Diabetes Therapeutics and Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435183 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Diabetes Therapeutics and Diagnostics Market Size

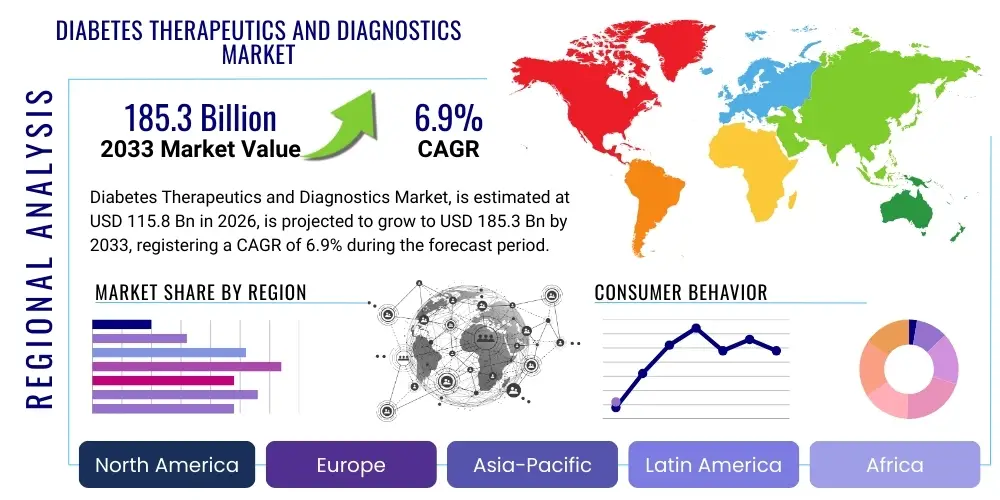

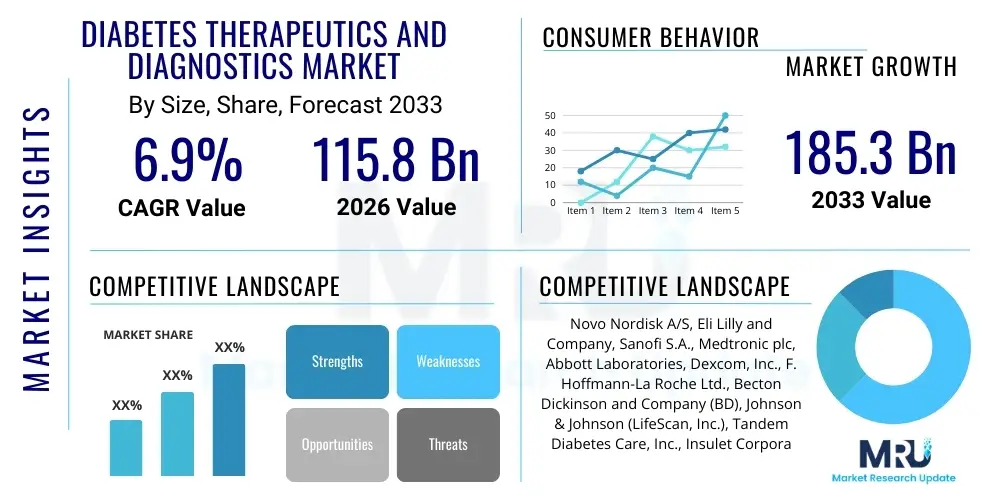

The Diabetes Therapeutics and Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 115.8 Billion in 2026 and is projected to reach USD 185.3 Billion by the end of the forecast period in 2033.

Diabetes Therapeutics and Diagnostics Market introduction

The global Diabetes Therapeutics and Diagnostics market encompasses a wide array of specialized medical interventions, sophisticated pharmaceutical agents, and advanced diagnostic technologies designed for the precise management, monitoring, and treatment of diabetes mellitus, a rapidly proliferating chronic metabolic disorder characterized by elevated blood glucose levels (hyperglycemia). This market is critical given the increasing global incidence of both Type 1 and Type 2 diabetes, a trend intrinsically linked to demographic shifts, specifically aging populations, and widespread adoption of sedentary lifestyles contributing to rising obesity rates worldwide. Therapeutic solutions are continually evolving, spanning traditional insulin therapies administered via advanced pen devices and automated pumps, to a newer generation of highly efficacious oral hypoglycemic agents (OHAs) and novel non-insulin injectables, such as the incretin-based therapies (GLP-1 receptor agonists) and agents targeting renal glucose reabsorption (SGLT-2 inhibitors). These modern treatments aim not only for glycemic control but also for mitigating severe microvascular and macrovascular complications, including diabetic neuropathy, retinopathy, nephropathy, and crucial cardiovascular protection, thereby improving both the longevity and quality of life for millions of affected individuals globally.

Product description within this market focuses on two primary pillars: Diagnostics and Therapeutics. The Diagnostics segment includes essential tools for both point-of-care and laboratory testing. This includes basic Blood Glucose Monitoring (BGM) meters, which rely on electrochemical test strips, and, increasingly, Continuous Glucose Monitoring (CGM) systems that provide real-time, interstitial glucose data, significantly enhancing the granularity of monitoring. Specialized diagnostic applications involve the measurement of HbA1c, which offers an average glucose control assessment over three months, and autoantibody testing crucial for Type 1 diabetes diagnosis. Therapeutics are divided into drugs and delivery systems. The drugs segment covers complex biological products like insulin analogs (rapid, short, intermediate, and long-acting) and synthetic pharmaceutical compounds. The delivery segment includes high-precision reusable and disposable insulin pens, syringes, and sophisticated insulin pumps, many of which are now integrating wireless communication and algorithmic dosing capabilities to establish 'smart' management ecosystems.

The major applications of these products span screening, early intervention, intensive disease management, and complication prevention across diverse clinical settings, from primary care physician offices to specialized endocrinology units and patient home settings. Key benefits derived from market offerings include enhanced patient adherence through less painful and more convenient delivery mechanisms, reduced incidence of dangerous acute events such as hypoglycemia, and substantially minimized risk of debilitating long-term complications. Driving factors sustaining the market’s robust growth include massive investment in miniaturization and non-invasive sensor technology, continuous favorable clinical trial data supporting the cardio-renal benefits of novel drug classes, and global strategic initiatives by governments and NGOs focused on improving public access to essential diabetes care tools and educational resources. Furthermore, the convergence of pharma, devices, and digital health is creating unprecedented opportunities for personalized medicine, which is a powerful catalyst for market expansion and value creation across the entire patient journey.

Diabetes Therapeutics and Diagnostics Market Executive Summary

The Diabetes Therapeutics and Diagnostics market landscape is currently defined by disruptive technological integration and a fundamental shift in pharmacological strategy. Strategic business trends emphasize partnerships between established pharmaceutical giants and innovative medical device start-ups specializing in digital health and sensor technology. This collaboration accelerates the development of integrated ecosystems, such as hybrid closed-loop systems, which are marketed as superior alternatives to siloed traditional treatments. Furthermore, M&A activity is focused on acquiring companies with strong intellectual property in proprietary algorithms, non-invasive sensors, and advanced drug delivery methods, signaling a concentrated effort to dominate the integrated diabetes management space. Financial performance across the sector is increasingly tied to the success of novel, patent-protected drugs (like GLP-1/GIP co-agonists) that promise superior efficacy and added benefits beyond glycemic control, challenging the market share of genericized oral anti-diabetic medications.

In terms of regional dynamics, North America continues to be the primary revenue generator, benefiting from high prevalence, strong patient spending power, and sophisticated private insurance coverage that readily accepts high-cost, cutting-edge therapies. However, Asia Pacific (APAC) represents the future growth engine, exhibiting double-digit expansion fueled by demographic factors, increasing awareness campaigns, and substantial governmental investment in upgrading healthcare infrastructure, particularly in urban areas of China, India, and Southeast Asia. Regulatory environments in Europe are focusing on rapid certification for devices demonstrating cybersecurity integrity and data interoperability, reflecting the region's commitment to connected health. Latin America and the Middle East are characterized by emerging market volatility and highly localized regulatory nuances, yet they present substantial untapped potential due to significant diabetes prevalence rates, especially Type 2, demanding tailored, cost-effective diagnostic screening solutions.

Analysis of segment trends confirms the ascendancy of diagnostics, specifically the Continuous Glucose Monitoring (CGM) subsegment, which is rapidly democratizing access to real-time glucose data, thereby enhancing the quality of care far beyond what traditional BGM systems offer. Within Therapeutics, the non-insulin injectables category is reshaping clinical practice. This segment, dominated by GLP-1 receptor agonists and novel combination therapies, is experiencing exponential growth, underpinned by landmark clinical trial results demonstrating profound reductions in major adverse cardiovascular events (MACE). Conversely, the traditional insulin segment remains foundational but faces pressures from biosimilar competition and patient preference for less frequent, non-injectable options. The key takeaway is the market's trajectory towards automation, personalization, and integrated metabolic health management, moving beyond the simple concept of sugar control.

AI Impact Analysis on Diabetes Therapeutics and Diagnostics Market

Common user questions related to the impact of Artificial Intelligence (AI) on the Diabetes Therapeutics and Diagnostics Market frequently address the feasibility and security of fully autonomous treatment systems, specifically concerning Automated Insulin Delivery (AID). Users are highly concerned about the reliability of algorithms in predicting rapid glucose changes influenced by complex factors like meals, stress, and exercise, and they seek clarity on the regulatory pathways for fully autonomous medical devices. Another central theme involves the potential for non-invasive or low-burden diagnostic tools, inquiring how machine learning can analyze physiological data (e.g., heart rate variability, sweat composition) to detect or predict glucose levels without traditional finger sticks. These concerns coalesce around the expectation that AI will deliver a highly personalized, predictive, and low-effort management system, reducing the daily mental burden inherent in living with diabetes, while ensuring robust data protection and algorithmic transparency for patients.

AI's transformative influence is most visible in the refinement of diagnostic accuracy and predictive capability. In diagnostics, advanced machine learning models are deployed to process the massive streams of data generated by modern CGM devices. These algorithms go beyond simple trend analysis, identifying subtle, non-linear correlations between environmental inputs (weather, ambient temperature), biological data (insulin resistance variability, hormonal cycles), and future glucose profiles. This enables the creation of highly refined glucose prediction models that can accurately forecast hyperglycemia or hypoglycemia 30 to 60 minutes in advance, a crucial window for preventative intervention. Moreover, AI algorithms are revolutionizing screening for complications; deep learning tools can automatically analyze retinal scans with expert-level accuracy to detect early signs of diabetic retinopathy, accelerating mass screening programs and ensuring timely intervention, which is vital in preventing vision loss globally.

In the therapeutic domain, AI is the engine driving the development and optimization of Automated Insulin Delivery (AID) systems, transitioning from simple proportional-integral-derivative (PID) control mechanisms to highly adaptive Model Predictive Control (MPC) and reinforcement learning algorithms. These systems continuously adapt the basal insulin rate and suggest bolus doses based on individual-specific patterns learned over weeks or months, effectively mimicking the natural feedback loop of a healthy pancreas. For pharmaceutical companies, AI accelerates preclinical research by analyzing genomic and proteomic data to identify novel biomarkers associated with disease progression or treatment response. This capability facilitates precision medicine, allowing drugs to be tailored to specific patient subgroups, maximizing efficacy and minimizing adverse effects, thereby significantly reducing the high attrition rate typically seen in diabetes drug development pipelines.

- AI-Powered Continuous Glucose Monitoring (CGM) interpretation for predictive glucose forecasting, offering up to an hour lead time before major excursions.

- Development of highly accurate Automated Insulin Delivery (AID) or closed-loop systems (Artificial Pancreas) utilizing advanced control algorithms (MPC, fuzzy logic).

- Accelerated drug discovery and target identification for novel anti-diabetic compounds using machine learning analysis of genomic and clinical trial data.

- Automated, scalable screening for diabetes complications, such as retinopathy and peripheral neuropathy, using deep learning image analysis.

- Personalized treatment recommendation generation, including dynamic insulin sensitivity factor adjustments and tailored dietary advice based on real-time data integration.

- Enhanced patient adherence through AI-driven coaching and behavioral modification platforms delivered via smart mobile applications.

- Optimization of complex clinical trials and post-market safety surveillance through predictive analytics and large-scale real-world data processing.

DRO & Impact Forces Of Diabetes Therapeutics and Diagnostics Market

The Diabetes Therapeutics and Diagnostics Market is profoundly influenced by an interplay of compelling macro-environmental drivers and economic complexities. The most significant structural driver is the relentless increase in the global prevalence of diabetes, projected by the International Diabetes Federation (IDF) to affect hundreds of millions by the end of the forecast period, ensuring an ever-growing patient pool requiring management tools. This demand is further amplified by significant technological drivers, particularly the rapid commercial maturation of continuous glucose monitoring (CGM) systems, which offer superior data granularity and convenience over traditional monitoring methods. Moreover, clinical breakthroughs, specifically the validated cardiorenal benefits demonstrated by novel drug classes such as SGLT-2 inhibitors and GLP-1 receptor agonists, have substantially broadened their therapeutic application beyond simple glucose control, making them indispensable components of comprehensive diabetes and metabolic syndrome management, thereby drastically increasing their market uptake across major economies.

Crucial restraints on market expansion revolve primarily around financial accessibility and regulatory complexity. The high cost of advanced therapeutic devices, notably insulin pumps and long-wear CGM consumables, creates a significant affordability barrier, limiting widespread adoption in cost-sensitive markets and among underinsured populations even in wealthy nations. Manufacturers also face intense pressure from global regulatory bodies (FDA, EMA) requiring extensive, costly, and time-consuming clinical trials to prove efficacy, safety, and, crucially, data integrity for connected digital health solutions. Additionally, the fragmented and often complex reimbursement landscape across different geographies, where coverage decisions often lag behind technological innovation, acts as a bottleneck, particularly hindering the penetration of closed-loop systems into primary care settings.

Conversely, strategic opportunities are abundant in technological convergence and geographical expansion. The successful integration of Artificial Intelligence and Machine Learning algorithms into diagnostics offers the lucrative opportunity of predictive healthcare, potentially preventing acute diabetic crises and reducing expensive hospitalizations. The pursuit of highly durable, truly non-invasive glucose monitoring technology represents a market-redefining opportunity that would instantly eliminate user compliance issues associated with current sensor insertion. Geographically, untapped emerging markets, particularly within APAC and Latin America, offer immense potential for scalable growth, provided manufacturers successfully tailor their pricing and distribution models to overcome local infrastructure and economic barriers. Furthermore, the increasing acceptance of digital therapeutics (DTx) provides a platform for recurring service revenue and dramatically enhances patient adherence, transforming the business model from pure product sales to integrated chronic disease management solutions, which is highly favored by value-based healthcare purchasers.

Segmentation Analysis

The Diabetes Therapeutics and Diagnostics market is meticulously segmented to reflect the diverse clinical needs and technological solutions available for managing this complex condition. This comprehensive stratification allows market players to accurately target specific disease populations, technology preferences, and geographical clusters. The fundamental split between Therapeutics (drugs and delivery devices) and Diagnostics (monitoring and screening tools) highlights the different competitive landscapes within the sector. The dominance of Type 2 Diabetes mellitus, accounting for over 90% of all diabetes cases globally, dictates that research and commercialization efforts are heavily weighted toward treatments suitable for this patient cohort, focusing on convenience, minimal side effects, and effective complication risk reduction, particularly leveraging the potent SGLT-2 and GLP-1 drug classes.

Within the Diagnostics sphere, the segmentation by technology reveals the strategic shift occurring across global standards of care. While Blood Glucose Monitoring (BGM) devices still command the largest volume due to affordability and ubiquity, the Continuous Glucose Monitoring (CGM) segment is driving revenue growth and technological advancement. CGM systems are increasingly segmented by wear time (e.g., 10-day, 14-day, 180-day implantable sensors) and connectivity features (standalone, hybrid, smartphone-integrated). The segmentation of diagnostic tests also includes specialized laboratory assays, such as HbA1c tests, which are essential for long-term glycemic control assessment, and tests for autoantibodies and C-peptide, crucial for distinguishing between Type 1 and Type 2 diabetes and assessing residual insulin production, further refining diagnostic strategy based on clinical necessity.

The Therapeutics segmentation is highly granular, differentiating between various drug classes based on their mechanism of action, including insulin products, oral anti-diabetic drugs (OADs), and the rapidly expanding non-insulin injectables. Insulin is segmented by duration of action (e.g., rapid-acting analogs, long-acting basal insulins) reflecting complex dosing regimens. Device segmentation includes the highly profitable insulin pump market (categorized into tethered pumps and patch pumps), which caters primarily to Type 1 patients and intensively managed Type 2 patients, and the high-volume pen market (disposable versus reusable). This multilayered segmentation underscores the necessity for manufacturers to offer a diversified portfolio that addresses the spectrum of patient needs—from basic, low-cost monitoring to highly sophisticated, fully automated treatment delivery systems, ensuring maximal market coverage across all socio-economic and clinical profiles.

- By Product Type (Diagnostics):

- Blood Glucose Monitoring (BGM) Devices (Meters, Test Strips, Lancets, Accessories)

- Continuous Glucose Monitoring (CGM) Systems (Transmitters, Sensors, Receivers, Integrated Smart Systems)

- HbA1c Testing Devices and Kits (Point-of-Care Analyzers, Lab-Based Immunoassays)

- Other Diagnostic Tests (Microalbuminuria Tests, Insulin/C-peptide Tests, Antibody Screening)

- By Product Type (Therapeutics):

- Insulin Delivery Devices (Insulin Pens, Syringes, Vials, External Insulin Pumps, Patch Pumps, Jet Injectors)

- Drugs (Insulins, Oral Anti-Diabetic Drugs (OADs), Non-Insulin Injectables)

- By Drug Class:

- Oral Anti-Diabetic Drugs (Biguanides (Metformin), Sulfonylureas, Thiazolidinediones (TZDs), DPP-4 Inhibitors, SGLT-2 Inhibitors, Alpha-Glucosidase Inhibitors, Meglitinides)

- Non-Insulin Injectables (GLP-1 Receptor Agonists, GLP-1/GIP Agonists, Amylin Analogs)

- Insulins (Rapid-Acting Analogs, Short-Acting Human Insulin, Intermediate-Acting, Long-Acting Basal Insulins, Premixed Insulins)

- By Disease Type:

- Type 1 Diabetes Mellitus (T1DM)

- Type 2 Diabetes Mellitus (T2DM)

- Gestational Diabetes Mellitus (GDM)

- By End-User:

- Hospitals and Specialty Clinics (Inpatient Care, Endocrinology Units)

- Diagnostic Centers and Reference Laboratories

- Home Care/Self-Monitoring Settings (Pharmacies, Direct-to-Consumer Channels)

Value Chain Analysis For Diabetes Therapeutics and Diagnostics Market

The comprehensive value chain for the Diabetes Therapeutics and Diagnostics Market begins with highly specialized upstream activities, primarily involving the sourcing and synthesis of ultra-pure raw materials. For therapeutic agents, this includes complex biotechnological processes for insulin production (e.g., yeast or E. coli fermentation) and the chemical synthesis of active pharmaceutical ingredients (APIs) for oral drugs, demanding strict adherence to Good Manufacturing Practices (GMP). For diagnostic devices, upstream involves procuring high-grade electronic components, specialized polymers, and advanced electrochemical biosensors. The intellectual property generated during the R&D phase—encompassing novel drug formulations, control algorithms for pumps, and proprietary sensor designs—is the single greatest driver of value addition at this stage, establishing high barriers to entry for new competitors and securing long-term revenue streams through patent exclusivity.

Midstream activities revolve around large-scale manufacturing, precise assembly, and quality assurance. For drugs, this encompasses sterile formulation, aseptic filling of cartridges or vials, and packaging, often requiring a robust cold chain logistics infrastructure to maintain product efficacy throughout transit. Device manufacturing requires high-precision engineering for assembling components of insulin pumps and CGM transmitters, which must meet exacting standards for accuracy, durability, and biocompatibility. Distribution channels are highly critical in the midstream and downstream transition. Direct distribution is typically favored for high-value, institutionally purchased equipment (e.g., laboratory analyzers), where installation, training, and ongoing technical support are mandatory. Indirect distribution relies heavily on global and regional wholesalers and specialized pharmacy networks to manage the high-volume flow of consumables like test strips and insulin pen needles, optimizing shelf presence and accessibility to the final consumer.

Downstream functions focus on market access, sales, and post-market support. Market access is secured through intense lobbying for favorable reimbursement codes from government payers (e.g., CMS in the U.S.) and private insurers, requiring extensive health economic outcome research (HEOR) to prove cost-effectiveness. The final segment of the value chain involves the end-user interaction: sales conducted through retail pharmacies, e-commerce platforms, and specialized medical supply retailers. Crucially, the modern downstream value includes digital services—patient education portals, remote monitoring services, and data integration with EHRs—which enhance customer retention and generate valuable real-world evidence (RWE). Post-market surveillance ensures continuous safety monitoring and facilitates product iterations based on user feedback, closing the loop and sustaining the competitive advantage derived from quality and safety.

Diabetes Therapeutics and Diagnostics Market Potential Customers

The primary and largest potential customer base is the global population of individuals diagnosed with Type 1 and Type 2 Diabetes, encompassing an extremely wide demographic range, from children requiring intensive management protocols to elderly patients managing multiple comorbidities. These end-users are the critical decision-makers for daily self-management tools, including Blood Glucose Monitoring (BGM) supplies, Continuous Glucose Monitoring (CGM) sensors, and personal insulin delivery systems (pens and pumps). Patient purchasing behavior is increasingly influenced by factors beyond price, prioritizing ease of use, minimal pain during use, device connectivity, and the perceived accuracy and reliability of the data provided. There is a rapidly growing segment of technology-savvy patients (often younger adults with T1DM) who seek integration with wearables and third-party software, demanding open-source protocols and interoperability.

Institutional purchasers constitute the second major customer cohort, dominated by hospitals, specialized endocrinology clinics, and large integrated healthcare networks. These organizations procure high-volume lab-based diagnostic equipment (e.g., HbA1c analyzers), bulk pharmaceuticals, and specialized inpatient continuous monitoring systems necessary for glycemic control during surgery or critical illness. For these buyers, product selection is primarily driven by clinical performance metrics, scalability for high throughput, cost-efficiency through bundled purchasing agreements, and regulatory clearance for institutional use. Furthermore, public sector entities, including national health services and governmental screening programs, are significant buyers of cost-effective diagnostic kits for population health management and early detection campaigns, particularly in regions striving to curb the incidence of undiagnosed diabetes.

Finally, a strategically important customer segment includes insurance providers, pharmacy benefit managers (PBMs), and commercial pharmacy chains. PBMs and insurers act as gatekeepers, determining which therapeutic agents and monitoring devices receive favorable formulary placement and reimbursement coverage. Their purchasing decisions are highly sensitive to health economic data, favoring products demonstrated to reduce long-term complication rates and overall healthcare expenditure. Retail pharmacy chains are direct customers for over-the-counter devices and prescription refills, serving as essential access points for the general diabetic population. The emerging customer profile also includes wellness centers and corporate health programs increasingly utilizing simplified, low-burden diagnostic tools for preventative screening and monitoring lifestyle interventions in pre-diabetic individuals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.8 Billion |

| Market Forecast in 2033 | USD 185.3 Billion |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novo Nordisk A/S, Eli Lilly and Company, Sanofi S.A., Medtronic plc, Abbott Laboratories, Dexcom, Inc., F. Hoffmann-La Roche Ltd., Becton Dickinson and Company (BD), Johnson & Johnson (LifeScan, Inc.), Tandem Diabetes Care, Inc., Insulet Corporation, Ascensia Diabetes Care Holdings AG, AstraZeneca plc, Merck & Co., Inc., Ypsomed AG, Senseonics Holdings, Inc., Beta Bionics, Inc., Viacyte, Inc., AgaMatrix, Inc., Takeda Pharmaceutical Company Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diabetes Therapeutics and Diagnostics Market Key Technology Landscape

The technological landscape of the Diabetes Therapeutics and Diagnostics market is undergoing a profound transformation, moving rapidly toward interconnected, predictive, and patient-centric solutions. At the forefront of this evolution is the maturation of Continuous Glucose Monitoring (CGM) systems. Recent innovations focus on reducing the size and improving the longevity of the subcutaneous sensors, with some implantable systems offering wear times up to six months. Critically, manufacturers are achieving lower Mean Absolute Relative Difference (MARD) values, signifying enhanced clinical accuracy comparable to laboratory standards. The technological challenge now centers on achieving true non-invasive glucose monitoring, exploring sophisticated approaches such as acoustic wave technology, specific light absorption spectroscopy, and advanced wearable patch sensors that analyze sweat or tears, which, if commercialized successfully, would instantly revolutionize patient comfort and significantly increase market penetration across all demographics.

Therapeutic delivery systems are dominated by the push for full automation via hybrid and eventually full Closed-Loop Systems (Artificial Pancreas). These systems integrate the CGM sensor data directly with a micro-dose insulin pump, managed by highly complex algorithms that leverage machine learning (AI) to optimize insulin delivery in real-time, anticipating carbohydrate intake and physiological stress responses. Key technological differentiators in this space include predictive algorithms capable of "learning" individual patient dynamics, enhanced interoperability standards (Interoperable Automated Glycemic Controller, iAGC), and the development of specialized "patch pumps" that are tubeless, smaller, and easier to wear, greatly increasing patient acceptance, especially among adolescents. The goal is to minimize user input while maximizing Time-in-Range (TIR), a new critical metric of glycemic control.

Beyond the core monitoring and delivery technologies, digital therapeutics (DTx) and advanced biosensor development form crucial supporting pillars. DTx platforms, often delivered as software applications, provide AI-driven behavioral modification, tailored coaching, and medication reminders, generating valuable real-world data (RWD) for providers. This convergence of pharma, devices, and digital insights ensures personalized care pathways. Furthermore, innovations in drug formulation, such as ultra-rapid-acting insulins designed to cover post-meal spikes more effectively, and development of combination injectable drugs targeting multiple hormonal pathways simultaneously, demonstrate the commitment to improving physiological outcomes. This highly integrated technological environment fosters ecosystems rather than standalone products, making data security and platform interoperability vital competitive advantages.

Regional Highlights

North America, particularly the United States, represents the epicenter of the Diabetes Therapeutics and Diagnostics Market, commanding the largest revenue share globally. This dominance is intrinsically linked to the high prevalence of Type 2 diabetes coupled with the rapid uptake of premium, cutting-edge technologies. The advanced healthcare ecosystem supports significant investment in R&D, leading to the early launch and commercialization of innovations such as the latest generation CGM devices and fully automated insulin pumps. Critical market acceleration factors include favorable and comprehensive reimbursement landscapes provided by major public (Medicare, Medicaid) and private insurance systems, which substantially mitigate the high out-of-pocket costs for patients, thereby stimulating high volume sales and technological adoption rates across both Type 1 and Type 2 populations requiring intensive insulin management. Furthermore, the strong integration of Electronic Health Records (EHRs) and telemedicine platforms facilitates remote patient monitoring and optimizes follow-up care, cementing the region's leadership in digital diabetes management.

Europe holds the second-largest position, characterized by strong governmental emphasis on chronic disease management, centralized healthcare procurement, and established clinical guidelines that promote early and intensive intervention. Key markets like Germany, the UK, and Scandinavia are strong adopters of both advanced non-insulin therapeutics (like GLP-1 RAs) and device technology, frequently integrating them into national formularies based on rigorous health technology assessments (HTA). The European market, however, places a greater emphasis on demonstrated cost-effectiveness for widespread governmental adoption, influencing pricing strategies for manufacturers. The presence of stringent data protection regulations (GDPR) mandates high levels of cybersecurity and interoperability for connected devices, driving technology standards. Regulatory harmonization efforts across the EU facilitate quicker market access compared to some other regions, supporting sustained growth through biosimilar market penetration and widespread use of standardized diagnostics and patient education initiatives.

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR) due to rapid epidemiological shifts and burgeoning economic growth. The high density of the population, coupled with changing dietary and physical activity patterns, is leading to an explosion in diabetes cases, particularly in highly populous nations like China and India, where the sheer volume of undiagnosed cases presents a massive opportunity for diagnostics manufacturers. While price sensitivity remains a major factor, driving demand for affordable Blood Glucose Monitoring (BGM) devices and generic oral anti-diabetic drugs, the rising middle class is increasingly accessing premium care, including imported CGM devices and advanced insulins. Governmental investment in healthcare infrastructure and public awareness campaigns targeting non-communicable diseases are critical regional drivers. Latin America and the Middle East & Africa (MEA) are marked by significant unmet needs; however, targeted investments in GCC nations (e.g., UAE, Saudi Arabia) in specialized diabetes centers and subsidized treatment plans are opening up profitable niches for high-end therapeutics and diagnostics, although overall market penetration remains challenged by limited infrastructure and economic constraints in broader sub-Saharan Africa, necessitating tiered product offerings.

- North America (U.S., Canada): Revenue leader due to high prevalence, advanced tech adoption (CGM, AID), and robust reimbursement coverage, fostering high per-patient spending and accelerated digital health integration.

- Europe (Germany, UK, France, Italy, Spain): Strong second market focusing on public health integration, stringent quality standards, and centralized procurement driving demand for clinically proven and cost-effective advanced therapies.

- Asia Pacific (China, India, Japan, South Korea): Fastest growth segment fueled by escalating disease burden, rapid economic development expanding access to specialized care, and massive governmental efforts to improve diagnostics accessibility and treatment coverage.

- Latin America (Brazil, Mexico, Argentina): Emerging market characterized by regional economic variation; demand focused on essential insulins and BGM devices, with slow but steady growth in advanced device uptake concentrated in private health sectors.

- Middle East and Africa (GCC Countries, South Africa): High endemic prevalence necessitates focused investment; strong growth potential in affluent GCC countries targeting specialized diabetes treatment facilities and utilizing private insurance funding, contrasting with affordability issues in other MEA markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diabetes Therapeutics and Diagnostics Market, encompassing both pharmaceutical giants and specialized medical device innovators.- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi S.A.

- Medtronic plc

- Abbott Laboratories

- Dexcom, Inc.

- F. Hoffmann-La Roche Ltd.

- Becton Dickinson and Company (BD)

- Johnson & Johnson (LifeScan, Inc.)

- Tandem Diabetes Care, Inc.

- Insulet Corporation

- Ascensia Diabetes Care Holdings AG

- AstraZeneca plc

- Merck & Co., Inc.

- Ypsomed AG

- Senseonics Holdings, Inc.

- Beta Bionics, Inc.

- Viacyte, Inc. (an affiliate of Vertex Pharmaceuticals)

- AgaMatrix, Inc.

- Takeda Pharmaceutical Company Limited

Frequently Asked Questions

Analyze common user questions about the Diabetes Therapeutics and Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Diabetes Therapeutics and Diagnostics Market?

The market is projected to expand at a robust Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. This growth rate is primarily sustained by the escalating global prevalence of both Type 1 and Type 2 diabetes, combined with accelerated technological evolution in both drug delivery systems and advanced monitoring solutions, particularly in closed-loop systems and novel oral therapeutics targeting multi-organ protection.

Which technology segment is expected to show the highest growth rate and why?

The Continuous Glucose Monitoring (CGM) segment within diagnostics is anticipated to achieve the highest growth rate. This rapid expansion is fueled by continuous sensor improvements (accuracy, longevity), increased favorable reimbursement coverage, and the mandatory requirement for CGM systems to operate as the foundational input for all next-generation Automated Insulin Delivery (AID) or artificial pancreas technologies.

How is Artificial Intelligence (AI) influencing the future of diabetes management?

AI is fundamentally transforming management by enabling predictive analytics for glucose forecasting, optimizing complex dosing decisions within AID systems via advanced algorithms (MPC), facilitating automated screening for complications (retinopathy), and driving personalized patient coaching and adherence programs through digital therapeutics platforms.

Which regional market holds the largest revenue share, and what are its driving factors?

North America maintains the largest revenue share, predominantly due to its high disease prevalence, advanced and comprehensive healthcare infrastructure, high patient acceptance of premium-priced technologies (CGM and pumps), and extensive reimbursement policies provided by both governmental and large private insurance entities that incentivize innovation.

What are the key therapeutic breakthroughs that are changing Type 2 Diabetes treatment standards?

The treatment paradigm is shifting due to the dominance of non-insulin injectable drug classes, specifically GLP-1 receptor agonists and SGLT-2 inhibitors. These therapies offer critical benefits beyond glucose lowering, including proven cardiovascular risk reduction, weight management, and renal protection, positioning them as essential first-line or second-line agents for most Type 2 patients, thereby changing global clinical guidelines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager