Dental Liners and Bases Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437294 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Dental Liners and Bases Market Size

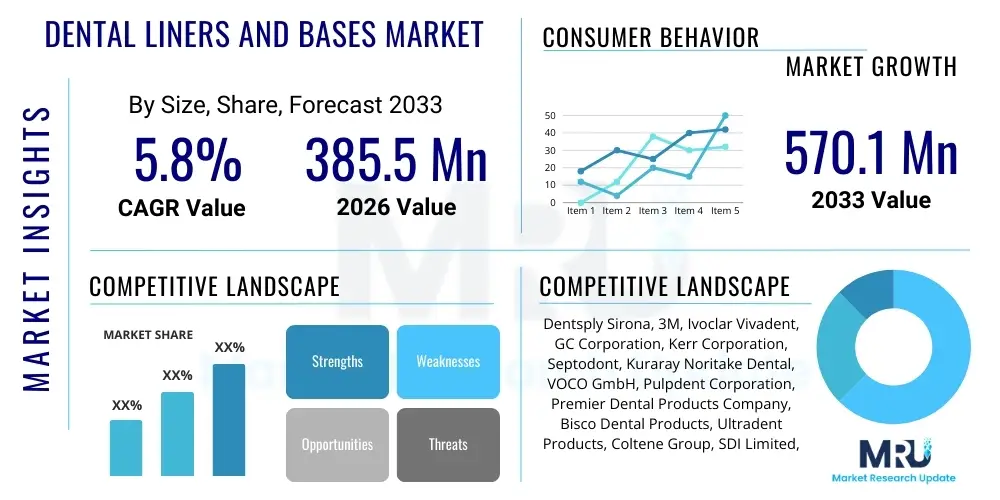

The Dental Liners and Bases Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 385.5 Million in 2026 and is projected to reach USD 570.1 Million by the end of the forecast period in 2033.

Dental Liners and Bases Market introduction

The Dental Liners and Bases Market encompasses essential materials utilized in restorative dentistry, primarily serving as protective layers beneath permanent dental restorations. Dental liners are typically thin layers (less than 0.5 mm) applied directly over the dentin wall to provide therapeutic benefits, such as pulp protection, insulation against thermal changes, or promotion of secondary dentin formation. Common liner types include calcium hydroxide, which is valued for its ability to stimulate reparative dentin, and glass ionomers, known for their fluoride-releasing capabilities. These materials are crucial in maintaining pulpal vitality and extending the longevity of restorations, especially in deep cavity preparations.

Dental bases, conversely, are thicker layers (1.0 mm or more) used to replace missing dentin, block out undercuts, and provide thermal protection or structural support for the final restorative material. Bases must possess high compressive strength and low solubility to withstand masticatory forces. The primary applications span across direct restorations (like amalgam and composite fillings) and indirect restorations (crowns and inlays), acting as an intermediary buffer. The integration of advanced materials, such as bioactive glass ionomers and resin-modified materials, is driving efficiency and improving clinical outcomes by reducing post-operative sensitivity and enhancing adhesion to tooth structure.

Market growth is predominantly driven by the escalating global prevalence of dental diseases, including dental caries and periodontal issues, necessitating restorative procedures. Furthermore, increased patient awareness regarding oral health, coupled with technological advancements leading to the development of highly biocompatible and durable materials, fuels market expansion. The expanding elderly population, which requires frequent dental care and restorative maintenance, provides a consistent demand base. The professional benefits of these materials, including simplified application protocols and improved aesthetic results, consolidate their essential role in modern dental practice.

Dental Liners and Bases Market Executive Summary

The Dental Liners and Bases Market is characterized by stable growth, fueled primarily by the global rise in dental disease burden and sustained technological innovation in material science. Key business trends include a strong shift towards resin-modified glass ionomer cements (RMGICs) and calcium silicate-based materials due to their superior handling characteristics, bioactivity, and enhanced physical properties. Manufacturers are heavily investing in research focused on materials that actively contribute to dentin regeneration and reduce microleakage, moving beyond passive protective roles to active therapeutic involvement. Mergers and acquisitions remain a consistent strategic approach, allowing major players to consolidate specialized technologies and expand their geographical footprints, particularly into rapidly developing economies in the Asia Pacific region.

Regionally, North America and Europe currently dominate the market, attributed to high healthcare expenditure, sophisticated dental infrastructure, and widespread adoption of premium restorative treatments. However, the Asia Pacific region is anticipated to record the fastest growth rate, driven by significant improvements in healthcare access, expanding dental tourism, and increasing disposable incomes supporting preventative and restorative dental care. Latin America and the Middle East & Africa are showing promising potential, stimulated by governmental initiatives focused on improving public oral health services and the rising presence of international dental product distributors.

Segment trends reveal that the Glass Ionomer category maintains a significant market share due to its established efficacy, fluoride release, and cost-effectiveness, although the Resin-Modified Glass Ionomer segment is growing rapidly due to better mechanical strength and reduced sensitivity to moisture. End-user analysis indicates that Dental Clinics remain the largest consumers, benefiting from the immediate application and high volume of routine restorative procedures. The future growth trajectory is heavily influenced by the adoption of minimally invasive dentistry techniques, which favor materials that offer strong adhesion and bioactive potential, thereby reducing the need for extensive tooth preparation.

AI Impact Analysis on Dental Liners and Bases Market

User queries regarding AI’s influence on the Dental Liners and Bases Market often center on how digital workflows impact material selection, the role of AI in predictive diagnosis leading to less extensive cavity preparations, and potential automated dispensing systems for material mixing. A key theme users inquire about is the precision and optimization offered by AI in determining the exact depth of cavity preparation and the optimal liner/base application thickness, minimizing human error and maximizing therapeutic outcomes. Concerns also arise regarding the integration cost of AI-driven diagnostic tools in standard clinics and whether this technology would favor newer, specialized materials over traditional ones. The collective expectation is that AI will primarily enhance diagnostic accuracy and potentially streamline inventory management for complex material portfolios, rather than directly altering the chemical composition of the liners and bases themselves.

- AI-enhanced diagnostic tools improve the early detection of deep caries, potentially reducing the necessity for extensive pulp protection protocols.

- Predictive analytics optimize material inventory management, forecasting the demand for specific liners (e.g., calcium silicate vs. ZOE) based on procedure volume.

- AI systems integrated into digital dentistry platforms may guide the automated mixing and dispensing of multi-component base materials, ensuring stoichiometric accuracy.

- Machine learning algorithms can analyze clinical outcomes data to recommend the most suitable liner/base material based on patient demographics and cavity characteristics.

- Advanced imaging analysis supported by AI assists in precisely mapping dentin depth, minimizing the risk of pulpal exposure and optimizing protective layer application thickness.

DRO & Impact Forces Of Dental Liners and Bases Market

The dynamics of the Dental Liners and Bases Market are driven by robust technological advancements, primarily focused on enhancing bioactivity and adhesive properties. The increasing global prevalence of dental caries, often requiring deep cavity preparations, is the primary driver generating consistent demand for pulpal protection. Furthermore, the rising adoption of cosmetic and restorative dental procedures, especially in developed economies, necessitates reliable base materials that ensure the longevity and structural integrity of aesthetic restorations. This is further compounded by a global aging population, which typically requires more extensive restorative and prosthetic care, thereby solidifying the market’s underlying demand structure.

However, market expansion faces significant restraints, notably the relatively high cost associated with advanced bioactive materials, such as calcium silicate cements, which can deter adoption in price-sensitive emerging markets. Additionally, the complexity and time required for stringent regulatory approvals for new material formulations pose a hurdle, slowing down the pace of innovation reaching clinical application. Clinician training and variability in application techniques across different regions also represent a persistent restraint, as incorrect application can compromise the effectiveness and durability of the liner or base.

Opportunities for future growth are significant, particularly in the development and commercialization of next-generation liners that possess true remineralizing capabilities, potentially simplifying the restorative process and improving long-term pulp health. The untapped potential in emerging economies, where dental infrastructure is rapidly improving and patient awareness is rising, offers expansive opportunities for market penetration. Furthermore, strategic integration of these materials into digital workflows, ensuring compatibility with intraoral scanners and CAD/CAM systems, presents a pathway for streamlining restorative procedures and increasing material usage efficiency. The ongoing shift towards minimally invasive protocols also favors advanced, adhesive liners that preserve maximum healthy tooth structure.

Segmentation Analysis

The Dental Liners and Bases Market is segmented primarily based on material type, clinical application, and end-user. The Material Type segment is critical, as it dictates the functional characteristics—such as strength, bioactivity, and thermal insulation—of the product. Glass ionomers, due to their fluoride release and good adhesion, represent a foundational material, while calcium hydroxide maintains its niche as a traditional direct pulp-capping agent. The fastest growth is seen in composite resins and bioactive materials, reflecting the industry's focus on materials that offer both physical protection and therapeutic benefits. Application segmentation differentiates between direct restorations (performed intraorally) and indirect restorations (fabricated outside the mouth), where bases are used to modify the prepared tooth structure for fitting prosthetic devices. End-user analysis highlights the dominance of specialized dental clinics, which execute the vast majority of restorative procedures.

- Type:

- Calcium Hydroxide

- Zinc Oxide Eugenol (ZOE)

- Glass Ionomer (Conventional and Resin-Modified)

- Resin-Based Composites

- Calcium Silicate-Based Materials

- Others (Polycarboxylate, etc.)

- Application:

- Direct Restorations

- Indirect Restorations (Crowns, Bridges, Inlays, Onlays)

- Pulp Capping (Direct and Indirect)

- Blocking Out Undercuts

- End-User:

- Dental Clinics

- Hospitals and Ambulatory Surgical Centers

- Dental Academic & Research Institutes

Value Chain Analysis For Dental Liners and Bases Market

The value chain for the Dental Liners and Bases Market starts with the upstream activities involving the sourcing and refinement of specialized raw materials, such as high-purity glass powders, specific resins, calcium compounds, and zinc oxides. Material suppliers focusing on stringent quality control and formulation consistency are critical at this stage. Following material procurement, manufacturers engage in complex R&D, formulation, mixing, and packaging processes, ensuring compliance with global regulatory standards (e.g., FDA, CE mark). The integration of proprietary blending techniques is essential to produce materials with optimal viscosity, working time, and mechanical strength suitable for clinical use. The complexity of regulatory compliance and the need for significant scientific validation often increase barriers to entry at the manufacturing level.

Downstream activities involve distribution and final clinical application. The distribution channel is often bifurcated into direct sales teams, especially for large corporate accounts and key opinion leaders, and indirect channels relying on specialized dental distributors, wholesalers, and e-commerce platforms. Distributors play a crucial role in managing inventory, providing logistics, and offering technical support and training to end-users. Direct distribution is favored for high-volume markets or specific premium products where technical expertise transfer is necessary, whereas indirect channels ensure broad market reach, particularly in fragmented international markets. The end-users—dental professionals—are responsible for the final application, where training and adherence to strict clinical protocols determine the success of the material.

The direct channel ensures tighter control over pricing and customer feedback, enabling manufacturers to quickly adapt product features based on practitioner input. This model is preferred for new, technically sensitive bioactive materials requiring specialized handling. Conversely, the indirect distribution model leverages established networks and logistics expertise, providing convenience and accessibility to smaller clinics globally. Optimization of the value chain is focused on reducing logistics costs, enhancing material traceability, and ensuring timely delivery of materials with specific shelf-life constraints, ultimately ensuring that high-quality, scientifically validated liners and bases reach the practicing dentist efficiently.

Dental Liners and Bases Market Potential Customers

Potential customers for dental liners and bases are primarily healthcare facilities and individual practitioners who perform restorative and endodontic procedures requiring pulp protection and dentin replacement. Dental clinics, ranging from single-chair practices to large multi-specialty group practices, constitute the largest end-user segment due to the high volume of routine fillings and restorative treatments they perform daily. These clinics require a continuous supply of various liners (calcium hydroxide, RMGICs) to manage diverse clinical scenarios, from shallow caries to deep restorations requiring direct pulp capping. Their purchasing decisions are often influenced by material handling properties, cost-effectiveness, and evidence-based clinical efficacy.

Hospitals and Ambulatory Surgical Centers (ASCs) are also significant customers, particularly those that house dental departments or specialized maxillofacial units. These institutions often handle more complex cases, including trauma, extensive operative dentistry, and procedures performed under general anesthesia, requiring specialized, high-performance base materials that adhere to strict institutional procurement standards. Furthermore, dental academic and research institutes serve as crucial customers; while their consumption volume may be lower than clinics, they are essential for product evaluation, material testing, and the education of future practitioners, influencing long-term material adoption trends across the industry. Their demand is often concentrated on novel and advanced bioactive materials used in experimental settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 385.5 Million |

| Market Forecast in 2033 | USD 570.1 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, 3M, Ivoclar Vivadent, GC Corporation, Kerr Corporation, Septodont, Kuraray Noritake Dental, VOCO GmbH, Pulpdent Corporation, Premier Dental Products Company, Bisco Dental Products, Ultradent Products, Coltene Group, SDI Limited, SHOFU Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Liners and Bases Market Key Technology Landscape

The technology landscape of the Dental Liners and Bases Market is centered on enhancing material bioactivity, improving handling characteristics, and optimizing polymerization methods. A major technological advancement involves the shift from traditional inert barrier materials to bioactive and biomimetic materials, most notably calcium silicate cements (like MTA and Biodentine derivatives). These newer technologies stimulate the release of calcium and hydroxide ions, promoting the formation of tertiary dentin and fostering biological healing, thus significantly improving prognosis following pulp exposure or deep caries removal. The development of self-adhesive and self-etching materials has also simplified clinical procedures by reducing the number of application steps and minimizing moisture sensitivity, leading to more predictable outcomes and reduced chair time for patients.

Furthermore, photopolymerization technology has been refined, particularly in resin-modified glass ionomers (RMGICs) and light-cured composite bases. Advances in light-curing units and photoinitiator systems allow for deeper and more efficient curing of thicker base layers, addressing previous concerns regarding inadequate polymerization depth. This is critical for ensuring mechanical stability under the final restoration. Another emerging technology is the integration of nanotechnology, utilizing nano-fillers within resin matrices to improve mechanical properties, reduce shrinkage stress during curing, and enhance polishability of overlying restorations, even when used as a base.

The future technology focus is leaning toward smart materials that can respond to environmental cues. For instance, liners that release antimicrobial agents when pH levels drop (indicating bacterial activity) are under intensive research. Additionally, the development of universal base materials compatible with various restorative techniques (composite, amalgam, ceramic) is simplifying inventory management and clinical decision-making. These innovations collectively aim to maximize the therapeutic potential of the materials while streamlining the application process within the demanding clinical environment of modern dentistry, ensuring materials meet both structural and biological requirements.

Regional Highlights

The analysis of the Dental Liners and Bases Market across global regions reveals distinct patterns in demand, adoption, and material preference, driven by economic development, healthcare infrastructure, and population demographics. North America, encompassing the United States and Canada, represents the largest market share, characterized by high consumer spending on advanced dental aesthetics, widespread insurance coverage supporting high-cost procedures, and the early adoption of premium bioactive materials, particularly calcium silicate-based liners.

Europe holds the second-largest position, with Western European countries (Germany, UK, France) showing mature markets driven by stringent quality standards and a strong focus on preventative dentistry. European dentists show a high preference for technologically advanced materials, often favoring glass ionomers and RMGICs for their proven fluoride release and durability. Regulatory harmonization within the EU facilitates the rapid introduction of certified innovative products across member states, sustaining steady market demand.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is primarily attributed to the massive untapped patient pool in countries like China and India, rapidly improving public and private dental infrastructure, and the expansion of medical tourism. While cost remains a significant factor, leading to higher consumption of traditional materials like ZOE and conventional glass ionomers, rising disposable incomes are enabling a gradual shift toward specialized resin and bioactive products.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets with substantial long-term growth potential. LATAM growth is stimulated by urbanization and increasing governmental focus on public oral health programs, particularly in Brazil and Mexico. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, benefits from high healthcare investment and a rising demand for specialized dental procedures, though product accessibility and price sensitivity remain key variables influencing local adoption rates.

- North America: Dominant market share due to high dental expenditure, strong regulatory environment, and rapid adoption of bioactive calcium silicate materials and advanced composites.

- Europe: Second-largest market, characterized by mature healthcare systems and high standards for material quality, driving consistent demand for glass ionomer and resin-modified bases.

- Asia Pacific (APAC): Fastest-growing region, fueled by expanding dental access, increasing prevalence of dental diseases, and rising investments in modern clinical facilities in key economies like China and India.

- Latin America (LATAM): Growth driven by expanding public health initiatives and increasing utilization of dental services, focusing on cost-effective yet reliable materials.

- Middle East & Africa (MEA): Emerging growth area, supported by significant healthcare infrastructure development and increasing demand for sophisticated restorative dentistry, especially in the GCC states.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Liners and Bases Market.- Dentsply Sirona

- 3M

- Ivoclar Vivadent

- GC Corporation

- Kerr Corporation

- Septodont

- Kuraray Noritake Dental

- VOCO GmbH

- Pulpdent Corporation

- Premier Dental Products Company

- Bisco Dental Products

- Ultradent Products

- Coltene Group

- SDI Limited

- SHOFU Inc.

Frequently Asked Questions

Analyze common user questions about the Dental Liners and Bases market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a dental liner and a dental base?

Dental liners are thin layers (typically <0.5 mm) applied directly to dentin for therapeutic purposes, such such as pulpal protection or stimulating reparative dentin. Dental bases are thicker layers (>1.0 mm) used to provide thermal insulation, replace missing dentin structure, or offer mechanical support for the final restoration, acting as a bulk-fill substitute.

Which type of dental base material is showing the fastest market growth?

The Resin-Modified Glass Ionomer Cements (RMGICs) segment is experiencing rapid growth. RMGICs offer the benefits of fluoride release (like conventional GICs) coupled with superior mechanical strength and improved handling characteristics due to the resin component, making them versatile for diverse clinical applications beneath composite restorations.

How does the shift towards bioactive materials impact the Dental Liners Market?

The introduction of bioactive materials, primarily calcium silicate-based cements, is shifting the market focus from passive protection to active tissue response. These materials promote the formation of reparative dentin and offer superior sealing, potentially reducing post-operative sensitivity and improving the long-term vitality of the tooth.

Which geographical region leads the global consumption of dental liners and bases?

North America currently holds the largest market share, driven by high per capita dental expenditure, robust insurance coverage, and a widespread clinical preference for advanced, high-performance restorative materials that adhere to stringent quality and performance standards.

Are dental liners necessary when using modern self-adhesive restorative materials?

While modern self-adhesive composites often eliminate the need for traditional bonding agents, liners and bases remain crucial in deep cavity preparations. Their function shifts to providing thermal insulation and stimulating pulp repair (bioactive liners) rather than solely improving adhesion, ensuring pulpal health is prioritized when dentin thickness is minimal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager