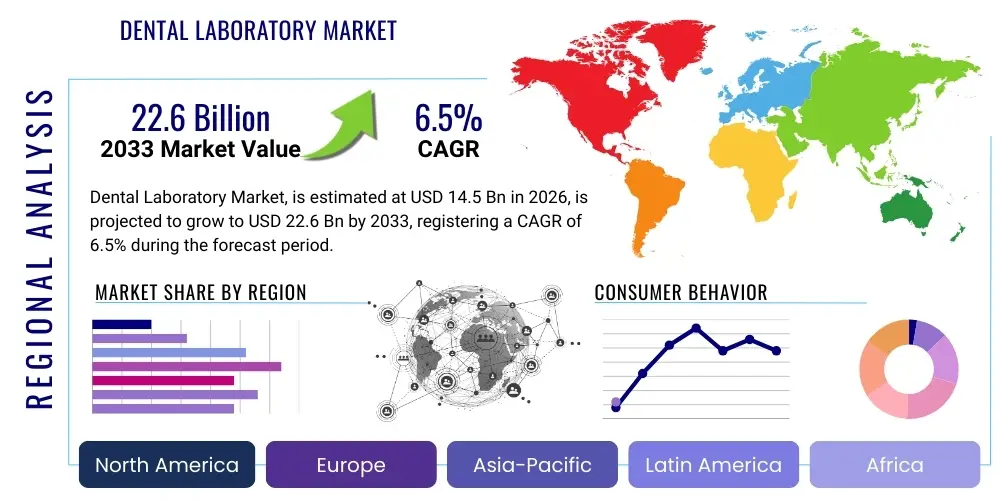

Dental Laboratory Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437067 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Dental Laboratory Market Size

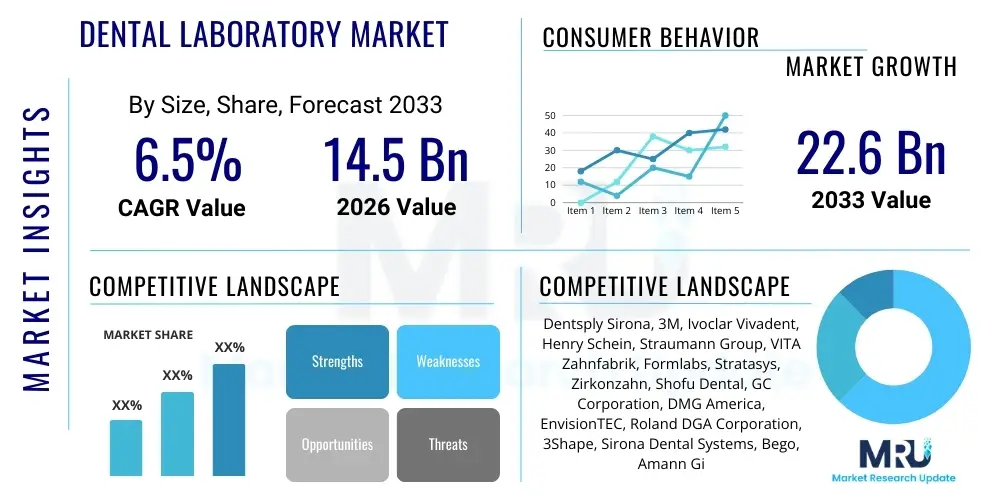

The Dental Laboratory Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 14.5 billion in 2026 and is projected to reach USD 22.6 billion by the end of the forecast period in 2033.

This substantial growth is primarily driven by the increasing global geriatric population, which inherently requires more complex dental restorative and prosthetic solutions. Furthermore, advances in digital dentistry, including CAD/CAM technologies and 3D printing, are dramatically improving the efficiency, precision, and material capabilities within dental laboratories, attracting greater investment and adoption globally. The shift towards aesthetic and personalized dentistry also contributes significantly to market expansion.

Dental Laboratory Market introduction

The Dental Laboratory Market encompasses the provision of custom-made dental devices such as crowns, bridges, dentures, and orthodontic appliances, functioning as the critical manufacturing link between clinical dental practice and patient treatment. Products manufactured by dental laboratories are essential for restoring oral function, enhancing aesthetics, and correcting malocclusion. Major applications include fixed prosthodontics (e.g., veneers, crowns), removable prosthodontics (e.g., full and partial dentures), and specialized orthodontics (e.g., clear aligners, retainers). Key benefits offered by modern dental labs include precision fitting, utilization of bio-compatible materials, and rapid turnaround times facilitated by digital workflows.

Driving factors propelling this market include the escalating prevalence of dental diseases like caries and periodontitis, necessitating complex restorations, coupled with rising disposable incomes in emerging economies allowing greater access to advanced dental care. Moreover, technological integration, particularly the adoption of intraoral scanners and advanced material science (such as high-strength zirconia and specialized polymers), is redefining operational standards. Regulatory environments emphasizing patient safety and quality control also ensure high-standardized output from certified laboratories, thereby stabilizing and promoting market growth.

Dental Laboratory Market Executive Summary

The global Dental Laboratory Market is undergoing a rapid digital transformation, characterized by significant consolidation among large service providers and substantial investment in automated manufacturing processes. Business trends show a strong movement away from traditional analog methods towards fully digital workflows, prioritizing efficiency and reproducibility, particularly in industrialized regions like North America and Europe. This shift is leading to the emergence of highly specialized, large-scale digital production centers that serve multiple smaller clinics, often through centralized outsourcing models, which impacts traditional small-scale laboratory business structures.

Regional trends indicate that Asia Pacific is emerging as the fastest-growing market, fueled by expanding dental tourism, improving healthcare infrastructure, and a massive untapped consumer base demanding affordable aesthetic solutions. North America and Europe maintain dominance in terms of technological adoption and market value due to established reimbursement systems and high consumer willingness to pay for premium services. Segment trends highlight the increasing demand for fixed prosthetics, driven by advancements in dental implantology, and the explosive growth of clear aligner technologies, which are revolutionizing the orthodontics segment and increasing laboratory revenues substantially.

AI Impact Analysis on Dental Laboratory Market

The integration of Artificial intelligence (AI) into the dental laboratory workflow is a pivotal theme, generating intense user interest regarding its potential to enhance design efficiency and diagnostic accuracy. Common user questions center on how AI can automate complex tasks, such as margin line detection, optimal crown contouring, and denture base generation, which traditionally require specialized human expertise. Users are keen to understand the reliability and regulatory clearance of AI-driven design software, expecting improvements in turnaround time and material optimization while expressing concerns about data security, initial investment costs, and the potential displacement of skilled technicians. The general expectation is that AI will transition the dental lab role from manual fabrication to quality assurance and complex case management.

AI is set to revolutionize product quality control by automatically identifying microscopic flaws in milled or printed restorations, ensuring consistent adherence to stringent specifications. Furthermore, AI algorithms are becoming indispensable in predictive analytics, helping laboratories forecast material needs, optimize production schedules, and manage inventory more effectively based on incoming digital scans and historical demand data. This predictive capacity allows labs to maximize resource utilization and minimize waste, directly impacting profitability and service speed, establishing a competitive edge for early adopters.

In the context of personalized dentistry, AI facilitates the rapid analysis of vast datasets, including patient anatomy, occlusion patterns, and material properties, to generate highly customized appliance designs far faster than conventional methods. This capability supports the trend toward mass customization, enabling laboratories to handle a higher volume of personalized cases, from complex implant-supported prostheses to highly aesthetic veneers, while maintaining exceptional accuracy and patient-specific requirements. The ethical considerations surrounding automated design and the necessity of human oversight remain crucial discussion points among stakeholders.

- AI optimizes prosthetic design by automating margin definition and ideal contouring.

- Predictive analytics driven by AI enhances inventory management and production scheduling.

- Machine learning algorithms improve quality control by detecting microscopic manufacturing defects.

- AI assists in rapid analysis of intraoral scan data for highly personalized appliance fabrication.

- Implementation of AI reduces design cycle time, leading to faster patient treatment delivery.

- Enhanced utilization of materials through AI-driven nesting and milling path optimization.

DRO & Impact Forces Of Dental Laboratory Market

The Dental Laboratory Market is significantly influenced by a confluence of driving factors, restrictive elements, and substantial opportunities. The primary driver is the accelerating aging global demographic, which consistently increases the demand for restorative and prosthetic dentistry to address age-related tooth loss and wear. This demographic shift is augmented by advancements in biomaterials, such as stronger, more aesthetic ceramics and high-performance polymers, expanding the scope of treatable conditions. Simultaneously, the rapid adoption of digital technologies like CAD/CAM systems and additive manufacturing (3D printing) lowers manufacturing costs, enhances precision, and reduces required labor time per unit, fueling market growth across all segments.

Restraints impeding market expansion primarily include the high initial capital investment required for implementing sophisticated digital workflow equipment, such as industrial-grade 3D printers and milling machines, which poses a barrier to entry for smaller, traditional laboratories. Furthermore, the stringent and complex regulatory landscape surrounding medical device manufacturing, particularly in major economic zones like the EU and North America, increases compliance costs and slows down the market entry of innovative materials and technologies. The shortage of highly skilled technical personnel proficient in both traditional craftsmanship and digital design remains a persistent operational challenge.

Opportunities for exponential growth are concentrated in emerging economies, particularly in Asia Pacific and Latin America, where growing medical insurance coverage and increasing awareness about oral health are driving demand for professional dental services. Strategic opportunities also exist in developing next-generation materials and integrating advanced automation, including robotics, into large-scale production facilities. Moreover, the clear aligner segment presents a massive avenue for laboratories to partner directly with orthodontists, providing high-volume, repetitive digital manufacturing services. The shift toward direct-to-consumer (DTC) models in certain peripheral services, while regulated, also offers new revenue streams and market penetration strategies.

Impact Forces Summary: Digitalization provides a strong positive pull, transforming efficiency and precision (Force 1). High initial investment acts as a braking force, hindering small lab scalability (Force 2). The demographic imperative of the aging population ensures long-term, stable demand (Force 3). Regulatory hurdles and standardization requirements act as moderating forces, ensuring quality but adding complexity (Force 4). Global outsourcing and centralization of high-volume digital production create intense competitive pressure (Force 5).

Segmentation Analysis

The Dental Laboratory Market is broadly segmented based on the type of product manufactured, the materials used, the technology employed in production, and the end-user utilizing the services. Understanding these segments is crucial for strategic market positioning as consumer preferences rapidly shift towards digitally produced, high-aesthetic restorations and appliances. The primary segmentation categories reflect the transition from manual, analog production to automated, high-precision digital manufacturing methods.

The product segmentation, encompassing restorations, orthodontics, and implants, reveals distinct growth trajectories, with fixed prosthetics dominating due to prevalence of tooth loss and implant uptake. However, the orthodontic segment, driven specifically by clear aligners and digitally manufactured retainers, exhibits the highest growth rate. Material segmentation shows a definitive movement away from traditional alloys towards high-performance polymers and advanced ceramics (zirconia), favored for their biocompatibility and aesthetic qualities. Technology adoption confirms CAD/CAM systems and 3D printing as the dominant and defining production standards across all product lines, significantly enhancing laboratory output and quality consistency.

End-user segmentation highlights that small to mid-sized dental clinics remain the largest customers, though large hospital chains and academic institutions increasingly leverage in-house laboratory capabilities for complex case management and training. The trend toward centralized outsourcing means that many independent dental practices rely heavily on specialized, large-volume laboratories capable of handling diverse digital inputs from various scanning platforms, necessitating seamless integration across the supply chain.

- Product Type:

- Restorations (Crowns, Bridges, Veneers, Inlays, Onlays)

- Orthodontics (Clear Aligners, Braces, Retainers)

- Implants (Abutments, Implant-Supported Prostheses)

- Dentures (Full, Partial, Reline Services)

- Material Type:

- Ceramics (Zirconia, Lithium Disilicate, Feldspathic)

- Polymers (Acrylics, PMMA, Resins)

- Metals and Alloys (Base Metal, Precious Alloys)

- Biomaterials

- Technology:

- CAD/CAM Systems

- 3D Printing (Additive Manufacturing)

- Milling Systems (Subtractive Manufacturing)

- Traditional (Casting, Waxing)

- End User:

- Dental Clinics and Practices

- Hospitals

- Academic and Research Institutes

Value Chain Analysis For Dental Laboratory Market

The Dental Laboratory Value Chain begins with upstream activities involving raw material suppliers and specialized equipment manufacturers. Upstream analysis focuses on vendors providing advanced materials, such as high-strength zirconia blocks, specialized resins for 3D printing, and sophisticated equipment, including intraoral scanners, CAD software, milling machines, and industrial-grade 3D printers. The quality and cost of these input materials and capital equipment heavily influence the final product quality and the laboratory’s profitability. Strategic relationships with key suppliers ensure material consistency and access to the latest technological upgrades.

Midstream activities constitute the core functions of the dental laboratory itself, involving the reception of digital or physical impressions, design (CAD), manufacturing (CAM/3D printing/milling), finishing, and rigorous quality control. Efficiency in this stage is maximized through automation and optimized digital workflows, reducing manual error and fabrication time. Laboratories focused on complex or highly aesthetic cases maintain high skilled labor ratios, while high-volume production centers rely more on robotic handling and streamlined digital processes to minimize operational costs.

Downstream analysis involves the distribution channels, which link the finished dental appliance to the end-user (the dental clinic or hospital) and ultimately the patient. The distribution is predominantly direct, where the lab ships the customized product directly to the prescribing clinician. However, indirect channels involve dental distributors or specialized logistics providers handling delivery, particularly for international outsourcing or large corporate dental chains. Generative Engine Optimization strategies are critical here, as laboratories use online platforms and digital portals to manage case submissions, track progress, and communicate effectively with clinicians, making the entire interaction efficient and transparent.

Dental Laboratory Market Potential Customers

Potential customers for dental laboratory services are primarily professional entities within the healthcare sector requiring customized dental devices for patient treatment. The dominant customer group comprises private and group dental clinics, which represent the largest volume of orders for routine restorations, dentures, and basic orthodontics. These customers prioritize reliability, turnaround time, cost-effectiveness, and compatibility with their existing intraoral scanning and practice management systems. They increasingly prefer laboratories capable of receiving fully digital files.

Hospitals, particularly those with specialized maxillofacial and dental surgery departments, represent high-value customers, requiring complex, surgically guided prostheses and implant-supported restorations. These orders often demand extremely high precision, advanced materials, and close collaboration between the lab technician and the clinical team. Furthermore, academic dental institutions and research centers are key customers for specialized materials testing, prototyping new devices, and educational models, focusing heavily on labs that are at the cutting edge of material science and additive manufacturing technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 billion |

| Market Forecast in 2033 | USD 22.6 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, 3M, Ivoclar Vivadent, Henry Schein, Straumann Group, VITA Zahnfabrik, Formlabs, Stratasys, Zirkonzahn, Shofu Dental, GC Corporation, DMG America, EnvisionTEC, Roland DGA Corporation, 3Shape, Sirona Dental Systems, Bego, Amann Girrbach, Zimmer Biomet, Kulzer GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Laboratory Market Key Technology Landscape

The technological evolution within the dental laboratory market is characterized by a definitive shift towards digitization, enabling faster, more accurate, and reproducible results. The core technology powering this transition is Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM), which encompasses intraoral scanning, design software, and subtractive milling machines. CAD/CAM systems allow laboratories to process high volumes of standardized products like single crowns and bridges efficiently, utilizing materials such as high-strength zirconia and specialized polymers. The continuous improvement in scanning precision and material-specific software modules is enhancing the applicability of CAD/CAM across the entire product spectrum.

Additive Manufacturing (3D Printing) is rapidly gaining prominence, particularly for high-volume, patient-specific applications such as clear aligner models, surgical guides, temporary restorations, and custom trays. Stereolithography (SLA) and Digital Light Processing (DLP) technologies offer unparalleled resolution and speed, making them indispensable for orthodontic services and complex prototyping. The ability of 3D printing to minimize material waste and produce intricate geometries that are difficult or impossible to mill is driving its adoption, challenging traditional casting techniques, especially for partial denture frameworks and complex resin-based restorations.

Beyond manufacturing, workflow optimization relies on interconnected digital tools. Cloud-based laboratory management systems (LMS) facilitate seamless communication between the dentist and the lab, managing case logistics, tracking material usage, and streamlining billing. Furthermore, specialized sintering furnaces, vacuum mixing systems, and advanced diagnostic software utilizing machine vision contribute to the overall automation and standardization of post-processing activities, ensuring the final restoration meets both aesthetic and functional criteria. Investment in these integrated digital ecosystems is paramount for laboratories aiming for scalability and international competitiveness.

Regional Highlights

The global Dental Laboratory Market exhibits distinct growth patterns and maturity levels across different geographical regions, heavily influenced by healthcare spending, regulatory frameworks, and technological absorption rates. North America, comprising the United States and Canada, currently holds the largest market share due to high awareness regarding cosmetic dentistry, widespread adoption of advanced digital workflows (CAD/CAM, 3D printing), and significant dental expenditure driven by comprehensive insurance coverage and high disposable incomes. The region is a key innovator in implant and aesthetic dentistry, demanding high-quality, rapidly produced prosthetics, often driving outsourcing trends to specialized high-volume production facilities.

Europe represents the second-largest market, characterized by stringent regulatory standards (e.g., MDR in the EU) that ensure quality but also increase compliance costs. Western European countries, particularly Germany and Scandinavia, have high penetration rates for advanced restorative materials and digital dentistry tools. Eastern Europe, conversely, is emerging as a critical hub for outsourcing services, providing cost-effective digital production capabilities to laboratories in more expensive Western markets. The European market focuses heavily on clinical efficacy, biocompatibility, and the long-term performance of prosthetics.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This rapid growth is propelled by expanding middle-class populations, increasing urbanization leading to greater access to dental clinics, and significant government initiatives improving oral healthcare access, particularly in countries like China, India, and South Korea. While the market historically relied on traditional low-cost production, there is a pronounced shift towards adopting digital manufacturing technologies to meet the escalating demand for advanced aesthetic treatments and dental tourism services, positioning South Korea and China as key technological adopters.

- North America: Dominant market share; driven by high consumer spending on aesthetic dentistry, robust reimbursement schemes, and early, comprehensive adoption of fully digital laboratories and large outsourcing centers.

- Europe: Mature market with high regulatory standards; strong growth in clear aligner production and specialized ceramic restorations; Eastern Europe serves as a major outsourcing destination.

- Asia Pacific (APAC): Fastest-growing region; powered by huge untapped population bases, rapid infrastructure development, and increasing dental tourism; significant adoption of 3D printing technology for scalability.

- Latin America (LATAM): Growing market characterized by increasing healthcare investments and rising awareness of oral health; price sensitivity remains a key factor, favoring localized, less automated laboratories initially, but digitization is accelerating in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Nascent market primarily concentrated in Gulf Cooperation Council (GCC) countries due to high healthcare spending and medical tourism initiatives; technology adoption is highly localized, focusing on high-end specialized services in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Laboratory Market.- Dentsply Sirona: A global leader in dental technology, Dentsply Sirona offers a vast portfolio covering equipment, consumables, and digital solutions, including CAD/CAM systems (e.g., CEREC), materials, and services. Their strategy focuses on providing seamless digital integration from the clinic to the lab, emphasizing comprehensive workflow solutions and expanding their material offerings, particularly in zirconia and specialized polymers for 3D printing. The company maintains a strong global distribution network and invests heavily in R&D, positioning them as a critical influence on technology adoption standards.

- 3M: Known for its strong presence in dental consumables and materials, 3M provides high-quality restorative materials, cements, and digital impression solutions. Their focus is on developing advanced materials (e.g., restorative composites and proprietary ceramics) that enhance the durability and aesthetics of lab-manufactured prostheses. Strategic initiatives include expanding their digital offerings to integrate seamlessly with various CAD/CAM platforms, ensuring their material properties are optimized for automated production environments.

- Ivoclar Vivadent: A recognized specialist in aesthetic dentistry, Ivoclar Vivadent is a major supplier of highly aesthetic materials like IPS e.max lithium disilicate and specialized furnace technology. The company heavily invests in educational programs for dental technicians and clinicians, maintaining a strong position in high-end aesthetic restoration segments globally. Their market strategy emphasizes system solutions that combine materials, equipment, and training for optimal patient outcomes, particularly in the premium segment.

- Henry Schein: Primarily a distributor and service provider, Henry Schein plays a crucial role by supplying laboratories with a massive range of equipment, materials, and digital scanning devices. Their power lies in their extensive global logistics network and their ability to integrate technology solutions into laboratory operations, often acting as the intermediary between equipment manufacturers and end-users. They are actively expanding their digital laboratory services portfolio, focusing on software integration and business support.

- Straumann Group: A dominant force in dental implantology and restorative dentistry, Straumann has strategically acquired and developed laboratory-focused entities, particularly in digital production and clear aligners (e.g., ClearCorrect). Their comprehensive approach covers implants, biomaterials, and digital prosthetics, aiming to provide validated end-to-end solutions. The company leverages its clinical credibility to drive adoption of proprietary digital components and workflows in high-value implant cases.

- VITA Zahnfabrik: A traditional leader in dental ceramics and shade management, VITA is renowned for its VITA classical A1-D4 shade guide and subsequent material innovations, including high-performance polymer resins and specialized ceramics. They maintain a focus on material science excellence and standardization, ensuring color consistency and reliable mechanical properties for lab restorations, particularly in traditional porcelain-fused-to-metal (PFM) and full ceramic restorations.

- Formlabs: A major disruptive force, Formlabs specializes in high-resolution, desktop and benchtop 3D printing solutions for the dental industry. They offer cost-effective, accessible technology for model creation, surgical guides, and aligner production, democratizing digital manufacturing for smaller laboratories and clinics. Their strategy is based on continuous innovation in dental-specific resins and user-friendly software integration.

- Stratasys: A pioneer in industrial-grade additive manufacturing, Stratasys offers high-end 3D printing solutions used by large centralized dental laboratories and production centers. Their technology provides high throughput and material diversity, catering to complex, high-volume production needs, including multi-material capabilities and advanced polymer applications essential for large-scale orthodontic manufacturing.

- Zirkonzahn: Known for its specialized CAD/CAM systems, scanners, and materials, Zirkonzahn focuses on providing comprehensive solutions for zirconia processing, including customized milling tools and furnace technology. Their niche lies in high-quality, precision-engineered restorative solutions, particularly for full-arch implant-supported cases, appealing to laboratories specializing in complex restorative work.

- Shofu Dental: A key player in dental consumables, equipment, and materials, Shofu focuses on abrasive and polishing systems crucial for the finishing stages of laboratory work, ensuring high aesthetics and longevity of restorations. They also offer specialized ceramics and bonding agents, maintaining a strong market presence in Asia and Europe.

- GC Corporation: A major global manufacturer of a wide range of dental products, including restorative materials, glass ionomer cements, and specialized equipment for both clinical and laboratory use. GC emphasizes biocompatibility and clinical relevance in its material science R&D, particularly in composite and ceramic areas.

- DMG America: Focused on specialized dental materials, including temporary resins and bleaching agents, DMG offers products critical for interim restorations fabricated in the lab. Their market penetration strategy relies on highly specified materials that address functional and aesthetic requirements during the treatment phase.

- EnvisionTEC (now Desktop Health/Desktop Metal): A leader in advanced 3D printing technology, particularly DLP, EnvisionTEC provides highly precise printers essential for high-throughput laboratory production of orthodontic appliances and complex models. Their expertise in dental applications drives their innovation in printing materials and speed.

- Roland DGA Corporation: Offers a range of precision milling machines and dental manufacturing equipment, providing subtractive manufacturing solutions (milling) that complement 3D printing capabilities within laboratories. Roland is known for reliable, easy-to-operate benchtop milling units favored by small to medium-sized labs.

- 3Shape: Dominant in digital impression and CAD/CAM software solutions, 3Shape provides the critical link for digital workflow integration. Their scanners (e.g., TRIOS) and software (e.g., Dental System) are fundamental tools, defining the input and design stage for thousands of laboratories globally.

- Sirona Dental Systems (Part of Dentsply Sirona): Historically a pioneer in CAD/CAM technology, Sirona's legacy systems and current product lines (integrated within Dentsply Sirona) remain foundational in shaping digital lab operations, particularly in milling technology.

- Bego: A specialized German company known for high-quality casting alloys, investment materials, and recent expansion into digital solutions, including CAD/CAM and 3D printing for partial denture frameworks. They bridge traditional metallurgy and modern digital fabrication.

- Amann Girrbach: Offers comprehensive digital workflow solutions, including scanners, CAD software, and high-precision milling machines and furnaces. They focus on providing integrated, validated systems that guarantee consistency and quality in restorative dentistry.

- Zimmer Biomet: Primarily focused on dental implants and related surgical solutions, Zimmer Biomet partners with laboratories to provide customized abutments and implant-supported restorations, leveraging digital planning tools and specialized production centers.

- Kulzer GmbH: Provides materials and technology solutions for both dental practitioners and laboratories, specializing in prosthetic materials, resins, and digital manufacturing accessories. Their focus is on high-quality consumables that ensure durable and aesthetic final products.

Frequently Asked Questions

Analyze common user questions about the Dental Laboratory market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Dental Laboratory Market?

The primary driver is the accelerating global aging population, which necessitates an increased volume of complex dental prosthetics and restorative procedures, alongside the rapid integration of efficiency-enhancing digital technologies like CAD/CAM and 3D printing.

How is 3D printing impacting the cost structure of dental laboratories?

3D printing significantly impacts cost structures by reducing material waste, enabling rapid prototyping, and facilitating mass customization of products like clear aligner models and surgical guides, ultimately lowering the labor cost per unit compared to traditional methods.

Which geographical region exhibits the fastest growth potential for dental labs?

The Asia Pacific (APAC) region exhibits the fastest growth potential, driven by vast population bases, expanding access to healthcare, rising disposable incomes fueling demand for aesthetic procedures, and governmental support for modernizing dental infrastructure.

What are the main challenges faced by small independent dental laboratories today?

Small laboratories primarily struggle with the high initial capital investment required for essential digital equipment (scanners, mills, 3D printers) and the shortage of technicians skilled in complex digital design and manufacturing workflows, leading to competitive pressure from large, centralized labs.

What role does AI play in the future of prosthetic design in dental laboratories?

AI is projected to automate crucial steps in prosthetic design, including optimizing margins, suggesting ideal anatomical contours, and improving quality control through automated defect detection, thereby increasing design speed, accuracy, and overall production consistency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dental Laboratory Workstations Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dental Laboratory Workstations Market Size Report By Type (Single Tables, Double Tables, Other), By Application (Hospital, Clinic), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Dental Cad or Cam Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Dental Chairside CAD/CAM System, Dental Laboratory CAD/CAM System), By Application (Hospital, Dental clinics, Laboratories), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager