Desoldering Station Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433622 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Desoldering Station Market Size

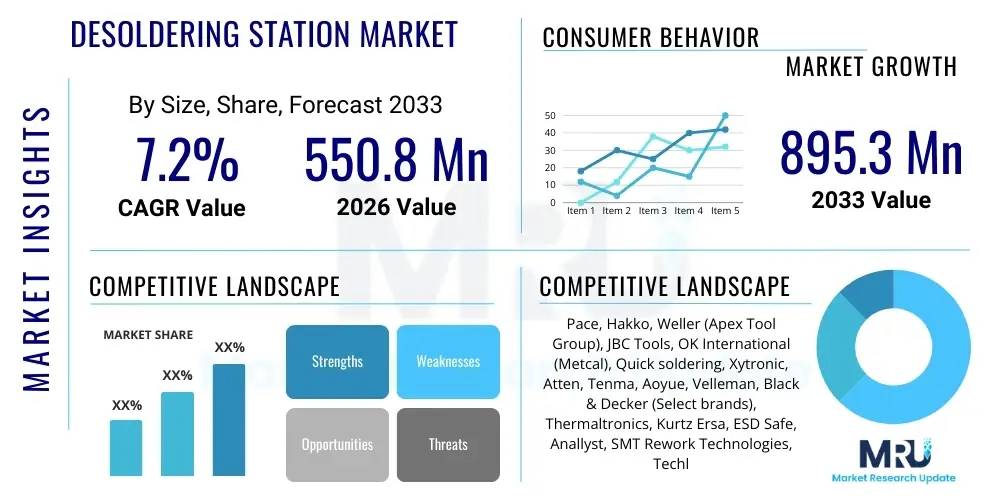

The Desoldering Station Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 550.8 Million in 2026 and is projected to reach USD 895.3 Million by the end of the forecast period in 2033.

Desoldering Station Market introduction

The Desoldering Station Market encompasses specialized electronic tools designed for the removal of solder from printed circuit boards (PCBs) and electronic components during repair, rework, or prototyping processes. These stations are essential instruments in the modern electronics ecosystem, providing controlled heat and vacuum or air pressure to facilitate the clean and safe extraction of components without damaging sensitive board traces or surrounding parts. The primary applications span across consumer electronics repair, industrial manufacturing lines, automotive electronics, and specialized aerospace and defense maintenance facilities, where precision and repeatability are non-negotiable requirements. The inherent complexity and miniaturization of contemporary electronic devices, particularly those utilizing surface-mount technology (SMT) and Ball Grid Arrays (BGAs), necessitate the use of highly sophisticated, digitally controlled desoldering stations capable of precise thermal management and efficient solder removal.

The market growth is fundamentally driven by the relentless cycle of electronic product innovation and the corresponding demand for repair and refurbishment services. As global e-waste increases and sustainability initiatives gain traction, the lifespan extension of electronic devices becomes a critical business imperative, directly fueling the need for high-quality desoldering equipment. Furthermore, the shift towards lead-free soldering processes, driven by regulatory frameworks such as RoHS and REACH, requires desoldering stations to operate effectively at higher temperatures while maintaining thermal stability, thus favoring advanced, closed-loop temperature control systems. These systems ensure that the required heat is delivered only to the solder joint, mitigating the risk of thermal shock to adjacent components or multilayer PCBs.

Key benefits provided by modern desoldering stations include enhanced operational efficiency, reduced component damage rates, and improved workflow compliance with stringent industry standards like ISO 9001 and IPC guidelines. Driving factors include the massive expansion of the Internet of Things (IoT) ecosystem, the rapid growth of the electric vehicle (EV) sector which relies heavily on complex power electronics, and continued investment in defense electronics infrastructure. These factors collectively push manufacturers towards adopting automated or semi-automated desoldering systems that offer superior performance compared to manual soldering irons or simple hand pumps.

Desoldering Station Market Executive Summary

The Desoldering Station Market is characterized by robust growth, primarily fueled by significant business trends including the rapid proliferation of high-density electronic assemblies (HDAs) and the increasing complexity of rework processes required for advanced microprocessors and memory chips. Segment trends indicate a substantial shift towards high-performance, digital vacuum desoldering stations equipped with integrated flux management and data logging capabilities, particularly favored by aerospace and high-reliability industrial segments. Geographically, the Asia Pacific region dominates the market, driven by its unparalleled concentration of electronics manufacturing, rapid urbanization, and massive consumer electronics market; however, North America and Europe show strong demand for specialized, high-precision rework equipment catering to R&D and specialized medical device manufacturing. Key strategic focuses for market leaders involve enhancing thermal stability, improving ergonomics, and integrating intelligent connectivity features to support Industry 4.0 initiatives within smart factories, ultimately aiming for seamless integration into sophisticated production and repair environments. This competitive landscape is pushing manufacturers toward proprietary tips, ergonomic interfaces, and enhanced safety features like anti-static discharge (ESD) protection to capture specialized market share.

AI Impact Analysis on Desoldering Station Market

User inquiries regarding the influence of Artificial Intelligence on the Desoldering Station Market predominantly center on three core areas: the potential for AI-driven automation in rework processes, the integration of predictive maintenance and fault detection, and the impact of AI-enhanced design verification processes. Users are concerned about whether AI systems will fully automate the highly delicate tasks associated with BGA and QFN desoldering, or if AI will primarily serve as an optimization tool for existing equipment. The key expectation is that AI algorithms, particularly those leveraging machine vision and deep learning, could drastically improve the precision of component alignment, optimize temperature profiles in real-time based on specific PCB thermal models, and minimize human error during critical repairs. This summarizes a user base seeking higher throughput, reduced operational variability, and preventative insights into equipment performance.

The integration of AI is not expected to replace the physical desoldering stations themselves, but rather to enhance the surrounding automation and decision-making apparatus. AI-powered machine vision systems can analyze the condition of solder joints before and after removal, providing immediate quality feedback and adjusting subsequent process parameters automatically. For example, in automated rework systems, AI can learn the precise thermal signatures required for thousands of different PCB types, dynamically compensating for variations in board thickness, copper pour, and component density, which conventional controllers struggle to manage efficiently. This level of optimization translates directly into higher yield rates and reduced board scrap in high-volume repair facilities.

Furthermore, AI facilitates predictive maintenance by monitoring the operational telemetry of the desoldering station, including pump cycles, heater element resistance, and tip wear patterns. By analyzing these data streams, AI can forecast potential equipment failures, schedule proactive maintenance, and automatically manage tip inventory, ensuring maximum uptime in critical manufacturing or repair environments. This shift from reactive to predictive operational management offers significant cost savings and throughput improvements, redefining the operational lifecycle management for high-capital desoldering equipment used in demanding industrial settings.

- AI-enhanced machine vision systems for precise component placement and post-removal quality inspection.

- Predictive maintenance algorithms utilizing operational data streams (heater health, pump longevity) to maximize equipment uptime.

- Real-time thermal profile optimization based on deep learning of complex PCB structures (BGA/QFN rework).

- Automated flux application and control mechanisms synchronized with AI-optimized heating cycles.

- Integration into smart factory ecosystems (Industry 4.0) for centralized process data logging and control.

- Improved operator training simulations using AI models to mimic real-world rework challenges and provide immediate feedback.

DRO & Impact Forces Of Desoldering Station Market

The Desoldering Station Market dynamics are shaped by a complex interplay of growth drivers, inherent operational restraints, strategic market opportunities, and external impact forces. A primary driver is the accelerating miniaturization of electronics coupled with the mandatory requirement for efficient rework of high-value components, particularly in sectors such as medical devices and telecommunications infrastructure where reliability is paramount. This demand necessitates investments in advanced, multi-channel rework systems. Conversely, a significant restraint is the high initial capital expenditure associated with sophisticated, high-precision desoldering equipment, particularly vacuum pump-based systems and automated BGA rework stations, making adoption challenging for smaller repair shops or educational institutions. This financial hurdle, combined with the required specialized technical expertise for operating and maintaining these intricate tools, acts as a brake on broader market penetration.

Opportunities abound in emerging markets where local electronics repair ecosystems are maturing rapidly, demanding more professional and reliable tools than basic soldering irons. The transition towards environmentally friendly, lead-free soldering alloys (which have higher melting points and require greater thermal stability) also presents a technological opportunity for manufacturers to innovate next-generation heating elements and closed-loop control systems. Furthermore, the growing trend of device refurbishment and circular economy initiatives across North America and Europe mandates standardized, high-quality desoldering processes, creating a dedicated niche market for certified refurbishment equipment. Strategic expansion into regions increasing their domestic semiconductor and PCB assembly capabilities is a key growth avenue.

The dominant impact forces influencing this market include rigorous regulatory mandates, specifically related to Electrostatic Discharge (ESD) protection and compliance with hazardous substance directives (RoHS, REACH). Manufacturers must ensure their products not only handle the higher temperatures of lead-free solder but also adhere strictly to ESD standards to prevent catastrophic damage to sensitive components, particularly integrated circuits. Economic cycles affecting consumer spending on electronics and subsequent repair volumes also constitute a significant force. Technology substitution risk, while low due to the specialized nature of desoldering, requires manufacturers to continuously integrate new features, such as wireless connectivity and faster heating recovery times, to maintain competitive differentiation against legacy manual methods.

Segmentation Analysis

The Desoldering Station Market is broadly segmented based on Type, Technology, and End-User, reflecting the diverse operational requirements across different industrial and commercial applications. The Type segmentation distinguishes between analog, digital, and integrated rework systems, where digital models offering precise temperature control and programmable profiles are experiencing the highest growth due to requirements for repeatability and traceability. The Technology segment focuses on the method of solder removal, primarily divided into Vacuum/Suction, Hot Air, and specialized Pincer/Tweezer stations, each tailored for different component types, ranging from through-hole parts (vacuum) to fine-pitch surface-mount devices (hot air).

The End-User segmentation provides insight into the primary consumption drivers, covering major industrial sectors such as Consumer Electronics, Automotive, Aerospace & Defense, and dedicated Repair & Rework Centers. The high-reliability sectors, notably Aerospace and Medical Devices, prioritize sophisticated, closed-loop thermal control systems that guarantee minimal thermal excursion and comply with strict quality assurance protocols. Conversely, large-scale Consumer Electronics manufacturing and repair operations favor high-throughput, robust systems capable of continuous operation with minimal downtime.

The increasing complexity of modern PCBs, incorporating micro Ball Grid Arrays (BGAs) and increasingly smaller chip components, necessitates specialized equipment, thereby driving the prominence of the Technology segment focused on integrated hot air and vacuum systems. This complex interplay of segment demands dictates the product development roadmap for key market players, emphasizing modularity and multi-functionality in contemporary desoldering station designs to cater to a wider array of rework scenarios encountered globally.

- By Type:

- Analog Desoldering Stations

- Digital Desoldering Stations (Microprocessor Controlled)

- Integrated Rework Systems (Combining Hot Air, Soldering, and Vacuum)

- Portable/Battery-Operated Desoldering Tools

- By Technology:

- Vacuum (Suction) Desoldering

- Hot Air Desoldering (Convection)

- Pincer/Tweezer Desoldering

- Infrared Rework Stations

- By End-User Industry:

- Consumer Electronics (Smartphones, Tablets, Laptops)

- Automotive Electronics (ECUs, Sensor Systems)

- Aerospace & Defense (Avionics, High-Reliability Systems)

- Telecommunications & IT Infrastructure

- Industrial & Manufacturing Equipment

- Repair and Rework Centers (Third-Party Service Providers)

- Educational and Research Institutions

Value Chain Analysis For Desoldering Station Market

The value chain for the Desoldering Station Market begins with upstream activities, focusing heavily on the procurement of high-quality raw materials and specialized components critical for thermal performance and operational durability. Key upstream elements include high-purity metals for soldering tips (often iron-plated copper or specialized alloys), high-tolerance heating elements (ceramic or nichrome), powerful vacuum pumps, and sophisticated sensor components for closed-loop temperature feedback systems. Manufacturers prioritize secure and sustainable supply chains for these components, as tip longevity and heater reliability are primary indicators of a station's quality and total cost of ownership. Research and development (R&D) in materials science, particularly for improving thermal conductivity and resistance to corrosive lead-free fluxes, also constitutes a vital upstream investment.

Midstream activities involve the specialized manufacturing and assembly processes. This phase includes the integration of microprocessor control units, precise calibration of temperature sensors, assembly of ergonomic handles and specialized nozzles, and rigorous quality assurance testing for ESD safety and compliance with international standards (e.g., CE, UL). Distribution channels represent the critical linkage to the end-user. Direct channels are often employed for large industrial clients (Tier 1 OEMs or global contract manufacturers) requiring high-volume orders, specific customization, and direct technical support. Indirect channels, encompassing global distributors, specialized electronics tool suppliers, and e-commerce platforms, serve the majority of the market, including smaller repair shops and hobbyists, providing localized inventory and quicker fulfillment.

Downstream activities center on post-sale services, including technical support, warranty provision, maintenance contracts, and the supply of consumable accessories, such as replacement tips, filters, and specialized nozzles. The high dependency on consumables ensures a recurring revenue stream for manufacturers. Effective downstream support, including training on lead-free rework techniques and equipment calibration, is crucial for maintaining customer loyalty and brand reputation, particularly in high-stakes environments like aerospace repair. The efficiency of the downstream network, including authorized service centers, directly impacts the overall customer experience and product lifecycle.

Desoldering Station Market Potential Customers

The primary customers for desoldering stations are professional entities engaged in the manufacture, maintenance, repair, and refurbishment of electronic assemblies, requiring specialized tools to interact safely with PCBs. The largest volume buyers are typically Electronics Manufacturing Services (EMS) providers and Original Equipment Manufacturers (OEMs) within the consumer electronics sector. These large-scale operators require robust, high-throughput integrated rework stations capable of handling millions of components annually. They often invest in sophisticated, multi-functional systems that can switch seamlessly between through-hole and SMT desoldering tasks, ensuring flexibility and maximizing line efficiency in production or quality control environments.

A rapidly growing segment of potential customers includes specialized Repair and Rework Centers (RRCs), often operating independently or as authorized service agents for major brands. These customers require modular, versatile stations that can address a wide variety of repair challenges, ranging from motherboard component replacement in laptops to complex circuit board repairs in industrial control systems. For RRCs, features like data logging, ergonomic design for prolonged use, and easy access to diverse tip geometries are highly valued, as they directly impact service quality and technician productivity. The shift towards device refurbishment mandates high-precision tools to ensure components removed can potentially be reused or replaced without collateral damage.

Furthermore, specialized industries such as Aerospace, Defense, and Medical Devices represent high-value customers who prioritize traceability, precision, and compliance over cost efficiency. These customers demand military-spec or medical-grade certified desoldering stations with ultra-precise closed-loop thermal controls, often requiring specific validation documentation to meet industry regulatory standards (e.g., MIL-STD, FDA requirements). The unique demands of these sectors drive innovation in specific features, such as extremely low thermal mass tips and advanced nitrogen inerting capabilities to prevent oxidation during high-temperature rework operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.8 Million |

| Market Forecast in 2033 | USD 895.3 Million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pace, Hakko, Weller (Apex Tool Group), JBC Tools, OK International (Metcal), Quick soldering, Xytronic, Atten, Tenma, Aoyue, Velleman, Black & Decker (Select brands), Thermaltronics, Kurtz Ersa, ESD Safe, Anallyst, SMT Rework Technologies, Techlead Tools, Soldering Solutions Inc., Circuit Repair Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Desoldering Station Market Key Technology Landscape

The technological landscape of the Desoldering Station Market is dominated by advancements in thermal management and vacuum efficiency. Modern stations heavily rely on closed-loop temperature control systems, utilizing internal sensors embedded near the heater element and tip to provide rapid, precise feedback to a microprocessor. This technology is critical for handling the high thermal demands of lead-free solder while preventing thermal runaway, thereby protecting multi-layer PCBs from delamination or stress. The most common heating technologies include high-frequency induction heating (popularized by brands like Metcal) and conventional ceramic heating elements, both striving for extremely fast heat recovery times to ensure stable tip temperature during demanding, high-mass desoldering tasks.

A core differentiator in advanced desoldering stations is the vacuum technology employed. High-end systems utilize powerful, self-contained diaphragm pumps or rotary vane pumps that provide high vacuum flow rate and superior suction strength, ensuring complete and quick removal of solder from plated through-holes (PTH). Effective suction minimizes the risk of lifting pads or damaging the barrel plating during component extraction. Furthermore, advancements include nozzle and tip design optimization, with manufacturers developing specialized geometries, such as non-contact nozzles for hot air stations, designed to minimize direct force on sensitive components like BGAs and minimize heat shadowing effects on adjacent parts.

The integration of digital connectivity and smart features is rapidly becoming standard. Many new stations incorporate USB or Ethernet ports for data logging, process control, and firmware updates, enabling compliance traceability crucial for ISO and military standards. Future technology trends focus on integrating machine vision for automated BGA alignment correction during re-balling and enhanced power delivery systems that dynamically adjust wattage based on the thermal load encountered at the solder joint, optimizing energy consumption while maintaining peak performance, further solidifying the link between rework equipment and Industry 4.0 paradigms.

Regional Highlights

The global distribution of the Desoldering Station Market reveals significant geographical variations in consumption patterns, largely dictated by regional electronics manufacturing capacities and the maturity of local repair infrastructure. The Asia Pacific (APAC) region stands as the undisputed market leader, accounting for the largest share of revenue and volume. This dominance is attributed directly to the concentration of global electronics manufacturing hubs in countries like China, South Korea, Taiwan, and Vietnam, necessitating vast quantities of both production-line rework stations and aftermarket repair tools. The rapid expansion of 5G infrastructure and massive investments in domestic semiconductor fabrication facilities further solidify APAC's leading position, driving demand for high-precision SMT and BGA rework systems.

North America and Europe represent mature markets characterized by high demand for specialized, high-reliability equipment. In these regions, the focus is less on sheer volume and more on quality assurance, traceability, and compliance with rigorous standards governing defense, aerospace, and medical device manufacturing. Customers here prioritize advanced, integrated rework systems featuring automated profiling, data logging capabilities, and superior ESD compliance. The strong presence of leading R&D institutions and specialized third-party repair services in the US and Germany drives steady innovation-led demand, favoring premium, high-cost equipment offering superior process control and thermal performance stability.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets experiencing accelerating growth due to increasing foreign direct investment in local assembly plants and the establishment of sophisticated service centers. While currently smaller in size, these regions present significant growth opportunities as urbanization and access to consumer electronics increase. Demand in these areas often focuses on robust, mid-range digital stations that offer a balance of price, durability, and essential features suitable for general electronics repair and educational training purposes, slowly transitioning away from basic, analog equipment towards reliable, microprocessor-controlled solutions.

- Asia Pacific (APAC): Market leader; driven by high volume electronics manufacturing (China, South Korea), significant growth in domestic semiconductor production, and massive consumer electronics repair demand.

- North America: High-value market focused on specialized, high-reliability applications (aerospace, medical), strong emphasis on compliance (ESD, traceability), and advanced R&D facilities.

- Europe: Mature market with strong demand from automotive electronics (EVs) and industrial control systems; regulatory drivers (RoHS, REACH) mandate high thermal stability in equipment.

- Latin America (LATAM): Emerging growth market; increasing assembly activities and maturing repair ecosystems driving demand for mid-range digital and reliable equipment.

- Middle East and Africa (MEA): Gradually increasing adoption, primarily concentrated in urbanized economic centers and driven by investments in telecommunications infrastructure and defense maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Desoldering Station Market.- Pace, Inc.

- Hakko Corporation

- Weller (Apex Tool Group)

- JBC Tools, S.A.

- OK International (Metcal)

- Kurtz Ersa GmbH

- Quick Soldering Tool Co., Ltd.

- Xytronic Industries Co., Ltd.

- Atten Technology Co., Ltd.

- Thermaltronics

- Aoyue International Limited

- Velleman Group

- Tenma Test Equipment

- Circuit Repair Systems

- Techlead Tools

- ESD Safe Solutions

- SMT Rework Technologies

- Soldering Solutions Inc.

- Anallyst Electronics

- Black & Decker (Select brands)

Frequently Asked Questions

Analyze common user questions about the Desoldering Station market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hot air and vacuum desoldering technologies?

Vacuum desoldering utilizes suction through a heated tip to remove solder primarily from through-hole components (PTH), ensuring clean removal of the entire solder joint. Hot air desoldering uses controlled streams of heated air to reflow solder on surface-mount devices (SMD), such as QFPs and BGAs, allowing for non-contact removal of multi-leaded components. The choice depends entirely on the component package type and PCB density.

How does lead-free solder affect the performance requirements of a desoldering station?

Lead-free solder alloys typically require higher melting temperatures (up to 30-40°C higher) than traditional tin-lead solder. Consequently, desoldering stations must possess superior wattage, faster heat recovery rates, and highly accurate closed-loop thermal control systems to efficiently melt the solder without causing thermal damage to the surrounding PCB material or adjacent sensitive components, which is crucial for high-reliability rework.

Why is Electrostatic Discharge (ESD) protection critical for desoldering equipment?

ESD protection is paramount because electronic components, particularly modern integrated circuits, are highly susceptible to damage from static discharge. High-quality desoldering stations are designed with ESD-safe materials, grounded tips, and conductive handles to safely dissipate any static buildup, preventing latent or catastrophic failure of the components being worked on, thereby ensuring compliance with international industry standards.

Which End-User industry is driving the highest demand for advanced BGA rework stations?

The Automotive Electronics sector and the Aerospace & Defense industry are currently driving the highest demand for advanced BGA rework stations. These sectors utilize complex, multi-layer PCBs with high-density components (BGAs, QFNs) in mission-critical applications (e.g., flight control systems, ECUs), necessitating highly precise, automated rework systems capable of ensuring process traceability and high reliability under stringent quality control protocols.

What are the key considerations when choosing between an Analog and a Digital desoldering station?

Digital desoldering stations are generally preferred for professional or industrial use due to their ability to offer precise, microprocessor-controlled temperature stability, programmable thermal profiles, and digital temperature display for visual verification, ensuring repeatability. Analog stations are simpler and less expensive but offer lower thermal accuracy and repeatability, making them better suited for basic or hobbyist applications where regulatory compliance and high precision are not mandatory requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager