Dewaxing Autoclaves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435233 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Dewaxing Autoclaves Market Size

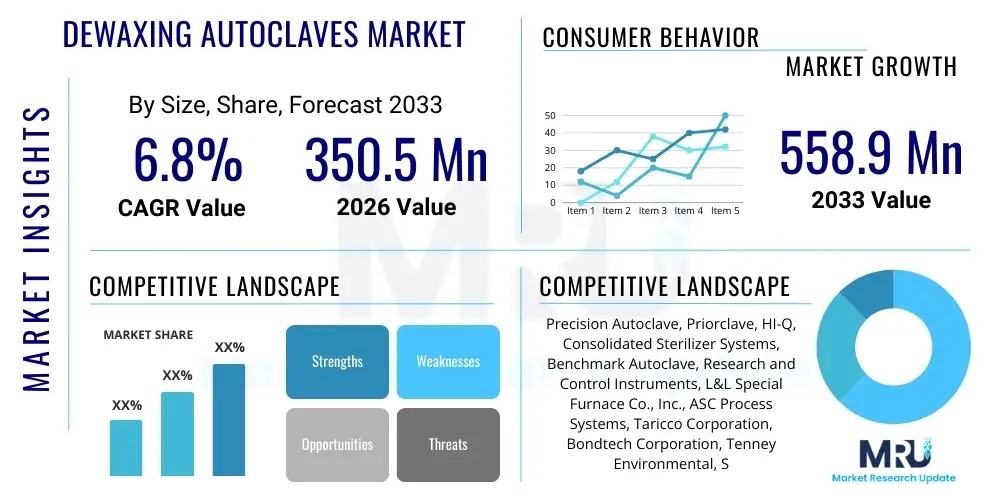

The Dewaxing Autoclaves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 558.9 Million by the end of the forecast period in 2033.

Dewaxing Autoclaves Market introduction

The Dewaxing Autoclaves Market encompasses specialized high-pressure vessels designed for the precise removal of wax patterns from ceramic molds in the investment casting process. This critical industrial step, also known as the lost-wax process, relies heavily on these autoclaves to ensure complete wax burnout without damaging the delicate ceramic shell structure. These advanced systems utilize steam pressure, hot water, or specific solvents under controlled temperature and pressure conditions to rapidly melt and remove the wax, which is essential for manufacturing high-integrity metal parts, particularly in demanding sectors like aerospace, defense, and medical device manufacturing.

The primary applications of dewaxing autoclaves are centered around producing complex, high-precision components that require superior surface finish and dimensional accuracy. Their benefits include enhanced processing speed, higher throughput compared to traditional oven methods, reduced risk of mold cracking (due to controlled heating), and improved environmental compliance through effective wax collection and recycling. The ability to handle large or intricately shaped molds uniformly makes them indispensable tools in modern foundries focusing on premium castings, driving their sustained market demand.

Major driving factors include the escalating global demand for investment castings in the aerospace sector, fueled by increased aircraft production and MRO activities requiring lightweight, high-temperature resistant components. Furthermore, the expansion of the medical device industry, particularly in orthopedic and surgical implants manufactured via investment casting, significantly contributes to market growth. Technological advancements focusing on automation, improved pressure control systems, and energy efficiency are further cementing the necessity and adoption of modern dewaxing autoclave technologies across various geographical regions.

Dewaxing Autoclaves Market Executive Summary

The Dewaxing Autoclaves Market is characterized by steady technological evolution and strong demand correlation with high-value manufacturing industries, notably aerospace and medical devices. Business trends indicate a shift towards larger capacity, automated systems that integrate advanced data logging and process control capabilities to meet stringent regulatory requirements imposed by key end-user sectors. Foundries are increasingly investing in sophisticated autoclaves that offer faster cycle times and enhanced reliability, necessitating partnerships between autoclave manufacturers and process control software developers. Supply chain resilience, particularly concerning high-pressure vessel certification and material sourcing, remains a pivotal factor affecting manufacturing costs and lead times within this specialized industry.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, driven by substantial industrial expansion, particularly in China and India, where rapid urbanization and government investments in aerospace and defense capabilities are escalating investment casting volumes. North America and Europe, while mature markets, maintain dominance in terms of technological innovation and high-specification autoclave adoption, primarily serving established aerospace primes and medical implant manufacturers. Regulatory scrutiny regarding safety and emissions in these Western markets is compelling manufacturers to prioritize highly efficient, closed-loop systems for wax recovery and solvent management.

Segment trends underscore the increasing preference for High-Pressure Autoclaves, as they offer superior performance in handling complex ceramic molds and reduce cycle times significantly compared to traditional low-pressure steam units. The adoption of large capacity autoclaves (greater than 10 cubic meters) is also rising, catering to high-volume commercial aerospace component production. Furthermore, the market is seeing increased customization, with many purchasers demanding bespoke dimensions, control systems, and integration features tailored specifically to their proprietary casting materials and mold geometries. This move toward customization elevates the importance of specialized engineering expertise among leading market players.

AI Impact Analysis on Dewaxing Autoclaves Market

User queries regarding AI in the Dewaxing Autoclaves Market generally focus on how artificial intelligence can optimize operational efficiency, predict equipment failure, and enhance the overall quality and consistency of the dewaxing process. Key themes revolve around the integration of machine learning algorithms for real-time fault detection in pressure and temperature sensors, optimizing cycle parameters based on mold load and geometry (predictive processing), and automating maintenance scheduling (predictive maintenance). Users are concerned about the complexity of implementing such systems and the return on investment, while simultaneously expecting AI to minimize energy consumption and reduce the incidence of catastrophic ceramic shell failure due to process inconsistencies.

AI's primary influence is moving dewaxing operations from reactive or fixed-parameter processing to truly predictive and adaptive control. By analyzing vast datasets generated during autoclave cycles—including pressure ramps, temperature distributions, vacuum levels, and material properties—AI models can detect subtle anomalies that signal impending process deviations far before standard monitoring systems. This level of granular control is crucial for high-value castings where defects resulting from improper dewaxing can lead to the rejection of expensive components. The integration of digital twin technology, powered by AI, is anticipated to allow foundries to simulate and optimize dewaxing strategies before execution, significantly accelerating new product introduction (NPI) cycles.

However, the adoption rate of advanced AI solutions in this sector is currently moderate, constrained by the high initial investment cost and the necessity for specialized data infrastructure and engineering talent. Smaller and medium-sized foundries often lag in implementation compared to large Tier 1 aerospace suppliers. Future development is expected to focus on user-friendly, modular AI integration packages that can interface seamlessly with existing legacy control systems, thereby democratizing access to predictive maintenance and optimized cycle control across the entire investment casting ecosystem, further driving efficiency and ensuring stringent quality compliance.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature fluctuation, pressure response) to forecast component failure, minimizing unexpected downtime and maximizing equipment uptime.

- Process Optimization: Machine learning models automatically fine-tune dewaxing cycle parameters (time, temperature gradient, steam pressure) based on mold dimensions and batch composition to ensure optimal wax removal and minimize shell damage.

- Quality Control Enhancement: AI utilizes integrated vision systems to inspect molds post-dewaxing for residual wax or structural integrity issues, offering instantaneous feedback and reducing reliance on manual inspection.

- Energy Efficiency Modeling: AI identifies patterns for heating and cooling phases, optimizing energy usage by adjusting boiler and chiller operations dynamically based on real-time throughput demands.

- Automated Data Logging and Compliance: AI systems automate the collection, correlation, and formatting of process data, ensuring meticulous adherence to industry standards (e.g., NADCAP) and simplifying audit trails.

- Digital Twin Simulation: Creating virtual models of the autoclave process allows operators to test new mold designs or processing parameters in a risk-free environment, guided by AI-driven performance prediction.

- Adaptive Control Systems: AI enables the autoclave to adapt instantaneously to load variations or external environmental changes, maintaining consistent internal conditions necessary for repeatable high-quality outcomes.

DRO & Impact Forces Of Dewaxing Autoclaves Market

The Dewaxing Autoclaves Market is fundamentally driven by the relentless demand for high-performance metal components, particularly from the aerospace and medical sectors, where investment casting is the preferred manufacturing methodology for complex geometries. Restraints include the significant capital expenditure required for purchasing and installing these specialized, high-pressure vessels, along with the operational costs associated with high-pressure steam generation and maintenance. Opportunities lie in developing environmentally sustainable dewaxing methods, such as solvent dewaxing or integrated wax recovery systems, and expanding market reach into emerging industrial sectors like high-efficiency turbine blade manufacturing and advanced industrial machinery components.

Impact forces currently shaping the market dynamics include rigorous regulatory mandates, especially concerning pressure vessel safety and environmental emissions from wax volatilization. The increasing competition among global foundries necessitates continuous investment in faster and more efficient dewaxing technologies (a major driver). Moreover, geopolitical instability affecting global aerospace supply chains and raw material costs (an external restraint) can influence investment decisions in new autoclave capacity. The technological force favoring automation and connectivity (Industry 4.0 integration) is pushing manufacturers to retire older, less efficient equipment in favor of modern, data-rich systems.

These dynamics result in a balanced market where high entry barriers (cost and specialized engineering) limit the number of manufacturers, ensuring pricing power remains moderate among established players. However, end-user demand is inelastic due to the criticality of the dewaxing step in producing mission-critical parts. The overall market trajectory is positive, supported by long-term secular growth trends in key end-user industries that demand the precision and complexity afforded by investment casting techniques, making incremental technological improvements in efficiency and safety paramount for competitive advantage.

- Drivers:

- Surging global demand for high-integrity, complex components in the aerospace and defense industries (e.g., turbine blades, structural parts).

- Rapid expansion and stringent quality requirements in the medical device manufacturing sector, especially for orthopedic and dental implants.

- Technological advancements leading to faster cycle times, greater precision in temperature/pressure control, and enhanced automation capabilities (Industry 4.0 integration).

- Growing adoption of investment casting techniques over traditional methods due to superior surface finish and dimensional accuracy achieved.

- Increased focus on wax recovery and recycling systems to reduce operational costs and meet environmental sustainability targets.

- Restraints:

- High initial capital investment and operational costs associated with acquiring, installing, and maintaining certified high-pressure dewaxing autoclaves.

- Stringent regulatory requirements and safety standards governing the design, fabrication, and operation of high-pressure vessels (ASME, PED), creating specialized certification hurdles.

- Volatility in the prices of key raw materials (e.g., high-grade steel alloys) used in autoclave manufacturing.

- Requirement for specialized technical expertise and training to operate and maintain sophisticated, automated dewaxing equipment effectively.

- Opportunities:

- Development of innovative solvent-based dewaxing techniques offering lower temperature operation and enhanced material compatibility.

- Expansion into emerging markets (APAC, Latin America) where industrialization and domestic defense manufacturing are rapidly increasing.

- Integration of AI and IoT for predictive maintenance, remote diagnostics, and advanced process optimization across foundries globally.

- Customization of autoclave designs to accommodate next-generation ceramic materials and larger-scale casting molds.

- Impact Forces:

- Supplier Power: Moderate; driven by specialized component suppliers (valves, controls) but mitigated by the relatively standard fabrication process for the main vessel.

- Buyer Power: Moderate to High; large investment casting foundries exert significant pressure for customization, volume discounts, and superior after-sales service.

- Threat of New Entrants: Low; high capital barriers, intense regulatory hurdles, and necessity for specialized engineering knowledge make market entry difficult.

- Threat of Substitutes: Low; while methods like flash-fire or conventional oven dewaxing exist, they lack the speed, efficiency, and mold preservation capabilities required for high-precision, large-scale investment casting.

- Competitive Rivalry: High; established manufacturers compete intensively on reliability, technical specifications, service quality, and adherence to specific end-user certifications (e.g., NADCAP accreditation support).

Segmentation Analysis

The Dewaxing Autoclaves Market segmentation provides critical insights into the varied requirements across different industrial applications and operational scales. The market is primarily segmented based on the operational parameters of the equipment, including the physical orientation (vertical vs. horizontal), the pressure range applied (low vs. high pressure), the total capacity, and crucially, the primary end-user industry utilizing the investment castings produced. This structure allows manufacturers to tailor their product offerings, focusing on specifications that maximize efficiency and compliance within a given vertical, such as the stringent traceability needs of the aerospace industry or the volume requirements of the general industrial sector.

Analyzing these segments reveals that capacity and end-user definitions are the most influential factors driving current market investments. Large capacity autoclaves (used predominantly in aerospace) command premium pricing due to the sophisticated engineering required to maintain uniformity and safety across massive chambers. Conversely, the segmentation by pressure type reflects a continuous technological migration towards high-pressure systems, which, despite higher cost, justify investment through substantially improved process yields and reduced cycle times. Understanding these segment dynamics is essential for strategic market positioning, guiding R&D efforts toward specific performance enhancements demanded by high-growth segments.

- By Type:

- Horizontal Autoclaves: Generally preferred for high-volume production lines and handling larger, longer molds. They facilitate easier loading and unloading, often integrated with automated conveyor systems.

- Vertical Autoclaves: Typically occupy a smaller floor footprint and are favored for deep mold configurations or facilities where space optimization is critical, often loaded via overhead hoisting mechanisms.

- By Operating Pressure:

- Low Pressure Autoclaves: Operate at pressures typically below 5 bar; generally used for less critical components or for foundries requiring simpler, lower-cost equipment, often employing steam or hot water.

- High Pressure Autoclaves: Operate at pressures significantly higher, allowing for faster wax melting and removal, minimizing thermal stress on ceramic shells. Dominant in aerospace and medical applications.

- By Capacity:

- Small Capacity (Under 5 m³): Suitable for R&D facilities, small custom foundries, and specific medical implant manufacturers focusing on low-volume, high-mix production.

- Medium Capacity (5 m³ – 10 m³): Standard size for general industrial and mid-sized aerospace component suppliers, balancing throughput and operational flexibility.

- Large Capacity (Above 10 m³): Essential for Tier 1 aerospace manufacturers and large commercial foundries requiring massive throughput for engine and structural parts.

- By End-User Industry:

- Aerospace and Defense: The largest segment, demanding the highest quality standards, traceability, and robust, high-pressure equipment for engine and airframe components.

- Medical Devices: Requires precision and sterility compliance (often linked to subsequent sterilization processes); focuses on small to medium, highly accurate castings (e.g., surgical tools, prosthetics).

- Automotive: Used for high-performance vehicle components (e.g., turbocharger parts, specific engine components) where high heat resistance is necessary.

- General Industrial: Includes components for power generation, heavy machinery, and general engineering applications, often utilizing medium-capacity autoclaves.

Value Chain Analysis For Dewaxing Autoclaves Market

The value chain for the Dewaxing Autoclaves Market begins with upstream activities focused on the sourcing and processing of high-grade materials, predominantly specialized stainless steel alloys required for pressure vessel construction, advanced control systems (PLCs, sensors), and safety components (valves, doors). Upstream stability is critical, as any fluctuation in the price or availability of certified pressure vessel steel directly impacts manufacturing costs and delivery lead times. Key activities at this stage include material certification, specialized forging, and component sub-assembly, where proprietary knowledge about pressure vessel manufacturing standards (e.g., ASME Boiler and Pressure Vessel Code) is essential.

The midstream involves the core manufacturing process: precision welding, assembly, integration of heating elements, and the complex engineering of door locking mechanisms, followed by rigorous testing and certification. Distribution channels are typically direct or utilize highly specialized technical representatives (indirect), especially for international sales, due to the need for installation supervision, localized safety certifications, and extensive post-sale technical support. The direct channel is preferred for large, customized systems sold to Tier 1 clients, ensuring better control over installation and commissioning.

Downstream activities center on installation, commissioning, validation (crucial for regulated industries like aerospace), operator training, and ongoing maintenance. The end-users, which are the investment casting foundries, dictate demand based on their own production schedules and capacity requirements. The continuous need for specialized consumables, spare parts, and periodic recertification creates a consistent, high-margin aftermarket revenue stream for autoclave manufacturers, extending the economic relationship long after the initial sale and emphasizing the importance of robust service networks.

Dewaxing Autoclaves Market Potential Customers

The primary customers for dewaxing autoclaves are the facilities engaged in the investment casting process, spanning various industrial verticals. These end-users are characterized by their need for high-precision, low-volume to medium-volume production of geometrically complex metal parts that cannot be efficiently manufactured using traditional forging or machining methods. Potential buyers range from global Tier 1 aerospace manufacturing giants who require dozens of large-scale, highly automated units for continuous production, down to smaller, regional foundries focusing on bespoke industrial parts or specialized medical components.

Key decision-makers within these organizations include foundry managers, process engineers, quality control directors, and procurement specialists. For aerospace customers, purchasing decisions are heavily influenced by the autoclave’s ability to meet stringent quality and traceability standards, such as those set by NADCAP. For medical customers, compliance with regulatory bodies (like the FDA or EU MDR) regarding process validation and sterility preparation is paramount. The shift towards in-house manufacturing in developing regions is also expanding the customer base, moving beyond traditional Western industrial centers.

The most lucrative customer segments remain those tied to long-term secular growth industries. Aerospace engine component manufacturers and orthopedic implant producers represent the highest potential, primarily due to the mission-critical nature of the components they produce, which necessitates investment in the most reliable, high-specification dewaxing equipment available. Conversely, general industrial foundries focus more on the total cost of ownership (TCO) and operational efficiency, preferring robust, medium-capacity machines with high durability and minimal maintenance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 558.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Precision Autoclave, Priorclave, HI-Q, Consolidated Sterilizer Systems, Benchmark Autoclave, Research and Control Instruments, L&L Special Furnace Co., Inc., ASC Process Systems, Taricco Corporation, Bondtech Corporation, Tenney Environmental, Systec GmbH, Fedegari Autoclavi S.p.A., Steris, Belimed, Tuttnauer, Shinva Medical, ESI Inc., WSF Industries, Thermal Product Solutions (TPS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dewaxing Autoclaves Market Key Technology Landscape

The technological landscape of the Dewaxing Autoclaves Market is primarily focused on enhancing safety, efficiency, and process control, moving away from rudimentary steam systems toward sophisticated, highly instrumented pressurized environments. Key technologies revolve around advanced process control systems (APCS) utilizing high-end Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs) for precise temperature ramping and pressure management, minimizing the thermal shock that can cause ceramic shell cracking. The incorporation of multiple independent sensors and safety interlocks, often redundant systems, is standard, meeting international pressure vessel codes and ensuring operator safety during high-pressure steam operations.

A significant trend involves the development of specialized door locking and sealing mechanisms, particularly for large horizontal autoclaves, which must maintain structural integrity under extreme differential pressures. Furthermore, the integration of vacuum technology is gaining prominence, where a pre-dewaxing vacuum cycle can remove air from the mold pores, allowing steam penetration to be more uniform and rapid. This vacuum-assisted dewaxing significantly improves the efficiency of the wax removal process, particularly for complex, tightly packed mold clusters, contributing directly to improved casting yield rates and reduced cycle times.

Moreover, the market is embracing digital connectivity via Industrial Internet of Things (IIoT) sensors, enabling real-time monitoring, remote diagnostics, and integration with wider foundry management execution systems (MES). This integration facilitates data transparency and traceability, which is non-negotiable for aerospace and medical customers. The focus is also on material science improvements, using corrosion-resistant alloys for internal components to withstand continuous exposure to high-pressure steam and condensed wax byproducts, thereby extending the lifespan and reducing the maintenance frequency of the equipment.

Regional Highlights

Regional dynamics heavily influence the Dewaxing Autoclaves Market, reflecting the concentration of high-value manufacturing and investment casting activities globally. North America and Europe currently represent the largest revenue share due to the established presence of major aerospace and medical device manufacturers who demand high-specification, certified equipment. However, the Asia Pacific region is demonstrating the most robust growth trajectory, driven by massive investments in infrastructure, defense capabilities, and indigenous manufacturing capacity, leading to a substantial increase in the construction of new high-throughput foundries.

The North American market, particularly the United States, is characterized by stringent quality assurance protocols (like NADCAP) that necessitate state-of-the-art process control and data logging features in autoclaves. The demand here is primarily focused on replacements, upgrades to larger capacity units, and equipment tailored for advanced alloy castings required by next-generation aircraft programs. Similarly, the European market, centered around Germany, the UK, and France, emphasizes energy efficiency and compliance with EU safety directives (PED), alongside high demand from automotive performance sectors and industrial gas turbine manufacturing.

In contrast, the APAC region, led by China and India, is undergoing a rapid transition. While price sensitivity remains a factor, the rapidly professionalizing aerospace and defense sectors in these countries are increasingly demanding high-quality, reliable autoclaves, shifting away from purely domestic, low-cost alternatives. Latin America and the Middle East & Africa (MEA) represent nascent markets, with growth concentrated in countries like Brazil, Saudi Arabia, and the UAE, where strategic initiatives to diversify economies through localized industrial manufacturing are driving initial adoption of investment casting technologies and associated equipment like dewaxing autoclaves.

- North America (US & Canada): Mature market focusing on high-specification, large-capacity autoclaves; demand driven by MRO and new aircraft production cycles; stringent regulatory compliance (ASME, NADCAP) is a key buying factor.

- Europe (Germany, UK, France): Focus on technological innovation, automation, and energy efficiency; strong demand from specialized high-performance automotive and industrial gas turbine component manufacturers; adherence to Pressure Equipment Directive (PED) is mandatory.

- Asia Pacific (China, India, Japan): Fastest growing region, fueled by rapid industrialization, increasing domestic defense spending, and relocation of global manufacturing facilities; growing demand for both volume capacity and quality assurance.

- Latin America (Brazil, Mexico): Emerging market primarily driven by infrastructure development and regional automotive supply chains; slower adoption pace but high potential as local manufacturing capabilities expand.

- Middle East and Africa (MEA): Niche market with increasing governmental investment in localized defense and energy sectors; characterized by project-based, strategic purchases of robust, reliable systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dewaxing Autoclaves Market.- Precision Autoclave

- Priorclave

- HI-Q Equipment

- Consolidated Sterilizer Systems

- Benchmark Autoclave

- Research and Control Instruments

- L&L Special Furnace Co., Inc.

- ASC Process Systems

- Taricco Corporation

- Bondtech Corporation

- Tenney Environmental

- Systec GmbH

- Fedegari Autoclavi S.p.A.

- Steris

- Belimed

- Tuttnauer

- Shinva Medical Instrument Co., Ltd.

- ESI Inc.

- WSF Industries Inc.

- Thermal Product Solutions (TPS)

Frequently Asked Questions

Analyze common user questions about the Dewaxing Autoclaves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a dewaxing autoclave in investment casting?

The primary function is to rapidly and efficiently remove the sacrificial wax pattern from the surrounding ceramic shell mold using high-pressure steam or solvent vapor under controlled thermal conditions. This process is crucial for preventing the ceramic shell from cracking during thermal expansion of the wax, ensuring the mold is ready for subsequent metal pouring.

How does high-pressure dewaxing compare to conventional flash dewaxing?

High-pressure dewaxing systems are significantly faster and offer superior mold protection compared to conventional flash dewaxing ovens. The high pressure ensures quick melting and forced ejection of the wax, minimizing the duration of thermal stress, which is essential for preserving the integrity of complex, thin-walled ceramic shells used in aerospace applications.

What are the key safety standards governing the manufacture and operation of dewaxing autoclaves?

Dewaxing autoclaves, being high-pressure vessels, must strictly adhere to international safety codes such as the ASME Boiler and Pressure Vessel Code (BPVC) in North America and the Pressure Equipment Directive (PED) in Europe. Additionally, operational environments in aerospace supply chains often require process validation compliant with standards like NADCAP for non-destructive testing and specialized processes.

Which end-user segment drives the largest demand for high-capacity dewaxing autoclaves?

The Aerospace and Defense segment drives the largest demand for high-capacity and high-pressure dewaxing autoclaves. This is due to the need to process large, intricate investment castings, such as engine components and structural airframe parts, efficiently and with uncompromising quality control to meet mission-critical performance requirements.

What technological trends are currently optimizing the efficiency of dewaxing processes?

Current technological trends include the integration of Industrial Internet of Things (IIoT) sensors and AI for predictive maintenance and real-time cycle optimization. Furthermore, manufacturers are incorporating advanced vacuum assistance and sophisticated PLC controls to ensure uniform steam penetration and rapid cycle completion, thereby maximizing throughput and energy efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager