Demolition services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432595 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Demolition services Market Size

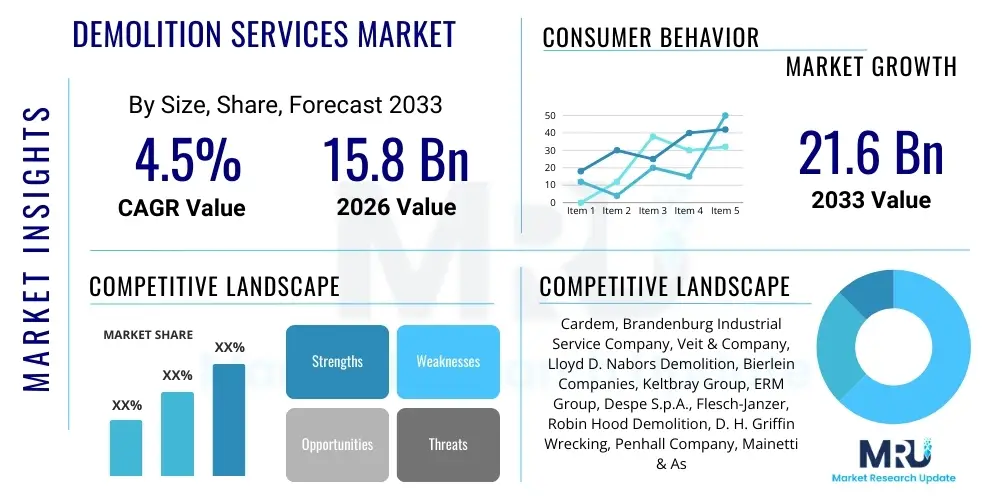

The Demolition services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 15.8 billion in 2026 and is projected to reach USD 21.6 billion by the end of the forecast period in 2033.

The expansion of the Demolition Services Market is fundamentally driven by accelerating urbanization globally, necessitating large-scale infrastructure renewal and redevelopment projects. Developed economies are focused on replacing aging structures, particularly in commercial and industrial sectors, while emerging economies are undergoing rapid construction cycles that often involve preliminary site clearing and preparation work, contributing significantly to market volume. Furthermore, stringent environmental regulations regarding material recycling and waste management necessitate professional demolition services capable of sustainable decommissioning, thereby increasing the value proposition of specialized firms.

Technological advancements, including the adoption of specialized robotic equipment, remote-controlled machinery, and advanced surveying techniques, are enhancing the efficiency and safety of demolition projects. These innovations allow firms to handle complex structures and hazardous environments with greater precision, mitigating risks associated with traditional methods. The increasing complexity of urban redevelopment projects, which often require selective or surgical demolition near operational structures, further reinforces the demand for high-skill, technology-driven service providers, supporting the forecasted steady growth rate.

Demolition services Market introduction

The Demolition Services Market encompasses the professional dismantling, razing, or removal of structures, ranging from residential buildings and commercial complexes to large-scale industrial facilities and infrastructure components like bridges and power plants. This essential service forms a critical component of the construction and urban renewal lifecycle, enabling subsequent redevelopment by preparing sites according to environmental and safety compliance standards. Market offerings include traditional total demolition, selective demolition (dismantling portions of a structure), deconstruction (manual dismantling for material salvage), and specialized services such as hazardous material abatement.

Major applications span across the entire built environment, including the decommissioning of obsolete industrial plants (e.g., chemical, manufacturing), the clearing of urban sites for mixed-use developments, and the removal of damaged or unstable infrastructure following natural disasters or structural failures. Key benefits derived from professional demolition services include improved site safety, regulatory compliance, efficient material recycling and waste diversion, and accelerated timelines for subsequent construction phases. Modern demolition emphasizes environmentally responsible practices, focusing heavily on minimizing landfill waste and maximizing the salvage rate of reusable materials like concrete, steel, and wood.

Driving factors propelling market expansion include favorable governmental policies promoting infrastructure modernization, particularly in transportation and utilities sectors, coupled with rising global awareness regarding sustainable construction practices. The continuous lifecycle of structures dictates that older buildings must eventually be replaced or repurposed, creating a perpetual demand stream for controlled, professional demolition expertise. Furthermore, the specialized knowledge required to safely handle potentially contaminated materials (e.g., asbestos, lead paint) ensures that demand remains concentrated among certified, experienced service providers, stabilizing the competitive landscape and driving market value.

Demolition services Market Executive Summary

The Demolition Services Market is currently experiencing robust growth, primarily fueled by global infrastructure rejuvenation cycles and stringent environmental mandates promoting recycling and material reuse. Key business trends indicate a shift towards highly specialized and selective demolition techniques, often requiring advanced robotics and precise laser-guided equipment to minimize disruption in densely populated urban areas. Mergers and acquisitions among regional specialized firms are becoming common as larger companies seek to consolidate technological expertise and expand geographic footprints, particularly into high-growth regions like the Asia Pacific where urbanization is proceeding rapidly.

Regionally, North America and Europe remain mature markets characterized by replacement demand for aging structures and high regulatory standards governing hazardous material removal. Conversely, the Asia Pacific region is expected to demonstrate the highest CAGR, driven by massive infrastructure spending in countries like India and China, alongside accelerated industrial site clearance activities. Latin America and MEA show potential, driven by oil and gas decommissioning projects and planned smart city developments, though market penetration is often constrained by local regulatory complexities and fragmented competition.

Segmentation trends highlight the increasing dominance of the Infrastructure segment, spurred by governmental investment in roads, bridges, and rail networks that require significant preliminary demolition work. The Service Type segment shows a notable rise in demand for Selective Demolition and Deconstruction, reflecting the industry's commitment to sustainability and preservation where complete structural removal is not necessary. Equipment utilization is also trending towards advanced, lower-emission machinery, particularly high-reach excavators and remote-controlled robots, optimizing safety and efficiency across all project scales.

AI Impact Analysis on Demolition services Market

Common user questions regarding the impact of Artificial Intelligence (AI) in the demolition sector revolve around project safety enhancement, efficiency in material sorting, and optimizing planning processes. Users are keen to understand how AI-powered computer vision can monitor job sites in real-time to detect safety hazards or structural instabilities before incidents occur. Another major thematic concern is the use of machine learning algorithms to accurately assess the structural integrity of buildings slated for demolition and predict the safest and most efficient collapse sequence. Expectations are high concerning AI's role in inventorying salvaged materials, using automated systems to grade, sort, and quantify reusable debris (like concrete and steel) much faster than manual methods, significantly improving sustainability metrics and reducing operational costs. The synthesis of these concerns points towards a strong industry expectation for AI to transform demolition from a high-risk, labor-intensive task into a highly controlled, predictive, and resource-efficient engineering process.

- AI-enhanced structural assessment: Utilizing machine learning models trained on structural data to predict instability points and optimize demolition strategy, minimizing unforeseen risks.

- Robotic process automation (RPA): Integrating AI for the autonomous or semi-autonomous operation of heavy machinery and specialized demolition robots, improving precision and reducing human exposure to hazardous environments.

- Safety monitoring via computer vision: Deploying AI algorithms to analyze real-time video feeds from job sites, detecting unsafe worker behavior, unauthorized entry, or potential structural collapses instantly.

- Optimized material sorting and recycling: Using AI-powered sensors and conveyor belt systems to rapidly categorize and sort demolition debris (steel, wood, concrete) for maximum salvage value and environmental compliance.

- Predictive maintenance for equipment: Applying machine learning to fleet management data to forecast equipment failure, reducing downtime and operational delays on critical projects.

- Enhanced project planning and scheduling: Leveraging AI to simulate various demolition scenarios, optimizing logistical requirements, explosive charges (in controlled demolition), and sequencing for rapid completion.

DRO & Impact Forces Of Demolition services Market

The Demolition Services Market is characterized by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively influenced by key Impact Forces that shape industry evolution. Primary drivers include global infrastructure replacement cycles, especially the need to decommission outdated power plants and manufacturing facilities, alongside increasing regulatory pressure in developed economies that mandates the safe removal of hazardous materials. However, growth is constrained by high upfront capital investment requirements for specialized equipment (e.g., high-reach excavators, remote robotics) and a persistent shortage of highly skilled labor capable of managing complex, highly technical demolition projects. Opportunities lie predominantly in technological adoption, particularly in drone-based surveying, AI-driven safety monitoring, and the growing lucrative market for deconstruction services focused on material salvage and reuse, aligning with global circular economy goals.

Impact forces currently shaping the market include rapidly evolving environmental regulations, which increase operational costs but simultaneously create new revenue streams through mandated recycling and disposal services. Technological advancements represent a significant force, driving efficiency and safety standards upwards, necessitating continuous investment in modern fleet management. Economically, global construction spending volatility and fluctuating commodity prices (especially steel scrap) directly influence project viability and material salvage returns. Societal impact forces emphasize minimizing neighborhood disruption (noise, dust, vibration), pushing service providers towards quieter, more controlled methods like hydro-demolition and remote operation.

The combination of these factors dictates strategic prioritization within the market. Firms must navigate the restraint of high investment costs by demonstrating clear return on investment through superior safety records and faster project completion times enabled by advanced technology. The underlying demand from aging infrastructure and urban renewal acts as a perpetual tailwind, ensuring sustained market activity, while the opportunity to capitalize on sustainable practices provides a competitive edge against less modernized competitors. Successful market players will be those who effectively integrate technology to mitigate risks and maximize resource recovery.

Segmentation Analysis

The Demolition Services Market is comprehensively segmented based on Service Type, End-Use, and Equipment utilized, providing a granular view of market dynamics and specialized demand areas. Service Type segmentation reflects the operational methodology employed, ranging from complete structural removal to precision interior dismantling. The End-Use analysis highlights the principal sectors driving demand, with varying regulatory and complexity requirements across residential, commercial, industrial, and infrastructure segments. Equipment segmentation details the technological tools necessary for execution, ranging from conventional heavy earthmoving machinery to highly specialized robotic systems designed for controlled, hazardous environments.

This structured segmentation allows market participants to identify niche opportunities, tailor their service offerings, and allocate capital efficiently towards specialized fleet acquisition or specific geographical regions experiencing concentrated demand in particular end-use sectors. For instance, high-volume industrial decommissioning requires different technological capabilities and certifications compared to urban selective demolition projects. Understanding the interplay between these segments is crucial for strategic business planning and forecasting future resource allocation in areas such as sustainability consulting and waste management integration, which are increasingly becoming integral to the overall service package.

- Service Type:

- Total Demolition

- Selective Demolition (Interior Demolition, Partial Structure Removal)

- Deconstruction (Manual Dismantling for Salvage)

- Implosion/Controlled Demolition

- End-Use:

- Residential

- Commercial (Office Buildings, Retail, Hospitality)

- Industrial (Manufacturing Plants, Power Generation, Chemical Facilities)

- Infrastructure (Bridges, Roads, Railways, Ports, Dams)

- Equipment:

- Excavators (High-Reach, Standard)

- Loaders and Dozers

- Specialty Demolition Equipment (Robots, Hydro-Demolition Systems)

- Cranes and Lifting Equipment

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Demolition services Market

The Demolition Services Value Chain begins with upstream activities involving the sourcing of specialized heavy machinery, protective gear, and advanced software for project planning and structural analysis. Key upstream suppliers include manufacturers of high-reach excavators, remote-controlled robots, and providers of advanced surveying and safety monitoring systems. The core value-addition stage involves the actual demolition execution, which requires specialized labor, adherence to strict safety protocols, environmental abatement services (handling asbestos/lead), and meticulous project management to ensure compliance and timely completion, representing the highest labor intensity in the chain.

The downstream segment of the value chain focuses heavily on waste management and material recovery. This includes sorting, crushing, and recycling construction and demolition (C&D) waste, such as concrete (for aggregate), steel, and wood. The profitability of demolition firms is increasingly tied to their efficiency in material salvage, as recovered commodities represent a significant revenue stream. Distribution channels for these recovered materials primarily involve direct sales to recycling facilities, aggregate producers, or secondary markets for repurposed building components, influencing overall project margins.

The market utilizes both direct and indirect distribution mechanisms. Direct channels are prevalent for large-scale industrial and infrastructure projects where service providers negotiate directly with government agencies or major industrial clients (owners). Indirect distribution occurs through general contractors (GCs) who subcontract specialized demolition tasks. The growing complexity of urban projects often necessitates highly specialized sub-contractors, reinforcing the importance of the direct relationship between specialized demolition firms and major construction consortia, ensuring specialized machinery and expertise are deployed optimally.

Demolition services Market Potential Customers

Potential customers for demolition services are broadly categorized into four major end-user groups, each driven by distinct needs and regulatory requirements. Governments and public sector entities constitute a critical customer base, driving demand through large-scale infrastructure projects, utility decommissioning (e.g., outdated dams, power grids), and urban renewal initiatives mandated by public policy. The infrastructure segment is characterized by complex, high-volume, and long-duration contracts requiring rigorous safety and environmental compliance standards, making established, large-scale service providers preferred partners.

The second key customer group comprises commercial real estate developers and property owners seeking site preparation for new commercial complexes, office towers, or residential subdivisions. These clients prioritize speed, minimal neighborhood disruption, and cost efficiency, often favoring selective demolition techniques that preserve surrounding structures. Industrial customers, including energy companies, manufacturers, and mining operations, represent a highly specialized niche, demanding decommissioning services for hazardous or structurally complex plants, prioritizing safety, environmental decontamination, and specialized expertise in controlled dismantling processes.

Finally, the residential sector, although often smaller in contract value, provides steady volume, driven by homeowner needs for removing condemned or heavily damaged structures, often requiring swift turnaround times and high sensitivity to neighborhood impact. Successful firms must maintain versatile operational capacity, addressing the detailed regulatory needs of industrial and governmental clients while maintaining cost-competitiveness and speed for the commercial and residential segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 billion |

| Market Forecast in 2033 | USD 21.6 billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cardem, Brandenburg Industrial Service Company, Veit & Company, Lloyd D. Nabors Demolition, Bierlein Companies, Keltbray Group, ERM Group, Despe S.p.A., Flesch-Janzer, Robin Hood Demolition, D. H. Griffin Wrecking, Penhall Company, Mainetti & Associates, P. W. Gillibrand Co., LTD, Controlled Demolition Inc., Dem-Tech, Mclaughlin & Harvey, Nippon Salvage Co. Ltd., North American Dismantling Corp., Nuvia Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Demolition services Market Key Technology Landscape

The technological landscape of the Demolition Services Market is rapidly evolving, shifting from traditional, highly manual processes to precision engineering enabled by digital and robotic tools. Key technologies include the use of Unmanned Aerial Vehicles (UAVs) or drones for pre-demolition site mapping, structural assessment, and progress monitoring. Drones equipped with LiDAR and photogrammetry capabilities generate high-resolution 3D models of structures, enabling engineers to calculate volumes accurately and plan precise cuts or controlled collapses, thereby minimizing risk and improving material quantity estimates. This pre-planning technology is essential for AEO optimization, providing specific, data-backed methods for safe operation.

Advanced heavy equipment forms the backbone of execution technology, specifically high-reach excavators equipped with remote monitoring and advanced hydraulic attachments, such as specialized shears and crushers that can process concrete and steel quickly and quietly. Furthermore, the integration of remote-controlled demolition robots is transforming the handling of structures containing hazardous materials or those requiring selective removal in confined, inaccessible spaces. These robots reduce human exposure to danger, improve efficiency, and operate with surgical precision, which is crucial for urban projects where collateral damage must be strictly avoided, aligning with strict environmental and safety regulations.

The future of demolition technology centers on enhanced data utilization. Building Information Modeling (BIM) data, when available, is being integrated into demolition planning to understand a structure’s internal composition, facilitating 'deconstruction' rather than destruction. Furthermore, specialized hydro-demolition systems utilize ultra-high-pressure water jets to remove concrete without causing vibrations, essential for sensitive structural repairs or partial removal near operational facilities. These technological advancements collectively drive the market towards safer, faster, and significantly more sustainable project outcomes, directly influencing customer preference and competitive advantage.

Regional Highlights

- North America: North America represents a mature and technologically advanced market, dominating market share due to continuous investment in infrastructure replacement and stringent environmental regulations. The region, particularly the United States, sees high demand for selective demolition and deconstruction services in dense urban centers (New York, Chicago, Toronto), driven by commercial redevelopment and refurbishment projects. The presence of major key players and a high adoption rate of remote-controlled machinery and safety technology solidify its leading position. Regulatory compliance regarding asbestos and lead abatement mandates professional, high-cost services, contributing significantly to market value.

- Europe: Europe is characterized by a strong focus on sustainability and the circular economy, leading to exceptionally high demand for deconstruction services and material recycling. Countries like Germany, the UK, and France are heavily investing in decommissioning old coal and nuclear power plants, driving the industrial segment. Strict EU directives on waste management push recovery rates significantly higher than global averages, making material salvage a critical component of service providers' profitability. The market here emphasizes low-vibration, low-noise techniques suitable for historically significant and densely packed urban environments.

- Asia Pacific (APAC): APAC is the fastest-growing market, projected to exhibit the highest CAGR due to rapid urbanization, massive infrastructure development, and industrial expansion in countries such as China, India, and Southeast Asian nations. The primary drivers are greenfield industrial site preparation and the clearing of large areas for new commercial and residential developments. While safety standards are rapidly improving, the market is characterized by high volume total demolition projects. Increased foreign direct investment is introducing advanced technology and higher safety standards to regional players, professionalizing the local industry landscape.

- Latin America (LATAM): The LATAM market growth is steady, primarily driven by mining, oil and gas decommissioning projects, and scattered urban renewal initiatives in major metropolitan areas like São Paulo and Mexico City. Market fragmentation and economic volatility often limit the widespread adoption of high-cost advanced robotics, although there is a growing trend towards professionalization and better environmental compliance, often spurred by international contractual requirements.

- Middle East & Africa (MEA): The MEA region is segmented, with the Middle Eastern countries showing strong growth due to large-scale infrastructure overhauls (e.g., Saudi Vision 2030, UAE development projects) and the need to decommission legacy oil and gas structures. Africa's market remains largely nascent, driven by localized mining and small-scale commercial site clearing, though significant investment in regional infrastructure projects presents a substantial long-term opportunity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Demolition services Market.- Cardem

- Brandenburg Industrial Service Company

- Veit & Company

- Lloyd D. Nabors Demolition

- Bierlein Companies

- Keltbray Group

- ERM Group

- Despe S.p.A.

- Flesch-Janzer

- Robin Hood Demolition

- D. H. Griffin Wrecking

- Penhall Company

- Mainetti & Associates

- P. W. Gillibrand Co., LTD

- Controlled Demolition Inc.

- Dem-Tech

- Mclaughlin & Harvey

- Nippon Salvage Co. Ltd.

- North American Dismantling Corp.

- Nuvia Group

Frequently Asked Questions

Analyze common user questions about the Demolition services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers of growth in the Demolition Services Market?

The market is primarily driven by global infrastructure modernization cycles, mandatory urban renewal projects replacing aging structures, and increasingly strict environmental regulations requiring professional hazardous material abatement and high rates of material recycling (deconstruction).

How does technological innovation impact demolition safety and efficiency?

Technology, including remote-controlled robots, high-reach excavators, and drone-based structural mapping (LiDAR), significantly enhances safety by reducing human exposure to risks, while improving efficiency through precise planning and faster, controlled dismantling techniques essential for complex, urban projects.

Which segment holds the largest share of the Demolition Services Market?

The Infrastructure End-Use segment, encompassing bridges, roads, and utilities, typically holds a dominant market share due to large-scale governmental investment globally in maintaining, replacing, or expanding public works and transportation networks.

What is 'Deconstruction' and why is it growing in importance?

Deconstruction is the systematic dismantling of a structure, often manually, with the explicit aim of salvaging materials for reuse or high-grade recycling. It is growing rapidly because it aligns with circular economy goals, minimizes landfill waste, and offers a profitable revenue stream through material recovery, driven by increasing sustainability mandates.

How does AI contribute to sustainable demolition practices?

AI significantly contributes to sustainability by optimizing waste separation processes. AI-powered computer vision systems rapidly identify, sort, and categorize different debris materials (steel, concrete, wood) on-site, maximizing the amount of material recovered and diverted from landfills, ensuring better resource efficiency.

What is the significance of the Asia Pacific region in the demolition market forecast?

The Asia Pacific region is forecast to exhibit the highest CAGR, primarily driven by unprecedented rates of urbanization and massive government investments in constructing new cities, industrial zones, and supporting infrastructure, leading to high-volume demand for site clearance and total demolition services.

What challenges do specialized demolition firms face regarding workforce?

Specialized demolition firms frequently face challenges related to a shortage of highly skilled labor proficient in operating advanced remote robotics, managing complex explosive sequences, and adhering to strict international hazardous material abatement protocols, requiring continuous investment in specialized training and certification programs.

Are specialty demolition methods like hydro-demolition becoming more common?

Yes, specialty methods like hydro-demolition, which uses high-pressure water jets to remove concrete without vibration, are becoming increasingly common, particularly in sensitive projects requiring selective removal or concrete repair near operational facilities where structural integrity of the surrounding components must be maintained.

How do volatile commodity prices affect the demolition industry?

Volatile commodity prices, particularly for salvaged materials like steel scrap, directly impact the profitability of demolition projects. Higher prices increase the value of deconstruction and recycling efforts, whereas low prices can reduce the incentive for meticulous material recovery, influencing overall project economic models.

What role does BIM (Building Information Modeling) play in modern demolition planning?

BIM data, when available, provides detailed digital insights into a building's structure, materials, and internal components. Demolition professionals utilize this data for precise planning, optimizing material recovery sequences, estimating removal volumes accurately, and ensuring controlled, predictable structural failure, minimizing unexpected risks.

What is the primary difference between Total Demolition and Selective Demolition services?

Total Demolition involves the complete removal of an entire structure down to the ground level or foundation. Selective Demolition involves the removal of only specific parts or interior components of a structure, often to facilitate renovation, preservation, or structural modification while keeping the primary building envelope intact.

In the Demolition Value Chain, where is the most significant opportunity for margin improvement?

The most significant opportunity for margin improvement lies in the downstream segment, specifically through efficient material recovery and recycling. Maximizing the salvage rate of high-value materials (e.g., specialized steel, non-ferrous metals) and effectively marketing recycled aggregate reduces waste disposal costs and generates auxiliary revenue streams.

How do safety regulations influence the cost structure of demolition contracts?

Stringent governmental and occupational safety regulations (e.g., OSHA requirements) necessitate significant investment in specialized safety equipment, regular training, site monitoring technology, and robust insurance coverage. These requirements increase the operational cost structure but are mandatory for securing high-value industrial and governmental contracts.

What is the market outlook for industrial decommissioning services?

The market outlook for industrial decommissioning is strong, driven by the global transition away from fossil fuels, leading to the necessary closure and dismantling of old coal power plants, manufacturing facilities, and chemical processing sites, requiring highly specialized, environmentally controlled demolition and remediation services.

What is the primary application of high-reach excavators in the demolition sector?

High-reach excavators are primarily used for safely demolishing tall structures (over seven stories) in urban environments. They allow operators to dismantle buildings from the ground level, maintaining a safe distance and using specialized hydraulic tools for precise, systematic dismantling, reducing the need for costly and complex crane work.

Which geographical market exhibits the most stringent environmental compliance requirements?

Europe, particularly Western Europe, exhibits the most stringent environmental compliance requirements, driven by European Union directives emphasizing cradle-to-grave material traceability, high mandatory recycling quotas for C&D waste, and strict limitations on noise and dust pollution during project execution.

What are the key components of an upstream analysis in the Demolition Services Value Chain?

Upstream analysis involves examining suppliers of essential inputs, including heavy equipment manufacturers, providers of specialized robotic systems and attachments, suppliers of advanced safety and surveying software, and specialized insurance/risk management providers crucial for initial project setup and execution capacity.

How does the fragmentation of the Demolition Services Market affect pricing?

The market is characterized by a few large, highly specialized global players and numerous smaller, regional firms. This fragmentation leads to competitive pricing for smaller, standard projects, while highly complex industrial or controlled implosion projects command premium pricing due to the required specific expertise and high capital investment of the leading firms.

What role do public-private partnerships (PPPs) play in driving demolition demand?

PPPs are crucial, particularly in the infrastructure and urban development segments. They mobilize private capital for large-scale public projects, such as freeway extensions or urban revitalization zones, which often necessitate extensive preparatory demolition work (e.g., clearing rights-of-way, removing obsolete structures), thereby securing major long-term contracts for the industry.

Beyond safety, how do remote-controlled robots benefit demolition firms?

Beyond enhancing safety, remote-controlled robots allow firms to operate in conditions too hazardous or confined for human workers, increasing operational hours, improving precision in selective removal, and accelerating project timelines by enabling continuous work cycles in challenging environments, ultimately improving overall productivity metrics.

What impact does urbanization have on the type of demolition services demanded?

Urbanization increases the demand for selective and controlled demolition (rather than total implosion) to manage noise, dust, and vibration impacts on nearby residential and commercial properties. It drives the adoption of quieter, precision techniques, often involving high-reach machinery and specialized internal dismantling.

How is the industrial segment defined in terms of demolition projects?

The industrial segment includes highly complex, often hazardous, projects such as the decommissioning of former manufacturing plants, chemical processing facilities, oil refineries, and large-scale power generation stations (e.g., nuclear or thermal). These projects typically involve hazardous material abatement and require specialized engineering expertise.

What is the current trend regarding fleet management and equipment utilization in the market?

The current trend is towards intelligent, low-emission, and multi-functional equipment. Firms are utilizing telematics and GPS tracking for enhanced fleet management to maximize utilization rates, track maintenance schedules predictively, and ensure regulatory compliance regarding emission standards, especially in regulated markets like Europe and North America.

How do insurers view the integration of AI safety systems in demolition operations?

Insurers view the integration of AI-powered safety systems favorably, as these technologies significantly reduce catastrophic risk by providing real-time hazard detection and predictive failure analysis. This can potentially lead to lower liability premiums for firms demonstrating verifiable, robust safety metrics through technological adoption.

What constitutes a major restraint on market growth in emerging economies?

Major restraints in emerging economies include economic instability, a less developed regulatory framework for C&D waste management, and limited access to the high-cost, specialized heavy machinery required for advanced, environmentally compliant demolition, often resulting in fragmented, low-technology local competition.

What are the typical end-users for recovered aggregate materials from demolition sites?

Recovered concrete aggregate is typically sold to construction companies for use in road bases, foundations, and non-structural concrete mixes, forming a sustainable, cost-effective alternative to virgin aggregates and reducing the overall environmental footprint of new construction projects.

How is controlled implosion distinct from other total demolition techniques?

Controlled implosion is a highly specialized total demolition technique that uses precisely placed explosive charges to cause the structure to collapse inward upon itself, minimizing the debris field. It requires detailed engineering calculations and highly restricted licenses, generally reserved for large, isolated structures where collateral damage risk is minimal.

What is the strategic importance of specializing in hazardous material abatement (e.g., asbestos)?

Specializing in hazardous material abatement is strategically important because it is a mandatory preliminary requirement for nearly all older industrial and commercial demolition projects globally. This specialization ensures compliance, mitigates extreme liability risks, and secures access to high-value contracts often restricted to certified, expert service providers.

In the context of GEO, what information must be highly visible in market reports?

For Generative Engine Optimization (GEO), highly visible information includes specific market size figures (in USD), growth rates (CAGR), clear segmentation breakdowns, specific regional growth narratives (e.g., APAC is fastest growing), and a comprehensive list of key industry players, ensuring the report addresses high-intent, analytical queries directly.

How do advancements in material science affect the longevity of demolition demand?

While advancements in material science can extend the lifespan of new structures, thereby potentially slowing future replacement demand, the sheer volume of aging infrastructure built before modern standards guarantees sustained short-to-medium-term demolition demand, requiring safer, more complex removal methods for obsolete materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager