Denatured Alcohol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432309 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Denatured Alcohol Market Size

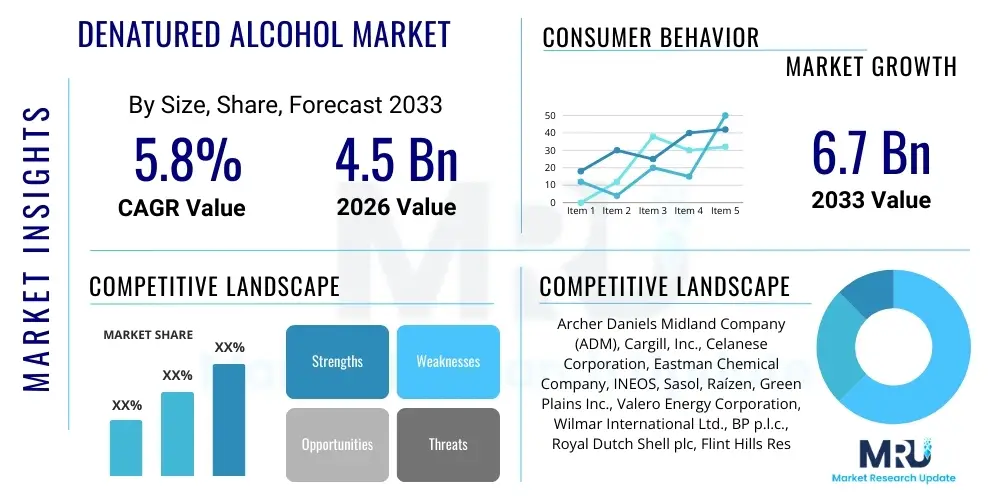

The Denatured Alcohol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Denatured Alcohol Market introduction

Denatured alcohol, fundamentally ethanol rendered unfit for human consumption through the addition of specialized denaturants, serves as a crucial intermediate chemical widely utilized across diverse industrial and consumer sectors. The primary function of denaturing is to exempt the product from hefty excise taxes levied on potable spirits, making it an economically viable and essential industrial solvent, cleaning agent, and fuel source. This chemical modification, which does not alter the core chemical properties pertinent to industrial applications, enables its use in large-scale manufacturing processes, promoting cost efficiency and broad market accessibility. Key types of denatured alcohol include completely denatured alcohol (CDA) and specially denatured alcohol (SDA), with the choice of denaturant being tailored precisely to the intended end-use application to prevent interference with the final product’s integrity, especially in sensitive areas like pharmaceuticals and cosmetics.

Major applications for denatured alcohol span chemical synthesis, industrial cleaning, fuel blending, and personal care formulations. In the solvent sector, it is invaluable for manufacturing varnishes, lacquers, and specialized paints due to its excellent solvency power and relatively low toxicity compared to other hydrocarbon solvents. As a fuel, particularly in the form of bioethanol, denatured alcohol is increasingly blended with gasoline to meet stringent environmental regulations concerning greenhouse gas emissions, positioning it as a pivotal component in the transition towards sustainable energy sources. Furthermore, its antiseptic properties make it indispensable in the healthcare and sanitation industries, serving as a foundational ingredient in disinfectants, hand sanitizers, and medical preparations, bolstering its consistent demand, especially in post-pandemic regulatory environments.

The market growth is primarily driven by the escalating demand from the cosmetics and personal care industry, which relies on denatured alcohol as a carrier, preservative, and quick-drying agent in products like perfumes, hairsprays, and lotions. Concurrently, the robust expansion of the automotive sector, particularly in emerging economies, coupled with governmental mandates favoring biofuel integration, is significantly propelling the utilization of denatured alcohol as a cleaner fuel additive. These driving factors, combined with continuous advancements in cost-effective and environmentally friendly denaturing processes, underscore the denatured alcohol market’s foundational role within the global chemical and energy landscapes, necessitating constant supply chain efficiency and compliance with evolving international chemical standards.

Denatured Alcohol Market Executive Summary

The Denatured Alcohol Market is characterized by dynamic business trends, marked notably by an increasing industry shift toward bio-based ethanol sources driven by global sustainability goals and consumer preferences for eco-friendly products. This pivot is redefining sourcing strategies, demanding greater traceability and transparency in the ethanol supply chain, pushing key market players to invest heavily in fermentation technologies that utilize agricultural waste or non-food crops. Business consolidation among large chemical manufacturers seeking to vertically integrate operations, from feedstock acquisition to final product distribution, is enhancing market efficiency but simultaneously creating barriers to entry for smaller specialized producers. Furthermore, regulatory complexity regarding denaturing formulas—which vary significantly by region and application—remains a critical compliance challenge influencing operational costs and market access, necessitating sophisticated logistics and regulatory affairs management.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, burgeoning manufacturing sectors in countries like China and India, and expanding middle-class consumption driving the demand for personal care and cleaning products. North America and Europe, while mature markets, maintain high revenue share due to strict adherence to biofuel mandates and robust applications in the pharmaceutical and specialty chemicals industries. European growth is intrinsically linked to the Renewable Energy Directive (RED II), accelerating the use of denatured ethanol as a transportation fuel component. Conversely, Latin America presents significant opportunities, particularly in biofuel production leveraging vast sugarcane resources, positioning the region as a major potential exporter and internal consumer of bio-based denatured alcohol.

Segment trends indicate that the solvent application segment retains the largest market share, essential for industrial manufacturing and coating applications, though the fuel blending segment is poised for the fastest Compound Annual Growth Rate, directly correlating with global biofuel policies and environmental targets. By source, the synthetic segment historically dominated but is rapidly losing ground to the bio-based segment, reflecting the environmental movement’s profound influence on chemical procurement decisions. In terms of product type, specially denatured alcohol (SDA) commands premium pricing and higher growth rates compared to completely denatured alcohol (CDA) due to its specialized use in high-value industries such as cosmetics and flavorings, where precise regulatory compliance and minimal residual interference are non-negotiable prerequisites for product formulation integrity and consumer safety.

AI Impact Analysis on Denatured Alcohol Market

User inquiries regarding AI's influence in the denatured alcohol market frequently center on supply chain volatility mitigation, optimizing the fermentation and distillation processes, and ensuring regulatory compliance across multiple jurisdictions. Common themes revolve around how predictive analytics can forecast demand fluctuations stemming from energy price shifts or changes in biofuel mandates, thereby optimizing raw material procurement (e.g., molasses or corn). Users are keen to understand the implementation of AI-driven quality control systems that automatically monitor denaturing agent concentration and purity, minimizing batch errors and ensuring compliance with highly specific governmental formulas (SDAs). Furthermore, there is significant interest in AI's role in advancing green chemistry initiatives, particularly through machine learning algorithms used in screening novel, less toxic, and more effective bio-denaturants, accelerating R&D cycles and lowering environmental footprints.

The integration of sophisticated AI models is transforming operational efficiency within denatured alcohol manufacturing facilities, primarily through predictive maintenance and process optimization. By analyzing vast streams of operational data—including temperature, pressure, reaction kinetics, and catalyst performance—AI can preemptively identify potential equipment failures, minimizing unexpected downtime that is costly in continuous chemical production environments. This proactive approach ensures higher asset utilization and reliable production throughput. Moreover, AI-powered simulation tools are enabling manufacturers to run virtual experiments to fine-tune distillation parameters, achieving higher ethanol yields and reducing energy consumption per unit of production, a critical factor given the energy-intensive nature of alcohol purification.

Beyond the manufacturing floor, AI significantly enhances market intelligence and risk management. Machine learning algorithms process real-time global regulatory updates concerning chemical registration, transportation restrictions, and denaturant requirements specific to different countries. This capability is vital for multinational corporations navigating complex export requirements, ensuring that specific batches are compliant before shipment, thus avoiding costly delays or seizure. AI also supports dynamic pricing strategies based on supply-demand forecasting, competitor analysis, and crude oil price volatility, allowing businesses to maximize profitability while maintaining competitive market positioning in a commodity-driven environment where minor price variations can dictate major purchasing decisions.

- Enhanced Supply Chain Resilience: AI-driven predictive modeling forecasts feedstock availability and optimizes logistics routes, minimizing volatility associated with agricultural harvests and global shipping bottlenecks.

- Optimized Production Yields: Machine learning algorithms fine-tune fermentation and distillation processes, maximizing ethanol yield and purity while minimizing energy use.

- Automated Quality Control (QC): Computer vision and sensor data analytics monitor denaturant levels in real-time, ensuring strict adherence to global regulatory formulas (SDA/CDA specifications).

- Accelerated Green Denaturant R&D: AI supports the identification and testing of sustainable, bio-based denaturing agents, aligning products with ecological demands and reducing dependence on petrochemical additives.

- Predictive Maintenance: AI models forecast equipment failure in fermentation tanks and distillation columns, significantly reducing unplanned downtime and operational expenditure.

- Regulatory Compliance Management: AI systems instantly flag regulatory changes globally, ensuring proactive adjustment of denaturing recipes and documentation for international trade compliance.

DRO & Impact Forces Of Denatured Alcohol Market

The Denatured Alcohol Market’s trajectory is heavily influenced by a balanced set of Drivers (D), Restraints (R), and Opportunities (O), whose collective force dictates industry growth and profitability. Key drivers include the global push for renewable energy sources, mandating the incorporation of denatured bioethanol into transportation fuels, particularly in developed and rapidly industrializing nations seeking to achieve carbon reduction targets. Simultaneously, continuous growth in the non-cyclical end-use industries—specifically pharmaceuticals, personal care, and specialized industrial cleaning—provides a stable, foundational demand. The primary restraints revolve around stringent, often contradictory, governmental regulations governing denaturant composition and purity standards, which increase compliance costs and limit flexibility in global supply chains. Furthermore, price volatility in raw materials (feedstock like corn or sugarcane) tied to agricultural yields and global commodity markets introduces significant production cost uncertainty. Opportunities lie predominantly in the development of third-generation bioethanol derived from cellulosic biomass, offering a sustainable, non-food competing feedstock, coupled with expansion into niche, high-value applications such as laboratory reagents and electronic cleaning agents that demand extremely high purity levels.

The primary driving forces center on sustainability mandates and industrial expansion. The commitment by major global economies to decarbonization treaties necessitates a substantial increase in biofuel consumption, positioning denatured bioethanol as a strategic commodity for the energy sector. This momentum is further amplified by the rapid urbanization and economic growth in APAC and Latin America, translating into higher industrial output across sectors requiring robust, cost-effective solvent systems for manufacturing, particularly in coatings, adhesives, and specialty chemicals. The versatility of denatured alcohol as a highly effective, rapidly evaporating solvent ensures its persistent relevance, even amidst competition from less environmentally friendly alternatives, especially when factoring in the cost advantage afforded by tax exemptions.

Conversely, market growth faces formidable restraints rooted in regulatory complexities and supply chain instability. The necessity for different denaturing specifications for diverse applications and geographic markets (e.g., EU regulations versus FDA requirements) fragments the market and complicates large-scale, standardized production, demanding meticulous batch management. Furthermore, public perception and regulatory scrutiny regarding the potential toxicity of certain traditional denaturing agents, such as methanol, necessitate continuous investment in safer, approved alternatives, which often carry higher production costs. The market is also subject to the overarching impact forces of crude oil price fluctuations, as ethanol, particularly for fuel blending, must remain economically competitive with gasoline, requiring constant internal cost management and hedging strategies to maintain favorable economics.

- Drivers:

- Increasing Global Demand for Biofuels and Ethanol Blending Mandates (E10, E85).

- Consistent Expansion of Personal Care, Cosmetics, and Pharmaceutical Manufacturing.

- Favorable Tax Exemptions on Denatured Industrial Alcohol vs. Potable Alcohol.

- Rising Demand for High-Purity Solvents in Electronics and Specialty Chemicals.

- Restraints:

- Strict, Varying, and Complex Governmental Regulations on Denaturant Composition and Use (SDA/CDA).

- Price Volatility of Raw Materials (Agricultural Feedstock) and Dependence on Commodity Markets.

- Competition from Alternative Solvents and Green Chemistry Substitutes.

- Logistical Challenges and High Costs Associated with Hazardous Material Storage and Transportation.

- Opportunities:

- Technological Advancements in Second and Third-Generation Bioethanol Production (Cellulosic Ethanol).

- Growth in Niche, High-Purity Applications requiring specialized Denaturing Agents.

- Strategic Partnerships with Petrochemical and Energy Companies for Fuel Blending Infrastructure Expansion.

- Development of Less Toxic and More Sustainable Denaturing Compounds Aligned with Green Chemistry Principles.

- Impact Forces:

- Substitution Threat: Medium (Driven by green solvent innovation).

- Buyer Power: High (Large industrial buyers dictate terms and demand purity specifications).

- Supplier Power: Medium to High (Depending on the scarcity of agricultural feedstock).

- Competitive Intensity: High (Market characterized by large integrated chemical companies).

- Regulatory Scrutiny: Very High (Compliance dictates market viability).

Segmentation Analysis

The Denatured Alcohol market is comprehensively segmented based on its source material, the type of denaturing applied, and its broad array of final applications. Understanding these segments is crucial for strategic market positioning, as each segment is subject to distinct regulatory frameworks, price sensitivity, and growth dynamics. The source segmentation differentiates between bio-based ethanol, derived primarily from sugarcane, corn, or biomass, and synthetic ethanol, derived from petrochemical processes, reflecting a fundamental industry pivot toward renewable resources driven by both environmental policy and feedstock availability. This source distinction profoundly influences carbon footprint assessments and eligibility for various biofuel incentives globally, making bio-based sourcing the current focus of aggressive capacity expansion.

Segmentation by application highlights the diversified utility of denatured alcohol. While the solvent segment remains the most volumetric due to its essential role across industrial manufacturing, the fuel segment exhibits the fastest growth trajectory, directly tied to governmental mandates promoting lower-carbon alternatives in the transportation sector. The pharmaceutical and cosmetics segments, conversely, require specially denatured alcohols (SDAs) characterized by extremely high purity and stringent traceability, commanding premium pricing and demanding highly specialized manufacturing and certification protocols. These high-value segments are less volume-driven but critical for maintaining profitability margins and technological edge within the highly competitive market landscape.

- By Source:

- Bio-based (Derived from corn, sugarcane, molasses, or cellulosic biomass)

- Synthetic (Derived from ethylene hydration)

- By Type:

- Completely Denatured Alcohol (CDA)

- Specially Denatured Alcohol (SDA)

- By Application:

- Fuel and Fuel Blending (Biofuel, Gasohol)

- Solvents (Paints, Coatings, Printing Inks, Resins)

- Personal Care and Cosmetics (Perfumes, Lotions, Hairsprays)

- Pharmaceuticals (Disinfectants, Medical Solvents, Excipients)

- Industrial Cleaning and Disinfectants (Sterilizers, Surface Cleaners)

- Others (Laboratory Reagents, Food Processing)

Value Chain Analysis For Denatured Alcohol Market

The Denatured Alcohol Value Chain commences with the critical upstream activities: the sourcing and processing of raw materials. For bio-based ethanol, this involves large-scale agriculture (corn, sugarcane, biomass) followed by rigorous fermentation and multi-stage distillation processes to achieve high-purity industrial ethanol (95% to 99%+ concentration). For synthetic routes, the upstream stage involves securing ethylene feedstock, a petrochemical derivative, followed by catalytic hydration. The efficiency and cost-competitiveness of the final product are highly sensitive to volatility in these upstream agricultural and petrochemical commodity markets, necessitating sophisticated hedging and long-term procurement contracts to stabilize input costs, particularly for major global suppliers who operate integrated biorefineries.

The midstream phase is where value addition specific to the market occurs: the denaturing process. This stage involves the precise blending of the base ethanol with authorized denaturing agents (such as methanol, MEK, gasoline, or specialized proprietary compounds) according to specific regulatory formulas (CDA or various SDA types). This process transforms tax-liable ethanol into tax-exempt industrial alcohol, fundamentally altering its commercial viability. Logistics and storage play a critical midstream role, requiring specialized infrastructure for handling flammable and hazardous liquids, including certified tank farms and compliant transportation networks (rail, tanker trucks, and maritime shipping), ensuring product integrity and safety during transit from manufacturing sites to regional distribution hubs.

The downstream segment encompasses distribution and delivery to a highly diversified end-user base, categorized into direct and indirect channels. Direct sales are common for large volume industrial customers, such as major fuel blenders or multinational cosmetic manufacturers, who engage in long-term supply agreements directly with the producers, requiring bespoke purity and formulation specifications. Indirect distribution, leveraging chemical distributors and specialized solvent trading houses, serves smaller to medium-sized enterprises (SMEs) in cleaning, coatings, and niche manufacturing. These indirect channels manage lower volume orders, handle smaller packaging requirements (drums, totes), and provide necessary regional inventory buffers, acting as critical conduits that bridge the gap between large-scale production and geographically fragmented demand clusters across the automotive, medical, and consumer goods sectors.

Denatured Alcohol Market Potential Customers

The customer base for denatured alcohol is exceptionally broad and structurally diverse, spanning multiple high-growth, stable industries globally. Key end-users include major energy corporations and independent fuel blenders who utilize denatured bioethanol as a critical component in formulating environment-compliant gasoline blends (e.g., E10 or E85), driven primarily by legislative mandates and the necessity to meet carbon reduction targets. This segment is highly volume-sensitive and price-driven, often requiring Completely Denatured Alcohol (CDA) specifications for ease of handling and cost-effectiveness. The purchasing decisions in this sector are heavily influenced by government energy policies, agricultural commodity prices, and the global crude oil market dynamics, necessitating robust supply chain planning from alcohol producers to ensure reliable, high-volume delivery compliant with strict transportation safety protocols.

Another major group of potential customers resides within the specialized manufacturing sectors, notably pharmaceuticals and cosmetics. Pharmaceutical companies use specially denatured alcohol (SDA) as a solvent for extraction, crystallization, and synthesis of active pharmaceutical ingredients (APIs), or as a primary component in topical disinfectants and medical device sterilization. Cosmetic manufacturers rely on SDA, often with highly specific denaturants to avoid residual odors or skin irritation, for manufacturing perfumes, aerosol sprays, and personal hygiene products. These customers demand superior purity, comprehensive quality control documentation, and long-term regulatory certification, driving market demand for premium-grade products that adhere to protocols such as USP or EP (United States Pharmacopeia or European Pharmacopoeia) specifications, prioritizing quality assurance over minor price advantages.

Furthermore, the industrial sector represents a foundational customer segment, encompassing manufacturers of paints, lacquers, adhesives, and printing inks, who rely on denatured alcohol as an effective, fast-evaporating solvent and dispersant. This sector is characterized by medium-to-large volume contracts and a strong focus on consistent supply and technical support regarding solvent substitution and volatile organic compound (VOC) compliance. Additionally, the growing institutional cleaning and sanitation market, including hospitals, hotels, and large commercial facilities, constitutes a steadily expanding customer base, particularly for high-volume disinfectant formulations where the antiseptic properties of denatured alcohol are essential for maintaining public health and hygiene standards, ensuring sustained, non-cyclical demand across geographical markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archer Daniels Midland Company (ADM), Cargill, Inc., Celanese Corporation, Eastman Chemical Company, INEOS, Sasol, Raízen, Green Plains Inc., Valero Energy Corporation, Wilmar International Ltd., BP p.l.c., Royal Dutch Shell plc, Flint Hills Resources, Bunge Limited, Alto Ingredients Inc., LyondellBasell Industries, Gevo, Inc., Renewable Energy Group (REG), Tate & Lyle PLC, Versalis S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Denatured Alcohol Market Key Technology Landscape

The technological landscape within the denatured alcohol market is predominantly focused on enhancing the efficiency of the upstream ethanol production processes and innovating safer, more effective denaturing methods in the midstream. Advanced fermentation technologies represent a critical area of innovation, particularly the development and deployment of genetically modified yeast and bacteria strains that are capable of higher ethanol yields, faster fermentation cycles, and the ability to tolerate broader temperature ranges or utilize diverse, cheaper feedstock sources, such as lignocellulosic biomass (Second and Third Generation Bioethanol). Continuous distillation processes, utilizing sophisticated energy recovery systems and advanced column designs, are also integral to reducing the high operational energy demand typically associated with achieving the necessary purity levels (99.5%+) required for industrial-grade alcohol and biofuel blending, thereby lowering the overall cost of production and enhancing competitive advantage.

A significant technological push is directed towards the development and standardization of non-toxic or less-toxic denaturing agents to replace traditional, highly regulated compounds like methanol, especially for consumer-facing products. Research focuses on compounds that effectively render the product non-potable without negatively impacting its performance as a solvent or carrier in cosmetics and pharmaceuticals. Concurrently, analytical technologies play a crucial role in ensuring regulatory compliance. Advanced chromatographic techniques, such as Gas Chromatography-Mass Spectrometry (GC-MS), are essential for rapidly and accurately verifying the concentration of denaturants and detecting trace impurities, ensuring that every batch of specially denatured alcohol (SDA) adheres precisely to the highly specific regulatory formulas mandated by different global bodies, mitigating legal risks and guaranteeing product quality in sensitive applications.

Furthermore, digitalization and automation are transforming facility management and quality assurance across the industry. Implementation of centralized control systems (DCS) and SCADA systems allows for real-time monitoring and adaptive control of the entire production line, from fermentation tank conditions to final blending ratios during the denaturing stage. This technology minimizes human error, optimizes resource allocation, and provides comprehensive data logs necessary for stringent regulatory audits. The focus on integrating these digital technologies aligns with industry 4.0 standards, promoting greater production agility, enabling rapid shifts between different denaturing specifications based on immediate customer demand, and strengthening the overall reliability and traceability of the denatured alcohol supply chain, a factor highly valued by major industrial consumers globally.

Regional Highlights

Regional dynamics heavily influence the denatured alcohol market, reflecting localized biofuel policies, industrial activity, and consumer purchasing power.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive industrial expansion in China, India, and Southeast Asian nations. The region’s demand is primarily fueled by manufacturing sectors requiring solvents (coatings, printing inks) and an increasingly affluent population boosting the consumption of personal care products. Government initiatives promoting bioethanol blending, although fragmented, are starting to gain traction, further cementing the region's importance, despite infrastructure gaps in certain developing economies.

- North America: This region holds a significant market share, characterized by robust regulatory frameworks supporting high-percentage ethanol blends (E10, E15). The US market, heavily reliant on corn-based ethanol, is mature but sees continuous demand from the specialty chemicals and pharmaceutical industries. High R&D investment focuses on optimizing production and integrating third-generation biofuels, maintaining its leading role in technological innovation and high-purity SDA supply.

- Europe: Europe is defined by stringent environmental directives, particularly the Renewable Energy Directive (RED II), which strictly governs the sustainability criteria for biofuels, favoring advanced bioethanol sourced from waste or residues. The market here demands high standards of traceability and primarily serves the sophisticated cosmetics and pharmaceutical industries, necessitating complex, highly regulated SDA formulas, making it a high-value, albeit slower-growth, market.

- Latin America (LATAM): LATAM, especially Brazil, is a global leader in bioethanol production, leveraging abundant sugarcane feedstock, which offers excellent economics and sustainability profiles compared to corn. The market is crucial for global supply, characterized by mature internal flex-fuel vehicle usage, making it a powerful exporter of bio-based denatured alcohol primarily utilized for fuel blending in other regions.

- Middle East and Africa (MEA): This region is primarily a net importer of denatured alcohol, with demand centered around industrial solvents for nascent manufacturing sectors and sanitation applications. Growth is moderate and sensitive to global pricing, with increasing localization efforts being observed in certain countries seeking to establish local supply chains for industrial chemicals and cleaning agents to reduce import dependency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Denatured Alcohol Market.- Archer Daniels Midland Company (ADM)

- Cargill, Inc.

- Celanese Corporation

- Eastman Chemical Company

- INEOS

- Sasol

- Raízen

- Green Plains Inc.

- Valero Energy Corporation

- Wilmar International Ltd.

- BP p.l.c.

- Royal Dutch Shell plc

- Flint Hills Resources

- Bunge Limited

- Alto Ingredients Inc.

- LyondellBasell Industries

- Gevo, Inc.

- Renewable Energy Group (REG)

- Tate & Lyle PLC

- Versalis S.p.A.

Frequently Asked Questions

Analyze common user questions about the Denatured Alcohol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between CDA and SDA in the denatured alcohol market?

Completely Denatured Alcohol (CDA) is formulated using standardized, harsh denaturants (like methanol or gasoline) that render it entirely unsuitable for human consumption, making it generally tax-exempt and suitable for general industrial use, cleaning, and fuel. Specially Denatured Alcohol (SDA) uses precise, authorized denaturant formulas tailored specifically for sensitive industries like cosmetics, pharmaceuticals, and food flavorings, requiring specific regulatory approval for each specialized use case and maintaining higher purity.

How is the growth of the bio-based segment affecting traditional synthetic denatured alcohol producers?

The increasing consumer and regulatory preference for bio-based ethanol, driven by sustainability goals and tax incentives for biofuels, is placing significant competitive pressure on synthetic producers, who rely on ethylene feedstock. Bio-based producers are capturing market share, especially in fuel and high-volume industrial segments, forcing synthetic producers to focus on niche, high-purity applications where petrochemical consistency might offer advantages.

Which geographical region is currently leading the market demand and why?

North America and Europe traditionally hold significant revenue share due to mature industrialization and established biofuel mandates. However, the Asia Pacific (APAC) region is demonstrating the highest growth rate, driven by accelerated manufacturing expansion, rapid urbanization, rising middle-class consumption in personal care, and emerging governmental mandates supporting the integration of bioethanol into their domestic energy infrastructure.

What are the key regulatory challenges influencing the denatured alcohol supply chain?

The key challenges stem from the lack of international standardization regarding denaturing formulas, purity standards, and permissible denaturing agents. Producers must adhere to differing national and regional excise laws and chemical safety regulations (e.g., US TTB, EU REACh), complicating cross-border trade, increasing compliance costs, and necessitating specialized batch production for various end-markets.

What impact does agricultural commodity price volatility have on the denatured alcohol market?

Since bio-based denatured alcohol relies heavily on agricultural feedstock (corn, sugarcane), fluctuations in commodity prices due to weather, trade disputes, or agricultural subsidies directly impact the cost of ethanol production. This volatility introduces significant risk and requires producers to implement sophisticated risk management strategies, including futures contracts and vertical integration, to maintain stable supply and competitive pricing against petrochemical alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager