Desalination Plants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433842 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Desalination Plants Market Size

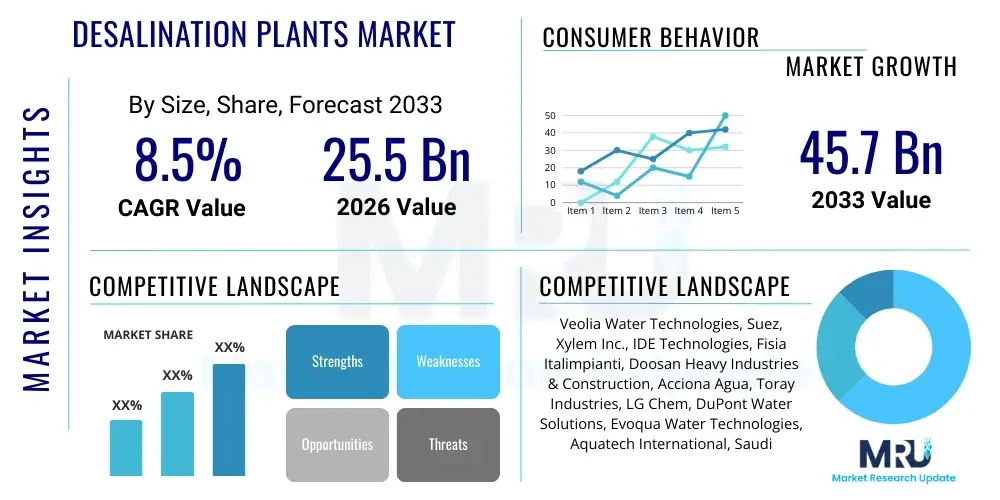

The Desalination Plants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 45.7 Billion by the end of the forecast period in 2033.

Desalination Plants Market introduction

The Desalination Plants Market encompasses the technology, infrastructure, and services necessary to convert saline water (seawater or brackish water) into potable or process water suitable for human consumption, agriculture, and industrial use. The core product involves complex filtration and thermal processes, primarily relying on Reverse Osmosis (RO) membranes or thermal distillation methods like Multi-Stage Flash (MSF) and Multi-Effect Distillation (MED). Major applications span municipal water supply in water-stressed regions, power generation, oil and gas exploration, and various manufacturing sectors requiring high-purity water. The paramount benefit of desalination is the creation of a stable, drought-proof water supply source, crucial for socio-economic stability in coastal and arid zones.

Driving factors propelling market expansion include rapidly escalating global water scarcity, exacerbated by climate change and unpredictable precipitation patterns. Population growth, particularly in arid coastal mega-cities, places immense pressure on conventional freshwater resources, making seawater desalination an increasingly viable, and often necessary, alternative. Furthermore, advancements in membrane technology have significantly reduced the energy consumption required for Reverse Osmosis, addressing the historical challenge associated with operational costs. Government investments and public-private partnerships in large-scale infrastructure projects, especially across the Middle East, North Africa, and parts of Asia, further cement the market's growth trajectory, ensuring long-term project viability and scalability.

The market is characterized by intense technological innovation focused on improving efficiency and environmental sustainability. Emerging technologies like Forward Osmosis (FO) and hybrid systems, combining thermal and membrane processes, are gaining traction by offering superior performance metrics, especially in handling challenging feedwater quality or optimizing thermal energy utilization. The need for water security in critical industrial processes, such as semiconductor manufacturing and thermal power plants, which require vast quantities of highly demineralized water, guarantees sustained industrial application demand, differentiating this market from purely municipal driven infrastructure investments.

Desalination Plants Market Executive Summary

The Desalination Plants Market is experiencing robust growth driven by irreversible trends in global water stress and technological cost reduction. Business trends highlight a significant shift toward membrane-based technologies, predominantly Reverse Osmosis (RO), which now dominates new capacity installations due to its lower energy consumption relative to traditional thermal methods. Key industry strategies involve vertical integration, focusing on enhancing pre-treatment stages to extend membrane life, and developing modular, standardized plant designs to accelerate deployment, particularly beneficial for industrial or remote site applications. Furthermore, the market is maturing towards service-centric models, where long-term operation and maintenance (O&M) contracts, often bundled with performance guarantees, represent substantial revenue streams for major players, indicating a focus on lifecycle management rather than just initial capital expenditure.

Regionally, the Middle East and Africa (MEA) remains the stronghold of desalination capacity, driven by high dependence on non-conventional water sources and massive government funding in countries like Saudi Arabia and the UAE. However, Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapid urbanization, industrial expansion, and deteriorating water quality in coastal regions of China, India, and Australia. North America and Europe are focusing on upgrading aging infrastructure, integrating advanced energy recovery systems, and addressing brackish water desalination for municipal resilience and mitigating drought impacts in states like California and Spain. Regional market dynamics are heavily influenced by local energy costs, regulatory frameworks concerning brine discharge, and the adoption pace of high-efficiency energy recovery devices (ERDs).

Segment trends reveal that the technology segment is strongly skewed toward RO, especially for large-scale seawater applications, while Multi-Effect Distillation (MED) retains importance in niche areas, particularly when co-located with power plants (co-generation) where waste heat can be effectively utilized. Application-wise, municipal use holds the largest market share due to the necessity of public water supply; however, the industrial segment, driven by power generation, refining, and mining, shows a higher growth rate, demanding specialized solutions for treating highly variable and complex feedwaters. The trend toward decentralized, small-to-medium-scale plants utilizing standardized, containerized RO units is also notable, catering specifically to remote communities or specific industrial needs independent of large central grids, thereby broadening the market accessibility.

AI Impact Analysis on Desalination Plants Market

User queries regarding the impact of Artificial Intelligence (AI) on the Desalination Plants Market predominantly revolve around three critical themes: energy efficiency optimization, predictive maintenance capabilities, and enhancing water quality management in real-time. Users frequently ask how AI can justify the high capital expenditure of new plants by guaranteeing superior operational expenditure savings, particularly concerning the significant electricity demand of Reverse Osmosis (RO) processes. There is a strong interest in AI's role in predicting equipment failure—specifically membrane fouling and pump wear—to transition from routine scheduled maintenance to condition-based intervention, thereby minimizing downtime and maximizing asset lifespan. Furthermore, stakeholders seek reassurance that AI algorithms can effectively manage the complexities of variable feedwater quality (e.g., changing salinity, temperature, algae blooms) to automatically adjust chemical dosing and operational parameters, ensuring consistent potable water output while minimizing chemical costs.

The integration of AI and machine learning (ML) is transforming desalination plant management from a reactive operational model to a proactive, highly optimized system. AI systems utilize massive datasets collected from SCADA systems, sensors, and laboratory analysis to build sophisticated predictive models. These models are crucial for fine-tuning pump speeds, optimizing the flux rate across membranes, and precisely controlling the energy recovery devices (ERDs) based on predicted energy prices and real-time plant performance. This leads to demonstrable reductions in specific energy consumption (SEC), a key metric for the profitability and sustainability of desalination projects, addressing core user concerns about operational efficiency.

Beyond internal plant efficiency, AI facilitates smarter integration with external infrastructure. ML algorithms are being deployed to optimize brine discharge strategies by predicting ocean current patterns and regulatory compliance windows, minimizing environmental impact. Moreover, AI-driven digital twins allow operators to simulate various scenarios, test operational changes virtually, and train personnel without impacting the live plant. This level of simulation and optimization significantly improves reliability, reduces operational risk, and shortens the learning curve for deploying advanced hybrid desalination technologies, ultimately positioning AI as a critical enabler for the next generation of highly automated, energy-efficient water production facilities.

- AI algorithms optimize energy consumption by predicting optimal operating parameters based on real-time energy prices and feedwater quality.

- Machine Learning models facilitate predictive maintenance for high-value assets like high-pressure pumps and membranes, extending asset lifespan and reducing unplanned downtime.

- AI enhances process control by dynamically adjusting chemical dosing and pre-treatment filtration stages to mitigate membrane fouling risks.

- Real-time data analytics provide superior monitoring of treated water quality and ensure immediate compliance with stringent public health standards.

- Digital twin technology, powered by AI, enables risk-free simulation of operational scenarios and continuous performance optimization.

DRO & Impact Forces Of Desalination Plants Market

The Desalination Plants Market is profoundly shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces dictating its trajectory. The primary driver is the pervasive and deepening global water crisis, compelling governments and industries to secure stable, non-conventional water sources. This driver is counterbalanced by significant restraints, chiefly the high initial capital expenditure (CAPEX) required for plant construction and the historically high operational energy consumption, which directly affects the cost of produced water. Opportunities lie predominantly in technological breakthroughs, such as the commercialization of highly efficient next-generation membranes (e.g., graphene or carbon nanotube membranes) and the successful integration of renewable energy sources (solar, wind) to power desalination facilities, fundamentally altering the market's economic viability and sustainability profile.

The impact forces are heavily weighted toward environmental and economic sustainability. While the necessity of water security (driver) exerts powerful market pull, the environmental challenge of brine disposal (restraint) often leads to stringent regulatory hurdles, increasing project complexity and cost. However, opportunities like Zero Liquid Discharge (ZLD) systems or advanced brine mining (extracting valuable minerals like lithium or magnesium) are emerging to transform this restraint into a potential revenue source. Furthermore, the political and social acceptance of desalination is an increasingly impactful force; public perception of desalinated water quality and the associated high energy demand necessitate transparency and integration of sustainable practices to ensure successful project implementation, particularly in democratized or politically sensitive regions.

The market’s inherent stability stems from the inelastic demand for potable water, ensuring that once established, desalination plants operate continuously, providing predictable long-term revenue streams (opportunity). This stability attracts large infrastructure investors and facilitates Public-Private Partnerships (PPPs). Conversely, the technological inertia and slow adoption rate of radical new technologies due to the risk-averse nature of critical infrastructure projects can act as a subtle restraint, favoring proven RO and MED technologies over potentially more efficient, yet less established, alternatives. Overall, the market progression is defined by a race to lower the Levelized Cost of Water (LCOW) through technological efficiency gains and large-scale investment mobilization.

Segmentation Analysis

The Desalination Plants Market is fundamentally segmented based on Technology, Application, and Feedwater Source, reflecting the diversity of methods used and the needs of various end-users. Technology segmentation distinguishes between Membrane-based methods (primarily Reverse Osmosis, RO) and Thermal-based methods (Multi-Stage Flash, MSF; Multi-Effect Distillation, MED). This differentiation is critical because it dictates the energy source (electricity vs. thermal heat), the quality of the raw water that can be treated, and the purity level of the final product. The market landscape is increasingly favoring membrane technologies due to their lower energy intensity and flexibility in modular scaling. Conversely, application segmentation divides the market into Municipal (public water supply) and Industrial sectors, each requiring tailored plant sizes, design robustness, and specific discharge regulations.

The feedwater source categorization, dividing the market into Seawater Desalination (SWRO), Brackish Water Desalination (BWRO), and others (e.g., wastewater reuse, industrial effluent), determines the specific pre-treatment requirements and the overall capital expenditure. SWRO, while essential for coastal cities, requires extensive pre-filtration and higher operational pressures, increasing costs. BWRO, utilizing less saline inland groundwater, is typically less energy-intensive and cheaper to operate, often serving inland industrial parks or agricultural users. Understanding these segments is vital for market players to focus their technological development and sales efforts, recognizing that the growth dynamics within BWRO are often tied to inland industrial expansion, whereas SWRO growth is linked to coastal mega-city resilience planning.

- By Technology

- Reverse Osmosis (RO)

- Multi-Stage Flash (MSF)

- Multi-Effect Distillation (MED)

- Electrodialysis (ED)

- Other Thermal Methods (e.g., Vapor Compression)

- By Application

- Municipal (Public Water Supply)

- Industrial (Power, Oil & Gas, Manufacturing, Mining)

- By Feedwater Source

- Seawater

- Brackish Water

- Others (e.g., Wastewater, Process Water)

Value Chain Analysis For Desalination Plants Market

The value chain of the Desalination Plants Market is highly complex, beginning with upstream activities focused on high-tech material procurement and advanced component manufacturing. The upstream phase is dominated by specialized suppliers providing core technologies, such as high-rejection membranes (polymer scientists and manufacturers), high-pressure pumps, and energy recovery devices (ERDs). The quality and durability of these components are paramount as they directly influence the plant’s operational lifespan and energy footprint. Key competitive advantages are secured in this stage through patented membrane materials and proprietary pump designs offering superior efficiency and chemical resistance, necessitating high R&D investment by specialized technology providers.

The midstream phase involves Engineering, Procurement, and Construction (EPC) services, where large global infrastructure firms manage the design, integration, and construction of the physical plants. These EPC contractors coordinate the complex supply chain, ensuring regulatory compliance and project timely completion. Following construction, the value shifts significantly to the downstream phase, dominated by Operation and Maintenance (O&M) services, often handled by the EPC firm or specialized water utilities companies through long-term contracts. Distribution channels are predominantly direct, involving direct negotiation between the plant builder/operator and the end-user (e.g., government water utility, industrial conglomerate) for large-scale projects, reflecting the high capital and strategic nature of the asset.

Indirect distribution plays a minor role, typically involving consulting engineers or specialized regional integrators who assist smaller industrial clients or remote community projects. The value chain highlights that profitability is increasingly tied to the downstream service contracts, as maintenance, chemical supply, and membrane replacement offer reliable, recurring revenue streams over the 20-30 year lifespan of a plant. The shift towards performance-based contracts means that the entire value chain is incentivized to minimize operational failures and maximize water output consistency, linking upstream component quality directly to downstream service provider profitability.

Desalination Plants Market Potential Customers

The potential customers for desalination plants are diverse, spanning governmental, municipal, and private industrial entities united by the critical need for secure, high-quality water supply. The largest and most frequent buyers are municipal and sovereign governmental water utilities, particularly those located in arid, water-stressed coastal regions or rapidly expanding urban centers. These entities procure large-scale plants (typically over 50,000 m³/day) through competitive tenders or Build-Own-Operate (BOO) and Build-Operate-Transfer (BOT) models, driven by population mandates and long-term water security planning. Their purchasing criteria heavily emphasize reliability, compliance with drinking water standards, and the lowest possible Levelized Cost of Water (LCOW), often favoring proven technologies like RO.

The industrial sector represents the second major customer base, seeking desalination for highly specific process requirements. Key industrial buyers include thermal and nuclear power generation plants (for boiler feed water), chemical and petrochemical complexes, microelectronics manufacturers (requiring ultrapure water), and mining operations. Industrial clients often prioritize tailored, resilient, and high-purity water solutions, typically opting for medium-to-small modular plants that integrate easily with existing infrastructure. Their purchasing decisions are primarily driven by minimizing operational disruption, ensuring product quality, and meeting strict environmental discharge limits, often prioritizing total lifecycle cost and scalability over the absolute lowest initial cost.

Emerging buyers include large agricultural enterprises, particularly in regions leveraging brackish water for irrigation where conventional surface water is scarce or heavily allocated. Furthermore, the oil and gas sector, specifically upstream production operations and refining, utilize desalination for enhanced oil recovery (EOR) and process water, demanding rugged, transportable, and high-capacity units for remote locations. Overall, the market is characterized by institutional buying behavior, long sales cycles, and high entry barriers, underscoring the necessity for deep technical expertise and strong governmental relationships from suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 45.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Water Technologies, Suez, Xylem Inc., IDE Technologies, Fisia Italimpianti, Doosan Heavy Industries & Construction, Acciona Agua, Toray Industries, LG Chem, DuPont Water Solutions, Evoqua Water Technologies, Aquatech International, Saudi Arabian Amiantit Company, Metito, Genesis Water Technologies, Hatenboer-Neptunus, Abengoa, Toshiba Water Solutions, Cadagua (Ferrovial), Pentair. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Desalination Plants Market Key Technology Landscape

The Desalination Plants Market is fundamentally defined by the ongoing technological rivalry and co-existence of two primary methods: membrane-based Reverse Osmosis (RO) and thermal distillation techniques (MSF, MED). RO dominates the new installation landscape due to continuous advancements in membrane chemistry and manufacturing, which have drastically improved salt rejection rates while simultaneously lowering operating pressure requirements. Key innovations in RO focus on thin-film composite (TFC) membranes, specialized anti-fouling coatings, and the development of new materials, such as aquaporin membranes, which promise superior selectivity and flux. Furthermore, the ubiquitous adoption of high-efficiency Energy Recovery Devices (ERDs), like Pressure Exchangers (PXs), has been pivotal in reducing the specific energy consumption (SEC) of large-scale SWRO plants to near-theoretical limits, solidifying RO's position as the most economically viable option for high-volume municipal supply.

Conversely, thermal technologies, particularly MED and MSF, maintain a critical, albeit shrinking, market presence, particularly in regions like the Middle East where abundant, low-cost waste heat is available, often integrated with power generation facilities (co-generation). Recent technological focus in the thermal sector involves optimizing heat transfer surfaces and operating at lower temperatures to minimize scaling and corrosion, thereby extending plant lifespan and reliability. A significant emerging trend is the hybridization of these two methods—for instance, combining MSF or MED with RO—to leverage the benefits of both: using the thermal output to treat the most challenging fraction of the water or using RO for initial bulk treatment followed by thermal polishing for ultra-high purity industrial applications, offering flexibility and resilience against varied feedwater conditions.

Beyond the core processes, the technological landscape is rapidly evolving in pre-treatment and post-treatment phases. Advanced pre-treatment solutions, including Dissolved Air Flotation (DAF), ultrafiltration (UF), and microfiltration (MF) systems, are crucial for mitigating biological and particulate fouling, which remains the single largest operational challenge for membrane plants. Post-treatment innovation focuses on re-mineralization and pH adjustment using low-cost, natural materials to ensure the desalinated water is non-corrosive and aesthetically pleasing for municipal consumption. Future-proofing desalination technology increasingly relies on integrating these various advanced stages with sophisticated AI-driven monitoring and control systems to optimize performance in real-time and reduce reliance on manual intervention, driving towards fully autonomous plant operation.

Regional Highlights

- Middle East and Africa (MEA): MEA stands as the global epicenter for large-scale desalination, possessing the highest installed capacity worldwide, primarily driven by severe water deficits and substantial hydrocarbon revenues funding infrastructure projects in the Gulf Cooperation Council (GCC) nations (Saudi Arabia, UAE, Qatar). Saudi Arabia leads the global market in terms of production volume. The region historically favored thermal distillation (MSF), but is now rapidly transitioning to high-capacity Seawater Reverse Osmosis (SWRO) to achieve higher efficiency and align with carbon reduction goals. Massive capital projects, often executed via Public-Private Partnership (PPP) models, ensure continuous market growth.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is spurred by explosive population growth, fast-paced industrialization, and increased contamination of existing freshwater sources in coastal megacities like Shanghai, Chennai, and Sydney. While China and India are major drivers for both municipal and industrial water needs (particularly power and textiles), Australia focuses heavily on drought-proofing capital cities through large, strategically placed SWRO plants. The region also sees high demand for brackish water desalination for agricultural and inland industrial use.

- Europe: The European market is mature, driven primarily by Mediterranean countries (Spain, Italy, Greece) addressing structural water shortages and seasonal tourism demands. Growth is focused on upgrading existing plants, enhancing energy efficiency through advanced ERDs, and increasing the utilization of renewable energy to power existing facilities, adhering strictly to EU environmental directives concerning brine disposal and carbon emissions. Spain remains a leader in installed capacity and technological innovation in RO technology application.

- North America: Market growth in North America is highly localized, concentrated primarily in drought-prone regions of the US (California, Texas) and certain areas of Mexico. The market is characterized by a strong emphasis on brackish water treatment and water reuse, though large-scale SWRO projects are implemented under stringent regulatory oversight. Technological demand focuses on modular systems, advanced pre-treatment for challenging brackish groundwater sources, and integration with smart water infrastructure.

- Latin America: This region presents a fragmented market with significant potential, especially tied to the booming mining sector (copper, lithium) in Chile and Peru, which requires massive volumes of water often sourced via dedicated coastal desalination plants. Municipal demand is slower but growing, driven by chronic water shortages in major metropolitan areas like São Paulo and Lima, focusing on robust, scalable RO technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Desalination Plants Market.- Veolia Water Technologies

- Suez

- Xylem Inc.

- IDE Technologies

- Fisia Italimpianti

- Doosan Heavy Industries & Construction

- Acciona Agua

- Toray Industries

- LG Chem

- DuPont Water Solutions

- Evoqua Water Technologies

- Aquatech International

- Saudi Arabian Amiantit Company

- Metito

- Genesis Water Technologies

- Hatenboer-Neptunus

- Abengoa

- Toshiba Water Solutions

- Cadagua (Ferrovial)

- Pentair

Frequently Asked Questions

Analyze common user questions about the Desalination Plants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving growth in the desalination market?

The primary technology driving current market growth is Reverse Osmosis (RO). RO is favored due to its lower energy consumption compared to thermal methods and continuous advancements in membrane technology and high-efficiency Energy Recovery Devices (ERDs).

How is the high energy consumption of desalination being addressed?

Energy consumption is being addressed through two primary methods: the widespread deployment of advanced ERDs, which recover up to 98% of brine pressure energy, and the increasing integration of solar and wind renewable energy sources to power desalination facilities, particularly in sun-rich regions like the Middle East and North Africa.

Which region holds the largest installed desalination capacity globally?

The Middle East and Africa (MEA), specifically the Gulf Cooperation Council (GCC) nations, holds the largest installed desalination capacity. This is due to severe water scarcity and substantial government investment in large-scale strategic water projects across the region.

What is the biggest environmental challenge associated with desalination plants?

The biggest environmental challenge is the disposal of highly concentrated brine effluent. Solutions are focused on advanced diffusion systems, deep-sea discharge, or emerging Zero Liquid Discharge (ZLD) technologies and brine mining to mitigate environmental impact on marine ecosystems.

What role does AI play in improving desalination plant operations?

AI plays a critical role in optimization by enabling predictive maintenance, fine-tuning chemical dosing based on real-time feedwater analysis, and dynamically adjusting pump speeds and flow rates to achieve maximum energy efficiency (minimum specific energy consumption) under variable operating conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager