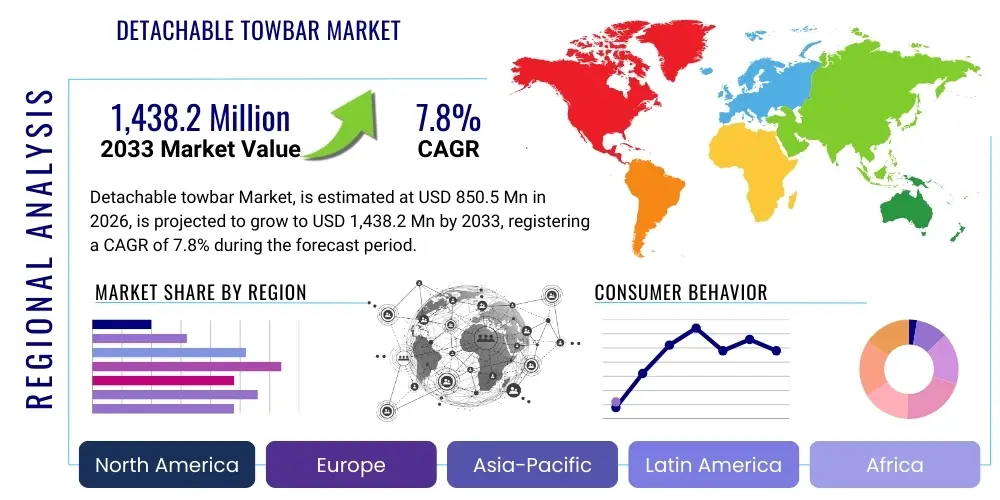

Detachable towbar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436128 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Detachable towbar Market Size

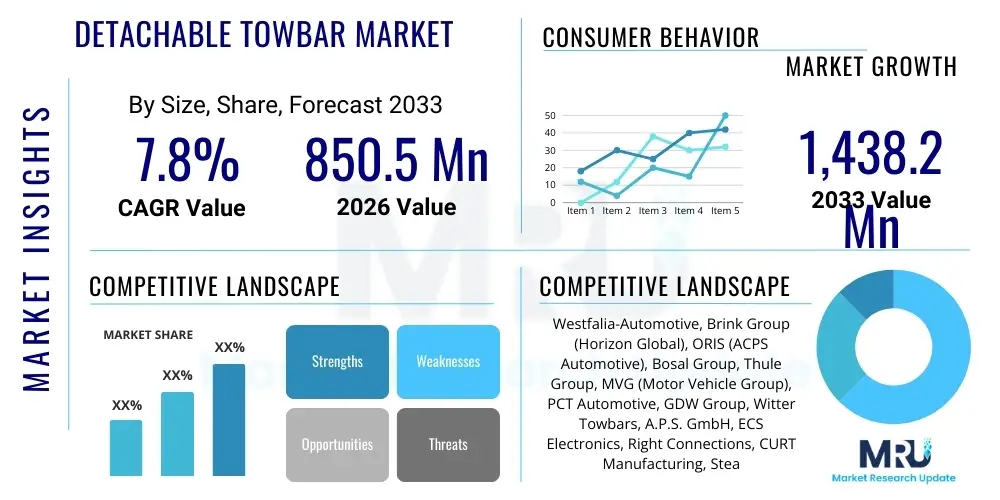

The Detachable towbar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% CAGR between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,438.2 Million by the end of the forecast period in 2033.

Detachable towbar Market introduction

The Detachable towbar Market encompasses the systems designed for vehicles, primarily passenger cars and light commercial vehicles, that allow the coupling mechanism (the towball neck) to be easily and non-permanently removed when not in use. This removal capability is a significant technological evolution from fixed or swan-neck towbars, addressing key consumer concerns related to vehicle aesthetics, potential damage to the towbar itself, and obstruction of rear parking sensors. The core product provides functionality for towing trailers, caravans, bike carriers, and specialized equipment while offering superior convenience and integration with modern vehicle designs, which often prioritize sleek lines and aerodynamic profiles. The market growth is fundamentally driven by the rising popularity of recreational vehicle use, increased consumer willingness to pay for premium vehicle accessories, and stringent regulatory requirements in regions like Europe mandating safer and less obstructive vehicle appendages.

Detachable systems are classified broadly into manual and automatic locking mechanisms. Manual systems typically require a key and a locking pin for secure attachment and detachment, offering robust security. Automatic systems, which utilize sophisticated lever or rotary mechanisms, provide enhanced user-friendliness, often requiring only a single hand operation, thereby driving adoption among mainstream vehicle owners who prioritize convenience. Major applications include leisure activities (caravanning, boating), commercial light-duty hauling, and the use of rear-mounted accessory carriers (such as bicycle racks). These products are critical safety components; hence, manufacturing processes adhere to demanding international standards such as ECE Regulation 55, ensuring the integrity and load-bearing capacity of the installed system.

The inherent benefits of detachable towbars—chiefly their aesthetic discretion and safety advantages when the neck is stored—are primary catalysts for market expansion. Driving factors include the continuous expansion of the global automotive parc, particularly in emerging economies where vehicle accessorization is gaining traction, and the rapid shift towards electric vehicles (EVs). Towbar manufacturers are actively innovating to produce lighter, stronger, and more EV-compatible systems that minimize drag and do not interfere with underbody battery packs. The aftermarket segment plays a crucial role, offering customization and installation services that cater to existing vehicle owners seeking versatile towing solutions without compromising the vehicle's original design profile, further bolstering overall market revenue generation.

Detachable towbar Market Executive Summary

The Detachable towbar Market is experiencing robust growth fueled primarily by evolving consumer preferences favoring discreet and multifunctional vehicle accessories, coupled with significant technological advancements in material science and locking mechanisms. Business trends indicate a strong move toward OEM integration, where detachable towbars are offered as factory-fitted options, capitalizing on vehicle purchasers' desire for seamless integration and warranty assurance. However, the aftermarket remains highly competitive, driven by innovation in quick-release mechanisms and compatibility solutions for the rapidly diversifying range of vehicle platforms, including SUVs and Crossovers, which are primary drivers of towing demand. Strategic partnerships between towbar manufacturers and vehicle electronics suppliers are becoming essential to ensure compatibility with advanced driver-assistance systems (ADAS) and rear sensor technology, preventing false alerts or system interference, thereby shaping the business development trajectory.

Regionally, Europe continues its dominance in the detachable towbar market, driven by high penetration of leisure vehicles (caravans and trailers) and historically strong regulatory backing for certified towing equipment. North America presents a substantial growth opportunity, characterized by a traditional high-volume towing culture, although detachable systems compete strongly against standard receiver hitches. Asia Pacific (APAC) is projected to exhibit the highest growth rate, albeit from a smaller base, propelled by the expanding middle class, increasing disposable incomes, and the consequent rise in recreational and outdoor activities in countries like Australia, China, and India. Investment in localized manufacturing and distribution networks is key to unlocking the potential in these burgeoning APAC markets, where demand for premium, non-permanent towing solutions is rapidly accelerating.

Segment trends reveal that the Automatic Detachable segment is gaining significant market share over manual versions due to enhanced ease of use and perceived premium value, aligning with the luxury and convenience positioning of modern vehicles. Furthermore, the Aftermarket segment, while facing price pressure, is innovating rapidly to service the massive installed base of vehicles, particularly focusing on plug-and-play wiring solutions that simplify professional installation. The integration of towbars into the burgeoning Electric Vehicle (EV) segment represents a crucial segment trend. Manufacturers are developing lightweight, specialized towbars that manage the high torque outputs of EVs while ensuring thermal management around the battery structure is not compromised, positioning these specialized EV-compatible products as a high-value niche driving future growth.

AI Impact Analysis on Detachable towbar Market

User queries regarding AI's influence on the Detachable towbar Market often center on how AI can enhance safety, optimize manufacturing efficiency, and contribute to personalized user experiences. Key concerns include the integration of towbar mechanics with complex vehicle ADAS (Advanced Driver Assistance Systems) and the potential for AI-driven predictive maintenance. Users frequently ask if AI is being used in the design phase to simulate stress tolerance more accurately than traditional methods and how machine learning (ML) algorithms can be deployed to predict component failure based on real-world usage data. The consensus expectation is that AI will primarily improve the security and functional reliability of the detachable mechanism through intelligent monitoring and feedback loops.

In manufacturing, AI is revolutionizing production by enabling predictive quality control and optimizing robotic welding and assembly processes. By utilizing computer vision and ML algorithms, manufacturers can detect micro-defects in critical components, such as locking pins or coupling mechanisms, significantly earlier than traditional inspection methods. This drastically reduces recall rates and enhances product reliability, which is paramount for safety-critical components like towbars. Furthermore, AI-driven demand forecasting allows supply chain managers to better predict fluctuations in both OEM and aftermarket demand, optimizing inventory levels of high-strength steel and specialized locking cylinders, thereby mitigating supply chain risks and increasing operational agility across global production facilities.

The most direct impact of AI at the consumer level involves integration with vehicle electronics. AI algorithms process data from rear sensors, electronic stability control (ESC) systems, and trailer sway control mechanisms. For detachable towbars, AI ensures that when the towball is attached, the vehicle automatically adjusts sensor sensitivity and alters the parameters for ESC and reversing aids. Future iterations may include machine learning models that assess the weight distribution and dynamic load of the attached trailer, optimizing vehicle performance settings in real-time to enhance safety and fuel efficiency during the towing operation, offering a significant value proposition to end-users.

- AI-driven optimization of material stress simulation during the design of high-strength steel components.

- Predictive maintenance algorithms monitoring towbar locking mechanism health based on usage patterns.

- Enhanced quality control in welding and casting using machine vision systems to detect microscopic flaws.

- AI integration with vehicle software to automatically adjust parking sensor range and calibrate Trailer Sway Control (TSC) upon towbar connection.

- Optimized supply chain and inventory management based on ML-driven global demand forecasting for specific towbar models.

DRO & Impact Forces Of Detachable towbar Market

The Detachable towbar Market is strategically influenced by a confluence of powerful Drivers, stringent Restraints, and compelling Opportunities, all shaped by overarching Impact Forces related to automotive safety, aesthetic standards, and technological compatibility. The key Drivers propelling growth include the strong consumer preference for non-permanent, aesthetically pleasing vehicle solutions, coupled with the increasing participation in leisure and outdoor activities requiring specialized towing equipment. These systems satisfy the dual demand for utility and seamless vehicle design, positioning them as a premium accessory. Simultaneously, the market faces Restraints such as the relatively high initial purchase and installation cost compared to fixed systems, and potential user error in ensuring the detachable mechanism is correctly locked, necessitating complex safety verification indicators in the product design.

Opportunities in the market are abundant, particularly focusing on compatibility with emerging vehicle technologies. The rapid electrification of the automotive industry presents a massive opportunity, requiring specialized, lightweight towbars compatible with EV platforms and high-voltage battery architecture. Furthermore, the development of fully automated, electrically retractable towbars that eliminate manual handling offers a superior user experience, attracting a wider demographic. The overarching Impact Forces include escalating global regulatory pressure concerning vehicle safety and pedestrian protection, pushing manufacturers to design systems that are less protruding and highly secure. Economic factors, particularly disposable income growth in developing regions, also act as a strong impact force, transforming towbars from purely utilitarian accessories into desirable lifestyle enhancements.

The interplay of these forces dictates market velocity. For instance, the demand for vehicles with high aesthetic appeal (a Driver) forces manufacturers to invest in complex retractable or detachable designs (an Opportunity). However, ensuring the integrity and safety of these complex mechanisms under high loads, while keeping costs competitive (a Restraint), requires significant R&D investment. Regulatory harmonization globally regarding towbar load ratings and testing procedures serves as a stable, positive impact force, ensuring market standardization and facilitating cross-border trade. Successfully navigating the high cost of specialized materials, such as specific alloys for strength-to-weight ratio optimization, while meeting strict safety certification timelines remains the central challenge and defining impact force for sustained market leadership.

Segmentation Analysis

The Detachable towbar Market is comprehensively segmented based on Type, Vehicle Type, and Sales Channel, reflecting the diverse application needs and distribution landscapes across global regions. Segmentation by Type distinguishes between manual and automatic (or semi-automatic) detachable systems. Manual systems, while cost-effective, require more physical interaction and often rely on robust mechanical locks. Automatic systems, conversely, utilize advanced spring mechanisms or even electrically operated locks for easier, one-touch attachment and detachment, commanding a higher price point but offering greater user convenience, and are increasingly favored in the luxury and premium vehicle segments. This distinction is crucial for manufacturers targeting different consumer demographics based on budget and expected ease of use.

Vehicle Type segmentation is critical for tailoring product design and load capacity. The segments include Passenger Cars (further detailed by Sedan, Hatchback, SUV, Crossover) and Commercial Vehicles (Light Commercial Vehicles/LCVs). The SUV and Crossover categories dominate the current market share, driven by their popularity as family vehicles suitable for recreational towing. LCVs, while historically using fixed or flanged towbars, are increasingly adopting detachable solutions to maintain vehicle flexibility when not towing, especially for urban fleets. Product development heavily focuses on achieving optimal integration with the varied chassis designs and suspension systems inherent in these different vehicle categories, specifically ensuring proper clearance and load transfer integrity.

The Sales Channel segmentation—OEM (Original Equipment Manufacturer) and Aftermarket—defines the competitive landscape and pricing strategies. The OEM channel provides towbars installed directly at the factory or dealership, offering certified compatibility and often integrating seamlessly with the vehicle’s electrical and diagnostic systems, commanding premium pricing. The Aftermarket channel involves independent distributors, specialized fitters, and online sales, offering a wider variety of models, often at more competitive prices, serving the large installed base of vehicles. The continuous tension between the high-assurance quality of OEM products and the cost-effectiveness and flexibility of Aftermarket solutions is a defining characteristic of this market’s competitive dynamics, with both channels demonstrating strong growth trajectories driven by distinct customer needs.

- By Type:

- Manual Detachable Towbars

- Automatic (Semi-Automatic/Push-and-Lock) Detachable Towbars

- By Vehicle Type:

- Passenger Cars

- SUVs and Crossovers

- Sedans and Hatchbacks

- Light Commercial Vehicles (LCVs)

- Passenger Cars

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Material:

- High-Strength Steel

- Alloy Metals (Aluminum/Composites for weight reduction)

Value Chain Analysis For Detachable towbar Market

The Value Chain for the Detachable towbar Market begins with the upstream procurement and processing of specialized raw materials, primarily high-grade, high-strength steel alloys, which are essential for meeting stringent load and safety requirements, alongside complex components like locking mechanisms and specialized plastics for housing and aesthetics. Upstream activities involve secure sourcing of materials, precision forging, and machining of the towbar beam and neck, often requiring specialized metallurgy knowledge to ensure durability, flexibility, and resistance to corrosion, particularly in diverse climatic conditions. Component suppliers, especially those providing advanced locking cylinder technologies and anti-corrosion coatings, form a critical part of this early stage, defining the quality and reliability of the final product.

Midstream activities involve sophisticated manufacturing and assembly processes. This stage is characterized by precision engineering, automated welding, and rigorous quality assurance testing, including fatigue testing and dynamic load simulations. Manufacturers must possess high technical competence to integrate the mechanical components with the increasing electronic demands of modern vehicles, particularly in managing CAN bus integration and vehicle sensors. Downstream analysis focuses on distribution and installation. Due to the safety-critical nature of the product, professional installation is heavily emphasized. Distribution channels are bifurcated: Direct distribution to OEMs requires tight integration into automotive assembly schedules, while Aftermarket distribution relies on a network of specialized wholesale distributors and certified installers who must maintain high standards of fitting accuracy and electrical integration.

The distinction between direct and indirect channels significantly impacts profitability and customer engagement. Direct sales to OEMs involve long-term contracts and economies of scale, focusing heavily on achieving vehicle platform compliance early in the design cycle. Indirect channels (Aftermarket) provide broader market access and competitive pricing but require robust technical training for thousands of independent installers globally. The effectiveness of the distribution channel is highly dependent on managing inventory of model-specific towbars and wiring kits, requiring sophisticated logistics. Ultimately, the successful value chain maximizes efficiency from raw material sourcing through precision manufacturing to certified professional installation, guaranteeing user safety and product performance over the vehicle’s lifetime.

Detachable towbar Market Potential Customers

The primary segment of potential customers for detachable towbars consists of private vehicle owners who frequently engage in recreational activities suchating, or cycling, necessitating the intermittent use of trailers or specialized carriers. This demographic values convenience, safety, and, crucially, the ability to maintain the aesthetic integrity of their vehicle when the towbar is not in use. They are typically owners of mid-to-high-end SUVs, Crossovers, and station wagons, characterized by higher disposable incomes and a willingness to invest in premium accessories that enhance their lifestyle. These customers often opt for the more expensive automatic detachable systems due to the ease of operation and seamless vehicle integration offered through the OEM or high-quality Aftermarket channel.

A secondary, yet rapidly growing, customer segment includes corporate and commercial vehicle fleets, particularly those involved in light-duty logistics, maintenance, or specialized services, such as utility companies or specialized equipment rental businesses. While traditionally favoring fixed towbars for robustness, these fleets are increasingly recognizing the benefits of detachable systems for versatility and reducing vehicle wear and tear when unnecessary equipment is removed. For this segment, factors like durability, quick attachment/detachment cycles, and total cost of ownership (TCO) are paramount. They primarily source through B2B contracts via the Aftermarket or fleet management partners, focusing on certified installations to meet stringent occupational safety standards.

A third crucial segment comprises caravan and trailer rental companies, along with dealerships specializing in recreational vehicles (RVs). These businesses require durable, safe, and easily operable towbars that can withstand frequent attachment and detachment by various users. Since towbars are essential components of their service offering, reliability and minimized maintenance downtime are key purchase criteria. They often act as bulk buyers, demanding high-quality, standardized components, focusing on systems with clear visual safety indicators to minimize user error, thereby reducing liability and ensuring customer satisfaction with their rented equipment. The EV owner base is also rapidly emerging as a potential customer, demanding specialized, lightweight detachable systems that do not unduly affect range or battery thermal management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,438.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Westfalia-Automotive, Brink Group (Horizon Global), ORIS (ACPS Automotive), Bosal Group, Thule Group, MVG (Motor Vehicle Group), PCT Automotive, GDW Group, Witter Towbars, A.P.S. GmbH, ECS Electronics, Right Connections, CURT Manufacturing, Stealth Hitches, VBG Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Detachable towbar Market Key Technology Landscape

The technology landscape within the Detachable towbar Market is rapidly evolving, driven by the need for enhanced safety, reduced weight, and improved user convenience. A major technological focus involves advanced material science, moving beyond conventional mild steel to incorporate high-strength, lightweight steel alloys and even specialized composite materials. These materials not only reduce the overall mass of the towbar assembly, which is crucial for maximizing vehicle payload and minimizing fuel/energy consumption (especially relevant for EVs), but also maintain or exceed the stringent regulatory requirements for dynamic load bearing and fatigue resistance. Furthermore, sophisticated anti-corrosion treatments, such as specialized electrocoating and powder coating techniques, are key technological differentiators, extending the operational lifespan and aesthetic appeal of the hidden components.

Another critical area of technological innovation is the locking and release mechanism itself. The shift towards semi-automatic and fully automatic detachable systems necessitates highly reliable, precision-engineered mechanical components. Key technologies here include positive locking indicators, which provide both audible and visual confirmation (often color-coded) that the towball neck is securely engaged, thereby minimizing the risk of accidental detachment—a significant safety concern. Additionally, electronic integration technologies are essential. Modern systems utilize advanced wiring looms and control units that communicate seamlessly via the vehicle's CAN bus network. This ensures that features like trailer light monitoring, parking sensor deactivation, and the activation of dedicated Trailer Sway Control (TSC) software modules are executed flawlessly upon towbar coupling, relying on high-fidelity electronic components and standardized connectivity interfaces.

The emerging technological frontier is the development of fully electrically retractable towbars, which, while technically often integrated into the vehicle structure, serve the same functional purpose as highly advanced detachable units. These systems use robust electric motors and gear trains controlled via a dashboard button or the vehicle’s infotainment screen, completely eliminating manual handling. This technology not only offers maximum convenience but also allows for better sealing and protection against environmental factors. In parallel, advancements in sensor technology are leading to systems that can self-diagnose mechanical issues within the locking mechanism and alert the driver, positioning the product line closer to an intelligent vehicle accessory rather than a simple mechanical component, pushing the boundary of both mechanical and electronic engineering in the segment.

Regional Highlights

- Europe: Market Dominance and Regulatory Leadership

Europe holds the dominant share in the Detachable towbar Market, driven by a deeply ingrained culture of caravanning and outdoor recreation, combined with strict and harmonized vehicle safety regulations (like ECE R55) that favor certified towing solutions. Countries such as Germany, the UK, the Netherlands, and France exhibit extremely high penetration rates. Regulatory pressure requiring towbars to be removed if they obscure the license plate or conflict with sensor systems, particularly on luxury vehicles, has cemented the detachable towbar as the standard solution. The market here is mature but continues to grow through the rapid adoption of premium automatic systems and specialized solutions for the burgeoning European EV segment. European manufacturers are the global leaders in innovation and quality assurance, often setting the benchmark for the rest of the world through rigorous testing protocols and advanced design integration.

The high density of specialized vehicle workshops and certified installers further supports market strength in Europe. Manufacturers actively engage with European automotive design houses to ensure that detachable towbars are integrated into the vehicle structure early in the design phase, maximizing load capacity and maintaining vehicle warranties. The focus on reducing vehicle emissions and improving pedestrian safety also favors detachable designs, as they are completely concealed when not in use, reducing aerodynamic drag and minimizing potential injury risk in low-speed accidents. This region serves as the primary testing ground for new technologies, including electronic retraction and advanced diagnostics, before they are introduced globally.

- North America: Shifting Preferences and High Towing Demand

While North America traditionally relies on standard square receiver hitches (Class I-V), the market for detachable and specialized concealed hitches is rapidly expanding, particularly within the SUV and premium passenger vehicle segments. North American consumers appreciate the convenience of the detachable system, which allows the vehicle’s rear aesthetic to remain uncluttered, contrasting with the visible permanence of traditional fixed receiver tubes. The demand is strong across the leisure segment, especially for towing light trailers, boats, and large bicycle carriers. However, the market must address the typically higher maximum tow ratings required in the US and Canada, necessitating robust and highly engineered detachable systems that meet US SAE J684 standards.

The growth strategy in North America involves overcoming the cost barrier and establishing stronger distribution networks that educate consumers and installers about the benefits and safety protocols of detachable European-style systems. Manufacturers are focusing on developing products that integrate seamlessly into existing truck and large SUV chassis, catering to the region's preference for larger vehicles. The advent of electric pickup trucks and SUVs in the region is a significant driver, as manufacturers look for innovative ways to offer high towing capability without compromising range or interfering with the large battery architecture, offering a key entry point for high-tech, detachable, lightweight solutions.

- Asia Pacific (APAC): Rapid Expansion and Urbanization

APAC is projected to be the fastest-growing region, driven by rising vehicle ownership, increasing disposable incomes, and the consequent growth of recreational tourism in countries like Australia, China, and South Korea. Australia, in particular, has a mature and robust market for towing equipment, favoring high-quality, durable detachable systems due to its vast distances and rugged terrain. In emerging economies like China and India, the market is still nascent but expanding rapidly, fueled by the demand for SUVs and the proliferation of local manufacturing capabilities.

Urbanization and limited parking space in major APAC cities further accelerate the adoption of detachable towbars, as fixed systems can pose logistical challenges in tight parking environments. The challenge in this region is the fragmentation of regulatory standards and the prevalence of lower-cost, lower-quality alternatives. Successful market entry requires manufacturers to establish strong local partnerships, tailor products to Asian vehicle specifications, and invest in consumer education regarding the safety benefits of certified detachable systems over cheaper, permanent fixtures. The OEM segment is crucial in APAC, as consumers often rely on dealership assurance for high-value accessories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Detachable towbar Market.- Westfalia-Automotive GmbH

- Brink Group (A Horizon Global Company)

- ACPS Automotive (ORIS)

- Bosal Group

- Thule Group

- MVG (Motor Vehicle Group)

- PCT Automotive

- GDW Group

- Witter Towbars

- A.P.S. GmbH

- ECS Electronics BV

- Right Connections UK Ltd.

- CURT Manufacturing LLC (A Lippert Component Company)

- Stealth Hitches LLC

- VBG Group AB

- Dixon-Bate (A Thule Group Brand)

- Ahlberg-Hansen A/S

- Tow-Trust Towbars Ltd.

- Erich Jaeger GmbH + Co. KG

- Apollo Towbars

Frequently Asked Questions

Analyze common user questions about the Detachable towbar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a detachable towbar over a fixed towbar?

The primary advantage is vehicle aesthetics and safety. Detachable towbars allow the towball neck to be completely removed and stored when not in use, maintaining the vehicle's original design, avoiding obstruction of rear parking sensors, and reducing the risk of collision damage or injury associated with a permanent protrusion.

Are detachable towbars safe and secure under heavy loads?

Yes, modern detachable towbars are highly safe. They are engineered to meet stringent global standards, such as ECE R55 certification, which mandates rigorous testing for strength, durability, and fatigue. When correctly locked, they perform identically to fixed towbars, often featuring positive visual and audible safety indicators to confirm secure engagement.

How does the compatibility of detachable towbars with Electric Vehicles (EVs) affect the market?

EV compatibility is driving innovation. Detachable towbars for EVs must be lightweight to minimize impact on driving range and designed specifically to avoid interference with the underfloor battery structure and thermal management systems. Specialized EV towbars represent a high-growth, high-value segment focusing on precise integration and specialized materials.

Is the Aftermarket or OEM channel better for purchasing a detachable towbar?

The OEM channel guarantees certified integration with the vehicle’s electronic systems and typically preserves the vehicle warranty, offering premium quality and seamless fit. The Aftermarket channel provides a wider selection of products, often at a lower cost, serving existing vehicles, but requires careful selection of certified installers to ensure safe and correct electronic integration.

What are the key technological advancements driving premium detachable towbar growth?

Key advancements include the proliferation of automatic, key-operated locking mechanisms for ease of use, integration of high-strength, lightweight steel alloys for performance optimization, and sophisticated electronic interface units that communicate via the vehicle's CAN bus for seamless control of lighting and safety features like Trailer Sway Control (TSC).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager