Dental Disposables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433290 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Dental Disposables Market Size

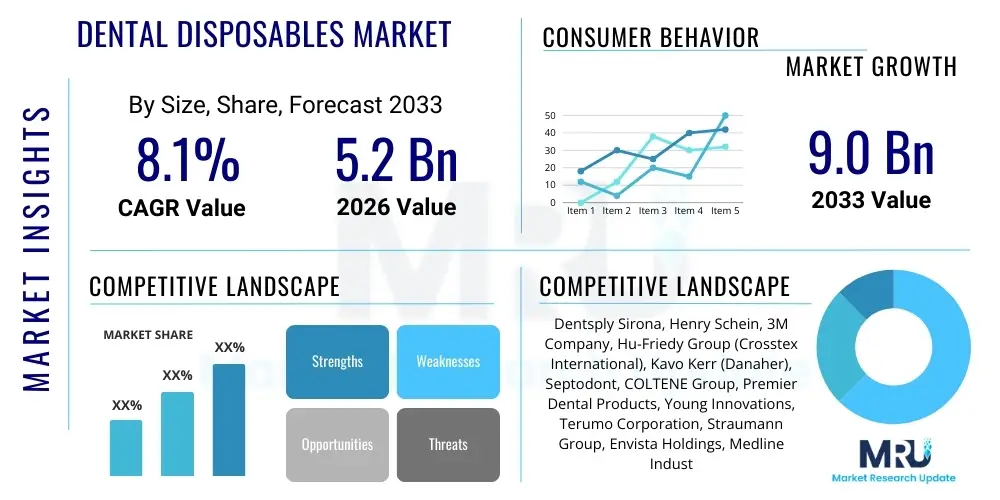

The Dental Disposables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Dental Disposables Market introduction

The Dental Disposables Market encompasses a wide range of single-use products crucial for maintaining stringent infection control and hygiene standards in dental practices, hospitals, and surgical centers. These products, which include gloves, face masks, syringe tips, saliva ejectors, cotton rolls, impression trays, and barrier films, are essential for preventing cross-contamination between patients, practitioners, and the environment. The fundamental market drivers stem directly from increasing global awareness of infectious diseases, coupled with mandatory regulatory guidelines established by bodies such as the CDC and WHO, which necessitate the replacement of reusable instruments with certified disposable alternatives whenever possible. The shift toward single-use items mitigates the risk associated with inadequate sterilization processes and streamlines clinical workflows, enhancing efficiency and patient safety simultaneously.

Product descriptions within this segment vary significantly, ranging from general protective wear, such as medical-grade nitrile gloves used universally during all procedures, to highly specialized items like disposable dental burs and protective drapes designed for specific surgical interventions. Major applications span prophylactic treatments, routine check-ups, restorative procedures (fillings, crowns), periodontics, endodontics, and complex oral surgeries. The core benefit of dental disposables is the immediate reduction in infection risk, coupled with cost-effectiveness when factoring in the reduced labor and equipment maintenance associated with sterilizing multi-use tools. Furthermore, the convenience offered by standardized disposable kits is increasingly driving adoption across high-volume dental chains and mobile dentistry units.

Driving factors for sustained growth include the global rise in dental tourism, the aging population requiring more complex dental care, and increased healthcare expenditure in emerging economies. The necessity for quick turnover rates in busy clinics further solidifies the demand for readily available, sterile disposable supplies. Manufacturers are continually innovating materials to improve comfort, durability, and most importantly, sustainability, with a growing emphasis on biodegradable and environmentally friendly components to address waste management concerns prevalent in the healthcare sector. This innovation cycle supports both market expansion and compliance with evolving environmental mandates.

Dental Disposables Market Executive Summary

The Dental Disposables Market is characterized by robust growth, primarily driven by heightened global hygiene standards and stricter regulatory enforcement across dental healthcare facilities. Current business trends indicate a significant shift towards environmentally conscious products, compelling major manufacturers to invest heavily in sustainable materials like biodegradable plastics and recycled non-wovens, thereby addressing the substantial waste generated by the sector. Mergers and acquisitions remain a key strategy for market consolidation, particularly allowing larger players to secure niche technologies, such as advanced material composites for surgical barriers, or expand geographical reach into rapidly developing Asian markets. Supply chain resilience, following recent global disruptions, has also become a critical focus, favoring companies with diversified manufacturing footprints and strong distributor networks capable of ensuring continuous product supply to essential healthcare providers.

Regionally, North America and Europe currently dominate the market due to established regulatory frameworks, high per capita dental expenditure, and advanced healthcare infrastructure. However, the Asia Pacific region is projected to exhibit the fastest growth rate, fueled by expanding access to dental care, increasing medical insurance penetration, and a burgeoning middle class willing to invest in routine dental health. Governments in countries like India and China are investing in public health initiatives that include mandatory hygiene protocols, dramatically boosting the foundational demand for basic disposables like gloves and masks. Latin America and the Middle East also represent promising high-potential areas, driven by infrastructure improvements and growing foreign investment in specialized dental clinics.

Segmentation trends highlight the Protective Barrier segment (gloves, masks, protective eyewear) as the largest revenue contributor, owing to its mandatory use in all procedures. Conversely, the Oral Hygiene and Impression Materials segments are showing high incremental growth, driven by product innovation focused on improved diagnostic accuracy and patient experience. End-user analysis reveals that large Dental Service Organizations (DSOs) and multi-specialty hospitals are the primary bulk purchasers, leveraging economies of scale. The rise of independent dental clinics in suburban and rural areas globally ensures a consistent, fragmented demand base, fostering intense competition among regional suppliers specializing in cost-effective, high-volume products. The market's future success hinges on balancing strict compliance requirements with the accelerating need for sustainable, cost-efficient product lines.

AI Impact Analysis on Dental Disposables Market

User queries regarding the impact of Artificial Intelligence (AI) on the Dental Disposables Market often revolve around indirect influences, focusing less on the disposables themselves and more on how AI affects dental practice management and procedural throughput. Common themes include whether AI-driven diagnostics will increase the frequency of high-acuity procedures (thereby increasing demand for specialized disposables), how AI optimizes supply chain management to prevent stockouts of critical items, and if AI can improve infection control compliance tracking, indirectly validating the consistent usage of disposable barriers. Users are concerned about the efficiency gains AI offers in minimizing chair time and maximizing patient volume, which necessitates a corresponding optimization of disposable inventory. The expectation is that AI will introduce predictive analytics for disposable consumption based on appointment scheduling, procedural mix, and historical usage patterns, leading to leaner inventory and reduced waste, although not diminishing the overall procedural demand.

- AI enhances demand forecasting accuracy for specific disposable items (e.g., endodontic files, surgical drapes) based on scheduled treatments.

- Predictive maintenance and diagnostics supported by AI can lead to earlier, more specialized interventions, potentially increasing the demand for complex surgical disposables.

- Optimization of clinic workflows through AI-driven scheduling increases patient throughput, requiring faster consumption rates of high-volume disposables (gloves, masks, patient bibs).

- AI-powered inventory management systems automatically trigger procurement based on consumption thresholds, reducing manual errors and ensuring stock continuity for essential supplies.

- Implementation of AI in remote monitoring and teledentistry could slightly shift the demand mix, emphasizing diagnostic disposables or home-care kits, though core in-clinic usage remains paramount.

- AI algorithms can analyze sterilization cycles and usage logs, indirectly supporting compliance efforts that mandate the strict use and disposal of single-use barriers.

DRO & Impact Forces Of Dental Disposables Market

The Dental Disposables Market is powerfully influenced by a confluence of accelerating regulatory pressures and intrinsic demand driven by healthcare expansion. The primary Drivers include the continuously increasing prevalence of dental diseases globally, the heightened emphasis on infection control following global health crises, and the implementation of non-negotiable standards by global regulatory bodies mandating the use of sterile, single-use instruments to protect both patients and healthcare workers. This regulatory push provides a resilient, non-cyclical foundation for market growth. Furthermore, the rising number of dental visits due to greater disposable income and improved awareness in developing regions substantially amplifies the volume demand. Technological advancements focusing on ergonomic design and material integrity in products like composite tips and saliva ejectors further encourage adoption over multi-use alternatives.

Conversely, significant Restraints impede explosive growth, notably the complex issue of medical waste management and disposal costs. Disposables contribute heavily to landfill waste, generating environmental backlash and increasing operating costs for dental practices due to specialized biohazard disposal requirements. Price sensitivity, particularly in highly competitive markets and publicly funded healthcare systems, sometimes limits the adoption of premium, higher-quality disposables, pushing practices toward less expensive, lower-margin products. Additionally, global supply chain volatility, exemplified by recent shortages of raw materials like nitrile and polypropylene, remains a structural challenge affecting manufacturing costs and product availability.

The main Opportunities lie in the development and commercialization of sustainable and biodegradable disposable materials, responding directly to both environmental mandates and consumer preference for green practices. Innovation in integrated disposable kits customized for specific procedures (e.g., endodontic kits, restorative kits) offers streamlined inventory management and reduced preparation time for clinics, representing a valuable upselling proposition for manufacturers. Furthermore, expansion into untapped rural markets in emerging economies, coupled with government initiatives to improve public dental health, presents substantial long-term growth avenues. The increasing sophistication of aesthetic dentistry also generates specialized demand for high-precision disposable tools. These dynamics create powerful Impact Forces, where regulatory necessity and environmental consciousness act as dual pressures, ensuring continuous innovation in material science while simultaneously boosting baseline procedural consumption.

Segmentation Analysis

The Dental Disposables Market is extensively segmented based on Product Type, Material, and End-User, reflecting the diverse applications and regulatory requirements within the dental healthcare ecosystem. Segmentation by product type is the most intricate, dividing the market into essential categories such as barrier and protective equipment, fluid management tools, impression materials accessories, and specialized surgical consumables. This detailed categorization helps stakeholders understand the specific dynamics driving each sub-segment; for instance, the rapid growth in specialized surgical kits is driven by increasing complexity in implantology, while the steady growth of gloves and masks is linked directly to patient volume and mandated infection control protocols. Analyzing these segments is crucial for strategic pricing and inventory management across the supply chain.

Segmentation by material is gaining paramount importance due to sustainability concerns. Traditional materials like plastics (polypropylene, polyethylene) and synthetic rubbers (nitrile, latex) still dominate, but the high growth potential lies within the emerging segments of biodegradable polymers and non-woven composites designed for enhanced environmental compatibility. End-user segmentation clearly defines the procurement landscape, identifying large volume buyers such as hospitals and Dental Service Organizations (DSOs), which prioritize bulk purchasing and negotiated contracts, versus smaller independent dental clinics and academic/research institutes, which often rely on regional distributors for smaller, customized orders. The detailed analysis of these segments reveals that the shift toward DSOs globally is consolidating purchasing power, impacting manufacturer margins and distribution strategies.

- By Product Type:

- Gloves (Latex, Nitrile, Vinyl)

- Face Masks and Protective Eyewear

- Saliva Ejectors and Suction Tips

- Dental Syringe Tips and Needles

- Impression Trays and Mixing Tips

- Cotton Rolls and Sponges

- Patient Bibs and Drapes

- Disposable Dental Mirrors and Probes

- Sterilization Pouches and Rolls

- Disposable Applicators and Brushes

- By Material:

- Plastic (Polypropylene, Polyethylene, PVC)

- Non-Woven Fabric

- Paper-based Products

- Latex and Non-Latex Materials (Nitrile, Vinyl)

- Biodegradable Materials

- By End-User:

- Dental Clinics and Private Practices

- Hospitals and Outpatient Facilities

- Academic and Research Institutes

- Dental Service Organizations (DSOs)

Value Chain Analysis For Dental Disposables Market

The value chain for the Dental Disposables Market begins with upstream activities focused on raw material procurement, encompassing polymers (for plastics and synthetic rubbers), non-woven fabrics, cotton, and packaging materials. Upstream analysis highlights the high dependency on petrochemical derivatives and the sensitivity of production costs to global oil prices and specialized chemical manufacturing capacity. Key challenges at this stage include securing high-quality, medical-grade raw materials that meet strict biocompatibility and sterility standards, coupled with the increasing strategic necessity of sourcing sustainable or recycled content to improve environmental profiles. Manufacturers must engage in rigorous quality control to ensure raw input consistency before processing.

The core manufacturing and assembly stage involves high-volume, automated production lines for items like gloves and masks, or precision molding for syringe tips and impression trays. Efficiency in manufacturing—minimizing scrap and optimizing sterilization cycles (usually gamma irradiation or ethylene oxide)—is paramount for cost competitiveness. Once manufactured and packaged, the downstream analysis focuses on market access and delivery. The distribution channel is often complex, involving a mix of direct sales to large hospital chains and DSOs, and indirect sales through large national or regional medical distributors (e.g., Henry Schein, Patterson Dental). Distributors provide essential logistical support, inventory management, and reach to fragmented end-users like small independent practices.

Direct sales offer manufacturers higher margins and greater control over brand messaging but require substantial investment in sales forces. Indirect channels, while adding margin compression, provide crucial market penetration and logistical coverage, especially in geographically dispersed or emerging markets. The choice of channel strategy heavily influences the final pricing and availability of disposable products. The value chain concludes with the end-user (dental clinic or hospital) and the subsequent critical phase of certified biohazard waste disposal, which represents an external cost factored into the overall value proposition of dental disposables.

Dental Disposables Market Potential Customers

The primary consumers and end-users of dental disposables are professional healthcare providers operating within organized clinical settings where patient safety and regulatory compliance are non-negotiable mandates. The largest group of buyers includes Dental Service Organizations (DSOs) and large corporate dental chains. These entities purchase disposables in massive quantities, often negotiating long-term contracts directly with manufacturers or Tier 1 distributors to secure favorable pricing and guaranteed supply, making them key strategic partners for market growth. Their consolidated buying power dictates quality standards and price points for high-volume items.

Independent dental clinics and smaller private practices form the most numerically significant segment of end-users. Although individually they purchase smaller volumes, their collective demand drives the robust network of regional distributors. These customers prioritize reliability, ease of ordering, and competitive pricing, often relying on local distributor relationships for quick fulfillment and inventory advice. Furthermore, hospitals with dedicated maxillofacial surgery units and outpatient dental surgery centers represent high-value customers, requiring specialized, high-grade surgical disposables like barrier drapes and specialized suction systems, driven by complex procedural requirements and stringent hospital accreditation standards.

Academic institutions and dental research laboratories also serve as significant, albeit specialized, customers. These bodies purchase disposables for training future practitioners, conducting research trials, and offering subsidized community care. Their demand profile tends to include a wider variety of specific diagnostic and experimental disposables, emphasizing educational bulk packaging. Lastly, public health organizations and governmental dental programs, particularly those focused on community outreach or preventative care (e.g., school dental programs), represent bulk purchasers driven primarily by achieving high coverage efficiency with cost-effective, basic protective items like masks, gloves, and fluoride applicators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Henry Schein, 3M Company, Hu-Friedy Group (Crosstex International), Kavo Kerr (Danaher), Septodont, COLTENE Group, Premier Dental Products, Young Innovations, Terumo Corporation, Straumann Group, Envista Holdings, Medline Industries, Cardinal Health, Ansell Limited, Halyard Health (now part of Owens & Minor), Shofu Inc., ULTRADENT Products, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Disposables Market Key Technology Landscape

The technology landscape in the Dental Disposables Market is primarily driven by advancements in material science, sterilization techniques, and manufacturing precision aimed at maximizing safety, efficiency, and sustainability. A critical technological focus is on developing advanced polymer formulations for gloves and protective barriers, such as thin-film nitrile technology that offers superior tactile sensitivity and puncture resistance compared to traditional latex or vinyl, without compromising barrier integrity. Innovation in disposable impression materials involves proprietary mixing tips and dispensing systems that ensure precise, bubble-free material delivery, crucial for accurate diagnostic models and restorative work. Manufacturers are employing automated, high-speed injection molding processes and aseptic packaging technologies to reduce cost per unit and increase production scalability while adhering to ISO and FDA standards for medical device manufacturing.

Another significant technological vector involves the shift towards sustainable materials. Research and development efforts are concentrated on creating medical-grade, compostable, or biodegradable substitutes for traditional petrochemical plastics used in items like saliva ejectors and packaging. This includes the use of bioplastics derived from renewable sources, requiring specialized polymer engineering to maintain the necessary stiffness, non-toxicity, and sterilization compatibility. Furthermore, the adoption of RFID (Radio-Frequency Identification) and IoT sensors is emerging, primarily in high-value or regulated disposable items. These technologies aid clinics in automatic inventory tracking, expiry date management, and usage logging, which is crucial for compliance reporting and efficient stock rotation, thereby indirectly optimizing disposable consumption.

The manufacturing process itself incorporates sophisticated sterilization validation technologies. Ensuring the Sterility Assurance Level (SAL) is met for every batch, especially those sterilized using EtO (Ethylene Oxide) or gamma irradiation, requires complex monitoring and validation software. Innovations are also seen in the design of ergonomic disposables, such as multi-functional syringe tips or pre-packaged procedure kits. These technological enhancements are aimed at reducing chair time and minimizing the procedural steps required by the clinician, thereby enhancing the overall operational efficiency of dental practices, solidifying the economic benefit of single-use solutions over reusable alternatives.

Regional Highlights

Regional dynamics heavily influence the consumption patterns, regulatory mandates, and market maturity levels of dental disposables globally. North America stands as the dominant market, characterized by highly developed healthcare infrastructure, substantial spending on dental care, and stringent regulatory oversight (FDA, CDC guidelines) that strictly mandate the use of disposables for virtually all patient contact procedures. The presence of major global market players and large consolidated buying groups (DSOs) further drives high-volume consumption. Continuous technological adoption and patient expectation for optimal infection control maintain North America's leadership position in value terms.

Europe represents the second-largest market, exhibiting steady growth fueled by strong public health systems and the European Union’s rigorous Medical Device Regulation (MDR), which enforces high standards for manufacturing and sterility. Western European nations (Germany, UK, France) are mature markets, focusing heavily on sustainability initiatives and seeking high-quality, eco-friendly disposable alternatives. Eastern Europe presents faster, though smaller, growth as dental infrastructure modernizes and aligns with EU quality standards. Demand is particularly strong for sterilization packaging and high-precision restorative accessories.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This rapid expansion is attributed to the enormous, expanding patient population, increasing disposable income leading to greater access to professional dental services, and significant governmental investment in improving healthcare access in countries like China, India, and Southeast Asia. While price sensitivity is high, the sheer volume of new dental clinics and hospitals being established provides an unparalleled growth opportunity for basic protective equipment (gloves, masks, suction tips). The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, driven by medical tourism investments and urbanization, leading to localized pockets of high-quality dental care adoption, though overall market penetration remains lower than in established regions.

- North America (U.S., Canada): Market leader by revenue, driven by high procedural volume, sophisticated regulatory environment, and dominance of large DSOs. Focus on premium, specialized disposables.

- Europe (Germany, UK, France, Italy): Mature market focused on compliance with MDR, rapid adoption of sustainable and biodegradable products, strong public healthcare spending supporting steady growth.

- Asia Pacific (China, India, Japan, South Korea): Fastest growth region fueled by increasing dental awareness, rapid expansion of clinical facilities, and massive patient pool. High demand for cost-effective, high-volume disposables.

- Latin America (Brazil, Mexico, Argentina): Growth driven by increased healthcare accessibility and modernization of dental practices; characterized by diverse purchasing habits and reliance on local distributors.

- Middle East and Africa (MEA): Growth concentrated in urban centers and countries leveraging medical tourism (UAE, Saudi Arabia); increasing adoption of international hygiene standards creates foundational demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Disposables Market.- Dentsply Sirona

- Henry Schein, Inc.

- 3M Company

- Hu-Friedy Group (Crosstex International)

- Kavo Kerr (Danaher Corporation)

- Septodont

- COLTENE Group

- Premier Dental Products Company

- Young Innovations, Inc.

- Terumo Corporation

- Straumann Group

- Envista Holdings Corporation

- Medline Industries, LP

- Cardinal Health

- Ansell Limited

- Halyard Health (Owens & Minor)

- Shofu Inc.

- ULTRADENT Products, Inc.

- Mydent International

- Nishikaa Dental

Frequently Asked Questions

Analyze common user questions about the Dental Disposables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Dental Disposables Market?

The primary driver is the stringent and escalating global enforcement of infection control regulations (e.g., mandated use of barrier products) established by public health organizations like the WHO and CDC, coupled with the increasing volume of specialized and routine dental procedures worldwide.

How are sustainability concerns impacting the development of dental disposables?

Sustainability is profoundly impacting the market by driving manufacturers to invest heavily in R&D for biodegradable polymers, compostable packaging, and eco-friendly non-woven materials, aiming to reduce the large environmental footprint generated by single-use clinical products.

Which product segment accounts for the largest share of the Dental Disposables Market revenue?

The Protective Barrier Equipment segment, which includes disposable medical gloves, face masks, and protective patient drapes, accounts for the largest revenue share due to the universal, mandatory use of these items in every clinical interaction to prevent cross-contamination.

Which region is expected to show the highest growth rate (CAGR) in the Dental Disposables Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by rapid healthcare infrastructure development, increasing access to dental services for large populations, and rising public and private health expenditure across major economies like China and India.

What are the key technological advancements influencing disposable dental products?

Key technological advancements include the development of high-sensitivity nitrile materials for gloves, precision-engineered dispensing systems for impression materials, and the integration of RFID technology for enhanced inventory management and regulatory compliance tracking in clinical settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager