Denatonium Benzoate Anhydrous Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433487 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Denatonium Benzoate Anhydrous Market Size

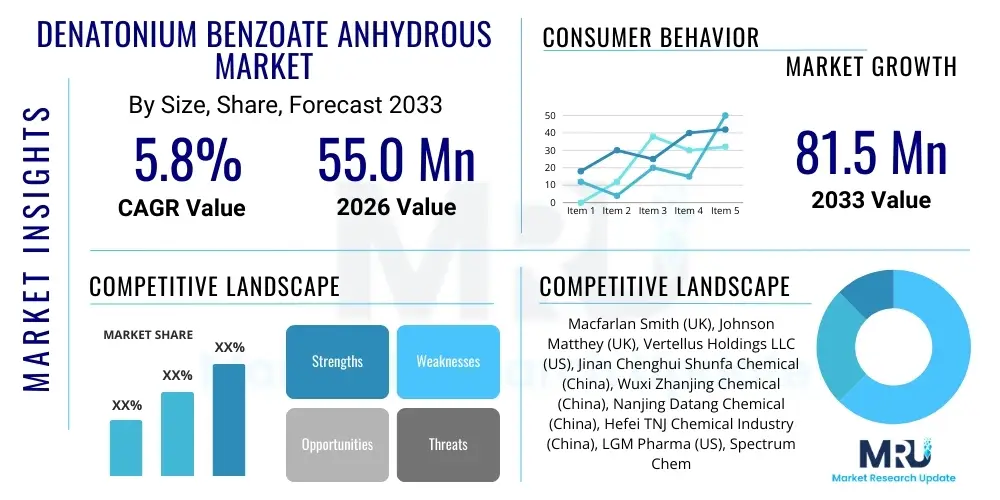

The Denatonium Benzoate Anhydrous Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $55.0 million in 2026 and is projected to reach $81.5 million by the end of the forecast period in 2033.

Denatonium Benzoate Anhydrous Market introduction

Denatonium Benzoate Anhydrous (DBA), widely recognized under its trade name Bitrex, is the most intensely bitter chemical compound known to science, typically used as an aversive agent. Its primary function is to prevent accidental ingestion of toxic or hazardous substances, driven primarily by stringent global safety and public health regulations. The compound acts as a crucial safety feature when incorporated into products such as household cleaners, antifreeze, specialized industrial solvents, and personal care items, making them unpalatable immediately upon contact with the mouth.

The market expansion for DBA is intrinsically linked to rising governmental mandates and consumer advocacy focused on child safety and accidental poisoning prevention. Regulatory bodies in key economic regions, including the U.S. Consumer Product Safety Commission (CPSC) and European Union agencies, increasingly recommend or require the inclusion of a bittering agent in specific formulations, such as methanol-based screen wash and potentially dangerous liquid detergents. This regulatory environment creates a baseline demand that drives consistent market growth.

Major applications span diverse industrial sectors, including the formulation of denatured alcohol (to prevent beverage consumption), the creation of nail-biting deterrents (in personal care), and its use in automotive products like antifreeze and brake fluid. Beyond regulatory drivers, the market benefits from manufacturers adopting DBA proactively to enhance brand reputation regarding safety and liability mitigation, positioning the chemical as an essential ingredient in consumer-safe product design across global supply chains. The anhydrous form ensures stability and ease of integration into diverse chemical matrices.

Denatonium Benzoate Anhydrous Market Executive Summary

The Denatonium Benzoate Anhydrous market is experiencing robust growth fueled primarily by evolving global legislative standards concerning chemical safety, particularly in household and automotive segments. A key business trend involves the increased adoption of ultra-pure DBA grades, demanded by pharmaceutical and cosmetic applications where minimal impurity is critical, creating a premium segment within the market. Furthermore, manufacturers are focusing on securing resilient supply chains, often diversifying sourcing across multiple specialized chemical producers, predominantly located in Asia Pacific, to mitigate geopolitical and logistical risks inherent in niche chemical markets.

Regionally, North America and Europe maintain dominance in terms of value, largely due to established, mature regulatory frameworks that mandate the use of bittering agents in high-risk consumer products. However, the Asia Pacific region is rapidly emerging as the primary growth engine, not only dominating the manufacturing landscape but also witnessing a surge in domestic demand as local governments in countries like China and India implement stricter consumer safety standards, mirroring Western regulatory approaches. This shift is driving significant investment in high-capacity, specialized manufacturing facilities across APAC.

In terms of segment trends, the Application segment focusing on Household Products and Detergents remains the largest consumer segment, benefiting from regulatory pushes for bittering agents in liquid laundry pods and specialized cleaning agents. Concurrently, the Form segment highlights a steady preference for the powder form due to its shelf stability and high concentration, making it easy to handle and dose precisely in large-scale industrial chemical blending operations. The market structure, while specialized, is seeing moderate consolidation as major chemical companies integrate DBA production into their specialty chemical portfolios to offer comprehensive additive solutions to FMCG and industrial clients.

AI Impact Analysis on Denatonium Benzoate Anhydrous Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Denatonium Benzoate Anhydrous market frequently center on three critical areas: optimization of complex synthesis processes, enhancement of quality assurance standards, and prediction of future regulatory landscapes. Users are keen to understand how AI can reduce the high cost associated with producing this highly specialized compound and ensure the extreme purity required for applications in pharmaceuticals and high-end cosmetics. There is a strong expectation that machine learning models will be utilized to analyze vast datasets relating to chemical reactions, optimizing yield and reducing waste in the multi-stage DBA synthesis process, thereby addressing supply chain efficiency and cost concerns.

Furthermore, AI-driven analytical tools, particularly in chemometrics and spectroscopy, are anticipated to revolutionize quality control. Traditional methods for purity assessment are rigorous but time-consuming; AI algorithms can rapidly interpret complex spectroscopic data (like high-resolution mass spectrometry or NMR) to detect minute impurities, ensuring compliance with the stringent requirements of key end-user sectors, ultimately lowering rejection rates and improving product consistency. Users also expect predictive AI modeling to forecast regulatory shifts in various geographies, allowing manufacturers and end-users (such as FMCG companies) to proactively adjust formulations and inventory levels well before new safety mandates come into effect, thereby minimizing market disruption.

The long-term impact of AI involves accelerating the R&D process for new denaturing or bittering formulations. While Denatonium Benzoate remains the gold standard due to its unmatched bitterness, AI can help researchers quickly screen thousands of potential additive combinations for stability, interaction with base chemicals, and optimal dispersal characteristics within various product matrices (e.g., highly viscous fluids vs. low-viscosity solvents). This capability ensures that DBA integration remains seamless and cost-effective across a continually diversifying range of consumer and industrial products, cementing its market position.

- AI optimizes complex DBA synthesis pathways, predicting optimal reaction conditions (temperature, pressure, catalyst load) to maximize yield and minimize energy consumption.

- Machine learning algorithms enhance quality control by performing rapid, sophisticated analysis of purity using spectroscopic data, immediately flagging contaminants.

- Predictive modeling utilizes regulatory history and public health data to forecast upcoming mandatory bittering laws in emerging markets, aiding strategic inventory planning.

- AI-driven supply chain management improves logistics efficiency, reducing lead times and ensuring the timely delivery of specialized DBA grades to global formulators.

- Robotics and automation, powered by AI, are increasingly integrated into handling and packaging highly potent and regulated chemical substances, improving worker safety and precision.

DRO & Impact Forces Of Denatonium Benzoate Anhydrous Market

The Denatonium Benzoate Anhydrous market dynamics are fundamentally shaped by strong regulatory imperatives (Drivers), the complexity and cost associated with its manufacture (Restraints), and the penetration into novel, high-growth industrial sectors (Opportunities). The most potent driving force is the global commitment to public safety, especially for children, codified through legislation in North America and Europe that mandates the inclusion of aversive agents in substances commonly linked to accidental poisoning, such as antifreeze, certain fuels, and concentrated liquid detergents. This legislative environment provides a non-cyclical, sustained demand floor for DBA.

However, the market faces significant restraints. DBA is a relatively high-cost specialty chemical, and its multi-step, complex synthesis process requires highly specialized equipment and strict quality control measures, which elevates the final price compared to other bulk chemical additives. Furthermore, while Denatonium Benzoate is unparalleled in its extreme bitterness, continuous research into lower-cost, equally effective bittering agents, driven by consumer goods manufacturers seeking cost efficiencies, represents a potential, albeit long-term, threat. Supply chain fragility, inherent in highly specialized chemical markets dominated by a few key producers, also poses a continuous operational risk.

Despite these challenges, significant opportunities exist, particularly in leveraging the expanding global markets. As developing nations, especially in Asia and Latin America, align their consumer safety standards with international norms, the mandate for bittering agents will rapidly expand beyond traditional applications. Furthermore, the rise of specialized solvents in new technologies, such as advanced heat transfer fluids in electric vehicle battery cooling systems and next-generation biofuels, provides untapped application niches where safety mandates regarding accidental ingestion are likely to be established early, providing a fresh avenue for market penetration and sustained revenue growth over the forecast period.

Segmentation Analysis

The Denatonium Benzoate Anhydrous market is structurally segmented based on crucial parameters, including purity grade, primary application, and physical form, each reflecting the diverse needs of end-user industries. Segmentation by purity is essential as regulatory requirements vary dramatically; for instance, cosmetic and pharmaceutical uses demand ultra-high purity (>99.5%), while industrial or fuel denaturing applications can utilize standard grades. This differentiation impacts pricing and manufacturing complexity across the supply chain, segmenting the market into premium and commodity tiers.

The segmentation by application is the most impactful driver of volume and regulatory compliance, with household products and industrial alcohols consuming the largest quantities due to widespread denaturing mandates. The growing segment of automotive products, especially in developed markets where consumer protection laws are strict regarding fluids like antifreeze and windshield washer fluid, represents a steady, high-value consumer base. Analyzing these segments provides strategic insights into which regulatory changes will have the most profound immediate market impact.

Segmentation by form (powder vs. granular) caters to logistical and formulation needs. Powdered DBA offers maximum surface area and concentration, preferred for large-scale, high-precision mixing in chemical manufacturing. Granular forms may be utilized where dust minimization is a priority or for specific blending processes in smaller-scale operations. Understanding these segment dynamics is crucial for manufacturers to tailor their product offerings and optimize distribution channels effectively.

- Purity Grade

- Standard Grade (99.0% Purity)

- High Purity Grade (99.5% Purity)

- Ultra-High Purity Grade (>99.5% Purity, often for Pharma/Cosmetics)

- Application

- Household Products (Detergents, Cleaners, Polishes)

- Industrial Alcohols (Denatured Ethanol, Methanol)

- Automotive Products (Antifreeze, Brake Fluid, Screen Wash)

- Cosmetics and Personal Care (Nail-biting deterrents, Specialized Sprays)

- Pet and Pest Control Products (Repellents, Deterrents)

- Others (Specialty Solvents, Lubricants)

- Form

- Powder

- Granular/Crystalline

Value Chain Analysis For Denatonium Benzoate Anhydrous Market

The value chain for Denatonium Benzoate Anhydrous begins with the sourcing of specialized upstream raw materials, primarily halogenated benzoic acid derivatives and related intermediates, which are themselves sourced from petrochemical complexes. This upstream phase requires specialized chemical handling due to the nature of the reactants. The core manufacturing process involves complex, multi-step synthesis and purification (Quaternization reactions are critical), which demands high capital investment in reactors, specialized distillation, and crystallization equipment to achieve the stringent purity levels required by the market, particularly the anhydrous form which necessitates careful drying processes.

Following synthesis, the product moves to the distribution channel, which is highly specialized. Due to the classified nature of DBA as a regulated chemical additive, distribution is often handled by specialized chemical distributors and agents rather than general commodity chemical wholesalers. These direct and indirect channels must adhere to strict handling, storage, and transport protocols. Direct sales often occur between large, captive manufacturers (primarily in China and Europe) and major FMCG companies or large industrial alcohol producers who purchase in metric-ton volumes for continuous production processes.

Downstream analysis highlights that the immediate buyers are chemical formulators who integrate DBA into their final products, which include major consumer goods conglomerates, automotive fluid manufacturers, and pharmaceutical companies. The final stage involves the sale of the formulated product (e.g., windshield wash, detergent pod, or anti-nail-biting solution) to the end consumer. Given that DBA usage is often regulatory mandated, the downstream demand is highly inelastic and driven by legislative changes rather than typical consumer market dynamics, making the entire chain focused on purity, compliance, and reliable supply.

Denatonium Benzoate Anhydrous Market Potential Customers

Potential customers for Denatonium Benzoate Anhydrous are predominantly large-scale industrial buyers who require chemical additives for safety and regulatory compliance across diverse product lines. The primary end-user segment includes multinational Fast-Moving Consumer Goods (FMCG) corporations that manufacture household cleaning products, notably liquid detergents, laundry pods, and concentrated surface cleaners. These companies integrate DBA to comply with child safety packaging and formulation standards globally, making them the largest volume purchasers.

Another significant customer base includes specialized chemical formulators in the automotive sector, focusing on antifreeze, engine coolants, and screen wash fluids. Since these products often contain toxic glycols (ethylene glycol), regulatory bodies mandate the inclusion of bittering agents. Furthermore, industrial alcohol producers and distributors constitute a foundational customer segment, utilizing DBA for the denaturation of ethanol and methanol, preventing their diversion and consumption as beverages, a critical process regulated by government excise departments worldwide.

Emerging segments include cosmetic and pharmaceutical manufacturers, although they demand smaller volumes, they require the ultra-high-purity grades, commanding premium pricing. These buyers use DBA in products like medicated sprays, topical pain relievers (where ingestion risk exists), and specialized cosmetic applications. Ultimately, the market is defined by institutional purchasers driven by adherence to CPSC, REACH, and other regional safety and toxicity regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.0 million |

| Market Forecast in 2033 | $81.5 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Macfarlan Smith (UK), Johnson Matthey (UK), Vertellus Holdings LLC (US), Jinan Chenghui Shunfa Chemical (China), Wuxi Zhanjing Chemical (China), Nanjing Datang Chemical (China), Hefei TNJ Chemical Industry (China), LGM Pharma (US), Spectrum Chemical (US), TCI Chemicals (India), Tokyo Chemical Industry Co., Ltd. (Japan), Santa Cruz Biotechnology (US), Cayman Chemical (US), Thermo Fisher Scientific (US), Avantor (US) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Denatonium Benzoate Anhydrous Market Key Technology Landscape

The core technology landscape in the Denatonium Benzoate Anhydrous market revolves less around radical product innovation and more around process optimization, purification efficiency, and analytical precision. Since DBA is a specialized quaternary ammonium salt, its synthesis requires stringent control over multi-stage chemical reactions, often involving proprietary catalysts and precise temperature management to ensure high yield and minimize side-product formation. Manufacturers are increasingly utilizing continuous flow chemistry techniques, moving away from traditional batch processing, to improve scalability, reduce variability, and enhance the overall safety profile of the manufacturing environment, which is critical when dealing with complex organic synthesis.

A major technological focus is on purification, specifically achieving the anhydrous form while ensuring ultra-low levels of residual solvents and reaction intermediates. This involves advanced crystallization and drying technologies, such as vacuum drying and fluid-bed drying, optimized by sophisticated process analytical technology (PAT) to monitor moisture content and crystal structure in real-time. This technological effort is crucial for satisfying the demand from the high-value cosmetic and pharmaceutical segments where regulatory approval hinges on exceptionally high purity standards and lot-to-lot consistency, making traditional purification methods often insufficient.

Furthermore, analytical technology plays a non-negotiable role. High-performance liquid chromatography (HPLC), Nuclear Magnetic Resonance (NMR) spectroscopy, and high-resolution mass spectrometry are standard tools used not only for final product verification but also for intermediate checks throughout the synthesis pathway. Investment in AI-enhanced analytical software, as previously mentioned, is becoming a key technological differentiator, allowing leading manufacturers to offer faster Certificates of Analysis (CoA) and guarantee superior quality assurance compared to smaller, less technologically advanced competitors who rely on slower, manual testing protocols. This combination of advanced synthesis and superior analytics defines the competitive edge in the DBA market.

Regional Highlights

The regional dynamics of the Denatonium Benzoate Anhydrous market reflect a strong correlation between economic maturity, established regulatory regimes, and market consumption value.

- North America (NA): Holds a significant share of the market value, driven by highly enforced regulations from bodies like the CPSC, particularly regarding antifreeze (containing ethylene glycol) and other household poisons. The U.S. and Canada are mature consumers, and demand is stable, focusing heavily on ultra-high purity grades for specialty applications and strict compliance across the automotive and consumer goods sectors.

- Europe: Represents the largest segment by value due to comprehensive legislative frameworks such as REACH and specific EU directives mandating the use of bittering agents in denatured alcohol and certain automotive fluids. Germany, the UK, and France are major consumption centers. European manufacturers emphasize high sustainability standards and often pioneer technologies for cleaner synthesis processes.

- Asia Pacific (APAC): Dominates the global manufacturing capacity for DBA, with China being the central hub for synthesis and export. This region is also transitioning from being purely a supply region to a major consumption region. Rapid economic development, coupled with increasing public awareness and governmental imposition of new safety laws (e.g., child-safe packaging initiatives in populous countries), is driving exponential domestic demand growth.

- Latin America (LATAM): Characterized by moderate consumption rates, primarily concentrated in larger economies like Brazil and Mexico. Market growth is accelerating as regulatory environments mature and multinational FMCG companies standardize their product formulations across regional boundaries, pulling in demand for DBA.

- Middle East and Africa (MEA): Currently the smallest market segment. Demand is concentrated in industrial applications (e.g., denaturing imported alcohols) and in highly regulated sectors within the GCC nations. Future growth is tied to infrastructure spending and the adoption of international safety standards in consumer products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Denatonium Benzoate Anhydrous Market.- Macfarlan Smith (UK)

- Johnson Matthey (UK)

- Vertellus Holdings LLC (US)

- Jinan Chenghui Shunfa Chemical (China)

- Wuxi Zhanjing Chemical (China)

- Nanjing Datang Chemical (China)

- Hefei TNJ Chemical Industry (China)

- LGM Pharma (US)

- Spectrum Chemical (US)

- TCI Chemicals (India)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- Santa Cruz Biotechnology (US)

- Cayman Chemical (US)

- Thermo Fisher Scientific (US)

- Avantor (US)

- AK Scientific (US)

- Alfa Aesar (US)

- VWR International (US)

- A&C Catalysts (Canada)

- Finetech Industry Limited (China)

Frequently Asked Questions

Analyze common user questions about the Denatonium Benzoate Anhydrous market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Denatonium Benzoate Anhydrous used for?

DBA is primarily used as the world's most bitter compound to prevent accidental ingestion of toxic substances like antifreeze, industrial alcohols, and household cleaners, mandated by global safety regulations for consumer protection.

Why is Denatonium Benzoate considered a high-cost additive?

The compound is high-cost due to its complex, multi-stage chemical synthesis process, the necessity for high-purity specialized intermediates, and the stringent quality control measures required to meet regulatory standards for zero-tolerance consumer safety products.

Which regions drive the demand for DBA?

North America and Europe are the largest consumption markets by value, driven by highly enforced child safety regulations; however, the Asia Pacific region is rapidly growing, dominating global production and expanding its domestic consumption due to emerging safety mandates.

Are there substitutes for Denatonium Benzoate?

While some less bitter substitutes exist, Denatonium Benzoate Anhydrous remains the industry standard due to its unparalleled, extreme bitterness and proven efficacy, making regulatory bodies hesitant to approve alternatives unless they demonstrate equal safety effectiveness.

How does the purity grade affect market segments?

High and Ultra-High Purity grades (>99.5%) command premium pricing and are required for highly regulated sectors such as cosmetics and pharmaceuticals, while Standard Grade (99.0%) is widely adopted by industrial alcohol and household product manufacturers for compliance purposes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager