Dental Wax Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438461 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Dental Wax Market Size

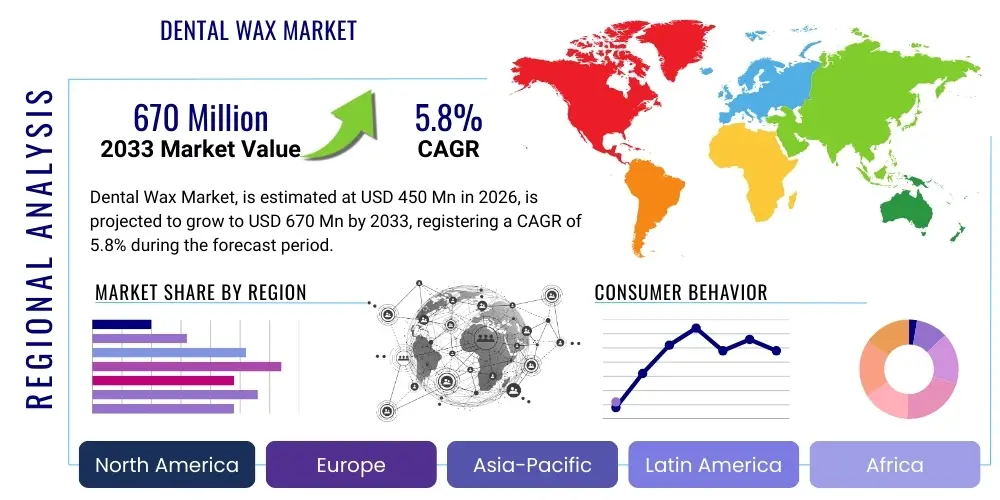

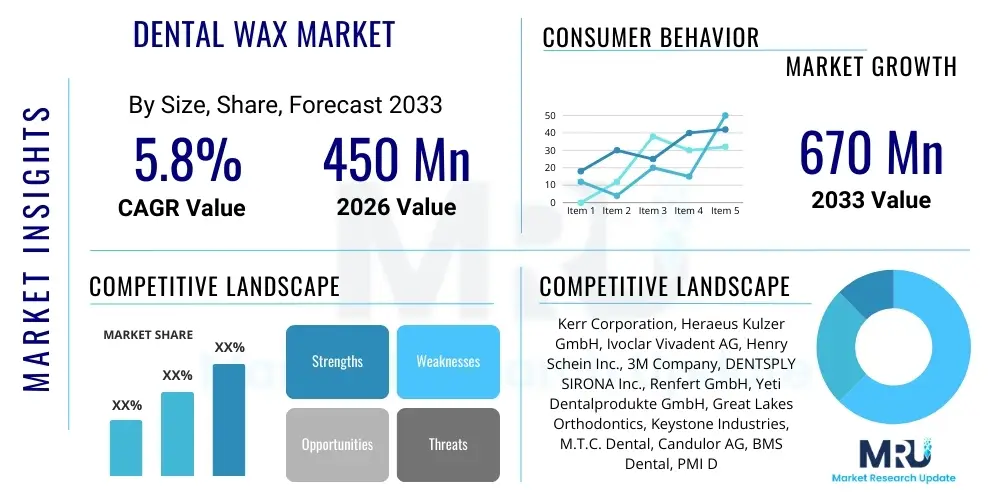

The Dental Wax Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 670 million by the end of the forecast period in 2033.

Dental Wax Market introduction

The Dental Wax Market encompasses various types of specialized waxes essential for numerous procedures within restorative and prosthetic dentistry. These materials serve critical functions, including impression taking, model fabrication, pattern creation for casting, and temporary protective measures for orthodontic patients. Dental waxes are complex mixtures primarily composed of natural waxes (such as beeswax, carnauba, and paraffin) blended with synthetic resins, oils, and coloring agents, formulated to achieve specific physical properties like melting temperature, flow, and ductility required for precise clinical and laboratory applications. The quality and consistency of dental wax directly influence the accuracy of the final dental restoration, making it a cornerstone material in modern dental practices and laboratories globally.

Major applications of dental wax span across prosthodontics, orthodontics, and restorative dentistry. In prosthetic workflows, inlay wax and casting wax are used to create precise patterns for metal frameworks, crowns, and bridges, ensuring proper fit and occlusion. Utility waxes and periphery waxes are utilized to modify impression trays, providing better anatomical capture and comfort for patients. Furthermore, corrective bite registration waxes are crucial for accurately documenting the relationship between the upper and lower jaws. The inherent malleability and thermoplastic properties of these waxes allow dental professionals to manipulate the material easily at room temperature and then harden it quickly for dimensionally stable results, catering to the increasing demand for customized dental solutions and high-quality aesthetic restorations.

The market growth is fundamentally driven by the escalating global incidence of dental disorders, including periodontitis and tooth decay, coupled with a surging geriatric population requiring extensive prosthetic and restorative treatment. Additionally, heightened awareness regarding oral hygiene and increased aesthetic consciousness among younger demographics are boosting the demand for orthodontic treatments, where relief wax plays an indispensable role in patient comfort. The continuous advancements in dental materials science, leading to the development of higher precision synthetic waxes with superior handling characteristics, further propel market expansion. Favorable government initiatives aimed at improving dental healthcare infrastructure in emerging economies also contribute significantly to the overall market trajectory, positioning dental wax as a consistently vital consumable in the dental supply chain.

Dental Wax Market Executive Summary

The Dental Wax Market is experiencing robust growth driven by the rising volume of advanced prosthetic and orthodontic procedures worldwide. Key business trends include a shift towards synthetic wax formulations offering improved mechanical properties, reduced shrinkage, and enhanced handling characteristics, catering to the precision demands of digital dentistry workflows, although dental wax remains a fundamentally analog material. Strategic mergers, acquisitions, and partnerships aimed at expanding product portfolios and regional distribution networks are prominent among market players. Furthermore, manufacturers are focusing on packaging innovations and ready-to-use formats to optimize workflow efficiency in large commercial dental laboratories. Price stability, governed by raw material volatility (especially natural waxes), remains a minor challenge, prompting greater reliance on petroleum-derived synthetic alternatives to mitigate supply chain risks.

Regionally, North America and Europe currently dominate the market share, primarily due to well-established dental healthcare systems, high patient spending power on elective dental procedures, and the early adoption of advanced dental laboratory techniques. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid expansion in APAC is fueled by expanding medical tourism, massive investments in healthcare infrastructure development, and a rapidly increasing middle-class population demanding improved aesthetic dentistry services. The adoption rates of advanced waxes in countries like China and India are accelerating, positioning them as critical growth engines for the global dental wax market, necessitating tailored distribution strategies for localized market entry and penetration.

Segment trends highlight the dominance of the pattern wax segment, particularly casting and inlay waxes, owing to their pervasive use in producing permanent restorations like crowns and bridges, which constitute the largest procedural volume globally. Utility and boxing waxes also maintain significant market share due to their essential role in preparing impressions. By end-user, dental laboratories represent the largest consuming sector, benefiting from economies of scale and high-volume processing requirements for outsourced prosthetic work. Nonetheless, dental clinics and hospitals are projected to witness faster growth rates, reflecting the trend of in-house laboratory capabilities expansion, particularly in specialized private practice settings that prioritize immediate patient care and rapid turnaround times for smaller restorative jobs requiring direct chairside pattern creation.

AI Impact Analysis on Dental Wax Market

User inquiries regarding AI's influence on the Dental Wax Market primarily center on two key themes: the potential obsolescence of wax patterns due to digital design and manufacturing (CAD/CAM and 3D printing), and how AI integration might improve the physical properties and development of new wax formulations. Users are concerned about whether AI-driven design processes eliminate the manual wax-up phase entirely, thereby reducing demand for specialized waxes like casting and modeling waxes. Conversely, there is an expectation that AI could be utilized in material science to predict and optimize the blend ratios of natural and synthetic components, leading to waxes with highly precise shrinkage control and superior surface detail reproduction. The consensus indicates that while AI accelerates the digital pathway, it also necessitates specialized waxes for validating digital models or for specific hybrid workflows where traditional tactile skills remain indispensable, particularly in complex full-arch reconstructions.

- AI-driven CAD software minimizes the need for traditional manual wax-ups in routine restorative cases.

- Increased utilization of 3D printing technologies, influenced by AI-optimized designs, may displace some pattern wax volumes.

- AI analytics can optimize raw material selection and formulation, enhancing the precision and stability of dental waxes.

- Quality control systems leveraging AI image recognition can ensure uniformity and consistency in manufactured wax blocks or sheets.

- Predictive maintenance algorithms aid in optimizing production machinery for continuous, high-quality wax manufacturing.

- AI is less likely to replace relief or utility waxes used for immediate, chairside patient comfort and impression modification.

- Hybrid workflows combining AI-aided design with physical wax realization for complex cases maintain demand for high-fidelity casting waxes.

- Data aggregation powered by AI helps identify optimal flow and melting points tailored for specific geographical climates, improving product efficacy.

DRO & Impact Forces Of Dental Wax Market

The market dynamics of the Dental Wax industry are predominantly shaped by the burgeoning demand for high-quality restorative dentistry driven by global demographic shifts, especially the aging population, which necessitates extensive prosthetic replacements. This constitutes a primary driver, alongside increasing discretionary spending on cosmetic dental procedures and growing awareness about advanced orthodontic treatments. Restraints primarily involve the accelerating adoption of digital scanning and additive manufacturing (3D printing) technologies that bypass the wax pattern stage, threatening long-term consumption volumes of traditional casting waxes. Furthermore, volatility in the pricing and supply chain of natural wax components (like Carnauba or Beeswax) poses operational challenges. Opportunities lie in developing specialized, biocompatible waxes for temporary in-mouth use and creating hybrid materials optimized for digital verification, bridging the gap between analog techniques and modern CAD/CAM workflows, ensuring continued relevance in a technologically evolving dental landscape. These factors exert significant influence, determining investment patterns and competitive strategies across the value chain.

Drivers: The sustained rise in disposable income across developing economies allows greater expenditure on non-essential, yet desired, cosmetic dental procedures, including veneers and aesthetic orthodontics, fueling the demand for specific high-precision waxes. Technological advancements, particularly in developing synthetic waxes that offer superior thermal stability and reduced polymerization shrinkage compared to natural counterparts, enhance the reliability and efficiency of dental pattern creation, encouraging their broader adoption by leading dental laboratories. Moreover, the prevalence of dental insurance schemes, particularly in North America and Europe, increases patient access to complex procedures that require meticulous planning utilizing dental wax for diagnostic and restorative phases.

Restraints: The most significant impediment is the rapid technological shift toward full-digital dental workflows. Intraoral scanners, coupled with 3D printers using specialized resins for temporary restorations and patterns, offer time and material savings, potentially cannibalizing the market share of traditional pattern waxes. Regulatory hurdles surrounding the sourcing and safe usage of certain chemical additives in synthetic waxes can also slow down product innovation and market entry in stringently regulated regions. Additionally, the inherent skill dependency associated with traditional wax-up techniques acts as a minor constraint, as younger dental technicians often prioritize learning digital design software over mastering manual wax manipulation, leading to a shortage of highly skilled traditional wax artists.

Opportunities: Opportunities are significant in addressing niche applications and unmet clinical needs, such as formulating highly adhesive and comfortable orthodontic relief waxes that offer extended wear time and superior protection against bracket irritation. Furthermore, developing advanced diagnostic waxes for occlusal analysis and functional impressions, which can integrate seamlessly with high-resolution digital scanning processes, opens new avenues for specialized product development. Emerging markets, with their large, underserved populations and rapid infrastructural growth, present untapped potential for both conventional and new wax products, particularly in regions where capital expenditure on expensive digital equipment remains prohibitive, ensuring that cost-effective wax solutions maintain a strong foothold for the foreseeable future.

Segmentation Analysis

The Dental Wax Market is extensively segmented based on the type of wax, the primary application, and the end-user utilizing the product. This segmentation is crucial for market participants to tailor their offerings and understand specific demand drivers within various dental fields. The market structure reflects the diversity of dental procedures, ranging from simple chairside comfort applications to complex laboratory procedures requiring high-precision casting patterns. Segmentation by type differentiates materials based on their intended mechanical and thermal properties (e.g., hardness, flow, and melting range), while application segmentation highlights the functional use, such as impression modification, pattern creation, or protective relief. End-user categorization identifies whether the material is consumed primarily by high-volume commercial laboratories or direct patient-facing institutions like clinics and hospitals.

- By Type:

- Inlay Wax

- Casting Wax

- Baseplate Wax

- Boxing Wax

- Utility Wax

- Bite Registration Wax

- Orthodontic Wax (Relief Wax)

- By Application:

- Prosthetic Dentistry (Crowns, Bridges, Dentures)

- Orthodontics (Brackets and Wire Protection)

- Restorative Dentistry (Impression Taking, Pattern Creation)

- Diagnostic Procedures (Occlusal Assessment)

- By End-User:

- Dental Laboratories

- Dental Clinics and Hospitals

- Academic and Research Institutes

- By Composition:

- Natural Waxes (Beeswax, Carnauba, Paraffin)

- Synthetic Waxes (Polyethylene, Waxes based on synthetic resins)

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Dental Wax Market

The value chain for the Dental Wax Market begins with upstream activities focused on raw material sourcing. This involves the extraction and purification of natural waxes (like beeswax and plant-derived carnauba) and the chemical synthesis of petroleum-derived synthetic waxes and resins. Raw material processing is critical, as the quality and purity of these foundational components directly dictate the mechanical and thermal characteristics of the final product. Key upstream suppliers include major petrochemical companies and agricultural commodity traders. Manufacturers then engage in compounding, blending, and formulation activities, where precise ratios of waxes, oils, and colorants are mixed under controlled temperatures to achieve the specific properties required for different dental applications (e.g., low-flow inlay wax versus highly pliable utility wax). Manufacturing efficiency and strict quality control are paramount at this stage to ensure product consistency.

The downstream segment involves packaging and distribution, which utilizes both direct and indirect channels. Direct channels often involve large manufacturers selling directly to major commercial dental laboratory chains or university hospitals through their specialized sales forces, facilitating technical support and bulk purchasing agreements. Indirect channels, which dominate the market for smaller clinics and individual dental practices, rely heavily on specialized dental distributors and wholesalers. These intermediaries manage inventory, warehousing, and localized logistics, ensuring that a broad portfolio of wax products is readily available across geographically dispersed customer bases. Effective management of these distribution logistics, including temperature control during transit for sensitive formulations, is vital for maintaining product integrity until it reaches the end-user.

The final stage involves the utilization of the wax by end-users (dental laboratories, clinics, and academic centers). Dental laboratories are the heaviest users, transforming the raw wax into intricate patterns for casting or processing dentures. The efficiency and reliability of the distribution network directly impact the laboratory's operational throughput. The transition toward globalized sourcing means manufacturers often must navigate complex international regulatory landscapes and tariffs, influencing final product cost. Therefore, optimizing the relationship between raw material suppliers, specialized compounders, and efficient logistical partners is key to maintaining competitive pricing and ensuring a reliable supply of high-quality dental waxes to the global dental industry.

Dental Wax Market Potential Customers

The primary end-users and potential customers for dental wax products fall into three distinct but interconnected categories: commercial dental laboratories, professional dental practitioners (clinics and hospitals), and educational/research institutions. Commercial dental laboratories represent the largest purchasing segment globally. These high-volume customers require vast quantities of casting, inlay, and baseplate waxes for the outsourced fabrication of crowns, bridges, partial dentures, and orthodontic appliances. Their purchasing decisions are highly influenced by bulk pricing, consistency, and the compatibility of the wax with subsequent laboratory processes like burnout and investing. Manufacturers often provide specialized technical support and customized formulations to cater to the stringent quality requirements and efficiency targets of these large-scale operations.

Dental clinics, private practices, and hospital dental departments constitute the second major customer base. While their volume consumption is lower than that of centralized laboratories, they are primary purchasers of specialized chairside waxes, such as orthodontic relief wax for patient comfort, utility wax for modifying impression trays, and bite registration wax for immediate clinical records. For these customers, factors such as convenience, ease of use, immediate availability, and patient safety are paramount. The procurement strategies often involve purchasing smaller quantities through local distributors, emphasizing the importance of a robust, localized supply chain. The increasing trend towards in-house digital workflow capabilities in clinics still requires diagnostic waxes for verification or for procedures where the tactile feedback of wax remains preferred.

Academic institutions and dental research centers form a crucial segment, although they account for a smaller overall market share. Universities and training hospitals require dental waxes for teaching foundational skills in restorative and prosthetic dentistry to students and residents. These customers prioritize educational value, standardized products, and materials suitable for simulating clinical conditions. Research facilities often demand specialized, highly pure, or experimental waxes for testing new dental materials, prosthetics designs, or manufacturing techniques. Serving this segment requires offering comprehensive product lines suitable for pedagogical purposes and maintaining strong relationships with influential key opinion leaders within the academic community who dictate future purchasing trends and product acceptance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kerr Corporation, Heraeus Kulzer GmbH, Ivoclar Vivadent AG, Henry Schein Inc., 3M Company, DENTSPLY SIRONA Inc., Renfert GmbH, Yeti Dentalprodukte GmbH, Great Lakes Orthodontics, Keystone Industries, M.T.C. Dental, Candulor AG, BMS Dental, PMI Dental Manufacturing, Modern Materials Inc., Pyrax Polymars, Metrodent Ltd., Protechno, Voco GmbH, SHOFU Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Wax Market Key Technology Landscape

The core technology landscape in the Dental Wax Market centers not around radical invention but rather continuous refinement of material composition and manufacturing precision. A key technological focus involves the substitution of traditional, highly variable natural waxes with advanced synthetic components, such as microcrystalline waxes and various polymers. These synthetic materials offer superior control over physical properties, specifically thermal expansion coefficient and shrinkage during cooling, which are vital for creating dimensionally stable patterns for the lost-wax casting technique. Manufacturers utilize advanced compounding machinery, including high-shear mixers and precision temperature control systems, to ensure homogenous blending of diverse ingredients, guaranteeing batch-to-batch consistency and minimizing defects like granularity or inconsistent flow, crucial factors for highly accurate dental applications.

Another area of technological innovation is the integration of specialized additives, including specific resins and fillers, designed to enhance the handling characteristics of the wax. For instance, color technology ensures that waxes used for pattern work provide high contrast against gypsum models, aiding visibility and precision carving. Furthermore, the development of waxes with optimal melting and setting kinetics is a critical technological achievement, allowing technicians adequate working time while ensuring rapid solidification to preserve intricate details. This specialized formulation technology supports faster turnaround times in dental laboratories, particularly those operating under stringent deadlines for complex restorative cases.

While dental wax itself remains an analog material, its application is increasingly influenced by digital technology interfaces. The development of 'scanning waxes' exemplifies this hybrid approach. These waxes are formulated with specific pigments or fillers that render them opaque or reflective enough to be accurately captured by 3D scanners, allowing physical wax patterns to be digitized efficiently. This technological bridge facilitates quality checks and archival purposes within a digital workflow, ensuring that dental wax maintains relevance even as CAD/CAM technologies proliferate. Manufacturers investing in rigorous material testing, utilizing technologies such as Differential Scanning Calorimetry (DSC) and rheometers, ensure that their products meet international standards for use in high-stakes dental procedures, reinforcing consumer confidence in the material's performance.

Regional Highlights

The North American market, comprising the U.S. and Canada, holds a dominant share of the global dental wax revenue. This supremacy is attributed to several factors, including extremely high per capita spending on dental care, a high prevalence of dental insurance, and a robust regulatory environment that encourages the use of high-quality, certified dental materials. The region is characterized by early adoption of new techniques and materials, driving demand for premium, specialized synthetic waxes that promise superior performance in complex restorative cases. The presence of major global market players and well-established distribution networks further solidify North America's position, focusing heavily on continuous education and technological innovation to maintain market leadership, particularly in the high-value pattern wax segment used for advanced prosthetics.

Europe represents another mature and substantial market for dental wax, benefiting from universal healthcare systems in many countries and a strong focus on aesthetic and preventive dentistry, particularly in Western European nations like Germany, France, and the UK. European dental professionals demonstrate a high degree of technical expertise, driving consistent demand for specialized waxes such as baseplate and utility varieties essential for denture fabrication, a market supported by the region's significant aging population. While growth is stable, the market is highly competitive, often necessitating manufacturers to differentiate through sustainability initiatives, such as offering waxes derived from eco-friendly or sustainably sourced natural ingredients, catering to environmentally conscious dental practices.

The Asia Pacific (APAC) region is projected to be the fastest-growing market segment during the forecast period. This rapid expansion is primarily fueled by massive population size, increasing economic prosperity resulting in higher disposable incomes, and significant improvements in dental healthcare accessibility in populous nations like China, India, and Southeast Asian countries. While digital adoption is accelerating in metropolitan areas, the vast majority of dental procedures still rely on cost-effective traditional techniques, sustaining immense demand for all categories of dental wax. Government focus on expanding public health infrastructure and rising dental tourism further contribute to this growth. Manufacturers are strategically investing in APAC by establishing local production facilities and forming distribution partnerships to address the region's diverse price sensitivities and logistical challenges, maximizing penetration in rural and semi-urban markets.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets with substantial untapped potential. LATAM growth is influenced by improving economic conditions and a rising interest in cosmetic dentistry, particularly in countries like Brazil and Mexico. The demand here tends to favor cost-effective, multi-purpose dental waxes, although high-end product adoption is visible in major urban centers. In the MEA region, market growth is more concentrated in the Gulf Cooperation Council (GCC) countries due to high healthcare expenditure and the presence of advanced private dental clinics. However, infrastructural limitations and lower dental awareness in sub-Saharan Africa restrain broader market development. Both regions require customized market entry strategies focusing on essential product offerings and educational outreach to dental professionals to drive sustained adoption rates.

- North America: Dominant market share due to high dental expenditure, strong regulatory framework, and early adoption of advanced synthetic waxes.

- Europe: Mature market characterized by stable demand, high technical expertise, and a growing focus on sustainability and material certification.

- Asia Pacific (APAC): Highest CAGR, driven by large population base, improving healthcare infrastructure, and rapid urbanization increasing access to dental services.

- Latin America (LATAM): Emerging market showing steady growth, with demand focusing on basic and cost-effective waxes, particularly in Brazil and Mexico.

- Middle East & Africa (MEA): Growth centered in the GCC region; influenced by government healthcare investments and preference for specialized, high-quality international brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Wax Market.- Kerr Corporation (A part of Envista Holdings)

- Heraeus Kulzer GmbH

- Ivoclar Vivadent AG

- Henry Schein Inc.

- 3M Company

- DENTSPLY SIRONA Inc.

- Renfert GmbH

- Yeti Dentalprodukte GmbH

- Great Lakes Orthodontics

- Keystone Industries

- M.T.C. Dental

- Candulor AG

- BMS Dental

- PMI Dental Manufacturing

- Modern Materials Inc.

- Pyrax Polymars

- Metrodent Ltd.

- Protechno

- Voco GmbH

- SHOFU Inc.

- Bego GmbH & Co. KG

- Ajanta Dental

Frequently Asked Questions

Analyze common user questions about the Dental Wax market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of dental wax in modern dentistry?

Dental wax is primarily used for creating accurate patterns for cast metal restorations (inlays, crowns, bridges), forming personalized impression trays (boxing and utility wax), registering the bite relationship between jaws, and providing protective relief for orthodontic patients against bracket irritation.

How does the shift to digital dentistry impact the consumption of dental wax?

The shift to digital dentistry (CAD/CAM and 3D printing) reduces the demand for traditional casting and inlay waxes by replacing manual pattern creation. However, specialized waxes are still necessary for diagnostic models, impression modifications, and creating physical patterns for complex cases that require tactile verification before final digital scanning or printing.

Which type of dental wax holds the largest market share by volume?

Casting and inlay waxes, which fall under the pattern wax category, typically hold the largest market share by volume due to their essential and high-volume use in dental laboratories for creating patterns for permanent restorative solutions like crowns and bridges globally.

What are the key differences between natural and synthetic dental waxes?

Natural waxes (like beeswax) offer biocompatibility but have greater variability in composition and higher thermal expansion. Synthetic waxes are chemically engineered for superior consistency, reduced shrinkage, and predictable thermal properties, offering enhanced precision required for advanced restorative procedures.

Which geographical region is expected to show the fastest growth in the Dental Wax Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by significant investments in healthcare infrastructure, rapidly increasing disposable income, and a large, underserved population demanding modern dental and orthodontic treatments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager