Diagnostic Wearable Medical Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436281 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Diagnostic Wearable Medical Devices Market Size

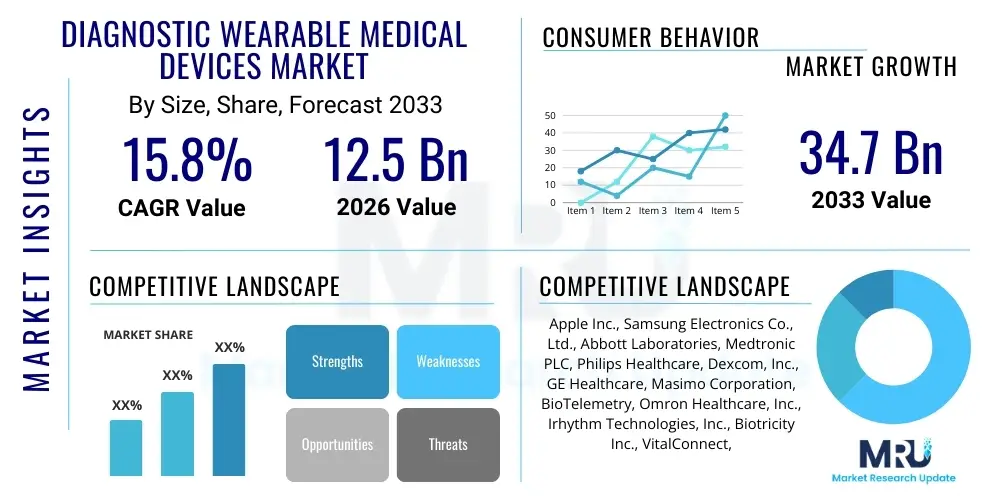

The Diagnostic Wearable Medical Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 34.7 Billion by the end of the forecast period in 2033.

Diagnostic Wearable Medical Devices Market introduction

The Diagnostic Wearable Medical Devices Market encompasses advanced technological solutions integrated into consumer-friendly formats, such as smart patches, wristbands, smartwatches, and specialized garments, designed for continuous or intermittent health data monitoring and diagnostic purposes outside traditional clinical settings. These devices leverage sophisticated sensors, connectivity features (like Bluetooth and Wi-Fi), and sophisticated algorithms to capture physiological parameters critical for assessing health status, detecting anomalies, and predicting potential health issues. Key parameters measured include heart rate variability, electrocardiogram (ECG) data, blood oxygen saturation (SpO2), blood pressure, glucose levels, body temperature, and complex sleep patterns. The primary function of these wearables is to facilitate early diagnosis, enhance patient engagement, and provide continuous data streams to healthcare providers, transitioning healthcare from reactive treatment models to proactive preventative management.

The product portfolio within this market spans across dedicated monitoring systems like Continuous Glucose Monitors (CGMs) for diabetes management, sophisticated ECG patches for arrhythmia detection, and multi-sensor platforms used in clinical trials and remote patient monitoring (RPM) programs. Major applications driving market adoption include managing chronic conditions such as cardiovascular diseases and diabetes, optimizing rehabilitation post-surgery, improving athletic performance monitoring, and enabling comprehensive elder care through real-time fall detection and vital sign tracking. The shift towards decentralized healthcare, catalyzed by technological advancements and the necessity for remote care management, solidifies the foundational demand for these diagnostic tools. Their non-invasive nature and ability to generate massive, longitudinal datasets make them invaluable for both personalized medicine and large-scale population health studies.

Market expansion is fundamentally driven by several critical factors, including the increasing global prevalence of chronic diseases, a burgeoning aging population requiring constant monitoring, and rapid improvements in sensor miniaturization and battery longevity. Furthermore, growing consumer awareness regarding proactive health management, coupled with the integration of wearables into insurance and reimbursement models, significantly accelerates adoption rates. The technological convergence of advanced analytics, artificial intelligence (AI), and secure cloud storage is enhancing the diagnostic accuracy and clinical utility of the data collected, transforming these devices from simple fitness trackers into certified medical instruments. This evolution positions diagnostic wearables as indispensable components of the future healthcare ecosystem, improving accessibility and reducing the overall cost of care delivery.

Diagnostic Wearable Medical Devices Market Executive Summary

The Diagnostic Wearable Medical Devices Market is experiencing robust growth, driven by a global shift towards preventative medicine and remote patient management, supported by significant technological maturation in biosensors and data analytics. Business trends highlight strategic partnerships between traditional medical device manufacturers and technology giants (e.g., Apple, Google) to ensure clinical validation and scalability, focusing on regulatory approvals for devices transitioning from consumer electronics to medical diagnostics. Investment in artificial intelligence (AI) and machine learning (ML) is paramount, primarily aimed at extracting actionable clinical insights from continuous data streams, enhancing diagnostic capabilities, and minimizing false alerts. Mergers and acquisitions are frequent, targeting specialized sensor companies or those with established remote monitoring platforms to achieve rapid portfolio expansion and market penetration in niche therapeutic areas like neurology and advanced cardiac monitoring.

Regionally, North America maintains the leading market share due to its established healthcare infrastructure, high technological adoption rates, favorable reimbursement policies for RPM, and the presence of key industry leaders. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth in APAC is fueled by expanding healthcare access, increasing governmental initiatives promoting digital health, and a vast, growing geriatric population, particularly in countries like China and India. European growth remains steady, underpinned by centralized healthcare systems integrating wearables for managing chronic diseases and reducing hospital readmission rates, though regulatory fragmentation across member states remains a moderate challenge.

Segment trends underscore the dominance of monitoring devices, specifically Continuous Glucose Monitors (CGMs) and advanced cardiac monitoring patches, driven by the high burden of diabetes and cardiovascular diseases globally. Technology segmentation shows increasing preference for smart patches due to their extended monitoring capabilities, discretion, and accuracy compared to generalized smartwatches, particularly in clinical settings. The application segment sees Remote Patient Monitoring (RPM) as the fastest-growing area, far outpacing the traditional sports and fitness niche, reflecting the critical need for continuous clinical-grade data transmission. Furthermore, distribution channels are evolving rapidly, with e-commerce platforms and direct-to-consumer models gaining prominence, supplementing traditional hospital and pharmacy sales, especially for over-the-counter (OTC) wearable diagnostics.

AI Impact Analysis on Diagnostic Wearable Medical Devices Market

Common user questions regarding AI's impact on diagnostic wearables often center on accuracy, data security, personalization, and the clinical workflow integration. Users frequently inquire: "How does AI make diagnoses more accurate than traditional methods?", "Can AI prevent medical emergencies based on wearable data?", and "What are the privacy risks associated with AI processing continuous health data?" These questions collectively highlight the market's high expectation for AI to transform passive data collection into active, predictive diagnostics. Key themes emphasize AI's potential to filter noise, identify subtle patterns indicative of impending health deterioration (e.g., pre-symptomatic viral infection, or cardiac events), and personalize intervention thresholds, moving beyond simple anomaly detection to clinical risk stratification. Simultaneously, there is a strong concern regarding regulatory oversight and ensuring ethical, transparent use of algorithms trained on sensitive physiological data, indicating that trust and security are paramount for mass clinical adoption.

- AI algorithms enable precise anomaly detection in continuous data streams, significantly reducing false positive alerts and enhancing the clinical relevance of wearable data.

- Machine learning models facilitate the prediction of acute events, such as cardiac arrests or hypoglycemic episodes, allowing for timely, preventative interventions.

- Natural Language Processing (NLP) aids in structuring unstructured patient reports generated from wearable data, streamlining integration into Electronic Health Records (EHRs).

- AI is crucial for sensor fusion, combining data from multiple sensors (ECG, temperature, motion) to create a comprehensive and validated view of the patient's physiological state.

- Deep learning optimizes battery consumption and data transmission efficiency by selectively prioritizing and processing only the most clinically relevant data points locally on the device.

- Personalized therapeutic recommendations and dosing adjustments are being developed using AI to analyze individual patient responses to treatments, based on continuous biometric feedback.

- Enhanced security and privacy protocols are being implemented, utilizing federated learning techniques where AI models are trained locally on device data, minimizing the need for raw data transfer.

DRO & Impact Forces Of Diagnostic Wearable Medical Devices Market

The Diagnostic Wearable Medical Devices Market is propelled by powerful drivers (D) such as the exponential increase in chronic disease management needs and the accelerating integration of digital health solutions into clinical pathways, supported by favorable reimbursement shifts in major economies. Restraints (R) primarily include the persistent challenges related to data security and privacy compliance (HIPAA, GDPR), coupled with high regulatory scrutiny required for transitioning consumer-grade sensors into certified medical devices. Opportunities (O) abound in developing highly specialized biosensors for niche areas like mental health monitoring and non-invasive continuous multi-parameter diagnostics. The interplay of these factors—including high-impact forces like technological convergence and shifts in consumer behavior—shapes the competitive landscape and dictates the pace of market evolution towards decentralized, patient-centric healthcare models.

Key drivers include the global aging demographic, which necessitates continuous, non-intrusive monitoring solutions for managing multiple comorbidities. The proven efficacy of Remote Patient Monitoring (RPM) in reducing hospitalizations and lowering overall healthcare expenditure further strengthens the business case for diagnostic wearables. Technological breakthroughs in flexible electronics, low-power processing chips, and advanced material science are enabling the creation of smaller, more accurate, and more comfortable devices with extended battery life. Furthermore, major technology companies are actively entering the clinical space, validating the market's commercial viability and increasing consumer trust in these diagnostic platforms, thereby standardizing data collection protocols and pushing for greater interoperability across different healthcare systems.

Conversely, the high initial cost of advanced diagnostic wearables and the persistent challenge of ensuring sustained user compliance (adherence to wearing the device) pose significant restraints, especially in price-sensitive markets. A critical impact force is the need for rigorous clinical validation. Devices must demonstrate performance comparable to, or superior to, gold-standard clinical equipment to secure widespread adoption by physicians and obtain favorable reimbursement codes. Opportunities lie in expanding accessibility in emerging markets through low-cost, high-utility devices and developing diagnostic wearables specifically tailored for infectious disease surveillance and occupational health monitoring. The primary impact force accelerating growth remains the regulatory clarity provided by bodies like the FDA regarding Software as a Medical Device (SaMD), facilitating faster market entry for innovative diagnostic algorithms embedded within these wearable platforms.

Segmentation Analysis

The Diagnostic Wearable Medical Devices Market is highly diversified and segmented across multiple dimensions, allowing vendors to target specific clinical needs and consumer preferences. The primary segmentation centers on device type, distinguishing between comprehensive monitoring solutions (such as continuous ECG monitors and multi-vital parameter trackers) and dedicated diagnostic patches or sensors focused on singular biomarkers (like specific blood metabolite analysis). Application segmentation delineates between the high-volume consumer segment (Sports & Fitness) and the higher-value clinical segments (Remote Patient Monitoring and Home Healthcare). Understanding these segments is crucial as clinical applications command higher prices, require stricter regulatory adherence, and generate substantial, recurring service revenue through associated software platforms and data analysis subscriptions.

- By Type:

- Monitoring Devices:

- Electrocardiogram (ECG) Monitors

- Blood Pressure Monitors

- Continuous Glucose Monitors (CGM)

- Neurological Monitors (e.g., EEG)

- Sleep and Activity Monitors

- Fetal Monitors and Obstetric Devices

- Diagnostic Devices (Specialized Sensors and Patches):

- Multi-parameter Patches

- Pulse Oximeters

- Body Temperature Sensors

- Biofeedback Sensors

- Monitoring Devices:

- By Application:

- Remote Patient Monitoring (RPM)

- Home Healthcare and Personal Wellness

- Clinical Trials and Drug Development

- Sports and Fitness Monitoring

- By Site/Wearable Type:

- Wrist-worn Devices (Smartwatches, Bands)

- Patches and Adhesives (Chest, Abdomen)

- Headbands and Ear-Worn Devices

- Garments and Specialized Clothing

- Handheld and Clip-on Devices

- By Distribution Channel:

- Pharmacies and Retail Stores

- E-commerce and Direct-to-Consumer Channels

- Hospitals, Clinics, and Medical Institutions

Value Chain Analysis For Diagnostic Wearable Medical Devices Market

The value chain for diagnostic wearable medical devices is complex, beginning with upstream activities focused on sophisticated raw material procurement, particularly specialized polymers, flexible circuitry, and high-precision biosensors (e.g., electrochemical, optical, or acoustic sensors). The midstream phase involves the design, miniaturization, and assembly of the medical device hardware, requiring stringent quality control and regulatory compliance checks, especially for devices seeking FDA or CE Mark clearance. This phase also includes the development and integration of proprietary algorithms and secured connectivity software platforms necessary for data processing and transmission. Efficient management of the upstream component supply chain, particularly semiconductor shortages and specialized sensor manufacturing, is critical for controlling production costs and maintaining scalability.

Downstream activities encompass rigorous clinical validation studies required to prove diagnostic accuracy and utility, followed by strategic market entry. Distribution channels are bifurcated into direct and indirect models. Direct sales focus on high-volume institutional buyers, such as large hospital systems, clinical research organizations (CROs), and specialized chronic care providers, often involving long-term contracts and direct integration services. Indirect distribution utilizes retail pharmacies, specialized medical equipment suppliers, and increasingly, high-volume e-commerce platforms (Amazon, dedicated health tech sites) for consumer-grade or over-the-counter diagnostic wearables, demanding effective digital marketing strategies and robust logistics for last-mile delivery to patients' homes.

Crucially, the post-sales service layer, which includes technical support, software updates, data security maintenance, and subscription-based analytics services, represents a growing and high-margin component of the value chain. Successful players focus not only on hardware innovation but also on creating comprehensive data ecosystems. Partnerships between device manufacturers and healthcare IT providers are essential for seamless integration of wearable data into Electronic Health Records (EHRs), ensuring that the data collected downstream is clinically actionable and meets the interoperability standards required by modern healthcare providers, thereby maximizing the device's true diagnostic utility.

Diagnostic Wearable Medical Devices Market Potential Customers

The potential customer base for Diagnostic Wearable Medical Devices is highly diverse, ranging from individual consumers focused on proactive health management to large clinical organizations seeking cost-effective remote monitoring solutions. Key end-users include patients managing complex chronic conditions, such as Type 2 diabetes, atrial fibrillation, hypertension, and sleep apnea, who require continuous, non-invasive monitoring to optimize their treatment plans and prevent acute exacerbations. Geriatric populations and individuals engaged in rehabilitation post-hospitalization are also primary buyers, driven by the need for continuous safety and health status checks that enable independent living while providing reassurance to caregivers and medical staff regarding their condition remotely.

Institutional customers form a high-value segment. Hospitals and specialized cardiology, endocrinology, and neurology clinics increasingly deploy these devices as part of structured Remote Patient Monitoring (RPM) programs, aiming to reduce patient readmission rates, manage high-risk populations efficiently, and extend clinical reach beyond the physical confines of the facility. Additionally, pharmaceutical and biotechnology companies represent a significant customer base, utilizing clinical-grade wearables to collect objective, high-frequency endpoints during clinical trials, thereby accelerating drug development, improving data granularity, and reducing the logistical burden associated with traditional site-based data collection methods. Insurers and governmental health agencies are also indirect but influential customers, actively promoting the adoption of diagnostic wearables that demonstrate long-term cost savings through preventative care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 34.7 Billion |

| Growth Rate | CAGR 15.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple Inc., Samsung Electronics Co., Ltd., Abbott Laboratories, Medtronic PLC, Philips Healthcare, Dexcom, Inc., GE Healthcare, Masimo Corporation, BioTelemetry, Omron Healthcare, Inc., Irhythm Technologies, Inc., Biotricity Inc., VitalConnect, Inc., Google (Fitbit), VivaLNK, Nihon Kohden Corporation, McKesson Corporation, Verily Life Sciences, Preventice Solutions, NeuroMetrix, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diagnostic Wearable Medical Devices Market Key Technology Landscape

The Diagnostic Wearable Medical Devices market is defined by several converging technological advancements, making data acquisition more accurate, comfortable, and continuous. Central to this landscape are highly sensitive, miniaturized biosensors, particularly those based on flexible electronics and integrated circuitry, which allow for seamless integration into patches and fabrics without compromising data quality. Key sensor types include non-invasive electrochemical sensors (for continuous glucose or lactate monitoring), advanced photoplethysmography (PPG) sensors used for heart rate and SpO2 tracking, and dry electrode technology utilized in long-term, clinical-grade ECG monitoring devices. The development of material science, enabling breathable and hypoallergenic patch adhesives, has significantly improved patient comfort and compliance for extended wear periods, which is critical for successful long-term diagnostics.

Connectivity and data processing form the second critical layer of the technology landscape. Low-power wireless communication standards, such as Bluetooth Low Energy (BLE) and emerging 5G connectivity, are essential for securely and efficiently transmitting high volumes of real-time physiological data to cloud-based analytical platforms. Edge computing capabilities are increasingly being integrated into the wearables themselves, allowing for preliminary data processing and filtering on the device (at the "edge"), reducing transmission latency, and minimizing power consumption. This local intelligence enables immediate alerts for critical events without relying solely on constant cloud communication, enhancing the reliability and safety profile of diagnostic applications.

Finally, the sophistication of the diagnostic algorithms and software platforms drives the clinical utility of these devices. Machine Learning (ML) and Artificial Intelligence (AI) are the foundational technologies for converting raw biometric data into validated, clinically actionable insights. Technologies such as deep learning are used to identify complex patterns indicative of early disease onset (e.g., detecting subtle changes in heart rate variability correlated with autonomic dysfunction or stress). Secure cloud infrastructure, compliant with strict regulatory standards (like HIPAA and GDPR), ensures data integrity, while robust interoperability standards (like FHIR) facilitate seamless data exchange between wearable platforms and existing Electronic Health Record (EHR) systems, confirming the devices' role as genuine diagnostic tools, rather than isolated data collectors.

Regional Highlights

The global market for diagnostic wearable medical devices exhibits significant regional disparities in adoption, regulation, and growth trajectory. North America, particularly the United States, commands the largest market share. This dominance is attributed to high healthcare expenditure, the early and successful implementation of favorable reimbursement models for Remote Patient Monitoring (RPM) under Medicare and private insurers, and a consumer base highly receptive to advanced digital health solutions. The presence of major technology hubs and leading medical device manufacturers fosters continuous innovation and rapid regulatory pathways for novel diagnostic devices, maintaining the region's technological leadership. The structured demand for managing chronic illnesses like cardiac conditions and diabetes ensures robust market stability and consistent revenue generation.

Europe represents a mature market experiencing steady growth, driven primarily by centralized government initiatives focused on controlling healthcare costs and promoting digital health integration within established national health services (NHS in the UK, centralized systems in Nordic countries). While regulatory complexities exist across the European Union (EU) member states, the robust implementation of the Medical Device Regulation (MDR) is helping standardize quality and safety, thereby boosting physician trust. Key growth centers in Europe include Germany, France, and the UK, focusing on wearables for elder care and chronic disease management, supported by strong academic research into health informatics and personalized medicine.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is spurred by an expanding healthcare infrastructure, rising disposable incomes, and governments (especially China, Japan, and India) increasingly investing in digital health to address the healthcare needs of large, aging populations in remote areas. While regulatory processes are still maturing in many APAC countries, the sheer volume of potential users and the rapid adoption of mobile technology make it an extremely attractive destination for wearable diagnostic manufacturers. Latin America, the Middle East, and Africa (MEA) currently hold smaller shares but are emerging, driven by efforts to improve diagnostic accessibility in underserved regions and increasing foreign investment in medical technology infrastructure.

- North America: Market leader due to advanced healthcare infrastructure, high technological readiness, and strong reimbursement policies promoting RPM services.

- Europe: Characterized by standardized regulatory efforts (MDR), focus on integrating wearables into national healthcare systems, and significant penetration in chronic disease management and rehabilitation.

- Asia Pacific (APAC): Highest CAGR projection; driven by massive populations, increasing government spending on digital health, and high demand for monitoring solutions for diabetes and cardiovascular diseases in countries like China and India.

- Latin America (LATAM): Emerging market with potential driven by urbanization and private sector investment aimed at addressing access gaps in specialized diagnostics.

- Middle East and Africa (MEA): Growing adoption, primarily concentrated in high-income Gulf Cooperation Council (GCC) countries, focusing on luxury wellness and advanced chronic care management technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diagnostic Wearable Medical Devices Market.- Abbott Laboratories

- Medtronic PLC

- Philips Healthcare

- Dexcom, Inc.

- Apple Inc.

- Samsung Electronics Co., Ltd.

- GE Healthcare

- Masimo Corporation

- Irhythm Technologies, Inc.

- Omron Healthcare, Inc.

- BioTelemetry (now part of Philips)

- Biotricity Inc.

- VitalConnect, Inc.

- Google (Fitbit)

- Verily Life Sciences

- Preventice Solutions (now part of Boston Scientific)

- Nihon Kohden Corporation

- NeuroMetrix, Inc.

- VivaLNK

- McKesson Corporation

Frequently Asked Questions

Analyze common user questions about the Diagnostic Wearable Medical Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Diagnostic Wearable Medical Devices Market?

The central driver is the global increase in chronic diseases, particularly cardiovascular conditions and diabetes, which necessitate continuous, real-time monitoring. This demand is further amplified by the shift toward cost-effective Remote Patient Monitoring (RPM) solutions supported by favorable regulatory and reimbursement changes.

How do Diagnostic Wearables differ from standard fitness trackers?

Diagnostic wearables are typically cleared or certified by regulatory bodies (e.g., FDA, CE Mark) as medical devices, ensuring clinical-grade accuracy and validation necessary for making therapeutic decisions. Standard fitness trackers, conversely, are designed primarily for wellness and activity tracking without strict clinical validation requirements.

Which geographical region holds the largest market share for these devices?

North America currently holds the largest market share, driven by a well-established healthcare system, high technological adoption, and advanced government support and reimbursement structures for digital health initiatives, particularly in the United States.

What role does Artificial Intelligence (AI) play in advancing diagnostic wearables?

AI is essential for transforming vast amounts of collected biometric data into clinically actionable insights. It enables predictive diagnostics, reduces false alarms through sophisticated pattern recognition, and facilitates highly personalized health management protocols based on continuous individual data streams.

What are the main regulatory and data security challenges facing this market?

Key challenges include navigating stringent regulatory pathways (especially for Software as a Medical Device—SaMD), ensuring compliance with international data privacy laws (like GDPR and HIPAA), and maintaining consumer trust regarding the secure handling and storage of extremely sensitive, continuous physiological data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager