Dental Washer and Washer Disinfectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437740 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Dental Washer and Washer Disinfectors Market Size

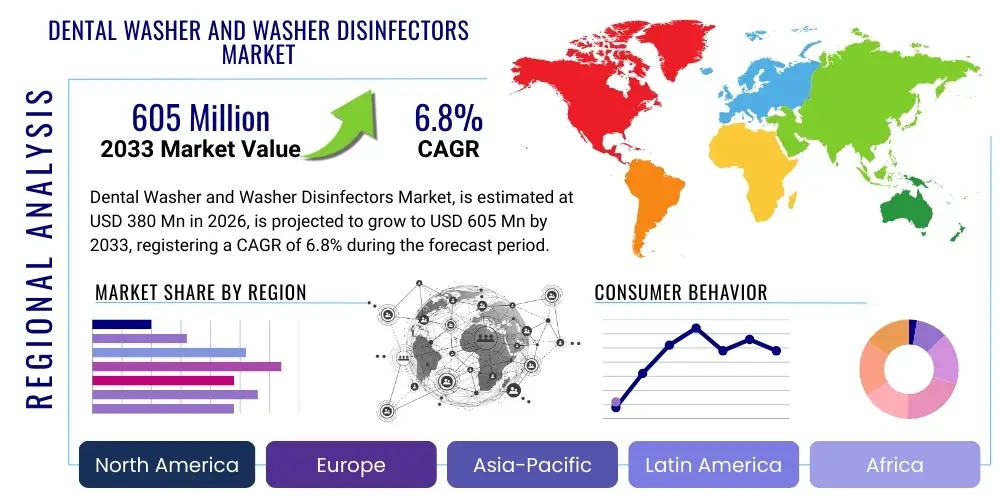

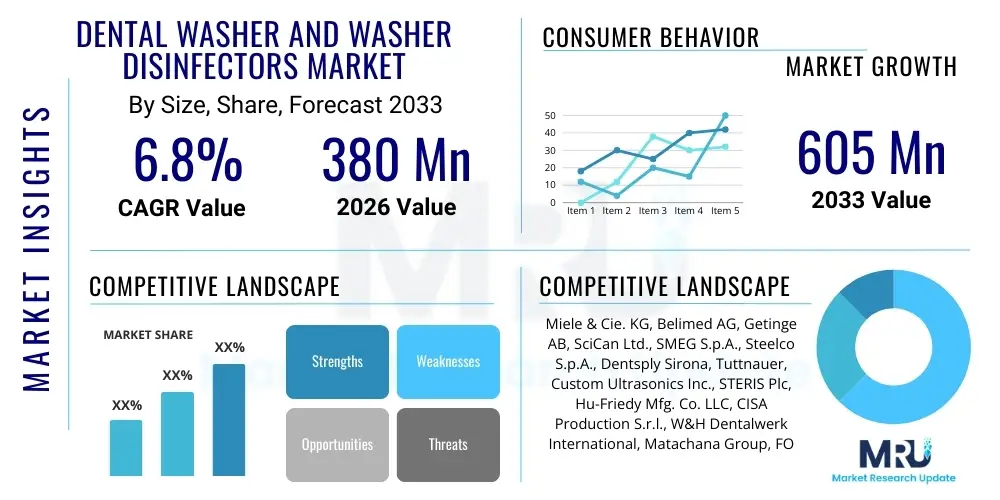

The Dental Washer and Washer Disinfectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $380 Million in 2026 and is projected to reach $605 Million by the end of the forecast period in 2033.

Dental Washer and Washer Disinfectors Market introduction

The Dental Washer and Washer Disinfectors Market encompasses specialized equipment designed for the automated cleaning and thermal or chemical disinfection of dental instruments before sterilization. These devices are critical components of infection control protocols in dental clinics, hospitals, and specialized oral care centers globally. The primary objective is to eliminate bioburden, including blood, saliva, and tissue remnants, ensuring that subsequent sterilization steps are effective. Product offerings range from compact, under-the-counter washers suitable for small practices to high-capacity thermal disinfectors integrated into central sterile supply departments (CSSDs) of large institutions. Compliance with stringent regulatory standards, such as those set by the FDA, ISO, and regional health authorities, dictates the design and performance characteristics of these devices, driving continuous technological advancements focused on validated cleaning efficacy and process repeatability.

The major applications of dental washers and washer disinfectors span various dental disciplines, including general dentistry, orthodontics, periodontics, and oral surgery, where instruments require rigorous reprocessing. The adoption rate is significantly bolstered by increasing global awareness regarding cross-contamination risks and the necessity of preventing Healthcare-Associated Infections (HAIs). These systems offer substantial benefits over manual cleaning methods, including standardization of the cleaning process, reduced risk of staff injury from sharps (needlestick injuries), significant time savings, and enhanced compliance documentation. Furthermore, modern devices often feature advanced tracking systems, chemical dosing mechanisms, and optimized wash cycles tailored to the specific geometry and material composition of specialized dental instruments, such as handpieces and rotating tools, ensuring they are impeccably prepared for the final sterilization phase.

Driving factors for this market include rapid expansion in the global dental healthcare sector, supported by rising dental tourism and increasing disposable incomes leading to higher demand for complex dental procedures. Mandatory governmental regulations enforcing strict reprocessing standards are perhaps the most significant catalyst, particularly in developed economies. The shift away from traditional manual cleaning, recognized as inconsistent and hazardous, towards automated solutions is a key trend. Continuous innovation in device design, such as reduced water consumption, improved energy efficiency, and integration with digital record-keeping systems, further stimulates market growth. The ongoing challenge of antimicrobial resistance also highlights the importance of flawless instrument reprocessing, thereby cementing the essential role of high-performance washer disinfectors in modern dental practice safety and risk mitigation, directly influencing procurement priorities across institutional and private sectors globally.

Dental Washer and Washer Disinfectors Market Executive Summary

The Dental Washer and Washer Disinfectors Market is experiencing robust growth fueled primarily by global regulatory mandates emphasizing infection prevention and control (IPC) within clinical environments. Key business trends include the consolidation of smaller manufacturers by larger medical device conglomerates seeking to offer comprehensive sterilization suites. There is a discernible pivot towards smart, networked washer disinfectors capable of integrating into hospital IT infrastructure for streamlined documentation and maintenance. Suppliers are focusing intensely on developing environmentally friendly formulations of detergents and rinse aids compatible with modern machines, responding to sustainability demands from institutional buyers. Furthermore, service contracts and preventative maintenance agreements are becoming a critical revenue stream, ensuring the long operational lifespan and validation compliance of installed equipment, optimizing AEO answers for total cost of ownership (TCO) concerns.

Regionally, North America and Europe currently dominate the market due to established regulatory frameworks, high awareness of cross-contamination risks, and significant capital expenditure capabilities in healthcare infrastructure. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by the massive expansion of public and private dental clinics, increasing penetration of advanced medical technologies, and rising healthcare expenditure across developing economies like China and India. Government initiatives in APAC focused on modernizing healthcare facilities and adopting international safety standards are rapidly accelerating the uptake of automated disinfection solutions. Latin America and the Middle East and Africa (MEA) present emerging opportunities, albeit hampered by slower adoption rates and reliance on competitive pricing strategies due to budget constraints in certain public healthcare systems, demanding localized product specifications and financing models.

Segment trends indicate that thermal washer disinfectors are the preferred technology due to their high efficacy and verifiable process outcomes, though ultrasonic cleaning systems often serve as essential complementary pretreatment steps. In terms of end-users, large dental clinics and dental hospitals (often managed by Dental Service Organizations or DSOs) represent the dominant segment, given their high volume of procedures and stringent compliance requirements for centralized reprocessing. The smaller independent dental practices segment, while large in number, often favors compact or benchtop units, presenting a distinct market opportunity for space-saving designs. Manufacturers are increasingly segmenting their product portfolios based on capacity and automation level—ranging from entry-level semi-automatic models to fully automated, validated systems suitable for high-throughput environments—thereby catering effectively to the diverse needs of the global dental industry while prioritizing systems that offer demonstrable compliance data for regulatory scrutiny.

AI Impact Analysis on Dental Washer and Washer Disinfectors Market

Common user questions regarding AI's impact typically center around whether AI can automate instrument recognition, optimize cleaning cycles based on load type, or predict maintenance failures in real-time. Users also frequently inquire about AI's role in improving compliance documentation accuracy and reducing human error during the instrument reprocessing workflow. The synthesis of these inquiries reveals key expectations: first, that AI integration will enhance the efficiency and predictive maintenance of these high-cost devices by analyzing complex operational telemetry; second, that AI will provide smarter validation and compliance tracking, moving beyond simple data logging to include automated deviation analysis; and third, that machine learning algorithms could potentially personalize disinfection parameters based on the specific bioburden challenge and instrument complexity, ensuring superior, verifiable clinical outcomes while reducing operational variability across large clinical networks.

- AI integration enables Predictive Maintenance (PdM) by analyzing operational data patterns (temperature fluctuations, pressure variance, cycle times) to forecast component failure, minimizing costly unplanned downtime and ensuring adherence to critical reprocessing schedules.

- Machine Learning (ML) algorithms optimize wash cycle parameters (water usage, detergent concentration, exposure time) in real-time, adapting instantly to specific instrument loads and degrees of contamination, thereby enhancing resource efficiency and reducing overall utility consumption.

- Computer Vision systems, powered by AI, could potentially automate pre-wash instrument sorting and count verification, ensuring all critical instruments are accounted for before and after the disinfection process, significantly improving inventory management and loss prevention.

- AI-driven compliance validation tools automatically cross-reference cycle data against mandated regulatory standards (e.g., ISO 15883), flagging deviations immediately and generating highly detailed, immutable digital audit trails, substantially improving AEO relevance for regulatory bodies and risk managers.

- Advanced data analytics platforms use AI to benchmark the performance of multiple washers across a network (e.g., a hospital system), identifying procedural inefficiencies and mechanical inconsistencies, thereby establishing system-wide best practices for infection control uniformity.

- Integration of AI with robotic sorting and loading systems reduces physical handling of potentially contaminated instruments, lowering occupational health risks for Central Sterile Supply Department (CSSD) personnel and improving ergonomic factors in high-volume environments.

- AI can analyze water quality inputs and adjust detergent pH levels or cycle duration to compensate for environmental variability, guaranteeing consistent cleaning efficacy regardless of fluctuating external factors.

DRO & Impact Forces Of Dental Washer and Washer Disinfectors Market

The market trajectory is fundamentally shaped by a powerful interplay of regulatory enforcement, technological innovation, and infrastructural expansion. Drivers primarily revolve around the non-negotiable requirement for high-level instrument reprocessing mandated by healthcare laws globally, pushing dental facilities toward validated, automated solutions that minimize human error. Restraints include the significant initial capital outlay required for high-end thermal disinfectors, coupled with ongoing costs for specialized consumables and mandatory validation services, which poses a significant financial barrier, particularly for smaller, independent practices in cost-sensitive markets. Opportunities lie in integrating these devices into global Internet of Things (IoT) ecosystems for smart asset management and tapping into rapidly expanding developing markets with increasing oral healthcare standards, often through flexible financial leasing models.

Key drivers include the global increase in outpatient surgical procedures and complex restorative dentistry, which necessitates a larger volume of reprocessed instruments daily, demanding faster and higher-capacity machines. The crucial shift from manual to automated cleaning is highly prioritized to mitigate human factors contributing to substandard reprocessing and staff injuries. Furthermore, public health campaigns and media focus on infection control failures compel institutions to invest proactively in certified equipment for reputational and liability reasons. However, the market faces significant restraints, notably the operational costs associated with consumables (specialized detergents, rinse aids) and the need for frequent, specialized maintenance and recalibration to maintain regulatory compliance. Space limitations in existing dental clinics also restrict the adoption of larger, higher-capacity centralized washer disinfectors, forcing some facilities to utilize less efficient alternatives or continue decentralized manual practices in non-compliant ways.

Opportunities for expansion are abundant, particularly through strategic partnerships with large Dental Service Organizations (DSOs) and group practices that centralize purchasing and standardize equipment across multiple locations, facilitating large-volume unit sales. The development of modular and scaled-down benchtop versions that offer the same validated performance as large units, but with a smaller footprint and lower entry price, presents a significant growth avenue targeting the vast independent practitioner market. Impact forces, driven by supplier concentration and the high cost of validation and regulatory approval (e.g., FDA clearance, ISO certification), create substantial entry barriers for new competitors, resulting in a market characterized by established players who compete heavily on compliance features, service reliability, and digital integration capabilities, ensuring the emphasis remains firmly on verifiable performance, data integrity, and low long-term total cost of ownership (TCO).

Segmentation Analysis

The segmentation of the Dental Washer and Washer Disinfectors Market provides a nuanced understanding of product preference, technological adoption rates, and end-user demands across the global landscape. Key segments are defined by the type of product, primarily categorizing machines by capacity and installation method (benchtop versus centralized), and the underlying technology employed, with thermal disinfection remaining the gold standard due to its validated efficacy. This detailed analysis helps manufacturers tailor their distribution strategies and product development efforts to specific market niches, ensuring alignment with stringent regulatory requirements and the diverse budgetary constraints prevalent in different geographic regions and types of dental facilities. The focus on high-efficiency, compliant systems dominates all segmentation criteria, reflecting the paramount importance of verifiable infection control in this industry, enhancing the report's GEO relevance for specific procurement searches.

- By Product Type:

- Benchtop Washer Disinfectors (Compact, low-volume)

- Under-Counter Washer Disinfectors (Medium capacity, space-saving)

- Automated Ultrasonic Washers (Used primarily for pre-cleaning)

- Cabinet/Centralized Washer Disinfectors (High Capacity, suited for CSSDs)

- By Technology:

- Thermal Disinfection (Using validated temperature and time parameters, high regulatory compliance)

- Chemical Disinfection (Utilizing chemical agents, often used where thermal methods are impractical)

- Combined Ultrasonic and Washer Disinfection Systems (Integrated two-stage cleaning)

- By End-User:

- Dental Hospitals and Large Clinics (Including Dental Service Organizations)

- Independent Dental Practices (General and specialty private clinics)

- Academic & Research Institutes (Focus on R&D and training)

- By Operation Mode:

- Fully Automatic Systems (Minimal human interaction, automated dosing and cycle selection)

- Semi-Automatic Systems (Require manual loading or process initiation)

Value Chain Analysis For Dental Washer and Washer Disinfectors Market

The value chain for the Dental Washer and Washer Disinfectors Market begins with upstream activities involving the sourcing of specialized components, including corrosion-resistant stainless steel chambers, sophisticated electronic controls (PLCs), high-precision dosing pumps, and highly durable seals and filters designed for continuous exposure to high heat and aggressive chemicals. Due to the stringent regulatory nature of the end product, component quality and supplier reliability are paramount. Manufacturers often integrate vertically for critical sub-assemblies, particularly software and control systems, to maintain proprietary control over quality assurance and intellectual property related to cycle optimization algorithms. Upstream efficiency and certified component sourcing significantly impact the final cost, durability, and compliance level of the finished washer disinfector unit. Key suppliers are often specialized in medical-grade materials, and their certification processes must align strictly with the device manufacturer’s required international standards, forming a crucial bottleneck that necessitates reliable long-term supplier relationships.

Midstream processes involve precise assembly, rigorous testing, and complex software integration. Unlike conventional manufacturing, the production of washer disinfectors includes extensive validation protocols to prove cycle efficacy, thermal mapping accuracy, and robust compliance with standards such as EN ISO 15883, often requiring sterile or clean environments for final assembly. This stage is capital-intensive, demanding specialized testing equipment and highly skilled technical labor for calibration and final product release. Downstream activities are dominated by distribution and mission-critical after-sales support. The vast majority of sales are handled through specialized indirect distribution channels, involving medical equipment distributors who possess the necessary technical expertise for complex installation, commissioning, validation support, and mandatory staff training in diverse clinical settings. Direct sales typically target large national hospital systems or government procurement contracts where centralized, complex negotiations are required.

Service and maintenance—including annual recalibration, mandatory performance qualification checks, and reliable supply of proprietary consumables (detergents, rinse aids)—form a critical, high-margin component of the downstream value chain. This heavy reliance on specialized, indirect channels emphasizes the importance of strong, often exclusive, partnerships with distributors who can ensure local compliance adherence and provide timely technical assistance, which is essential given the critical role of these devices in patient safety. The complexity and regulatory necessity of post-sale support means it is often bundled into mandatory, multi-year service contracts, transforming the relationship between manufacturer and customer from transactional to long-term partnership-based. This structure ensures that only manufacturers capable of supporting a comprehensive global service network can compete effectively in the high-end institutional segment of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $380 Million |

| Market Forecast in 2033 | $605 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Miele & Cie. KG, Belimed AG, Getinge AB, SciCan Ltd., SMEG S.p.A., Steelco S.p.A., Dentsply Sirona, Tuttnauer, Custom Ultrasonics Inc., STERIS Plc, Hu-Friedy Mfg. Co. LLC, CISA Production S.r.l., W&H Dentalwerk International, Matachana Group, FOTRIC Instruments Co. Ltd., DentalEZ Group, Medisafe International, Coltene Whaledent, MELAG Medizintechnik, IC Medical GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Washer and Washer Disinfectors Market Key Technology Landscape

The current technology landscape is predominantly defined by microprocessor-controlled thermal disinfection systems that utilize precise temperature and hold times to achieve validated A0 values, ensuring consistent and reproducible pathogen inactivation according to EN ISO 15883 standards. Modern units feature advanced connectivity, enabling critical functions such as remote diagnostics, secure cycle verification via digital signatures, and seamless integration with third-party instrument tracking systems (like barcode or RFID systems). These digital features are paramount for establishing the mandated comprehensive audit trail and enhancing GEO relevance for compliance-focused searches. Innovation is heavily focused on hydraulic and mechanical optimization to improve cleaning efficacy in hard-to-reach areas of complex dental instruments, simultaneously reducing water consumption per cycle through intelligent recirculation and high-efficiency filtration systems.

A critical technological trend involves the development of specialized systems engineered to address the unique challenge of reprocessing narrow lumen instruments, particularly complex dental handpieces. This includes implementing specialized high-pressure injection ports and proprietary adapters that force detergent and disinfectant through internal channels, followed by validated air purging to ensure internal drying. Furthermore, manufacturers are focusing on sophisticated Human-Machine Interface (HMI) design, providing intuitive, error-proofing touchscreen controls that simplify complex cycle selection and minimize the risk of procedural mistakes by busy clinic staff. The chemical aspect is also advancing, with manufacturers collaborating with detergent suppliers to develop highly effective, environmentally compliant enzymatic detergents and rinse aids that are precisely dosed by the machine to maximize cleaning performance while preserving the integrity of expensive dental tools.

Looking ahead, the technology landscape is rapidly converging with the broader Internet of Medical Things (IoMT). New generations of washer disinfectors are designed not just to log data, but to communicate proactively with Central Sterile Supply Department (CSSD) management software, automatically logging cycle success/failure data, triggering preventative maintenance alerts, and contributing to the centralized instrument history record. This drive toward integrated data security and automated compliance reporting facilitates superior quality management and operational efficiency analysis across entire networks of clinics. Moreover, complementary technologies, such as enhanced ultrasonic cleaning, are seeing improvements in power regulation and frequency modulation to ensure more uniform and effective pre-treatment cavitation across diverse loads, further supporting the robust, multi-stage reprocessing workflow deemed necessary by international safety regulators.

Regional Highlights

- North America: This region is characterized by exceptionally strict regulatory oversight (FDA and CDC standards) and high healthcare spending. The market is mature and dominated by large-scale Dental Service Organizations (DSOs) that demand high-capacity, fully automated thermal disinfectors with advanced tracking and validation features. High adoption is driven by mandatory compliance and a strong emphasis on mitigating medico-legal risks associated with cross-contamination, ensuring this region remains a leader in technology adoption and premium pricing.

- Europe: Europe represents a highly significant market, propelled by harmonized standards such as EN ISO 15883 and robust national regulations (e.g., UK's HTM 01-05). Western European countries, particularly Germany, the UK, and Scandinavia, are major revenue contributors, demonstrating high adoption of technologically advanced, energy-efficient machines. Sustainability mandates are also crucial here, driving innovation toward reduced chemical usage and lower energy footprints, offering AEO relevance for Green Procurement inquiries.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally. This expansion is fueled by rising dental healthcare expenditure, rapidly increasing public awareness of hygiene standards, and significant government investment in modernizing public and private healthcare infrastructure in countries like China, India, and South Korea. While price sensitivity exists, the rapid establishment of modern dental chains and increasing adherence to international safety protocols are accelerating the demand for reliable, automated washing and disinfection solutions across the region.

- Latin America (LATAM): The LATAM market is growing steadily, though often constrained by macroeconomic instability and reliance on imported equipment. Adoption is concentrated in private clinics in major metropolitan areas seeking to align with international patient safety standards to attract medical tourism. Benchtop models offering high performance at a moderate investment are popular, and market penetration heavily relies on localized service support, financing options, and distributor relationships capable of navigating complex import regulations.

- Middle East and Africa (MEA): Growth in the MEA region is strongly focused in the wealthy Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia, Qatar), where massive investment in state-of-the-art medical tourism facilities drives demand for premium, high-specification disinfectors, often requiring systems compatible with advanced hospital management software. Outside of the GCC, the market remains nascent, focused mainly on basic cleaning solutions, with uptake accelerating only in urban private healthcare centers where recognized international accreditation demands validated infection control procedures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Washer and Washer Disinfectors Market.- Miele & Cie. KG

- Belimed AG

- Getinge AB

- SciCan Ltd.

- SMEG S.p.A.

- Steelco S.p.A.

- Dentsply Sirona

- Tuttnauer

- Custom Ultrasonics Inc.

- STERIS Plc

- Hu-Friedy Mfg. Co. LLC

- CISA Production S.r.l.

- W&H Dentalwerk International

- Matachana Group

- FOTRIC Instruments Co. Ltd.

- DentalEZ Group

- Medisafe International

- Coltene Whaledent

- MELAG Medizintechnik

- IC Medical GmbH

- Kavo Kerr (Envista Holdings Corporation)

- Midmark Corporation

- Planmeca Oy

- Tecno-Gaz SpA

- Schuster Dental GmbH

Frequently Asked Questions

Analyze common user questions about the Dental Washer and Washer Disinfectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a dental washer and a washer disinfector?

A dental washer primarily uses detergent and water to clean instruments (removing physical bioburden), whereas a washer disinfector performs the cleaning function and follows it with a validated thermal or chemical disinfection cycle, ensuring inactivation of vegetative bacteria and certain viruses before instruments proceed to sterilization, thus meeting higher regulatory safety thresholds.

Why are automated washer disinfectors replacing manual cleaning in dental practices?

Automated washer disinfectors ensure standardization, traceability, and repeatability of the cleaning process, critical for regulatory compliance (e.g., ISO 15883). They significantly reduce the risk of staff exposure to sharps injuries and guarantee a measurable level of pre-sterilization cleanliness that manual methods cannot reliably guarantee.

Which regulatory standard is most critical for washer disinfector compliance?

The most critical international standard is EN ISO 15883, which specifies requirements for equipment used for the cleaning and thermal disinfection of medical devices. Compliance ensures the machine achieves validated performance, particularly regarding the A0 value for thermal disinfection, which is essential for audit trails.

How does the capacity of the washer disinfector affect purchasing decisions for dental clinics?

The required capacity is determined by the clinic’s daily instrument throughput and physical space constraints. High-volume Dental Service Organizations (DSOs) require centralized, cabinet-style units, while smaller independent practices prioritize compact, under-counter or benchtop units to optimize limited operational space and minimize initial capital expenditure.

What is the role of digital integration or IoT in the future of these devices?

Digital integration allows for automated documentation, remote performance monitoring, real-time cycle data verification, and predictive maintenance alerts. This significantly enhances traceability for audit purposes and minimizes operational downtime, transforming the device into a critical node in the facility's overall digital patient safety and compliance management system.

The increasing complexity of dental procedures, particularly in areas like implantology and endodontics, mandates the use of increasingly specialized and delicate instruments, which require highly sophisticated reprocessing protocols. This drives manufacturers to invest heavily in cycle customization software and instrument-specific racks and holders to protect instrument integrity while maximizing cleaning exposure. The shift towards minimal processing time without compromising efficacy is a central competitive battleground. Manufacturers are continuously refining wash chemistry, focusing on enzymatic detergents that operate efficiently at lower temperatures, reducing the thermal load on instruments and potentially extending their operational life. This focus on instrument preservation is a key marketing angle, particularly appealing to large dental organizations that manage significant asset inventories and face rising costs for instrument replacement. Furthermore, regulatory bodies in mature markets, such as the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA), are continually updating guidance, forcing companies to implement robust post-market surveillance and continuous validation studies, reinforcing the barrier to entry for smaller or non-compliant firms. The longevity and verifiable performance of the equipment are now prioritized over initial purchase cost, reflecting a mature market focused on total cost of ownership (TCO) and risk management, which aligns perfectly with AEO strategies emphasizing long-term value propositions over simple price comparisons. This dynamic provides a competitive advantage to legacy manufacturers with established validation documentation and global service networks capable of supporting high-stakes clinical operations across multiple continents.

In the context of geographical segmentation, the burgeoning middle classes in Asia Pacific nations are demanding higher standards of oral healthcare, which directly translates into increased investment in modern dental infrastructure. Governments in India, China, and Southeast Asian countries are launching extensive initiatives to combat communicable diseases and modernize healthcare facilities, making infection control technology a national health priority. This regional demand is often characterized by a need for rugged, easy-to-maintain equipment that can handle variations in water quality and power supply reliability, necessitating localized product adaptations and robust filtering mechanisms. Conversely, in North America, market growth is sustained not only by relentless regulatory enforcement but also by the rapidly accelerating consolidation trend in dentistry, where Dental Service Organizations (DSOs) purchase large volumes of standardized equipment to centralize sterilization activities across dozens or hundreds of affiliated clinics. This centralization requires high-throughput models that interface flawlessly with computerized maintenance management systems (CMMS) and enterprise resource planning (ERP) software, pushing innovation towards systems optimized for high utilization and minimal, error-prone human interaction. The economic resilience of the dental sector, even during minor recessions, due to the essential and often non-discretionary nature of acute dental care, provides a necessary stabilizing factor for the demand for essential capital equipment like washer disinfectors, guaranteeing sustained market growth throughout the entirety of the forecast period.

Technological differentiation extends beyond simple washing cycles to include sophisticated features designed explicitly for operator safety and comprehensive process assurance. Many advanced units incorporate automated double door locking mechanisms during critical phases, integrated air drying cycles using filtered high-efficiency particulate air (HEPA) to prevent post-disinfection recontamination, and internal conductivity monitoring systems to meticulously ensure final rinse water purity meets regulatory standards. These features directly address common points of failure and operational risk in the reprocessing chain. The trend towards sustainable operation is also driving the adoption of heat recovery systems, where waste thermal energy from the high-temperature wash cycles is efficiently captured and utilized to preheat subsequent loads, thereby substantially reducing the system's overall energy consumption and operational expense. This commitment to environmental compliance is increasingly valued by institutional customers operating under mandatory mandates for green purchasing policies and corporate social responsibility goals. Furthermore, the communication link between the washer disinfector and the final sterilization equipment (autoclaves) is becoming tighter, with seamless, secure data transfer ensuring that a complete, unbroken chain of custody and validation is maintained for every instrument set. This end-to-end data security and compliance verification capability is particularly compelling for regulatory auditors and is a key driver for upgrading older, standalone units to integrated, network-enabled systems capable of generating fully auditable digital records.

The challenge of reprocessing dental handpieces, which contain extremely complex internal channels and moving parts, has spurred significant specialized investment in washer disinfector technology. Traditional cleaning methods consistently struggled to ensure adequate fluid dynamics within these narrow lumens. Modern machines feature specialized, high-pressure pressurized injection ports that actively flush detergent and disinfectant solutions through these channels, combined with validated air purging cycles to remove moisture and prevent microbial re-growth post-disinfection. This specialization demonstrates the market's agility in responding to specific high-risk clinical needs and regulatory demands. Furthermore, material compatibility remains a critical restraint; the specialized chemistry used in detergents must be rigorously tested to ensure it does not cause pitting, tarnishing, or corrosion to the often expensive and sensitive instruments, which frequently include highly polished titanium or complex ceramic components. Manufacturers must provide rigorous scientific evidence that their cleaning agents and cycle parameters are universally safe for the vast array of materials used in contemporary dental instrumentation, placing product chemistry development firmly within the market’s technological and competitive scope. The market is thus highly technical, driven equally by precision mechanical engineering, advanced chemical science, and computational control systems, demanding specialized expertise from all market participants.

In terms of competition, the market structure is moderately consolidated, with a few global leaders maintaining a dominant position by dictating technological standards and market pricing, particularly in the high-capacity institutional segment. However, regional manufacturers maintain a strong and vital presence in the benchtop and mid-range segment by offering regionally competitive pricing and localized service advantages tailored to specific market demands. Mergers and acquisitions remain common as larger entities strategically seek to acquire patented technologies or rapidly expand their geographical footprint into high-growth APAC or LATAM territories, leveraging acquisition to bypass lengthy regulatory approval processes. Strategic competitive positioning requires not only superior product performance but also exceptional reliability of the accompanying service infrastructure—including a highly skilled team of validation experts, rapid spare parts availability, and guaranteed 24/7 technical support. Failure to provide consistent, high-quality after-sales support can rapidly erode market share, given the mission-critical nature of the equipment in the infection control workflow. Investment in sophisticated digital platforms that allow end-users to troubleshoot minor issues or schedule preventative maintenance remotely is becoming standard practice to enhance the customer experience and reduce critical service response times, further optimizing the entire value proposition for potential customers seeking maximum uptime and documented regulatory compliance, significantly boosting the GEO profile of service-focused suppliers.

The influence of AI in optimizing reprocessing workflows is highly anticipated to move beyond mere data monitoring and evolve into autonomous, risk-based decision-making regarding optimal cycle selection. For example, future AI systems could use sophisticated image recognition technology to scan the instrument load, accurately identify the specific types and material composition of instruments present, and automatically select the most aggressive yet compatible cleaning cycle, thereby minimizing instrument wear while ensuring maximum disinfection efficacy. This level of smart automation drastically reduces reliance on extensive operator training and adherence to complex procedural manuals, minimizing the potential for human error. Furthermore, seamless integration with electronic health records (EHR) systems will enable full traceability of sterilized instruments back to the individual patient and procedure, a crucial requirement for advanced medico-legal risk management and epidemiological tracking. This deep data linkage transforms the washer disinfector from a simple piece of cleaning equipment into an integral component of the digital patient safety record, demanding a high degree of cybersecurity. The evolution towards smart factories in the dental equipment manufacturing sector also implies that AI will optimize the production and supply chain of the disinfectors themselves, predicting global demand fluctuations with greater accuracy and optimizing inventory levels for faster delivery to high-growth regions, thereby strengthening the efficiency of the entire market ecosystem and improving supplier response times.

The expansion of group dental practices, known as Dental Service Organizations (DSOs), represents a fundamental shift in the market's purchasing power dynamics. DSOs leverage massive scale to enforce strict standardization across all their affiliated locations, creating substantial bulk purchasing opportunities and driving demand for standardized, fully networkable washer disinfector models that simplify training and maintenance across a geographically dispersed portfolio of clinics. This centralization requires high-level data management capabilities, where performance data from every unit in the network is aggregated into a single, centralized dashboard for compliance oversight and quality assurance analysis. This elevated demand for deep integration pushes manufacturers toward developing open architecture software platforms that can communicate effectively with proprietary DSO management systems, further demonstrating the increasing reliance on complex IT infrastructure within the traditionally mechanical domain of instrument reprocessing. The core emphasis here is on minimizing operational variation and maximizing verifiable data integrity across the entire organization, making AEO relevant data reporting and compliance certification a non-negotiable feature for top-tier market positioning and procurement tenders issued by DSOs and large institutional buyers worldwide.

Regarding restraints, the initial capital cost hurdle is significantly exacerbated by the need for associated infrastructural upgrades, such as specialized plumbing for continuous distilled or deionized water supply, enhanced ventilation systems to manage steam and heat dissipation, and dedicated high-voltage electrical circuits required for powerful thermal units. For small independent practices, these ancillary infrastructural costs can sometimes surpass the initial purchase price of the unit itself, often becoming the deciding factor against adoption. To address this, manufacturers are strategically developing lower-powered or highly water-efficient models that minimize infrastructural demands, specifically targeting the vast, under-penetrated market of single-chair and two-chair dental offices globally. Furthermore, the market faces significant challenges related to staff training efficacy and compliance fatigue. Even the most advanced automated system requires correct instrument loading and accurate cycle parameter setting by rigorously trained personnel. Therefore, manufacturers that successfully integrate sophisticated instructional guidance, error-proofing mechanisms, and easily navigable user interfaces gain a substantial competitive edge by effectively reducing operational risk and ensuring reliable, compliant performance in routine clinical use, thereby directly addressing AEO searches related to ease-of-use and staff training effectiveness.

The opportunity presented by technological convergence extends profoundly into sophisticated maintenance and training solutions, particularly through the use of augmented reality (AR). Field service engineers are beginning to utilize AR overlays projected onto the machines to quickly diagnose complex mechanical issues and guide remote technical assistance, significantly reducing the downtime required for complex repairs. For end-users, AR-guided training modules can ensure instruments are correctly positioned in the wash racks, eliminating a major source of reprocessing failure (improper loading). This fusion of durable hardware with advanced digital service delivery illustrates how the dental washer and washer disinfectors market is evolving beyond simple machinery towards integrated, data-rich infection control platforms. The inherent specialization of the technology and the strict regulatory environment ensure that generic manufacturing firms cannot easily enter this segment, preserving the specialized expertise and market share of established medical device specialists who possess the necessary intellectual property, validation track records, and global service capabilities required for successful governmental and institutional procurement contracts, thus maintaining a stable competitive landscape fiercely focused on verifiable quality and documented compliance over pure cost competition.

The robust global focus on sustainability and environmental stewardship is increasingly compelling manufacturers to rethink the chemistry, water usage, and energy consumption associated with the disinfection process. Research and development efforts are now strategically focused on creating highly effective, biodegradable, and non-toxic detergents and optimizing rinse cycles to minimize water consumption, addressing not only environmental concerns but also the high operational costs associated with purified water usage, particularly in regions facing severe water scarcity. The exploratory development of advanced technologies like localized cold plasma or highly efficient advanced oxidation processes for potential future integration is being examined as potentially highly energy-efficient alternatives to traditional thermal methods, although these currently remain largely in the experimental phases for high-volume dental applications. Current thermal units are rapidly improving their energy footprint through better chamber insulation, faster heating elements, and intelligent cycle scheduling software. The market narrative is increasingly centering on "Green Sterilization," appealing strongly to healthcare systems committed to reducing their carbon footprint, which acts as a powerful secondary purchasing driver alongside the primary concerns of regulatory compliance and guaranteed clinical efficacy. This emphasis on dual benefits—unwavering safety and demonstrable sustainability—significantly enhances the market's visibility and relevance in broader healthcare policy discussions globally, favoring vendors that can document superior ecological performance metrics.

Another key factor driving the adoption in emerging regions is the increased availability of localized financing and creative leasing models. Recognizing the substantial upfront investment required for high-end automated equipment, manufacturers and large distributors are strategically offering flexible payment structures, making high-quality, validated systems financially accessible to smaller clinics in APAC and LATAM that might otherwise be forced to rely on manual or outdated, riskier methods. This financial innovation effectively lowers the barrier to entry and dramatically accelerates the transition away from non-compliant cleaning practices. Furthermore, governmental incentives, such as investment subsidies frequently seen in European Union member states or tax breaks for certified medical equipment, play a pivotal role in stimulating regional demand. These incentives effectively subsidize the compliance upgrade process, further cementing the dominance of automated washer disinfectors over non-validated manual alternatives. The long-term growth projection for the market is therefore strongly correlated not only with continued stringency in global health regulations but also with the corresponding innovation in financing and service delivery models, ensuring that validated reprocessing technology becomes universally accessible across all economic tiers of the global dental industry, solidifying the market's trajectory towards its projected valuation by 2033.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager