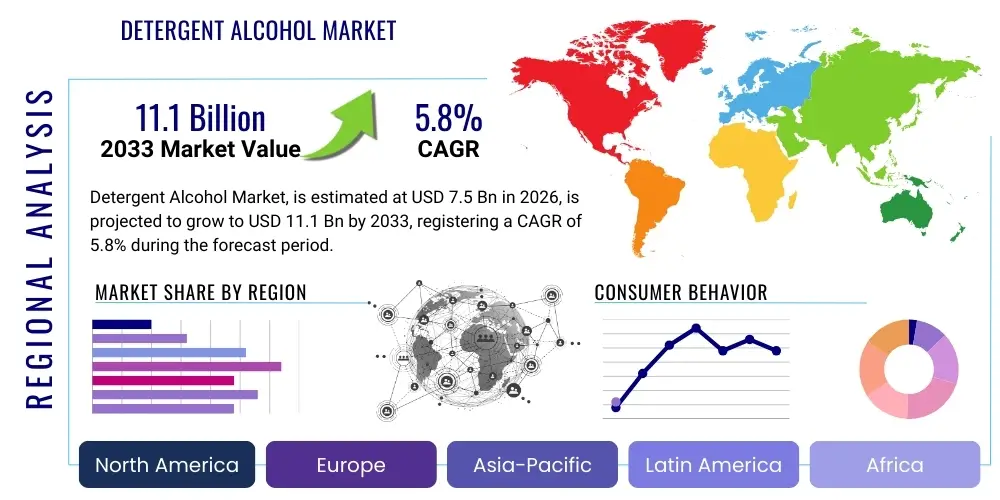

Detergent Alcohol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436965 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Detergent Alcohol Market Size

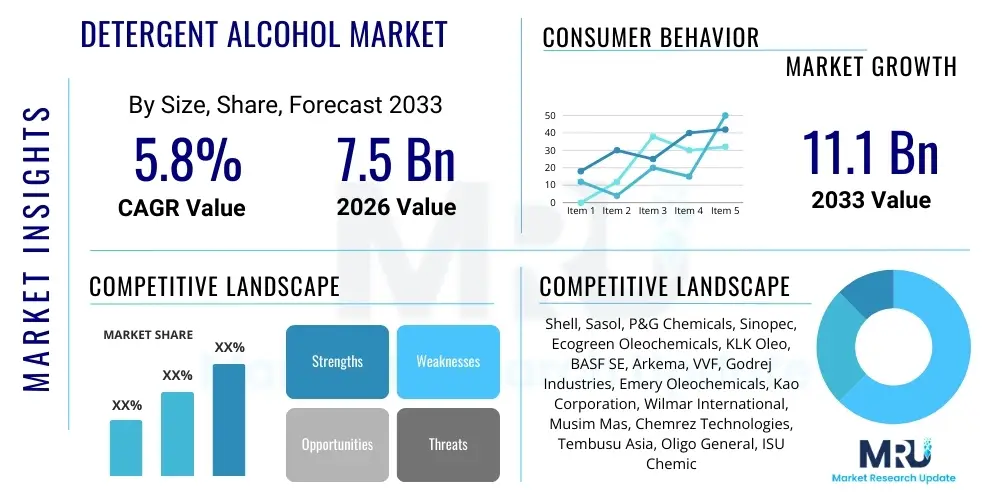

The Detergent Alcohol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $11.1 Billion by the end of the forecast period in 2033.

Detergent Alcohol Market introduction

Detergent alcohols, commonly known as fatty alcohols, are long-chain aliphatic alcohols that serve as fundamental building blocks in the chemical industry, particularly in the production of surfactants. These alcohols, characterized by chain lengths typically ranging from C8 to C18, are crucial for manufacturing materials used in cleaning, personal care, and industrial processes. Their primary function lies in the synthesis of ethoxylates, sulfates, and ether sulfates, which are the main active ingredients that impart cleansing and emulsifying properties to detergents and personal care products. The market growth is intricately linked to the burgeoning demand for high-performance and specialty cleaning formulations across both developed and rapidly industrializing economies, driven by evolving consumer standards of hygiene and cleanliness globally.

The sourcing of detergent alcohols is divided primarily into two major categories: natural (oleochemicals) derived from vegetable oils such as palm kernel oil and coconut oil, and synthetic (petrochemicals) derived from petroleum sources like ethylene. The increasing consumer preference for bio-based and sustainable products has significantly accelerated the demand for natural detergent alcohols, placing pressure on raw material supply chains and necessitating stringent certification processes related to sustainable sourcing, such as RSPO certification. Furthermore, detergent alcohols are not confined solely to cleaning agents; they are also widely utilized as emollients and thickeners in cosmetics, intermediates in plasticizer production, and high-pgrade lubricants, diversifying their application portfolio and stabilizing market demand against fluctuations in any single end-use sector.

Key benefits derived from detergent alcohols include their excellent biodegradability, especially the naturally sourced varieties, and their ability to produce high-foaming and effective cleaning agents. The market is substantially driven by macroeconomic factors such as rising disposable incomes, population growth, and increasing urbanization, which collectively fuel the consumption of packaged household cleaning products. Technological advancements in catalysis and process engineering are continuously being introduced to enhance the efficiency of both synthetic and oleochemical production routes, aiming to reduce production costs, minimize waste, and improve the purity profiles of the resulting alcohol products, thereby supporting sustainable and cost-effective expansion across the globe.

Detergent Alcohol Market Executive Summary

The Detergent Alcohol Market is experiencing dynamic shifts, largely characterized by a pronounced transition towards sustainable and bio-based feedstocks, impacting global business trends significantly. Major market players are heavily investing in expanding their oleochemical capacity, particularly in Southeast Asia, which is the epicenter of palm oil production. This trend reflects the stringent regulatory environment in developed markets, which increasingly favors biodegradable ingredients, compelling manufacturers to adapt their supply chains and product portfolios. Furthermore, consolidation within the downstream consumer goods sector is influencing procurement strategies, leading to demand for long-term, stable, and certified sustainable supply agreements, thereby stabilizing pricing mechanisms despite volatility in feedstock commodity markets.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant force in both production and consumption, primarily due to the high availability of raw materials and rapid expansion in end-use industries like household and personal care in China, India, and Indonesia. Conversely, mature markets in North America and Europe are focusing intensely on innovation, particularly in developing ultra-concentrated formulas and specialty C12-C14 alcohols that offer superior performance in cold water washing. The regulatory landscape in the EU, driven by mandates like the European Green Deal, is setting global benchmarks for sustainability, challenging synthetic alcohol producers to demonstrate comparable environmental performance or risk displacement by natural alternatives.

Segmentation trends highlight the increasing premiumization of mid-cut fatty alcohols (C12–C14) due to their optimal performance profile in surfactant production. While synthetic alcohols maintain a stable presence due to their price competitiveness and consistent quality, the natural alcohol segment is expected to outpace growth, fueled by consumer preference for natural labeling and corporate commitments to environmental, social, and governance (ESG) goals. Within applications, the surfactants segment holds the overwhelming majority of market share, although emerging uses in high-performance synthetic lubricants and specialized industrial cleaning applications are providing critical growth avenues, diversifying the overall segment portfolio and ensuring robust demand structure.

AI Impact Analysis on Detergent Alcohol Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Detergent Alcohol Market frequently revolve around optimizing complex supply chain logistics, predicting volatile feedstock prices (especially palm oil derivatives), and enhancing process efficiency in hydrogenation and purification stages. Users are deeply interested in how AI can introduce predictive maintenance protocols to minimize downtime in high-capital manufacturing facilities and how machine learning algorithms can rapidly analyze complex chemical formulations to accelerate the development of new, high-performance, and sustainable surfactant products. Key concerns center on the capital investment required for integrating smart factory technologies and the need for specialized data infrastructure to handle real-time monitoring of chemical reactions and global inventory movements. The consensus expectation is that AI will primarily drive cost reduction through improved operational efficiency and enhance market responsiveness by better forecasting demand fluctuations based on complex environmental and consumer datasets.

- AI optimizes predictive feedstock pricing models, mitigating risks associated with volatile commodity markets.

- Machine learning enhances chemical synthesis processes, leading to higher yield and purity in alcohol production.

- AI-driven supply chain transparency improves traceability for sustainable (RSPO certified) natural alcohols.

- Predictive maintenance algorithms minimize plant downtime, significantly reducing operational expenditures (OPEX).

- Advanced analytics supports accelerated R&D for novel surfactant compositions and specialty alcohol derivatives.

- Automated quality control systems ensure precise adherence to technical specifications for high-grade industrial applications.

DRO & Impact Forces Of Detergent Alcohol Market

The dynamics of the Detergent Alcohol Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to significant Impact Forces stemming from global sustainability mandates and raw material availability. Key drivers include the exponential increase in demand for personal care and household cleaning products, especially in emerging markets where hygiene awareness and disposable incomes are rising. Furthermore, the mandatory shift towards high-performance and biodegradable surfactants is inherently driving the demand for specialty C12–C14 fatty alcohols. Restraints, however, include the extreme price volatility of natural feedstocks (palm oil and coconut oil), which impacts the cost structure of major oleochemical producers, leading to unpredictable profit margins. Additionally, stringent environmental regulations regarding the production and sourcing of these chemicals pose compliance burdens, particularly for smaller market players, necessitating significant investment in sustainable practices and ethical sourcing verification.

Opportunities in the market center around the expansion into niche applications such as enhanced oil recovery (EOR) chemicals, specialized emollients for premium cosmetics, and bio-lubricants, which offer higher margins compared to bulk detergent ingredients. The increasing industrial focus on green chemistry and circular economy principles also presents opportunities for technological innovation in waste valorization and the development of non-conventional oleochemical feedstocks. Moreover, geographical expansion, particularly into underserved sub-Saharan African and specific Latin American markets, provides untapped avenues for growth as urbanization accelerates in these regions, fueling baseline consumption of cleaning agents and related products.

The primary impact forces acting upon this market are regulatory shifts concerning sustainability and the geopolitical stability affecting global supply chains. Regulatory bodies are increasingly scrutinizing the environmental footprint of petrochemical derivatives, thereby accelerating the substitution of synthetic alcohols with natural alternatives. Concurrently, issues related to land use, deforestation, and labor practices associated with palm oil cultivation generate intense consumer scrutiny, forcing detergent alcohol manufacturers to invest heavily in robust impact force mitigation strategies such as achieving and maintaining certifications from organizations like the Roundtable on Sustainable Palm Oil (RSPO). These forces collectively dictate long-term investment decisions regarding capacity expansion, feedstock selection, and geographical operational focus, profoundly shaping the competitive landscape for the coming decade.

Segmentation Analysis

The Detergent Alcohol Market segmentation provides crucial insights into product specialization and end-user consumption patterns, allowing for precise market targeting and strategic resource allocation. The market is fundamentally segmented by Type (Natural vs. Synthetic), Application (Surfactants, Plasticizers, Solvents), and End-Use Industry (Household Care, Industrial & Institutional Cleaning, Personal Care). Analyzing these segments reveals that the overwhelming majority of volume is directed toward surfactant production, which serves as the largest consumer base, demanding specific chain length distributions for optimal performance in various cleaning formulations. The differentiation between natural and synthetic origins is the most critical axis of segmentation, increasingly influencing purchasing decisions based on sustainability goals and feedstock price stability, with natural derivatives showing higher growth rates.

Within the type segmentation, natural fatty alcohols are segmented further by source, such as those derived from palm kernel oil or coconut oil, each imparting slightly different characteristics regarding chain length distribution. The synthetic alcohol segment, derived mainly through the Ziegler process or Oxo synthesis, provides manufacturers with excellent control over chain uniformity, a critical advantage for highly specialized industrial applications where precise chemical properties are paramount. Furthermore, end-use segmentation demonstrates strong resilience in the household care sector, driven by non-discretionary consumer needs, while the personal care segment exhibits higher value growth due to its requirement for high-purity, often cosmetic-grade, alcohols used as emollients and emulsifiers.

Geographical segmentation, while not explicitly listed as a primary metric in the bullet points below, heavily influences the product mix within applications. For example, North America and Europe demand sophisticated, sustainable, and specialized surfactants based on C12-C14 alcohols, whereas developing regions often prioritize C16-C18 alcohols for industrial formulations where cost-effectiveness remains the principal consideration. Understanding the interplay between chain length, origin, and regional preference is essential for optimizing supply chain logistics and ensuring alignment with specific regulatory requirements across different global markets.

- By Type:

- Natural Alcohol (Oleochemical)

- Synthetic Alcohol (Petrochemical)

- By Application:

- Surfactants (Anionic, Non-ionic, Amphoteric)

- Plasticizers

- Solvents

- Lubricants and Oilfield Chemicals

- Emollients and Thickening Agents

- Others (e.g., Agricultural Adjuvants)

- By End-Use Industry:

- Household Care (Laundry Detergents, Dishwashing Liquids)

- Industrial & Institutional (I&I) Cleaning

- Personal Care (Cosmetics, Shampoos, Soaps)

- Agriculture

- Textiles and Leather Processing

Value Chain Analysis For Detergent Alcohol Market

The value chain for the Detergent Alcohol Market is extensive, starting from highly volatile upstream raw material sourcing and extending through complex chemical processing to a highly diversified downstream end-user base. The upstream analysis focuses heavily on the procurement of feedstocks: crude oil derivatives (ethylene) for synthetic production, and crude palm kernel oil (CPKO) or coconut oil for natural production. Volatility in the commodity markets for these raw materials directly dictates the manufacturing cost of the final product, compelling producers to engage in sophisticated hedging and forward-contract strategies. Production involves high-capital, energy-intensive processes such as high-pressure hydrogenation for natural oils or the multi-stage Ziegler process for synthetic routes, requiring specialized technological expertise and significant operational scale to achieve cost efficiencies.

The midstream section involves the conversion of raw alcohols into derivatives, primarily ethoxylates, sulfates, and ether sulfates, which are the functional components of detergents. This conversion stage often involves proprietary catalytic processes and significant capital expenditure. Distribution channels are highly structured, relying on a combination of direct sales and specialized chemical distributors. For high-volume producers serving multinational consumer goods companies, a direct sales model ensures better quality control, customized product specifications, and stronger relationship management. Conversely, smaller end-users, especially in industrial cleaning or regional specialty applications, rely on indirect distribution through regional chemical wholesalers who manage inventory, repackaging, and smaller, localized deliveries.

Downstream analysis highlights the role of Fast-Moving Consumer Goods (FMCG) giants as the primary purchasers, integrating detergent alcohols into massive product lines encompassing laundry, dishwashing, and body care. The demand signals from these downstream users are highly influential, particularly concerning sustainability requirements (e.g., preference for RSPO Mass Balance or Segregated certified materials) and requirements for specific chemical profiles (e.g., specific carbon chain length splits). The effectiveness of the overall value chain hinges on synchronized, transparent, and robust logistics, ensuring timely delivery of sensitive chemical ingredients globally while adhering to stringent handling and regulatory standards. The trend toward vertical integration, especially among companies that control both oleochemical feedstock processing and detergent formulation, aims to minimize supply chain risk and maximize margin capture across multiple stages.

Detergent Alcohol Market Potential Customers

The potential customer base for the Detergent Alcohol Market is broad and characterized by high volume consumption across several distinct industrial sectors, driven primarily by the need for effective surfactants and functional chemical intermediates. The primary end-users are multinational and regional corporations operating within the Household Care and Personal Care sectors. These customers, including major laundry detergent and cosmetics manufacturers, demand large, consistent volumes of C12-C14 alcohols (and their derivatives) that meet specific performance criteria, such as superior foam stability, emulsification properties, and, increasingly, high biodegradability metrics. Procurement decisions within this segment are highly sensitive to both price stability and documented evidence of sustainable sourcing practices.

A secondary, yet rapidly expanding, segment of potential customers includes Industrial and Institutional (I&I) cleaning service providers and chemical formulators serving heavy industry. These customers utilize detergent alcohols in high-concentration industrial degreasers, cleaning concentrates for hospitals and food service, and specialized metal surface preparation agents. The requirement here is less focused on cosmetic elegance and more on robustness, efficacy in extreme conditions (high pH or temperature), and cost-effectiveness. Furthermore, specialized chemical companies producing plasticizers (phthalates and non-phthalates) also represent important buyers, using detergent alcohols as vital intermediates to impart flexibility and durability to polymer products.

In addition to the traditional cleaning sectors, the agricultural chemicals industry is an increasingly significant customer, utilizing detergent alcohols as formulating aids, emulsifiers, and dispersants in pesticide and fertilizer applications to ensure effective delivery and spreadability. Lubricant manufacturers also constitute a niche, high-value customer base, particularly those focusing on environmentally acceptable lubricants (EALs) and synthetic fluids where fatty alcohol derivatives provide superior viscosity and lubricity characteristics. Engaging with these diverse potential customers requires a specialized sales strategy, tailored technical support, and the ability to provide documentation verifying product purity and compliance with diverse regional chemical registration requirements (e.g., REACH, TSCA).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $11.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shell, Sasol, P&G Chemicals, Sinopec, Ecogreen Oleochemicals, KLK Oleo, BASF SE, Arkema, VVF, Godrej Industries, Emery Oleochemicals, Kao Corporation, Wilmar International, Musim Mas, Chemrez Technologies, Tembusu Asia, Oligo General, ISU Chemical, PTT Global Chemical, Mitsubishi Chemical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Detergent Alcohol Market Key Technology Landscape

The technological landscape of the Detergent Alcohol Market is defined by continuous innovation aimed at improving feedstock efficiency, enhancing product purity, and minimizing environmental impact across both synthetic and oleochemical production pathways. In the synthetic segment, the primary focus is on advancing catalytic systems used in the Ziegler process (ethylene oligomerization) and Oxo synthesis to gain tighter control over the carbon chain length distribution. Newer technologies are concentrating on highly selective catalysts that can produce narrow-cut alcohol fractions with superior consistency, which is particularly critical for high-end industrial and specialty chemical applications. Furthermore, significant research and development efforts are dedicated to optimizing the energy consumption of these processes, leveraging process intensification techniques to reduce operational expenditures and carbon footprint, thereby addressing environmental scrutiny facing petrochemical-derived products.

In the natural alcohol sector, the key technological advancements revolve around efficient hydrolysis and high-pressure hydrogenation techniques required to convert fatty acids from vegetable oils into fatty alcohols. Continuous processing technologies and advanced reactor designs are being implemented to increase throughput and yield while reducing the need for harsh chemicals. A crucial innovation area involves the purification and fractionation technology, particularly molecular distillation and specialized crystallization methods, used to separate mixed-chain alcohols into specific, market-preferred cuts (e.g., high-purity C12 or C14 cuts). These precision separation techniques are essential for meeting the stringent quality requirements of the personal care and high-performance surfactant markets, ensuring the final product is free from undesirable impurities that could affect foaming or stability.

A third, emerging area of technological innovation involves sustainable sourcing and alternative feedstocks. Research is accelerating into producing detergent alcohols via fermentation pathways, utilizing renewable resources such as sugars or industrial waste streams, potentially bypassing the volatility and environmental criticisms associated with traditional palm oil cultivation. While still nascent, these bio-fermentation technologies represent a significant long-term shift, offering a pathway to truly sustainable, non-crop-based detergent alcohol production. Furthermore, digital technologies, including sensors and AI-driven process control systems, are becoming standard across both synthetic and natural plants, enabling real-time monitoring and optimization of complex chemical reactions, leading to unprecedented levels of operational efficiency and product quality assurance across the entire production matrix.

Regional Highlights

The global demand and supply dynamics of the Detergent Alcohol Market are heavily segmented by geographical region, reflecting differences in raw material access, regulatory frameworks, economic development, and consumer maturity. Asia Pacific (APAC) dominates the market, primarily serving as the major production hub for natural fatty alcohols due to its proximity to abundant oleochemical feedstocks in Malaysia and Indonesia. Countries like China and India are also the largest consumption centers, driven by rapid urbanization, massive population bases, and burgeoning middle classes that exhibit high and accelerating demand for packaged household and personal care products. The regional strategic focus in APAC is on expanding large-scale, cost-efficient production capacity to meet both internal demand and global export requirements, often leading to competitive pricing structures.

North America and Europe represent mature, high-value markets characterized by stringent regulatory oversight and a strong emphasis on product sustainability and premiumization. European regulations, spearheaded by directives like REACH and strong public pressure, drive high demand for certified sustainable (RSPO) natural alcohols and high-purity, specialized synthetic alcohols that minimize environmental toxicity. North America mirrors this trend, focusing on high-performance formulations, cold-water efficacy, and the development of high-concentration detergent pods and liquids. Manufacturers in these regions prioritize innovation in downstream product formulation and seek supply chain transparency, often willing to pay a premium for materials that ensure compliance and enhance corporate sustainability credentials.

Latin America and the Middle East & Africa (MEA) are characterized by significant growth potential, although they currently hold smaller market shares. In Latin America, economic recovery and industrialization are fueling increasing consumption across all end-use sectors, particularly in Brazil and Mexico. The MEA region, heavily reliant on imports, is seeing consumption growth driven by population expansion and hygiene initiatives. Furthermore, the Middle East, with its significant petrochemical infrastructure, maintains strong stability in the supply of synthetic detergent alcohols, serving as a regional source for specific industrial applications. Regional disparities necessitate localized strategies for market entry, distribution, and product offering, taking into account variances in purchasing power and existing regulatory structures regarding chemical import and usage.

- Asia Pacific (APAC): Dominates both production (oleochemicals) and consumption; high growth driven by China and India's booming consumer markets.

- Europe: High focus on sustainability, biodegradable inputs, and stringent chemical regulations (REACH); drives demand for certified natural and specialized synthetic grades.

- North America: Mature market prioritizing high-performance, ultra-concentrated formulas; strong regulatory emphasis on consumer safety and environmental impact mitigation.

- Latin America: Growing market potential driven by improving economic conditions and increasing demand for household and personal care staples, especially in Brazil.

- Middle East and Africa (MEA): Emerging growth area; Middle East maintains importance as a key producer of synthetic alcohols due to petrochemical infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Detergent Alcohol Market.- Shell

- Sasol

- P&G Chemicals

- Sinopec

- Ecogreen Oleochemicals

- KLK Oleo

- BASF SE

- Arkema

- VVF

- Godrej Industries

- Emery Oleochemicals

- Kao Corporation

- Wilmar International

- Musim Mas

- Chemrez Technologies

- Tembusu Asia

- Oligo General

- ISU Chemical

- PTT Global Chemical

- Mitsubishi Chemical

Frequently Asked Questions

Analyze common user questions about the Detergent Alcohol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between natural and synthetic detergent alcohols?

Natural detergent alcohols are derived from renewable oleochemical sources like palm kernel or coconut oil and are inherently biodegradable. Synthetic alcohols are petroleum-derived (petrochemicals) and offer higher chain length consistency and purity control, often at a more stable price point, though they face greater environmental scrutiny regarding their source material.

Which carbon chain lengths are most critical for surfactant manufacturing?

The most critical carbon chain lengths are C12 to C14 (dodecanol to tetradecanol). These "mid-cut" alcohols provide the optimal balance of water solubility and oil affinity required for superior foaming, emulsifying, and cleaning performance in most laundry and personal care surfactants.

How does the volatile nature of palm oil impact the Detergent Alcohol Market?

Palm oil price volatility directly affects the cost structure of natural (oleochemical) detergent alcohols, impacting profitability and requiring producers to employ complex hedging strategies. Furthermore, sustainability issues linked to palm oil cultivation necessitate expensive certification (RSPO) and careful supply chain management, driving up compliance costs.

What are the fastest-growing application segments in this market?

While the Surfactants segment remains the largest consumer, the fastest growing application segments include high-end Personal Care (emollients and thickening agents in cosmetics) and specialized Industrial & Institutional (I&I) cleaning products, driven by stricter hygiene standards globally and consumer demand for premium formulations.

Which geographical region is expected to lead market growth in the forecast period?

The Asia Pacific (APAC) region is projected to lead market growth throughout the forecast period (2026-2033), primarily due to its position as the major global production hub for natural alcohols and the tremendous, accelerating domestic demand generated by large, rapidly expanding consumer bases in China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager