Dental Scalers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438731 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Dental Scalers Market Size

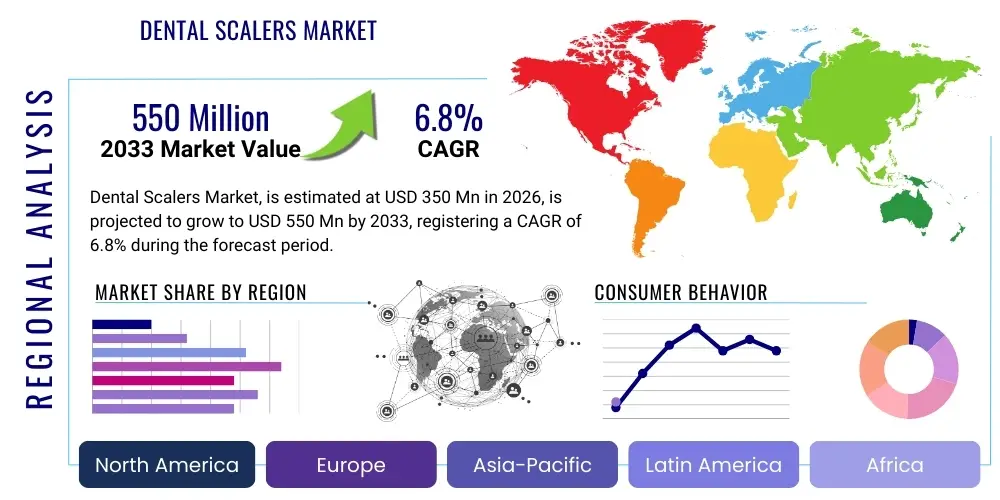

The Dental Scalers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 550 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing global prevalence of periodontal diseases, heightened awareness regarding oral hygiene practices, and the continuous technological advancements in scaling and root planing instruments. Market penetration is also accelerating due to favorable reimbursement policies and the expansion of dental care infrastructure in emerging economies.

The transition from traditional manual scalers to advanced ultrasonic and piezoelectric technologies represents a significant shift driving value growth. These modern devices offer superior efficiency, reduced chair time, and improved patient comfort during dental prophylaxis and deep cleaning procedures. Furthermore, the rising adoption of specialized scalers, such as those integrated with laser technology, contributes to higher average selling prices and drives overall market valuation upward.

Dental Scalers Market introduction

The Dental Scalers Market encompasses a wide range of specialized instruments designed for the professional removal of plaque, calculus (tartar), and biofilms from tooth surfaces, both above and below the gum line, crucial procedures for preventing and treating periodontal disease. Products include manual (hand) scalers, ultrasonic scalers (magnetostrictive and piezoelectric), sonic scalers, and specialized devices used in advanced periodontology. Major applications span general dental prophylaxis, periodontal maintenance, root planning, and endodontic procedures, serving dental clinics, hospitals, and specialized periodontic centers worldwide. Key driving factors accelerating market growth include the rising global incidence of chronic periodontitis, an aging global population requiring intensive dental care, the emphasis on minimally invasive dental treatments, and sustained innovation in ergonomics and material science leading to enhanced clinical outcomes and operator comfort. The instruments offer significant benefits, including effective disease management, reduced risk of secondary systemic infections linked to oral health, and maintenance of overall oral hygiene.

Dental Scalers Market Executive Summary

The Dental Scalers Market is poised for robust growth driven by favorable business trends centered on technological innovation and expanding geographical reach. Segment trends show a decisive shift toward powered scaling devices, particularly ultrasonic scalers, due to their efficiency and versatility, although manual scalers maintain a strong presence in regions with cost constraints. The market is highly competitive, characterized by frequent product launches featuring enhanced ergonomics, bio-compatible tip coatings, and integrated irrigation systems designed to improve patient safety and clinical efficacy. Strategic mergers and acquisitions among established industry leaders are also shaping the competitive landscape, aiming to consolidate market share and leverage distribution networks across diverse territories.

Regional trends indicate North America and Europe currently dominate the market due to established dental infrastructure, high public awareness of oral health, and high consumer spending capacity on preventative care. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, primarily fueled by rapid economic development, increasing penetration of corporate dental chains, and significant government initiatives promoting dental healthcare access. Business expansion is also being driven by increased expenditure on dental tourism and the rising number of trained dental professionals entering the workforce in emerging markets like India and China.

AI Impact Analysis on Dental Scalers Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Dental Scalers Market often revolve around whether AI will automate the scaling procedure entirely, how AI can improve diagnostic accuracy before scaling, and the role of machine learning in optimizing scaler usage or designing ergonomic instruments. Users are particularly concerned about the integration of AI-powered diagnostic tools, such as those analyzing radiographs or intraoral scans, to precisely map out calculus deposits and inform the dental professional on the required scaling intensity and location. Expectations are high that AI will enhance procedural standardization, reduce human error, and potentially lead to the development of 'smart' scalers that provide real-time feedback on pressure, angle, and coverage during treatment, thereby improving clinical efficiency and patient outcomes without fully replacing the skilled practitioner.

- AI-enhanced diagnostic tools improve the accurate detection and mapping of subgingival calculus severity prior to scaling.

- Machine learning algorithms assist in optimizing the design and ergonomics of scaler handles and tips, reducing operator fatigue.

- Potential for AI-guided robotic systems to assist in standardized, repetitive scaling motions, increasing procedural predictability.

- Integration of real-time feedback mechanisms in ultrasonic units, powered by AI, to ensure optimal frequency and power settings for specific dental conditions.

- AI platforms analyze large clinical datasets to predict the required maintenance scaling frequency for individual patients, improving preventative care planning.

DRO & Impact Forces Of Dental Scalers Market

The Dental Scalers Market growth is primarily driven by the escalating global burden of periodontal diseases and the growing geriatric population, which requires consistent and specialized oral prophylaxis. Restraints include the high initial cost and maintenance associated with advanced ultrasonic scaling units, especially in low-income settings, alongside the risks associated with aerosol generation during powered scaling procedures, amplified post-COVID-19. Opportunities arise from the untapped potential in developing nations where access to standardized dental care is low, coupled with the rapid evolution of specialized scaler tips designed for implant maintenance and minimally invasive procedures. The key impact forces include intense competitive pricing, stringent regulatory approval processes for new devices, and technological substitution, particularly the rise of laser dentistry as an alternative scaling method.

Drivers

The primary driver for the expansion of the Dental Scalers Market is the globally increasing prevalence of gingivitis and chronic periodontitis, conditions that necessitate professional intervention using scaling instruments. According to global health estimates, a significant percentage of the adult population suffers from some form of periodontal disease, driving continuous demand for effective prevention and treatment tools. Furthermore, heightened public awareness campaigns, often government-backed, emphasizing the link between oral health and systemic diseases (such as cardiovascular conditions and diabetes), encourage regular professional dental cleaning, thereby stimulating equipment purchasing by dental practitioners globally.

Technological refinement in power scalers also acts as a critical driver. Modern ultrasonic scalers are equipped with features like automated water irrigation systems, adjustable power settings, and LED lighting, significantly enhancing procedural precision and reducing patient discomfort compared to older manual methods. The shift towards preventive dentistry models, focusing on early intervention and regular maintenance rather than purely restorative measures, ensures a sustained baseline demand for these essential instruments. These advancements not only improve clinical outcomes but also contribute to reduced operator strain, making advanced equipment a compelling investment for dental practices.

The third major driver is demographic change, specifically the aging global population. Older individuals often retain their natural teeth longer but face increased risk factors for periodontal disease and root caries, necessitating more frequent and complex scaling and root planing procedures. This demographic shift, particularly prominent in North America, Europe, and parts of Asia, guarantees a stable long-term patient base requiring services reliant on high-quality dental scalers. The expansion of dental insurance coverage and increased disposable income in developing regions further facilitate the adoption of sophisticated scaling technologies.

- Escalating global prevalence of periodontal diseases.

- Technological advancements in ultrasonic and piezoelectric scaling units.

- Increasing public awareness regarding oral hygiene and preventative care.

- Growing geriatric population requiring specialized dental maintenance.

- Expansion of dental facilities and healthcare infrastructure in emerging economies.

Restraints

A significant restraint hindering the rapid adoption of advanced dental scalers is the relatively high cost associated with sophisticated ultrasonic scaling units, including the initial capital investment and the recurring expenses for specialized tips and maintenance. This cost barrier is particularly pronounced for independent or smaller dental clinics in budget-sensitive markets, leading to the continued reliance on more affordable, though less efficient, manual scalers. Furthermore, the specialized training required for optimal operation of certain advanced scaling technologies, such as those used for implant maintenance, can also limit immediate market uptake by general practitioners.

Another major restraint, brought into sharp focus by the recent global pandemic, is the risk associated with aerosol generation during the use of powered scalers. Ultrasonic scaling procedures generate a significant bioaerosol plume, posing infection risks for both the dental professional and the patient. While mitigation strategies, such as high-volume evacuation systems and specialized scaler settings, are available, the inherent risk necessitates stringent infection control protocols, potentially increasing procedural complexity and chair time, which can deter some practices from maximizing their use of powered instruments. Regulatory hurdles regarding the safety and efficacy of novel scaling materials and technologies also contribute to delayed market entry.

The perception of procedural pain or discomfort associated with deep scaling and root planing remains a psychological restraint for patients, often leading to avoidance of necessary treatments. While modern scalers are designed to minimize discomfort, patient apprehension can indirectly limit the volume of scaling procedures performed. Additionally, the increasing popularity and accessibility of alternative treatments, such as certain dental lasers for calculus removal, pose a competitive restraint by offering potential substitution for traditional mechanical scaling methods in select applications.

- High initial capital cost and maintenance of advanced ultrasonic scaling equipment.

- Risks and concerns associated with bioaerosol generation during powered scaling procedures.

- Shortage of highly specialized training required for advanced scaling techniques (e.g., implant care).

- Patient anxiety and perceived discomfort associated with deep scaling treatments.

- Strict regulatory landscape governing dental device safety and efficacy.

Opportunities

Significant market opportunities exist in the expansion into untapped emerging economies, particularly in Asia Pacific and Latin America, where rapid urbanization, increasing disposable incomes, and the modernization of healthcare systems are creating massive potential demand for advanced dental equipment. As these regions shift from reactive to proactive dental care models, the adoption rate of modern ultrasonic scalers in both public health clinics and private practices is expected to surge. Manufacturers can leverage strategic partnerships and localized distribution networks to penetrate these rapidly growing markets effectively.

The development of specialized scaling instruments tailored for niche applications, such as the maintenance of complex dental implants and clear aligner therapies, represents a lucrative product differentiation opportunity. Implant scaling requires instruments that are gentle yet effective, often featuring non-metal or plastic tips to prevent scratching the titanium surface. Investing in R&D to produce innovative materials and ergonomic designs specifically for these high-value procedures allows companies to capture premium segments of the market. Furthermore, the integration of smart features, such as Bluetooth connectivity for data logging and personalized patient records, opens avenues for higher-value product offerings.

Another compelling opportunity lies in focusing on sustainable and infection-control-focused product development. The market is increasingly seeking disposable tips or reusable tips made from highly durable, sterilization-resistant materials that enhance procedural safety and reduce cross-contamination risk. Companies that can effectively marry eco-friendly production with superior infection control standards will gain a competitive advantage, meeting the rising demands of environmentally conscious and health-aware dental professionals globally.

- Market penetration and expansion into high-growth emerging economies (APAC, LATAM).

- Development of specialized scalers for dental implant maintenance and orthognathic care.

- Integration of advanced diagnostics and AI technology into scaling units for improved precision.

- Focus on minimally invasive technologies, including laser-assisted scaling adjuncts.

- Growth in the dental tourism sector driving demand for high-standard equipment.

Impact Forces

The competitive rivalry within the Dental Scalers Market is intense, driven by the presence of several established global players and numerous regional manufacturers, leading to price wars and rapid product cycle churn. Companies continuously strive to differentiate through improved ergonomics, proprietary tip designs (e.g., Slimline, Universal), and integrated technology features, which act as a powerful force compelling constant innovation. This high degree of competition ensures that manufacturers must maintain operational efficiencies and strong distribution channels to retain market share, particularly in the saturated North American and European markets.

The threat of substitutes, primarily posed by advanced dental laser systems (e.g., Nd:YAG and Er:YAG lasers) capable of removing calculus and sterilizing the periodontal pocket, remains a moderate but growing impact force. While lasers have high initial costs, their perceived advantages in pain reduction and patient compliance could shift demand in high-end cosmetic or specialized practices. Furthermore, the bargaining power of buyers, represented primarily by large dental service organizations (DSOs) and group purchasing organizations (GPOs), is substantial. These large entities leverage volume purchasing to negotiate lower prices, placing continuous pressure on manufacturer margins and necessitating flexible pricing strategies.

Regulatory impact is significant, particularly in markets like the U.S. (FDA) and EU (MDR), where stringent safety and performance standards dictate design specifications and lengthy approval processes. Compliance requires significant investment in clinical testing and documentation, acting as a barrier to entry for smaller firms and slowing the introduction of radically new technologies. Finally, the rapid pace of technological change necessitates constant reinvestment in R&D to ensure existing product lines remain competitive against new, often more efficient or patient-friendly, models introduced by rivals.

- Intense competitive rivalry driven by ergonomic and feature-based product differentiation.

- Significant bargaining power exerted by large dental service organizations (DSOs) and group purchasing organizations (GPOs).

- Moderate, increasing threat of substitution from dental laser technology for calculus removal.

- Stringent and evolving regulatory requirements (FDA, MDR) impacting time-to-market.

- High dependence on intellectual property (IP) protection for proprietary tip designs.

Segmentation Analysis

The Dental Scalers Market is comprehensively segmented based on product type (Manual vs. Powered), technology (Ultrasonic, Sonic, Piezoelectric, Magnetostrictive), application (Periodontal, Restorative, Implant Care), and end-user (Dental Clinics, Hospitals). Understanding these segments is crucial as technological preferences dictate purchasing patterns and market values. The Powered Scalers segment, dominated by ultrasonic devices, holds the largest market share due to superior efficiency and reduced procedural time, but the Manual Scalers segment remains essential for intricate subgingival work and in resource-limited settings. Application segmentation highlights the growing demand for specialized tips designed for advanced implant maintenance, reflecting a high-growth niche within the professional dental care market.

- By Product Type: Manual Scalers, Powered Scalers.

- By Technology: Ultrasonic (Piezoelectric, Magnetostrictive), Sonic, Others.

- By Application: Periodontal Procedures, General Prophylaxis, Restorative Dentistry, Implant Maintenance.

- By End-User: Dental Clinics and Offices, Hospitals, Academic and Research Institutes.

Product Type Analysis

The market is bifurcated into Manual Scalers and Powered Scalers, each catering to distinct procedural needs and operator preferences. Manual scalers, including Sickle Scalers, Curettes (universal and specialized), and Chisels, represent the foundational segment. They are valued for their tactile sensitivity, precision in root planing, and low acquisition cost, requiring no external power source. While procedural time is longer, they are indispensable for fine-tuning root surfaces and are often preferred by periodontists for specific deep pocket debridement. The stability and predictability of manual instruments ensure they retain a substantial market share, particularly in markets where durability and low maintenance are prioritized.

Powered scalers, encompassing ultrasonic and sonic devices, form the largest and fastest-growing segment. Ultrasonic scalers, operating at frequencies typically between 25 kHz and 40 kHz, utilize rapid vibrations to shatter calculus deposits and generate cavitation effects that aid in irrigation and debris removal. Their primary advantages include speed, reduced effort required by the clinician, and suitability for bulk deposit removal. The adoption of powered scalers is directly linked to the increasing volume of prophylactic and periodontal procedures performed globally, as they significantly improve practice efficiency and patient turnover, making them a standard investment for modern, high-throughput dental practices.

Technology Analysis

Within the powered segment, ultrasonic technology is dominant, further subdivided into Piezoelectric and Magnetostrictive units. Piezoelectric scalers utilize ceramic crystals to generate linear vibrations, offering highly controllable movement and often requiring less water cooling, which appeals to clinicians seeking precision and patient comfort. These devices are generally considered highly efficient and versatile, capable of addressing both supragingival and subgingival calculus with appropriate tips. Manufacturers continually refine piezoelectric units by integrating features like auto-tuning and LED illumination to enhance their clinical performance.

Magnetostrictive scalers rely on a stack of metal rods (or a ferrite rod) that vibrate in a magnetic field, creating an elliptical motion pattern. They are known for their robust power output and are often preferred for heavy calculus removal. Although they typically require more coolant water than piezoelectric units, the broad distribution of vibrational energy can offer advantages in certain clinical situations. Sonic scalers, which operate at lower frequencies (2 kHz to 6 kHz) and connect directly to a dental unit’s air line, constitute a smaller but significant segment, valued for their lower cost and reduced aerosol generation compared to high-frequency ultrasonic counterparts.

Application Analysis

The application spectrum of dental scalers is broad, ranging from routine General Prophylaxis to highly specialized Implant Maintenance. General prophylaxis, encompassing the routine removal of plaque and calculus during check-ups, accounts for the largest volume segment, as it is a standard preventive procedure required by nearly all dental patients. This segment drives the demand for universal scaler tips and standard ultrasonic units, focusing on efficiency and ease of use in daily practice. Growth here is tied directly to the frequency of dental visits globally.

Periodontal Procedures, involving deep scaling and root planing (SRP) for treating advanced periodontitis, represent a high-value application segment. These procedures require specialized, thin-profile scaler tips (e.g., periodontal curettes and slim ultrasonic inserts) designed to access deep pockets and delicate root surfaces without causing trauma. The escalating prevalence of chronic periodontitis globally ensures steady growth in this segment. Furthermore, Implant Maintenance is emerging as one of the fastest-growing niche applications. As dental implant adoption rises, the need for specialized plastic, titanium, or carbon-fiber scalers that can effectively clean implant abutments without damaging the surface material becomes critical, driving high-demand for specific premium product lines.

End-User Analysis

Dental Clinics and Offices constitute the primary end-user segment, holding the overwhelming majority of the market share. This includes independent general practices, specialized periodontal clinics, and large Dental Service Organizations (DSOs). DSOs, in particular, are volume purchasers, driving standardized equipment adoption and negotiating competitive pricing for scaler units and consumables. The high volume of patient visits and prophylactic procedures conducted in these settings ensures continuous demand for both manual and powered scaling instruments, along with frequent replacement of tips.

Hospitals, particularly those with comprehensive dental or maxillo-facial surgery departments, represent the second largest end-user segment. While hospitals may perform fewer routine prophylactic cleanings than private clinics, they often utilize advanced scaling equipment for complex surgical periodontal cases or procedures requiring general anesthesia. Academic and Research Institutes form a smaller but vital segment, driving demand for the latest, most sophisticated units used for clinical training and materials testing. These institutions often purchase cutting-edge models to ensure students are trained on the latest technology and techniques available in the market.

Value Chain Analysis For Dental Scalers Market

The value chain for the Dental Scalers Market initiates with upstream activities involving the sourcing of specialized raw materials, primarily medical-grade stainless steel, titanium, plastic polymers, and piezoelectric ceramics. Key processes at this stage include precision forging, CNC machining, and advanced tip coating technologies (e.g., diamond or nitride coatings) which are critical for instrument durability and efficacy. Midstream activities are dominated by manufacturing, assembly of powered units (including electronics and fluid systems), stringent quality control, sterilization, and packaging. Direct and indirect distribution channels define the downstream segment. Direct sales are often utilized by major manufacturers targeting large DSOs or governmental tenders, allowing for greater control over pricing and customer relationship management. Indirect sales, relying on extensive networks of dental supply distributors and dealers, are crucial for reaching independent dental clinics globally, especially in fragmented international markets. Downstream analysis emphasizes post-sales support, including equipment maintenance, tip replacement sales (which represent a significant recurring revenue stream), and specialized technical training for clinical staff on advanced unit operation, ensuring prolonged product lifecycle and customer loyalty.

Dental Scalers Market Potential Customers

The primary consumers and end-users of dental scalers are dental professionals operating within various clinical and institutional settings. This includes General Dentists (GPs), who perform routine prophylactic cleanings, and Dental Hygienists, who utilize both manual and powered scalers extensively for preventative and maintenance care. Periodontists form a critical segment, demanding high-precision curettes and specialized thin ultrasonic tips for non-surgical periodontal therapy and complex root planing procedures. Beyond specialized clinicians, institutional buyers such as large Dental Service Organizations (DSOs) purchase equipment in bulk, seeking standardized, durable, and cost-effective solutions for their multiple clinic locations. Furthermore, government-operated public health dental clinics and military dental units are significant buyers, focusing on reliable, high-volume equipment capable of serving large populations with standardized care protocols. Academic dental schools represent another key buyer group, requiring high-quality instrumentation for student training and clinical research purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 550 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Hu-Friedy Group (Crosstex International), EMS Electro Medical Systems, KaVo Dental (Envista Holdings), NSK Ltd., A-dec Inc., Bien-Air International, Acteon Group, Satelec, ZAP Lasers, W&H Dentalwerk, Ultradent Products, Coltene Holding AG, FKG Dentaire, Mectron S.p.A., Woodpecker Medical Instrument Co., Flight Dental Systems, Parkell Inc., Osada Electric Co., Den-Mat Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Scalers Market Key Technology Landscape

The technology landscape of the Dental Scalers Market is defined by the ongoing evolution of powered scaling systems, focusing heavily on integrating digital controls, improved material science, and enhanced infection control features. Ultrasonic technology, particularly the shift towards advanced piezoelectric units with linear tip motion, dominates the landscape, offering predictable power output and enhanced patient comfort compared to older magnetostrictive models. Key innovations include auto-tuning frequency systems that maintain optimal scaling efficiency regardless of the tip load, and integrated LED illumination within the handpiece to improve visibility in the periodontal pocket. Furthermore, manufacturers are focusing on creating non-metallic tips, often using specialized plastic or carbon fiber, crucial for safe and non-abrasive maintenance of sophisticated dental implants, reflecting the market’s response to the rise of implant dentistry. The convergence of hardware and software, including units capable of logging procedure parameters, is setting the stage for future data-driven dental hygiene protocols.

Regional Highlights

The global Dental Scalers Market exhibits distinct regional consumption and growth patterns influenced by healthcare expenditure, prevalence of oral diseases, and technological adoption rates.

- North America: This region maintains the largest market share, driven by high per capita healthcare spending, an established network of specialized dental clinics, and high patient awareness leading to frequent prophylactic visits. The adoption of premium, advanced ultrasonic scaling units (both piezoelectric and magnetostrictive) is robust, supported by favorable reimbursement scenarios and the widespread presence of large Dental Service Organizations (DSOs) which standardize equipment procurement. The U.S. remains the core consumer, characterized by early adoption of sophisticated dental technologies and stringent standards for periodontal care, necessitating the use of high-quality, precision instruments.

- Europe: Europe represents the second-largest market, characterized by strong governmental support for public dental health programs and a focus on preventive care, particularly in Western European countries (Germany, UK, France). The market is mature, with a high replacement rate for existing scaling units and a strong preference for ergonomic, energy-efficient piezoelectric systems. The stringent European Union Medical Device Regulation (MDR) drives manufacturers to ensure high product quality and safety, favoring established international players with certified product lines.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market due to dramatic increases in dental healthcare infrastructure investment, rising middle-class disposable incomes, and the modernization of dental practice in countries like China, India, and South Korea. While manual scalers and lower-cost sonic units currently hold significant share, the market is rapidly transitioning toward affordable, mass-produced ultrasonic units. Government initiatives to improve oral health access in rural areas and the burgeoning dental tourism sector further stimulate demand for a wide range of scaler products.

- Latin America (LATAM): This region is marked by moderate growth, driven primarily by the private dental sector in major economies such as Brazil and Mexico. The market is highly price-sensitive, balancing the need for reliable equipment with budget constraints, leading to strong demand for value-priced conventional and powered scalers.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, supported by high healthcare spending and expatriate populations demanding high-standard care. However, the market remains heterogeneous, with significant variations in technology adoption and affordability across the African sub-region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Scalers Market.- Dentsply Sirona

- Hu-Friedy Group (Crosstex International)

- EMS Electro Medical Systems

- KaVo Dental (Envista Holdings)

- NSK Ltd.

- A-dec Inc.

- Bien-Air International

- Acteon Group

- Satelec

- ZAP Lasers

- W&H Dentalwerk

- Ultradent Products

- Coltene Holding AG

- FKG Dentaire

- Mectron S.p.A.

- Woodpecker Medical Instrument Co.

- Flight Dental Systems

- Parkell Inc.

- Osada Electric Co.

- Den-Mat Holdings

Frequently Asked Questions

Analyze common user questions about the Dental Scalers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between piezoelectric and magnetostrictive ultrasonic scalers?

Piezoelectric scalers use ceramic crystals to create highly controlled, linear tip movements, typically generating less heat and requiring less water, focusing on precision. Magnetostrictive scalers use metal stacks vibrating in a magnetic field, resulting in an elliptical movement and often providing higher power, suitable for heavy calculus removal.

How does the increasing adoption of dental implants affect the demand for dental scalers?

The rise in dental implant procedures significantly drives demand for specialized, non-metallic (e.g., plastic or carbon-fiber) scaler tips. These materials are essential for maintenance cleaning to prevent peri-implantitis without scratching the delicate titanium or zirconium implant surfaces.

What are the primary factors restraining the growth of the powered dental scalers market?

Key restraints include the high initial capital investment required for advanced ultrasonic units, the recurring cost of specialized tips, and significant concerns regarding the generation of infectious bioaerosols during high-frequency scaling procedures, necessitating costly infection control measures.

Which region is expected to experience the fastest growth rate in the Dental Scalers Market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) due to expanding dental healthcare infrastructure, increasing disposable incomes, and greater emphasis on preventative oral health care across key countries like China and India.

Are manual scalers being phased out by advanced powered instruments?

No, manual scalers are not being phased out. While powered instruments are preferred for bulk calculus removal, manual scalers, particularly specialized curettes, remain indispensable for fine root planing, achieving tactile sensitivity, and accessing deeply localized subgingival areas where powered instruments may cause unnecessary trauma.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager