Dental Washer-Disinfectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435158 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Dental Washer-Disinfectors Market Size

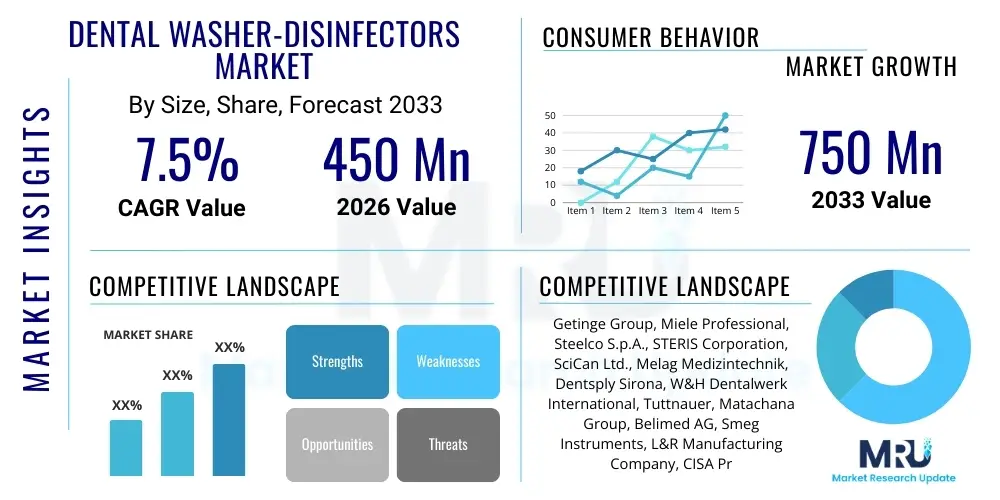

The Dental Washer-Disinfectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Dental Washer-Disinfectors Market introduction

The Dental Washer-Disinfectors Market encompasses specialized medical devices designed to automate the cleaning and thermal disinfection of dental instruments prior to sterilization. These sophisticated machines represent a crucial advancement in infection control protocols within dental clinics, hospitals, and academic institutions globally, ensuring consistent and reproducible high-level disinfection far superior to manual cleaning processes. The core function of these devices is to remove biological debris, blood, and other contaminants from complex instruments, thereby maximizing the efficacy of subsequent sterilization steps. As regulatory bodies worldwide enforce increasingly stringent guidelines regarding cross-contamination prevention, the adoption of automated washer-disinfectors has become an industry standard, replacing less reliable ultrasonic baths and manual scrubbing methods that pose significant risk to both patients and clinical staff. The market growth is inherently tied to the rising global awareness of healthcare-associated infections (HAIs) and the persistent expansion of dental services driven by cosmetic dentistry and increasing disposable income in emerging economies.

Product offerings in this sector vary primarily by capacity, cycle speed, connectivity features, and specialized instrument racks tailored for specific dental tools such such as high-speed handpieces, endodontic files, and general operative instruments. Major applications span general dentistry, oral surgery, periodontics, and orthodontics, where the high throughput of instruments necessitates rapid and reliable decontamination cycles. The integration of advanced features like validation logging, automated detergent dosing, and cycle traceability systems is central to the value proposition, allowing dental practices to maintain robust audit trails compliant with international standards like ISO 15883. Furthermore, the ergonomic benefits for staff, who are shielded from direct exposure to contaminated sharps and chemical cleaning agents, further accelerate the replacement cycles of older, less automated disinfection equipment, cementing the market’s steady upward trajectory.

The key driving factors propelling the adoption of dental washer-disinfectors include the mandated need for enhanced patient safety standards, technological advancements leading to faster and more energy-efficient machines, and the economic benefit derived from reduced labor costs and standardization of disinfection procedures. The consistent cleaning performance minimizes the risk of instrument damage associated with manual handling and ensures prolonged longevity of expensive dental tools. Coupled with the rising incidence of infectious diseases, the necessity for validated and automated instrument processing methodologies positions dental washer-disinfectors as indispensable assets in modern dental healthcare infrastructure. Investment in infrastructure upgrades and the establishment of centralized sterilization departments (CSDs) within larger multi-specialty dental centers further reinforces the demand structure.

Dental Washer-Disinfectors Market Executive Summary

The Dental Washer-Disinfectors Market exhibits strong business trends characterized by intense competition among established medical device manufacturers, a consistent focus on compliance with stringent quality and validation standards, and a notable shift towards integrated, smart connectivity solutions. Regional trends indicate that North America and Europe currently dominate the market due to robust regulatory frameworks and high healthcare expenditure, while the Asia Pacific region is poised for the highest growth rate, driven by rapidly expanding dental tourism and increasing foreign direct investment in private dental clinics. Segment trends highlight the dominance of larger capacity units, particularly in institutional settings, and a rising preference for thermal disinfection methods utilizing demineralized water for optimal instrument preservation. Furthermore, consumables such as specialized cleaning detergents and rinsing aids constitute a significant recurring revenue stream, influencing long-term vendor selection and service contract renewals.

The market environment is witnessing a consolidation trend, with leading players acquiring smaller specialized technology providers to enhance portfolio breadth and geographic reach. A key strategic imperative across the industry is the development of washer-disinfectors optimized for complex, narrow-lumened instruments, such as dental handpieces, which require specific injection ports and cycle parameters to ensure thorough internal cleaning and oil removal before sterilization. Innovation is centered on improving user interface (UI) design, reducing cycle times to improve clinic throughput, and enhancing energy and water efficiency, aligning with broader sustainability goals within healthcare operations. These technological enhancements are crucial for maintaining market share in highly regulated mature economies.

The increasing digitalization of dental practices significantly influences the washer-disinfector segment. Connectivity features that enable automated data logging, remote diagnostics, and integration with practice management software are increasingly becoming standard requirements, particularly for large dental service organizations (DSOs) managing multiple locations. This emphasis on data integrity and ease of auditing minimizes administrative burden and maximizes operational efficiency. The market segments are also seeing increased differentiation based on size—from compact benchtop models suited for small private practices to large-volume floor-standing units required by dental schools—ensuring that solutions are available across the entire spectrum of dental care providers, guaranteeing sustained market penetration.

AI Impact Analysis on Dental Washer-Disinfectors Market

Common user questions regarding AI's impact on dental washer-disinfectors revolve primarily around operational efficiency, preventative maintenance, and cycle validation integrity. Users frequently inquire about how AI algorithms can predict equipment failure based on usage patterns, optimize wash cycle parameters in real-time depending on the instrument load composition, and autonomously verify compliance with disinfection standards by analyzing cycle data anomalies. Key themes emerging from these queries highlight a desire to minimize downtime, reduce human error in compliance documentation, and leverage machine learning to move beyond fixed cycle times to dynamically adjusted, resource-efficient processes. Concerns often center on the security of cloud-based data storage related to compliance logs and the reliability of AI-driven validation systems substituting human oversight.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is beginning to transform the operational intelligence of dental washer-disinfectors, although the primary cleaning mechanism remains electro-mechanical and thermal. AI’s influence is most pronounced in predictive maintenance capabilities. By analyzing historical performance data, temperature fluctuations, pressure deviations, and component wear, ML algorithms can accurately predict potential component failures (e.g., pump issues or heating element degradation) before they occur. This shift from reactive to proactive servicing significantly minimizes unexpected downtime in busy dental environments, enhancing overall instrument processing efficiency and maximizing asset utilization, which is critical for profitability.

Furthermore, AI is instrumental in enhancing cycle validation and documentation. Advanced systems utilize ML models to analyze real-time cycle data—including water quality parameters, chemical dosing volumes, and temperature gradients—against pre-defined validated thresholds. If the system detects subtle anomalies that might not trigger standard alarms but indicate suboptimal performance (e.g., slightly lower residual enzyme activity), the AI can flag the cycle for closer human review or automatically initiate a diagnostic check. This smart validation layer ensures higher fidelity in infection control processes, crucial for meeting complex regulatory requirements and bolstering patient confidence in the practice’s decontamination integrity, thus serving as a potent differentiator in a competitive market.

- AI-driven predictive maintenance reducing unexpected equipment downtime.

- Machine learning optimization of wash and disinfection cycles based on instrument load and water quality.

- Enhanced, autonomous data logging and cycle validation integrity checks using algorithms.

- Integration with inventory management systems to track instrument reprocessing frequency and lifespan.

- Improved error detection and root cause analysis in failed disinfection cycles.

DRO & Impact Forces Of Dental Washer-Disinfectors Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces shaping adoption rates and technological trajectory. The principal driver is the non-negotiable requirement for regulatory compliance, specifically related to the prevention of bloodborne pathogen transmission in healthcare settings. Restraints often include the significant initial capital outlay required for high-end automated systems, particularly burdensome for smaller private practices, and the perceived complexity of transitioning from familiar manual procedures to sophisticated automated workflows, requiring specialized training and maintenance expertise. However, substantial opportunities arise from the global trend toward centralized sterilization processing and the increasing demand for validated documentation, which automated washer-disinfectors inherently provide, offering a clear competitive advantage over manual or semi-automated methods.

Impact forces are primarily characterized by economic pressures and regulatory mandates. Economic forces push manufacturers to develop energy-efficient models with reduced water consumption, lowering the total cost of ownership for end-users. The continuous evolution of materials science in dental instrumentation also impacts washer-disinfector design; instruments are becoming more delicate and complex (e.g., 3D-printed guides or specialized rotary files), requiring gentler, yet highly effective, cleaning protocols that only advanced automation can guarantee. The collective impact of these forces fosters an environment where innovation is mandatory, favoring manufacturers capable of offering integrated solutions that cover cleaning, disinfection, traceability, and drying in a single, efficient footprint.

Technological impact forces are driving the convergence of washing, disinfection, and documentation into a seamless process. The industry is moving towards systems capable of real-time monitoring and reporting, reducing reliance on manual record-keeping. The growing prevalence of multi-drug resistant organisms (MDROs) also serves as a strong underlying force, compelling healthcare providers to adopt the highest standard of instrument reprocessing available. While the high maintenance cost and the dependence on specialized consumables (detergents, neutralizers) can act as short-term restraints, the long-term benefits in terms of liability reduction, enhanced patient safety, and improved clinical efficiency strongly outweigh these initial hurdles, ensuring sustained market expansion.

Segmentation Analysis

The Dental Washer-Disinfectors Market is comprehensively segmented based on product type, capacity, technology, and end-user, allowing for precise market analysis and strategic targeting. Segmentation by product type primarily distinguishes between standalone washer-disinfectors, which dominate the market, and integrated sterilization centers, which combine washing, disinfection, and sterilization functionalities into a unified system. Capacity segmentation is vital, separating high-volume units (typically floor-standing models used in large dental hospitals or CSDs) from medium and low-volume benchtop models favored by smaller private practices. Technology segmentation differentiates thermal disinfection using high temperatures from chemical disinfection methods, though thermal methods are generally preferred for superior validation and reduced chemical residue risks.

The end-user segment is crucial for understanding demand patterns, identifying dental hospitals, specialized dental clinics, educational institutions (dental schools), and research laboratories as key consumer groups. Dental hospitals and large clinics require the highest capacity and fastest throughput due to their volume of procedures, driving demand for technologically advanced, network-integrated units. Conversely, smaller specialty clinics prioritize compactness and ease of use. This structural heterogeneity mandates that manufacturers maintain a diversified product portfolio capable of meeting the distinct operational requirements and budget constraints across the varying segments.

Further granularity is achieved through regional segmentation, where regulatory differences significantly influence market preference. For example, strict national standards in Europe often lead to higher adoption rates of validated, thermal washer-disinfectors compared to some regions where budget constraints might favor less sophisticated cleaning solutions. Analyzing these segments provides stakeholders with actionable intelligence regarding emerging market needs, competitive positioning, and opportunities for product localization and differentiation, ultimately supporting effective resource allocation and strategic market entry decisions across different geographical areas.

- By Product Type:

- Cabinet Type (Floor-standing)

- Benchtop Type

- By Capacity:

- High-Volume (>10 Trays)

- Medium-Volume (5-10 Trays)

- Low-Volume (<5 Trays)

- By Technology:

- Thermal Disinfection

- Chemical Disinfection

- By End-User:

- Dental Hospitals and Clinics

- Dental Academic and Research Institutes

- Dental Service Organizations (DSOs)

Value Chain Analysis For Dental Washer-Disinfectors Market

The value chain for the Dental Washer-Disinfectors Market commences with upstream activities involving the sourcing of high-grade stainless steel, precision pumps, heating elements, control boards, and specialized sensors from component suppliers, necessitating rigorous quality control to ensure longevity and reliability under high heat and chemical exposure. Manufacturing involves complex assembly processes, stringent adherence to ISO 13485 standards, and extensive validation testing to meet medical device regulatory requirements globally. Midstream activities involve the formulation and supply of proprietary cleaning agents (enzymes, detergents, and neutralization chemicals), which are critical consumables and often represent a high-margin revenue stream for key equipment providers, or are supplied by specialized chemical partners.

Downstream activities center on distribution channels, which are bifurcated into direct sales and indirect sales models. Direct sales are often utilized for large-scale institutional contracts, such as supplying major hospital groups or national purchasing organizations, allowing manufacturers to maintain tight control over pricing, installation, training, and long-term service agreements. Indirect channels involve authorized medical equipment distributors and dental supply houses, particularly effective for reaching smaller, geographically dispersed private dental practices. These distributors offer localized inventory, immediate service support, and integration expertise, acting as vital conduits for market penetration in highly fragmented segments.

Post-sales service and maintenance form a crucial component of the value chain, heavily influencing customer satisfaction and repeat business. Due to the critical nature of these devices in infection control, rapid response times for repairs, periodic calibration, and preventative maintenance contracts are highly valued. The profitability of the overall ecosystem is significantly determined by the steady sales of specialized cleaning consumables and high-value service contracts, rather than solely on the initial hardware sale. The effectiveness of the distribution channel, supported by comprehensive technical training and accessible customer support, directly correlates with market share dominance and brand loyalty.

Dental Washer-Disinfectors Market Potential Customers

Potential customers for dental washer-disinfectors are diverse yet uniformly centered on professional settings requiring stringent, validated instrument reprocessing. The primary and largest segment of end-users consists of Dental Hospitals and Large Specialty Clinics, including those affiliated with university medical centers. These institutions manage vast numbers of surgical and examination instruments daily, necessitating high-capacity, automated units that can integrate seamlessly with Central Sterilization Service Departments (CSSD) infrastructure and provide robust traceability features for audit trails. Their purchase decisions are typically driven by throughput capacity, compliance features, and long-term service agreements.

The second major group comprises Private Dental Practices and Dental Service Organizations (DSOs). While individual private practices may opt for smaller benchtop models, DSOs, which aggregate multiple locations under centralized management, increasingly require standardized, network-compatible washer-disinfectors to enforce uniform infection control protocols across all sites. Standardization allows for centralized purchasing of consumables and simplified staff training, making efficiency and connectivity key purchasing determinants for this growing segment.

The third significant customer base includes Dental Academic and Research Institutions, such as dental schools. These entities utilize the equipment not only for clinical service but also for training future professionals and conducting research on infection control efficacy. They often seek equipment that provides maximal instructional flexibility and detailed data logging for academic studies. Finally, specialized medical laboratories that handle dental prosthetic materials or perform testing related to oral health and microbiology also represent niche but important buyers requiring precise and validated disinfection protocols for their instruments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Getinge Group, Miele Professional, Steelco S.p.A., STERIS Corporation, SciCan Ltd., Melag Medizintechnik, Dentsply Sirona, W&H Dentalwerk International, Tuttnauer, Matachana Group, Belimed AG, Smeg Instruments, L&R Manufacturing Company, CISA Production S.p.A., Zhermack S.p.A., Coltene Whaledent, Midmark Corporation, 3M Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Washer-Disinfectors Market Key Technology Landscape

The technological landscape of the Dental Washer-Disinfectors Market is defined by precision engineering aimed at validation, efficiency, and connectivity. The dominant technology remains Thermal Disinfection, utilizing high temperatures (typically 90-95°C) maintained for a specified time (A0 value) to achieve microbiological inactivation, primarily favored for its high reproducibility and lower reliance on chemical residue management compared to pure chemical disinfection. Advanced systems incorporate precise dosage pumps for enzymatic detergents and neutralizers, ensuring that the critical cleaning phase optimally removes proteinaceous contamination without harming specialized instrument coatings or micro-surfaces. The use of high-efficiency particulate air (HEPA) filtered drying systems is also standard, crucial for preventing recontamination after the disinfection cycle and preparing instruments properly for subsequent sterilization.

A significant technological focus is on Automated Cycle Validation and Data Traceability. Modern washer-disinfectors are equipped with integrated microprocessors, real-time monitoring sensors (tracking temperature, pressure, and conductivity), and non-volatile memory for storing detailed cycle logs. Connectivity through Ethernet or Wi-Fi allows these logs to be automatically transferred to centralized data management systems, meeting stringent legal requirements for documentation. This capability moves the market beyond basic data recording to offering predictive analytics and seamless integration with patient records, optimizing compliance workflows and significantly reducing administrative burden related to manual log verification and storage.

Furthermore, innovations specific to dental requirements are driving the market. This includes the development of Specialized Injection Systems for Handpieces and Lumened Instruments. Dental handpieces, being complex medical devices with internal channels for water and air, require dedicated high-pressure flushing systems within the washer-disinfector unit to ensure internal cleaning and oil removal. Leading manufacturers differentiate their offerings by engineering specific coupling mechanisms and cycle parameters tailored to the delicate nature and lubrication requirements of different types of rotary instruments, ensuring both effective disinfection and prolonged instrument lifespan. These precise technological adaptations are essential for maintaining efficacy and cost-efficiency in high-volume dental practices.

Regional Highlights

The global Dental Washer-Disinfectors Market displays pronounced regional disparities in adoption, regulation, and growth momentum, fundamentally shaping competitive strategies for market players. North America, particularly the United States, represents a mature market characterized by the highest healthcare spending globally, the presence of numerous large Dental Service Organizations (DSOs), and extremely rigorous infection control regulations enforced by bodies like the FDA and CDC. This high regulatory pressure drives the demand for premium, validated, automated systems with advanced traceability features. The market here is highly replacement-driven, focusing on upgrades to networked, high-efficiency models.

Europe is another dominant region, defined by highly standardized regulations, especially under the European Medical Device Regulation (MDR) and specific national standards (e.g., DIN standards in Germany and HTM guidelines in the UK). Western European countries exhibit high penetration rates for automated washer-disinfectors, often favoring manufacturers who meet or exceed the stringent EN ISO 15883 standards. Economic stability and public healthcare investments ensure consistent demand, with innovation focused on environmental impact reduction, such as lower water and energy consumption.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This growth is fueled by substantial investments in healthcare infrastructure, the expansion of dental tourism, and increasing disposable income leading to higher utilization of private dental services in countries such as China, India, and South Korea. While price sensitivity remains a factor, the rapid urbanization and adoption of Western standards in major metropolitan areas are accelerating the shift from manual cleaning methods to automated disinfection, creating immense opportunity for entry-level and mid-range automated washer-disinfectors.

- North America: Dominant market share due to stringent regulatory environment (CDC, FDA) and high adoption rates in DSOs; focus on network connectivity and high throughput.

- Europe: High market maturity driven by comprehensive standards (ISO 15883, MDR); strong emphasis on thermal disinfection and environmental efficiency.

- Asia Pacific (APAC): Highest CAGR projected, propelled by rising healthcare expenditure, infrastructure development, and growing medical/dental tourism sector.

- Latin America (LATAM): Emerging market characterized by fragmented distribution and growing awareness of infection control; potential driven by privatization of healthcare.

- Middle East and Africa (MEA): Growth concentrated in affluent GCC nations investing heavily in medical infrastructure; demand for high-end European and American models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Washer-Disinfectors Market.- Getinge Group

- Miele Professional

- Steelco S.p.A.

- STERIS Corporation

- SciCan Ltd.

- Melag Medizintechnik

- Dentsply Sirona

- W&H Dentalwerk International

- Tuttnauer

- Matachana Group

- Belimed AG

- Smeg Instruments

- L&R Manufacturing Company

- CISA Production S.p.A.

- Zhermack S.p.A.

- Coltene Whaledent

- Midmark Corporation

- 3M Company

Frequently Asked Questions

Analyze common user questions about the Dental Washer-Disinfectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a washer-disinfector and an ultrasonic cleaner in dental settings?

A washer-disinfector provides both cleaning and validated thermal or chemical disinfection, meeting regulatory requirements for high-level reprocessing before sterilization. An ultrasonic cleaner only provides basic cleaning (cavitation) and does not perform the critical disinfection step required by modern infection control guidelines, necessitating manual handling afterward.

How does the A0 value relate to thermal disinfection and validation?

The A0 value (A nought value) is a measure used in thermal disinfection cycles, particularly for washer-disinfectors, which quantifies the total microbiological lethal effect achieved during the cycle. An A0 value of 600, common in healthcare, corresponds to maintaining 80°C for 10 minutes, ensuring the inactivation of vegetative bacteria and most viruses, guaranteeing a standardized level of microbiological safety.

Which regulatory standards govern the manufacture and use of dental washer-disinfectors globally?

The devices are primarily governed by international standards such as ISO 15883 (Washer-disinfectors), the European Medical Device Regulation (MDR) in Europe, and 510(k) clearance protocols set by the FDA in the United States. Compliance with these standards ensures the devices meet documented performance requirements regarding cleaning efficacy and disinfection safety.

Are specialized dental handpiece coupling systems required for effective washing?

Yes, specialized injection coupling systems are essential for thorough reprocessing of dental handpieces. These attachments ensure the internal narrow lumens and moving parts of the handpiece are effectively flushed with cleaning agents and disinfected water under pressure, removing internal debris and residual oil before the final sterilization cycle.

What are the key factors driving the adoption of high-volume, floor-standing models?

High-volume models are driven by the need for superior throughput in large dental hospitals, university clinics, and centralized sterilization departments (CSDs). These facilities require systems capable of processing hundreds of instruments daily, prioritizing fast cycle times, high capacity, connectivity for traceability, and robust integration with automated instrument management software.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dental Washer-Disinfectors Market Size Report By Type (Benchtop Dental Washer-Disinfectors, Undercounter Dental Washer-Disinfectors, Freestanding Dental Washer-Disinfectors), By Application (Dental Clinics, Hospitals, Laboratories), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Dental Washer-Disinfectors Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Benchtop, Undercounter, Freestanding), By Application (Dental Clinics, Hospitals, Laboratories), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager