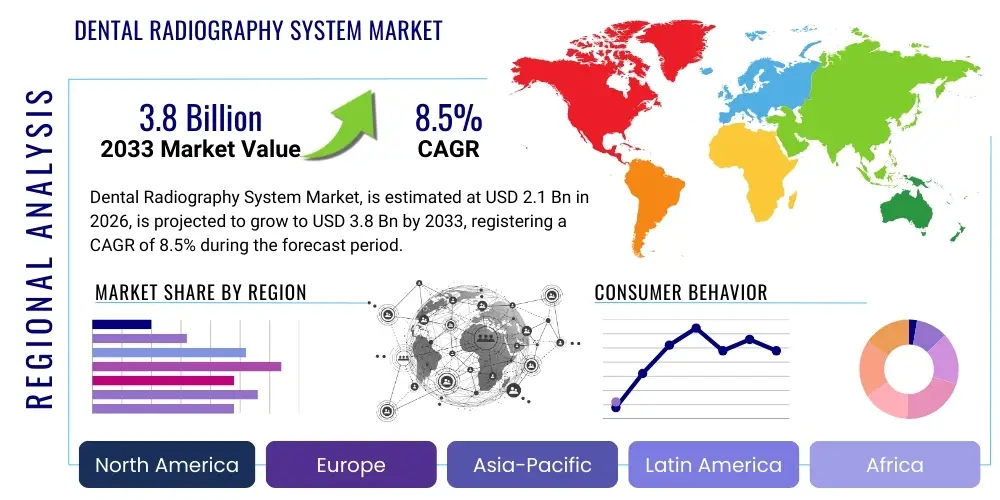

Dental Radiography System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435650 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Dental Radiography System Market Size

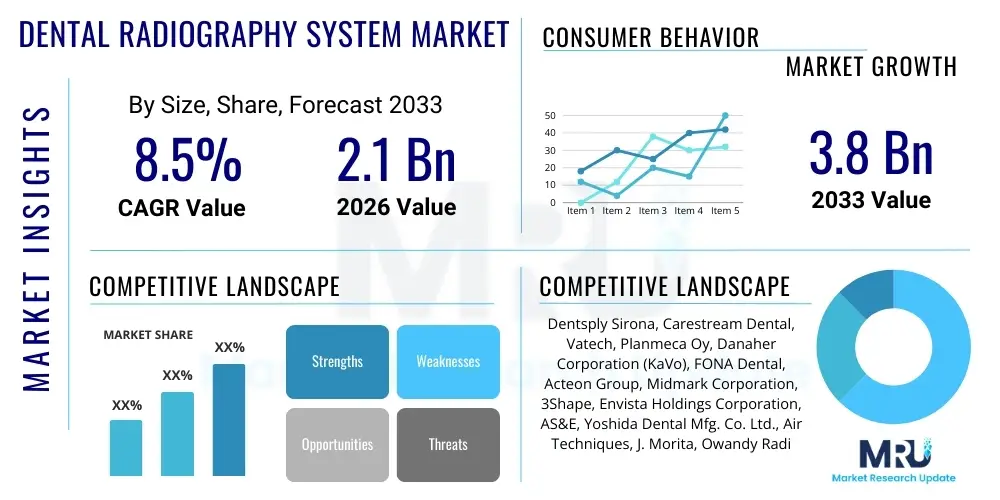

The Dental Radiography System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

Dental Radiography System Market introduction

The Dental Radiography System Market encompasses devices and technologies used to capture images of the teeth, bones, and surrounding soft tissues within the oral cavity. These systems are crucial for diagnosing dental diseases, planning complex treatments, and monitoring recovery progress. The shift from traditional film-based (analog) systems to digital radiography, characterized by superior image quality, reduced radiation exposure, and immediate image availability, is the core driver defining the current market landscape. Products range from basic intraoral sensors used for periapical and bitewing images to sophisticated extraoral systems like Panoramic and Cone-Beam Computed Tomography (CBCT) units, which provide three-dimensional (3D) views essential for endodontics, orthodontics, and implantology.

Major applications of dental radiography systems include caries detection, periodontal assessment, evaluation of alveolar bone structure, temporomandibular joint (TMJ) disorders analysis, and surgical planning, particularly for dental implants and complex extractions. The primary benefits offered by modern digital systems are enhanced diagnostic accuracy due to advanced image manipulation capabilities, streamlined workflow efficiency in dental practices, and significant patient safety improvements by minimizing ionizing radiation dose compared to older technologies. Furthermore, digital records facilitate easier sharing and integration with Electronic Health Records (EHRs), enhancing collaborative care.

Driving factors propelling market growth include the rising global incidence of dental and oral health issues, such as periodontitis and tooth decay, necessitating frequent diagnostic procedures. Concurrent technological advancements, notably the miniaturization of sensors, integration of artificial intelligence for automated detection, and increasing adoption of 3D imaging (CBCT) for precision dentistry, are further fueling demand. The growing awareness among patients and practitioners regarding the advantages of early and accurate diagnosis, coupled with rising disposable incomes in developing economies allowing for investment in advanced dental infrastructure, collectively contribute to the robust expansion of this vital healthcare segment.

Dental Radiography System Market Executive Summary

The Dental Radiography System Market is undergoing a rapid digital transformation, characterized by the accelerated adoption of Cone-Beam Computed Tomography (CBCT) and high-resolution intraoral sensors, positioning the market for substantial growth through 2033. Business trends indicate a strong move toward consolidation among major players, alongside increased emphasis on subscription-based software services that integrate imaging, diagnostic tools, and practice management. Manufacturers are focusing heavily on developing portable, low-dose radiation devices and integrating artificial intelligence (AI) for automated image analysis, improving diagnostic reliability and workflow efficiency in clinical settings. The competitive landscape is defined by continuous innovation in sensor technology and software integration, making interoperability a critical purchasing criterion for dental professionals.

Regionally, North America currently holds the largest market share, driven by high healthcare expenditure, established dental infrastructure, and quick adoption of premium technology, particularly CBCT units for specialized procedures like implantology. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) due to expanding dental tourism, increasing government investments in oral healthcare infrastructure, and a growing middle-class population demanding higher standards of dental care. Europe remains a significant market, primarily adopting digital systems due to stringent regulatory standards regarding radiation safety and the widespread availability of specialized dental clinics.

Segment trends highlight the dominance of the Digital Radiography segment (comprising both direct sensors and Phosphor Storage Plates (PSP)) over traditional analog systems. Among product types, CBCT systems are experiencing the fastest growth, driven by their necessity in complex surgical planning and endodontic treatments, offering volumetric data superior to 2D imaging. End-user analysis shows that private dental clinics and specialized practices are the dominant purchasers, investing in advanced systems to enhance their service offerings and patient outcomes. The focus remains on ergonomic design and software capabilities that seamlessly integrate diagnostic information into the entire treatment pathway, reinforcing the market’s trajectory toward high-precision digital solutions.

AI Impact Analysis on Dental Radiography System Market

User inquiries concerning the impact of AI on the Dental Radiography System Market frequently revolve around automation capabilities, diagnostic accuracy improvement, and data security concerns. Key themes analyzed from user questions include: "How accurately can AI detect early caries or subtle bone loss?"; "Will AI reduce the need for human interpretation?"; "What are the regulatory challenges associated with AI diagnostics?"; and "How does AI integration affect the cost of digital systems?" Users are primarily concerned with AI's ability to serve as a reliable second opinion, minimize diagnostic errors, and automate repetitive tasks like measurement and charting, thereby streamlining practice management. The expectation is that AI will transform image interpretation from a subjective process into an objective, standardized one, while simultaneously reducing the time spent on initial screenings and enhancing the identification of complex or asymptomatic conditions often missed by the human eye.

The implementation of AI algorithms, specifically deep learning and convolutional neural networks (CNNs), is revolutionizing the processing and interpretation of dental radiographs, both 2D and 3D. These algorithms are trained on vast datasets of annotated images to automatically detect, classify, and measure various pathologies, including periodontal disease progression, periapical lesions, dental caries, and morphological anomalies. This automated analysis significantly improves the consistency and speed of diagnosis, acting as an indispensable tool for dental practitioners by highlighting potential problem areas and standardizing reporting across multi-site practices. Furthermore, AI contributes substantially to radiation dose management by optimizing imaging parameters based on patient size and required diagnostic depth, ensuring the lowest possible exposure while maintaining high image quality.

However, the widespread adoption of AI necessitates overcoming challenges related to data privacy, regulatory approvals (particularly FDA and CE mark certification for software as a medical device), and ensuring the clinical validation of algorithms across diverse patient populations. Despite these challenges, the economic value proposition of AI—namely, increased operational efficiency, reduced chair time, and improved patient outcomes through earlier and more accurate detection—is driving significant investment from key market players. The future trajectory indicates that AI will transition from merely detecting conditions to assisting in complex treatment planning, predicting treatment success rates, and personalizing patient care pathways, fundamentally altering the role of the dental professional toward supervisory and procedural expertise rather than primary diagnostic interpretation.

- AI algorithms enable automated detection and classification of dental pathologies (caries, bone loss, lesions).

- Improved diagnostic consistency and reduced inter-observer variability in radiographic interpretation.

- Streamlining of workflow through automated measurements, annotation, and charting in imaging software.

- Optimization of radiation exposure parameters for patient safety.

- Enhanced treatment planning support, especially in implantology and orthodontics, using predictive analytics.

- Development of sophisticated decision support systems for general dentists and specialists.

- Potential reduction in human error during primary image screening.

DRO & Impact Forces Of Dental Radiography System Market

The dynamics of the Dental Radiography System Market are shaped by a strong interplay of drivers and opportunities that accelerate technological adoption, tempered by significant restraints primarily related to cost and regulatory complexity. Key drivers include the global increase in dental disease prevalence, particularly driven by aging populations retaining more natural teeth and lifestyle factors increasing cosmetic dentistry demand. The rapid shift towards digital imaging, offering instantaneous results, reduced chemical waste, and lower radiation doses (LDR), is a powerful market accelerator. Complementing this is the opportunity arising from emerging economies, where rapid urbanization and increasing access to advanced healthcare facilities create untapped potential for digital system adoption. These opportunities are further enhanced by the potential for integrating teledentistry, allowing remote diagnostic consultation based on digitally acquired images, expanding the reach of specialized care.

However, the market faces critical restraints that moderate its growth rate. The foremost restraint is the high initial capital investment required for advanced systems, particularly high-end Cone-Beam Computed Tomography (CBCT) units and sophisticated intraoral sensors, which can be prohibitive for small, independent dental practices. Furthermore, the steep learning curve associated with operating and interpreting 3D imaging data necessitates continuous staff training, adding to operational costs. Regulatory scrutiny surrounding medical devices, especially concerning radiation safety and software integration (SaaS models), presents ongoing compliance challenges for manufacturers and end-users. These regulatory hurdles can slow down the introduction of innovative products and increase research and development expenditures.

The impact forces within this ecosystem are substantial, driving market evolution toward non-invasive, high-precision diagnostics. Increasing patient awareness and demand for high-quality, low-radiation dental care act as a major push factor, compelling clinics to upgrade outdated analog equipment. Competitive intensity among key players necessitates continuous innovation in resolution, speed, and software usability, leading to rapid product cycles. The consolidation of dental service organizations (DSOs) and large group practices also exerts significant influence, as these entities command greater purchasing power and often opt for standardized, high-volume digital solutions across their network, accelerating the displacement of older technologies and influencing global procurement trends. The pervasive nature of digital data management and the need for seamless integration with Electronic Health Records (EHR) ensure that software capabilities now impact purchasing decisions as much as hardware specifications.

Segmentation Analysis

The Dental Radiography System Market is comprehensively segmented based on Technology, Product Type, Application, and End-User, reflecting the diverse diagnostic needs within the dental industry. The segmentation analysis reveals a clear transition toward technology-driven solutions, with digital systems dominating the market share due to their superior efficiency and diagnostic quality. Within product types, the market is characterized by a strong dichotomy between the high-volume, accessibility-focused intraoral devices and the high-value, specialized nature of CBCT systems. This granular segmentation allows market participants to tailor their strategic investments, focusing on high-growth areas such as CBCT and AI-enhanced digital sensors, while recognizing the enduring demand for reliable 2D imaging tools in routine check-ups. Analyzing these segments is critical for understanding procurement patterns across different clinical settings.

The Technology segment, encompassing Digital (direct sensors, PSP) and Analog (film-based), clearly illustrates the industry's digital maturity curve. Digital systems offer immediate image capture, integration into digital patient records, and the ability to enhance and manipulate images post-acquisition, making them the preferred choice globally. Product type segmentation identifies the specific diagnostic utility, ranging from simple intraoral imaging to complex 3D reconstruction necessary for maxillofacial surgery. The continuous evolution of sensor technology, focusing on smaller pixel sizes and increased dynamic range, is blurring the lines between high-end and standard digital offerings, placing competitive pressure on pricing models, especially for intraoral systems.

Application segmentation (Diagnostic, Therapeutic, Cosmetic) shows that diagnostic use remains the foundational and largest segment, underpinning all subsequent treatments. However, the therapeutic segment, particularly driven by implant placement and advanced endodontics utilizing CBCT, is showing accelerated growth. Finally, the End-User segment highlights the importance of Dental Clinics, which constitute the primary revenue generator due to the sheer volume of routine procedures performed, contrasting with Hospitals and Academic Institutes, which typically focus on high-complexity cases and research, requiring the most advanced imaging modalities available. Strategic marketing efforts must therefore be differentiated, targeting clinics with efficiency-boosting sensors and large institutions with high-capacity CBCT scanners.

- Technology

- Digital Radiography (Intraoral Sensors, Phosphor Storage Plates (PSP))

- Analog Radiography (Film-Based)

- Product Type

- Intraoral Systems (Sensors, PSP Scanners)

- Extraoral Systems (Panoramic, Cephalometric)

- Cone-Beam Computed Tomography (CBCT) Systems

- Application

- Diagnostic (Caries detection, Periodontal assessment)

- Therapeutic (Surgical planning, Root canal treatment)

- Cosmetic Dentistry

- End-User

- Dental Clinics & Specialized Practices

- Hospitals & Diagnostic Centers

- Academic & Research Institutes

Value Chain Analysis For Dental Radiography System Market

The value chain of the Dental Radiography System Market begins with the upstream activities centered on the development and supply of highly specialized components, primarily high-resolution image sensors (CCD/CMOS), X-ray tubes, advanced software algorithms (including AI modules), and raw materials such as proprietary plastics and metals for housing. Suppliers of these core technical components often operate in highly niche, oligopolistic markets, conferring significant bargaining power upstream. Manufacturers rely heavily on maintaining robust relationships with these suppliers to ensure the quality, consistency, and technological superiority of their final products. Research and Development (R&D) activities at this stage are crucial, focusing on miniaturization, dose reduction, and speed improvement, which directly influence the competitive advantage of the finished system.

Midstream activities involve the assembly, integration, and manufacturing of the final radiography units, ranging from compact intraoral devices to large CBCT machines. This stage includes stringent quality control checks, software integration (ensuring compatibility with practice management systems), and obtaining necessary regulatory clearances (e.g., FDA, CE). Distribution forms the crucial link between manufacturing and the end-user. Distribution channels are varied, including direct sales forces for large, high-value systems (like CBCT) sold directly to hospitals and large dental service organizations (DSOs), and indirect channels utilizing authorized distributors, dealers, and value-added resellers (VARs) for standard intraoral systems. VARs often provide essential services such as installation, technical support, and user training, adding value beyond the simple sale of the hardware.

Downstream analysis focuses on the end-users—dental clinics, specialized practices, and hospitals—which represent the final consumption point. The successful integration and utilization of the radiography system are paramount at this stage. Post-sales service, including maintenance contracts, software updates, and immediate technical support, becomes a key differentiator for manufacturers, influencing customer loyalty and repeat purchases. The movement towards cloud-based imaging solutions and subscription services (SaaS) is redefining the downstream segment, offering recurring revenue streams for manufacturers and reducing the initial total cost of ownership for end-users. The entire value chain is characterized by the imperative for seamless data flow and cybersecurity, given the sensitive nature of patient images and records.

Dental Radiography System Market Potential Customers

The primary and most frequent purchasers of dental radiography systems are independent and group-owned dental clinics and specialized private practices. These clinics represent the backbone of the market due to the high volume of routine diagnostic procedures, including standard check-ups, restorative dentistry, and minor surgical interventions, all of which necessitate reliable 2D digital imaging (intraoral sensors/PSP). Specialized practices, such as orthodontists, endodontists, and periodontists, constitute a high-value customer segment, as their procedural complexity mandates investment in advanced 3D imaging capabilities, particularly Cone-Beam Computed Tomography (CBCT) systems, to facilitate precision planning for implants and complex root canals. The decision-making process in this segment is driven by efficiency gains, diagnostic accuracy, and return on investment (ROI) derived from offering premium services.

A rapidly growing segment of potential customers includes Dental Service Organizations (DSOs), which operate multiple dental practices under a centralized administrative structure. DSOs are high-volume buyers, often seeking bulk purchases and standardized equipment across their network to achieve economies of scale and consistent quality standards. Their purchasing decisions are heavily influenced by centralized procurement teams focused on interoperability, system reliability, and long-term service contracts. Furthermore, public and private hospitals, particularly those with maxillofacial surgery or emergency departments, are crucial customers for advanced, high-throughput panoramic and CBCT systems, used for trauma assessment and complex reconstructive surgeries.

Academic and research institutes represent a smaller yet vital segment, primarily purchasing cutting-edge systems for training future dentists and conducting advanced research into new diagnostic methodologies and materials. These institutions require systems with high flexibility, advanced research features, and robust data extraction capabilities. Finally, government health agencies and community health centers in developing nations constitute an increasingly important customer base, often purchasing entry-level to mid-range digital systems as part of public health initiatives aimed at improving access to basic oral healthcare diagnostics. Their purchasing criteria often prioritize durability, ease of use, and cost-effectiveness tailored for deployment in rural or underserved areas.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Carestream Dental, Vatech, Planmeca Oy, Danaher Corporation (KaVo), FONA Dental, Acteon Group, Midmark Corporation, 3Shape, Envista Holdings Corporation, AS&E, Yoshida Dental Mfg. Co. Ltd., Air Techniques, J. Morita, Owandy Radiology, Trident S.p.A., Genoray Co. Ltd., LargeV Instrument Corp., Ray America Inc., Sirona Dental Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Radiography System Market Key Technology Landscape

The current technology landscape in the Dental Radiography System Market is dominated by advanced digital sensor technologies, primarily Complementary Metal-Oxide-Semiconductor (CMOS) and Charge-Coupled Device (CCD) sensors, which offer significantly higher resolution, faster image capture, and greater resilience compared to older digital technologies. These sensors are integrated into both intraoral devices and extraoral panoramic systems. The crucial focus area for technological advancement is minimizing the effective radiation dose while maintaining diagnostic image quality, leading to the development of low-dose protocols, particularly critical for Cone-Beam Computed Tomography (CBCT). Manufacturers are continually refining focal spot size and exposure geometry to enhance image clarity, thereby improving the ability to detect subtle details like hairline fractures and early-stage periodontal bone loss.

The most transformative technology in this market segment is the evolution of CBCT imaging. Modern CBCT systems feature iterative reconstruction algorithms that significantly reduce noise and artifacts, allowing for clearer visualization of complex anatomical structures in three dimensions. Crucially, these systems are increasingly bundled with sophisticated planning software for implantology, orthodontics, and guided surgery. This software often includes tools for nerve tracing, simulated implant placement, and integration with intraoral scanning data (digital impressions), creating a complete digital workflow from diagnosis to treatment execution. The capability to merge 3D radiological data with optical surface scans is essential for high-precision treatment modalities, solidifying CBCT's position as a key growth catalyst.

Furthermore, artificial intelligence (AI) and machine learning are rapidly becoming foundational components of the technology stack, moving beyond image acquisition into image analysis. AI algorithms are embedded directly into the viewing software to automate detection tasks, such as highlighting suspected carious lesions, measuring bone density, and generating automated cephalometric analyses. Cloud computing and platform integration are also vital technological trends, enabling secure, accessible storage of large imaging files and facilitating seamless data transfer between different dental software systems (Practice Management Software, CAD/CAM systems). The future technological trajectory is focused on fully autonomous diagnostic systems that rely on AI-driven interpretation of ultra-low-dose 3D images, enhancing accessibility and efficiency across all scales of dental practice.

Regional Highlights

The market dynamics for dental radiography systems vary significantly across geographical regions, influenced by economic maturity, healthcare spending patterns, regulatory frameworks, and oral health awareness.

- North America: This region maintains market leadership due to high levels of healthcare expenditure, sophisticated digital infrastructure, and the high adoption rate of advanced, high-value systems like CBCT. The presence of major market players and a robust framework for dental insurance coverage encourage continuous technological upgrades in private clinics and large Dental Service Organizations (DSOs). The U.S. and Canada are early adopters of AI-integrated diagnostic software.

- Europe: Characterized by stringent radiation safety regulations, which have accelerated the shift from analog to low-dose digital systems. Western European countries, particularly Germany, the UK, and France, exhibit strong demand, driven by specialized dental tourism and publicly funded healthcare systems that prioritize high standards of care. Eastern Europe presents growing opportunities as infrastructure modernization progresses.

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by rising disposable incomes, expanding dental tourism, and increasing government investment in primary oral healthcare infrastructure (especially in China, India, and South Korea). While cost-sensitivity remains in certain segments, the rapid establishment of new private dental clinics and the high prevalence of oral diseases ensure robust demand for both mid-range digital panoramic systems and high-end CBCT units for implantology.

- Latin America: This region is marked by moderate growth, driven primarily by the professionalization of dental practices and growing awareness regarding advanced diagnostics. Key markets like Brazil and Mexico are witnessing increased investments in digital systems, often utilizing Phosphor Storage Plates (PSP) as a cost-effective intermediate step before full sensor adoption. Economic stability and regulatory environments impact procurement decisions significantly.

- Middle East and Africa (MEA): Growth is primarily concentrated in the GCC countries (UAE, Saudi Arabia) due to high per capita income and significant government investment in high-quality healthcare facilities, leading to the adoption of premium CBCT technology. The African segment remains nascent, with demand focused on basic, durable, and easily maintainable digital systems in urban centers, often supported by international health aid programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Radiography System Market.- Dentsply Sirona

- Carestream Dental

- Vatech

- Planmeca Oy

- Danaher Corporation (KaVo)

- FONA Dental

- Acteon Group

- Midmark Corporation

- 3Shape

- Envista Holdings Corporation

- AS&E

- Yoshida Dental Mfg. Co. Ltd.

- Air Techniques

- J. Morita

- Owandy Radiology

- Trident S.p.A.

- Genoray Co. Ltd.

- LargeV Instrument Corp.

- Ray America Inc.

- Sirona Dental Systems

Frequently Asked Questions

Analyze common user questions about the Dental Radiography System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Dental Radiography System Market?

The Dental Radiography System Market is projected to exhibit a CAGR of 8.5% between the forecast years of 2026 and 2033, driven primarily by digital technology adoption and the increasing demand for 3D imaging (CBCT).

Which product segment is showing the fastest growth trajectory?

Cone-Beam Computed Tomography (CBCT) systems are demonstrating the fastest growth. This acceleration is due to their indispensable role in advanced surgical planning, implant placement, and complex endodontic procedures, offering superior volumetric data compared to traditional 2D systems.

How is Artificial Intelligence (AI) influencing dental radiography diagnostics?

AI is significantly influencing the market by automating image analysis, improving the detection accuracy of subtle pathologies like early caries and periodontal bone loss, standardizing diagnostic reporting, and optimizing radiation dose management, enhancing both efficiency and patient safety.

What are the primary factors restraining market growth?

The main restraints on market growth are the high initial investment cost associated with advanced digital systems, particularly high-resolution CBCT units, and the complexity of regulatory compliance regarding radiation safety and medical software certifications.

Which region currently dominates the Dental Radiography System Market?

North America currently holds the largest market share, attributed to high per capita healthcare spending, advanced infrastructure, the concentration of key market players, and the rapid adoption of sophisticated digital and AI-integrated imaging solutions in dental practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager