Dent Removal Kit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437667 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Dent Removal Kit Market Size

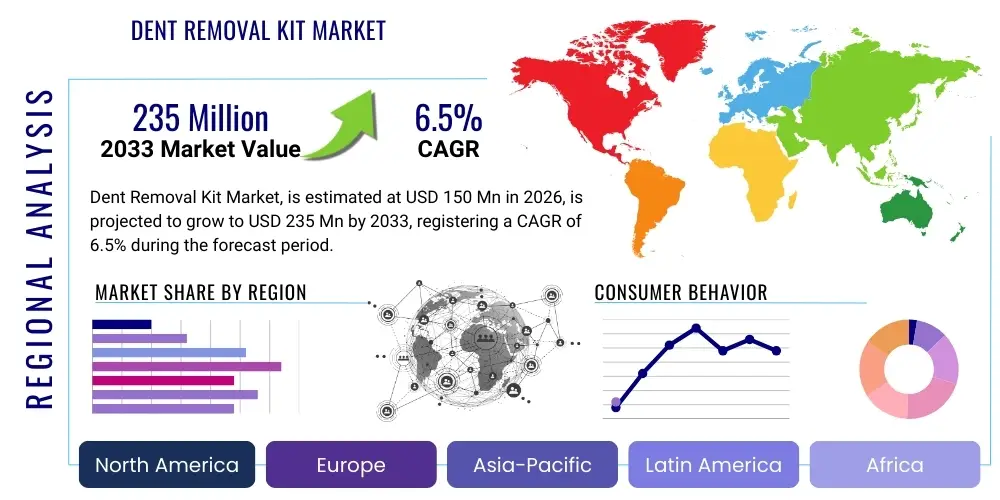

The Dent Removal Kit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 235 Million by the end of the forecast period in 2033.

Dent Removal Kit Market introduction

The Dent Removal Kit Market primarily revolves around Paintless Dent Repair (PDR) technology, offering non-invasive solutions for removing minor dents and dings from automotive bodies. PDR kits utilize specialized tools—such as glue pullers, rods, whale tails, and slide hammers—to massage the metal back into its original form without damaging the factory paint finish. This technique has gained immense traction in the automotive repair industry due to its cost-effectiveness, speed, and ability to preserve the vehicle’s original coating, which is crucial for maintaining resale value. The market caters extensively to professional body shops, certified PDR technicians, and increasingly, the do-it-yourself (DIY) consumer segment looking for convenient, at-home repair options.

The core application of dent removal kits lies in addressing minor cosmetic damages, often resulting from parking lot incidents, minor collisions, or environmental factors such as hail. These kits eliminate the need for traditional bodywork processes involving sanding, filling, and repainting, significantly reducing repair time and labor costs. Products range from basic kits suitable for shallow dents accessible from the exterior to sophisticated, professional-grade kits comprising dozens of specialized tools designed to access difficult-to-reach areas inside door panels, fenders, and roofs. The continuous innovation in tool materials, ergonomics, and pulling strength remains a key element defining market competitiveness and consumer adoption.

Major driving factors include the rising frequency of severe weather events globally, leading to increased demand for hail damage repair, especially in regions prone to severe storms. Furthermore, the burgeoning market for used and certified pre-owned vehicles necessitates efficient and cost-effective cosmetic repair solutions before resale. The convenience offered by these kits, combined with extensive instructional content available online, is democratizing minor auto body repair, expanding the user base beyond traditional automotive professionals to include semi-professional users and automotive enthusiasts. This blend of professional reliability and DIY accessibility ensures steady market growth and continuous product diversification.

Dent Removal Kit Market Executive Summary

The Dent Removal Kit Market exhibits robust business trends characterized by rapid technological advancement in PDR tools and an increased focus on specialized kits addressing specific damage types, such as creased dents or aluminum body repairs. Key industry players are concentrating on developing ergonomic designs and incorporating stronger, yet safer, adhesive formulations for glue-pulling systems, enhancing both efficiency and user experience. A significant trend involves the integration of digital training and diagnostic tools, often bundled with professional kits, to assist technicians in assessing damage severity and selecting the optimal repair method. Furthermore, strategic partnerships between tool manufacturers and vocational training centers are helping standardize PDR skills, driving professional adoption and market legitimacy across all regions.

Regionally, North America maintains its dominance, driven by a high concentration of vehicle ownership, sophisticated aftermarket services, and recurring large-scale hail events, necessitating robust PDR services. Europe follows, propelled by strict environmental regulations favoring non-destructive repair methods and a mature automotive repair infrastructure. However, the Asia Pacific (APAC) region is projected to experience the fastest growth, fueled by the rapid expansion of the automotive sector, increasing disposable income leading to higher vehicle maintenance expenditure, and the localization of manufacturing capabilities. Emerging economies within APAC are quickly adopting PDR techniques as a cost-effective alternative to traditional panel replacement, stimulating demand for entry-level and mid-range kits.

Segment trends highlight the Professional Grade Kits segment dominating the market in terms of revenue, attributed to their high cost, durability, and necessity for complex repairs performed by certified technicians. Conversely, the DIY/Consumer Kits segment is witnessing the fastest volume growth, driven by e-commerce penetration and the growing willingness of vehicle owners to perform simple cosmetic repairs themselves. By application, Automotive Repair Shops and specialized PDR service providers remain the largest end-users. Future growth trajectory is strongly influenced by the adoption of specialized equipment required for repairing modern vehicle bodies constructed from high-strength steel and lightweight aluminum alloys, requiring more sophisticated, heat-managed PDR solutions.

AI Impact Analysis on Dent Removal Kit Market

User queries regarding AI's influence in the Dent Removal Kit market primarily center on how artificial intelligence can automate or significantly improve the precision of the Paintless Dent Repair (PDR) process. Common questions revolve around AI’s role in accurate damage assessment, determining the optimal access point for tools, and training new technicians. Users are concerned about whether AI-driven robotic systems will replace skilled human labor or if AI will serve merely as an augmentation tool. There is a strong expectation that AI, perhaps integrated with computer vision and augmented reality (AR), will standardize quality control across different technicians and streamline complex hail damage estimates for insurance purposes, thereby reducing claim processing times and improving repair quality consistency across large-scale projects.

The integration of AI into the PDR ecosystem is already moving beyond theoretical discussions, starting with advanced image recognition algorithms used for instantaneous damage detection and volumetric assessment. AI tools, often utilizing mobile applications or integrated diagnostic hardware, can scan a damaged panel and immediately classify the type, depth, and size of the dent, providing technicians with a precise roadmap for repair. This diagnostic capability minimizes subjective estimations, which traditionally led to variations in repair outcomes and pricing. By analyzing thousands of successful repair instances, AI can predict the exact force and leverage required for specific dent geometries, significantly enhancing the success rate and speed of the repair process.

Looking forward, the highest impact will be observed in robotic PDR systems, where AI guides precision actuators and specialized tooling. Although full automation is still nascent, semi-autonomous systems are being developed to handle repetitive tasks, particularly large-scale operations like hail matrix removal. For the Dent Removal Kit market itself, AI influences the design and marketing of tools by identifying recurring repair challenges that require specialized solutions. For instance, AI analysis of repair data might reveal frequent issues with specific leverage angles, leading manufacturers to design next-generation rods with optimized geometries, thus ensuring the tools sold are perfectly aligned with modern repair requirements and training methodologies.

- AI-Powered Diagnostic Scanning: Automated assessment of dent size, depth, and complexity using computer vision, leading to accurate repair time and cost estimations.

- Predictive Tool Selection: AI algorithms suggest the optimal specific tool (e.g., glue tab size, rod tip type) and repair sequence based on the input damage analysis.

- Augmented Reality (AR) Training and Guidance: AR overlays, driven by AI, guide novice technicians by illustrating precise tool placement and movement paths on the damaged surface.

- Robotic PDR Development: AI enables high-precision movement for semi-autonomous PDR robots, particularly crucial for large surface areas or consistent quality control in fleet maintenance.

- Supply Chain Optimization: Predictive analytics use AI to forecast demand for specific kit components (e.g., specialized glues or tabs) based on seasonal weather patterns (hail frequency).

- Standardized Quality Control: AI systems analyze post-repair scans to ensure the panel has returned to its OEM specification smoothness, reducing human error in final quality checks.

DRO & Impact Forces Of Dent Removal Kit Market

The Dent Removal Kit Market is fundamentally driven by the rising consumer preference for cost-effective and environmentally friendly repair solutions, coupled with the increasing global incidence of severe weather events, particularly hailstorms. The major restraint lies in the high skill threshold required for professional PDR application, which necessitates extensive training and limits the number of certified technicians, posing a bottleneck in service delivery. However, significant opportunities exist in developing specialized equipment for new lightweight vehicle materials (aluminum, composites) and expanding into untapped geographical regions, particularly in Asia and Latin America, where vehicle density is increasing rapidly and traditional body shops are often costly and slow. The market impact forces emphasize the delicate balance between technological innovation (leading to easier-to-use kits) and the intrinsic reliance on technician expertise for achieving high-quality, undetectable repairs.

Drivers: A primary driver is the economic advantage of PDR over conventional body repair, often reducing costs by 50% or more, making it attractive to both consumers and insurance providers seeking reduced claim payouts. Furthermore, the global fleet of vehicles is increasing, and with it, the necessity for maintaining the aesthetic value of automobiles, whether for private sale or fleet management turnover. The DIY trend, amplified by accessible instructional videos and user-friendly kits, allows minor repairs to be performed at home, significantly broadening the market base. Finally, growing environmental consciousness supports PDR, as it avoids the use of harmful solvents, fillers, and paints, aligning with sustainable repair practices favored in developed economies.

Restraints: The most significant restraint is the limitation of the PDR technique itself; it is only suitable for dents where the paint is intact and the metal is not severely stretched or compromised. Furthermore, while basic kits are easy to use, achieving a flawless, professional finish requires significant dexterity, experience, and specialized knowledge, creating a dependency on high-cost expert labor. Counterfeit or low-quality kits flood the online market, often leading to substandard repairs that can permanently damage the vehicle's panel, thus eroding consumer trust in DIY solutions and potentially harming the reputation of legitimate PDR methods. Managing the perception of complexity and ensuring professional skill standards are maintained remains a constant challenge.

Opportunities: Technological advancements offer substantial opportunities, particularly the development of induction heating PDR systems that can safely relax the metal memory without direct contact or gluing, speeding up the repair process for mild dents. The expansion of mobile PDR services—where technicians travel directly to the customer—is a burgeoning segment, requiring highly portable and robust kit solutions. Furthermore, establishing standardized global certification programs for PDR technicians and equipment could foster greater confidence among insurance carriers and large automotive dealerships. Lastly, targeting specialized industrial applications, beyond just automotive (e.g., aerospace panels or large metal appliance repair), presents diversification potential for specialized tool manufacturers.

Segmentation Analysis

The Dent Removal Kit market segmentation is crucial for understanding the diverse needs of end-users, ranging from highly specialized PDR technicians to casual vehicle owners. The market is primarily differentiated based on the complexity and nature of the tools included, distinguishing between sophisticated professional setups and simplified consumer kits. Product classification also relies heavily on the mechanism of repair—whether it involves leveraging and pushing tools (rods and levers) or adhesive technology (glue pullers). Geographic segmentation remains vital due to variations in vehicle construction materials (e.g., regional differences in aluminum body adoption) and the prevalence of specific types of damage, such as localized hail intensity, influencing regional kit demand.

Analysis of product type reveals that combination kits, which integrate both traditional rod methods and modern glue pulling systems, are gaining prominence as they offer maximum versatility to professional users facing varied dent geometries and locations. Within the application segment, the shift towards mobile PDR services demands compact, durable, and comprehensive kits suitable for on-site usage. Furthermore, the increasing complexity of modern vehicle panels, featuring internal bracing and high-strength steel (HSS), is driving the growth of segments focused on specialized access tools and proprietary lighting systems necessary to accurately visualize the minute contours of the repair.

Distribution channel segmentation reflects the dichotomy between professional and consumer procurement. Professional users often rely on specialized distributors and direct manufacturer relationships for warranty and certification purposes, ensuring tool quality and accessing technical support. Conversely, the DIY segment overwhelmingly utilizes e-commerce platforms, favoring brand visibility, competitive pricing, and user reviews. This dual channel approach requires manufacturers to maintain distinct product lines, marketing strategies, and pricing structures tailored to the procurement preferences and technical expertise level of each segment, optimizing market reach and sales efficiency across the entire value chain.

- By Product Type:

- Leverage Tools/Rods (Whale Tails, Hook Rods, Jigglers)

- Glue Pulling Systems (Standard Pullers, Slide Hammers, Suction Cups, Specialized Glue Tabs)

- Induction Heating Systems (PDR Hot Boxes)

- Combination Kits (Professional Grade)

- DIY/Consumer Kits (Entry-Level)

- By Application:

- Automotive Repair Shops (Body Shops)

- Dedicated PDR Service Providers (Mobile and Stationary)

- Automotive Dealerships and Fleet Services

- Individual Consumers/DIY Enthusiasts

- Insurance Companies (for damage assessment and repair management)

- By Vehicle Material:

- Steel Panels Kits

- Aluminum Panels Kits (Requires specialized tools and lower heat tolerance)

- By Damage Type:

- Ding/Door Dent Repair

- Crease Dent Repair (Requires high-leverage tools)

- Hail Damage Repair (High volume kits)

- By Distribution Channel:

- Online (E-commerce, Manufacturer Websites)

- Offline (Specialty Tool Distributors, Automotive Retail Stores)

Value Chain Analysis For Dent Removal Kit Market

The value chain for the Dent Removal Kit market begins with the procurement of specialized raw materials, primarily high-grade stainless steel alloys, specialized plastics for ergonomic handles, and proprietary chemical formulations for PDR glues and release agents. Upstream analysis focuses on material quality, as the performance and longevity of PDR rods and tools rely heavily on precise alloy composition to ensure strength without brittleness or excessive flexibility. Suppliers of specialized materials, particularly those providing proprietary coatings for slide hammers or high-tensile strength carbon fiber components, hold significant power in determining initial manufacturing costs. Manufacturing involves precision engineering, often utilizing CNC machining and advanced forging techniques to produce tools with specific curves and tip geometries necessary for effective dent manipulation. Quality control at this stage is paramount, as minute deviations in tool shape can render them ineffective for professional use.

Midstream activities center on assembly, kitting, and packaging, where various components—rods, glue guns, lighting systems, and instructional materials—are grouped into market-specific kits (e.g., master kits for professionals or basic kits for DIY users). The distribution channel plays a bifurcated role: Direct channels primarily serve large professional PDR organizations and specialized training academies, allowing manufacturers to maintain tight control over pricing and technical support. These direct sales often involve customized tooling solutions and bulk purchasing agreements. Indirect channels utilize automotive aftermarket distributors, tool wholesalers, and increasingly, major e-commerce platforms (Amazon, eBay, specialized auto tool sites) to reach the vast consumer and small-to-medium-sized body shop segment.

Downstream activities include marketing, sales, and aftermarket service. Given the high skill requirement of PDR, the market heavily relies on technical education and certification, often provided by the manufacturers or affiliated training institutions. The final end-users—PDR technicians and body shops—are highly discerning, relying on brand reputation, tool ergonomics, and documented effectiveness. The rise of sophisticated online communities and peer reviews significantly impacts purchasing decisions in the downstream segment. Effective value capture requires manufacturers not only to produce high-quality tools but also to invest heavily in training content and strong customer service support, particularly for complex proprietary systems like induction heaters or specialized glue formulations, completing a chain driven by precision, accessibility, and expertise.

Dent Removal Kit Market Potential Customers

The primary customer base for high-end, comprehensive Dent Removal Kits consists of certified Paintless Dent Repair (PDR) technicians and independent automotive body shops. These professionals require durable, specialized tools—often sold as master kits containing hundreds of individual pieces—to handle a vast array of dent sizes, shapes, and locations, including complex repairs on high-end or newer vehicles with specialized metal structures. For PDR technicians, the investment in top-tier equipment is directly correlated with their quality of service and efficiency, making them less price-sensitive and more focused on technological superiority, ergonomics, and brand reliability. Their procurement is often recurring, driven by tool wear, breakage, and the necessity to adopt the latest tool designs optimized for new vehicle models.

A secondary, yet rapidly expanding, customer segment includes automotive dealerships, fleet management companies, and vehicle rental agencies. These entities require quick, efficient, and cost-effective cosmetic repair solutions to maximize the resale or rental value of their assets. They often establish in-house PDR capabilities or maintain standing contracts with dedicated PDR mobile units, purchasing medium-sized, highly portable kits focused on volume ding and dent repair. For fleets, minimizing vehicle downtime is critical, and PDR kits facilitate quick turnaround times compared to traditional body shop repairs, driving substantial operational savings and maintaining inventory appeal.

The third major segment is the DIY consumer market, characterized by price sensitivity and a preference for simple, intuitive kits, primarily purchased through online retail. These users typically seek solutions for small, shallow dents (parking dings) and prioritize ease of use, clear instructions, and low financial outlay over professional-grade durability. While the revenue contribution per consumer kit is lower, the sheer volume of this segment, driven by the increasing accessibility of video tutorials and the desire for instant gratification, makes it a critical growth area. Targeting this group requires robust digital marketing and focusing product development on user safety and simplicity, often featuring high-visibility glue tabs and simple lever mechanics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 235 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PDR Tool Company, Keco Body Repair Products, Dentcraft Tools, Astro Pneumatic Tool, Eastwood, Gliston, Super PDR, ProPDR, Maneloo, Betoo, Ding King, Mookis, Wyoone, Tesgo, S&G Tool Aid, GearWrench, Power-TEC, Blackhawk, Snap-on, Matco Tools |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dent Removal Kit Market Key Technology Landscape

The technological landscape of the Dent Removal Kit market is constantly evolving, driven by the need for higher precision, faster repair times, and compatibility with modern, lightweight vehicle materials such as aluminum and high-strength steel (HSS). A key technological advancement is the refinement of specialized tool alloys, ensuring that PDR rods offer the necessary stiffness and memory retention while being lightweight and durable. Manufacturers utilize aerospace-grade materials and proprietary heat treatment processes to create tools that can navigate complex internal bracing structures without failing. Furthermore, the development of specialized reflective lighting systems—often LED or advanced fluorescent panels—is paramount; these lights project controlled line patterns onto the panel surface, allowing the technician to accurately visualize the crown and valley of the dent, transforming an abstract repair into a scientifically measurable process.

Induction heating technology represents a significant disruptive force. Induction PDR tools, sometimes referred to as 'hot boxes,' use electromagnetic energy to gently heat specific, localized spots on the panel. This controlled heat relaxes the metal's memory, allowing the shallow dent to pop out naturally without physical pushing or pulling. This method dramatically speeds up repair for certain types of dents and is gaining traction, especially for use on larger, flatter surfaces where access may be limited. Although induction heaters do not replace traditional mechanical kits entirely, they act as an essential auxiliary technology, especially useful for managing aluminum panels which require careful heat management to avoid panel distortion, driving market demand for comprehensive hybrid repair systems.

Moreover, the technological frontier includes the integration of digital measuring and diagnostic aids. Tools incorporating laser measurement or ultrasound technology assist technicians in precise pre- and post-repair assessment, ensuring repairs meet rigorous OEM standards. Adhesive technology has also seen remarkable progress, with new glue formulations offering stronger, more aggressive pulls on various paint types while still ensuring clean, residue-free removal via proprietary release agents. The combination of superior physical tooling, advanced visual aids, controlled thermal management, and reliable adhesion methods defines the high-tech edge of the current dent removal kit market, facilitating professional excellence and expanding the scope of damage that can be successfully repaired using the PDR method.

Regional Highlights

Regional dynamics within the Dent Removal Kit Market are significantly shaped by automotive penetration rates, average vehicle age, climate vulnerability (specifically hail frequency), and the maturity of aftermarket service infrastructure. North America, encompassing the United States and Canada, remains the largest revenue contributor. This dominance is driven by high per capita vehicle ownership, consumer demand for maintaining cosmetic vehicle integrity, and a robust insurance industry that actively promotes PDR due to its cost savings over conventional repairs. Furthermore, frequent, high-intensity hailstorms across the Midwest and Southern US necessitate massive, annual PDR mobilization efforts, which sustains high demand for bulk professional kits and specialized mobile repair tools.

Europe represents a mature and technically demanding market. Strict regulatory standards related to environmental impact favor PDR over traditional painting methods, bolstering market penetration. Germany, the UK, and France are key contributors, characterized by a sophisticated network of independent body shops and specialized PDR service providers who demand high-quality, specialized tools compliant with stringent manufacturing standards. The European market sees steady growth, prioritizing tool ergonomics and efficiency, particularly in urban environments where minor collision damage is common. The region is also a crucial early adopter of induction heating PDR technology due to the need for efficient repair solutions in high-labor-cost economies.

Asia Pacific (APAC) is positioned as the fastest-growing region. This explosive growth is attributed to the rapid expansion of vehicle manufacturing and sales, particularly in China, India, and Southeast Asian nations, leading to a burgeoning aftermarket service sector. While professional PDR adoption is still emerging compared to Western markets, the opportunity is massive. Economic factors favor PDR, as consumers often seek budget-friendly repair options, accelerating the adoption of mid-range and consumer-grade kits. Localized manufacturing and distribution centers are being established in APAC to capitalize on lower labor costs and serve the rapidly growing domestic demand, making it a pivotal area for future market expansion and investment, particularly for DIY product lines distributed via vast e-commerce networks.

- North America: Market leader, high volume demand driven by frequent hail damage and strong insurance acceptance of PDR methods. Focus on professional master kits and advanced diagnostic integration.

- Europe: Stable growth, driven by environmental regulations and high demand for precision and quality. Strong adoption of ergonomic tools and newer technologies like induction heating.

- Asia Pacific (APAC): Fastest-growing region, fueled by expanding vehicle fleets and cost-consciousness. Significant market potential in entry-level and consumer kits distributed via e-commerce channels.

- Latin America (LATAM): Emerging market with localized high demand, particularly in areas prone to seasonal storms. Growth dependent on infrastructure development and technician training programs.

- Middle East and Africa (MEA): Nascent market; demand concentrated in urban centers and for high-end vehicles. Growth potential tied to increasing auto imports and establishing regional PDR training centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dent Removal Kit Market.- PDR Tool Company

- Keco Body Repair Products

- Dentcraft Tools

- Astro Pneumatic Tool

- Eastwood

- Gliston

- Super PDR

- ProPDR

- Maneloo

- Betoo

- Ding King

- Mookis

- Wyoone

- Tesgo

- S&G Tool Aid

- GearWrench

- Power-TEC

- Blackhawk

- Snap-on

- Matco Tools

Frequently Asked Questions

Analyze common user questions about the Dent Removal Kit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Paintless Dent Repair (PDR) and why are Dent Removal Kits preferred?

PDR is a method of removing small dents and dings from a vehicle's body without damaging the factory paint finish. Kits are preferred because PDR is significantly faster (often minutes instead of days), substantially cheaper, and preserves the vehicle's original paint integrity, thereby maintaining higher resale value compared to traditional body filling and repainting methods.

What are the primary factors driving the growth of the Professional Dent Removal Kit segment?

Growth is driven by the increasing incidence of large-scale hail events globally, necessitating rapid and high-volume repairs, and the rising adoption of PDR by insurance companies seeking to minimize claim costs. Professionals require highly specialized, durable tools (rods, leverage tools, and advanced glue systems) for complex repairs that DIY kits cannot handle effectively.

How does the advent of aluminum vehicle bodies affect the demand for Dent Removal Kits?

Aluminum bodies require specialized PDR kits, as aluminum is softer and more sensitive to heat and pressure than traditional steel. This shift drives demand for specific tools, including induction heaters for controlled thermal management and specialized, non-marring tools designed to manipulate softer metals without causing stretching or cracking, increasing the market value of proprietary professional kits.

Which technology is currently offering the greatest disruption to traditional mechanical Dent Removal Kits?

Induction heating technology (PDR Hot Boxes) is the most disruptive, offering a non-contact method to remove shallow dents by quickly heating and relaxing the metal, causing the dent to pop out naturally. This method significantly speeds up the repair process for mild damage and reduces the reliance on physical pushing or pulling tools in certain repair scenarios.

What is the key difference in distribution strategies between professional and DIY Dent Removal Kit segments?

Professional kits are primarily distributed through specialized distributors or direct manufacturer channels to ensure quality control, technical support, and necessary certification. Conversely, DIY kits heavily rely on high-volume e-commerce platforms (online retail) where pricing, user reviews, and accessibility are the dominant factors influencing consumer purchasing decisions.

What role does specialized lighting play in the effective use of Dent Removal Kits?

Specialized lighting, often utilizing LED or fluorescent panels with reflective line patterns, is essential for professional PDR. These lights highlight the distortion of the metal's surface tension (the crown and valley of the dent), allowing the technician to precisely visualize the repair area and guide the tip of the PDR tool accurately for achieving a flawless finish.

Are Dent Removal Kits suitable for large, deep dents or damage involving cracked paint?

No. PDR techniques and associated kits are strictly limited to minor dents where the paint is completely intact. If the dent is too deep, if the metal is severely stretched, or if the paint is cracked or chipped, traditional bodywork methods involving fillers and repainting are required, restricting the application scope of dent removal kits.

How do global economic trends, such as fluctuating used car sales, influence the Dent Removal Kit Market?

High used car sales volume positively impacts the market. Dealers and private sellers invest in PDR to maximize the resale value of vehicles, ensuring quick, affordable cosmetic fixes before listing. Economic downturns often increase PDR usage as vehicle owners look for cheaper alternatives to maintain their existing vehicles rather than purchasing new ones.

What impact does inadequate PDR technician training have on the market reputation?

Inadequate training leads to inconsistent, poor-quality repairs, such as hail damage that remains visible or 'push-to-paint' scenarios where the technician damages the paint. This erodes consumer confidence in the PDR method and increases the demand for certified technicians and high-quality, professional kits that offer superior results and prevent reputational harm to the industry.

What are the major challenges related to the adhesive technology used in glue pulling systems?

Challenges include developing glue formulations that maintain optimal pulling strength across varying ambient temperatures (too hot or too cold), ensuring they adhere well to different types of vehicle clear coats and paint, and designing safe release agents that allow the technician to remove the glue residue quickly and cleanly without damaging the finish.

How is the Dent Removal Kit market addressing the growing need for environmental sustainability?

The PDR method itself is inherently environmentally friendly as it eliminates the use of volatile organic compounds (VOCs) found in paints, primers, and body fillers. Manufacturers further contribute by developing tools made from recycled or sustainable materials and innovating cleaner, biodegradable glue and release agent formulations.

What is the significance of the "whale tail" PDR tool design?

The whale tail is a critical PDR tool known for its flat, thin profile and leveraged angle. Its significance lies in its ability to slide through very narrow access points, especially bracing or internal supports, to apply broad, controlled pressure over a large area of the dent, crucial for blending the repair seamlessly into the panel.

How do manufacturers ensure the durability and longevity of professional-grade PDR rods?

Manufacturers utilize high-grade materials like heat-treated stainless steel or specialized chrome vanadium alloys. They employ precision forging and CNC machining to ensure consistent strength, prevent corrosion, and maintain the precise tip geometry, which must withstand immense internal leverage without bending or breaking.

In which region is the demand for PDR tools for aluminum panels highest?

North America and Europe currently exhibit the highest demand for specialized aluminum PDR tools due to the accelerated adoption of aluminum in vehicle construction by major automotive OEMs seeking weight reduction for fuel efficiency and performance enhancement, requiring different repair protocols.

What is the role of insurance companies in influencing the Dent Removal Kit Market?

Insurance companies play a vital role by mandating or heavily promoting PDR for appropriate damage claims (especially hail), due to the significant cost savings over traditional body repair. Their endorsement validates the technology and creates high-volume demand for professional, certified PDR services and associated kits.

Why are specialized diagnostic tools, such as laser measurement, becoming integrated into PDR kits?

Digital diagnostic tools are integrated to ensure quantifiable quality control. Laser measurement verifies that the repaired surface has returned precisely to its original contour and removes subjectivity from the repair process, which is essential for satisfying both OEM standards and insurance company requirements.

What are the strategic implications of the growing popularity of mobile PDR services?

Mobile PDR services drive demand for compact, highly portable, and comprehensive master kits that can handle diverse repairs in varied environments. It also emphasizes the need for durable storage solutions and efficient battery-powered tools (like mobile induction heaters) that minimize dependence on stationary infrastructure.

How do manufacturers adapt their glue pulling systems for colder climates?

In colder climates, manufacturers offer specialized, low-temperature adhesive formulations that retain their necessary elasticity and strength despite low ambient temperatures. They also recommend higher wattage glue guns and provide insulated accessories to maintain optimal working temperatures during outdoor repairs.

What is the 'memory' of the metal, and how is it relevant to PDR?

The 'memory' of the metal refers to its inherent tendency to return to its original, manufactured shape. PDR works by carefully manipulating the metal (often with heat or specific pressure) to encourage it to relax back into its original form without stretching or requiring heat treatment, which is central to the non-invasive nature of the technique.

Is the DIY Dent Removal Kit segment cannibalizing the professional market?

No, the DIY segment addresses only the simplest, shallowest dents that professionals often consider low-margin work. While it handles basic damage, complex dents, creased damage, or extensive hail repair still necessitate the highly specialized tools, lighting, and advanced skills possessed only by certified professional PDR technicians.

What future role will specialized materials like carbon fiber play in PDR tools?

Carbon fiber is increasingly used for PDR tools, particularly long access rods, due to its superior strength-to-weight ratio. This allows technicians to apply significant leverage without the tool flexing excessively, while simultaneously reducing the physical strain on the technician during prolonged repair sessions.

How does the segmentation by Damage Type (Ding vs. Crease) impact kit selection?

Ding repair kits often feature standard rods and small glue tabs, focusing on point pressure. Crease repair, however, requires specialized whale tails and high-leverage tools capable of spreading force over a linear area, necessitating distinct tool subsets within a professional kit to manage the complexities of stretched metal along a line.

Why is the quality of the adhesive release agent crucial in glue pulling systems?

The release agent quality is crucial because a poorly formulated agent can leave residue on the paint, requiring abrasive cleaning, or, worse, chemically damage the clear coat. High-quality release agents, typically formulated with specific alcohols, ensure the adhesive is deactivated and removed instantly, preserving the factory finish.

How does the increase in urbanization globally affect the demand for PDR services and kits?

Increased urbanization leads to higher population density and more crowded parking lots and traffic, significantly increasing the frequency of minor cosmetic damages (door dings, minor bumps). This higher incidence of repairable damage directly drives demand for quick, localized PDR services and the kits required to perform them efficiently.

What is the significance of the Base Year 2025 in the market analysis timeline?

The Base Year 2025 serves as the anchor point for current market valuation and structural analysis. It incorporates the most recent available data, reflecting the immediate post-pandemic recovery trends, current supply chain dynamics, and the latest technological adoptions (like wider induction heating use) before projecting future growth.

Why is the repair of high-strength steel (HSS) panels a growing challenge for PDR kits?

HSS is highly resistant to manipulation, requiring significantly more force to push back into shape compared to mild steel. Repairing HSS necessitates specialized, ultra-stiff rods and tools with reinforced tips to prevent breakage, demanding higher manufacturing quality and specialized kits for professional users.

How does the trend of electric vehicles (EVs) impact the Dent Removal Kit market?

EVs often feature large, smooth panel surfaces and use advanced lightweight materials (including aluminum) to offset battery weight, increasing the susceptibility to visible cosmetic damage. This drives demand for PDR, as preserving the high-quality finish on expensive EV bodies is paramount to maintaining high resale value.

What is the typical difference in pricing and complexity between DIY and Professional Dent Removal Kits?

DIY kits are inexpensive (typically under $50), include 5-10 generic tools, and focus on simplicity. Professional kits range from hundreds to thousands of dollars, containing over 100 specialized tools, proprietary lighting, advanced leverage systems, and specialized materials requiring extensive technical training for effective use.

In the Value Chain, what is the importance of specialized distributors over mass retailers for professional kits?

Specialized distributors are crucial as they offer expert technical consultation, warranty services, and access to proprietary tool designs and certification training, which mass retailers cannot provide. This relationship ensures professional users receive reliable, performance-guaranteed equipment necessary for high-stakes repairs.

What security measures are manufacturers taking to combat the restraint of low-quality counterfeit kits?

Manufacturers are implementing unique serialization codes, advanced packaging security features, and digital authentication platforms (QR codes) that allow consumers and professionals to verify the authenticity of high-end PDR tools, protecting brand reputation and ensuring repair quality.

How does the increasing adoption of PDR in the Middle East and Africa (MEA) differ from APAC?

MEA adoption is slower and primarily focused on high-end vehicle maintenance in major cities, driven by wealthier consumers. APAC adoption is widespread across all vehicle segments, driven by cost-saving mandates and high volume growth across broader socio-economic classes.

What criteria are used to classify a dent as "repairable" using the PDR method?

A dent is classified as repairable if the panel material (metal or plastic) has not been stretched past its yield point, the paint layer remains intact (no chipping or cracking), and the dent location is accessible to PDR tools, either directly or via glue pulling techniques.

Why is tool ergonomics a key factor in the professional Dent Removal Kit market?

Tool ergonomics is crucial because PDR technicians spend long hours using leverage tools in constrained positions. Poorly designed tools lead to technician fatigue, hand strain, and reduced precision. Manufacturers invest in ergonomic handles and lightweight designs to enhance user comfort and repair quality over long shifts.

How do advancements in specialized glues address the challenge of repairing flexible plastic bumpers?

Specialized, highly flexible glue formulations and unique soft-pulling tabs are developed specifically for plastic bumpers. These systems apply controlled, gentle force to manipulate the plastic without tearing or warping the material, a common risk with traditional, high-tensile metal pulling glues.

What future technological integration is anticipated between AI analysis and PDR kits?

Future integration anticipates AI-driven feedback systems embedded in specialized PDR rods. These smart tools will provide real-time pressure and force feedback to the technician via a connected device, ensuring optimal pressure application and preventing over-pushing or potential paint damage during the repair process.

What are the implications of the "Combination Kits" segment dominating revenue?

The dominance implies that professional versatility is highly valued. Technicians require the capability to switch between leverage (rods) and adhesion (glue) methods instantly, depending on the dent location and geometry, ensuring they are equipped for virtually any repair scenario encountered in a typical body shop or mobile service.

How is the market adapting to the complexity of modern vehicle panel structures (internal bracing)?

The market is adapting by developing specialized access tools, including flexible or articulating rods (jigglers) and longer, thinner whale tails that can maneuver around the complex internal bracing found in modern vehicle designs, allowing technicians to reach otherwise inaccessible areas.

What impact do specialized PDR training academies have on market growth?

These academies are vital for controlled market growth. They standardize skill levels, increase the supply of certified technicians, and create informed demand for high-quality, professional-grade kits, acting as a crucial bridge between tool manufacturers and the skilled labor force.

How do manufacturers cater to the unique demands of fleet management companies for PDR kits?

Manufacturers provide fleet management companies with robust, medium-sized, highly standardized kits focused on rapid, repetitive ding repair. These kits are often bundled with comprehensive training packages designed for in-house maintenance teams to minimize asset downtime and maintain vehicle consistency.

What makes the use of specialized lighting systems essential for achieving 'undetectable' repairs?

The human eye cannot easily detect subtle imperfections. Specialized lighting exaggerates the reflection of light lines on the panel, revealing minute imperfections (pushed spots or crowns) that must be precisely blended out to ensure the repair is completely undetectable under normal viewing conditions, meeting professional quality thresholds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager