Dialysis Catheter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431904 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Dialysis Catheter Market Size

The Dialysis Catheter Market is experiencing robust expansion, driven primarily by the escalating global incidence of Chronic Kidney Disease (CKD) and End-Stage Renal Disease (ESRD), requiring continuous renal replacement therapies. The necessity for reliable vascular access, particularly in emergency situations or for long-term hemodialysis, underpins the consistent demand for high-quality dialysis catheters. Ongoing technological innovations focused on improving catheter patency, reducing infection risks, and enhancing flow rates are key contributors to market valuation growth. Furthermore, favorable reimbursement policies in developed economies and increasing healthcare expenditure across emerging markets are stabilizing the investment landscape for manufacturers, encouraging the development of advanced catheter designs, including those with antimicrobial properties.

The persistent transition towards patient-centric care models, including the rising adoption of home dialysis modalities (peritoneal dialysis and home hemodialysis), while sometimes competing, also necessitates specialized vascular access devices, maintaining the growth trajectory of certain acute and chronic catheter segments. Market stakeholders are focusing on integrating advanced materials, such as specific polyurethanes and silicones, to balance biocompatibility with mechanical strength. Regulatory scrutiny remains high, particularly concerning infection control standards, compelling manufacturers to invest heavily in clinical trials and post-market surveillance to validate the safety and efficacy of new products entering the complex nephrology device sector.

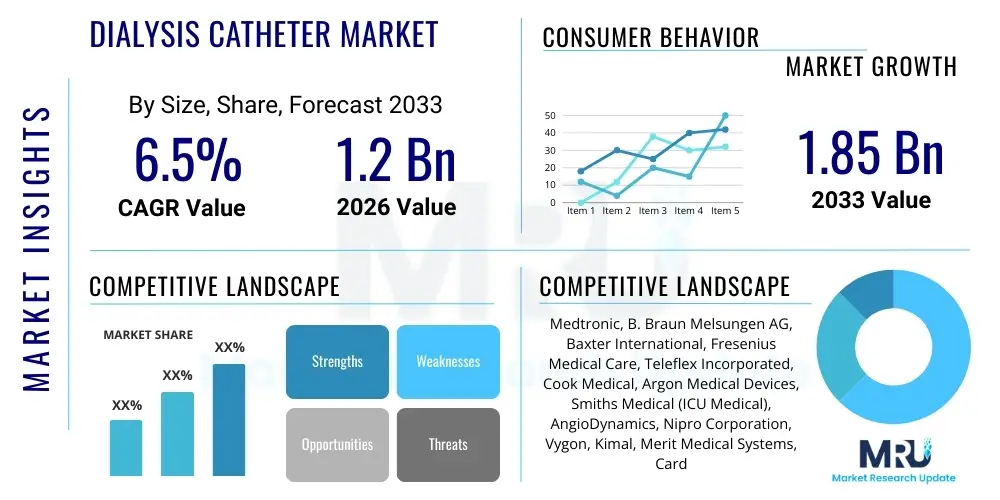

The Dialysis Catheter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Dialysis Catheter Market introduction

The Dialysis Catheter Market encompasses a range of specialized medical devices designed to establish temporary or semi-permanent vascular access necessary for patients undergoing hemodialysis or continuous renal replacement therapy (CRRT). These devices facilitate the necessary high blood flow rates required for effective removal of waste products and excess fluids from the blood when kidney function is severely compromised. The fundamental structure of a dialysis catheter typically includes dual lumens, allowing for simultaneous blood withdrawal and return, and is optimized for insertion into large central veins, such as the internal jugular, subclavian, or femoral veins. The primary product variations include acute (non-cuffed) catheters for short-term use and chronic (cuffed and tunneled) catheters intended for prolonged use, differentiated by their material composition, design, and mechanisms for infection resistance and secure placement.

Major applications of dialysis catheters center around managing End-Stage Renal Disease (ESRD) patients awaiting the maturation of an arteriovenous fistula (AVF) or graft, or those who are unsuitable for permanent surgical access. They are also critical in intensive care settings for patients requiring CRRT due to acute kidney injury (AKI) or other life-threatening conditions. The benefits derived from the use of these catheters include immediate vascular access, crucial for stabilizing critically ill patients; relative ease of insertion compared to surgical options; and providing a necessary lifeline for patients undergoing chronic, life-sustaining treatments. However, the inherent risks, primarily central line-associated bloodstream infections (CLABSIs) and catheter malfunction due to thrombosis, necessitate continuous design improvements and stringent clinical guidelines for use.

The market is predominantly driven by the surging global prevalence of diabetes and hypertension, which are the leading causes of CKD, thus continuously expanding the population needing dialysis intervention. Moreover, the increasing geriatric population, which is inherently more susceptible to renal comorbidities, significantly contributes to market expansion. Technological advancements are focused on reducing complications, particularly through the incorporation of antimicrobial coatings, improved tip geometries for reduced recirculation, and enhanced materials offering better biocompatibility and durability. Government initiatives aimed at improving renal care infrastructure, especially in emerging economies, further solidify the positive outlook for market growth across all product segments.

Dialysis Catheter Market Executive Summary

The Dialysis Catheter Market demonstrates robust growth, propelled by demographic trends, specifically the global aging population and the escalating incidence of diabetes and hypertension leading to ESRD. Business trends reveal intense competition centered on innovation in catheter materials and design, particularly focusing on mitigating the persistent challenge of catheter-related bloodstream infections (CRBSIs) and improving long-term patency. Leading manufacturers are adopting aggressive strategies involving strategic mergers, acquisitions, and collaborations to expand their geographic footprint and enhance their product portfolios with anti-microbial and anti-thrombotic technologies. Furthermore, there is a pronounced shift towards user-friendly designs that simplify insertion procedures and reduce complication rates, appealing directly to hospital and dialysis center procurement needs. The market’s sustainability is increasingly dependent on balancing cost-effectiveness with clinical efficacy, especially in healthcare systems under immense cost containment pressure.

Regionally, North America and Europe currently dominate the market, largely due to established healthcare infrastructures, high awareness of renal disease management, and favorable reimbursement structures supporting advanced dialysis treatments. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by rapidly improving healthcare access, increasing disposable incomes, and the sheer volume of patients diagnosed with CKD in densely populated countries like China and India. Regional trends also show a diversification of manufacturing capabilities, with several APAC-based companies increasing their R&D investments to compete globally. Successful penetration in these high-growth regions requires navigating diverse regulatory environments and adapting products to varying clinical standards and procurement processes.

Segment trends underscore the criticality of chronic (tunneled) catheters, which hold a significant market share due to the rising number of patients requiring long-term vascular access. Simultaneously, the material segmentation highlights the increasing preference for advanced polyurethane materials over traditional silicone, attributed to polyurethane’s superior mechanical strength and reduced wall thickness, which allows for better flow rates. The End-User segment shows sustained dominance by hospitals, driven by acute care needs and CRRT applications, though dedicated Dialysis Centers are rapidly gaining prominence as the primary locations for chronic outpatient treatment. The future segmentation outlook is focused on specialized catheters tailored for home dialysis settings, reflecting the broader movement toward decentralized healthcare delivery.

AI Impact Analysis on Dialysis Catheter Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Dialysis Catheter Market frequently center on its role in improving patient outcomes, predicting catheter failure, and optimizing resource allocation within dialysis centers. Users are keenly interested in how machine learning algorithms can analyze vast datasets—including patient comorbidities, catheter insertion history, and blood parameters—to forecast the risk of complications such as infection or thrombosis, thereby enabling proactive intervention. Key themes revolve around personalized catheter selection (matching the optimal device characteristics to individual patient needs), enhancing training simulations for interventionalists, and leveraging predictive analytics to monitor catheter performance remotely. Concerns often address data privacy, the validation of AI models in diverse patient populations, and the required infrastructure investment for AI implementation in clinical settings, establishing expectations for AI to primarily serve as a decision support tool rather than a fully autonomous diagnostic system in vascular access management.

- AI models enhance predictive maintenance by analyzing blood flow characteristics and patient vital signs to forecast potential catheter malfunction or thrombosis risk, allowing for timely replacement or intervention.

- Machine learning algorithms optimize catheter placement procedures by analyzing real-time imaging data (e.g., ultrasound guidance) to determine the most stable and least compromised venous insertion site, improving first-attempt success rates.

- AI assists in infection control protocols by analyzing electronic health records and microbiological surveillance data to identify high-risk patient subgroups or environmental factors contributing to CRBSIs, enabling targeted preventative strategies.

- The use of AI-driven tools facilitates personalized treatment planning, helping clinicians select the most appropriate catheter type (acute vs. chronic, material choice) based on long-term patient survival prognosis and anticipated duration of dialysis dependency.

- AI-powered virtual reality or simulation platforms improve the competency of healthcare professionals in complex catheter insertion and maintenance techniques, reducing human error rates in clinical practice.

DRO & Impact Forces Of Dialysis Catheter Market

The Dialysis Catheter Market dynamics are shaped by a complex interplay of driving forces, inherent limitations, and untapped opportunities, all governed by the critical need for effective renal replacement therapy. The primary driver is the pervasive and increasing global burden of Chronic Kidney Disease (CKD) and the progression to End-Stage Renal Disease (ESRD), largely attributed to lifestyle diseases such as diabetes and hypertension. This sustained increase in the patient pool necessitates continuous access to hemodialysis. Simultaneously, technological advancements, particularly in surface modification and anti-microbial technologies, create opportunities for market differentiation. However, the market faces significant restraints, most notably the high incidence and severity of Catheter-Related Bloodstream Infections (CRBSIs), which lead to increased patient morbidity, prolonged hospitalization, and higher healthcare costs. Furthermore, the inherent complication risks associated with central venous access, such as venous stenosis and thrombosis, necessitate ongoing surveillance and management, limiting the perceived safety profile of catheter use compared to permanent surgical access options like AVFs.

Opportunities for market growth are abundant within the realm of home dialysis and personalized medicine. The shift towards decentralized care models encourages the development of catheters optimized for extended dwelling times and easier handling in non-clinical settings, potentially expanding market reach. Moreover, emerging markets present lucrative prospects due to improving healthcare infrastructure and rising awareness of renal diseases, making investments in localized manufacturing and distribution channels strategically crucial. Impact forces, which include external factors significantly shaping the market, are dominated by stringent regulatory pathways imposed by bodies like the FDA and EMA, which mandate extensive clinical data for new product approvals, particularly concerning infection prevention claims. Economic pressures from healthcare payers, demanding cost-effective solutions without compromising patient safety, also force manufacturers to continually optimize production costs and demonstrate superior clinical utility through economic analyses.

The market is further influenced by the strong advocacy for primary use of arteriovenous fistulas (AVFs) as the preferred vascular access method, which represents a structural restraint on the chronic catheter segment. While catheters offer immediate access, clinical guidelines consistently prioritize AVFs due to their superior long-term outcomes and lower complication rates, positioning dialysis catheters largely as bridging or last-resort access solutions. Successful navigation of the market requires manufacturers to aggressively address the infection challenge through next-generation coatings and advanced locking solutions while optimizing materials to enhance durability and flow dynamics, thereby minimizing the duration a patient relies on a catheter before transitioning to permanent access or during periods when permanent access is unavailable or compromised.

Segmentation Analysis

The Dialysis Catheter Market is comprehensively segmented based on various technical and application criteria, reflecting the diverse clinical needs associated with renal replacement therapy. Key dimensions for segmentation include the intended duration of use (acute vs. chronic), the specific tip configuration designed for flow dynamics, the material used for biocompatibility and strength, and the clinical setting where the catheter is employed (end-user). This detailed segmentation is crucial for manufacturers to target specific clinical niches, such as high-flow, infection-resistant catheters for critical care settings, or long-term, reliable catheters for chronic outpatient hemodialysis. The segmentation analysis helps in understanding the varying demands across different healthcare environments and patient populations, emphasizing the market’s responsiveness to both temporary immediate access needs and sustained long-term access requirements.

- By Product Type:

- Acute Dialysis Catheters (Non-cuffed)

- Chronic Dialysis Catheters (Cuffed and Tunneled)

- By Tip Configuration:

- Step Tip Catheters

- Split Tip Catheters

- Straight Tip Catheters (e.g., Symmetric Tip)

- By Material:

- Polyurethane

- Silicone

- Others (e.g., Teflon, advanced polymers)

- By End-User:

- Hospitals

- Dialysis Centers/Clinics

- Ambulatory Surgical Centers (ASCs)

Value Chain Analysis For Dialysis Catheter Market

The value chain for the Dialysis Catheter Market begins with upstream activities focused on the procurement and processing of specialized raw materials, primarily medical-grade polymers such as high-performance polyurethane and silicone. The selection and sourcing of these materials are critical as they directly influence the catheter’s biocompatibility, mechanical properties (flexibility, tensile strength), and capacity to accommodate advanced features like antimicrobial coatings or radiopaque fillers. Upstream suppliers are typically chemical and material science companies that must adhere to stringent medical device quality standards (ISO 13485). Managing the supply chain stability and quality consistency for these specialized materials is a key differentiator, especially for ensuring uniform manufacturing output and clinical safety standards across diverse product lines.

The midstream stage involves the complex manufacturing and assembly process, which includes extrusion of the catheter tubing, tip molding, incorporation of lumens, application of specialty coatings (e.g., heparin-based or silver-ion coatings), and rigorous quality assurance testing. Leading manufacturers invest heavily in automated precision assembly lines and cleanroom environments to minimize contamination risks and ensure precise dimensional tolerances for optimal blood flow and reduced risk of recirculation. Following manufacturing, the distribution channel dictates how the products reach the end-users. Distribution utilizes both direct sales forces, particularly for large, integrated healthcare networks and major dialysis center chains, and indirect channels involving specialized medical device distributors who manage logistics, inventory, and localized clinical support for smaller clinics or regional hospitals. The choice between direct and indirect distribution often depends on the geographic market size, existing regulatory barriers, and the manufacturer’s established presence.

Downstream activities center on the end-users—Hospitals, specialized Dialysis Centers, and increasingly, home healthcare settings—where the catheters are clinically deployed. Hospitals primarily utilize acute catheters in emergency and critical care (CRRT) settings, demanding immediate availability and robust performance. Dialysis Centers, conversely, are the main consumers of chronic, tunneled catheters for routine outpatient hemodialysis. The final link in the chain involves post-market surveillance, clinical training provided by manufacturers to end-users (crucial for proper insertion technique and complication prevention), and feedback mechanisms that inform R&D regarding material performance, infection rates, and user satisfaction. Effective value chain management requires seamless communication and quality control from raw material input to clinical application, ensuring patient safety and maximizing product lifecycle utility.

Dialysis Catheter Market Potential Customers

The primary consumers and end-users of dialysis catheters are clinical institutions that provide renal replacement therapy services across varying levels of patient acuity. Hospitals, particularly large tertiary and quaternary care facilities with high-volume Intensive Care Units (ICUs), Emergency Departments, and Nephrology departments, represent the most significant segment of the acute catheter market. In the hospital environment, catheters are indispensable for managing patients with Acute Kidney Injury (AKI) requiring Continuous Renal Replacement Therapy (CRRT), or for patients with newly diagnosed End-Stage Renal Disease (ESRD) who require immediate hemodialysis access before permanent vascular access options, such as AV fistulas or grafts, can be established and matured. Hospital customers demand catheters that offer high flow rates, ease of insertion under ultrasound guidance, and advanced infection-resistant properties to manage critically ill, often immunocompromised, patient populations effectively.

Specialized Dialysis Centers or Nephrology Clinics constitute the largest purchasing segment for chronic, tunneled dialysis catheters. These centers are dedicated facilities focusing on scheduled outpatient hemodialysis treatments for stable ESRD patients. Although clinical guidelines prioritize permanent access, a significant proportion of chronic patients either cannot develop or maintain an AV fistula/graft or are awaiting transplant, making long-term catheters a necessity. These customers prioritize longevity, low thrombosis rates, enhanced patient comfort, and proven durability under repeated access. The procurement decisions in this segment are highly sensitive to cost-per-procedure metrics and clinical evidence demonstrating reduced complication rates, directly impacting overall operational efficiency and patient quality of life metrics.

A rapidly emerging customer segment includes Ambulatory Surgical Centers (ASCs) and, increasingly, Home Healthcare Providers. ASCs often perform the initial insertion and placement of tunneled catheters under sterile conditions as outpatient procedures, minimizing hospital stays. The growing trend toward decentralized care, including home hemodialysis, is generating demand for specialized catheters and accompanying maintenance kits designed for use by trained caregivers or the patients themselves. While this segment is smaller currently, its growth rate is substantial, driven by patient preference for convenience and technological advancements that make home-based access management safer and more feasible, requiring products with intuitive locking mechanisms and robust infection prevention measures suitable for non-clinical environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, B. Braun Melsungen AG, Baxter International, Fresenius Medical Care, Teleflex Incorporated, Cook Medical, Argon Medical Devices, Smiths Medical (ICU Medical), AngioDynamics, Nipro Corporation, Vygon, Kimal, Merit Medical Systems, Cardinal Health, Asahi Kasei, Becton Dickinson (BD), Terumo Corporation, Marvao Medical, C. R. Bard (BD). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dialysis Catheter Market Key Technology Landscape

The current technology landscape in the Dialysis Catheter Market is intensely focused on mitigating the two major clinical complications associated with their use: infection and thrombosis. A pivotal area of innovation involves the development and integration of advanced antimicrobial and antithrombogenic coatings. Manufacturers are employing technologies such as silver-ion impregnated surfaces, heparin-bonded materials, and novel antibiotic-eluting coatings to reduce bacterial adherence and subsequent biofilm formation, which are the primary precursors to Catheter-Related Bloodstream Infections (CRBSIs). The effectiveness of these coatings is under continuous refinement, requiring substantial investment in clinical trials to ensure long-term efficacy and patient safety while avoiding the development of antibiotic resistance, which remains a key regulatory concern. Furthermore, innovative locking solutions, utilizing citrate or ethanol-based products that dwell within the catheter lumen between dialysis sessions, are gaining acceptance as a chemical adjunct to infection and thrombus prevention.

Another crucial technological advancement focuses on optimizing catheter geometry and material science to improve patency and performance. Modern catheters utilize advanced thermoplastic polyurethanes (TPUs) that offer superior kink resistance, material strength, and biocompatibility compared to older silicone models, enabling thinner walls and larger internal diameters, which translates directly to higher and more reliable blood flow rates. The optimization of the tip design is equally important; technologies like the Split-Tip and Step-Tip configurations are engineered to minimize flow recirculation—the mixing of arterial (outflow) and venous (return) blood within the catheter—thereby maximizing dialysis efficiency. Symmetric tip designs, intended to reduce positional dependence, are also gaining traction, offering consistent performance regardless of patient movement or positioning. These design improvements directly address common reasons for catheter failure and subsequent replacement.

The integration of visualization and sensing technologies represents a forward-looking area. Catheters are increasingly being paired with insertion kits that incorporate ultrasound guidance systems, enhancing the accuracy and safety of placement, especially in patients with complex venous anatomy. Furthermore, research is exploring embedded or external sensor technology capable of non-invasively monitoring blood flow dynamics or detecting early signs of fibrin sheath formation within the catheter, allowing for predictive maintenance before total catheter failure occurs. The overall trend emphasizes developing complete procedural kits that streamline the insertion process, standardize care, and incorporate all necessary antimicrobial and anti-thrombotic safeguards, thus reducing variability and improving long-term clinical outcomes for the end-stage renal disease patient population.

Regional Highlights

The regional market analysis reveals distinct consumption patterns and growth drivers influenced by healthcare infrastructure maturity, disease prevalence, and regulatory frameworks.

- North America (U.S. and Canada): This region maintains the largest market share globally due to the extremely high prevalence of ESRD, driven primarily by lifestyle diseases, coupled with highly advanced healthcare infrastructure and well-established reimbursement policies (e.g., Medicare in the U.S.). The market here is characterized by early adoption of premium, high-flow, anti-microbial catheters and a strong focus on clinical best practices aimed at reducing CLABSI rates. Competition is high, and technological superiority in chronic catheter solutions is a key purchasing factor.

- Europe (Germany, UK, France, etc.): Europe is a mature market exhibiting stable growth, supported by universal healthcare coverage and comprehensive renal care programs. However, pricing pressures and stricter regulations regarding material safety and performance require manufacturers to offer compelling clinical and economic value propositions. Demand is shifting towards cost-effective, yet highly reliable chronic catheters, and the region is a significant testing ground for innovative material technologies and advanced locking solutions.

- Asia Pacific (APAC) (China, India, Japan): APAC is projected to be the fastest-growing market globally. This rapid expansion is fueled by the massive, increasing patient base suffering from CKD, particularly in populous nations like China and India, where improved access to dialysis facilities is accelerating. While Japan and Australia possess highly developed, technology-forward markets, emerging economies in Southeast Asia are driving demand for more affordable, functional catheters as healthcare expenditure rises and infrastructure expands, creating significant opportunities for localized production and distribution networks.

- Latin America, Middle East, and Africa (MEA): These regions show steady but fragmented growth. Growth in Latin America is linked to increasing awareness of renal diseases and improving healthcare investment. The MEA region’s growth is highly concentrated in Gulf Cooperation Council (GCC) countries due to high prevalence rates of diabetes and state investments in specialized healthcare, driving demand for high-quality catheters. Market penetration often requires navigating challenging procurement processes and addressing infrastructural gaps in clinical settings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dialysis Catheter Market.- Medtronic plc

- B. Braun Melsungen AG

- Baxter International Inc.

- Fresenius Medical Care AG & Co. KGaA

- Teleflex Incorporated

- Cook Medical LLC

- Argon Medical Devices, Inc.

- Smiths Medical (ICU Medical, Inc.)

- AngioDynamics, Inc.

- Nipro Corporation

- Vygon SAS

- Kimal PLC

- Merit Medical Systems, Inc.

- Cardinal Health, Inc.

- Asahi Kasei Corporation

- Becton, Dickinson and Company (BD)

- Terumo Corporation

- Marvao Medical Devices

- C. R. Bard (acquired by BD)

- R. Bard

Frequently Asked Questions

Analyze common user questions about the Dialysis Catheter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Dialysis Catheter Market?

The market growth is primarily driven by the rising global incidence of Chronic Kidney Disease (CKD) and End-Stage Renal Disease (ESRD), largely linked to the increasing prevalence of diabetes and hypertension, alongside the aging global population requiring renal replacement therapy.

What is the most significant restraint impacting the Dialysis Catheter Market?

The most significant restraint is the high risk of complications associated with central venous access, particularly Catheter-Related Bloodstream Infections (CRBSIs) and thrombosis, which increase patient morbidity and necessitate costly interventions or catheter replacements.

How is technological advancement influencing the design of dialysis catheters?

Technological advancement is focused on incorporating anti-microbial coatings, utilizing advanced polyurethane and silicone materials for improved flow and biocompatibility, and optimizing tip configurations (e.g., split-tip) to minimize blood recirculation and enhance dialysis efficiency.

Which segment of dialysis catheters holds the largest market share by product type?

Chronic (cuffed and tunneled) dialysis catheters currently hold the largest market share, driven by the increasing population of ESRD patients who require long-term, semi-permanent vascular access for routine hemodialysis treatments.

Which geographic region is expected to show the highest growth rate in the market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), stimulated by rapidly improving healthcare infrastructure, substantial increases in healthcare spending, and the vast, expanding patient pool suffering from CKD in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager