Dental Implant Abutment Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433264 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Dental Implant Abutment Systems Market Size

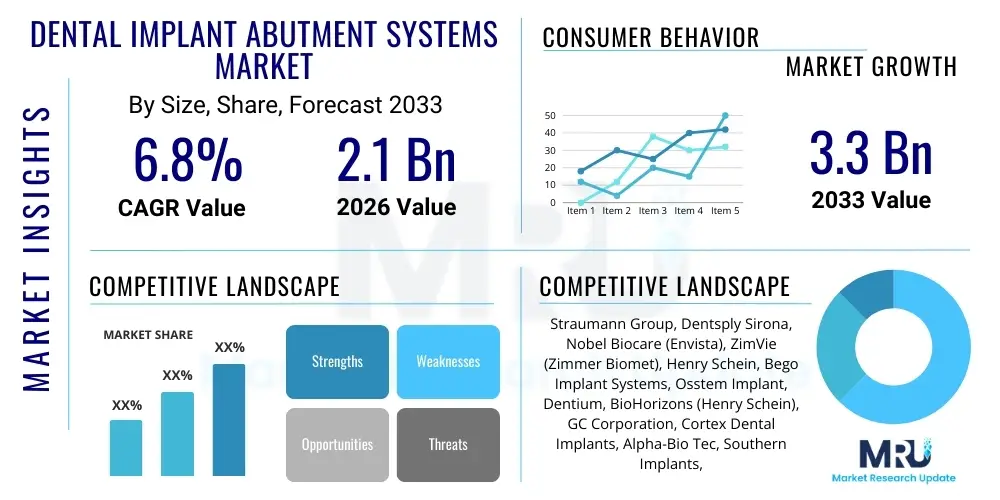

The Dental Implant Abutment Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.3 Billion by the end of the forecast period in 2033.

Dental Implant Abutment Systems Market introduction

The dental implant abutment systems market encompasses the manufacturing, distribution, and utilization of components crucial for connecting the dental implant fixture, which is surgically placed into the jawbone, to the final prosthetic restoration, such as a crown or bridge. These abutments serve as the interface, transferring occlusal forces and ensuring stability, aesthetics, and long-term functional success of the implant treatment. Product variations are significant, including custom abutments (CAD/CAM-designed), prefabricated abutments (stock), and specialized options based on connection type (internal hex, external hex, conical) and material (titanium, zirconia, gold alloy). The rising global prevalence of tooth loss, primarily due to periodontal diseases, trauma, and caries, coupled with increasing aesthetic awareness among populations in developed and emerging economies, is fundamentally driving demand for sophisticated abutment systems that offer improved biocompatibility and precision fit. Furthermore, the continuous advancements in digital dentistry workflows, particularly intraoral scanning and 3D printing, are enabling dentists and dental laboratories to fabricate highly customized abutments efficiently, thereby improving patient outcomes and streamlining the restoration process significantly. This technological integration is pivotal in maintaining market momentum.

Major applications of dental implant abutment systems span across single-tooth replacements, multiple-tooth prostheses, and full-arch rehabilitations, catering to edentulous and partially edentulous patients seeking durable and fixed solutions. The inherent benefits of these systems, when compared to traditional removable dentures, include superior stability, improved chewing efficiency, preservation of adjacent teeth (unlike bridges), and stimulation of the alveolar bone, preventing bone atrophy over time. The market's growth is inherently linked to the aging demographic, as older adults represent the largest consumer base for dental restoration procedures globally. Furthermore, the expansion of dental tourism, wherein patients travel across borders for high-quality, cost-effective implantology services, particularly to regions in Asia Pacific and Latin America, provides an additional impetus for market expansion, driving the adoption of internationally recognized abutment standards and systems. The increased longevity of the global population necessitates durable, long-term restorative solutions, positioning dental implants and their corresponding abutment systems as essential components of modern geriatric dental care, ensuring functional mastication and improved quality of life for seniors. The shift toward immediate loading protocols, where temporary or provisional abutments are placed shortly after surgery, further expands the applications and complexity of the required product portfolio.

Key driving factors accelerating the growth of the dental implant abutment systems market include technological innovations focused on enhancing the strength and aesthetic properties of materials, such as monolithic zirconia abutments which combine durability with high aesthetic outcomes. Increased disposable income in developing nations allows a greater percentage of the population to opt for higher-cost implant solutions over budget-friendly alternatives. Additionally, comprehensive clinical data supporting the long-term success rates of implant treatments, combined with aggressive marketing and educational initiatives by major manufacturers targeting dental professionals, are fostering broader acceptance and utilization of implant procedures. The move toward standardized, highly precise components that minimize peri-implantitis risk is also a crucial factor shaping product development and market dynamics, ensuring that system longevity meets patient expectations for quality and functional longevity. Regulatory support for new biocompatible materials and the establishment of global quality standards are also foundational elements reinforcing the growth structure of this specialized medical device market.

Dental Implant Abutment Systems Market Executive Summary

The Dental Implant Abutment Systems market is characterized by robust growth, driven by shifting demographics towards an older population segment, significant advancements in digital manufacturing technologies like CAD/CAM, and heightened patient expectations for aesthetic and durable restorative dentistry. Business trends indicate a consolidation among key market players, with increasing emphasis on vertical integration encompassing implant fixtures, abutments, and restorative materials to offer streamlined, proprietary solutions. A noticeable trend is the rising demand for connection-specific abutments compatible with multiple major implant platforms, necessitating broader inventory management but offering greater flexibility to clinicians. Furthermore, sustainability in material sourcing and manufacturing processes is beginning to influence corporate strategies, driven by evolving regulatory and consumer preferences for environmentally responsible dental products. The shift from traditional stock abutments toward custom-designed, patient-specific solutions is redefining laboratory workflows and increasing the value proposition of specialized abutment providers, demanding advanced software and machining capabilities. Strategic alliances between implant manufacturers and digital solution providers (e.g., intraoral scanner companies) are becoming increasingly important to secure dominance in the integrated digital workflow ecosystem, which dictates abutment design and fabrication.

Regionally, North America and Europe maintain leading positions, primarily due to high healthcare expenditure, established reimbursement frameworks, and widespread adoption of sophisticated dental technologies. These regions are the primary drivers of innovation, setting global benchmarks for material performance and prosthetic design complexity. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rapidly expanding middle-class populations, increasing health insurance penetration, and governmental initiatives promoting oral health awareness and access to advanced dental care services. Countries like China and India are emerging as critical markets, not just for consumption but also for local manufacturing and distribution of cost-effective implant solutions, although regulatory harmonization remains a challenge. Latin America, particularly Brazil and Mexico, presents substantial opportunities, marked by a high demand for cosmetic dentistry and significant investment in clinical training for implant specialists, encouraging the adoption of premium abutment systems in private practices. Market growth in the Middle East is highly concentrated in GCC countries, propelled by substantial healthcare infrastructure investment and medical tourism initiatives demanding high-end implant services.

Segment trends reveal that the 'Custom Abutments' category, facilitated by CAD/CAM technology, dominates the market share owing to superior fit, reduced chair time, and improved long-term prognosis compared to prefabricated alternatives. This segment's growth is inherently linked to the decreasing cost and increased accessibility of digital scanners and laboratory milling units. Material segmentation indicates that titanium remains the gold standard due to its excellent mechanical properties and biocompatibility, but zirconia is rapidly gaining ground, particularly in the anterior aesthetic zone, capitalizing on its metal-free composition and natural tooth color. In terms of end-use, dental clinics and hospitals remain the primary revenue generators, though the rise of specialized dental chains and large group practices (DSOs) is influencing procurement patterns, often favoring suppliers who can offer bulk discounts and extensive educational support packages. The continuous evolution of hybrid materials combining the best attributes of polymers and ceramics is anticipated to introduce further disruptive changes in the materials segment during the latter half of the forecast period, focusing on achieving optimal shock absorption and superior marginal sealing characteristics.

AI Impact Analysis on Dental Implant Abutment Systems Market

User inquiries regarding Artificial Intelligence (AI) in the dental implant abutment sector commonly revolve around three core themes: precision and personalization, workflow efficiency, and diagnostic accuracy influencing treatment planning. Users frequently ask if AI can automate the design phase of custom abutments, how AI models improve the prediction of peri-implant bone loss, and whether machine learning algorithms can optimize material selection based on patient-specific loading conditions. The overarching concern is often related to the integration cost and the learning curve associated with adopting sophisticated AI tools into existing CAD/CAM dental laboratory setups. Furthermore, there is keen interest in AI's role in streamlining the entire surgical and prosthetic workflow, from initial radiographic assessment (identifying bone density and nerve proximity) to the final prosthetic fitting, aiming for a reduction in procedural complications and failures linked to poor abutment selection or design. The market seeks definitive evidence that AI tools can translate complex anatomical data into immediate, clinically superior design parameters, minimizing the reliance on iterative adjustments typically required in traditional digital workflows.

The key expectations center on AI's potential to dramatically increase the success rate of implant treatments by providing hyper-personalized design specifications that minimize mechanical and biological complications. AI is expected to analyze massive datasets of successful and failed cases to refine design parameters that currently rely on operator experience, leading to truly evidence-based abutment design. Users anticipate that AI-driven software will flag potential structural weaknesses in materials or designs before milling, thereby reducing material waste and production time in dental labs. Specifically, AI's ability to automatically assess the optimum cement gap, screw access channel angulation, and soft tissue volume around the abutment emergence profile is highly valued. Ultimately, the adoption of AI is viewed as the next logical step toward fully automated, predictable, and highly efficient digital dentistry, fundamentally reshaping how dental professionals approach the restorative phase of implantology, moving toward prescriptive solutions rather than purely descriptive interventions. This shift is expected to enhance consistency across different clinical settings, democratizing access to high-quality customized abutments.

- AI enhances diagnostic imaging (CBCT analysis) for precise abutment placement planning, optimizing angulation and emergence profile based on biomechanical modeling.

- Machine learning algorithms automate the preliminary design of custom abutments, optimizing contour and fit based on virtual antagonist models, tissue depth, and occlusal force simulation.

- Predictive analytics forecasts the mechanical load distribution on various abutment designs and materials, identifying potential stress points and reducing the risk of fatigue failure.

- AI-driven quality control systems verify the dimensional accuracy and surface finish of milled or printed abutments post-production, ensuring tight tolerances for the implant-abutment connection.

- Streamlining inventory management through AI forecasting demand for specific stock abutment sizes and connection types based on regional surgical volumes and clinician purchasing patterns.

- Facilitation of personalized treatment reports and patient outcome simulations based on proposed abutment systems, improving patient communication and case acceptance rates.

- Optimization of milling paths in CAD/CAM processes using AI to minimize material waste and increase the efficiency of complex abutment fabrication.

- Automated analysis of peri-implant bone levels in follow-up radiographs to proactively identify risk of bone loss related to abutment design or placement.

- AI-assisted decision-making tools help clinicians select the most appropriate connection type (e.g., internal vs. conical) and material (e.g., titanium vs. zirconia) based on specific clinical parameters and long-term risk assessment.

DRO & Impact Forces Of Dental Implant Abutment Systems Market

The dynamics of the Dental Implant Abutment Systems market are shaped by a confluence of accelerating drivers and constraining factors, balanced by emerging opportunities. The primary driver is the accelerating aging population globally, which significantly increases the incidence of tooth loss and subsequent demand for permanent restorative solutions like implants. Technological sophistication, particularly the widespread adoption of CAD/CAM and 3D printing technologies for producing custom abutments with unparalleled precision, acts as a powerful enabling force. These digital workflows enhance predictability and reduce turnaround time, making complex procedures more accessible. Furthermore, increasing cosmetic awareness, particularly in younger demographics, drives demand for aesthetically superior solutions, heavily favoring metal-free zirconia abutments. However, high procedural costs associated with implantology and the limited reimbursement coverage in many key geographies serve as significant restraints, limiting accessibility for lower- and middle-income segments. Concerns regarding peri-implantitis and the long-term clinical maintenance required for implants also introduce a level of restraint as patients evaluate risks versus benefits. Market players must consistently work to lower system costs and provide comprehensive educational materials to mitigate these restraints.

Opportunities lie primarily in expanding access in untapped emerging markets, where rapid economic growth is increasing disposable income and healthcare spending. Developing cost-effective hybrid materials that retain the longevity of titanium but offer better aesthetics provides a substantial avenue for innovation and market capture in price-sensitive regions. Leveraging teledentistry platforms to improve initial consultation and follow-up care, thereby supporting the procedural lifecycle, also represents a novel opportunity for optimizing patient management and compliance. Moreover, the development of universal or compatible abutment systems that work seamlessly across various major implant brands presents a significant opportunity for third-party manufacturers, although navigating intellectual property issues remains a critical barrier. The market is subject to substantial impact forces, including stringent regulatory approval pathways for new biocompatible materials and continuous pressure from competitive pricing strategies, especially in the stock abutment segment, requiring constant innovation to maintain margin stability and differentiate product offerings based on superior long-term clinical data.

Regulatory hurdles pose a continuous impact force, particularly concerning the validation of new materials and connection mechanisms to ensure long-term osseointegration and prevention of peri-implant diseases. For instance, the transition to customized, unique abutment designs requires careful adherence to medical device standards across different jurisdictions (e.g., FDA clearance, EU MDR compliance). Economic stability also plays a vital role; during economic downturns, elective procedures like dental implants are often postponed by patients, impacting sales volume. Conversely, increasing global awareness regarding the critical link between oral health and systemic well-being acts as a long-term positive impact force, driving public health policies that favor access to restorative dental care. The intensity of rivalry among the top players remains high, fueled by product launch cycles, strategic mergers, and aggressive geographical expansion, leading to rapid market changes. The ability of manufacturers to successfully navigate these regulatory complexities and economic sensitivities, while simultaneously innovating material science and digital integration, will determine their market positioning and long-term sustainability and ensure compliance with evolving global supply chain requirements.

Segmentation Analysis

The Dental Implant Abutment Systems market is highly fragmented based on key attributes such as product type, material composition, connection type, and end-user application, reflecting the diverse clinical needs and technological capabilities across the global dental landscape. Segmentation provides critical insights into the underlying demand patterns, highlighting the rapid technological shift from standardized, off-the-shelf components toward personalized, digitally designed restorations. The evolution in product categories is fundamentally driven by the clinician’s need for greater control over aesthetics and biomechanics, especially in complex cases involving immediate loading protocols or challenging anatomical limitations. Custom abutments, created via CAD/CAM, offer unmatched benefits in terms of ensuring optimal marginal fit, tissue contouring, and compensating for non-ideal implant angulation, justifying their premium pricing and dominating the revenue share in developed markets. Understanding these segments is crucial for strategic business planning, allowing manufacturers to allocate resources effectively toward research and development in high-growth areas, such as monolithic zirconia customization or novel titanium alloys designed for enhanced stability.

The analysis of material segmentation reveals a dual market approach: high-strength materials like titanium dominate in molar regions requiring maximum mechanical integrity and load-bearing capacity, while aesthetic materials such as zirconia are preferred in the anterior regions where color matching and soft tissue integration are paramount. Titanium alloys, including Grade 4 and Grade 5, offer proven long-term clinical success and cost-effectiveness, securing their enduring position. The rising trend of using Peek (Polyether ether ketone) for temporary or provisional abutments is also gaining traction, offering lightweight, shock-absorbing, and cost-effective options during the healing phase, particularly in two-stage protocols. Furthermore, connection type segmentation—categorized into internal hex, external hex, and conical connections—directly correlates with the proprietary designs of major implant manufacturers, forcing abutment providers to maintain broad compatibility portfolios to capture maximum market share, leading to complex product matrices. Conical connections are witnessing increased popularity due to their biomechanical advantage in reducing micro-gap size and preventing bacterial infiltration, which is crucial for preventing peri-implant inflammation.

The end-user segmentation clearly indicates that specialized dental clinics and private practices remain the primary consumers of high-quality abutment systems, given their focus on elective, specialized procedures. These independent practices prioritize product quality and ease of use. However, hospitals and large dental chains, often incorporating oral and maxillofacial surgery departments, are increasingly becoming centralized purchasers, influencing price points and logistics requirements due to their aggregated volume. Geographical segmentation demonstrates that mature markets define technology trends and premium pricing, while emerging markets offer volume-driven growth opportunities, often favoring more standardized and economical abutment solutions. These segmented demands require tailored marketing and distribution strategies to ensure product relevance and maximum penetration across diverse healthcare infrastructural settings globally, demanding local manufacturing or robust supply chains capable of delivering specialized, regulatory-compliant products efficiently.

- By Product Type:

- Stock/Pre-fabricated Abutments

- Custom Abutments (CAD/CAM-designed)

- Provisional Abutments

- Healing Abutments

- Specialty Abutments (e.g., Ball, Bar Retained)

- By Material:

- Titanium

- Zirconia

- Gold Alloy

- PEEK (Polyether Ether Ketone)

- Hybrid Materials

- By Connection Type:

- Internal Hexagonal

- External Hexagonal

- Conical Connection

- Others (e.g., Trilobe, Octagonal)

- By End User:

- Dental Clinics

- Hospitals and Ambulatory Surgery Centers

- Dental Laboratories

- Academic and Research Institutes

Value Chain Analysis For Dental Implant Abutment Systems Market

The value chain for dental implant abutment systems begins with upstream activities centered on the procurement and processing of raw materials, primarily high-grade titanium alloys (such as Ti-6Al-4V) and medical-grade zirconia blocks. This initial stage involves rigorous quality control to ensure biocompatibility and mechanical integrity, as material defects at this level directly compromise the final product's performance and patient safety. Upstream providers include specialized material processing companies and often involve proprietary synthesis techniques, particularly for advanced ceramic materials that require precise sintering and shaping protocols. Key activities here also include research and development focusing on new alloys, advanced surface treatments (e.g., anodization for color coding or improved tissue integration), and ceramic pressing techniques. The competitiveness in the upstream segment relies heavily on maintaining a stable, certified supply chain, adherence to ISO standards for medical devices, and achieving economies of scale in material procurement, which can significantly influence the final production cost of the abutment components and their market pricing.

The subsequent phase involves core manufacturing, encompassing precision machining (CNC milling, multi-axis lathes) for high-volume stock abutments and advanced digital workflows (CAD/CAM systems, specialized 3D printing) for custom abutments. This stage requires substantial capital investment in high-precision manufacturing equipment, sophisticated measurement tools, and robust quality assurance protocols to meet strict dimensional tolerances—critical for ensuring a passive, accurate fit with the implant fixture and preventing component failure or screw loosening. Downstream analysis focuses on distribution and the crucial steps of marketing and sales. Direct distribution channels are often employed by major global implant companies (vertically integrated players), leveraging a dedicated, specialized sales force to engage directly with implant specialists, Dental Service Organizations (DSOs), and hospitals, providing comprehensive technical training and detailed clinical support. This direct approach ensures better control over inventory, consistent pricing strategies, and specialized product education, which is vital for complex medical devices requiring precise handling and installation techniques.

Indirect distribution channels involve utilizing dental distributors, wholesalers, and specialized commercial dental laboratories, particularly for smaller manufacturers or in geographically dispersed markets where a direct sales force is cost-prohibitive. These intermediaries provide logistical efficiency and local market expertise but introduce additional costs and potential complexities in maintaining brand consistency and technical support quality across various regions. Dental laboratories play a pivotal role, acting as both potential indirect customers (when they purchase abutment blanks/Ti-bases) and key value-add partners, as they often receive the digital files from dentists and fabricate the custom abutments using sophisticated manufacturer-provided CAD/CAM systems and validated libraries. The final stage involves the provision of clinical services by dentists and surgeons, representing the point of consumption, where the efficacy, aesthetics, and ease of use of the abutment system directly influence repeat purchases, long-term brand loyalty, and the professional reputation of the manufacturer. Continuous education, post-sales support, and clinical research dissemination are integral to sustaining competitive advantage throughout the entire value chain.

Dental Implant Abutment Systems Market Potential Customers

The potential customers for dental implant abutment systems are highly specialized entities within the healthcare sector, fundamentally comprising dental professionals and the institutions in which they practice, representing a multi-tiered purchasing structure. The primary end-users are Oral and Maxillofacial Surgeons (OMS), Periodontists, and General Dentists who have received extensive advanced training in restorative and surgical implantology. These individual practitioners and their private clinics represent the largest volume consumers of abutment systems, prioritizing product reliability, seamless compatibility with the various implant systems they utilize in their practice, and responsive clinical support from the manufacturer. Demand from this segment is critically driven by patient inflow for elective cosmetic and restorative procedures and the practitioners’ professional preference for systems that optimize workflow efficiency, minimize procedural chair time, and reduce the long-term risk of biological complications such as peri-implant mucositis or screw loosening, which can severely impact patient satisfaction and clinical reputation. Specialized training programs and continuing medical education (CME) courses often serve as highly effective marketing platforms for manufacturers to directly influence the purchasing decisions and brand loyalty of these key clinical customers.

Institutional buyers, including large public and private hospitals, academic medical centers with dedicated dental faculties, and specialized ambulatory surgery centers, constitute another significant customer base. These institutions typically purchase abutment systems in larger, standardized volumes through highly centralized procurement departments, placing a disproportionately high value on cost-effectiveness, long-term supply contracts, and guaranteed logistical reliability to manage complex inventories. University dental schools and research institutes also represent important, albeit smaller in volume, customers, primarily utilizing abutments for educational purposes, hands-on surgical training simulations, and rigorous clinical trials focused on material science and biomechanics. Their purchasing decisions are often influenced by institutional budgets, large research grants, and the ability of the system to integrate seamlessly with the latest didactic technologies, allowing students and residents to train on state-of-the-art, evidence-based equipment, thereby shaping future clinical preferences within the dental community and providing valuable feedback for product iteration.

Furthermore, specialized Dental Service Organizations (DSOs) and large group practices are increasingly influential, transforming the procurement landscape of the market. DSOs, operating multiple geographically dispersed clinics under one centralized administrative and financial umbrella, possess substantial aggregated purchasing power. They demand highly competitive pricing, standardized product usage across their entire network to ensure consistent patient care, and often require tailored logistics and bundled services, including educational platforms and proprietary digital planning software integration. Manufacturers that can provide comprehensive, cost-effective digital solutions, centralized logistics management, and large-scale training packages specifically tailored to the DSO model gain a substantial competitive edge in penetrating this rapidly consolidating sector. Finally, commercial dental laboratories, especially those equipped with high-throughput centralized CAD/CAM milling facilities, function as essential indirect customers, purchasing specialized abutment blanks, titanium bases (Ti-bases), and corresponding components to efficiently fulfill the high volume of custom restoration orders placed by a myriad of dental practitioners globally. Their purchasing preference is heavily driven by material compatibility, milling efficiency, profitability metrics, and the seamless integration of proprietary digital libraries provided by the abutment system manufacturers into their production environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Straumann Group, Dentsply Sirona, Nobel Biocare (Envista), ZimVie (Zimmer Biomet), Henry Schein, Bego Implant Systems, Osstem Implant, Dentium, BioHorizons (Henry Schein), GC Corporation, Cortex Dental Implants, Alpha-Bio Tec, Southern Implants, Adin Dental Implant Systems, MIS Implants Technologies, MegaGen Implant, Thommen Medical, Neoss, A.B. Dental Devices, Shofu Dental. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Implant Abutment Systems Market Key Technology Landscape

The technology landscape governing the dental implant abutment systems market is heavily defined by the digital transformation occurring throughout restorative dentistry, primarily centered on achieving superior precision, enhanced biocompatibility, and personalized patient outcomes. Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM) systems are the foundational technologies, enabling the efficient creation of custom-milled abutments from standardized industrial blocks (blanks) of titanium or high-translucency zirconia. These systems rely on high-resolution data acquisition, either through intraoral scanners capturing the patient's mouth digitally or laboratory scanners processing physical models and implant analogs. The resulting three-dimensional digital model is then manipulated by proprietary or third-party software, often incorporating advanced algorithms, to meticulously design the optimal abutment contour, emergence profile, and marginal seal, leading to highly predictable aesthetic and functional results. The current trend favors open-architecture CAD/CAM systems, as they offer greater flexibility and cost-effectiveness for dental laboratories, allowing them to integrate various implant component libraries and material options provided by different manufacturers, challenging the dominance of closed, proprietary systems.

Additive manufacturing, specifically various forms of 3D printing (e.g., SLA, DLP, and binder jetting for metals), is rapidly emerging as a complementary or alternative technology, especially for fabricating provisional PEEK or resin abutments used during the healing period, and for accurately generating precise surgical guides. These guides directly dictate the optimal trajectory, depth, and angulation for implant placement, which, in turn, simplifies the selection and seating of the final abutment, reducing the need for highly angled or complex custom solutions. While direct 3D printing of permanent, load-bearing metal or ceramic abutments is under intense research, primarily concerning achieving the necessary mechanical strength, fatigue resistance, and surface finish certification, the use of centralized, high-throughput milling centers utilizing robust subtractive manufacturing for titanium and zirconia remains the industry dominant standard for final restorations. Furthermore, specialized surface modification technologies, such as plasma-spraying, electrochemical anodization, and sophisticated sandblasting with acid etching (SLA and RBM techniques), are routinely employed to treat the titanium surfaces of abutments to enhance cellular adhesion, promote superior soft tissue attachment (gingival cuff integration), and mitigate the risk of peri-implantitis—a major biological complication and cause of long-term implant failure.

The continuous refinement of the implant-abutment connection design technology represents a critical area of ongoing innovation and patent litigation. Manufacturers are consistently developing and patenting proprietary internal and conical connection geometries aimed at drastically reducing micro-movement, minimizing the micro-gap between components, and preventing bacterial ingress into the internal components—all factors fundamental to ensuring long-term biological success and preventing chronic inflammation. These advanced sealing mechanisms often involve extremely tight manufacturing tolerances (measured in microns), requiring state-of-the-art precision engineering during all stages of component manufacturing and rigorous quality control testing, such as fatigue testing and leak detection. Software integration, including Artificial Intelligence (AI) and Machine Learning (ML)-driven treatment planning modules that can automatically simulate complex occlusal loading patterns, analyze patient-specific bone density, and predict long-term bone remodeling around the abutment neck, is also rapidly shaping the technology landscape. The ultimate market objective is to achieve a seamless, highly predictable, end-to-end digital workflow, from the initial patient consultation and diagnosis to the final prosthetic insertion, ensuring maximum reproducibility, efficiency, and superior clinical outcomes for the patient.

Regional Highlights

The global dental implant abutment systems market demonstrates significant regional variances driven by economic development, healthcare infrastructure maturity, regulatory environments, and demographic profiles.

- North America (United States and Canada): This region dominates the market, characterized by high disposable incomes, significant expenditure on elective dental procedures, and the early, enthusiastic adoption of advanced digital dentistry technologies, including sophisticated CAD/CAM customization and guided surgery systems. The presence of major global market players (e.g., Dentsply Sirona, Henry Schein) and robust intellectual property protection encourages continuous, high-end innovation and supports premium pricing strategies for custom abutment solutions. The US, in particular, exhibits high clinical acceptance rates for complex restorative cases, leading to a strong, sustained demand for advanced custom titanium and high-aesthetic monolithic zirconia abutments. Regulatory stringency via the FDA ensures exceptionally high product quality and safety standards, but often increases the time-to-market for novel materials and connection designs.

- Europe (Germany, France, UK, Italy, Spain): Europe is a mature and highly segmented market known for high standards in clinical implantology, extensive professional training, and strong governmental focus on oral healthcare quality and safety. Germany, Switzerland, and Scandinavia are particularly strong adopters of implant-based solutions, driven by well-established clinical consensus, long-term scientific evidence supporting material choices, and generally favorable public health insurance schemes that partially cover implant treatments, especially in functional necessity cases. The market is highly competitive, emphasizing cross-platform compatible systems and innovative connection designs focused on preventing peri-implant disease. Demand is driven by system longevity and rigorous scientific documentation supporting material choices and specific surface treatments of the abutment collar.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is projected to be the fastest-growing region globally, fueled by massive, rapidly aging populations, increasing dental awareness spurred by public health campaigns, and surging economic prosperity across major economies like China and India. South Korea and Japan are established global centers of manufacturing excellence and technological adoption, known for high clinical usage rates and the global export strength of local companies (e.g., Osstem, Dentium). The market in emerging APAC countries is inherently price-sensitive, leading to a high initial demand for cost-effective stock abutments and entry-level implant systems, although the demand for premium custom solutions and aesthetic restorative components is quickly growing among the affluent urban populations and specialized clinics. Investment in local manufacturing and localized supply chains is a key trend, particularly for companies seeking to circumvent tariffs and optimize logistics within the region.

- Latin America (LATAM) (Brazil, Mexico, Argentina): LATAM is a critical emerging region, especially Brazil, which maintains one of the largest concentrations of dental professionals worldwide and a strong market for aesthetic dentistry. The market growth is sustained by a pronounced culture of cosmetic self-improvement and a high regional prevalence of periodontal issues requiring extraction and replacement. While price competition among local and international providers is extremely fierce, the underlying demand for quality implant restorations is strong, often favoring fixed prosthetics over traditional removable dentures. Local manufacturing capabilities within countries like Brazil are growing significantly, increasing local market share and putting persistent price pressure on imported premium components, requiring international players to adjust their operational and pricing models.

- Middle East and Africa (MEA): This region is characterized by high, albeit localized, growth concentrated in specific, high-wealth countries (UAE, Saudi Arabia, Qatar) driven primarily by substantial governmental and private sector investments in creating world-class healthcare infrastructure and promoting medical tourism. Demand in these hubs is concentrated in urban centers and leans heavily toward premium imported brands due to the perception of superior quality and established clinical track records. However, affordability challenges persist across the broader African markets, limiting the widespread adoption of advanced, custom abutment systems primarily to high-end private clinics servicing expatriate and high-net-worth local patient populations. Development of training programs and local distribution networks is essential for market penetration in this diverse area.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Implant Abutment Systems Market.- Straumann Group

- Dentsply Sirona

- Nobel Biocare (Envista Holdings Corporation)

- ZimVie (formerly Zimmer Biomet Dental)

- Henry Schein, Inc. (including BioHorizons Camlog)

- Bego Implant Systems GmbH & Co. KG

- Osstem Implant Co., Ltd.

- Dentium Co., Ltd.

- GC Corporation

- Cortex Dental Implants Industries Ltd.

- Alpha-Bio Tec Ltd.

- Southern Implants (PTY) Ltd.

- Adin Dental Implant Systems

- MIS Implants Technologies Ltd.

- MegaGen Implant Co., Ltd.

- Thommen Medical AG

- Neoss Group

- A.B. Dental Devices Ltd.

- Shofu Dental Corporation

- Ivoclar Vivadent AG (Abutment materials and digital workflow)

- Zest Dental Solutions

Frequently Asked Questions

Analyze common user questions about the Dental Implant Abutment Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the dental implant abutment systems market?

The primary driver is the accelerating increase in the global aging population, coupled with rising prevalence of tooth loss due to periodontal disease and trauma, which mandates permanent restorative solutions like dental implants. Furthermore, technological advances in CAD/CAM customization significantly enhance procedural success rates and aesthetics, reinforcing market demand for specialized abutments.

How does zirconia compare to titanium in modern abutment systems?

Titanium remains the industry standard, valued for its superior strength, high biocompatibility, and excellent mechanical properties, making it ideal for high-stress posterior areas. Zirconia is gaining significant market share, favored for its exceptional aesthetic qualities (tooth-colored, metal-free) and optimal soft tissue integration, positioning it as the preferred material for anterior, highly visible restorations and cement-retained crowns.

What impact is digitalization (CAD/CAM) having on the use of dental abutments?

Digitalization has fundamentally shifted the market toward custom abutments. CAD/CAM technology allows for precise, patient-specific designs based on virtual models, leading to optimal fit, emergence profile, and tissue health compared to prefabricated components, thereby significantly reducing chair time and minimizing the long-term risk of biological complications.

Which regional market shows the highest growth potential for implant abutment systems?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, exhibits the highest projected growth potential. This rapid expansion is driven by increasing dental tourism, expanding middle-class demographics gaining accessibility to advanced dental care, and increasing health awareness supported by significant governmental investment in regional healthcare infrastructure development.

What are the main connection types used in implant abutment systems and why are conical connections gaining popularity?

The main connection types are Internal Hexagonal, External Hexagonal, and Conical Connections. Conical connections are gaining popularity because they create a tighter, friction-fit seal between the implant and the abutment, significantly reducing the micro-gap size. This improved seal minimizes micro-movement and bacterial ingress, which is crucial for preventing chronic inflammation and subsequent peri-implant bone loss.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager