Dental Diagnostic Imaging Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435191 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Dental Diagnostic Imaging Equipment Market Size

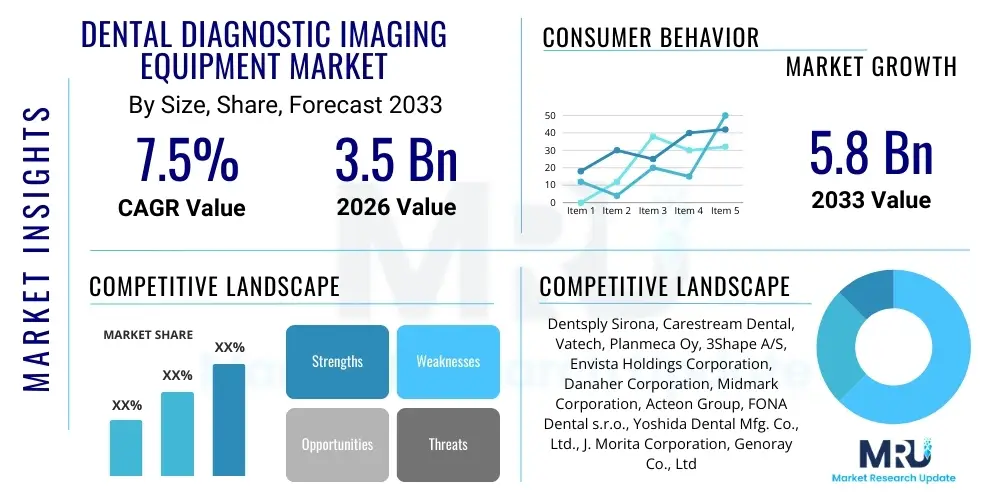

The Dental Diagnostic Imaging Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033. This robust expansion is fueled primarily by the global shift from traditional film-based radiography to advanced digital imaging modalities, such as Cone Beam Computed Tomography (CBCT) and digital intraoral sensors, which offer superior diagnostic quality and improved patient workflow efficiency.

Dental Diagnostic Imaging Equipment Market introduction

The Dental Diagnostic Imaging Equipment Market encompasses devices used by dental professionals, including orthodontists, endodontists, and general dentists, to capture detailed images of the oral and maxillofacial structures for diagnosis, treatment planning, and monitoring. Key products within this market include intraoral X-ray systems, extraoral X-ray systems (like panoramic and cephalometric units), Cone Beam Computed Tomography (CBCT) devices, and advanced digital scanners. These systems are essential for detecting caries, periodontal disease, structural abnormalities, impacted teeth, and pathologies, forming the bedrock of modern, evidence-based dentistry globally.

Product descriptions range from simple digital sensors replacing traditional film to highly complex 3D imaging systems like CBCT, which provide volumetric data crucial for implantology and complex surgical procedures. Major applications span across general dentistry, prosthodontics, periodontics, and increasingly, specialized fields like forensic odontology. The primary benefits of these digital systems include reduced radiation exposure compared to older technologies, instantaneous image processing, seamless integration with electronic health records (EHRs), and enhanced patient communication due to the clarity of digital imagery.

Driving factors propelling market growth include the rising global prevalence of dental diseases, the increasing disposable income in emerging economies enabling better access to sophisticated dental care, and significant technological advancements such as the integration of Artificial Intelligence (AI) for automated image analysis and diagnostics. Furthermore, the growing elderly population, which requires more complex restorative and implant procedures, inherently drives the demand for high-resolution 3D imaging equipment, sustaining the upward trajectory of the market size and technological innovation.

Dental Diagnostic Imaging Equipment Market Executive Summary

The global Dental Diagnostic Imaging Equipment Market is experiencing accelerated expansion, fundamentally driven by pervasive digitalization across dental practices and specialized clinics worldwide. Business trends indicate a strong preference among practitioners for high-throughput, low-dose imaging solutions, specifically favoring CBCT technology due to its capability to generate highly accurate three-dimensional representations required for complex procedures like dental implant planning and orthodontic assessments. Key industry strategies revolve around strategic mergers and acquisitions, and partnerships aimed at integrating software solutions, particularly those involving AI-driven diagnostic features, directly into existing hardware ecosystems to maximize efficiency and reduce user errors.

Regional trends highlight North America and Europe as dominant market leaders, characterized by high healthcare expenditure, established digital infrastructure, and rapid adoption of premium, advanced imaging modalities. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, fueled by burgeoning dental tourism, expanding healthcare accessibility, and government initiatives focused on modernizing healthcare facilities. Regulatory environments are also evolving, particularly in major markets, ensuring that new devices meet stringent safety and efficacy standards, thereby influencing product launch timelines and market competitiveness.

Segmentation trends reveal that the CBCT segment is the most lucrative product category, attributed to its versatile applications and superior diagnostic yield compared to traditional 2D systems. The end-user segment is heavily dominated by dental clinics and private practitioners, who prioritize compact, efficient, and integrated diagnostic tools that fit within smaller operational footprints. Overall, the market remains competitive, with major players continuously investing in R&D to launch more portable, cost-effective, and technologically integrated imaging solutions, particularly focusing on cloud connectivity and real-time image sharing capabilities to enhance collaborative dentistry models.

AI Impact Analysis on Dental Diagnostic Imaging Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Dental Diagnostic Imaging Equipment Market center primarily on its ability to enhance diagnostic precision, improve clinical workflow efficiency, and address the associated costs and regulatory challenges. Users frequently question how AI algorithms can automate the detection of subtle pathological changes, such as early-stage caries or periapical lesions, often missed by the human eye, and whether AI tools can standardize radiographic interpretation across different practitioners. Concerns also arise regarding data security, the need for extensive datasets for algorithm training, and the clarity of regulatory guidelines (like FDA clearance) for AI-assisted diagnostic software integrated into dental imaging hardware. Furthermore, practitioners seek clarity on the return on investment (ROI) associated with implementing AI-enabled equipment, focusing on reduced chair time and minimizing the need for repeat scans.

The core theme emerging from these inquiries is the expectation that AI will transition dental imaging from a purely capture-based process to an intelligent, analytical one. Users anticipate that AI will significantly streamline tedious tasks, such as automatic tooth numbering, identification of anatomical landmarks in cephalometric analysis, and volumetric segmentation in CBCT scans. This shift promises to liberate dentists from routine interpretative work, allowing them to focus more on complex treatment planning and patient interaction. However, the market’s successful integration hinges on seamless compatibility between proprietary imaging systems and third-party AI platforms, necessitating open API strategies and standardization in data formatting (e.g., DICOM files) to ensure universal accessibility and maximum utility across different clinical settings.

Ultimately, the consensus suggests that AI integration will lead to higher quality, faster, and more reproducible diagnostic outcomes, positioning AI as a crucial differentiator for next-generation dental imaging systems. While initial adoption may face barriers related to software validation and initial training, the long-term impact is overwhelmingly positive, driving demand for imaging equipment that is ‘AI-ready’ and capable of processing the large data volumes required for accurate algorithmic function. This technological evolution not only improves patient care but also establishes new benchmarks for operational excellence and predictive dentistry, particularly in specialized fields like orthodontics and oral surgery where precision is paramount.

- Automated lesion detection and quantification (caries, bone loss, infections).

- Enhanced image quality optimization and noise reduction in low-dose protocols.

- Streamlining of treatment planning through automatic segmentation and measurement.

- Standardization of radiographic reporting and reduction of inter-operator variability.

- Improved workflow management by prioritizing complex cases requiring human review.

- Accelerated cephalometric analysis and orthodontic landmark identification.

- Development of predictive models for implant success and failure risk assessment.

DRO & Impact Forces Of Dental Diagnostic Imaging Equipment Market

The Dental Diagnostic Imaging Equipment Market is primarily driven by the escalating demand for minimally invasive procedures and accurate 3D diagnostics, particularly for implantology and complex restorative dentistry. Restraints include the high capital investment required for advanced systems like CBCT and the associated installation and maintenance costs, which pose significant barriers to adoption, especially for small private practices in developing regions. Opportunities lie in expanding the market reach through portable and handheld imaging devices, coupled with the integration of AI to maximize diagnostic output and minimize operational burdens. These elements collectively shape the competitive landscape and technological trajectory of the market, ensuring continuous innovation despite economic hurdles.

Drivers: A major impetus is the increasing global geriatric population, which inherently requires more complex dental interventions and diagnostics, alongside growing awareness among consumers regarding the benefits of preventive and advanced dental care. Furthermore, technological leaps, such as the miniaturization of sensors and the advent of low-radiation dose protocols, make digital imaging systems more appealing to both practitioners and patients. Government initiatives supporting digitalization in healthcare across various regions also mandate the upgrade from analog to digital systems, significantly stimulating market movement and investment in modern equipment infrastructure.

Restraints: Beyond initial cost, the market faces constraints related to stringent regulatory approval processes that can delay product launches, particularly for novel technologies involving radiation exposure. Concerns about data privacy and security (HIPAA and GDPR compliance) related to managing vast amounts of sensitive patient imaging data stored in cloud or network environments also restrict widespread adoption in some regions. Additionally, a notable restraint is the need for specialized training for dental professionals to effectively operate and interpret advanced imaging modalities like CBCT, which represents an ongoing educational and financial burden.

Opportunities & Impact Forces: The most significant opportunities reside in the untapped potential of emerging markets like India, China, and Brazil, where the dental infrastructure is rapidly developing, supported by increasing affluence and expanding dental insurance coverage. The shift towards teledentistry and remote diagnostic services opens up new avenues for cloud-connected, portable imaging devices. Impact forces, such as competitive pricing strategies adopted by Asian manufacturers and disruptive technologies like AI and machine learning, compel established market leaders to accelerate innovation, ultimately leading to higher efficiency, greater accuracy, and a broader accessibility of diagnostic tools across all tiers of dental practice.

Segmentation Analysis

The Dental Diagnostic Imaging Equipment Market is comprehensively segmented based on product type, technology, application, and end-user, allowing for a detailed analysis of specific growth pockets and demand patterns across the global landscape. Product segmentation highlights the dominance of intraoral systems, although extraoral and specialized CBCT units are rapidly gaining market share due to their superior capabilities in handling complex procedures. Technology breakdown reveals a fundamental transition towards digital sensors and plate systems, moving away from conventional film-based systems, emphasizing the industry’s commitment to faster results and reduced environmental impact. Application analysis identifies implantology and orthodontics as key areas demanding high-resolution diagnostic support, driven by the global increase in aesthetic and functional dental corrections. The end-user segment underscores the critical role of private dental clinics as the largest consumer base for these advanced diagnostic tools.

- By Product Type:

- Intraoral Systems (Sensors, PSP Systems, Digital Radiography)

- Extraoral Systems (Panoramic X-ray Systems, Cephalometric Systems)

- Cone Beam Computed Tomography (CBCT) Systems

- Hybrid Imaging Systems

- By Technology:

- Digital Imaging

- Film-based Imaging

- By Application:

- Implantology

- Endodontics

- Orthodontics

- Periodontics

- Oral and Maxillofacial Surgery

- By End-user:

- Dental Clinics and Hospitals

- Dental Laboratories

- Academic and Research Institutes

Value Chain Analysis For Dental Diagnostic Imaging Equipment Market

The value chain for the Dental Diagnostic Imaging Equipment Market begins with upstream activities involving the sourcing of highly specialized electronic components, sensor technology (CMOS/CCD), and advanced software development for image processing and reconstruction. Key suppliers provide core technologies such as X-ray tubes, detectors, and proprietary software algorithms, often requiring strong intellectual property protection. The manufacturing stage is characterized by high precision engineering and rigorous quality control to ensure compliance with medical device regulations (e.g., FDA, CE marking). This stage often involves significant R&D investment, particularly in developing lower-dose imaging protocols and integrating new features like AI-assisted software functionalities directly into the hardware architecture, positioning manufacturers as crucial innovators in the overall chain.

Downstream analysis focuses on distribution and logistics, which involves both direct and indirect sales channels. Direct channels are typically utilized by market leaders to sell high-value, complex CBCT systems to large hospitals or dental chains, allowing for better margin control and specialized technical support during installation and training. Indirect channels, involving authorized regional distributors, dental supply houses, and specialized technology resellers, are more common for intraoral sensors and panoramic units, particularly in fragmented markets or regions with limited direct OEM presence. These distributors play a vital role in providing localized inventory, financing options, and immediate technical services, which are critical for maintaining customer satisfaction and minimizing equipment downtime in clinical settings.

The final stage involves end-users (dental clinics, hospitals) and post-sales services, which are essential for recurring revenue and long-term customer relationships. The service component includes maintenance contracts, software updates, and ongoing technical support, especially crucial for complex digital equipment. Furthermore, training programs for clinicians and technicians are integrated into the distribution channel to ensure the optimal utilization of the equipment’s advanced features. The efficiency of the distribution channel, coupled with the robustness of the post-sales support infrastructure, directly influences market penetration and end-user adoption rates, highlighting the strategic importance of choosing the right partners in specific geographical areas.

Dental Diagnostic Imaging Equipment Market Potential Customers

Potential customers for Dental Diagnostic Imaging Equipment are diverse, ranging from small single-chair private dental practices to large multi-specialty corporate dental chains and major academic research institutions. The primary buyer segment remains private dental clinics, driven by the necessity to upgrade from analog to digital systems to meet evolving patient expectations for efficiency and low-radiation diagnostics. These clinics prioritize equipment that offers excellent image quality, user-friendly interfaces, and seamless integration with existing practice management software, particularly focusing on intraoral sensors and modern panoramic units that offer a strong balance between cost and performance for routine care.

Another significant segment comprises specialized dental centers, particularly those focused on implantology, orthodontics, and maxillofacial surgery. These buyers constitute the largest market for high-end CBCT systems, demanding superior resolution and advanced features such as guided surgery planning capabilities and dynamic navigation. These sophisticated end-users require high-capital investment equipment that significantly improves diagnostic certainty and procedural outcomes. Hospitals, especially those with trauma centers or comprehensive oral healthcare departments, also represent key buyers, often procuring hybrid systems that combine panoramic and cephalometric functionalities with CBCT capabilities to serve a broader scope of specialized patient needs and research objectives.

Finally, academic institutions and dental training hospitals serve as crucial potential customers, not only purchasing equipment for patient care but also for teaching and research purposes. These institutions often require access to the latest, most cutting-edge technologies, including advanced digital scanners and AI-enabled diagnostic software, to train the next generation of dental professionals. Their purchasing decisions are often influenced by grant funding, research goals, and the need for robust, durable equipment that can withstand high-volume use and facilitate complex clinical studies, making them influential early adopters of emerging diagnostic technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Carestream Dental, Vatech, Planmeca Oy, 3Shape A/S, Envista Holdings Corporation, Danaher Corporation, Midmark Corporation, Acteon Group, FONA Dental s.r.o., Yoshida Dental Mfg. Co., Ltd., J. Morita Corporation, Genoray Co., Ltd., Asahi Roentgen Ind. Co., Ltd., Air Techniques, Inc., Align Technology, Inc., Belmont Dental Manufacturing Co., Ltd., Owandy Radiology, KaVo Dental GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Diagnostic Imaging Equipment Market Key Technology Landscape

The technological landscape of the Dental Diagnostic Imaging Equipment Market is rapidly evolving, driven by the pursuit of higher resolution imaging with minimized patient radiation dose. Cone Beam Computed Tomography (CBCT) remains the most impactful technology, offering volumetric 3D data essential for complex surgical planning and highly accurate measurements that 2D radiography cannot provide. Advancements in CBCT focus on iterative reconstruction algorithms that dramatically reduce scan time and required dosage, making 3D imaging safer and more accessible for routine dental practices. Furthermore, system manufacturers are prioritizing the integration of large Field-of-View (FoV) options, allowing for comprehensive maxillofacial evaluations in a single exposure, coupled with software enhancements for distortion correction and artifact reduction stemming from metal restorations.

Digital radiography technology, encompassing both Charged Coupled Device (CCD) and Complementary Metal-Oxide-Semiconductor (CMOS) sensors for intraoral imaging, has effectively replaced traditional film due to superior image clarity and instantaneous visualization. Key technology advancements here include improved sensor durability, thinner sensor profiles for enhanced patient comfort, and direct USB connectivity for streamlined integration without requiring separate processing hardware. Phosphor Storage Plate (PSP) systems continue to hold relevance, particularly in clinics transitioning from analog systems, due to their cost-effectiveness and ability to utilize existing film holders, offering a flexible intermediate step toward full digitalization, although they require additional processing steps compared to direct digital sensors.

The emerging technological front is dominated by data management and analysis tools, including Picture Archiving and Communication Systems (PACS) optimized for dental use and cloud-based platforms enabling secure data sharing across multiple locations. Most critically, Artificial Intelligence (AI) and Machine Learning (ML) are being integrated at the software level to enhance post-processing, automate measurements, and assist in pathological detection, effectively shifting the diagnostic workflow towards greater standardization and efficiency. This integration requires imaging hardware capable of fast, reliable data transfer and processing power, making system computing capabilities a critical differentiator in the competitive landscape.

Regional Highlights

- North America: This region holds the largest market share, characterized by high adoption rates of advanced imaging technologies, robust healthcare spending, and favorable reimbursement policies. The presence of key market players and a mature digital infrastructure encourages the widespread use of CBCT and AI-enabled diagnostic tools. Investment in large corporate dental organizations (DSOs) drives bulk purchases of integrated imaging solutions.

- Europe: Europe is a substantial contributor to the market, primarily due to stringent regulatory standards promoting patient safety (low-dose radiation protocols) and high awareness of preventive dental care. Western European countries, particularly Germany and the UK, are early adopters of premium digital systems, while Eastern European markets present significant growth potential fueled by modernizing dental practices and increasing expenditure on healthcare equipment.

- Asia Pacific (APAC): APAC is anticipated to exhibit the fastest CAGR during the forecast period. This rapid growth is attributed to rising disposable incomes, expanding dental tourism, and aggressive government initiatives in countries like China and India focused on improving public health infrastructure. The market is highly competitive, with local manufacturers providing cost-effective digital solutions, driving the shift from analog to basic digital radiography in high-volume settings.

- Latin America (LATAM): Growth in LATAM is driven by increasing foreign investment in healthcare and the rising prevalence of chronic dental disorders. Brazil and Mexico are primary markets, showing increasing demand for mid-range diagnostic equipment, often focusing on advanced panoramic and cephalometric units rather than high-end CBCT, due to price sensitivity and localized reimbursement challenges.

- Middle East and Africa (MEA): This region offers nascent yet substantial potential, primarily centered around Gulf Cooperation Council (GCC) countries like the UAE and Saudi Arabia, which boast high per capita healthcare spending and luxury medical tourism sectors. Investment is concentrated in urban centers, focusing on high-end CBCT technology to support advanced aesthetic and implant dentistry services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Diagnostic Imaging Equipment Market.- Dentsply Sirona

- Carestream Dental

- Planmeca Oy

- Vatech Co., Ltd.

- 3Shape A/S

- Envista Holdings Corporation

- J. Morita Corporation

- Acteon Group

- Asahi Roentgen Ind. Co., Ltd.

- Midmark Corporation

- Genoray Co., Ltd.

- FONA Dental s.r.o.

- Yoshida Dental Mfg. Co., Ltd.

- Align Technology, Inc. (Through integrated solutions)

- KaVo Dental GmbH (A subsidiary of Envista)

- Owandy Radiology

- Air Techniques, Inc.

- Belmont Dental Manufacturing Co., Ltd.

- Cefla S.C.

- Suni Medical Imaging Inc.

Frequently Asked Questions

Analyze common user questions about the Dental Diagnostic Imaging Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the transition from 2D to 3D imaging technologies in modern dental practices?

The transition is driven primarily by the need for enhanced diagnostic accuracy, especially in complex procedures like implant placement, root canal treatment planning, and orthodontic assessments. 3D imaging, such as CBCT, provides volumetric data, eliminating superimposition and offering precise measurements essential for optimal patient outcomes and reduced procedural risks.

How significant is the role of Artificial Intelligence (AI) in the future of dental imaging?

AI is highly significant, impacting the market by automating diagnostic tasks such as caries detection, periodontal bone level measurement, and landmark identification. AI integration boosts clinical efficiency, standardizes interpretation, and allows practitioners to focus on treatment planning, thereby maximizing the return on investment (ROI) of digital equipment.

Which product segment holds the highest growth potential in the Dental Diagnostic Imaging Equipment Market?

The Cone Beam Computed Tomography (CBCT) segment holds the highest growth potential. Its versatility across multiple dental specialties—from implantology and endodontics to periodontics—and continuous innovation in low-dose protocols ensure sustained demand and high market value globally.

What are the primary factors restraining the adoption of advanced dental imaging equipment, particularly in emerging markets?

The primary restraining factors include the substantial initial capital expenditure required for high-end systems (like CBCT), high maintenance and service costs, and the lack of readily available specialized technical training needed for the effective operation and interpretation of advanced digital images.

Which geographical region is expected to demonstrate the fastest growth rate in the forecast period?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This acceleration is fueled by increasing healthcare infrastructure investment, a rapid rise in dental tourism, and rising disposable incomes driving greater access to modern, high-quality dental care across populous nations like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager