air drying, which represents the most widespread and cost-effective method for bulk production. Air drying, utilizing hot air chambers, remains crucial for producing large volumes of powder and flakes destined for the general food processing market, prioritizing cost efficiency over minor flavor retention nuances. However, continuous efforts are being made to enhance air drying through improved temperature and humidity controls, minimizing heat damage and preserving the organoleptic properties of the onion. Innovations focus on continuous belt drying systems that offer greater throughput and uniformity in moisture removal, critical for preventing microbial growth and extending shelf stability.

Increasingly, higher-value segments are adopting advanced technologies such as freeze drying and vacuum drying. Freeze drying, though significantly more expensive and time-consuming, yields the highest quality product, retaining nearly all the original color, aroma, and nutritional compounds. This technology is vital for premium applications, including gourmet spice blends and high-end ready-to-eat backpacking meals, where quality is paramount. Vacuum drying represents a balanced approach, operating at lower temperatures to preserve heat-sensitive compounds better than traditional air drying, providing a middle ground in terms of quality and operational cost for specialized industrial use.

Beyond the core drying processes, the technological landscape includes critical auxiliary systems, such as advanced slicing, blanching, and sorting machinery. Automated optical sorting systems utilize high-speed cameras and image processing (often leveraging AI) to ensure physical contaminants and discolored pieces are rigorously removed, meeting stringent international food safety standards. Furthermore, advancements in packaging technology, utilizing barrier films and modified atmosphere packaging (MAP), are essential for maintaining the product's quality and preventing moisture ingress during the extensive distribution cycle, especially in humid regions, thereby maximizing the effective shelf life of the dehydrated product.

Regional Highlights

The global Dehydrated Onion Market exhibits distinct regional dynamics, driven by localized production capacities, consumption habits, and regulatory environments.

- Asia Pacific (APAC): APAC holds a dual status as the largest global producer and one of the fastest-growing consumption markets. Countries like India and China benefit from vast onion cultivation areas, low labor costs, and established processing infrastructure, making them export powerhouses. The region's increasing adoption of Western dietary habits and rapid growth of the domestic convenience food industry drive high internal demand for dehydrated ingredients.

- North America: North America is characterized by high per capita consumption of processed foods and a strong preference for high-quality, standardized ingredients. The market is mature, focusing heavily on value-added products like organic, non-GMO, and specialized colored onion derivatives. Strict food safety standards necessitate the use of advanced processing technologies, driving innovation in quality control and flavor preservation.

- Europe: Europe is a major importer of dehydrated onions, driven by a highly developed food industry that demands consistent quality and traceable sourcing. Regulatory focus on clean-label ingredients and sustainable production practices influences market trends, favoring suppliers who adhere to strict environmental and social governance (ESG) criteria. Germany, the UK, and France are key consumption hubs, particularly in the savory snacks and ready meal segments.

- Latin America (LATAM): This region is an emerging market, showing promising growth tied to increasing urbanization and the expansion of domestic food processing operations. While local production exists, importation remains significant to meet the quality specifications required by multinational food companies operating in the region. Economic stability and disposable income growth are key determinants of market maturation here.

- Middle East and Africa (MEA): The MEA market is primarily driven by expanding tourism, institutional catering, and governmental efforts to diversify food supply chains. The demand for long-shelf-life ingredients is high due to logistical challenges and climatic conditions. Countries in the GCC region, with high expatriate populations, show strong demand for diverse international seasonings incorporating dehydrated onion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dehydrated Onion Market.- Jain Farm Fresh Foods Ltd.

- Olam Food Ingredients (OFI)

- McCormick & Company, Inc. (Through Spiceworks)

- Garlico Industries Ltd.

- Dehydrated Vegetables & Spices (DVS)

- V.P. Spices & Food Products

- Pardes Dehydration Company

- Kings Dehydrated Foods Pvt. Ltd.

- Gujarat Agro Infrastructure Mega Food Park

- Natural Dehydrated Vegetables Pvt. Ltd.

- Shivam Dehydrated Foods Pvt. Ltd.

- Darshan Foods Pvt. Ltd.

- S V Agri Foods

- BSF Spices Pvt. Ltd.

- Kripa International

- Goldwood Food Products

- Qingdao Yuanhe Food Co., Ltd.

- Sensient Technologies Corporation

- Synthite Industries Ltd.

- Unilex International

Frequently Asked Questions

Analyze common user questions about the Dehydrated Onion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Dehydrated Onion Market?

Market growth is primarily driven by the increasing global demand for convenience foods, the necessity for standardized and consistent flavor profiles in industrial food manufacturing, and the superior shelf stability and logistical advantages offered by dehydrated ingredients over fresh onions.

Which drying technology is currently dominant in the dehydrated onion industry?

Air drying remains the dominant technology due to its cost-effectiveness and high-volume throughput, making it suitable for bulk production of powders and flakes. However, freeze drying and vacuum drying are rapidly gaining traction for premium, high-quality segments requiring optimal flavor and nutrient retention.

How does raw material price volatility affect the dehydrated onion industry?

Volatile pricing of raw onions, heavily influenced by weather patterns and agricultural yields, constitutes a significant restraint, forcing processors to manage inventory cautiously and impacting profit margins. This volatility encourages long-term contractual agreements and vertical integration to secure supply stability.

Which geographic region holds the largest market share for dehydrated onion production and consumption?

Asia Pacific, notably India and China, leads both in production capacity due to agricultural resources and as a growing consumption market, driven by its expansive food processing industry and shifting consumer preferences toward convenience foods. North America and Europe are major consumers of high-specification products.

What role do health and regulatory standards play in shaping product offerings?

Strict global food safety regulations necessitate high-quality processing, sterilization, and rigorous contaminant testing. Furthermore, consumer demand for clean-label, organic, and non-GMO certified dehydrated onions is compelling manufacturers to invest in advanced traceability and sustainable sourcing practices.

Market Dynamics and Growth Vectors

Understanding the fundamental dynamics governing the Dehydrated Onion Market is crucial for strategic planning. The market is currently undergoing a structural transformation characterized by an intensified focus on technological efficiency and product diversification. The baseline demand remains robust, anchored by the stable growth of the global packaged food sector. However, the vector of growth is shifting away from purely commodity-driven volume towards value-added differentiation. This includes expanding the portfolio of organic certifications, specialized color variants (e.g., white onion flakes for sauces, red onion powder for seasonings), and products tailored for specific functional food applications, thereby commanding higher price points and better margins.

Regulatory adherence, particularly concerning pesticide residues and microbial safety, acts as a continuous filtering mechanism, favoring large, integrated players capable of investing in stringent quality management systems and advanced sterilization techniques like steam sterilization or irradiation. This regulatory pressure, while a barrier to entry for smaller firms, stabilizes the market by ensuring a high quality floor for internationally traded products. Moreover, the long-term outlook is increasingly tied to sustainability metrics. Buyers are prioritizing suppliers who demonstrate reduced water usage and lower carbon footprints during the energy-intensive drying process, suggesting a future pivot towards solar or other renewable energy sources in processing plants.

The interdependence of the dehydrated onion market with allied industries, particularly the spice and seasoning market, is profound. Dehydrated onions form a cornerstone ingredient in nearly all savory seasoning blends globally. As the demand for ready-to-use spice mixes (e.g., taco seasoning, curry powder, barbecue rub) accelerates, the underlying demand for onion powder and granules grows proportionally. This strong industrial linkage ensures continuous volume off-take, minimizing risks associated with reliance on fluctuating consumer retail demand alone, and solidifying the dehydrated onion market's strategic position within the broader food ingredient landscape.

- Value Chain Refinement: Increased adoption of integrated supply chains from farm-to-factory minimizes post-harvest losses and ensures consistent raw material characteristics.

- Flavor Stabilization Technologies: Focus on microencapsulation techniques to protect volatile flavor compounds and enhance the stability of onion products during storage and cooking.

- Sustainability Focus: Growing market preference for suppliers using renewable energy sources (solar, biogas) to mitigate the environmental impact of the dehydration process.

- Product Differentiation: Strategic segmentation based on specific volatile sulfur compound profiles to offer products optimized for distinct flavor requirements (e.g., sweet vs. pungent).

Competitive Landscape Analysis

The competitive landscape of the Dehydrated Onion Market is characterized by a mix of large, multinational food ingredient corporations and numerous smaller, regional specialized processors, particularly concentrated in key production areas like India, China, and Egypt. The market exhibits moderate consolidation, with the top tier players focusing on global distribution networks, advanced technology adoption (especially freeze drying), and strong vertical integration to control raw material sourcing. Key competitive factors include price competitiveness, consistency of quality, compliance with international food safety certifications (e.g., FSSC 22000, BRC), and the ability to deliver customized particle sizes and color specifications requested by large industrial buyers.

Regional players often compete based on low-cost production and proximity to local supply chains, dominating domestic and adjacent regional markets. However, their ability to meet the stringent quality and volume requirements of major Western packaged food companies is often limited, creating a dual-market structure. Major multinational food companies, such as Olam and McCormick, participate either through direct processing or strategic sourcing and blending, using their brand equity and existing distribution infrastructure to capture high-value end-user segments. Innovation in packaging, offering bulk industrial packaging with long-term barrier protection, is also a key competitive edge.

Future competitive advantages are expected to emerge from leveraging digitalization and automation. Companies that successfully implement AI-driven production monitoring for yield optimization, predictive maintenance for machinery uptime, and digital traceability systems will gain a substantial edge. Furthermore, the strategic acquisition of smaller, technologically advanced players or firms specializing in niche segments (like organic or specific colored onions) is a common strategy employed by market leaders to rapidly expand capacity and product diversity without extensive greenfield investment.

- Key Competitive Metrics: Production capacity, raw material price hedging capabilities, stringency of quality certifications (e.g., USDA Organic, European Organic), and energy consumption efficiency.

- Market Concentration: Moderate; dominated by a few large global players alongside fragmented regional specialists, leading to intense price competition in commodity grades.

- Differentiation Strategy: Focus on specialized products (e.g., toasted/roasted dehydrated onions) and non-GMO verification to achieve premium pricing.

- Geographic Expansion: Major players are actively seeking to establish processing hubs outside traditional areas (India/China) to diversify risk and access new raw material sources, such as in Eastern Europe or South America.

Pricing and Cost Structure Analysis

The pricing structure of the Dehydrated Onion Market is intrinsically linked to agricultural commodity cycles and global energy prices. Raw onion costs typically constitute the largest variable component (35-45%) of the total production cost, making processors highly susceptible to weather-related crop failures or market speculation. Energy consumption, necessary for the drying process, forms the second major cost component (20-30%), especially for large-scale air drying operations. Consequently, the final market price exhibits significant quarterly volatility, particularly for standard air-dried powder, forcing buyers to engage in forward contracting to mitigate risk.

Pricing also varies dramatically based on product type and required specifications. Premium products, such as freeze-dried white onion flakes or organic certified powders, command a substantial premium (often 100-300% higher) due to lower processing yields, higher technology costs, and specialized certifications. Conversely, lower-grade, highly fragmented onion powder is priced competitively, often serving as a bulk filler in cost-sensitive seasoning blends. The geographic origin also influences price, with products from high-cost, high-regulation regions like the U.S. or Europe being generally more expensive than those sourced from APAC.

Cost management strategies focus intensely on improving thermal efficiency during dehydration and optimizing raw material utilization through advanced sorting and cleaning to minimize waste. Investment in renewable energy sources directly tackles the high energy cost burden. Furthermore, logistical costs, including freight and packaging, are substantial, especially for intercontinental trade, necessitating the utilization of efficient, high-density packaging solutions and optimal load planning to protect margins. Successful companies are those that master the art of hedging against both commodity price fluctuations and currency risks associated with international trade.

- Key Cost Drivers: Raw Onion Procurement (35-45%), Energy/Fuel for Drying (20-30%), Labor, Packaging, and Quality Assurance overheads.

- Price Determinants: Drying Technology utilized (Freeze-dried > Vacuum > Air-dried), Product form (Flakes > Powder), Color (White > Red), and Certifications (Organic/Non-GMO).

- Pricing Strategy: Largely based on Cost-Plus pricing, heavily moderated by global commodity market indices and long-term supply contracts.

- Profit Margins: Typically narrow for high-volume commodity grades, significantly higher for specialty and certified products requiring advanced processing.

Regulatory Framework and Compliance

The Dehydrated Onion Market operates under a complex framework of international, national, and regional food safety regulations that dictate processing standards, permissible additive levels, and labeling requirements. In mature markets like the European Union (EU) and the United States (U.S.), regulations such as the Food Safety Modernization Act (FSMA) and the EU’s General Food Law require processors to implement preventative controls and ensure full traceability from farm to table. Compliance with these frameworks is non-negotiable for accessing major import markets and involves substantial investments in hazard analysis and critical control points (HACCP) protocols and sanitation programs.

A critical area of regulation involves the management of potential contaminants, including heavy metals, pesticide residues, and mycotoxins. Suppliers must provide extensive testing documentation to prove their products meet maximum residue limits (MRLs) set by importing nations. Furthermore, the use of fumigants and sterilization methods (such as steam sterilization or gamma irradiation, sometimes mandatory for microbial control) is strictly regulated, requiring specific permits and clear labeling. Non-compliance results in product detention, rejection, and significant reputational damage, making robust quality assurance a core business function.

Labeling standards are also evolving, driven by consumer demand for transparency and clean labels. Requirements related to allergen declarations (though onions are not a major allergen, cross-contamination is scrutinized), non-GMO status, and country of origin must be met accurately. For organic dehydrated onions, adherence to specific regional organic certification bodies (e.g., USDA Organic, EU Organic) requires separate auditing of the entire supply chain, from cultivation and harvest through final processing and packaging, creating a significant regulatory burden but opening access to premium consumer segments.

- Key Regulations: FSMA (U.S.), EU General Food Law, CODEX Alimentarius standards for spices and culinary herbs.

- Mandatory Certifications: HACCP, ISO 22000, FSSC 22000, or BRC Global Standards for food safety management.

- Critical Compliance Areas: Pesticide Maximum Residue Limits (MRLs), microbiological testing (pathogens and yeast/mold counts), and heavy metal content verification.

- Emerging Requirements: Enhanced traceability systems using blockchain technology and mandatory nutritional labeling for food service applications.

Market Opportunities and Future Outlook

The future outlook for the Dehydrated Onion Market is overwhelmingly positive, driven by persistent macroeconomic trends, including population growth, expanding middle-class consumption in emerging economies, and the continuous demand for convenience. One of the most significant opportunities lies in catering to the burgeoning demand for specialized and premium dehydrated onion products. This includes increasing the supply of certified organic, specific color (e.g., specialty pink or sweet white onion varieties), and highly concentrated freeze-dried forms required for high-end ready meals and sophisticated savory flavor houses globally.

Technological advancement presents another major avenue for growth. Investment in more energy-efficient drying systems, such as solar-assisted heat pump dryers or advanced vacuum microwave drying, will reduce operational costs, enhance sustainability credentials, and improve product quality consistency. Furthermore, integrating AI and IoT sensors into the processing line allows for dynamic optimization of drying parameters, leading to higher yields of quality product and reduced energy waste. Companies that pioneer these sustainable and efficient methodologies will capture substantial market share by appealing to environmentally conscious consumers and cost-sensitive industrial buyers simultaneously.

Geographic expansion, particularly penetrating high-growth emerging markets in Southeast Asia (e.g., Vietnam, Indonesia) and specific African nations experiencing rapid economic growth, offers substantial volume potential. These regions are increasingly adopting packaged food products, creating localized demand for raw ingredients. Establishing regional processing and distribution hubs minimizes logistical bottlenecks and time-to-market. The development of new applications, particularly in the pet food industry and functional food encapsulation where concentrated natural ingredients are valued, also represents a viable pathway for diversification and sustained revenue growth beyond traditional savory applications.

- Targeted Product Development: Expansion into organic, non-GMO, and specialized colored onion segments to capture higher margins in niche markets.

- Efficiency Gains: Implementing next-generation drying technologies to reduce energy costs by up to 40% and enhance flavor retention.

- New End-Use Markets: Exploration of nutraceuticals, health supplements, and premium pet food applications utilizing concentrated onion compounds.

- Supply Chain Digitalization: Adoption of blockchain for enhanced transparency and traceability, meeting the demands of global food safety regulators and sophisticated buyers.

The global dehydrated onion market is structurally sound and poised for sustained expansion. Key players are expected to focus heavily on vertical integration to stabilize raw material input and technological upgrades to comply with environmental and quality standards. Strategic alliances and acquisitions are anticipated as a means of market consolidation and rapid geographical penetration, ensuring that the market remains highly competitive and continuously evolving to meet the complex demands of the modern food industry.

The convergence of robust demand from the processed food industry, coupled with stringent quality requirements and a push toward sustainable processing, will define the market leaders over the forecast period. Companies prioritizing transparency, quality control, and energy efficiency are best positioned to leverage the growth opportunities presented by urbanization and the global appetite for diverse and convenient savory food products. The market's resilience, even amidst commodity price volatility, underscores the essential nature of dehydrated onions as a foundational global food ingredient.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager