Dental Equipment and Consumables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434439 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Dental Equipment and Consumables Market Size

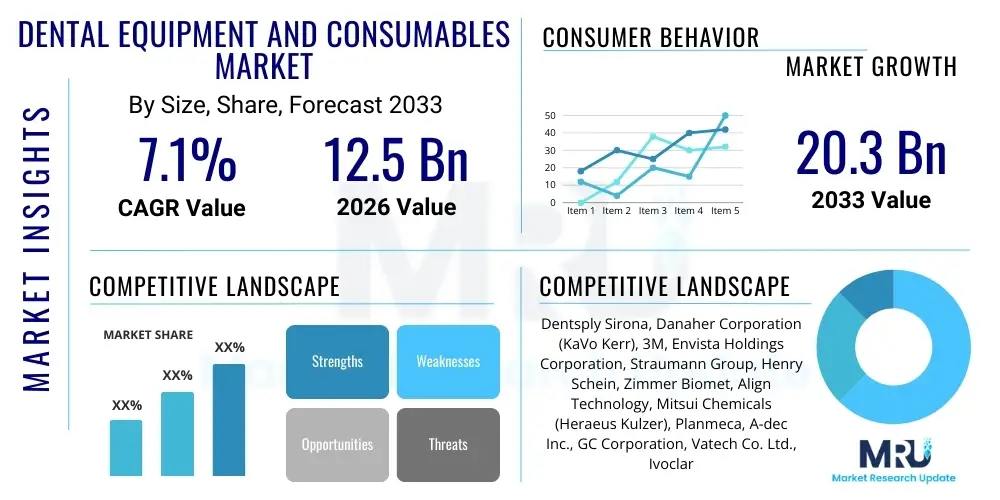

The Dental Equipment and Consumables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of [Insert 7.1% CAGR] between 2026 and 2033. The market is estimated at [Insert USD 12.5 Billion value] in 2026 and is projected to reach [Insert USD 20.3 Billion value] by the end of the forecast period in 2033.

Dental Equipment and Consumables Market introduction

The Dental Equipment and Consumables Market encompasses a vast array of specialized products vital for diagnostic, preventative, and restorative dental procedures globally. This market includes sophisticated capital equipment such as CAD/CAM systems, dental imaging devices (intraoral scanners, CBCT), dental lasers, and sterilization equipment, alongside high-volume consumables like dental implants, prosthetics, impression materials, bonding agents, and restoratives. The primary application landscape spans general dentistry, orthodontics, periodontics, endodontics, and oral maxillofacial surgery. Continuous advancements in material science and digital technology are fundamentally reshaping the operational efficiency and treatment quality offered by practitioners worldwide, driving significant market expansion, particularly in emerging economies where dental healthcare infrastructure is rapidly improving.

A key benefit driving market momentum is the shift towards minimally invasive dentistry, enabled by advanced imaging and laser technologies. These innovations reduce patient discomfort, accelerate healing times, and improve long-term oral health outcomes, aligning with rising patient expectations for high-quality care. Furthermore, the increasing prevalence of dental diseases, including periodontal conditions and caries, particularly among the geriatric population, mandates continuous investment in both sophisticated equipment for complex procedures and daily-use consumables for basic care. The global aging demographic, combined with growing awareness regarding the link between oral health and systemic well-being, serves as a structural catalyst for sustained market growth across developed and developing regions.

Major driving factors include the surging adoption of digital workflows, such as intraoral scanning replacing traditional impressions, which significantly enhances precision and reduces procedural time. Increased disposable incomes in nations across Asia Pacific and Latin America allow greater access to cosmetic and restorative dental treatments, moving beyond basic extraction and palliative care. Government initiatives supporting preventative dental care and favorable reimbursement policies in key markets further stimulate demand for both capital investments in dental clinics and the frequent procurement of necessary consumables. The integration of 3D printing and advanced biocompatible materials is also enabling highly customized treatment solutions, pushing the market toward higher-value products.

Dental Equipment and Consumables Market Executive Summary

The global Dental Equipment and Consumables Market is characterized by robust technological innovation and significant competitive consolidation. Business trends indicate a strong move toward digitalization, with leading manufacturers focusing on comprehensive digital dentistry platforms that integrate imaging, design (CAD), and fabrication (CAM/3D printing). Mergers and acquisitions remain a crucial strategy for expanding product portfolios, particularly in specialized segments like clear aligners and premium implant systems, ensuring market leaders can offer end-to-end solutions to large dental service organizations (DSOs) and private practices. Investment in research and development is accelerating the commercialization of AI-powered diagnostic tools and advanced material science solutions, streamlining clinical workflows and enhancing diagnostic accuracy across the sector.

Regional trends highlight North America and Europe as established, high-value markets, driven by favorable reimbursement structures, high aesthetic awareness, and rapid adoption of cutting-edge technology such as Cone-Beam Computed Tomography (CBCT) and advanced dental lasers. Conversely, the Asia Pacific region (APAC) is emerging as the fastest-growing market, primarily fueled by massive, untapped patient populations, expanding middle classes, and government efforts to improve dental healthcare accessibility. Countries like China and India are seeing significant growth in the establishment of new dental clinics and hospitals, translating into high demand for both affordable and mid-range equipment and consumables to cater to diverse economic segments.

Segment trends underscore the dominance of the consumables segment, which commands a larger market share due to its high-frequency replacement cycle, particularly driven by restorative materials and implants. Within equipment, the diagnostic and imaging segment, especially CBCT and intraoral scanners, is experiencing the highest growth rate, reflecting the industry's shift towards precision and non-invasive diagnostics. The increasing sophistication of biomaterials used in implantology and endodontics is boosting average selling prices within the consumables category. Furthermore, the rise of specialized DSOs that leverage centralized purchasing power is influencing the procurement landscape, favoring manufacturers capable of offering volume discounts and comprehensive training and support packages.

AI Impact Analysis on Dental Equipment and Consumables Market

Analysis of common user questions reveals a collective focus on how Artificial Intelligence (AI) will enhance diagnostic precision, optimize clinical workflows, and potentially reduce the reliance on human expertise in certain procedural aspects. Key concerns frequently raised revolve around the integration costs of AI platforms, data privacy requirements for sensitive patient records, and the necessary regulatory clarity (FDA/CE approval) for AI-driven software acting as a medical device. Users are particularly keen to understand the quantifiable return on investment (ROI) that AI tools—such as those assisting in caries detection, periodontal disease classification, and treatment planning—will provide, especially regarding improved patient outcomes and time savings within busy practice environments. Expectations are high that AI will transform imaging analysis, shifting it from a purely human observational process to a collaborative, digitally assisted diagnosis.

The core theme emerging from these inquiries is the expectation that AI integration will mitigate diagnostic variability and standardize treatment planning. Dentists are looking for AI tools that can accurately identify subtle pathologies in radiographs or CBCT scans, which might be missed by the human eye, thereby improving early intervention. This is directly impacting the demand for and design of new dental imaging equipment, requiring them to be AI-ready with superior data processing capabilities and cloud connectivity. The rise of AI-assisted design in orthodontics and prosthetics is also a major theme, promising faster production of customized restorations and clear aligners, directly benefiting the consumables segment by increasing the throughput of specialized products.

Ultimately, the impact of AI is viewed as an enabling technology that enhances the value proposition of existing dental equipment, moving the industry toward predictive and personalized dentistry. While AI software itself may not be a consumable or a piece of traditional equipment, its embedded presence in new diagnostic devices, practice management software, and CAD/CAM systems dictates future purchasing decisions. Manufacturers are leveraging AI as a key differentiator, focusing on integrating machine learning algorithms that assist in everything from treatment simulation to automated quality control of 3D-printed restorations. This trend mandates significant educational investment for practitioners to effectively utilize these advanced capabilities.

- AI enhances diagnostic accuracy in radiology and pathology detection (caries, periodontal bone loss).

- Optimizes workflow efficiency through automated image processing and treatment planning assistance.

- Drives demand for advanced, connected digital imaging equipment (CBCT, intraoral scanners).

- Facilitates personalized dentistry via AI-assisted design for prosthetics, implants, and orthodontics (clear aligners).

- Supports predictive maintenance and usage tracking for capital dental equipment.

DRO & Impact Forces Of Dental Equipment and Consumables Market

The market dynamics of the Dental Equipment and Consumables sector are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers center on demographic shifts, specifically the global increase in the elderly population who require extensive restorative and prosthetic treatments, coupled with the rising incidence of dental disorders across all age groups due to changes in diet and lifestyle. Technological advancements serve as a continuous force multiplier, enabling better patient outcomes through digital dentistry integration, including enhanced imaging and precise manufacturing technologies like 3D printing. Furthermore, increasing consumer awareness and rising disposable income, particularly in emerging markets, enable greater uptake of elective and cosmetic dental procedures, strengthening overall market demand.

Restraints primarily revolve around the high initial capital investment required for advanced equipment (e.g., CBCT scanners, CAD/CAM systems), posing significant financial barriers for small or solo practices, especially in budget-constrained regions. Regulatory hurdles, particularly the stringent and often prolonged approval processes by bodies like the FDA and EMA for new devices and biomaterials, can delay market entry and innovation uptake. Additionally, the increasing cost pressures exerted by dental service organizations (DSOs) seeking volume discounts, and the shortage of skilled dental professionals capable of operating complex digital equipment in some areas, impede optimal market penetration and growth potential.

Opportunities for growth are predominantly found in the expansion of teledentistry and mobile dental services, which broadens access to care, particularly in rural or underserved populations, thereby increasing the demand for portable equipment and basic consumables. The convergence of oral healthcare with systemic health monitoring presents a significant long-term opportunity, driving innovation in preventative and diagnostic technologies. Furthermore, targeting markets with high penetration potential for specialized consumables, such as bio-regenerative materials and premium aesthetic solutions (e.g., clear aligners and ceramic restorations), offers substantial avenues for high-margin revenue expansion. The ongoing focus on environmentally sustainable and minimally invasive products also opens niches for specialized manufacturers.

Impact Forces Summary: The dominant impact force is technological disruption, where the rapid iteration cycle of digital dentistry (e.g., AI, 3D printing) forces continuous investment and obsolescence cycles, maintaining high market activity. This force is amplified by demographic shifts (aging population) but moderated by economic constraints (high equipment cost and labor shortages). Regulatory landscapes act as a stabilizing yet sometimes inhibiting force, ensuring product safety but slowing speed to market. The cumulative effect is a highly dynamic market requiring continuous adaptation from both suppliers and practitioners.

Segmentation Analysis

The Dental Equipment and Consumables Market is extensively segmented based on the type of product, application, and end-user, reflecting the diverse range of solutions required in modern dental practice. Segmentation provides crucial insights into the spending patterns and technological preferences across different sub-sectors. The product segmentation is highly detailed, differentiating between capital-intensive equipment categories—suchaging devices, lasers, and operating accessories—and volume-driven consumables, which include restoratives, implants, endodontic supplies, and orthodontic components. The consumables segment consistently holds the majority market share due to the required frequency of repurchase for every patient procedure, ensuring steady revenue streams for manufacturers.

Application segmentation typically breaks down the market into general dentistry, prosthodontics, periodontics, and orthodontics, reflecting specialized procedural demands. For instance, the orthodontics segment has seen explosive growth, fueled largely by the global demand for clear aligner systems, a high-value consumable product. The End-User segmentation distinguishes between dental hospitals and clinics, laboratories, and educational or research institutions. Dental clinics, including large Dental Service Organizations (DSOs) and individual practices, represent the largest end-user segment, driving demand for a balance of sophisticated imaging equipment and high-throughput consumables essential for daily patient care and revenue generation.

Understanding these segments is critical for manufacturers to tailor their marketing and distribution strategies. Equipment manufacturers focus on long-term leasing models and integration capabilities, emphasizing precision and longevity. In contrast, consumables providers prioritize supply chain efficiency, sterility assurance, and the development of materials with superior physical and aesthetic properties. The interdependency between equipment and consumables, such as CAD/CAM systems requiring specific block materials, ensures that innovation in one segment often drives corresponding demand in the other, leading to bundled product strategies becoming increasingly common among key market players.

- By Product:

- Dental Equipment (Imaging Systems, CAD/CAM Systems, Dental Lasers, Handpieces, Equipment Accessories)

- Dental Consumables (Implants, Prosthetics, Restoratives, Orthodontic Supplies, Endodontic Supplies, Impression Materials)

- By Application:

- Orthodontics

- Endodontics

- Peridontics

- Prosthodontics

- General and Diagnostic Dentistry

- By End-User:

- Dental Clinics and Hospitals

- Dental Laboratories

- Academic and Research Institutes

Value Chain Analysis For Dental Equipment and Consumables Market

The value chain for the Dental Equipment and Consumables Market is intricate, starting with upstream activities involving raw material procurement, specialized component manufacturing, and biomaterials development (e.g., titanium, ceramics, polymers). Upstream suppliers are vital, particularly those providing high-purity titanium alloys for implants or advanced ceramic blocks for CAD/CAM restorations, as material quality directly impacts the clinical success and longevity of the final product. Research and development activities, often involving partnerships between academic institutions, material scientists, and medical device engineers, are intensely focused at this stage to develop next-generation biocompatible and aesthetic materials that meet stringent regulatory standards and clinical needs.

Midstream activities involve the core manufacturing, assembly, and quality control of both complex equipment (e.g., CBCT machines, dental units) and mass-produced consumables (e.g., resin composites, burs). Manufacturers invest heavily in precision engineering, sterile packaging, and automated production lines to ensure product consistency and regulatory compliance. The distribution channel, representing the downstream segment, is critical for market access. This segment typically involves a mix of direct sales forces for large capital equipment, which often require extensive installation and training, and indirect distribution through specialized dental dealers and wholesalers for high-volume consumables. These dealers provide essential logistical support, inventory management, and often serve as the primary relationship managers with local dental practices.

The efficacy of the value chain is increasingly dependent on efficient logistics and centralized warehousing, especially given the global nature of supply and the need for rapid replenishment of critical consumables. Direct distribution models are favored by large companies for specialized, high-cost items like implants and digital systems, as it allows greater control over pricing and customer support. However, indirect channels remain indispensable for reaching small practices and ensuring wide geographical coverage. Furthermore, post-sales services, including technical support, software updates, and maintenance contracts for equipment, form a crucial component of the downstream value chain, establishing long-term customer relationships and ensuring optimal device performance, which is a key competitive differentiator.

Dental Equipment and Consumables Market Potential Customers

The primary and most significant end-users and buyers in the Dental Equipment and Consumables Market are professional healthcare entities involved directly in patient care. This segment is dominated by individual dental practices, which range from small, single-dentist offices to large, multi-specialty group practices. These customers require a full spectrum of products, from basic preventative consumables to advanced restorative materials and specialized diagnostic equipment. Their purchasing decisions are heavily influenced by clinical efficacy, cost-effectiveness, dealer reliability, and patient volume, leading to a complex procurement process often managed by the lead practitioner or a specialized office manager.

A rapidly growing segment of potential customers is the Dental Service Organizations (DSOs) and large corporate dental chains. DSOs represent high-volume buyers, leveraging centralized purchasing power to negotiate significant discounts on both equipment upgrades and recurring consumable orders. Their procurement strategies often focus on standardization across multiple locations, favoring manufacturers who can provide integrated digital solutions, training services, and consistent, high-quality supply at scale. The expansion of DSOs, particularly in North America and Europe, is fundamentally changing the way manufacturers interact with their client base, shifting the focus from individual sales to long-term enterprise agreements.

Other vital customers include specialized dental laboratories, which are heavily reliant on advanced CAD/CAM equipment, 3D printers, and related restorative materials (e.g., zirconia, ceramics, polymers) to produce crowns, bridges, and customized dental appliances. Academic and research institutions also form a stable customer base, requiring high-end equipment for both clinical training and material science research, often prioritizing the latest technological innovations regardless of immediate cost constraints. Finally, public health agencies and government-funded hospitals constitute buyers focused on providing essential dental care, often procuring basic equipment and essential consumables in large tenders guided by budgetary constraints and population health needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | [Insert USD 12.5 Billion] |

| Market Forecast in 2033 | [Insert USD 20.3 Billion] |

| Growth Rate | [Insert 7.1% CAGR] |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Danaher Corporation (KaVo Kerr), 3M, Envista Holdings Corporation, Straumann Group, Henry Schein, Zimmer Biomet, Align Technology, Mitsui Chemicals (Heraeus Kulzer), Planmeca, A-dec Inc., GC Corporation, Vatech Co. Ltd., Ivoclar Vivadent, Bien-Air Dental, Morita Corporation, Septodont, Ultradent Products, Coltene Group, SHOFU Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Equipment and Consumables Market Key Technology Landscape

The technological landscape of the Dental Equipment and Consumables Market is dominated by the transition to fully digital workflows, commonly referred to as Digital Dentistry. Core technologies include Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) systems, which allow for the in-office creation of highly accurate restorations (crowns, inlays, veneers) using advanced milling or 3D printing techniques. These systems rely heavily on intraoral scanners, which utilize optical technology to capture precise digital impressions, effectively eliminating the need for traditional, messy impression materials. The accuracy and speed provided by these integrated systems are fundamentally transforming restorative and prosthetic dentistry, reducing patient waiting times and improving overall fit and aesthetics.

Another crucial technological area is advanced dental imaging, specifically Cone-Beam Computed Tomography (CBCT). CBCT technology provides high-resolution 3D images of dental structures, bone, and surrounding tissues, which is indispensable for complex procedures like implant planning, endodontic diagnosis, and surgical guides. The evolution of CBCT includes features such as lower radiation doses and faster scanning times, enhancing patient safety and operational efficiency. Furthermore, the increasing integration of AI software into these imaging modalities assists practitioners in automated analysis, measurement, and pathological detection, enhancing diagnostic certainty and standardization across different clinical settings globally.

In the consumables sector, technological breakthroughs are centered on material science and biocompatibility. This includes the development of high-strength, aesthetic ceramics (like zirconia and lithium disilicate) for highly durable and natural-looking restorations. Implantology is benefiting from advancements in surface treatments and regenerative biomaterials, enhancing osseointegration and reducing healing times. Parallelly, dental lasers (Diode, Er:YAG, etc.) are becoming standard equipment, offering minimally invasive options for soft tissue procedures, caries removal, and periodontal treatments, showcasing the industry's continued drive towards precision, reduced chair time, and superior patient comfort.

Regional Highlights

North America is consistently positioned as the largest market for dental equipment and consumables, driven by substantial healthcare expenditure, rapid adoption of cutting-edge digital technologies, and high patient awareness regarding advanced cosmetic dentistry. The U.S. market, in particular, benefits from favorable reimbursement policies and the presence of numerous large dental service organizations (DSOs) that continually invest in high-end capital equipment to maintain competitive advantage. The trend towards specialized dentistry, coupled with high procedural volumes, ensures steady demand for premium consumables, implants, and sophisticated imaging systems, solidifying its leading market position.

Europe represents a mature and technologically advanced market, second only to North America. Growth in this region is primarily propelled by aging demographics in Western European nations (Germany, France, UK), which necessitate increased demand for prosthetic and restorative solutions. Regulatory harmonization within the EU facilitates smoother market entry for innovative products, though budgetary constraints in some publicly funded healthcare systems can occasionally slow the uptake of high-cost equipment. Emphasis on preventative care and high standards of clinical education also sustain robust demand for quality consumables and diagnostic tools across the continent.

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This accelerated expansion is attributable to dramatic improvements in dental healthcare infrastructure, rising disposable incomes in populous nations like China and India, and expanding medical tourism focusing on specialized dental care. While price sensitivity remains a factor, the massive, underserved patient base creates immense opportunities for both established global players and local manufacturers offering cost-effective solutions. Government initiatives aimed at improving oral health and establishing dental training institutions are key catalysts boosting both equipment sales and long-term consumable consumption across APAC.

- North America: Market leader; driven by DSOs, high disposable income, and early adoption of CAD/CAM and AI integration.

- Europe: Mature market; sustained by an aging population, strict quality standards, and high demand for implants and restoratives.

- Asia Pacific (APAC): Fastest-growing region; fueled by increasing healthcare access, infrastructure development, and growing dental tourism.

- Latin America (LATAM): Developing market; characterized by rising demand for cosmetic dentistry and improving private healthcare investment.

- Middle East & Africa (MEA): Emerging market; growth concentrated in GCC countries due to wealth accumulation and high investment in modern clinic infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Equipment and Consumables Market.- Dentsply Sirona

- Danaher Corporation (KaVo Kerr)

- 3M Company

- Envista Holdings Corporation

- Straumann Group

- Henry Schein, Inc.

- Zimmer Biomet Holdings, Inc.

- Align Technology, Inc.

- Mitsui Chemicals, Inc. (Heraeus Kulzer)

- Planmeca Oy

- A-dec Inc.

- GC Corporation

- Vatech Co., Ltd.

- Ivoclar Vivadent AG

- Bien-Air Dental SA

- Morita Corporation

- Septodont SAS

- Ultradent Products, Inc.

- Coltene Group

- SHOFU Inc.

Frequently Asked Questions

Analyze common user questions about the Dental Equipment and Consumables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major technological advancements are driving the dental market growth?

The primary driver is the shift to digital dentistry, encompassing the integration of intraoral scanners, Cone-Beam Computed Tomography (CBCT), CAD/CAM systems, and 3D printing technology. These technologies enhance diagnostic accuracy, streamline restorative procedures, and enable personalized, minimally invasive treatments, thereby increasing clinical efficiency and patient satisfaction.

Which market segment holds the largest share, equipment or consumables?

The consumables segment consistently holds the largest market share. This dominance is due to the necessity of continuous, high-volume repurchase of products such as dental implants, restorative materials, impression compounds, and orthodontic supplies, which are required for every patient procedure across general and specialized practices globally.

How is the rise of Dental Service Organizations (DSOs) impacting procurement?

DSOs impact procurement significantly by centralizing purchasing power. They leverage volume buying to negotiate substantial discounts on both capital equipment and consumables, favoring manufacturers who can provide integrated, standardized digital solutions and comprehensive, cost-effective supply agreements across multiple clinic locations.

What are the key growth opportunities in emerging regions like Asia Pacific (APAC)?

APAC offers immense growth opportunities driven by expanding dental healthcare infrastructure, rising per capita income facilitating access to advanced care, and a vast, underserved patient population. Key areas include demand for affordable digital imaging equipment and high-quality restorative and orthodontic consumables.

What are the main restraints hindering the adoption of new dental equipment?

The principal restraints include the high initial capital investment required for advanced digital equipment (like CBCT and CAD/CAM systems), posing financial barriers for small practices. Additionally, stringent regulatory approval processes and the requirement for specialized training to operate new technologies can slow adoption rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager