Desktop CNC Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433311 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Desktop CNC Machines Market Size

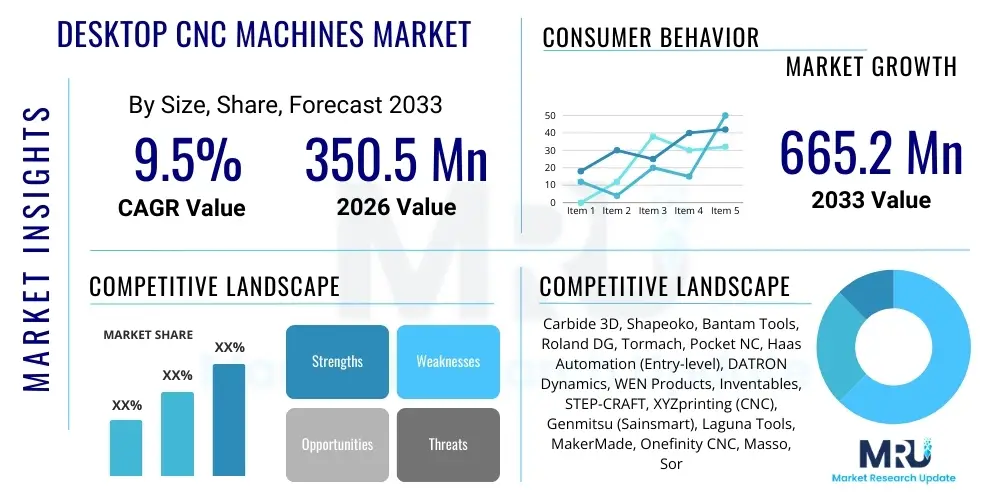

The Desktop CNC Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 665.2 Million by the end of the forecast period in 2033.

Desktop CNC Machines Market introduction

The Desktop CNC Machines Market encompasses compact, computer numerically controlled systems designed for personal use, small workshops, educational institutions, and prototyping labs. These machines, capable of performing operations such as milling, routing, turning, and engraving on various materials (including plastics, soft metals, and wood), offer precision manufacturing capabilities previously restricted to large industrial settings. Desktop CNC solutions are characterized by their smaller footprint, ease of operation, lower investment cost, and increased safety features compared to their industrial counterparts, making advanced manufacturing techniques accessible to a broader demographic.

The core product description revolves around highly integrated, user-friendly hardware and software packages. Modern desktop CNC machines often feature plug-and-play setups, open-source compatibility, and enhanced connectivity, catering primarily to hobbyists, educators, and professional designers requiring rapid iteration cycles. Major applications span across jewelry making, custom parts fabrication for drones or robotics, model making, customized consumer electronics casing, and educational STEM programs. The versatility of these machines allows users to translate complex digital designs into physical objects efficiently and accurately, fostering innovation across multiple sectors.

The primary benefits driving market expansion include the democratization of manufacturing processes, significantly reduced lead times for prototyping, and the ability to produce highly customized, low-volume products on demand. Key driving factors involve the global rise of the maker movement, increasing demand for affordable educational tools in technical fields, and continuous advancements in stepper motor technology and control software, which enhance the precision and reliability of these compact systems. Furthermore, the necessity for decentralized, agile manufacturing solutions, particularly post-pandemic, has cemented the desktop CNC machine's role as an essential tool for small-scale production.

Desktop CNC Machines Market Executive Summary

The Desktop CNC Machines Market is experiencing robust growth fueled by technological convergence and expanding end-user adoption across prototyping and customization sectors. Key business trends indicate a significant shift toward open-source platforms, hybrid functionality (combining CNC milling with 3D printing capabilities), and subscription models for advanced design software, enhancing accessibility and reducing the barrier to entry for small businesses and independent professionals. Strategic partnerships between hardware manufacturers and software developers are crucial for driving innovation in user interface design and material compatibility. Investment in advanced safety features and noise reduction technologies is also becoming a competitive differentiator, aligning products with home and office environments.

Regionally, North America and Europe maintain dominance due to established maker communities, high disposable income for hobbyist equipment, and significant investment in STEM education initiatives. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by rapid industrialization in countries like China and India, the expansion of local electronics manufacturing, and increasing government focus on vocational training and small-scale entrepreneurship. Latin America and MEA are nascent markets but show potential, particularly in academic research and niche customized manufacturing applications, supported by favorable import policies for technology goods.

Segment trends reveal that machines categorized by 3-Axis configuration dominate the market share due to their affordability and sufficiency for most common applications (2D/2.5D carving). However, the demand for high-precision 5-Axis desktop CNC machines is rising sharply, particularly among professional designers and aerospace/medical prototyping firms requiring complex geometry capabilities. The software segment, especially cloud-based CAD/CAM solutions, is witnessing high growth, emphasizing ease of integration and real-time collaboration. The primary end-user segment remains Hobbyists and Makers, but the fastest-growing segment is expected to be Small and Medium Enterprises (SMEs) and Educational Institutions, leveraging these tools for in-house rapid prototyping and technical skill development.

AI Impact Analysis on Desktop CNC Machines Market

User queries regarding the impact of Artificial Intelligence (AI) on the Desktop CNC Machines Market commonly focus on automation, optimization, and enhanced safety. Users frequently ask: "How can AI reduce material waste in my CNC workflow?", "Will AI automate toolpath generation completely?", and "How does machine learning improve predictive maintenance on desktop units?" The consensus themes are the expectation of smarter, more autonomous operation, requiring less direct manual input, and the desire for AI-driven process optimization to improve efficiency and component quality. Concerns often revolve around the cost integration of AI features into low-cost desktop units and the potential reliance on proprietary algorithms limiting user customization.

AI's integration primarily centers on two areas: advanced process control and intelligent design-to-manufacture pathways. AI algorithms are increasingly being used to simulate milling processes, predict material stress points, and dynamically adjust feed rates and spindle speeds based on real-time sensor data, minimizing chatter and tool wear. Furthermore, sophisticated machine learning models analyze historical machining data to identify optimal tooling sequences and minimize overall cycle time, which is critical for maximizing the output of smaller, less powerful desktop units. This transition from static, manually defined parameters to dynamic, optimized execution represents a significant leap in desktop manufacturing capability.

The deployment of AI also greatly enhances preventive maintenance protocols. By continuously monitoring vibration, temperature, and current draw, AI systems can accurately predict component failures (such as bearing wear or motor degradation) before they impact production quality or cause catastrophic damage. This capability translates directly into higher uptime, reduced maintenance costs, and increased machine longevity—factors highly valued by both professional users and hobbyists who rely on their desktop machines for consistent performance. This predictive capability shifts the maintenance paradigm from reactive fixes to proactive health management, thereby lowering the total cost of ownership.

- AI-Powered Toolpath Optimization: Generates highly efficient, material-saving cutting strategies based on geometry and material properties.

- Predictive Maintenance: Machine learning models analyze real-time sensor data (vibration, temperature) to forecast equipment failure, maximizing uptime.

- Design for Manufacturability (DFM) Feedback: AI integrated into CAD/CAM software offers instant feedback on design complexity relative to machine capability.

- Automated Error Detection: Real-time monitoring of the cutting process to detect and correct anomalies or errors, enhancing part quality.

- Adaptive Control Systems: Dynamic adjustment of machining parameters (e.g., feed rate, depth of cut) based on material hardness variations and tool condition.

DRO & Impact Forces Of Desktop CNC Machines Market

The Desktop CNC Machines Market is primarily driven by the expanding accessibility and affordability of precision manufacturing technology, coupled with the rapid proliferation of the global maker and DIY movements. Restraints often include limitations in material handling (smaller desktop units struggle with extremely hard materials), the steep learning curve associated with advanced CAD/CAM software for absolute beginners, and concerns regarding machine rigidity and vibration compared to industrial-grade equipment. Opportunities lie in the massive educational sector uptake, the development of integrated, user-friendly software ecosystems (minimizing reliance on multiple third-party tools), and the emergence of hybrid machines that combine multiple fabrication methods. These factors collectively define the market trajectory, emphasizing democratization, customization, and continuous technological refinement.

Drivers: A primary driver is the accelerating trend of personalized fabrication and rapid prototyping across industries, particularly consumer electronics, medical devices, and custom tooling. As product lifecycles shorten, the ability to prototype quickly and in-house becomes a critical competitive advantage, which desktop CNC machines perfectly address due to their compact size and relatively low operational costs. Furthermore, the substantial increase in online tutorials, community support forums, and open-source software packages has significantly lowered the entry barrier for new users, amplifying adoption among hobbyists, small businesses, and academic research groups worldwide. The integration of high-resolution stepper motors and affordable servo systems has also driven precision improvements, making desktop models viable for more demanding applications.

Restraints: Significant restraints include the inherent size and power limitations that restrict the size of workpieces and the speed of material removal, making these machines unsuitable for high-volume, large-scale industrial production. Market growth is also hindered by the complexity of integrating diverse software components—from design (CAD) to machining preparation (CAM) and control—often requiring specialized knowledge. Moreover, cheap, low-quality imports can destabilize pricing and negatively affect the perception of machine reliability and long-term performance, creating trust issues among professional users seeking durable solutions. Addressing these educational and quality control challenges is essential for sustained market expansion.

Opportunities: Major opportunities exist in developing specialized, application-specific desktop CNC solutions, such as highly accurate dental milling machines or compact jewelry fabrication systems, catering to lucrative vertical markets. The evolution towards smart manufacturing, facilitated by IoT connectivity and cloud-based monitoring, offers avenues for remote diagnostics and centralized fleet management for educational institutions or distributed small businesses. Furthermore, the opportunity to bundle comprehensive training and certification programs with hardware sales can effectively mitigate the steep learning curve restraint, increasing the value proposition, particularly in regions where technical skills are rapidly developing. The continuous push toward sustainable manufacturing also offers a niche for desktop machines used to recycle or repurpose materials.

Impact Forces: The impact forces are currently skewed toward moderate-high influence due to technological advancements and favorable macro-environmental trends (such as the work-from-home revolution driving home-based manufacturing). The high impact of drivers (Maker Movement, Prototyping demand) currently outweighs the moderate impact of restraints (size limits, complexity). Market growth is expected to remain positive but is highly susceptible to economic downturns which might curb consumer spending on premium hobbyist equipment. Innovation in motor and spindle technology acts as a strong positive force, continuously redefining the performance envelope of compact systems, maintaining the market's trajectory despite competitive pressures from high-end 3D printing technologies.

Segmentation Analysis

The Desktop CNC Machines Market is extensively segmented based on axes type, configuration, material processing capacity, end-user industry, and component type (hardware vs. software). This detailed segmentation helps in understanding the varying needs across diverse customer groups, ranging from entry-level enthusiasts to demanding professional workshops. The configuration segmentation, particularly distinguishing between 3-Axis, 4-Axis, and 5-Axis machines, is critical as it directly relates to the complexity of parts that can be fabricated, influencing pricing and target market. Component segmentation highlights the growing importance of proprietary and third-party software solutions, which often provide the critical interface and processing power needed for sophisticated operations on compact hardware.

Segmentation by end-user provides crucial insights into growth pockets, with the Hobbyist segment representing the largest volume base, prioritizing affordability and ease of use. In contrast, the Small and Medium Enterprises (SMEs) segment demands higher reliability, integration capabilities, and robust support, driving the demand for mid-range and professional-grade desktop units. Material processing segmentation, although broad, focuses on the core capability differences between machines optimized for soft materials (wood, plastics) and those capable of machining harder metals (aluminum, brass), directly influencing the spindle power and machine frame rigidity requirements. These distinctions are vital for manufacturers tailoring product lines to specific vertical market needs.

The convergence of these segmentation criteria allows market players to develop targeted marketing strategies and product roadmaps. For instance, catering to the Educational segment requires emphasizing safety features and bundled curriculum support, often favoring 3-Axis machines with intuitive software. Conversely, targeting professional product developers necessitates focusing on 5-Axis capabilities, high precision specifications (micron-level accuracy), and seamless integration with industrial-standard CAD/CAM software suites. Understanding the interplay between these segments is paramount for accurately forecasting demand shifts and allocating research and development resources effectively across the product portfolio.

- By Axis Type: 3-Axis, 4-Axis, 5-Axis

- By Configuration: Desktop Milling Machines, Desktop Routers, Desktop Lathes/Turners, Desktop Engravers

- By End-User: Hobbyists/Makers, Small and Medium Enterprises (SMEs), Educational Institutions, Research & Prototyping Labs, Jewelry & Watchmaking

- By Application/Material: Wood/Plastic Machining, Soft Metal Machining (Aluminum, Brass), Composite Materials

- By Component: Hardware (Machine Frame, Spindles, Motors, Control Boards), Software (CAD, CAM, Control Interface)

Value Chain Analysis For Desktop CNC Machines Market

The value chain for the Desktop CNC Machines Market starts with upstream activities involving component manufacturing and raw material sourcing. Key upstream suppliers provide specialized components such as high-precision stepper/servo motors, durable linear rails and ball screws, high-frequency spindles, and sophisticated control electronics (microcontrollers, drivers). The quality and cost of these components directly impact the final product's performance and market price. Manufacturers often rely on globalized supply chains, particularly those centered in Asia, for cost-efficient sourcing of mechanical and electronic parts, necessitating robust quality control mechanisms to ensure reliability in the compact desktop format.

The middle segment of the chain focuses on core manufacturing, assembly, software integration, and branding. Desktop CNC manufacturers differentiate themselves not just through hardware robustness but crucially through the proprietary or customized control software and user experience (UX). Software development, including post-processors for CAM tools and user-friendly control interfaces, adds significant value. Direct and indirect distribution channels play a vital role here. Direct channels, typically e-commerce platforms and dedicated brand stores, allow manufacturers higher margins and direct customer interaction for support and feedback. Indirect channels primarily involve specialized distributors, technical wholesalers, and increasingly, major online retail platforms (e.g., Amazon, specialized hobbyist stores) that provide warehousing, localized support, and broader geographic reach.

Downstream activities involve sales, installation, user training, and aftermarket support. Given the technical nature of CNC machining, responsive and knowledgeable technical support is a key differentiator, influencing customer loyalty, especially among beginners. Educational outreach, including webinars and community forums, further strengthens the brand ecosystem. The end-users—ranging from individual makers to small enterprises—derive value through the machine’s ability to rapidly transform digital concepts into physical reality, enhancing productivity and creative freedom. The circular flow of value is completed by user feedback, which informs product updates, particularly concerning software features, material compatibility, and ease of maintenance.

Desktop CNC Machines Market Potential Customers

The Desktop CNC Machines Market addresses a diverse range of end-users, broadly categorized into vocational, commercial, and personal segments. The primary consumer is the Hobbyist or Maker, who utilizes these machines for personal projects, artistic creation, small-scale custom gadgets, and repairs. This segment demands intuitive operation, competitive pricing, and strong community support. They are often early adopters of new features and represent the largest volume base, driving demand for entry-to-mid-level 3-Axis machines optimized for soft materials like wood, acrylic, and PCB milling.

A rapidly growing customer base is composed of Small and Medium Enterprises (SMEs), particularly those engaged in rapid prototyping, short-run manufacturing, or custom product fabrication in sectors like medical devices, consumer products, and specialized tooling. These commercial users prioritize machine accuracy, repeatability, high spindle power for metal machining, and integration capability with existing professional software environments. For SMEs, the desktop CNC machine acts as a cost-effective alternative to outsourcing prototypes, significantly shortening time-to-market and retaining intellectual property in-house.

The third significant segment includes Educational Institutions, ranging from high school STEM programs to university engineering departments and vocational training centers. These buyers seek durable, safe, and easily managed machines suitable for teaching principles of subtractive manufacturing, CAD/CAM, and design realization. They often purchase machines in batches and require institutional support, curriculum materials, and robust safety certifications. Additionally, niche professional markets, such as custom jewelry makers and dental labs, form a high-value customer group demanding extremely high-precision desktop CNC solutions for intricate detailing and specialized material processing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 665.2 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carbide 3D, Shapeoko, Bantam Tools, Roland DG, Tormach, Pocket NC, Haas Automation (Entry-level), DATRON Dynamics, WEN Products, Inventables, STEP-CRAFT, XYZprinting (CNC), Genmitsu (Sainsmart), Laguna Tools, MakerMade, Onefinity CNC, Masso, Sorotec, M-TEK, DMG MORI (Compact Solutions) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Desktop CNC Machines Market Key Technology Landscape

The technology landscape of the Desktop CNC Machines Market is characterized by continuous innovation aimed at increasing precision, maximizing material versatility, and simplifying user interaction. A core advancement is the migration from basic stepper motor systems to closed-loop servo systems in higher-end desktop units. Servo systems offer enhanced torque, superior positional accuracy, and real-time error correction, which significantly boosts the machine's reliability and ability to handle harder materials without losing steps. Furthermore, the development of specialized, high-speed, compact spindles optimized for high revolutions per minute (RPM) is crucial for achieving smooth finishes and efficient material removal within the limited power constraints of a desktop footprint, particularly when dealing with intricate details in soft metals or composites.

Software development represents an equally critical technological frontier. The industry is rapidly adopting browser-based and cloud-native Computer-Aided Manufacturing (CAM) tools, which lower the hardware requirements on the user's computer and facilitate collaborative design workflows. These modern software ecosystems often feature simplified graphical user interfaces (GUIs), integrated material libraries, and automated toolpath generation algorithms, drastically reducing the complexity traditionally associated with CNC programming. Furthermore, the integration of Internet of Things (IoT) sensors and connectivity protocols is allowing for remote monitoring of machine status, performance metrics, and consumption data, paving the way for advanced fleet management and predictive maintenance strategies, particularly important for educational labs managing numerous units.

Material science innovation also plays a role, particularly in the structural components of the desktop machines. While industrial CNC systems rely on heavy cast iron for rigidity, desktop manufacturers are increasingly using advanced materials such as aerospace-grade aluminum, carbon fiber composites, and stabilized polymer concrete (in smaller formats) to achieve high damping capacity and rigidity while maintaining a light and manageable footprint. This balance between high rigidity (necessary for precision) and low weight (necessary for desktop portability) is a persistent technological challenge. Other notable technologies include automatic tool changers (ATCs) integrated into desktop units, which minimize human intervention, and advanced work holding solutions (e.g., vacuum tables and smart clamps) that enhance setup time efficiency and job security.

Regional Highlights

- North America (NA): North America holds a substantial market share, primarily driven by the robust presence of the DIY and maker culture, strong adoption in K-12 and university STEM education, and a high concentration of small technology startups requiring in-house prototyping capabilities. The US market, in particular, benefits from high disposable income, fostering demand for premium, high-specification desktop models that incorporate advanced features like 5-Axis capabilities and integrated software suites. Significant growth is observed in customized manufacturing and rapid product development sectors, where speed and proprietary control are valued over outsourced production.

- Europe: The European market is characterized by high demand for precision and quality, supported by well-established engineering and design industries, particularly in Germany, the UK, and France. Strict adherence to safety standards and the demand for energy-efficient machinery influence product design here. Educational and vocational training centers are major consumers, reflecting Europe's strong emphasis on technical skills development. The region shows a growing appetite for desktop CNC machines used in jewelry making, small batch aerospace component prototyping, and specialized craft industries.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period. This rapid expansion is fueled by massive industrialization, the proliferation of small and medium-sized manufacturing enterprises (SMEs) in countries like China, India, and South Korea, and favorable government policies promoting local manufacturing. The affordability of desktop CNC machines makes them a preferred choice for new businesses looking to rapidly scale production capabilities without significant capital expenditure. Competitive pricing pressure is highest here, but demand for high-throughput, entry-level professional machines is soaring.

- Latin America (LATAM): The LATAM market is currently characterized by moderate but steady growth. Adoption is strongest in educational sectors (universities and technical colleges) and small-scale custom production workshops (e.g., signage, woodworking). Market expansion faces challenges related to economic volatility and import complexities, yet opportunities are emerging through increased foreign investment in manufacturing and the decentralization of supply chains, necessitating localized prototyping capabilities in key markets like Brazil and Mexico.

- Middle East and Africa (MEA): MEA represents an emerging market, with adoption primarily concentrated in technology hubs in the UAE and Saudi Arabia, driven by governmental initiatives aimed at diversifying economies away from hydrocarbon dependence toward technology and manufacturing. Demand is focused on educational training centers and architectural model making. The slow initial uptake is balanced by high potential growth as regional investments in infrastructure and technology education increase, opening pathways for affordable desktop manufacturing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Desktop CNC Machines Market.- Carbide 3D

- Inventables

- Roland DG Corporation

- Bantam Tools (Makerspace)

- Tormach Inc.

- Pocket NC

- Shapeoko (A brand by Carbide 3D)

- WEN Products

- Genmitsu (Sainsmart)

- STEP-CRAFT Systems GmbH

- Laguna Tools

- DATRON Dynamics, Inc. (Compact Series)

- Onefinity CNC

- Axiom Precision

- XYZprinting (CNC Machines)

- DMG MORI (Compact/Entry-Level Solutions)

- Masso CNC Controller

- Sorotec CNC

- Routakit CNC

- Makita (Entry-level Routers)

Frequently Asked Questions

Analyze common user questions about the Desktop CNC Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Desktop CNC Machines Market?

The Desktop CNC Machines Market is projected to grow at a CAGR of 9.5% between 2026 and 2033, driven primarily by increasing demand from the SME and educational sectors for rapid prototyping solutions.

Which segmentation axis holds the largest market share in terms of unit sales?

The 3-Axis configuration segment currently holds the largest market share in terms of unit sales due to its high affordability, ease of use, and sufficiency for the majority of hobbyist and educational applications involving 2D and 2.5D carving.

How does the integration of AI affect the operation of desktop CNC machines?

AI integration significantly enhances desktop CNC operation by providing real-time process optimization, automated toolpath generation, and advanced predictive maintenance capabilities, which reduce material waste and increase machine uptime for users.

Which region is expected to experience the highest market growth?

The Asia Pacific (APAC) region is forecasted to exhibit the highest market growth rate, propelled by rapid industrialization, strong government support for vocational training, and the expanding base of small manufacturing enterprises seeking cost-effective production tools.

What are the primary restraints impacting the market adoption of desktop CNC solutions?

Primary restraints include the inherent limitations on workpiece size and material handling due to the compact nature of desktop units, as well as the complexity and steep learning curve associated with advanced CAD/CAM software for novice users.

Are desktop CNC machines suitable for machining hard metals like steel?

While most entry-level desktop CNC machines are optimized for softer materials (wood, plastics, aluminum), specialized high-end desktop models featuring robust frames, high-power spindles, and enhanced cooling systems are available for limited, light-duty machining of harder metals, though they cannot replace industrial machines for heavy-duty tasks.

What role do open-source platforms play in the market?

Open-source hardware and software platforms (like GRBL and LinuxCNC) play a critical role by democratizing access to CNC technology, reducing software costs, and fostering strong community support and customization, thereby driving rapid innovation and adoption among hobbyists.

How do desktop CNC manufacturers mitigate the issue of machine rigidity?

Manufacturers mitigate rigidity issues by utilizing structural enhancements such as advanced aerospace-grade aluminum extrusions, incorporating heavy, high-damping composite bases, and minimizing moving component mass, ensuring better precision and reduced chatter during high-speed operations.

Which end-user segment is the fastest growing for desktop CNC machines?

The Small and Medium Enterprises (SMEs) segment, particularly those focused on rapid product iteration and custom parts fabrication, is the fastest growing end-user segment, utilizing these machines to enhance operational agility and reduce reliance on external prototyping services.

What is the main value proposition of a 5-Axis desktop CNC machine?

The main value proposition of a 5-Axis desktop CNC machine is its capability to machine highly complex, contoured geometries and undercut features without requiring multiple manual part repositionings, which is essential for professional prototyping in medical and aerospace sectors.

How is the value chain structured for desktop CNC machines?

The value chain begins with upstream component sourcing (motors, controllers), moves through core manufacturing and software integration, and concludes downstream with specialized distribution, direct sales via e-commerce, and crucial after-sales technical support and training.

What technological advancements are key to lowering the learning curve?

Key technological advancements lowering the learning curve include intuitive, browser-based control software, automated toolpath generation features, integrated material profile libraries, and sophisticated real-time simulation tools that prevent common machining errors before execution.

Is the cost of proprietary software a significant factor in the total ownership cost?

Yes, for professional-grade desktop CNC systems, the licensing fees and subscription costs for industry-standard CAD/CAM software can be a significant portion of the total ownership cost, although this is often offset by the use of open-source or free entry-level packages.

What is the market relevance of the educational sector?

The educational sector is critical as it serves as a foundational market, fostering future adoption by training the next generation of engineers and designers on subtractive manufacturing principles, thereby ensuring long-term market sustainability and growth.

What is the role of IoT in desktop CNC machine management?

IoT enables advanced machine management by allowing remote monitoring of machine health, utilization rates, and performance data, facilitating fleet management for institutional buyers and enabling manufacturers to offer more accurate predictive maintenance services.

How do hybrid machines impact the desktop CNC market?

Hybrid machines, which combine CNC milling with functionalities like 3D printing or laser engraving, offer increased versatility and consolidated manufacturing capabilities in a single desktop unit, appealing particularly to hobbyists and small workshops seeking multi-functional tools to maximize workspace efficiency.

What materials are most commonly processed by desktop CNC machines?

The most commonly processed materials include wood (hardwoods and softwoods), plastics (acrylic, ABS, nylon), composites (carbon fiber sheets, PCBs), and non-ferrous soft metals such as aluminum and brass, reflecting the typical power and rigidity limitations of the desktop format.

How significant is the influence of the maker movement on market growth?

The global maker movement exerts a high level of influence, acting as a core market driver by creating sustained demand for accessible, affordable, and easy-to-use manufacturing tools, continually pushing innovation toward user-friendly hardware and integrated software solutions.

What types of technical support are most valued by desktop CNC users?

Users highly value responsive technical support that includes troubleshooting via remote access, comprehensive documentation, active community forums, and readily available spares and replacement parts, crucial for minimizing downtime in small operations.

How do manufacturers ensure the safety of desktop CNC machines used in educational environments?

Manufacturers ensure safety through features such as fully enclosed work areas, emergency stop buttons (E-stops), mandatory safety interlocks on access doors, reduced noise levels, and specialized safety training modules bundled with the machine purchase.

Why is software integration a key focus for desktop CNC market leaders?

Software integration is a key focus because the user experience, ease of toolpath creation, and machine control interface are often the primary differentiators, providing the essential bridge between digital design and physical fabrication, which is critical for simplifying the CNC process for non-industrial users.

What role do distribution channels play in regional market penetration?

Distribution channels are critical for regional penetration; direct e-commerce models work well in developed markets, while indirect channels utilizing local technical wholesalers and distributors are vital for providing localized support, inventory, and training in emerging markets like LATAM and MEA.

What is the competitive landscape like in the desktop CNC sector?

The competitive landscape is fragmented, featuring a mix of highly innovative, specialized small companies (e.g., Pocket NC, Carbide 3D) alongside larger industrial players (e.g., Roland DG, Tormach) who offer scaled-down professional products, resulting in intense competition focusing on feature sets and price-to-performance ratio.

How does reduced prototyping time benefit small businesses using desktop CNC?

Reduced prototyping time allows small businesses to iterate designs faster, respond quickly to market demands, and test product feasibility internally, significantly accelerating the development cycle and maintaining a competitive edge against larger firms with longer outsourced production lead times.

What advancements are being made in spindle technology for desktop units?

Advancements include compact, high-frequency, water-cooled spindles that achieve higher RPMs (up to 60,000 RPM) necessary for fine detailing and efficient material removal, while minimizing vibration and thermal expansion, which are crucial for maintaining precision in smaller machines.

How do desktop CNC machines compete with advanced 3D printing technologies?

Desktop CNC machines offer superior material strength, tighter tolerances, and smoother surface finishes compared to most desktop 3D printing technologies, making them preferred for functional parts, metal components, and applications requiring traditional subtractive manufacturing properties, often complementing 3D printing rather than replacing it.

What are the typical power constraints of desktop CNC machines?

Desktop CNC machines are generally limited to standard single-phase electrical outlets (110V/220V) and typically feature lower wattage spindles (ranging from 300W to 2.2kW) compared to industrial systems, restricting the speed and depth of cuts, especially in hard materials.

What are the key differences between a desktop CNC router and a desktop CNC mill?

Desktop CNC routers typically have a larger work area and are optimized for soft materials like wood and plastics, using high-speed, lower-torque spindles. Desktop CNC mills are usually smaller, built with higher rigidity, and use higher-torque spindles suitable for precision machining of soft metals and engineering plastics, offering superior accuracy.

Why is the need for decentralized manufacturing driving adoption?

The push for decentralized manufacturing, amplified by global supply chain disruptions, is driving adoption by allowing businesses and individuals to control their production means locally, reducing reliance on remote fabrication facilities and improving resilience against external shocks.

What materials are being used to enhance the rigidity of light desktop CNC frames?

Manufacturers are employing materials like high-density polymer concrete (granite-epoxy composites), thick-walled cast aluminum, and specialized reinforced steel tubing to enhance frame rigidity and dampen vibrations effectively, ensuring higher accuracy despite the machine's compact size.

What is the expected long-term trend in desktop CNC machine pricing?

The long-term trend suggests continued pricing pressure, particularly in the entry-level 3-Axis segment, due to component commoditization and strong APAC competition. However, the price for professional 4- and 5-Axis desktop machines is expected to stabilize or increase slightly, reflecting the cost of integrating complex, high-precision servo technology and advanced software licenses.

How important is the accuracy specification (e.g., repeatability) for professional users?

Accuracy and repeatability specifications are critically important for professional users (SMEs, research labs), especially those in medical or aerospace prototyping, where tolerances must be maintained within tens of microns to ensure functional product performance and certification standards compliance.

What challenges do new market entrants face in the desktop CNC industry?

New entrants face challenges including intense price competition from established budget brands, the necessity of developing reliable and easy-to-use proprietary control software, and establishing trust regarding long-term machine reliability and customer support responsiveness.

How does the focus on sustainability affect the design of desktop CNC machines?

Sustainability focus encourages designs that minimize material waste through AI-optimized toolpaths, utilize more energy-efficient motors and components, and simplify component replacement to extend machine lifespan, aligning with environmentally conscious manufacturing practices.

Which component segment (hardware or software) is growing faster in terms of revenue?

While hardware dominates overall revenue, the software component segment (including specialized CAM packages, cloud services, and control interfaces) is experiencing faster revenue growth, driven by increasing demand for integrated, subscription-based, and feature-rich digital ecosystems that simplify the workflow.

What specific applications drive demand in the jewelry and watchmaking sectors?

In jewelry and watchmaking, demand is driven by high-precision engraving, wax model milling for investment casting, and direct machining of small, intricate metal components (e.g., watch parts), requiring highly rigid, compact 4- and 5-Axis desktop machines.

How does the increasing complexity of CAD models influence demand for 5-Axis desktop machines?

The increasing complexity of modern CAD models, often incorporating organic shapes and complex undercuts, necessitates 5-Axis capability to efficiently machine these geometries without complex fixturing or multiple setups, driving demand for these high-end desktop configurations among designers.

What impact does the availability of low-cost Chinese imports have on the market?

The influx of low-cost Chinese imports places significant downward pressure on pricing, particularly in the hobbyist and entry-level segment, making the technology highly accessible but also forcing established brands to differentiate through superior quality, support, and advanced software features to justify higher prices.

What is the primary difference in requirements between educational users and SMEs?

Educational users prioritize safety, curriculum support, and ease of management for multiple units. SMEs prioritize accuracy, high utilization rates, durability for continuous use, and seamless integration with existing professional engineering software ecosystems.

How critical is localized customer support in the emerging markets of LATAM and MEA?

Localized customer support is extremely critical in LATAM and MEA due to technical import barriers, language differences, and the necessity of on-site maintenance and training, making reliance on regional distributors with strong technical knowledge a key purchasing factor.

What is the trend regarding automatic tool changers (ATCs) on desktop units?

The trend shows ATCs increasingly being offered, often as premium options, on professional desktop CNC units. While ATCs add complexity and cost, they dramatically enhance automation and efficiency, making them highly desirable for users running long, complex, multi-tool machining jobs.

How are manufacturers addressing noise and vibration constraints for home use?

Manufacturers are addressing noise and vibration through fully enclosed sound-dampening enclosures, using quieter brushless DC motors, and employing advanced material composites in the frame structure to absorb kinetic energy, making the machines suitable for residential or office environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager