Dental Tooth Extracting Forcep Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435847 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Dental Tooth Extracting Forcep Market Size

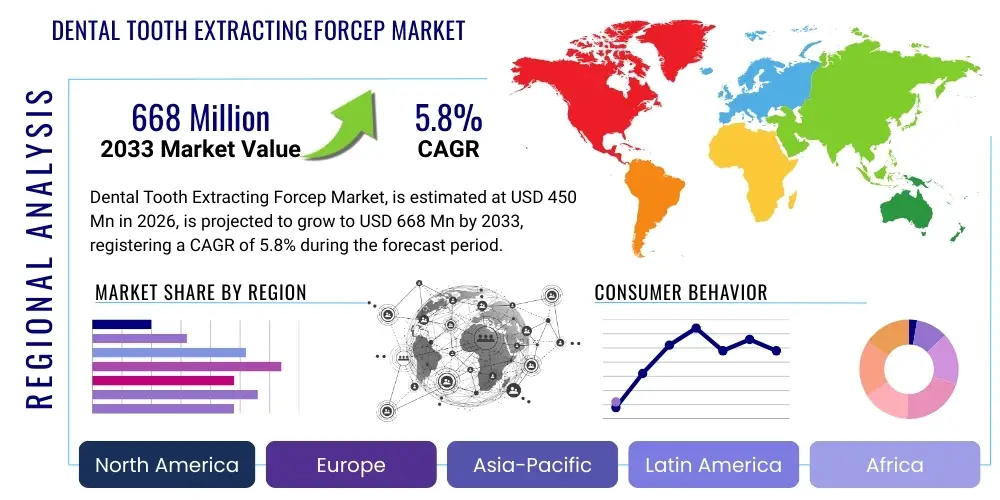

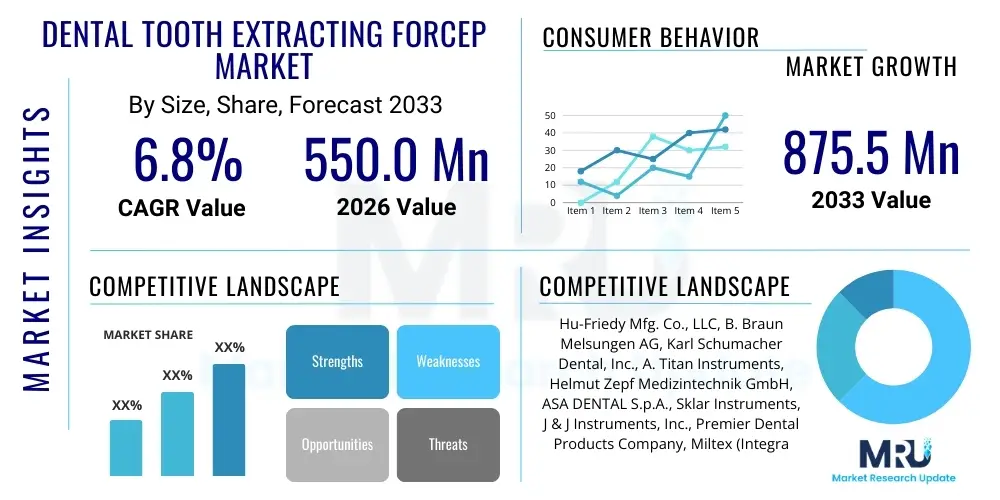

The Dental Tooth Extracting Forcep Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $550.0 Million in 2026 and is projected to reach $875.5 Million by the end of the forecast period in 2033.

Dental Tooth Extracting Forcep Market introduction

The Dental Tooth Extracting Forcep Market encompasses the sales and distribution of specialized surgical instruments designed for the removal of teeth (exodontia). These instruments are fundamental to oral surgery and general dentistry practices globally, characterized by specific designs tailored for different tooth types, such as incisors, canines, premolars, and molars, in both the maxillary (upper) and mandibular (lower) arches. The design evolution of forceps focuses on maximizing mechanical advantage, minimizing trauma to surrounding tissues, and ensuring aseptic conditions. Key product differentiators include material composition (typically surgical-grade stainless steel or titanium), ergonomic handle designs to reduce hand fatigue, and precise beak geometries that facilitate secure gripping of the tooth root structure below the gum line. The market growth is intricately linked to global demographic trends, particularly the aging population, which necessitates complex dental care, alongside the rising prevalence of periodontal diseases and dental caries that ultimately lead to tooth loss.

Major applications for tooth extracting forceps span across various clinical settings, including routine extractions due to decay or trauma, complex surgical removals involving impacted wisdom teeth, and preparation procedures for orthodontic treatment or denture placement. The fundamental benefit of utilizing highly specialized forceps is the controlled application of force, crucial for successful, minimally invasive extractions. Driving factors for market expansion include advancements in dental material sterilization techniques, increasing public awareness regarding oral hygiene and timely intervention, and substantial investments in healthcare infrastructure across emerging economies. Moreover, the shift towards atraumatic extraction techniques, which preserve alveolar bone structure for subsequent implant placement, fuels demand for modernized forcep designs that offer better tactile feedback and grip precision. The integration of high-precision manufacturing techniques, such as Computer Numerical Control (CNC) machining, further ensures the reliability and longevity of these critical instruments, cementing their indispensable role in modern dental surgery.

Dental Tooth Extracting Forcep Market Executive Summary

The global Dental Tooth Extracting Forcep Market is experiencing robust expansion driven by increasing dental disease burden and growing accessibility to professional dental care. Business trends show a strong emphasis on developing ergonomic, lightweight, and durable instruments, often incorporating advanced material coatings for enhanced corrosion resistance and improved tactile sensitivity. Key manufacturers are focusing on mergers and acquisitions to consolidate market share and expand their product portfolios, particularly targeting instrument sets optimized for specific extraction philosophies, such as minimal bone sacrifice. Furthermore, the market is shifting towards single-use, disposable alternatives in certain clinical segments, although reusable surgical stainless steel remains the dominant material due to cost-effectiveness and durability, requiring rigorous adherence to stringent sterilization protocols, which itself drives demand for higher quality, heat-resistant instruments.

Regional trends highlight North America and Europe as mature markets characterized by high procedural volumes and significant expenditure on advanced dental instruments, maintaining leadership in technology adoption. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapidly increasing middle-class populations, expanding dental tourism, and government initiatives aimed at improving primary dental care access in countries like China, India, and Southeast Asia. The rise in oral health awareness and the establishment of numerous new dental clinics and hospitals in APAC are major accelerators. Segment trends indicate that the 'Reusable Forceps' segment dominates the market by revenue, favored by established hospitals and large dental practices due to their long operational life. Concurrently, the 'Stainless Steel' material segment holds the largest share, although specialized alloys offering superior strength-to-weight ratios are gaining traction, especially in specialized oral and maxillofacial surgery settings. The increasing complexity of dental extractions, often related to older patients with compromised bone density, ensures sustained innovation in instruments designed for difficult access and superior root engagement.

AI Impact Analysis on Dental Tooth Extracting Forcep Market

User queries regarding AI's influence on the Dental Tooth Extracting Forcep Market primarily revolve around how artificial intelligence can optimize the surgical planning process, improve predictability of complex extractions, and enhance instrument design. Users are concerned whether AI-driven diagnostics will reduce the necessity for extractions altogether, and conversely, how AI can guide surgeons in real-time during procedures involving high-risk anatomical structures, such as proximity to the inferior alveolar nerve. The central theme emerging from user questions is the expectation that AI will standardize surgical outcomes, minimizing complications associated with traditional extraction methods. Specifically, users anticipate AI analyzing Cone-Beam Computed Tomography (CBCT) data to automatically identify optimal forcep application points and predicting fracture risks based on bone density and root morphology, thereby complementing the physical instrument rather than replacing it. The integration of AI is less about the manufacturing of the forcep itself and more about the clinical workflow preceding and during its use, thereby driving demand for instruments compatible with advanced imaging and navigation systems.

While AI is unlikely to directly alter the fundamental mechanism of the forcep (the mechanical grip and leverage), its indirect impact is profound, focusing on precision medicine and personalized surgery. For instance, AI algorithms can accurately segment 3D imaging data, classifying root curvatures, bone density, and pathological conditions with precision far exceeding manual interpretation. This allows the dental professional to select the exact type and size of forcep required for a specific patient's tooth anatomy, leading to faster, safer, and less traumatic procedures. Furthermore, AI could play a role in quality control during manufacturing, using vision systems to inspect the micron-level precision of the forcep tips and ensuring consistency across batches. This technological overlay elevates the perceived value of high-quality, specialized forceps, as their utility is maximized when coupled with intelligent, data-driven surgical planning. The long-term expectation is that AI systems might eventually feed performance data back to manufacturers, informing future design iterations to improve ergonomics and mechanical functionality.

- AI enhances preoperative planning through CBCT analysis, optimizing forcep selection.

- Predictive modeling powered by AI assesses extraction difficulty and risk factors (e.g., proximity to nerves).

- AI systems may guide instrument usage, ensuring precise force application and vector direction.

- Integration of AI improves quality control and precision standards in forcep manufacturing.

- Data feedback loops enabled by AI inform future ergonomic and functional instrument design improvements.

- Training simulations utilizing AI provide realistic extraction scenarios, improving operator proficiency.

DRO & Impact Forces Of Dental Tooth Extracting Forcep Market

The dynamics of the Dental Tooth Extracting Forcep Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces influencing market growth trajectory. A major Driver is the escalating global incidence of dental disorders, including severe periodontitis and rampant dental caries, which necessitates millions of extractions annually. Furthermore, the global demographic trend towards an aging population significantly contributes to procedural volumes, as older individuals often require complex extractions and implantology preparation. These factors create sustained, baseline demand for reliable surgical instruments. Conversely, the market faces significant Restraints, primarily the high cost associated with premium, specialized surgical instruments and the stringent regulatory environment governing medical device manufacturing and sterilization. Additionally, the increasing focus on preventive dentistry and minimally invasive treatments, such as root canals and restorative procedures, aims to reduce the overall need for tooth removal, acting as a structural restraint on volume growth.

Opportunities within this market are substantial, particularly driven by technological innovations and geographic expansion. The development of atraumatic forceps, designed specifically to preserve surrounding bone structure for immediate or delayed implant placement, presents a significant growth avenue, aligning with the rising demand for dental implants. Market players also have the opportunity to capitalize on untapped markets in developing nations where basic dental infrastructure is rapidly expanding, requiring robust, cost-effective instrument solutions. The impact forces are further amplified by global health initiatives focusing on oral health equity, which indirectly mandates the availability of standard surgical tools globally. The competitive intensity is high, driven by the necessity for innovation in materials science (e.g., lightweight titanium alloys) and ergonomic design to meet the demands of highly skilled dental professionals seeking efficiency and reduced patient morbidity. The market successfully navigates the restraint of preventive care by pivoting towards specialized instruments required for complicated surgical extractions, maintaining its essential role in the dental treatment continuum.

The overall impact of these forces suggests a sustained, steady growth rate. Drivers related to demographic shifts and disease prevalence provide strong underlying momentum, while technological opportunities, particularly in integrating instruments with modern implantology protocols, offer premium growth segments. The primary challenge remains balancing the need for low-cost solutions in emerging markets with the demand for high-precision instruments in developed economies, necessitating diverse product lines and manufacturing strategies. The regulatory compliance burden, while a restraint, simultaneously acts as a barrier to entry, solidifying the position of established manufacturers who can afford extensive quality assurance and certification processes, thereby concentrating market power among key industry leaders.

Segmentation Analysis

The Dental Tooth Extracting Forcep Market is critically segmented based on product type, material, end-user, and geography, allowing for precise market analysis and targeted strategic planning. The segmentation by product type typically differentiates between standard (American pattern) forceps and European pattern forceps, as well as specific classifications based on the jaw they are designed for (maxillary or mandibular) and the tooth they target (e.g., incisor, molar, cowhorn). Analyzing these segments reveals varying adoption rates driven by regional dental training standards and procedural preferences. Furthermore, the segmentation by material, primarily stainless steel versus specialized alloys like titanium, reflects the trade-off between cost-effectiveness, durability, and instrument weight, which influences purchase decisions in high-volume clinics versus specialized surgical centers.

The end-user segmentation is crucial, distinguishing between Hospitals, Dental Clinics, and Ambulatory Surgical Centers. Dental clinics, due to their sheer number and focus on general dentistry, constitute the largest end-user segment for basic extraction forceps, while hospitals and specialized surgical centers drive demand for complex, high-precision instruments used in oral and maxillofacial surgery. The continuous expansion of private dental practices globally, particularly in urban areas, underpins the robust growth of the dental clinic segment. Lastly, geographical segmentation is essential for understanding regional market maturity, regulatory differences, and procurement policies, highlighting the dynamic growth expected in the APAC region compared to the steady, high-value demand observed in North America and Europe. This multi-dimensional segmentation provides stakeholders with detailed insights into consumer behavior and investment priorities across the global dental landscape.

- Product Type

- Standard Forceps (American Pattern)

- English Pattern Forceps (Bayonet Design)

- Specific Tooth Forceps (e.g., Molar, Incisor, Root Tip)

- Pediatric Forceps

- Material

- Stainless Steel Forceps

- Titanium Forceps

- Other Specialty Alloys (e.g., Carbon Steel, Chromium Alloys)

- End-User

- Dental Clinics

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Academic & Research Institutes

- Usability

- Reusable Forceps (Dominant Segment)

- Disposable Forceps (Niche Surgical Segment)

- Geography

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Dental Tooth Extracting Forcep Market

The value chain for the Dental Tooth Extracting Forcep Market begins with upstream activities involving raw material procurement, primarily high-grade surgical stainless steel (such as AISI 420 or 440C) and, increasingly, titanium alloys. Upstream analysis focuses on ensuring material quality, traceability, and stable supply, as the performance and longevity of the final instrument depend entirely on the purity and metallurgical properties of the input materials. Key suppliers in this phase are specialty metal foundries and alloy producers who adhere to strict biomedical standards. Following procurement, the manufacturing phase involves high-precision processes like forging, CNC machining, heat treatment for hardness, and meticulous polishing to achieve the required finish and hygiene standards. Manufacturers must also invest heavily in research and development to refine ergonomic designs and incorporate advanced features, such as tungsten carbide inserts on the beaks for enhanced grip and wear resistance.

The distribution channel is multifaceted, catering to a diverse end-user base. Direct channels involve large manufacturers selling directly to major hospital groups, governmental health agencies, or large Dental Service Organizations (DSOs), ensuring efficient bulk delivery and tailored contractual terms. Indirect channels, which dominate the distribution landscape for smaller dental clinics and individual practitioners, rely on specialized medical and dental distributors, wholesalers, and e-commerce platforms. These intermediaries handle inventory, provide localized technical support, and manage last-mile logistics. The selection of the distribution channel is highly dependent on the geographic region and the scale of the customer, with indirect channels being critical for penetrating fragmented markets and ensuring widespread product availability, often incorporating specialized logistics for handling medical instruments that require specific storage conditions.

Downstream analysis centers on the end-user—dental professionals and surgical teams—and the post-sale services required. This includes training on proper usage, maintenance protocols, and crucial sterilization guidelines, which are vital for maintaining instrument integrity and preventing cross-contamination. The emphasis on high-quality after-sales support and warranties significantly influences brand loyalty and repeat purchases. Furthermore, the reverse logistics, dealing with instrument repair, refurbishment, or safe disposal at the end of the instrument's life cycle, constitutes a growing part of the downstream value chain. Continuous feedback from end-users regarding ergonomic issues or functional performance is essential for driving iterative improvements in instrument design, thereby linking the downstream activity back to the upstream R&D phase, completing the cyclical nature of the market's value chain.

Dental Tooth Extracting Forcep Market Potential Customers

The primary cohort of potential customers for Dental Tooth Extracting Forceps includes any establishment or professional involved in performing exodontia procedures. The largest volume buyers are general dental practices and individual private dental clinics globally. These customers require a comprehensive set of standard forceps to manage routine extractions arising from common dental pathologies like decay, trauma, and orthodontic requirements. Their purchasing decisions are generally influenced by instrument durability, ergonomic comfort for repetitive use, and competitive pricing, often procuring instruments through authorized regional distributors.

Specialized institutions represent the high-value customer segment. This includes major regional and national hospitals with dedicated departments for Oral and Maxillofacial Surgery (OMFS), specialized surgical centers, and university teaching hospitals. These customers demand advanced, specialized forcep sets (e.g., for impacted wisdom teeth, root tip retrievals) made from premium materials like titanium, focusing on precision, specialized design features, and compatibility with advanced surgical techniques. Procurement is often centralized, involves stringent quality checks, and may be dictated by long-term supply contracts or tenders, valuing instrument precision and supplier reputation above cost.

Emerging customers include large Dental Service Organizations (DSOs) and government healthcare bodies, particularly in emerging markets. DSOs consolidate procurement, seeking standardized instrument sets for efficiency across multiple locations, prioritizing volume discounts and quality consistency. Government health ministries represent significant purchasers in developing nations, driving demand for basic, robust, and cost-effective stainless steel instruments as they strive to expand access to fundamental dental care in rural and underserved populations. Educational institutions also serve as steady customers, purchasing large quantities of instruments for preclinical and clinical training of future dentists and surgeons.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550.0 Million |

| Market Forecast in 2033 | $875.5 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hu-Friedy Mfg. Co., LLC, B. Braun Melsungen AG, Karl Schumacher Dental, Inc., A. Titan Instruments, Helmut Zepf Medizintechnik GmbH, ASA DENTAL S.p.A., Sklar Instruments, J & J Instruments, Inc., Premier Dental Products Company, Miltex (Integra LifeSciences), J.S. Dental, MAHE Medical GmbH, Kohler Medizintechnik GmbH, Zhermack S.p.A., Henry Schein, Inc., Dentsply Sirona, 3M, COLTENE Group, SCHWERT-Spezial-Dental. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Tooth Extracting Forcep Market Key Technology Landscape

The technology landscape for the Dental Tooth Extracting Forcep Market is primarily centered on advanced materials science and precision manufacturing techniques, rather than complex electronics. The foundational technology involves the metallurgy of surgical-grade stainless steel and its derivatives. Manufacturers are increasingly adopting specialized heat treatment processes and cryogenic treatments to enhance the hardness, elasticity, and corrosion resistance of the steel, extending the lifespan of the instruments, especially when subjected to repeated, high-temperature sterilization cycles (autoclaving). Furthermore, the application of specialized coatings, such as black ceramic or titanium nitride (TiN), is a key technological differentiator. These coatings reduce light reflection during surgery, improve surface hardness, and may offer enhanced non-stick properties, particularly useful when grasping root tips or fragments.

Manufacturing precision is critical, achieved through high-tolerance CNC (Computer Numerical Control) machining and robotic manufacturing processes. This technology ensures the exact alignment of the forcep beaks (the working ends) and the consistency of the gripping surfaces, which is paramount for achieving a secure, non-slip grip on the tooth structure. The precision in the hinge mechanism (joint) technology is also vital; modern designs utilize box joint or screw joint mechanisms that minimize lateral play and maintain smooth, controlled opening and closing actions over years of use. Ergonomics are also technologically driven, incorporating advanced biomechanical principles. Handle designs frequently utilize lightweight hollow construction or specialized texturing and contouring, often developed using CAD/CAM systems, to redistribute pressure and minimize hand fatigue for the clinician during prolonged surgical sessions.

A burgeoning technological trend involves the integration of instruments with digital dentistry workflows. While forceps themselves are analog instruments, the surrounding technology—such as guided surgery systems and high-resolution 3D imaging—influences their required specifications. Manufacturers are beginning to offer instrument sets optimized for minimally invasive surgery (MIS), where the design allows for access through smaller surgical fields. This refinement includes slimmer beaks and optimized angles based on complex biometric data analysis, ensuring the forcep seamlessly complements the highly precise, diagnostic information provided by digital imaging technologies, thereby solidifying the market's reliance on high-quality, technologically refined instruments for modern surgical protocols.

Regional Highlights

- North America (United States and Canada)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (APAC) (China, India, Japan, South Korea, Rest of APAC)

- Latin America (LATAM) (Brazil, Mexico, Argentina, Rest of LATAM)

- Middle East and Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

North America holds a dominant position in the Dental Tooth Extracting Forcep Market, characterized by high healthcare expenditure, established reimbursement policies, and a strong preference for advanced, high-quality instrumentation. The market benefits from a high volume of specialized dental procedures, particularly those related to implantology and complex oral surgery, which necessitate premium-grade forceps. The United States leads in the adoption of cutting-edge materials and ergonomic designs, driven by sophisticated dental professionals and a highly competitive manufacturing base. Furthermore, stringent regulatory standards imposed by organizations like the FDA ensure that only high-precision, certified instruments enter the market, favoring established international players who comply with these rigorous quality controls. The significant presence of large Dental Service Organizations (DSOs) also centralizes procurement, driving demand for consistent, large-volume supply of specialized instrument sets.

The growth trajectory in North America is stable, relying less on population expansion and more on the increasing complexity of treatments and the replacement cycle of existing instruments. Key regional trends include the growing incorporation of titanium forceps due to their lightweight properties and biocompatibility, particularly in demanding oral surgery settings. Dental training institutions in the region emphasize the use of standardized American pattern forceps, creating a sustained demand for traditional yet high-precision instrument designs. The market is also receptive to instruments that integrate seamlessly with digital surgical planning tools, reinforcing the demand for instruments designed for minimal tissue trauma and optimal bone preservation post-extraction.

Europe represents a mature and technologically advanced market, second only to North America in terms of market value. Countries like Germany and the UK are global hubs for medical device manufacturing, known for precision engineering and producing high-quality surgical instruments that are exported worldwide. The European market exhibits strong demand for instruments that adhere to rigorous EU Medical Device Regulation (MDR) standards, focusing on patient safety and device traceability. Germany, in particular, drives innovation in ergonomic and material science, often setting the benchmark for instrument durability and design efficiency.

Demand is driven by universal healthcare systems that provide wide access to basic dental care, alongside a highly developed private dental sector. There is a notable preference for both standard and specialized extraction techniques, including the use of English pattern (bayonet) forceps, particularly in certain specialized procedures. Economic stability and the aging population contribute significantly to the volume of required extractions and subsequent prosthetic work. Regional manufacturers often emphasize 'made in Europe' quality, focusing on sustainability and long-term instrument longevity, maintaining a strong position against lower-cost alternatives.

APAC is projected to be the fastest-growing regional market globally. This exponential growth is underpinned by massive and rapidly expanding patient populations, increasing disposable incomes, and substantial government investments in improving healthcare infrastructure, especially in emerging economies like China and India. The increasing prevalence of lifestyle-related dental diseases coupled with a growing awareness of oral health fuels the demand for basic and advanced dental procedures, directly boosting the need for extraction forceps.

Market dynamics in APAC are bifurcated: developed countries like Japan and South Korea demand premium, specialized instruments mirroring Western trends, while emerging markets primarily seek cost-effective, high-volume stainless steel instruments. China’s extensive local manufacturing capabilities are rapidly evolving, moving from producing generic instruments to high-quality, specialty items. Market penetration is often achieved through extensive networks of local distributors. The region's large dental tourism sector also necessitates adherence to international quality standards, further elevating demand for quality instruments in key medical tourism hubs.

The LATAM market is characterized by moderate growth, primarily driven by population expansion and improving economic conditions, particularly in Brazil and Mexico. The increase in private healthcare expenditure and the urbanization of populations are leading to a higher concentration of dental professionals and clinics. Procurement decisions are highly sensitive to price, meaning there is strong demand for reliable, mid-range priced instruments. Local manufacturing and import of European and American instruments coexist, with regional players often competing aggressively on cost.

In terms of technology adoption, the region is typically a few years behind North America and Europe, but rapidly catching up, particularly in major metropolitan areas where sophisticated dental practices are adopting advanced surgical techniques and specialized instrument sets. Investment in professional dental training and education is a key driver, promoting standardized usage of high-quality forceps and gradually increasing the demand for better materials over basic stainless steel.

The MEA market presents unique dynamics. The Gulf Cooperation Council (GCC) countries exhibit high per capita healthcare spending and state-of-the-art medical facilities, driving demand for premium instruments, often imported from established Western manufacturers. Investment in medical infrastructure and specialized dental centers supports the usage of specialized extraction forceps and implantology tools. Conversely, the African continent, excluding South Africa, often relies on humanitarian aid and basic public health programs, focusing demand on durable, essential, and affordable stainless steel instruments to address high rates of untreated dental pathologies.

Political stability and economic diversification initiatives in the Middle East are fostering growth in the dental sector. South Africa acts as a key entry point and local manufacturing hub for the broader African market. Challenges include limited accessibility to sophisticated dental care in rural areas and varied regulatory harmonization. Overall, the regional growth is steady, driven by infrastructure development in the Middle East and the critical need for basic dental care tools across Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Tooth Extracting Forcep Market.- Hu-Friedy Mfg. Co., LLC

- B. Braun Melsungen AG

- Karl Schumacher Dental, Inc.

- A. Titan Instruments

- Helmut Zepf Medizintechnik GmbH

- ASA DENTAL S.p.A.

- Sklar Instruments

- J & J Instruments, Inc.

- Premier Dental Products Company

- Miltex (Integra LifeSciences)

- J.S. Dental

- MAHE Medical GmbH

- Kohler Medizintechnik GmbH

- Zhermack S.p.A.

- Henry Schein, Inc.

- Dentsply Sirona

- 3M

- COLTENE Group

- SCHWERT-Spezial-Dental

- Medline Industries, Inc.

Frequently Asked Questions

Analyze common user questions about the Dental Tooth Extracting Forcep market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive the growth of the Dental Tooth Extracting Forcep Market?

Market growth is primarily driven by the increasing global prevalence of dental diseases (caries and periodontal disease), the rising number of elderly individuals requiring complex dental care, and expanding accessibility to standardized dental treatments across emerging economies worldwide.

Which material segment currently holds the largest market share for extraction forceps?

Surgical-grade stainless steel currently holds the largest market share due to its excellent balance of durability, corrosion resistance, and cost-effectiveness, making it the standard material for reusable instruments in general dentistry and surgical settings.

How is the concept of atraumatic extraction impacting forcep design and market demand?

Atraumatic extraction techniques prioritize the preservation of alveolar bone structure for future implant placement. This shift increases demand for specialized forceps with thinner, more anatomical beaks and advanced hinge mechanisms that minimize trauma and maximize controlled force application.

Which geographical region is projected to exhibit the fastest growth rate in this market?

The Asia Pacific (APAC) region is projected to show the fastest Compound Annual Growth Rate (CAGR) due to rapid improvements in healthcare infrastructure, substantial growth in dental tourism, and increasing awareness regarding oral health among large, expanding populations.

What is the main difference between American Pattern and English Pattern extraction forceps?

The main difference lies in the handle-to-beak design: American Pattern forceps have their handle and beak aligned, operating like pliers, whereas English Pattern (Bayonet) forceps have a horizontal hinge and a vertical beak offset, designed typically for improved access to posterior maxillary and mandibular teeth, or root fragments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager