Department store retailing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436960 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Department store retailing Market Size

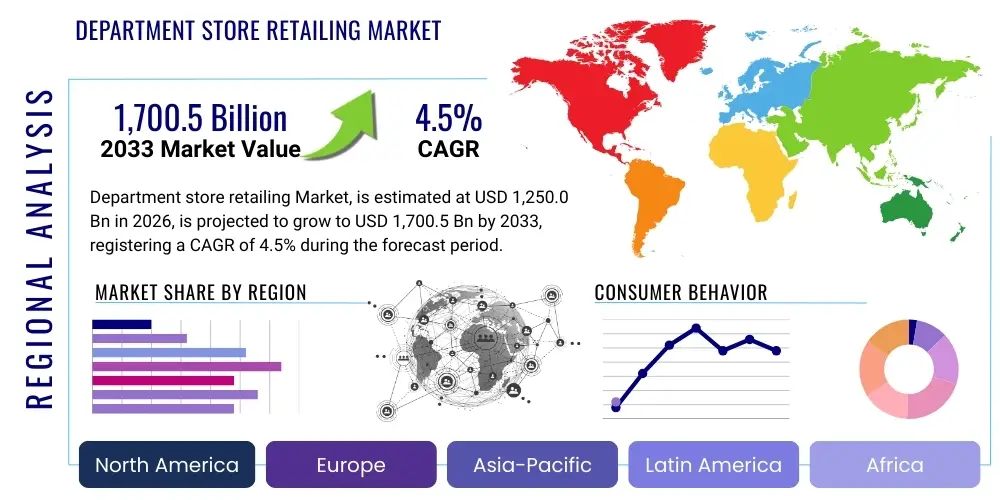

The Department store retailing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1,250.0 Billion in 2026 and is projected to reach USD 1,700.5 Billion by the end of the forecast period in 2033.

The resilience of the department store sector, despite significant competition from pure-play e-commerce platforms and specialized retailers, is driven by their pivot toward omnichannel strategies and experiential retail formats. While traditional physical footprints are being optimized, investment is rapidly shifting to digital integration, supply chain modernization, and leveraging data analytics to enhance customer personalization. This strategic realignment is crucial for maintaining market share, especially in mature economies where brick-and-mortar stores continue to serve as major destinations for bundled shopping experiences.

Growth is particularly robust in developing economies across Asia Pacific, where rising middle-class disposable incomes and rapid urbanization are fueling demand for branded, centralized retail environments. Department stores in these regions often represent aspirational shopping, integrating luxury goods alongside mass-market products, thus capturing a broad demographic. Furthermore, the focus on sustainable sourcing and localized product assortments is increasingly defining competitive advantages, appealing to ethically conscious consumers and driving premiumization across certain segments.

The forecasted market expansion is not solely volume-driven but relies heavily on value addition through enhanced service offerings, integration of technology like augmented reality (AR) mirrors, and efficient last-mile delivery solutions. The shift from transactional retail spaces to immersive lifestyle centers ensures that department stores remain relevant in a highly digitized consumer landscape. Success during the forecast period will depend on the speed and effectiveness with which retailers adapt their legacy infrastructure to support seamless, hybrid shopping journeys.

Department store retailing Market introduction

The Department store retailing Market encompasses large-scale retail establishments that offer a wide assortment of merchandise across distinct product categories, often organized into separate departments, under a single roof. These retail hubs traditionally serve as comprehensive shopping destinations, providing convenience by consolidating apparel and accessories, home furnishings, cosmetics, and increasingly, specialized food and beverage offerings. The major applications of this model revolve around serving middle to high-income consumers seeking quality, variety, and bundled shopping experiences, often including high-touch services such as personal styling and product consultation. Key benefits derived by consumers include convenience, assured product quality (due to brand affiliations), and the opportunity for experiential shopping, which remains a core differentiator from pure online retail.

The modern department store model has evolved significantly, transitioning from predominantly brick-and-mortar operations to highly sophisticated omnichannel networks. Driving factors for the market include rising global disposable incomes, particularly in the APAC region, coupled with ongoing urbanization that concentrates consumer populations near major retail centers. Furthermore, the necessity for established physical retailers to integrate advanced digital technologies, such as improved inventory management systems and robust e-commerce platforms, is a major impetus for structural growth and efficiency gains. This integration allows stores to leverage their physical assets—such as for click-and-collect or returns processing—while expanding their digital reach.

Despite facing existential pressures from discounters and specialized online retailers, the department store remains a vital part of the retail ecosystem by providing curation and trust. Product descriptions are increasingly tailored to highlight brand ethos and sustainability efforts. Major driving factors include strategic partnerships between department stores and emerging direct-to-consumer (DTC) brands seeking physical presence, as well as the continual renovation of store layouts to emphasize experiential zones (e.g., in-store cafes, beauty treatment rooms). These efforts are focused on converting shopping trips into leisure activities, thereby enhancing foot traffic and increasing average transaction values across all departments.

Department store retailing Market Executive Summary

The Department store retailing Market is undergoing a fundamental transformation characterized by an aggressive shift toward digital synergy and optimized physical footprints. Business trends indicate a focus on portfolio rationalization, with retailers divesting underperforming stores while heavily investing in flagship locations that serve as experiential centers and logistics hubs. The overarching strategy is centered on creating a unified commerce platform, where inventory visibility is universal across all channels, thus mitigating out-of-stock scenarios and improving customer satisfaction. Key financial indicators show that companies prioritizing data analytics for personalized marketing and dynamic pricing are outperforming competitors relying on traditional, blanket promotional strategies, suggesting a strong correlation between technological adoption and profitability in the highly competitive retail environment.

Regional trends highlight divergence in growth paths. North America and Europe, saturated markets, are focused on restructuring, enhancing productivity per square foot, and innovating service offerings like subscription boxes tailored to departmental inventory. Conversely, the Asia Pacific region, led by China and India, is experiencing rapid organic growth, driven by an expanding consumer base demanding luxury and branded Western products. Retailers operating in APAC are often adopting a "retail-tainment" approach, integrating leisure facilities and dining to maximize dwelling time. Latin America and MEA show moderate growth, contingent upon political stability and infrastructural improvements supporting streamlined supply chain operations and consumer credit availability.

Segmentation trends reveal strong performance in the Cosmetics and Personal Care departments, which often drive high-frequency traffic and are inherently suited for experiential retail (e.g., makeovers, product testing). Apparel and Accessories remain the largest revenue generators, though margin compression is evident due to fast fashion competition. The trend toward Private Label (store brand) merchandise across all segments is gaining traction, offering higher margins and exclusive product differentiation, thereby reducing reliance on external vendor brands. Furthermore, the shift in location segment shows that suburban and regional shopping centers incorporating department stores are becoming increasingly relevant as post-pandemic work patterns sustain population decentralization away from major urban cores.

AI Impact Analysis on Department store retailing Market

Users commonly inquire how Artificial Intelligence can salvage or revitalize the traditional department store model, focusing on questions related to inventory accuracy, hyper-personalization, and automated customer service. Key concerns center around the capital expenditure required for AI implementation and whether legacy systems can integrate modern machine learning tools effectively. Users expect AI to move beyond basic chatbots, seeking systems that can predict fashion trends accurately based on real-time social media data, optimize supply chains to minimize waste, and create truly unique in-store digital experiences (such as smart dressing rooms). The core theme is leveraging AI to restore the personalized, high-touch experience historically offered by department stores, scaled across a vast customer base, thereby making the physical space more efficient and enticing.

- AI-driven predictive analytics optimize inventory allocation, reducing markdowns and obsolescence rates across seasonal products.

- Implementation of personalized recommendation engines drives higher conversion rates, both online and via associate-facing tools in physical stores.

- Automated pricing and promotional optimization tools allow for real-time adjustments based on competitor activity and current stock levels.

- AI-powered visual search capabilities enhance the mobile shopping experience, linking customer photos to similar in-stock products instantly.

- Deployment of sophisticated chatbots and virtual assistants provides 24/7 customer support, handling routine inquiries about store hours, returns, and product availability.

- Enhanced security and loss prevention through AI video analysis, identifying potential shoplifting or fraud patterns in real-time.

- Optimized store layout and merchandising based on AI analysis of foot traffic patterns, maximizing exposure for high-margin items.

DRO & Impact Forces Of Department store retailing Market

The Department store retailing Market is significantly influenced by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. Key drivers include the ongoing global trend of consumer demand for omnichannel convenience, requiring retailers to maintain robust physical presence supported by advanced digital infrastructure. The experiential appeal of flagship department stores, offering curated assortments and leisure amenities, continues to attract high-value customers. However, the market faces severe restraints, most notably intense competition from specialized e-commerce platforms and fast-fashion discounters, which often undercut pricing. Furthermore, the substantial fixed operating costs associated with maintaining large physical retail spaces and the complexity of managing global supply chains introduce significant financial pressure.

Opportunities for growth are concentrated in strategic digital transformation and market diversification. Specifically, the expansion into high-growth international markets, particularly APAC, offers untapped consumer bases. Moreover, the strategic development of exclusive private-label brands across categories presents an opportunity to capture higher margins and establish unique market identity, reducing reliance on third-party brands. Another crucial opportunity lies in leveraging physical locations as micro-fulfillment centers for online orders, drastically improving delivery speed and efficiency in urban areas. The successful exploitation of these opportunities hinges on rapid technological investment and efficient capital deployment.

The overarching Impact Forces shaping the sector are primarily technological and socioeconomic. Technological disruption compels traditional retailers to innovate rapidly, transforming store environments into sophisticated service hubs. Socioeconomic forces, such as shifting consumer preference toward sustainable and ethically sourced products, exert pressure on supply chain transparency and product curation. Demographic shifts, including the rise of Gen Z consumers who prioritize unique in-store experiences combined with seamless digital integration, dictate future investment priorities. Retailers must manage these forces—driving innovation while mitigating cost pressures—to sustain profitability and competitive relevance over the forecast period.

Segmentation Analysis

The Department store retailing Market is segmented primarily based on product category, location type, and ownership structure, reflecting the diverse operational models and consumer target groups within the sector. Product segmentation is vital as different categories (e.g., luxury cosmetics vs. mass-market home goods) possess varying growth trajectories and margin profiles, influencing departmental space allocation and marketing strategies. Location segmentation highlights the differing strategic roles of urban flagship stores versus suburban mall anchors. Understanding these segments is crucial for investors and retailers to identify optimal operational efficiencies and revenue channels in an increasingly competitive retail landscape characterized by rapid shifts in consumer spending habits and channel preferences.

- By Product Type:

- Apparel and Accessories (Menswear, Womenswear, Childrenswear, Footwear, Jewelry)

- Home Goods and Furnishings (Bedding, Kitchenware, Small Appliances, Décor)

- Cosmetics and Personal Care (Skincare, Makeup, Fragrances, Haircare)

- Food and Beverages (Gourmet Foods, Cafes, Specialty Drinks)

- Others (Electronics, Toys, Seasonal Items)

- By Location:

- Urban/Downtown (Flagship stores, High-density retail areas)

- Suburban/Regional Malls (Anchor tenants, Lifestyle centers)

- By Ownership Type:

- Independent Department Stores (Often high-end, regionally focused)

- Chain Department Stores (National and international multi-branch operations)

Value Chain Analysis For Department store retailing Market

The value chain for department store retailing begins with upstream activities heavily focused on sourcing, procurement, and manufacturing, especially for private label goods. Upstream analysis involves complex global supply chain management, ensuring ethical sourcing, managing quality control, and negotiating optimal cost of goods sold (COGS) with thousands of diverse vendors, ranging from large international brands to small, independent designers. Efficient logistics and inventory planning at this stage are paramount to mitigating risks associated with seasonal demand and long lead times. Effective management of the upstream segment ensures product exclusivity and competitive pricing, which are critical differentiators in the crowded retail landscape.

Downstream analysis focuses predominantly on customer interaction, sales execution, and post-sale services. This stage includes in-store merchandising, personalized customer service (both human and digital), maintaining the brand experience, and managing omnichannel fulfillment processes, such as buy online, pick up in store (BOPIS) and hassle-free returns. The efficiency of downstream operations directly impacts customer loyalty and repeat purchases. Investment in high-quality digital platforms and employee training is essential to maintain the reputation for high service standards traditionally associated with department stores.

The distribution channel is complex, involving both direct and indirect paths. Direct distribution primarily involves products sold through the department store's own physical locations and dedicated e-commerce sites. Indirect distribution can include utilizing third-party logistics providers (3PLs) for warehousing and final-mile delivery, or increasingly, partnering with marketplace platforms where the department store curates a shop-in-shop experience. The balance between direct (control over experience, higher margin) and indirect (broader reach, scalability) channels is a key strategic decision. Modern distribution networks rely heavily on sophisticated warehouse management systems (WMS) to integrate disparate inventory sources and provide customers with accurate, real-time product availability across all selling points.

Department store retailing Market Potential Customers

Potential customers for the Department store retailing Market span a wide demographic range, though they are often characterized by a preference for curated selection, reliable quality, and a bundled shopping experience. The primary target demographic includes middle-to-high income households, particularly those aged 35 and above, who prioritize convenience and brand trust over the lowest possible price point. These customers value the ability to purchase items across multiple categories—from luxury cosmetics to high-end apparel—in a single, comfortable environment. Furthermore, the experiential elements, such as in-store dining and premium services, appeal strongly to consumers seeking leisure combined with consumption, making the department store a destination rather than just a transaction point.

A growing secondary segment includes aspirational young professionals (Millennials and Gen Z) who are increasingly drawn to department stores that successfully integrate emerging digital brands and emphasize sustainable product lines. While often transacting heavily online, this segment utilizes the physical store for high-value purchases, product discovery, and social interaction. Retailers are actively tailoring their offerings—introducing pop-up concepts, interactive displays, and engaging social content—to capture this digitally native consumer base, viewing them as long-term loyalty prospects. The success in attracting these younger buyers hinges on authentic representation of brand values and seamless digital-physical transitions.

Another crucial customer segment consists of tourists and international buyers, particularly in major urban centers and luxury-focused department stores. These shoppers often seek high-value, tax-free purchases and unique global brands that may not be easily accessible in their home countries. Department stores cater to this segment by offering multilingual services, concierge programs, and integrated tax refund processing. The purchasing behavior of these end-users is often less price-sensitive and more focused on brand prestige and the overall memorable experience provided by the retailer, making them highly profitable targets for premium and luxury departmental offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,250.0 Billion |

| Market Forecast in 2033 | USD 1,700.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Macy's Inc., Nordstrom Inc., Kohl's Corporation, J.C. Penney Company LLC, Dillard's Inc., Saks Fifth Avenue (HBC), Neiman Marcus Group, John Lewis Partnership, El Corte Inglés, Galeries Lafayette, Takashimaya Co. Ltd., Shinsegae Department Store, Lotte Department Store, Harvey Nichols, Debenhams (Online), Sears Holdings (Residual Operations), Hudson's Bay Company, Bloomingdale's (Macy's Subsidiary). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Department store retailing Market Key Technology Landscape

The technological evolution within the department store retailing sector is centered on integrating the physical and digital shopping worlds to enhance customer experience and operational efficiency. Central to this landscape are robust Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS) that provide real-time, unified visibility of inventory across all sales channels. This unified view is essential for executing complex omnichannel strategies like ship-from-store or BOPIS, mitigating stockouts, and improving forecasting accuracy. Furthermore, advanced Point-of-Sale (POS) systems are evolving to become mobile, enabling sales associates to process transactions anywhere in the store, provide instant product information, and manage loyalty program interactions seamlessly.

Customer-facing technologies are dominated by personalized engagement tools driven by machine learning and AI. This includes sophisticated Customer Relationship Management (CRM) platforms that capture and analyze customer data to tailor marketing messages and in-store recommendations, ensuring relevance and increasing basket size. Augmented Reality (AR) and Virtual Reality (VR) are being deployed, particularly in high-growth segments like cosmetics and apparel, allowing customers to digitally try on products (e.g., virtual mirrors) before purchase, reducing fitting room friction and return rates. These interactive technologies transform the physical store into a testing ground for digital interaction.

Additionally, the backend technology landscape is being optimized through the adoption of cloud computing for scalability and rapid deployment of new services, particularly essential for peak retail seasons. IoT (Internet of Things) sensors are increasingly utilized within stores to monitor foot traffic, optimize energy consumption, and manage security. Blockchain technology is also gaining relevance, primarily in enhancing supply chain transparency and verifying the authenticity of high-value luxury goods, addressing increasing consumer demand for ethical sourcing and combating counterfeiting, thereby reinforcing brand trust crucial for premium department stores.

Regional Highlights

- North America: This region is characterized by market maturity and significant consolidation, with major players like Macy's and Nordstrom focusing intensely on omnichannel integration and rightsizing their physical portfolios. The market dynamic is driven by investment in flagship experiential stores in major metropolitan areas and leveraging loyalty programs powered by advanced analytics. Innovation is concentrated on personalized fulfillment options and leveraging AI for inventory optimization to combat margin pressure from Amazon and specialized vertical retailers.

- Europe: The European market displays diversity, with strong regional players like John Lewis (UK) and El Corte Inglés (Spain) maintaining relevance through localization and high-quality private labels. The trend here is toward embedding sustainability and circular economy principles into retail operations, appealing to environmentally conscious consumers. France and Germany remain key hubs for luxury department stores (e.g., Galeries Lafayette), which are expanding digital outreach while maintaining opulent physical experiences.

- Asia Pacific (APAC): APAC represents the primary growth engine for the global market, fueled by rapidly expanding middle-class populations in China, India, and Southeast Asia. Department stores in Japan (e.g., Takashimaya) focus on hyper-efficient customer service and high quality, while South Korean retailers (e.g., Shinsegae, Lotte) are pioneering "retail-tainment," integrating cultural centers, art galleries, and dining experiences into the shopping environment to maximize dwell time and differentiation.

- Latin America (LATAM): Growth in LATAM is constrained by economic volatility and infrastructural challenges, yet opportunities exist through strategic modernization and digital investment. Retailers are focused on improving supply chain transparency and payment solutions. Department stores often serve as reliable gateways for international brands, providing trust and stability for consumers wary of informal market channels.

- Middle East and Africa (MEA): The MEA market, particularly the GCC countries, is dominated by luxury and high-end retail, driven by high disposable incomes and a large expatriate community. Department stores serve as key destinations for global luxury brands. The region is seeing rapid adoption of advanced in-store technology and personalized concierge services, reflecting the high-value consumer base seeking exclusive shopping experiences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Department store retailing Market.- Macy's Inc.

- Nordstrom Inc.

- Kohl's Corporation

- J.C. Penney Company LLC

- Dillard's Inc.

- Saks Fifth Avenue (HBC)

- Neiman Marcus Group

- John Lewis Partnership

- El Corte Inglés

- Galeries Lafayette

- Takashimaya Co. Ltd.

- Shinsegae Department Store

- Lotte Department Store

- Harvey Nichols

- Debenhams (Online)

- Sears Holdings (Residual Operations)

- Hudson's Bay Company

- Bloomingdale's (Macy's Subsidiary)

Frequently Asked Questions

Analyze common user questions about the Department store retailing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Department store retailing Market?

The Department store retailing Market is projected to exhibit a CAGR of 4.5% during the forecast period spanning 2026 to 2033, driven primarily by omnichannel strategy execution and expansion in Asian markets.

How are department stores adapting to competition from e-commerce giants?

Department stores are adapting by shifting investments to omnichannel integration, utilizing physical locations as fulfillment centers, enhancing experiential retail through services like in-store dining and styling, and developing exclusive, high-margin private label brands.

Which product segment contributes most significantly to department store revenue?

The Apparel and Accessories segment traditionally contributes the largest portion of revenue to department store retailing, although Cosmetics and Personal Care frequently demonstrate the fastest growth rates and highest customer frequency.

What role does Artificial Intelligence play in modern department store operations?

AI is crucial for operational efficiency, primarily used for predictive inventory management, dynamic pricing optimization, hyper-personalized customer recommendations (both online and in-store), and advanced supply chain transparency.

Which geographic region is expected to show the strongest growth in department store retailing?

The Asia Pacific (APAC) region is forecasted to exhibit the strongest growth due to expanding middle-class consumer bases, rapid urbanization, and significant investment by major regional and international retailers in new, large-scale experiential retail formats.

The strategic imperative for modern department store retailers is centered on redefining the value proposition of the physical store, moving beyond simple product exchange to creating curated, unique, and socially engaging destinations. The successful integration of digital capabilities—using data analytics to predict consumer behavior and personalize the entire shopping journey—is now non-negotiable for sustained profitability. Furthermore, environmental, social, and governance (ESG) criteria are increasingly factoring into consumer choices, compelling retailers to implement sustainable sourcing and transparent supply chain practices, thus affecting vendor selection and product assortment across all departments.

The global retail environment mandates continuous adaptation, particularly regarding labor optimization and spatial efficiency. Retailers are leveraging advanced workforce management software to deploy staff effectively during peak hours, ensuring high service levels without overspending on payroll. The restructuring of physical space involves dedicating more area to high-margin services, such as beauty treatment zones or specialized tech repair bars, while simultaneously downsizing unproductive general merchandise areas. This approach maximizes return on investment per square foot and reinforces the store's position as a premium service provider.

Looking forward, competitive advantage will belong to department stores that successfully balance heritage and innovation. This involves maintaining the trust and high-quality curation associated with traditional brands while aggressively adopting emerging technologies, such as blockchain for product traceability and virtual reality for enhanced product visualization. Capitalizing on opportunities in cross-border e-commerce, facilitated by streamlined logistics and localized payment systems, will also be a key differentiator, especially for firms targeting high-net-worth consumers globally. The market's resilience will be tested by the ability of key players to execute these multifaceted transformation strategies simultaneously across their extensive retail networks.

Financial performance across the sector shows a clear demarcation between retailers who have committed early and heavily to digital transformation and those still reliant on outdated, large-format models. Companies that have invested in a modular and flexible supply chain, capable of handling rapid shifts between online and in-store demands, are demonstrating greater financial stability. Furthermore, successful department stores are utilizing their prime real estate assets creatively, sometimes by integrating non-traditional tenants (e.g., fitness studios, medical clinics) to drive consistent foot traffic and generate alternative revenue streams, demonstrating a nuanced approach to asset management.

The consumer electronics and home goods segments, while not the primary focus, are seeing renewed interest due to the integration of 'smart home' technology. Department stores are capitalizing on this by creating immersive, interconnected display areas where consumers can interact with various smart devices, thereby providing a superior demonstration environment that pure online retailers cannot easily replicate. This segmentation strategy aims to capture the high average transaction value associated with technology purchases and positions the store as a provider of comprehensive lifestyle solutions rather than just individual products.

In terms of operational excellence, process automation across back-office functions—including finance, human resources, and procurement—is becoming standard practice. Robotics and automation are finding niche applications in large distribution centers managed by department store chains, primarily for sorting, packing, and moving inventory efficiently. This focus on automation not only cuts long-term operating costs but also increases the speed and accuracy of order fulfillment, directly impacting customer satisfaction in the highly demanding age of instant gratification.

The regulatory environment, particularly concerning data privacy (e.g., GDPR in Europe), places considerable constraints on department store operators who rely heavily on collecting and analyzing consumer data for personalization. Compliance with these stringent regulations requires significant investment in cybersecurity infrastructure and transparent data handling protocols. Failure to adhere to these standards poses substantial reputational and financial risks, making regulatory adherence a critical, non-market constraint impacting operational budgets and strategic planning across all major geographic markets.

The competitive landscape includes both horizontal rivals (other department stores) and vertical rivals (specialty chains and brand boutiques). To maintain distinctiveness, leading department stores are moving toward highly localized product assortments, partnering with regional artisans and designers to offer products unique to specific store locations. This regional sensitivity helps foster community loyalty and provides a strong counterbalance to the standardized, globally sourced offerings typically found on large e-commerce marketplaces.

Finally, the evolution of payment technologies, including mobile wallets, contactless payments, and installment plan options (Buy Now, Pay Later or BNPL), significantly influences consumer spending behavior within department stores. Integration of these flexible payment methods reduces purchase barriers, especially for high-ticket items, and is strategically important for attracting younger consumers who are less reliant on traditional credit card infrastructure. Department stores that provide a frictionless checkout experience, regardless of the payment method chosen, gain a significant advantage in transaction conversion rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager