Dental Silica and Paper Mass Silica Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437675 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Dental Silica and Paper Mass Silica Market Size

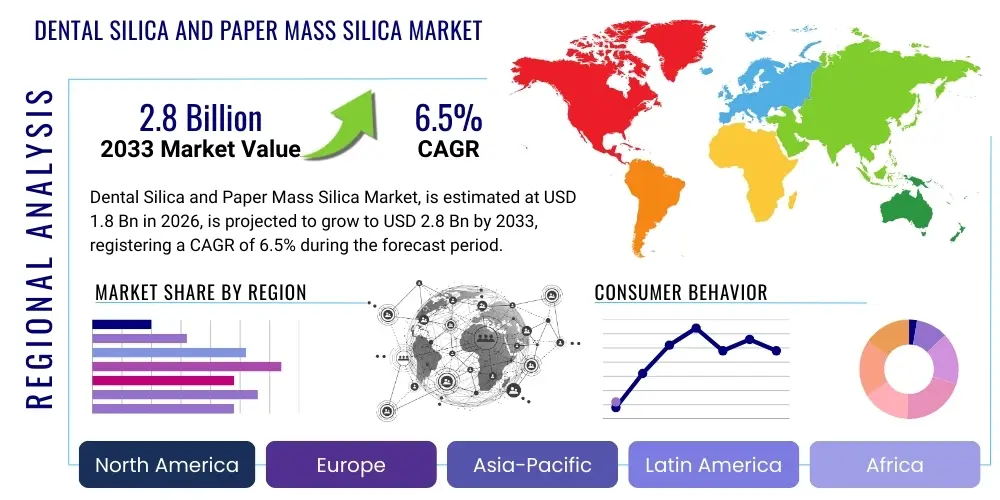

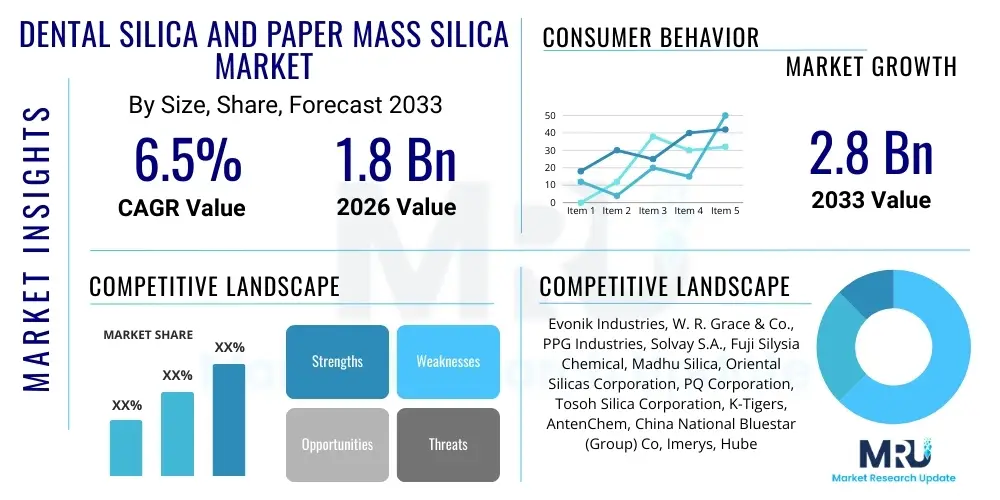

The Dental Silica and Paper Mass Silica Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

The valuation surge in the dental and paper mass silica sector is primarily attributed to the expanding global oral hygiene consciousness, particularly in emerging economies where disposable incomes are rising, leading to increased demand for high-performance toothpaste and specialized dental care products. Dental silica, essential for its abrasive, cleaning, and thickening properties in oral care formulations, benefits directly from consumer preference shifts toward premium, aesthetically enhanced toothpastes, including those focused on whitening and sensitivity relief. Simultaneously, the persistent demand for paper mass silica, largely utilized in the manufacturing of specialty papers, such as high-definition printing and inkjet papers, supports the overall market growth trajectory, acting as a crucial functional filler to improve brightness, print quality, and mechanical strength.

Future market expansion is heavily reliant on technological advancements in precipitated silica manufacturing, aiming to achieve highly tailored particle size distributions and surface modifications. These innovations enable the creation of high-abrasion silica suitable for specialized polishing applications, alongside high-structure silica required for efficient thickening in complex gel formulations. Furthermore, the paper industry's pivot towards sustainable manufacturing processes and the need for lightweight yet high-opacity papers continue to drive demand for highly efficient synthetic silica grades. This sustained innovation, coupled with stringent quality control standards in both the healthcare and materials sectors, solidifies the market's robust long-term financial outlook, making it a critical segment within the broader specialty chemicals industry.

Dental Silica and Paper Mass Silica Market introduction

The Dental Silica and Paper Mass Silica Market encompasses the global trade and utilization of synthetic amorphous silicon dioxide, specifically tailored for application in oral care products (dental silica) and paper manufacturing processes (paper mass silica). Dental silica serves indispensable roles in toothpaste formulation, acting predominantly as a mild abrasive to remove plaque, a thickening agent to maintain product consistency, and a clarifier for aesthetically pleasing gel toothpastes. Its functionality is precise, requiring careful control over particle size, surface area, and oil absorption capacity to ensure effective cleaning without causing enamel damage, thus positioning it as a core functional ingredient driving the modern oral care industry.

Conversely, paper mass silica, predominantly high-purity precipitated silica, is integrated into the paper pulp during manufacturing as a functional filler or coating pigment. In paper applications, it significantly enhances key characteristics such as brightness, opacity, printability, and ink reception, particularly crucial for high-end digital printing and specialized packaging materials. The synergy between the growing premiumization trends in oral care (demanding advanced silica grades) and the sustained industrial need for high-quality functional fillers in paper manufacturing provides a stable and diversified demand base for the overall market. Major applications include abrasive toothpaste, transparent gels, paper mass filling, and specialized paper coatings.

The primary benefits driving market expansion include the superior performance characteristics of synthetic silica over natural alternatives, such as customizable morphology and high chemical purity. Key driving factors involve increasing global standards of oral hygiene, significant investment in R&D focusing on low-abrasion high-cleaning formulations, the continued growth of the global packaging and printing sectors, and the adoption of advanced manufacturing technologies that yield high-performance silica tailored for specific end-use requirements. Regulatory mandates related to consumer safety and the pursuit of eco-friendly and sustainable manufacturing processes further influence product development and market penetration strategies across different geographical regions.

Dental Silica and Paper Mass Silica Market Executive Summary

The Dental Silica and Paper Mass Silica Market is witnessing robust expansion, driven primarily by favorable business trends centered around consumer health awareness and materials science innovation. Business trends indicate a strong move towards specialized silica grades, particularly high-performance dental silicas that offer enhanced whitening capabilities or specialized properties for sensitive teeth formulations, demanding higher margins for manufacturers capable of precise particle engineering. Supply chain optimization remains a critical focus, especially following recent global logistical challenges, emphasizing localized production and secure sourcing of raw materials to maintain competitive pricing and consistent product availability across major consumption hubs in Asia Pacific and North America.

Regionally, the Asia Pacific (APAC) market dominates in terms of consumption volume, fueled by rapid urbanization, increasing per capita spending on hygiene products in countries like China and India, and the expansive growth of the domestic paper and packaging industries. North America and Europe, while exhibiting slower volume growth, maintain dominance in terms of value, driven by high adoption rates of premium dental products and stringent regulatory requirements that favor high-quality, certified silica grades. Emerging markets in Latin America and the Middle East and Africa (MEA) are projected to show accelerated CAGR due to infrastructural development in consumer goods manufacturing and rising penetration of modern dental care products, presenting significant untapped opportunities for key market players.

Segmentation trends highlight the increasing prominence of high-performance precipitated silica, which caters to both the abrasive/thickening needs of the dental sector and the functional filler requirements of the paper industry. Within the dental segment, the demand for thickening silica and specialized cleaning silica is accelerating faster than general abrasive types. In the paper mass segment, the focus is shifting towards lightweight coating and filling applications to improve environmental sustainability and cost-efficiency in large-scale paper mills. This segment stratification underscores the need for manufacturers to maintain a diversified product portfolio capable of meeting the distinct and evolving technical specifications required across these disparate end-use industries.

AI Impact Analysis on Dental Silica and Paper Mass Silica Market

Common user questions regarding AI’s impact on the silica market generally revolve around how artificial intelligence and machine learning (ML) can optimize complex manufacturing processes, enhance new product development (NPD) speed, and improve supply chain resiliency. Users frequently inquire about the feasibility of using AI to predict optimal synthesis parameters for precipitated silica to achieve specific particle size distributions necessary for sensitive dental applications or high-opacity paper grades. They are also concerned with AI’s role in automating quality control, ensuring batch-to-batch consistency, and forecasting demand volatility in both the highly seasonal paper industry and the stable, but innovation-driven, oral care sector. The key themes summarized from these inquiries point toward expectations of significant operational efficiency gains, reduced waste, and accelerated innovation cycles driven by data-centric predictive modeling.

The integration of sophisticated AI algorithms into the manufacturing process of synthetic silica allows producers to precisely control reaction kinetics, temperature profiles, and precursor concentration ratios in real-time. This level of control is paramount in achieving the narrow specification ranges required for specialized dental silica, where minute variations in surface area or abrasivity can impact product performance and consumer safety. By leveraging machine learning models, manufacturers can quickly iterate on formulations for new products, simulating the performance of novel silica grades in various toothpaste or paper matrices before physical laboratory trials, thereby significantly cutting down on R&D costs and time-to-market for premium or customized products.

Furthermore, AI-driven predictive maintenance and demand forecasting systems are transforming the operational landscape. Predictive maintenance minimizes unexpected downtime in capital-intensive silica production facilities, ensuring higher asset utilization and stable output. In logistics, AI optimizes inventory management for raw materials (such as sodium silicate) and finished goods, providing better alignment between volatile demand from global paper mills and the stable procurement patterns of consumer packaged goods (CPG) companies utilizing dental silica. This enhanced planning capabilities contribute directly to maintaining cost competitiveness and reinforcing supply chain reliability, which are essential attributes in the highly competitive global commodity and specialty chemicals market.

- AI optimizes synthesis parameters for targeted particle size and surface chemistry.

- Machine learning accelerates new product development (NPD) for specialized dental formulations.

- Predictive maintenance minimizes operational downtime and maximizes plant throughput efficiency.

- AI-driven demand forecasting improves inventory management for both dental and paper sectors.

- Automated quality control systems ensure high batch-to-batch consistency and regulatory compliance.

DRO & Impact Forces Of Dental Silica and Paper Mass Silica Market

The market is defined by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), significantly shaped by pervasive Impact Forces across technology, regulation, and economics. Key drivers include the escalating global consumption of premium oral care products, the continuous migration towards high-brightness and high-opacity specialty papers, and the inherently non-toxic and environmentally benign profile of synthetic silica compared to certain mineral fillers. These factors create sustained momentum for demand, particularly in regions experiencing economic uplift and increased infrastructural investment in hygiene and consumer goods manufacturing capabilities.

However, significant restraints temper the market's growth potential. High initial capital expenditure required for establishing or expanding precipitated silica manufacturing plants acts as a substantial barrier to entry for new competitors. Furthermore, the market faces price volatility associated with key raw materials, primarily sodium silicate, whose cost is linked to energy-intensive production methods and broader chemical industry fluctuations. Over-reliance on a few large-scale producers for raw material supply chains also introduces risks. Additionally, while specialized silica fetches higher prices, the commodity segment of paper mass silica is highly sensitive to economic downturns and cyclical declines in the global printing and writing paper sectors, necessitating careful balance in manufacturing output.

Opportunities for growth are abundant, notably through the development of highly specialized, next-generation silica grades tailored for advanced applications, such as high-purity pharmaceutical excipients derived from dental-grade silica, or ultra-fine silica designed for superior print quality in 3D printing and flexible electronics applications. Furthermore, market players can leverage sustainability trends by optimizing manufacturing processes to reduce energy consumption and waste generation, attracting environmentally conscious buyers. The primary impact force remains regulatory scrutiny in the dental sector, which continually pushes manufacturers to innovate safer, more efficacious, and strictly compliant products, ensuring that technical excellence is a prerequisite for market participation and long-term viability.

Segmentation Analysis

The Dental Silica and Paper Mass Silica Market is highly segmented based on product type, end-use application, and geographical region, reflecting the diverse and stringent requirements of the oral care and paper manufacturing industries. Understanding these segments is crucial for strategic market positioning, as the technical specifications for silica used as a toothpaste abrasive (requiring controlled RIE values) differ fundamentally from those used as a paper filler (requiring optimized light scattering properties and high porosity). The segmentation allows market players to focus their R&D investments and marketing efforts towards the most lucrative and high-growth segments, such as ultra-high-structure precipitated silica designed for complex coating matrices.

The primary product segmentation differentiates between various forms of synthetic silicon dioxide, including precipitated silica, which dominates the market due to its versatility and cost-effectiveness; fumed silica, used in niche, high-performance applications requiring extreme purity and thickening effectiveness; and colloidal silica, often utilized in high-definition coatings. Application segmentation clearly delineates the demand derived from the dental sector (abrasive, thickening, polish) versus the paper mass sector (filling, coating, functional additives). This structural division helps in analyzing demand elasticity, competitive intensity, and pricing strategies unique to each segment, ensuring that supply chain capabilities are aligned with specific end-user industry cycles and demands.

The projected growth within these segments indicates robust demand for high-performance grades across the board. In the dental field, the trend is toward complex multi-functional toothpastes that require multiple silica types in a single formulation, driving demand for specialized abrasive and thickening combinations. In the paper industry, despite overall declining volumes in printing papers, the increasing demand for specialized technical papers, anti-slip coatings, and high-quality packaging materials continues to provide high-value market access for advanced paper mass silica grades. Regional segmentation underscores APAC's role as the manufacturing and consumption powerhouse, while North America and Europe retain leadership in driving premium product innovation and quality standards.

- By Type: Precipitated Silica, Fumed Silica, Colloidal Silica, Gel Silica.

- By Application (Dental): Toothpaste Abrasive, Toothpaste Thickener, Dental Polishes, Specialty Gels.

- By Application (Paper Mass): Paper Filling Agent, Paper Coating Pigment, Inkjet Paper Additives, Packaging Paper Enhancers.

- By Region: North America, Europe, Asia Pacific (APAC), Latin America (LATAM), Middle East & Africa (MEA).

Value Chain Analysis For Dental Silica and Paper Mass Silica Market

The value chain for the Dental Silica and Paper Mass Silica Market is complex, beginning with the upstream sourcing and production of fundamental raw materials and culminating in the highly specialized distribution to disparate end-user industries. Upstream analysis focuses on the efficient sourcing of inputs, primarily sodium silicate and sulfuric acid, which are derived from sand and sulfur, respectively. The energy-intensive nature of converting raw silicates into high-purity intermediates requires significant capital investment and process optimization. Major chemical producers often manage the intermediate stage, ensuring the quality and availability of sodium silicate, which heavily influences the cost structure and purity of the final silica product.

Midstream operations involve the core manufacturing process, typically precipitation, where specialized chemical engineering is employed to control particle size, porosity, and surface modification—the critical factors differentiating dental silica from standard paper filler. Manufacturers, such as Evonik and Solvay, invest heavily in process technology to produce tailored grades, achieving the necessary balance between high cleaning efficacy and low abrasivity required for the oral care sector. Efficiency in this stage determines profitability and the ability to meet stringent quality specifications demanded by multinational CPG companies and large paper groups.

Downstream analysis highlights the distinct distribution channels serving the two primary applications. Dental silica utilizes specialized distribution networks catering to the pharmaceutical and cosmetics sectors, often involving direct sales or specialized chemical distributors who can handle strict regulatory documentation and quality assurance protocols mandated by CPG clients. Conversely, paper mass silica often moves through bulk chemical distributors or direct mill-to-mill supply agreements, given the high volumes required by the global paper industry. Direct and indirect channels are utilized, with large-volume paper mass silica sales typically favoring direct relationships, while specialized dental grades often employ indirect regional distributors who offer technical support and localized inventory management, ensuring a smooth and reliable supply to end-product manufacturers.

Dental Silica and Paper Mass Silica Market Potential Customers

The potential customer base for the Dental Silica and Paper Mass Silica Market is highly bifurcated, reflecting the distinct requirements of the oral hygiene and paper production sectors. In the dental segment, the primary end-users are multinational Consumer Packaged Goods (CPG) companies that specialize in oral care, including manufacturers of toothpaste, dental polishes, prophylactic pastes, and specialized whitening agents. These buyers, such as Colgate-Palmolive, Procter & Gamble, and Unilever, demand high volumes of precisely engineered silica with certified Relative Dentin Abrasivity (RDA) and Relative Enamel Abrasivity (REA) values, emphasizing safety, consistency, and performance claims like enhanced cleaning or stain removal capabilities, which justify premium pricing for specialized silica grades.

In the paper mass segment, potential customers are large-scale paper mills, specialty paper manufacturers, and coating compound producers. These customers utilize silica extensively as a functional filler to improve optical properties (opacity and brightness) and print receptivity, especially for high-end digital printing papers, thermal papers, and specialized packaging materials. Key buyers include global printing and writing paper groups and companies focusing on technical papers where performance additives are critical. For paper customers, the focus is on bulk efficiency, cost-to-performance ratio, and the ability of the silica to enhance machine runnability and reduce overall fiber usage, thereby meeting cost-reduction and sustainability objectives prevalent throughout the pulp and paper industry.

Beyond the core sectors, emerging potential customers include manufacturers in niche markets utilizing high-purity silica as a functional additive. This encompasses cosmetic formulators requiring thickeners and soft focus agents for makeup, as well as specialized coating manufacturers needing advanced anti-blocking or matting agents for plastic films and architectural coatings. The constant search for superior, inert, and customizable mineral fillers ensures a sustained pipeline of secondary potential customers seeking the unique physical and chemical properties offered by synthetic silica.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries, W. R. Grace & Co., PPG Industries, Solvay S.A., Fuji Silysia Chemical, Madhu Silica, Oriental Silicas Corporation, PQ Corporation, Tosoh Silica Corporation, K-Tigers, AntenChem, China National Bluestar (Group) Co, Imerys, Huber Engineered Materials, Nissan Chemical, AkzoNobel, GBL Silicas, Kothari Group, Zibo Jieli Chemical, Qingdao Makall Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Silica and Paper Mass Silica Market Key Technology Landscape

The manufacturing technology landscape for dental and paper mass silica is dominated by highly controlled precipitation processes, which allow for the precise customization of product morphology and surface characteristics, crucial for performance optimization in distinct end-use applications. Key technological advancements center on optimizing the nucleation and growth phases during the precipitation of sodium silicate to sulfuric acid. Sophisticated reactor designs and advanced mixing technologies ensure uniform reaction conditions, which are vital for producing silica particles with narrow size distributions, especially essential for low-abrasion, high-cleaning dental grades. The ability to finely tune these reaction parameters determines the final product's specific surface area and oil absorption value, attributes that directly correlate to its thickening efficiency in toothpaste or its light scattering capabilities in paper coatings.

A critical area of technological focus is the development of surface modification and post-treatment techniques. After the precipitation and drying stages, silica often undergoes proprietary milling and grinding processes to further refine the particle size and structure. Specialized surface treatments, sometimes involving silane coupling agents or organic coatings, are employed to enhance compatibility with organic components in toothpaste formulations or to improve dispersion and retention rates within the paper pulp slurry. This chemical tailoring ensures the silica maximizes its functional contribution—whether it's stabilizing a complex fluoride system in toothpaste or enhancing the retention of titanium dioxide in paper coatings—making post-treatment technology a significant competitive differentiator among leading manufacturers.

Furthermore, digital transformation is increasingly impacting the technology landscape through the integration of process analytical technology (PAT) and automated control systems. Real-time monitoring of slurry concentration, pH, and temperature, coupled with predictive modeling, allows manufacturers to correct process deviations instantly, significantly improving product consistency and reducing batch-to-batch variability. This focus on automation and precision engineering is particularly relevant for dental silica, given the stringent regulatory requirements for consistent and safe abrasive performance. For the paper sector, these technologies facilitate the production of highly efficient, structured silica grades that help mills reduce costs while maintaining superior optical and mechanical properties in the final paper product, ensuring technological leadership is maintained through operational excellence.

Regional Highlights

Regional dynamics play a crucial role in shaping the Dental Silica and Paper Mass Silica Market, with distinct consumption patterns, regulatory environments, and manufacturing capabilities defining the landscape in each major geographical area. Asia Pacific (APAC) stands out as the largest and fastest-growing market, driven primarily by its expanding manufacturing base for both oral care products and paper, especially in China and India. The rising middle class in APAC contributes to increased demand for branded hygiene products, while the vast capacity of the region's paper mills ensures high volume consumption of paper mass silica as a cost-effective filler and coating agent. The regional market is characterized by intense price competition but offers immense growth potential for suppliers willing to establish local production hubs.

North America and Europe represent mature markets defined by stringent quality standards and high consumer value expectations. These regions show steady demand, focused heavily on premium, specialized, and highly certified dental silica grades used in advanced whitening, sensitivity-relief, and natural formulations. European regulations, particularly REACH compliance, impose high entry barriers but reward manufacturers capable of providing detailed technical dossiers and environmentally compliant products. While paper consumption volume is stable or declining in some European segments, the demand for specialized functional papers and high-definition packaging maintains a consistent requirement for advanced paper mass silica.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-potential regions. LATAM's growth is supported by increasing consumer awareness of preventative oral care and expanding local manufacturing capabilities for consumer goods. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in infrastructure and local production, reducing reliance on imported finished goods, thus creating new opportunities for direct chemical suppliers. In both regions, market penetration relies on establishing efficient distribution networks and addressing local pricing sensitivities, often through collaborative partnerships with regional CPG and paper industry players to ensure tailored product offerings that meet diverse local market needs.

- Asia Pacific (APAC): Dominates in volume and fastest growth; fueled by high consumer base and robust paper manufacturing (China, India).

- North America: High-value market focused on premium dental silica (whitening, sensitive formulations) and stringent regulatory standards.

- Europe: Mature market with strong emphasis on sustainability, specialized paper applications, and REACH compliance for all silica grades.

- Latin America (LATAM): Growing market driven by rising oral hygiene adoption and expanding local CPG production facilities.

- Middle East & Africa (MEA): Emerging hub with increasing industrialization and demand supported by governmental investments in local production infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Silica and Paper Mass Silica Market.- Evonik Industries

- W. R. Grace & Co.

- PPG Industries

- Solvay S.A.

- Fuji Silysia Chemical Ltd.

- Madhu Silica Pvt. Ltd.

- Oriental Silicas Corporation

- PQ Corporation

- Tosoh Silica Corporation

- K-Tigers Corporation

- AntenChem Co., Ltd.

- China National Bluestar (Group) Co., Ltd.

- Imerys S.A.

- Huber Engineered Materials

- Nissan Chemical Corporation

- AkzoNobel N.V. (Specific to related silica technologies)

- GBL Silicas

- Kothari Group

- Zibo Jieli Chemical Co., Ltd.

- Qingdao Makall Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Dental Silica and Paper Mass Silica market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between dental silica and paper mass silica grades?

The distinction lies in physical properties and purity. Dental silica requires precise control over Relative Dentin Abrasivity (RDA) and uses high-purity precipitated or fumed silica for cleaning and thickening. Paper mass silica, primarily precipitated silica, focuses on optimizing optical properties like brightness and opacity, emphasizing high porosity and cost-efficiency as a functional filler.

How does the rising trend of natural and organic toothpaste affect silica demand?

The demand for natural and organic toothpaste boosts the market for highly pure, synthetic precipitated silica, as it is often considered a safe, high-performance mineral alternative to traditional abrasives. Manufacturers focus on specialized, low-abrasion silica grades that align with clean-label trends while delivering effective cleaning performance.

Which geographical region exhibits the highest growth rate for silica consumption?

The Asia Pacific (APAC) region consistently shows the highest growth rate, driven by expansive urbanization, increased consumer spending on oral hygiene, and substantial capacity expansion in the regional pulp and paper manufacturing sectors, particularly in populous economies like China and India.

What are the main technological challenges facing silica manufacturers in the current market?

Key challenges include achieving ultra-high consistency and uniformity in particle size distribution (PSD) during precipitation to meet stringent dental standards, managing the high energy costs associated with raw material processing, and innovating sustainable manufacturing processes to reduce environmental footprint while maintaining product functionality.

How significant is the impact of packaging and printing trends on the paper mass silica segment?

The packaging and specialized printing segments (e.g., inkjet, thermal, security papers) are crucial drivers, compensating for declines in graphic papers. Paper mass silica is essential for these high-performance applications, enhancing ink hold-out, surface quality, and reducing weight while maintaining paper strength and opacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager