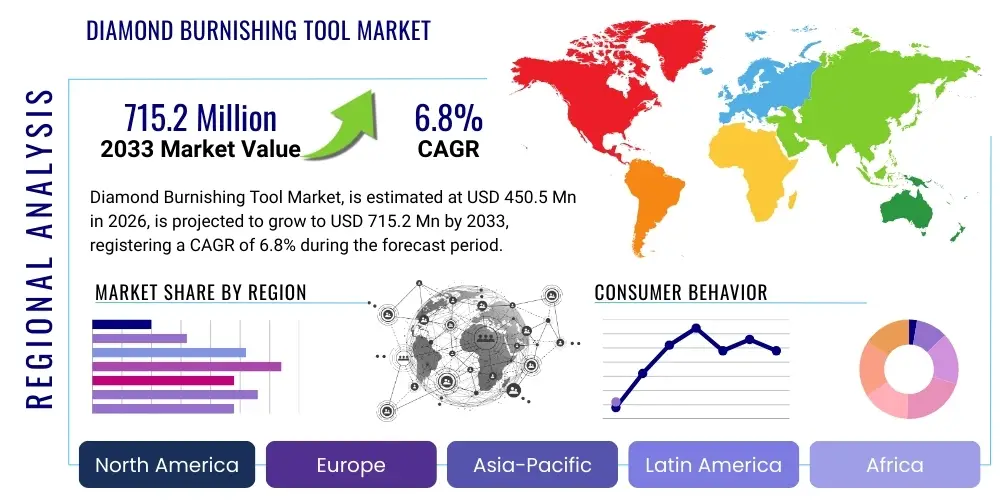

Diamond Burnishing Tool Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435974 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Diamond Burnishing Tool Market Size

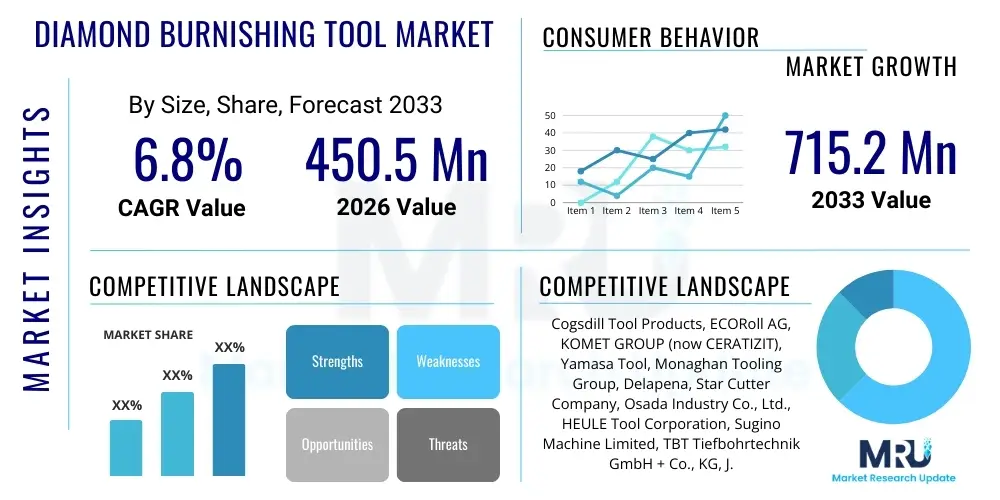

The Diamond Burnishing Tool Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 715.2 Million by the end of the forecast period in 2033.

Diamond Burnishing Tool Market introduction

The Diamond Burnishing Tool Market encompasses specialized tools utilizing non-cutting plastic deformation processes to achieve superior surface finishes, often replacing traditional grinding or honing methods. These tools feature highly polished synthetic or natural diamond inserts that cold-work the surface of components, resulting in increased surface hardness, compressive residual stresses, and improved wear and fatigue resistance without removing material. The primary product segments include single-point diamond burnishing tools, specialized roller burnishing tools, and tools designed for internal and external surface applications across various geometries.

Major applications for these high-precision tools are predominantly found in demanding sectors such as aerospace, automotive, medical device manufacturing, and precision mold making, where stringent surface integrity and dimensional accuracy are paramount. For instance, in the aerospace industry, diamond burnishing is crucial for treating turbine components and landing gear pins to enhance fatigue life. In the automotive sector, it is increasingly used for finishing camshafts, crankshafts, and transmission parts to reduce friction and improve efficiency. The inherent benefit of producing superior finishes with minimal material loss and improved mechanical properties is a significant driving factor for market adoption.

Driving factors propelling this market include the global trend toward miniaturization and high-precision component manufacturing, coupled with the rising demand for enhanced material performance, especially in high-stress environments. Furthermore, the operational efficiency gained through the use of diamond burnishing, which is typically faster and cleaner than conventional abrasive finishing, contributes to its increasing integration into automated manufacturing workflows, ensuring consistent quality and reduced production cycle times across diverse industrial landscapes.

Diamond Burnishing Tool Market Executive Summary

The global Diamond Burnishing Tool Market is characterized by robust growth driven by accelerating demand for precision components in the electric vehicle (EV) sector and orthopedic medical implants. Current business trends indicate a strong shift towards multi-roller burnishing solutions, which offer higher throughput and process stability compared to single-point tools, particularly within mass production environments. Technological advancements focus heavily on developing adaptive tool holders capable of integrating seamlessly with CNC machining centers, allowing for real-time pressure adjustment and process monitoring to optimize surface integrity on complex geometries. Strategic collaborations between tool manufacturers and machine tool builders are becoming central to integrating burnishing processes directly into the main manufacturing cycle, eliminating separate finishing operations and thus significantly improving operational expenditure for end-users.

From a regional perspective, Asia Pacific (APAC) dominates the consumption landscape, primarily fueled by massive automotive and electronics manufacturing bases in China, Japan, and South Korea, alongside rapid expansion in aerospace component production in India. North America and Europe, while being mature markets, exhibit strong demand for advanced, customized burnishing solutions, especially within the high-value aerospace and defense sectors, prioritizing tool longevity and surface property control. Regional trends also reflect stringent quality control standards, particularly the European Union's focus on sustainable manufacturing, which favors cold-working processes like diamond burnishing due to their low waste generation and energy efficiency.

Segmentation trends reveal that tools designed for internal diameter (ID) burnishing, such as bore burnishing tools, are experiencing the highest growth due reflecting the complexity of internal features in modern engine blocks and hydraulic components. By material application, the segment catering to hardened steels and superalloys exhibits rapid expansion, necessitated by the increasing use of advanced materials in high-performance applications. The market structure remains moderately consolidated, with a few established global players setting the technological pace, yet niche manufacturers specializing in custom geometries and specialized diamond grades continue to capture specific high-precision market segments globally.

AI Impact Analysis on Diamond Burnishing Tool Market

Common user questions regarding AI’s impact on diamond burnishing tools center on how artificial intelligence can move the finishing process from a skilled, manual adjustment to an autonomous, optimized operation. Users frequently inquire about AI's capability to predict tool wear, optimize burnishing parameters (pressure, feed rate, speed) based on material microstructure variations, and integrate real-time quality assurance. The key themes emerging from this analysis include the expectation that AI will standardize finishing quality across different machines and operators, significantly reduce setup time for new part geometries, and enable predictive maintenance to maximize the lifespan of expensive diamond inserts. The integration of machine learning algorithms is anticipated to transform surface finishing from a trial-and-error process into a highly efficient, data-driven operation, crucial for achieving stringent tolerances required in critical applications like turbine blades and medical stents. This shift involves leveraging data from sensors embedded in the tool holder and machine spindle to generate corrective feedback loops instantly.

- AI-driven optimization of burnishing parameters (speed, feed, force) based on component material variability and required surface roughness targets.

- Predictive maintenance algorithms utilizing vibration and thermal signatures to forecast diamond insert failure, maximizing tool utilization and preventing scrap components.

- Real-time adaptive control systems, enabling the burnishing tool to adjust pressure dynamically during the process to compensate for machine deflection or minor geometrical errors.

- Integration of machine vision and AI for non-contact, high-speed surface quality inspection immediately post-burnishing, verifying required roughness and integrity.

- Automated generation and optimization of complex burnishing toolpaths for free-form or irregular surfaces, reducing manual programming efforts and setup time.

- Enhanced supply chain management through AI forecasting of diamond raw material demand based on global manufacturing capacity utilization trends.

- Simulation and digital twinning of the burnishing process powered by machine learning to reduce physical prototyping cycles and validate process stability.

DRO & Impact Forces Of Diamond Burnishing Tool Market

The Diamond Burnishing Tool Market is fundamentally driven by the pervasive industry requirement for superior surface integrity and dimensional stability, particularly in high-performance applications where components operate under extreme stress or friction. A primary driver is the need to impart deep compressive residual stresses into the component surface, which dramatically improves fatigue life—a necessity in aerospace and heavy machinery. Restraints include the high initial capital investment required for precision burnishing equipment and specialized tooling, alongside the technical complexity of correctly setting burnishing parameters, which still necessitates specialized operator skill and detailed knowledge of material science. Opportunities are significantly expanding through the development of specialized micro-burnishing tools for extremely small components, such as those used in micro-robotics and advanced electronics packaging, and the ongoing shift toward lightweight materials, like specialized aluminum alloys and composites, that still require high surface hardness. These forces collectively shape the market, favoring manufacturers that can offer integrated, easy-to-use, and highly durable tooling solutions that meet complex regulatory and performance standards.

Segmentation Analysis

The Diamond Burnishing Tool Market is extensively segmented based on the type of tool mechanism, the application surface (internal or external), the end-use industry, and the operational platform (CNC or conventional). The segmentation provides granularity essential for manufacturers to tailor their product offerings and for end-users to select the most appropriate tooling for specific tasks, ranging from high-volume automotive part finishing to ultra-precision medical component production. Understanding these segments helps highlight the current market preference for integrated, multi-functional tools capable of performing burnishing operations within standard machining centers, minimizing capital expenditure on dedicated finishing equipment.

- By Type:

- Single-Point Diamond Burnishing Tools

- Multi-Roller/Cylindrical Burnishing Tools

- Spherical/Ball Diamond Burnishing Tools

- Combined Burnishing and Skiving Tools

- By Application Surface:

- Internal Diameter (ID) Burnishing (Bore finishing, Hydraulic Cylinders)

- External Diameter (OD) Burnishing (Shafts, Spindles, Pins)

- Face/Flat Surface Burnishing (Sealing surfaces, Flanges)

- Tapered Surface Burnishing

- By End-Use Industry:

- Automotive (Engine components, Powertrain, Gearbox shafts)

- Aerospace and Defense (Turbine components, Landing gear, Structural parts)

- Medical and Healthcare (Orthopedic implants, Surgical instruments)

- Heavy Machinery and Industrial Equipment (Hydraulic rods, Pump components)

- Precision Mold and Die Manufacturing

- Oil and Gas (Downhole tools, Valve components)

- By Operation Mode:

- CNC Machine Integration Tools (Lathes, Machining Centers)

- Conventional/Manual Operation Tools

- Specialized Dedicated Machine Tools

Value Chain Analysis For Diamond Burnishing Tool Market

The value chain for the Diamond Burnishing Tool Market begins upstream with the procurement of specialized raw materials, primarily high-quality synthetic diamonds, which require precision synthesis and certification. This stage also includes suppliers of high-grade tool steel and specialized alloys used for the tool bodies and holders, demanding stringent quality checks for durability and stiffness. The midstream manufacturing process involves highly specialized precision machining, diamond insertion, polishing, and calibration, which are core competencies for leading tool producers. This critical manufacturing step requires proprietary knowledge in geometry optimization and surface treatment of the diamond contact area to ensure maximum effectiveness and longevity of the tool, distinguishing high-quality market participants.

Downstream analysis focuses on distribution and integration into the end-user environment. Distribution channels are typically bifurcated: direct sales channels are preferred for highly customized or complex aerospace and medical applications, allowing for close technical consultation and support regarding process implementation. Indirect sales through specialized industrial distributors and tooling resellers dominate the high-volume automotive and general engineering segments, offering broad reach and immediate availability of standard tools. Effective after-sales support, including re-polishing and calibration services for the diamond inserts, is crucial for maintaining tool performance and is a key competitive differentiator in the aftermarket phase of the value chain.

The final stage involves the actual integration and utilization of the tools within the end-user's CNC machinery or dedicated finishing setup. This stage emphasizes optimizing process parameters, training operators, and leveraging digital tools for process monitoring. The efficiency of the upstream diamond sourcing and the precision of midstream manufacturing directly influence the performance metrics—surface finish, hardness, and tool life—that are critical for downstream customer satisfaction and long-term contract acquisition, thereby linking the entire value chain to final component quality.

Diamond Burnishing Tool Market Potential Customers

The primary potential customers for Diamond Burnishing Tools are organizations operating in high-precision, high-reliability manufacturing sectors that require surfaces with enhanced mechanical properties and extremely low roughness values (typically Ra < 0.2 µm). These include Tier 1 and Tier 2 suppliers to the global automotive industry, particularly those involved in producing engine components, transmission shafts, and complex bearing surfaces for both internal combustion engines and next-generation electric vehicle powertrains, where friction reduction is critical for energy efficiency. The shift towards manufacturing lighter, higher-performing electric drivetrain components, which often utilizes specialized aluminum and treated steel alloys, drives significant demand.

Another crucial customer segment encompasses manufacturers in the aerospace and defense sector, including OEMs and specialized subcontractors, focused on producing critical safety components such as landing gear cylinders, hydraulic rods, and turbine engine parts. These components operate under extreme thermal and mechanical loads, making the compressive residual stress imparted by diamond burnishing essential for meeting rigorous safety and fatigue life standards established by regulatory bodies. The long lifespan required for these components justifies the investment in high-end burnishing technology, positioning these firms as premium customers.

Furthermore, the medical device manufacturing industry, especially orthopedic and prosthetic implant producers (e.g., knee and hip replacements), represents a rapidly growing customer base. The surfaces of these implants must be ultra-smooth, biocompatible, and highly wear-resistant to minimize friction and prevent particle shedding within the human body. Precision mold makers, particularly those serving the optics and electronics industries, also constitute significant customers, as they require mirror-like finishes on complex mold cavities to ensure product release and surface fidelity without requiring manual polishing, thereby streamlining their production cycles and ensuring superior product quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 715.2 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cogsdill Tool Products, ECORoll AG, KOMET GROUP (now CERATIZIT), Yamasa Tool, Monaghan Tooling Group, Delapena, Star Cutter Company, Osada Industry Co., Ltd., HEULE Tool Corporation, Sugino Machine Limited, TBT Tiefbohrtechnik GmbH + Co., KG, J. H. Williams Tool Group, Superior Tool & Gauge Co., P.B. Tools Co., Ltd., KERN-LIEBERS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diamond Burnishing Tool Market Key Technology Landscape

The contemporary technology landscape in the Diamond Burnishing Tool Market is defined by the integration of advanced mechanical systems with sophisticated process control technologies. A key development is the proliferation of hydrostatic and pneumatic damping mechanisms within tool holders. These mechanisms are crucial for maintaining consistent burnishing force, especially when processing components with subtle variations in geometry or material hardness, thereby ensuring uniform surface integrity and preventing tool chatter or premature wear. Furthermore, the design of diamond inserts has evolved significantly, moving beyond simple geometry to incorporate complex facet designs and specialized coatings that optimize material flow during the cold working process and extend tool life when processing high-hardness materials like tool steel and superalloys used in aviation.

Another prominent technological trend involves the development of modular and adaptive tooling systems. Modern diamond burnishing tools are increasingly designed for quick changeovers and compatibility with standard CNC machine interfaces, maximizing machine utilization. This includes features like integrated sensors for real-time monitoring of force, temperature, and vibration. These sensors provide the necessary data inputs for closed-loop control systems, allowing the machine to dynamically adjust feed and speed parameters, ensuring optimal residual stress profiles are achieved across the component surface, which is a critical requirement in safety-critical applications.

The future technology landscape is centered around micro-burnishing and the integration of advanced metrology. Specialized micro-roller burnishing tools are being developed to address components smaller than 5mm, crucial for the electronics and micro-robotics sectors. Concurrently, efforts are focused on integrating in-situ metrology—such as laser profilometers or Eddy current sensors—directly into the burnishing head. This allows for immediate, non-contact measurement of surface roughness and inspection of subsurface integrity immediately after the burnishing pass, significantly streamlining the quality control loop and accelerating the overall production timeline, aligning the market with Industry 4.0 principles of autonomous quality verification.

Regional Highlights

- North America: This region is a major contributor, characterized by high spending on aerospace and defense manufacturing, driving demand for high-end, customized diamond burnishing tools. The focus here is on process optimization, material compatibility with superalloys (e.g., Titanium and Inconel), and the integration of highly automated finishing solutions. The presence of major R&D centers and stringent quality mandates contributes significantly to the market's value segment.

- Europe: Europe represents a mature market with a strong emphasis on precision engineering, particularly in Germany, Italy, and the UK. The automotive industry, especially the shift towards high-performance European luxury vehicles and precision tooling manufacture, is a significant driver. European manufacturers prioritize environmentally friendly, cold-working processes, favoring diamond burnishing over processes requiring heavy coolants or generating significant waste. Stringent quality standards for medical devices also bolster demand for ultra-precise finishing tools.

- Asia Pacific (APAC): APAC is the fastest-growing region, dominating the market in terms of volume consumption due to its massive manufacturing base, particularly in China, Japan, and India. The rapid expansion of automotive production, coupled with significant governmental investment in aerospace and localized defense manufacturing capabilities, fuels demand. The region benefits from lower labor costs but increasingly invests in automation to meet rising global quality expectations and scale production efficiently. Japan and South Korea lead in adopting advanced CNC-integrated burnishing systems.

- Latin America (LATAM): The LATAM market, while smaller, shows potential, driven primarily by investments in the automotive assembly sector and heavy industry machinery refurbishment, particularly in Brazil and Mexico. The focus here is often on robust, reliable tools for maintenance, repair, and overhaul (MRO) applications, with growth tied directly to foreign direct investment in localized manufacturing and extraction industries.

- Middle East and Africa (MEA): Growth in MEA is specialized, concentrated primarily within the oil and gas sector for finishing critical components like drilling tools, valves, and hydraulic systems that require high wear resistance. Investment in localized manufacturing diversification, particularly in the UAE and Saudi Arabia, presents emerging opportunities for general industrial tooling adoption, focusing on durability under harsh operating conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diamond Burnishing Tool Market.- Cogsdill Tool Products

- ECORoll AG

- KOMET GROUP (now CERATIZIT)

- Yamasa Tool

- Monaghan Tooling Group

- Delapena

- Star Cutter Company

- Osada Industry Co., Ltd.

- HEULE Tool Corporation

- Sugino Machine Limited

- TBT Tiefbohrtechnik GmbH + Co., KG

- J. H. Williams Tool Group

- Superior Tool & Gauge Co.

- P.B. Tools Co., Ltd.

- KELLER Diamond Tools

- Micro-Finish Tools

- Guangzhou Aotian Tools Co., Ltd.

- ZEUS Tooling Systems

- MAPAL Präzisionswerkzeuge Dr. Kress KG

- KEO Cutters

Frequently Asked Questions

Analyze common user questions about the Diamond Burnishing Tool market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using diamond burnishing tools over traditional abrasive finishing methods?

The primary benefit is the significant enhancement of the component's mechanical properties, including increased surface hardness and the introduction of beneficial compressive residual stresses, which dramatically improve fatigue life and resistance to surface wear, all achieved without generating chips or material loss.

In which industries are Diamond Burnishing Tools most frequently utilized for high-volume production?

Diamond Burnishing Tools are most frequently utilized in the automotive industry for high-volume finishing of critical components like crankshafts, camshafts, and transmission parts, where friction reduction and durability are essential performance metrics for mass-produced vehicles.

How does tool type affect the burnishing process (e.g., single-point vs. multi-roller)?

Single-point tools are preferred for internal or complex geometries requiring high precision and customization, while multi-roller (cylindrical) tools are favored for high-throughput applications on external cylindrical surfaces, offering greater stability and faster feed rates for high volume production runs.

Can diamond burnishing be applied to hardened steel and superalloys, and what are the limitations?

Yes, advanced diamond burnishing tools are effective on hardened steel and superalloys (such as Inconel or Titanium alloys). The primary limitations involve materials with excessively high hardness (>65 HRC) or components that are too thin-walled, which may deform under the required burnishing force.

What is the estimated lifespan of a typical diamond insert used in burnishing tools?

The lifespan of a diamond insert is highly variable but often measured in hundreds of kilometers of burnishing distance, significantly exceeding abrasive tools. With proper use and timely re-polishing, a single high-quality diamond insert can last for millions of components, making it highly cost-effective in the long run.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager